The Founding Fathers described the kind of country they were shaping on July 4, 1776 with the most well known sentence in the English language:

We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty and the pursuit of Happiness. – Declaration of Independence

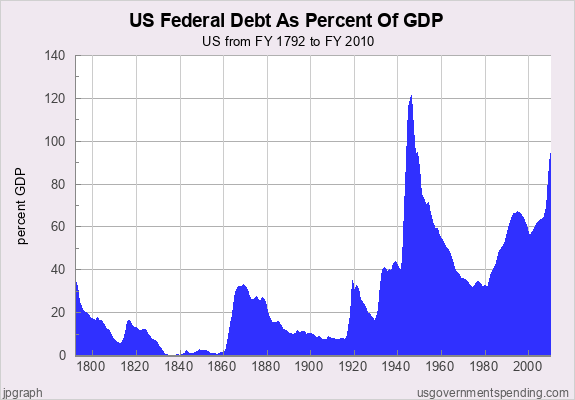

In 1776, America was an idea born of noble intentions. An idea that every citizen had the opportunity to succeed, prosper and achieve based upon their hard work and abilities. The government did not provide advantages or a safety net for its citizens. People were free to succeed or fail based upon their own merits. America had a frontier spirit because it was still a frontier. Individual effort, intellect and willingness to sweat allowed you to move up the socio-economic ladder. The government provided a National Defense, and very little else. In 1794, the country had a population of 4.4 million and a GDP of $310 million. Government spending totaled $7.1 million, or 2.3% of GDP, and was split between Defense and interest on the Revolutionary War debt. Today, Federal Government spending totals $3.7 trillion, or 25% of GDP.

James Truslow Adams in his 1931 Epic of America described the America that once existed in reality, but only exists as a phantom today:

“The American Dream is that dream of a land in which life should be better and richer and fuller for every man, with opportunity for each according to ability or achievement. It is a difficult dream for the European upper classes to interpret adequately, also too many of us ourselves have grown weary and mistrustful of it. It is not a dream of motor cars and high wages merely, but a dream of social order in which each man and each woman shall be able to attain to the fullest stature of which they are innately capable, and be recognized by others for what they are, regardless of the fortuitous circumstances of birth or position.”

“The American Dream that has lured tens of millions of all nations to our shores in the past century has not been a dream of material plenty, though that has doubtlessly counted heavily. It has been a dream of being able to grow to fullest development as a man and woman, unhampered by the barriers which had slowly been erected in the older civilizations, unrepressed by social orders which had developed for the benefit of classes rather than for the simple human being of any and every class.” – James Truslow Adams – Epic of America

His assessment of the American Dream was made in 1931. He saw signs that the American Dream had begun to die. He was right. The American Dream began to develop a terminal illness in 1913 with the creation of the Federal Reserve and the passage of the 16th Amendment to the Constitution, creating a permanent income tax.

Song of the Century

Sing us a song of the century

It sings like American Eulogy

The dawn of my love and conspiracy

Forgotten hope and the class of 13

Tell me a story into that goodnight

Sing us a song for me – American Eulogy – Green Day

At the outset of the last century America was still a vital, free, growing country on the rise. The song of the century began as a joyous ballad and ended as a funeral dirge. The creation of a Central Bank, which could create inflation on demand, and allowing politicians the ability to buy votes through pork spending, paid for with ever increasing taxation, have sucked the life out of the American Dream. According to the Federal Reserve’s own website, their mandates were clear. Below are those mandates and an assessment of their success.

Conducting the nation’s monetary policy by influencing the monetary and credit conditions in the economy in pursuit of maximum employment, stable prices, and moderate long-term interest rates.

- Due to loose monetary policy in the 1920’s, the Federal Reserve created a stock bubble, a stock market crash of 89%, a decade long Great Depression, and unemployment of 25% in the 1930’s.

- Due to loose monetary policies in the 1970’s, the Federal Reserve created raging inflation that reached 14% in the early 1980’s and needed to raise interest rates to 18% in order to break the back of inflation, resulting in unemployment surging to 9.7% in 1982.

- Due to loose monetary policies in the early 2000’s, the Federal Reserve created the largest housing bubble in history, with the subsequent collapse bringing the financial system to within hours of collapse, and driving unemployment to 9.9% in 2009.

