Authored by Ray Dalio via LinkedIn.com,

I say these things because:

- Money is free for those who are creditworthy because the investors who are giving it to them are willing to get back less than they give. More specifically investors lending to those who are creditworthy will accept very low or negative interest rates and won’t require having their principal paid back for the foreseeable future. They are doing this because they have an enormous amount of money to invest that has been, and continues to be, pushed on them by central banks that are buying financial assets in their futile attempts to push economic activity and inflation up.

The reason that this money that is being pushed on investors isn’t pushing growth and inflation much higher is that the investors who are getting it want to invest it rather than spend it. This dynamic is creating a “pushing on a string” dynamic that has happened many times before in history (though not in our lifetimes) and was thoroughly explained in my book Principles for Navigating Big Debt Crises. As a result of this dynamic, the prices of financial assets have gone way up and the future expected returns have gone way down while economic growth and inflation remain sluggish. Those big price rises and the resulting low expected returns are not just true for bonds; they are equally true for equities, private equity, and venture capital, though these assets’ low expected returns are not as apparent as they are for bond investments because these equity-like investments don’t have stated returns the way bonds do. As a result, their expected returns are left to investors’ imaginations. Because investors have so much money to invest and because of past success stories of stocks of revolutionary technology companies doing so well, more companies than at any time since the dot-com bubble don’t have to make profits or even have clear paths to making profits to sell their stock because they can instead sell their dreams to those investors who are flush with money and borrowing power. There is now so much money wanting to buy these dreams that in some cases venture capital investors are pushing money onto startups that don’t want more money because they already have more than enough; but the investors are threatening to harm these companies by providing enormous support to their startup competitors if they don’t take the money. This pushing of money onto investors is understandable because these investment managers, especially venture capital and private equity investment managers, now have large piles of committed and uninvested cash that they need to invest in order to meet their promises to their clients and collect their fees.

- At the same time, large government deficits exist and will almost certainly increase substantially, which will require huge amounts of more debt to be sold by governments—amounts that cannot naturally be absorbed without driving up interest rates at a time when an interest rate rise would be devastating for markets and economies because the world is so leveraged long. Where will the money come from to buy these bonds and fund these deficits? It will almost certainly come from central banks, which will buy the debt that is produced with freshly printed money. This whole dynamic in which sound finance is being thrown out the window will continue and probably accelerate, especially in the reserve currency countries and their currencies—i.e., in the US, Europe, and Japan, and in the dollar, euro, and yen.

- At the same time, pension and healthcare liability payments will increasingly be coming due while many of those who are obligated to pay them don’t have enough money to meet their obligations. Right now many pension funds that have investments that are intended to meet their pension obligations use assumed returns that are agreed to with their regulators. They are typically much higher (around 7%) than the market returns that are built into the pricing and that are likely to be produced. As a result, many of those who have the obligations to deliver the money to pay these pensions are unlikely to have enough money to meet their obligations. Those who are recipients of these benefits and expecting these commitments to be adhered to are typically teachers and other government employees who are also being squeezed by budget cuts. They are unlikely to quietly accept having their benefits cut. While pension obligations at least have some funding, most healthcare obligations are funded on a pay-as-you-go basis, and because of the shifting demographics in which fewer earners are having to support a larger population of baby boomers needing healthcare, there isn’t enough money to fund these obligations either. Since there isn’t enough money to fund these pension and healthcare obligations, there will likely be an ugly battle to determine how much of the gap will be bridged by 1) cutting benefits, 2) raising taxes, and 3) printing money (which would have to be done at the federal level and pass to those at the state level who need it). This will exacerbate the wealth gap battle. While none of these three paths are good, printing money is the easiest path because it is the most hidden way of creating a wealth transfer and it tends to make asset prices rise. After all, debt and other financial obligations that are denominated in the amount of money owed only require the debtors to deliver money; because there are no limitations made on the amounts of money that can be printed or the value of that money, it is the easiest path. The big risk of this path is that it threatens the viability of the three major world reserve currencies as viable storeholds of wealth. At the same time, if policy makers can’t monetize these obligations, then the rich/poor battle over how much expenses should be cut and how much taxes should be raised will be much worse. As a result rich capitalists will increasingly move to places in which the wealth gaps and conflicts are less severe and government officials in those losing these big tax payers will increasingly try to find ways to trap them.

