“You’d be William Munny out of Missouri, killer of women and children”. – Little Bill Daggett – Unforgiven

“That’s right, I’ve killed women and children, I’ve killed just about everything that walked or crawled at one time or another, and I’m here to kill you Little Bill, for what you did to Ned” – Willam Munny – Unforgiven

Funny thing, killin’ a man. You take away everything he’s got and everything he’s gonna have. – William Munny – Unforgiven

Clint Eastwood’s final western was one of the darkest, most violent, vicious westerns ever made. Much of the film takes place in darkness. The tone of the film is depressing, with a drained wintery look reminiscent of High Plains Drifter. The script had been written in 1976 during our last Awakening, but Eastwood held off making the movie until 1991 when he was old enough to play the lead role. Age, stages of life, and mood are key elements in the movie, as they are in the plot playing out in the world today. Unforgiven is a story of atonement, justice and retribution. The cold forbidding atmosphere reflects a Fourth Turning mood. We’ve entered our hibernal Crisis, with its violent struggles and compulsory sacrifices in an era of maximum danger and ultimately a fight for survival. This decisive test of human strength and fortitude was as predictable as the change in seasons. Strauss and Howe understood the generational dynamics of the country would align to create the mood change which would usher in the third Fourth Turning in American history:

“The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II.” – Strauss & Howe – The Fourth Turning

Unforgiven follows the journey of William Munny, a cold blooded vicious bandit in his youth, turned peaceful farmer in his old age. As a widower with two kids and a failing farm, he agrees to kill two cowboys who had disfigured a prostitute in the town of Big Whiskey, in return for a reward of $1,000. In his youth he drank heavily and murdered for fun, now he was killing for money. The town is run with an iron fist by an aging gunfighter, turned sheriff, named Little Bill Daggett, who doesn’t allow guns in his town. Munny and his two companions arrive amidst a driving rain storm in the middle of the night. They proceed to execute the two cowboys, but both of Munny’s companions reveal they don’t have a stomach for killing anymore. After collecting the reward, Munny finds out that his friend Ned was captured, tortured, and murdered by Little Bill Daggett. He takes a drink of whiskey and the tale turns into a story of retribution and atonement. He arrives back in town in the pitch black of night and enters the saloon where Little Bill and his men are gathered. He guns down six men, including Little Bill. As he lies on the floor wounded, Bill laments that he doesn’t deserve to die this way. Munny declares:

“deserves got nothin’ to do with it.”

Bill tells Munny he will “see him in hell”, a sentiment which Munny agrees with. Munny then kills him. There is no rousing ending. No cheers from the audience. The ugliness of violence is portrayed realistically and myths of the Old West are demolished. You are left to meditate about the concepts of age, repute, courage, heroism and the fine line between good and evil.

The themes, atmosphere, violence, brutality and finale of this eulogy to the western genre are a perfect representation of our current dire circumstances. The town of Big Whiskey represents the United States. The sheriff rules with an iron fist over the population, but his cronies can get away with murder. Hypocrisy abounds across the U.S. as politicians use the rule of law to keep the masses controlled while rewarding their corporate and banker cronies with government handouts, tax breaks, and free money. I see Munny, his companions and the prostitutes as symbols of the flawed citizens of the United States. They’ve made mistakes, committed crimes, made poor life choices, but they ultimately tried to make an honest living as upstanding citizens. When the authorities pushed them to the brink with their overbearing regulations, brazen criminal actions and blatant institutional corruption, each constituent reacted differently. Some responded with defiance, most rolled over, some ran away, and Munny responded with viciousness and retribution.

This is how it will play out over the next ten to fifteen years. Cynicism about solutions put forth by corrupt politicians, distrust of government bureaucrats and crooked bankers, and a society wide demoralization, as widespread unemployment and declining living standards for middle class Americans has darkened the landscape like an approaching winter storm. The disillusionment of average Americans is reflected in poll after poll, with only 20% of the population satisfied with the direction of the country versus 70% just prior to 9/11. The mood change in the country since 2005 is palpable. The gap between the Haves and the Have Nots has never been greater and continues to widen. The middle class has floundered for decades, while bankers, politicians and corporate titans have reaped vast riches through peddling debt and gaming a system rigged in their favor.

Recent data from the Pew Foundation finds that Americans are sick of being the world’s policeman. Even conservative Republicans are becoming more isolationist in their views. This was also the case during the 1930’s in the last Fourth Turning. The vast majority of Americans want to keep our noses out of other countries’ affairs because they realize the trillions spent are bankrupting the country.

Even though Americans, by a large majority, favor slashing foreign aid, ending our three foreign wars of aggression, and no longer allowing the super rich and mega-corporations to use the 60,000 page tax code as their means to avoid taxes, our leaders increase war spending, continue to meddle in the affairs of foreign countries, and seek further tax benefits for the super rich and mega-conglomerates. The will of the people is ignored because the government has been bought by the financial and military industrial complex, with funding by the Federal Reserve and the banking cartel that pulls the strings on their puppet – Ben Bernanke.

I’ve previously detailed how the baby boom generation contributed to our financial quandary in Part One – For a Few Dollars More, how the traitorous deeds of the Federal Reserve over the last few decades have ruined the middle class and placed the country on the precipice of disintegration in Part Two – Fistful of Dollars, addressed the nefarious conception of a central bank in Part Three – The Good, the Bad, and the Ugly and revealed how the super rich have used the tax code and their control of politicians to pillage the nation in Part Four – Outlaw Josey Wales. Now I will detail the likely result of years of frivolous consumerism, creation of a debt tsunami, corrupt myopic leadership, crooked bankers, and a angry despondent populace. The lack of preparation by government and individuals ensures this Crisis will be far worse than it had to be. The violent clash between competing forces will be extreme, bloody and result in retribution dished out to the guilty. Ultimately, the country will need to atone for its sins.

