It’s getting more and more difficult to write with interest about the challenges the world economy is currently facing. Not because there’s a shortage of interesting things to write about — wars, sanctions, failed money-printing experiments, the list is long — but rather because most of the negative news and major world events we see around us are symptoms of the disease, not the disease itself.

There are only so many times you can describe the disease, before it becomes too repetitive for both the writer and the reader. Instead, I find it far more interesting to focus on the root causes, because then real solutions can be explored that offer the possibility of actual remedy.

So let’s start here, with a simple grounding in the facts as we know them. No spin, no agenda; just some numbers.

Demographics

There are approximately 7.2 billion humans on the planet, and consensus estimates put that number at 9.6 billion by 2050. Over the same time period in the U.S., people aged 65 and older will increase from 46 million currently to 84 million, a 82% increase, while the entire U.S. population is projected to swell from its current 319 million to 400 million, a 25% increase.

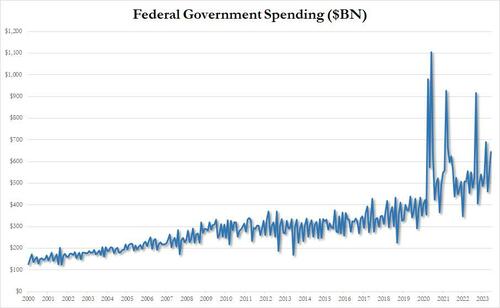

Debts

Next, the net present value of the actual liabilities of the US federal government are somewhere between $69 trillion and more than $200 trillion depending on whether you prefer the Treasury as your source or the CBO.

The real fiscal deficit of the U.S. government, as opposed to what was reported, was just over $1 trillion in FY 2014 (as measured by the actual increase in the federal debt).

When your debts and liabilities are increasing at several multiples of your income growth, you have a math problem that sooner or later will catch up with you.

The only nonpainful way out of such a math bind is to reverse the situation and grow our income faster than our debts and liabilities. The painful way involves either a hard default or a stealth default via inflation. Let’s assume we all wish to avoid the painful route.

This means we have to ask some hard questions. What will be the engines of all that future growth? Why has growth been so difficult to come by of late? What if the hoped-for future growth doesn’t materialize? Even worse, what if we get a sustained period of negative growth? Then what?

Here’s where things get sticky.

Energy production

One of the more solid economic correlations we know of is that between a growing economy and growing energy usage. And oil is one of the main factors in this relationship, if not the key factor. For now, the U.S. is enjoying a resurgent period of oil production thanks to shale (or “tight”) oil. The U.S. can use that energy to grow its economy, or we can export it to other countries so they can grow theirs.

Now, let’s widen our view back out to 2050. Where is the U.S. tight oil story then? Well, according to the Energy Information Administration, it will be 31 years in the rearview mirror, as the EIA projects that U.S. tight oil production will peak in 2019. That’s right, in just five short years from now, the U.S. “shale oil miracle” will start becoming a historical artifact.

On top of that, virtually every single oil reservoir in the world currently in production will be in decline by 2050. Perhaps we’ll find additional oil under the Arctic, or in ultra-deep ocean deposits, or in even tighter rock formations, but it won’t be cheap oil —- the sort that we rely on to drive economic expansion.

These trends in oil, debt and demographics are stark all on their own, but together they are staggering.

And if we then tie them to the obvious ecological strains of meeting the needs of 7.2 billion souls (let alone the 9.6 billion by 2050), any adherence to the status quo seems worse than delusional. For example, since 1970, overall world wildlife populations have been reduced by 40% (land and sea) to 70% (river). Perhaps it’s time plot our course a bit more carefully, before those losses approach 100%.

The disease

The disease then is our blind adherence to growth at any cost. Its symptoms are the limits we are bumping into with increasing frequency along the way. They’re more numerous today than before the world’s central banks began their grand global money printing experiment and yet, like a quack doctor prescribing more Vicodin to mask a serious underlying malady, the central planners and their political overseers refuse to reconsider the situation.

As economist Herb Stein once said, “if something cannot go on forever, it will stop.” Someday, perhaps soon, the inexorable logic of simple math will force wrenching changes upon those who refuse to change on their own.

Which brings me to the title of this piece: Ready or Not. The unsustainable status quo will end, likely sooner than we want, whether we are prepared for it to or not.