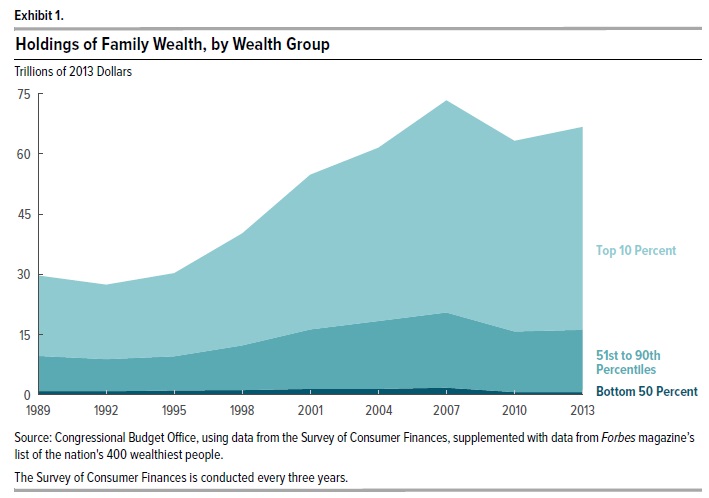

- At the same time as money is essentially free for those who have money and creditworthiness, it is essentially unavailable to those who don’t have money and creditworthiness, which contributes to the rising wealth, opportunity, and political gaps. Also contributing to these gaps are the technological advances that investors and the entrepreneurs that I previously mentioned are excited by in the ways I described, and that also replace workers with machines. Because the “trickle-down” process of having money at the top trickle down to workers and others by improving their earnings and creditworthiness is not working, the system of making capitalism work well for most people is broken.

This set of circumstances is unsustainable and certainly can no longer be pushed as it has been pushed since 2008. That is why I believe that the world is approaching a big paradigm shift.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

This whole scheme has gone on long enough. I for one am cheering this collapse on. Yes I understand things could get really ugly, many will suffer, and many will perish. Is life worth living as a slave? Many believe they have wealth because of all the digits in their bank account or the all the stocks and bonds they think they own. I say at this point in time this is nothing more than the carrot dangling from a stick and we all know the animal being led on by that never actually gets it. I am hopeful that on the other side of this a better world can be rebuilt.

You’re not a slave.

You are light years ahead shit hole dwellers around the world and still have plenty of mental tools available to improve your lot in life.

Communist cretins do not have those tools.

You do… or ought to!

“None are more hopelessly enslaved than those who falsely believe they are free.”~ Johann von Goethe

https://www.zerohedge.com/personal-finance/watch-you-are-slave-property-corporation-called-united-states-america

You sir are correct. I am not a slave. Many people around the world are in situations where there are very few differences between their situation and a slave. However the trend has certainly been we get more and more taken from us by those who do not produce or provide anything at all. Death by 1000 paper cuts. I simply see no solution other than to batten down the hatches and hope once the storm resides there is the possibility to improve the situation.

Slaves maybe not, but indentured servants for sure!

Let this sink in for a moment!

ALL U.S. Dollars printed by the FED come into the system as a debt to “We the People!”

TRY and WRAP your HEAD around that one!

At least with slavery owners paid large upfront costs to acquire the slave. They had incentive to keep him healthy. Nowadays when your slave gets sick you just fire him and get another, nice!

Agreed. Just hope the system runs long enough for me to finish my greenhouse project. Once that is up and running, Phooey to Them.

FEDZILLA and the NANNY STATE have an answer for everything you can dream up.

Hey Ray, instead of leading with “I say these things because: Money is free…” just say “I say these things because: Money is fake…”

Then you could skip the article and people would leave smarter than when they arrived.

