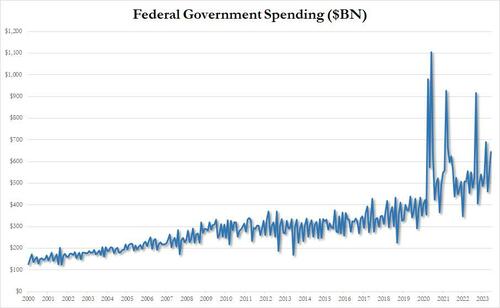

There was a shocking number in today’s latest monthly US Budget Deficit report. No, it wasn’t that US government outlays unexpectedly soared 15% to $646 billion in June, up almost $100 billion from a year ago…

… while tax receipts slumped 9.2% from $461 billion to $418 billion, resulting in a TTM government receipt drop of over 7.3%, the biggest since June 2020 when the US was reeling from the covid lockdown recession; in fact never have before tax receipts suffered such a big drop without the US entering a recession.

Needless to say, surging government outlays coupled with shrinking tax revenues meant that in June, the US budget deficit nearly tripled from $89 billion a year ago to $228 billion, far greater than the consensus estimate of $175 billion. One can only imagine which Ukrainian billionaire oligarch’s money laundering bank account is currently enjoying the benefits of that unexpected incremental $50 billion US deficit hole: we know for a fact that the FBI will never get to the bottom of that one, since they can’t even figure out who dumped a bunch of blow inside the White House – the most protected and surveilled structure in the entire world.

And with the monthly deficits coming in higher than expected and also far higher than a year ago, it is also not at all surprising that the cumulative deficit 9 months into the fiscal year is already the 3rd highest on record, surpassed only by the crisis years of 2020 and 2021: at $1.393 trillion, the fiscal 2022 YTD deficit is already up 170% compared to the same period last year.

Again, while sad, none of the above numbers are surprising: they merely confirm that the US is on an ever faster-track to fiscal death, but not before the Fed is forced to monetize the debt once again (one wonders what financial crisis the Jekyll Island folks will invoke this time to greenlight the next multi-trillion QE).

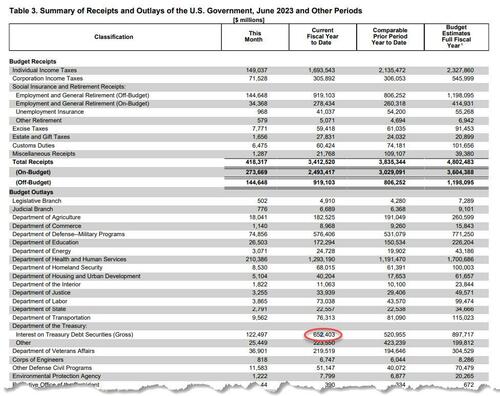

No, the one number that was truly shocking was found all the way on page 9, deep inside Table 3 of the latest Treasury Monthly Statement: the only highlighted below, and which shows that in the 9 months of the current fiscal year, the US has already accumulated a record $652 billion in gross debt interest.

This number was more than 25% higher compared to the Interest Expense payment for the comparable period a year ago, which amounted to $521 billion.

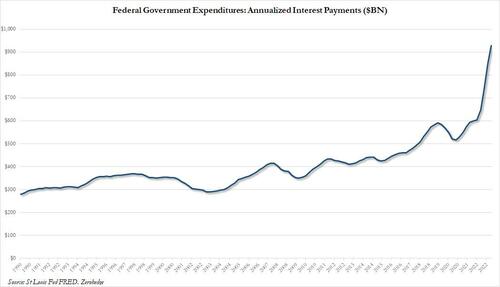

Soaring interest rates, driven by the panicked Fed’s scramble to undo its epic policy failure of 2020 and 2021 when the Fed kept rates at zero for far too long while injecting trillions into various asset bubbles, have been the key driver of the deficit, with the Federal Reserve boosting its benchmark rate by 5% since it began hiking in March last year. Five-year Treasury yields are now about 3.96%, versus 1.35% at the start of last year. As lower-yielding securities mature, the Treasury faces steady increases in the rates it pays on outstanding debt: that’s right – even when the Fed starts cutting rates, due to the delay of rolling over maturing debt, actual interest payments will keep rising for the foreseeable future.

For context, the weighted average interest for total outstanding debt at the end of June was only 2.76%, a level that’s not been surpassed since January 2012, according to the Treasury. That’s up from 1.80% a year before, the department’s data show, and if the Fed indeed keeps rates “higher for longer”, the blended rate on the debt will surpass 4% in one year.

That would be a complete disaster for the US, and it would mean that interest payments on total US debt of $32.3 trillion would hit $1.3 trillion within 12 months, potentially making interest on the debt the single biggest US government expenditure and surpassing social security!

But we don’t even have to wait that long until the exploding interest on US government debt becomes a major talking point ahead of the coming presidential elections. According to the St Louis Fed’s FRED and the BEA, the interest payments by the Federal Government have now surpassed $900 billion for the first time ever, and within a quarter will hit probably rise above $1 trillion, a historic benchmark that will probably begin the countdown to the US Minsky Moment.

One of the most incompetent puppets in the Biden admin (and there are countless), Treasury Secretary Janet Yellen, has played down concerns about higher rates. She has instead flagged that the ratio of interest payments to GDP, after adjustment for inflation, remains historically low. The problem with Yellen’s argument is that GDP will crater after the next recession (which will also spark the next financial crisis, one which Yellen will not live to see), but US debt will never again drop in either absolute or relative terms, as the good folks at the CBO have been so kind to make clear to even such intellectual midgets as the former Fed chairwoman.

In short, the endgame has now arrived, and all the US can do now is rearrange the deck chairs .

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

So. Starving the beast DOES work! There it is in black and white.

Make the unsustainable unmistakable! SHOW THEM.

There are certain articles on ZH that make me think, Ah Admin will post that. Invariably he does and it avoids giving the hated Tyler clicks. This one was a doosy.

TBP is the only place you can comment of ZH articles without getting banned.

I agree. ZH has no face or person, thus its either a jew-run operation or CIA or both. The articles on ZH are cherry-picked. There used to be some good commenters that offered useful links. Most are gone.

A trillion here, a trillion there – and soon we’re talking real money!

Pretty soon we’ll be talking about REAL money…LOL

Real money is made of gold, silvr, copper, and nickel, but mostly silver.

Paper money, a Federal Reserve Note, FRN, it’s called a Note because it’s a debt instrument whether made out of paper or digitally.

An FRN is not money, and it never has been.

It’s called sarcasm. My posts have already established that I know the difference.

Stop whining get out there and work 2 or 3 extra jobs and pay your fair share you dumb white mother fuckers.The shaniquas of the world are counting on you

More significantly, giant corporations and moguls are counting on you. Be sure to serve in their armies and bureaucracies, too, so they may maintain the lifestyles to which we’ve enabled them by our passive, insouciant compliance.

Sachwerte! Sachwerte! Get your Sachwerte here!

This is interest on money “borrowed” from the federal reserve. Cancel the fed reserve and pay them costs associated with their ponzi, and nothing more. This debt (and interest) can be cancelled tomorrow and the jews drop-kicked to Iran. Enough said. Wake up americans. Take charge from these insane evil psychopaths. Remove your consent

since mccarty shoved the budget deal thru a couple of months back we’ve added nearly a trillion more in debt —