- Due to the loosest monetary policy in history, today, inflation has begun to rage across the globe, leading to riots, protests and bloody revolutions, with more on the way.

- The Federal Reserve has achieved their stable prices mandate by inflating away 96% of the purchasing power of the US dollar in less than 100 years. The price of gold continues to soar, as faith in the US dollar diminishes by the minute. I guess stability is in the eye of the beholder.

Supervising and regulating banking institutions to ensure the safety and soundness of the nation’s banking and financial system and to protect the credit rights of consumers.

- The Federal Reserve’s supervisory and regulatory expertise can be observed in the graph above. This graph doesn’t do the Fed justice, as it begins in 1934. Sixteen years after its origination, the Fed managed to let 10,000 out of 25,000 banks in the country fail between 1929 and 1932.

- Their glorious history also includes residing over the failure of 2,800 banks during the 1980’s S&L crisis.

- While protecting their mega-bank Wall Street masters, the Fed has allowed over 300 small banks to go under so far. There are 900 banks on the troubled list that will eventually meet their maker.

Maintaining the stability of the financial system and containing systemic risk that may arise in financial markets.

- Generally, maintaining the stability of the financial system and containing systematic risk doesn’t include allowing the worldwide financial system to come within hours of collapse as described by Rep. Paul Kanjorski:

“On Thursday [the 18th], at about 11 o’clock in the morning, the Federal Reserve noticed a tremendous drawdown of money market accounts in the United States to a tune of $550 billion being drawn out in a matter of an hour or two. The Treasury opened up its window to help. They pumped $105 billion into the system and quickly realized that they could not stem the tide. We were having an electronic run on the banks.

They decided to close the operation, close down the money accounts, and announce a guarantee of $250,000 per account so there wouldn’t be further panic and there. And that’s what actually happened. If they had not done that their estimation was that by two o’clock that afternoon, $5.5 trillion would have been drawn out of the money market system of the United States, would have collapsed the entire economy of the United States, and within 24 hours the world economy would have collapsed.

Now we talked at that time about what would have happened if that happened. It would have been the end of our economic system and our political system as we know it.”

Providing financial services to depository institutions, the U.S. government, and foreign official institutions, including playing a major role in operating the nation’s payments system.

- It seems this is the only mandate the Federal Reserve has taken seriously is providing services to its owners, the banks. Did the bankers and politicians that met on Jekyll Island to mastermind this Central Bank envision that those services would include: buying $1.5 trillion of toxic mortgages from the banks; allowing the mega-banks to borrow from the Fed at 0% and reinvest those funds at 2.5% risk free; pumping $600 billion directly into the stock market through their QE2 scam; allowing banks to falsely overstate the value of their mortgage and commercial loans; and never ever enforcing basic risk management regulations.

- While providing Wall Street banks with billions of unearned risk free profits, 0% interest rates further impoverish the savers and senior citizens of the country. The Federal Reserve has fulfilled their unstated mandate of enriching bankers at the expense of middle class Americans.

To strengthen U.S. standing in the world economy.

- The Federal Reserve’s affect on the world economy is best revealed in a pictorial tribute to their policies:

TUNISIA

ALGERIA

EGYPT

The Federal Reserve has not been alone in killing the American Dream. Politicians since 1913 have done their part in suffocating the dream. The tax code consisted of 400 pages in 1913 and tax rates ranged from 1% to 7%. In less than a century politicians of both parties have carved out 70,000 pages of payoffs, entitlements, and bribes for their contributors and constituents. Tax rates now range from 10% to 35%. Those 70,000 pages of rules, regulations and tax breaks do not benefit the average middle class American. They benefit those who had the money and power to buy off a Congressman.

The Federal Reserve and the US Tax Code bastardized the American Dream, created barriers to economic advancement, and supported the accumulation of wealth and power by a select few. The ruling elite have used their power and control over the media to convince the majority of Americans that the American Dream is about accumulating material possessions with debt. The American Dream no longer meant attaining the fullest measure of your capabilities, but living in the biggest McMansion, driving the nicest BMW, watching the biggest TV and wearing the latest fashions, all acquired with debt. America is dying.