I like Mike Maloney’s definition of money. It’s everything currency is and its a store of value. Whenever I read this articles I have to substitute ‘currency’ in place of ‘money’.

Is a chicken money? Well it does have intrinsic value, but is not divisible(unless you cook it), and does not hold its value indefinately(that chicken is going to die someday, and when they get to old they can be tough eating). Is paper with a picture of some dead dude and some numbers on it that a bank wished into existence money? Well I guess chickens make better money than paper currency and although chickens do get old and die they can pay dividends(eggs) and reproduce.

For the record, I have said 2 things over the last 10 years.

1) Wealth/income inequality is the #1 issue plaguing America.

2) Good or bad, like it or not, right or wrong income/wealth inequality, if it gets bad enough, creates big problems. Big problems.

Do you think that is why the idea of Jubilee came into popularity. (not to invoke the J word, but it is interesting.)

Yes. If you want a small cadre of people in charge of a monetary system, you must have jubilee. For me to explain why, I would need to sit down and write an essay (maybe I will do that this weekend). Without jubilee, you have what we have now…growing discontent among economic participants/citizens and imperialism. The best answer I can come up with is complete currency creation/competing currencies. We kind of have competing currencies but, not really. The $ is king still(?). The SDR will take over(?). How will the SDR evolve? It will be fiat controlled by a cadre. No good imo.

Jubilee or complete freedom regarding currency creation.

wip,

wealth inequality is a problem & what is making it so bad is that it is becoming tougher 4 the “little guy” to succeed in comparison to previous times in history–

when people believe that the future is bleaker 4 them & their kids they are more willing to believe populist,sometimes rational rhetoric–

Wealth inequality has always been here with us, and it always will be.. That’s the way it is.. If you want socialism ( which is even worse wealth inequality) then vote for it..

nkit,

i agree with you but what do we do to fix the inequality?

how do we sell it to the voters?

Red..

I don’t think they can be sold anymore. They have been so deliberately Dis and Mal educated they’ll fall for Bernie and Pokeyhauntus.

Nkit,

Since 2007/2008 the wealth gap between the upper one percent and the bottom 90% has grown to its greatest margin in history.

This one breaks it down even further

Thanks. I’ll look forward to that essay…

We are about to get a big push towards utter poverty Bangladesh style.

China is preparing to announce that they have 20,000 tons of gold in storage and are releasing a gold backed crypto to go along with the Russian/Chinese swift system for interbank settlements. The dollar, Yen and Euro will collapse overnight.

Before you tell me how it would destroy their own economy, do some research. We are destroying their economies as we speak. Any remaining dollars they are stuck with are a lean on our land and resources and people. People will be demanding that the Chinese Pharaoh by them as slaves so they can eat.

Of course the big banks will be in on it but that doesn’t change the results. Shanghai and London will be the new financial centers. Remember you heard it here first.

Is this what we have in our future?

“The stories began to appear in the Soviet press in the autumn of 1921, each one more gruesome than the last. There was the woman who refused to let go of her dead husband’s body. “We won’t give him up,” she screamed when the authorities came to take it away. “We’ll eat him ourselves, he’s ours!” There was the cemetery where a gang of 12 ravenous men and women dug up the corpse of a recently deceased man and devoured his cold flesh on the spot. ”

https://airmail.news/issues/2019-11-2/how-to-serve-man

Lord have mercy on us.

Mary.

Amen.

Allow me to repeat something about the bolshies.

It cannot be overstated. Bolshevisim committed the greatest human slaughter of all time.

The fact that most of the world is ignorant and uncarring about this enormous crime is proof that the global media is in the hands of the perpetuators. Solzhemitsyn.

I think you meant hands of the Perpetrators, but I think Perpetuators works equally well.

good catch.

I’ve read some of the stories about what happened in Estonia and Lithuania. I cannot imagine the horror they faced.

By the way, I haven’t sent an email. Shit happens and delays us, as you know. I picked the novena this time in a freak way. My friend asked (I picked Mary, Undoer of Knots last time) and I had just heard Hey Jude played not long before and said “What’s old St. Jude got for prayers?”

Turns out St. Jude is the Novena one prays for Lost Causes.

“Saint Jude is the patron of Hopeless Causes and Desperate Situations.

Pray these novena prayers to Saint Jude with confidence.

Catholics have relied on his intercession in times of extreme need for centuries. This Apostle and Martyr has helped countless souls through his epistle in the New Testament and his intercessions on behalf of those who seek his aid in times of trial. Pray this novena for your intentions asking St. Jude to intercede to God the Father, His Son Jesus Christ and the Holy Spirit on your behalf.

St. Jude Answers Prayers!

Here is a testimony about one example of St. Jude answering prayers for someone who prays with us here at strong >PrayMoreNovenas.com: “[My son] had a hard time and struggled, but I believe that God heard my prayers to St. Jude asking for my son to be successful — and the prayers were answered. My son passed all his exams and worked his way up from the lowest position in a hotel and today he is General Manager of this hotel. As a little boy, he had dyslexia and so school was not an easy road for him but with constant prayers to St. Jude, he succeeded.” – Annabella

Read more at: https://www.praymorenovenas.com/st-jude-novena

St. Jude is very powerful, even over dyslexia.

Your name is on the bead counting maniac’s list. Of course, since the Hail Mary is part of the ritual, your name is on EVERY bead counter’s list.

Blessings. I’m up at midnight baking bread… seriously. I’ll

take a photo and upload it.

Am back… bread is done. House smells awesome.

This is why I’m baking bread at midnight

… I married that guy and he just goes and goes and goes. That is the barn, mind you. That is the primer over texture.

Not, not a weirdo of walmart… just showing you the guy that makes it all happen around here. (He doesn’t like sprayers. They splatter. It’s a barn turned workshop.)

M G

You and your husband are pretty darn awesome. You go girl.

I married well. The second time, anyway.

We decided to paint it a pale lemon yellow. When I say “we” I mean Nick.

Day 17 of 54. St. Jude, intercede for us all.

lien, skinny…

Flea,

The Gold has been flowing West to East for a long time and everyone knows it.

Who knows what is really in Ft. Knox…the recent PR visit proved absolutely nothing. Matter of fact if it all was really there why wouldn’t they just show it and stop all the rumors?

The IMF is moving to China and the SDR will be the lender of last resort after TSHTF.

https://www.reuters.com/article/us-imf-china-lagarde-idUSKBN1A922L

The other angle to the dangle is we (the US) is MIA when it comes to prophecy and that could be because your post comes to pass.

Mark.

The fort knox pics could be fakes as well. Iv’e been telling anyone who would listen about the move to china. Rothchilds and all.

My first time reading Revelations, the absence of the U.S. jumped right out at me. Mary just posted something on the cannibalism in Russia in 1921. I can see more than a few americans doing that. I say it with sadness.

One of my favorite authors.

https://www.youtube.com/watch?v=S37N8McqpWY

I watched a piece by him earlier today… I’ll book mark this one to make sure I’ve seen it. I feel like there are not enough hours in the day to do what we need to get done.

Blessings to you and yours… I believe in God even when He is silent.

His book The Creature from Jekyll Island is in its 5th printing and has topped a million sales, if I could wave a magic reading wand, and every American read it we could get this revolution on the road and start hanging Banksters.

However, he understands Joe Sixpack – and that is our most serious problem the sheeple people.

He gave Hunter (who I like) a run for his money when it came to who Trump could really be and they played tennis with the ‘controlled opposition’ ball for an interesting exchange.

The interview fits this thread.

Blessings back at you.

The Silence of God

Find a worthy young adult in your life and make them listen and understand this video interview.

Explain whatever part of it they might not understand.

Once the lesson is learned, present them with two presents, for their attendance and study.