Mass Hysteria

Red alert is the color of panic

Elevated to the point of static

Beating into the hearts of the fanatics

And the neighborhood’s a loaded gun

Idle thought lead to full-throttle screaming

And the welfare is asphyxiating

Mass confusion is all the new age and it’s creating a feeding ground for the bottom feeders of hysteria

Hysteria, mass hysteria!

Mass hysteria!

Mass hysteria!

Mass hysteria! – American Eulogy – Green Day

Green Day captures the essence of America since the turn of the century. The country has been in the throes of mass hysteria since 9/11. The once independent, self sufficient individualists that populated this country have become dependent, government reliant, quivering shadows of the frontiersmen that created this country. In the name of safety and security, the American people have allowed their government to accumulate complete control over every aspect of our lives. Only a country in the grip of mass hysteria would allow their leaders to run the National Debt from $5.8 trillion to $14.1 trillion in less than 10 years. Only a country in the clutches of mass hysteria could believe they could get rich by trading internet stocks and houses to a greater fool. Only a country seized by mass hysteria would allow its leaders to promote democracy at the point of a cruise missile as we continue to fight $3 trillion wars in the Middle East, while nearly tripling the amount spent on Defense to more than $1 trillion per year.

Defense Budget Breakdown for 2011

| Defense-related expenditure |

2011 Budget request & Mandatory spending |

Calculation |

| DOD spending |

$721.3 billion |

Base budget + “Overseas Contingency Operations” |

| FBI counter-terrorism |

$2.7 billion |

At least one-third FBI budget. |

| International Affairs |

$10.1–$54.2 billion |

At minimum, foreign arms sales. At most, entire State budget |

| Energy Department, defense-related |

$20.9 billion |

|

| Veterans Affairs |

$66.2 billion |

|

| Homeland Security |

$54.7 billion |

|

| NASA, satellites |

$3.4–$8.5 billion |

Between 20% and 50% of NASA’s total budget |

| Veterans pensions |

$58.4 billion |

|

| Other defense-related mandatory spending |

$7.5 billion |

|

| Interest on debt incurred in past wars |

$114.8–$454.2 billion |

Between 23% and 91% of total interest |

| Total Spending |

$1.060–$1.449 trillion |

|

If you had told someone on September 10, 2001 that ten years later America would be running $1.5 trillion annual deficits, fighting two wars of choice in countries that despise our presence, and had not only not addressed the $100 billion of unfunded welfare liabilities but added billions more with Medicare D and Obamacare, they would have thought you were a crazy doomster predicting the end of the world. They would have put you away in a padded cell if you had further predicted that politicians would cut taxes three separate times, that the Wall Street banks that leveraged themselves 40 to 1 and destroyed the financial system were handed $2 trillion of taxpayer funds so they could pay themselves multi-million dollar bonuses, and that the Federal Reserve would triple its balance sheet to $2.45 trillion by running its printing presses at hyper-speed and handing the money to those same Wall Street Mega-Banks.

What caused the mass hysteria that has destroyed the soul of America? Was it just the madness of crowds? Or was it something more sinister?

True sounds of maniacal laughter

And the deaf-mute is misleading the choir

The punch-line is a natural disaster

And it’s sung by the unemployed

Fight fire with a riot

The class war is hanging on a wire because the martyr is a compulsive liar

When he said “it’s just a bunch of niggers throwing gas into the ….” – American Eulogy – Green Day

Whenever an act doesn’t make sense and seems irrational, you need to ask yourself, “who benefits?” Who has benefitted from the hysteria? The answer is in plain sight. The moneyed interests benefitted. The military industrial complex benefitted. The Federal Government bureaucracy benefitted. Wall Street bankers benefitted. Mega-corporations and their CEOs benefitted. The top 1% ruling elite gained more wealth and more power. They created the mass hysteria with the assistance of their corporate owned mainstream media and completed their pillaging of the middle class with the cooperation of regulators, rating agencies and their ultimate weapon, the privately owned Federal Reserve bank, that has enriched its owners while impoverishing those whose only aspiration was to do an honest day’s work, raise their families, and live in relative comfort, safety, and happiness.

I Don’t Wanna Live In The Modern World

I don’t wanna live in the modern world!

I don’t wanna live in the modern world!

I don’t wanna live in the modern world!

I don’t wanna live in the modern world!

I am a nation without bureaucratic lies

Deny the allegation as it’s written (fucking lies!)

I want to take a ride to the great divide

Beyond the “up to date” and the neo-gentrified

The high definition for the low resident

Where the value of your mind is not held in contempt

I can hear the sound of a beating heart

That bleeds beyond a system that’s falling apart

With money to burn on a minimum wage

I don’t give a shit about the modern age – American Eulogy – Green Day

The modern world in no way resembles the world James Truslow Adams wrote so passionately about in 1931. Green Day’s version of bureaucratic lies, high definition TVs for the poor, contempt for those who use their minds, and a debt flooded system that is falling apart is an accurate assessment of America today. The modern world is ruled by the few with wealth and power, sustained by government. The misinformation and propaganda dished out by the mainstream media creates a smokescreen that obscures who wields the true power in this country. The corporate mainstream media has done such a good job spreading the Big Lie that a vast number of Americans actually admire and worship the ultra-rich.

Most Americans still believe the fairy tale of the American Dream, that no matter how humble your beginnings, everyone has a fair chance to become rich in America. The truth is that the wealthy ruling class owns the country. The top 1% control 43% of the financial wealth of the nation. The top 10% control 83% of the financial wealth of the nation. There is a misperception that the ultra-rich earn their wealth. The facts show otherwise. In 2008, only 19% of the income reported by the 13,480 individuals or families making over $10 million came from wages and salaries. Remember the financial crisis of 2008-2009 that wiped out 7 million jobs, cut the value of many homes in half, and required a taxpayer bailout of Wall Street? According to research done by economist Edward Wolff, “there has been an “astounding” 36.1% drop in the wealth (marketable assets) of the median household since the peak of the housing bubble in 2007. By contrast, the wealth of the top 1% of households dropped by far less: just 11.1%. So as of April 2010, it looks like the wealth distribution is even more unequal than it was in 2007.”

Source: William Domhoff

The bottom 90% own less than 19% of stocks and mutual funds in the country. Reality is that the 10% richest Americans own the country. The top 1% control 50% of the investment assets and only 5% of the total debt in the country. The bottom 90% control 12% of the investment assets and are burdened with 73% of the total debt. You can clearly see that the Wall Street bailout and the current Federal Reserve QE2 plan to boost stock prices have only benefitted the top 10% richest Americans. What is good for Wall Street is not good for Main Street. The American middle class has been lured into debt by the purveyors of debt, the ultra-rich elite who control the financial industry. The further into debt the bottom 90% descend, the greater the enrichment of the ruling class. This is why Wall Street shysters, political hacks and the corporate mainstream media have urged Americans to whip out those credit cards and “Save America” by spending money they don’t have, again. It is reminiscent of President Bush’s heartfelt plea to the American public to defeat terrorism by buying a GM car with 0% down.

The propaganda that is constantly pounded into the brains of Americans about “death taxes” and the rich paying more than their fair share of taxes is part of the Big Lie perpetrated by the powerful ruling class. The “huge” issue of estate tax impacts only the few thousand richest Americans. According to a study published by the Federal Reserve Bank of Cleveland, only 1.6% of Americans receive $100,000 or more in inheritance. Another 1.1% receive $50,000 to $100,000. On the other hand, 91.9% receive nothing (Kotlikoff & Gokhale, 2000). The richest families in the country provide the funding for the mainstream media propaganda needed to eliminate estate taxes.

The lies about the ultra-rich paying more than their fair share of taxes are refuted in the graph above. The top 1% actually pays a lower percentage of their income than the next 9%. The tax code isn’t 70,000 pages for nothing. The ultra-rich have used their wealth to great advantage by having loopholes and tax dodges inserted into the tax code by their bought off congressmen. The average American can’t afford high powered tax specialists and lawyers to help them stash their wealth in off-shore tax havens in the Caribbean and Switzerland. The consistent theme in America today is that the middle class gets screwed and the ultra-rich ruling class accumulates more wealth and power.