1. A 1 oz. Silver Eagle or Maple Leaf, and

2. A good, book, similar to Griffin’s.

And leave them with an open invitation to learn more lessons, if so inspired, by returning to you as teacher, for additional advice and study.

But stress to them that time is running short, and it’d be foolish to delay.

Augee,

I have about 20 family and friends I have been working on for years about PMs, another 25 on politics. Know of at least five of the 20 who have listened. I will send each one of them this vid and a message.

I will post a letter I’m mailing to my 8 year old grandson under this in a minute. Its a bit over his head, but its intended to be. Its also intended to open his parents eyes.

He owns some silver I have given him, and there is a serious PM stash set aside for him he doesn’t know about yet. I defiantly want him educated on ‘money’ ASAP.

For me, some version of a 1 oz., for each youngster in the extended family, held for safekeeping by their parents at Christmas season dinner celebrations.

I’ve presented Eagles, Leafs, Peace, Morgans, and Pandas.

Better than a savings bond, and way better than toys or clothing.

Good books for the younguns to be able to understand money theory and savings would be good, too.

I’ve gifted George S. Clason’s ‘The Richest Man in Babylon” to a few HS grads, with a good bookmarker that explains Maturity.

Too deep, though for pre teens.

Augee,

This is going out to my grandson today. (I also want his parents to read it).

Big Boy,

Keep this letter, as you get older re-read it as I want to pass on to you some history, truths, and facts about Gold and Silver.

Seeing how you are accumulating some Silver Coins I want to explain their value as money and how both Gold and Silver has been a store of wealth throughout history.

There is a take on an old saying I like:

Gold is the money of Kings

Silver is the money of Gentlemen

Barter is the money of Peasants

And

Debt is the money of Serfs and Slaves

GOLD

Gold and silver have occupied a unique social status for thousands of years. Both have a long history as valuable money and their history is far from over.

From the ancient Egyptians to the modern U.S. Treasury, there are few metals that have had such an influential role in human history as gold and silver.

Gold and silver are mentioned in the Bible many times. In Genesis 2:10-12 (the very beginning of God’s book) it describes the lands of Havilah, near Eden, as a place where good gold can be found.

There’s one common trend across all ancient civilizations: gold is a status symbol used to separate one class from another. From emperors and kings to skilled engineers and corporate managers (like your Father and Mother) to the extreme wealthy and upper middle class, those who held gold also tended to have generational wealth and hold power and most important to me, they had independence to live how they wanted to.

1792 – THE UNITED STATES ADOPTS A GOLD AND SILVER STANDARD

In 1792, the United States Congress made a decision that would change the modern history of gold and silver. Congress passed the Mint and Coinage Act. This Act established a fixed price of gold in terms of U.S. dollars. Gold and silver coins became legal tender in the United States, as did the Spanish Real (a silver coin of the Spanish Empire).

At the time, gold was worth approximately 15 times more than silver.

This ratio of 15 ounces of silver being worth one ounce of gold, had been the traditional ratio throughout most of history. I will say more about that later on in this letter.

Silver was used for small denomination purchases while gold was used for large denominations and large purchases. Silver was used for day to day transactions, like going to the market and buying food, and Gold for storing wealth and big transactions like buying horses or lumber to build a house or even a house or a farm (like mine and your grandmother’s).

The U.S. mint was legally required to buy and sell gold and silver at a rate of 15 parts silver to 1 part gold. As a result, the market rate for gold rarely varied beyond that range.

That ratio would change after the Civil War. During the Civil War, the U.S. was unable to pay off all its debts using gold or silver, it didn’t have enough of both. In 1862, paper money (its also called fiat – that means it is just paper) was declared to be legal tender, marking the first time a fiat currency (paper like the dollar – not convertible on demand at a fixed rate) was used as an official currency in the United States. (I know that is complicated but you will figure it out when you get older).

Remember this: Paper money like the dollar is call ‘currency’. Gold and silver are considered ‘money’. As you get older I believe these differences will become important.