The Death of America

“Remember, democracy never lasts long. It soon wastes, exhausts, and murders itself. There never was a democracy yet that did not commit suicide.” – John Adams

Two hundred and thirty five years ago, our Founding Fathers declared that we all had the unalienable rights of life, liberty and the pursuit of happiness. These rights have been restricted and bastardized over two centuries. Liberties have been severely restricted as your government tracks you through your social security number, is able to monitor your phone and internet communications, and regulates your education, healthcare, business, and a thousand other daily activities. The right to happiness was based upon James Treslow Adams’ view that we were free to attain “the fullest stature of which they are innately capable”. The happiness of becoming a success through your individual exertion, intelligence and efforts has been subverted by the happiness of material goods acquired through the use of debt, peddled by the ruling class.

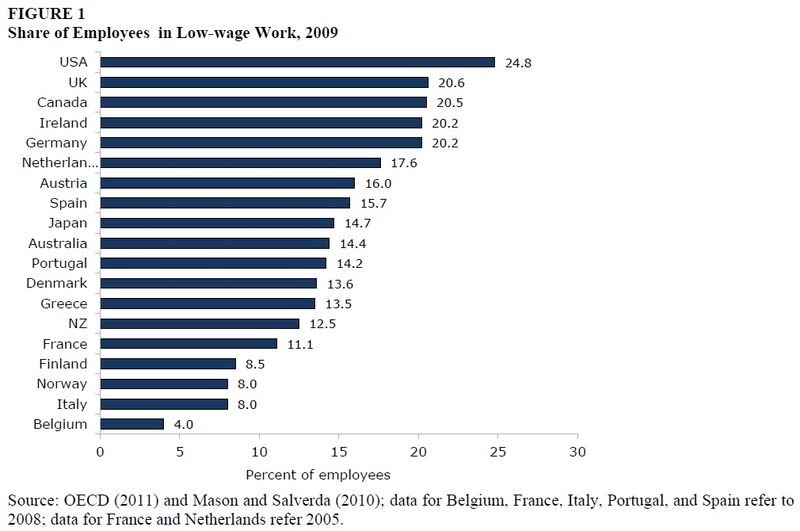

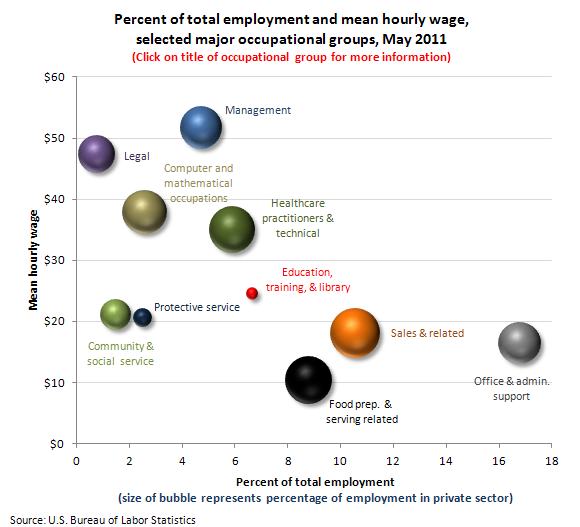

The American Dream where every person had the opportunity to live a richer and fuller life began to die in 1913. Every generation born in this country had an excellent chance to live a better life than their parents. Relentless progress was the American way. I have three teenage sons. Based on the actions of this country’s ruling oligarchy, I doubt that my sons will live a richer and fuller life than myself. The debts are too extreme, the military overreach too excessive, the looting by the financial class too great, the political corruption too extensive, and the opportunities too few. The dream of a social order where everyone could rise to the highest level of their capabilities regardless of their birth has been systematically squashed. With 66% of households making less than $65,000 and college costs out of reach for 80% of Americans without incurring crushing levels of debt, the chances for most Americans to climb the social ladder through educational advancement are nil. Even if they do graduate from college, the CEOs in corporate America, who “earn” 300 times the average worker, have outsourced their jobs to China and India.

The ruling class provides their children with private schooling and necessary preparation to keep their place in the social order. Wealth begets wealth. The elite send their kids to the elite Ivy League schools and use their connections with their fellow ruling elite to get them jobs on Wall Street, the prestigious connected corporations or government jobs in Washington DC. The wealth of the few has erected barriers to advancement of the many. America has progressively become a stratified class oriented society that has begun to spiral downward as the ruling class has gone too far. The revolutions flaring across the globe are occurring because the ruling class went too far and took too much. The ruling class in America should take note. They have shattered the American Dream and the retribution from those who have been swindled will be unexpected and violent.