Just a few years later, silver was officially removed from the U.S. Mint’s fixed rate system in a bill called the Coinage act of 1873 (and criticized by American citizens as the Crime of ’73 and I believe it was a terrible thing to do). This removed the silver dollar from circulation, although coins worth less than $1 still contained silver.

The United States would never use silver dollars again. Throughout the late 1800s, the issue remained an important political topic. In 1900, the gold dollar was declared to be the standard unit of account in the United States and paper dollars were issued to represent the country’s gold reserves.

1870S GOLD RUSHES

A number of gold rushes occurred throughout the 1800s. Since a single gold nugget could make someone a millionaire, prospectors rushed to far-flung corners of the planet in search of riches

Notable gold rushes included:

• North Carolina (1799): The first major gold rush in America occurred in 1799 in North Carolina, when a young boy discovered a massive 17 pound gold nugget in Cabarrus County. Not too far from where we live!

• California (1848): The San Francisco 49ers football team is famously named after the gold rush of 1848/49 in California. Prospectors came from across the world to San Francisco. Before 1848, only about 1,000 people lived in San Francisco then. Within two years of gold being discovered in the region, the population had swelled to 25,000. There were so many recent migrants to San Francisco, in fact, that the massive San Francisco harbor was filled with empty ships. Nobody wanted to sail away from the bustling boom town!

• Klondike (1896): Gold was discovered in the Klondike River in the Yukon Territory and in other parts of British Columbia. Prospectors travelled far north and fought harsh winters to claim their fortune in the land of the midnight sun.

• Australia (1850s onward): Australia hosted a number of major gold rushes throughout the latter half of the 19th century. Gold was discovered in New South Wales and Victoria in the 1850s and in Western Australia in the 1890s. Gold rushes helped to populate empty areas of the Australian Outback. Towns throughout Australia owe their existence to the gold rushes of the 1800s.

1944 – BRETTON WOODS PEGS THE GLOBAL PRICE OF GOLD

Here is more history you will probably won’t be learning in school. The two World Wars wreaked havoc on the gold standard and world financial markets. Of course, it didn’t help matters that the Great Depression occurred in between those two wars. (This is a history lesson as well as Gold & Silver lesson, your Father can fill you in on the details).

After decades of war and conflict, world leaders came together under the Bretton Woods Agreements. This system created a gold exchange standard where the price of gold was fixed to the U.S. dollar. This was a radical experiment that had never been done before and it made the United States very powerful on the world’s markets.

The U.S. dollar was chosen for the Bretton Woods system because the United States was easily the world’s strongest economy coming out of the Second World War. Unlike previously strong European nations, the United States did not have to rebuild its cities that had been bombarded throughout World War 2.

The day the price of gold was pegged to the U.S. dollar is one of the most important points of U.S. history because it helped make the United States the global superpower it is today. I will tell you more about that as you get older.

1970S – GOLD STANDARD ENDS WITH THE VIETNAM WAR

In 1944, gold was fixed at $35 per ounce for the foreseeable future. In the early 1970s, another war – the Vietnam War (that’s the one I fought in) – caused the gold exchange standard to collapse. America’s budget was in ruin and in 1971, President Nixon suddenly decided to end the Bretton Woods system with a moment known in history as the Nixon Shock. (I was just 21 then, four years before I met Honey, and before your Mom was even born).

Between 1971 and 1976, a number of attempts were made to salvage the gold standard. However, the price of gold continued to rise beyond what any currency could sustain.

That’s why many gold pricing charts begin around 1970. Between 1970 and 1971, the price of gold was relatively flat before skyrocketing to a record high of $800+ an ounce in 1980. If you were to look at a gold pricing chart from the 1940s to 1970s, it would be a flat line of $35 per ounce, which is why you don’t see too many gold pricing charts that extend before 1970.

PRESENT DAY – NO COUNTRIES IN THE WORLD USE A GOLD STANDARD

As of 2019, no countries in the world use a gold standard. In other words, no paper currency (or fait – including the dollar) in the world is backed by gold.

Of course, that doesn’t mean that countries have sold all their gold or that their currencies are based on nothing. Most countries in the world maintain large gold reserves in order to defend their currency against possible future emergencies.

America’s gold reserves are famously held at Fort Knox, Kentucky. The heavily-defended location holds an unknown amount of gold, as the amount is officially classified by the United States government. However, it’s widely accepted that the United States holds more gold bullion than any other country in the world (approximately 1.3 times as much gold as the next leading country, Germany). I do not know if that is really true…we will see.

MODERN DAY – GOLD INVESTMENT RISES

Gold has been seen as a smart investment for thousands of years. However, the use of gold as an investment became hugely popular after the end of the Bretton Woods system in 1971.

Since the 1970s, the price of gold has steadily increased. In 1970, gold was pegged at $35 per ounce. In August 2011, that number had risen to nearly $2000 per ounce. However, the years in between were not a smooth upward slope and gold –it has gone through a number of ups and downs over the past few decades.

When looking at gold investment charts, it’s important to recognize inflation. Some charts show the price of gold as virtually a straight line from the bottom left corner of the graph to the top right corner.

However, the price of gold has experienced two major spikes since the 1970s: once in 1980 and the other in 2011.

By carefully weighing all of this information and current trends, you can build an accurate view of the present value and future value of gold.

2000s and 2010s – Gold in modern times

Over the past two decades (a decade is 10 years) gold has gone through a number of major changes. August 1999 was a landmark moment in the price of gold as it dropped to a price of $251.70 per ounce. I knew that was a great time to buy some Gold, and I did!

This occurred after central banks around the world were rumored to be reducing their gold bullion reserves and at the same time, mining companies were selling gold in forward markets.

By February 2003, outlook on gold had reversed. Many viewed gold as a safe-haven after the U.S. invasion of Iraq in 2003.

Geopolitical tensions between 2003 and 2008 continued to raise the price of gold. And in 2008, the global economic crisis (it is called the Great Recession) increased the price of gold even further. After reaching a high of over $1,900 per ounce in 2011, gold has fallen to between $1,200 to $1,400 in recent years. But, then in 2019 it started rising again and as I write this it is worth over $1,500 an ounce.

Many people believe Gold and Silver are going to continue to rise in value and I am one of them.

WHY IS GOLD VALUABLE?

This simple question comes with a complex answer. There’s no single reason why gold has been seen as valuable money throughout all of human history.

REASONS WHY THE PRICE OF GOLD IS HIGH INCLUDE:

• Scarcity: Gold is difficult to find and mine in the real world. In the late 1800s, any town with a single gold nugget was instantly transformed into a gold rush town. Today, only about 2,000 tons of gold are created per year. To put that number into perspective, about 10,500 tons of steel are produced in the United States every hour.

• Physical characteristics: Gold has some phenomenal physical characteristics – especially when used in electrical applications. It’s an excellent conductor, for example. Furthermore, no metal is more malleable than gold. That means that just a small bit of gold can be hammered into many smaller sheets. In fact, one ounce of gold can be stretched to form a wire that is 50 miles long. Gold plated copper wire sounds expensive but it only requires one ounce of gold to plate a 1,000 mile long thread of copper.

• Aesthetic attributes: One of the simplest reasons why gold is valuable is that it looks cool. Over time, rulers have loved displaying gold in throne rooms, tombs, and on top of Egyptian pyramids. Its unique coloring and luster have fascinated humans for thousands of years.

• Wealth storage: The times when gold has increased in value are almost always coupled with extreme economic circumstances. These extreme circumstances cause people to lose faith in their country’s paper currency (like the dollar) and buy a more concrete form of wealth: gold. Gold is seen to be a good wealth storage tool around the world. That is one of the major reasons I like it, and want you to understand that fact about it.

WHY IS SILVER VALUABLE?

Silver (like gold) is a precious metal and therefore is widely known to be valuable. When examining silver it’s easy to see why silver is valuable, it’s all about the many uses which silver has, these include:

• Investment asset – silver is widely used as an investment asset, both for making silver coins and bars

• Use in medicine – silver has very high anti-microbial qualities and therefore is used in medicine for wound dressings and treatment of infections

• Solar panel industry – tapping into solar energy is an important part of green energy initiatives. It’s therefore interesting to know that due to its reflective qualities silver is used in photovoltaic cells within solar panels. This creates a very high demand for silver worldwide

• Use in electrical components – silver has very high levels of conductivity, which is why it is so actively used in many electrical components. Often copper is used as a cheaper alternative, but for some applications, even with a higher price, silver is preferred.

The above just gives a flavor of the uses of silver. There are other uses too. What’s important to remember that the price of a ‘commodity is all about supply vs demand’.

Due to the high demands for silver worldwide, which exceeds mining production – many Analysts are predicting a rise in the price of silver in the years to come.

I believe there is more potential for silver to rise in value than gold.

Today the ratio of silver to golds is over 80 to 1…so it takes 80 ounces of silver to be worth one ounce of gold. That ratio historically is usually 15 to

one. One day the 15 to 1 ratio will return and the value of silver will skyrocket.

Today the ratio of silver to golds is well over 80 to 1…so it takes 80 ounces of silver to be worth one ounce of gold. That ratio historically is usually 15 to one. One day the 15 to 1 ratio will return and the value of silver will skyrocket.

OK Big Boy, keep this letter and as you get older re-read it. I put a copy in your ‘Legacy’ trunk in the Little House, it’s with my prayer journals…those are for you to, someday.

Love,

Dad-Doo

XXXOOO

oops can’t edit out the repeat paragraph.

I’m having all kinds of problems with my BRAVE browser on TBP, can’t comment or vote but can read?

That has been happening to me as well Mark! Beyond F ing frustrating to say the least! Especially when a good conversation was going on with Flea yesterday on the LLPOH thread.

Plato.

At 400+ comments it was getting hard to converse anyway.

Flea,

So true but lots of nuggets of knowledge and wisdom there. Hope others take the time and deal with the frustration to learn themselves something and expand their worldviews.

Mark,

FYI, after you mentioned your web browser Brave was giving you the same problems, I decided to uninstall Brave on my phone then download it again from the APP store and installed it. So far so good. It seems to be allowing me to actually post replies or give thumbs up or thumbs down now.

+100.

I love it. With your permission, may I copy, paste and print to accompany my gifts this holiday?

Nit picking, but maybe worthy of addition:

-1913 and its importance to the story re: Fiat;

-FDRs confiscation at $20, then reprice to $35.

-the modern trend of movement in bullion purchases, from West to East; i.e., Russia & China stockpiling.

Nevertheless, a fantastic keepsake read, for those you’d wish to educate. Well done.

Bravo.

Yea man…I also have set aside some key books for him that cover everything, but I know he (and his parents) will read the letters.

I have more being drafted.

Mark.

Allow me to add one more item.

If as Lynette Zang said yesterday, that the dollar is now .04 cents of the 1913 dollar. What does that say about how high silver has to go to even out!

When the price begins finding it’s true roots. Nobody will touch dollars with somebody elses hands and nobody will sell PM’s without a swat team in their living room. It will be like hearing the door of the Ark closing

FWIW, Dahlmer said human tastes like filet. Might not be so bad if you get a moderately healthy one that isn’t all fatty or all skin and bones or all lean and gristly from working out too much.

They might get enough broth out of me for soup like an old rooster.

I’m stunned by what an incredible “Insider’s Expose” this is. So much money in the system that startups that are flush and don’t want anymore are being threatened that the money they don’t want will be given to their competitors. Let that sink in. I knew it was bad but I had no idea that it was this over the top. By any metric this is seriously frightening.

There are millions of people who are expecting payouts they will unfortunately never receive. At the same time they are expected to pay more for these benefits they will never recieve.

What could go wrong?