Preparation

“Reflect on what happens when a terrible winter blizzard strikes. You hear the weather warning but probably fail to act on it. The sky darkens. Then the storm hits with full fury, and the air is a howling whiteness. One by one, your links to the machine age break down. Electricity flickers out, cutting off the TV. Batteries fade, cutting off the radio. Phones go dead. Roads become impossible, and cars get stuck. Food supplies dwindle. Day to day vestiges of modern civilization – bank machines, mutual funds, mass retailers, computers, satellites, airplanes, governments – all recede into irrelevance. Picture yourself and your loved ones in the midst of a howling blizzard that lasts several years. Think about what you would need, who could help you, and why your fate might matter to anybody other than yourself. That is how to plan for a saecular winter. Don’t think you can escape the Fourth Turning. History warns that a Crisis will reshape the basic social and economic environment that you now take for granted.” – Strauss & Howe – The Fourth Turning

This Fourth Turning was as predictable as the seasons. The American Revolution Crisis ended in 1794. The Civil War Crisis arrived 66 years later in 1860. That abbreviated vicious Crisis ended in 1865. The Depression/World War II Crisis arrived 64 years later in 1929. Our current Crisis arrived in the 2008/2009 time frame, exactly 64 years after the end of the last Crisis. Strauss and Howe wrote their book in 1996. They knew we had about a decade to prepare for the looming winter ahead. We had time to fortify, prepare, save, not waste our seed corn on foreign adventures, and reduce all non-essential spending. Not only did we not do what needed to be done, we did the exact opposite of what needed to be done.

The reason is the country has been run by ideologue linear thinkers. Believers in linear history are constantly blindsided by the fact that history is cyclical and periods of progress are counterbalanced by periods of regression. As neo-con Republicans continue to push their lowering taxes on the rich, Christian fundamentalism, drill drill drill energy plan, bowing down to Wall Street bankers and wars on Muslims, drugs, and immigrant agenda, the mood of the country has shifted away from their falsehoods and fabrications. As ultra-liberal Democrats continue to push their agenda of ever increasing entitlements, ridiculous Keynesian stimulus, disengenuous green energy plans, blind support of corrupt unions, wars to prove they’re as tough as Republicans, pushing for gay marriage and rolling over for Wall Street bankers the people of the country have tired of their lies and deceit.

Our country had a decade to prepare for the coming tempest. All generations should have worked to elevate the moral and cultural standards of the country. Instead the decadence, selfishness, materialism and profligacy of the nation were taken to new heights. The complete lack of self control exercised by the media and the public has allowed government bureaucrats to impose despotic laws and regulations to protect us from ourselves and phantom terrorists. The Federal government needed to cut back its size and scope so that it would be nimble in the face of the Crisis. Politicians needed to prevent further civic decay by speaking bluntly and honestly to the American people about the future challenges, while stressing collective duties over personal rights. We needed a revival of citizenship over individualism, with a focus on future generations who would be left with the fallout of thirty years of debt induced societal degradation. The government should have shifted its budgetary focus away from the non-needy old to the young people of our once great Republic. The future of the country depends on the young, not the old. The preparation scorecard on all these accounts is a miserable failure:

- Since 9/11 the American public has willingly allowed the government to strip liberties and freedoms away in the name of safety and security through passage of the Patriot Act, spying on US citizens, and wars of aggression in Iraq, Afghanistan and Libya.

- The government wolves control the sheep through the use of fear and misinformation. The War on Terrorism is used at every opportunity to keep the sheep-like populace under control in their holding pens.

- The corporate owned mainstream media glorifies wealth, celebrity, and sensationalism while infecting the culture with a vapid mind numbing array of TV shows and spewing toxic levels of filth and porn across the airwaves and internet.

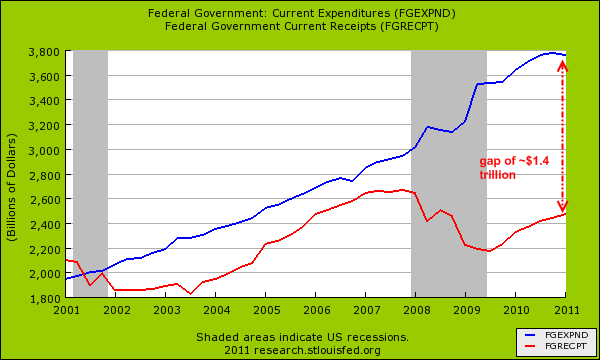

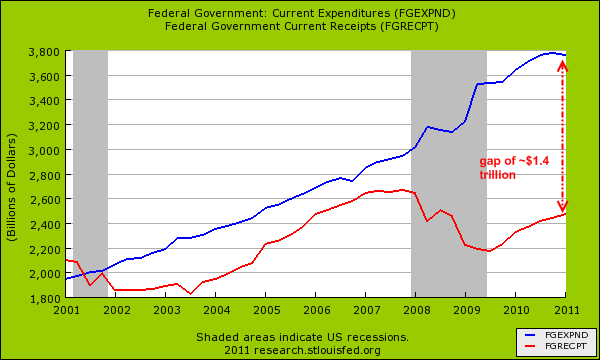

- The Federal government cut back its scope by increasing its annual spending to $3.8 trillion in 2011 versus the $1.6 trillion it spent in 1996, a 138% increase in fifteen years. Meanwhile, GDP only increased by 92% over this same time frame.

- Our leaders prepared for the tough times ahead by increasing the National Debt from $5.2 trillion to $14.3 trillion in fifteen years, a 175% increase, or almost twice the rate of GDP growth. Rational leaders always triple their debt level when knowing harsh times are coming.

- The blunt talk coming from politicians since 1996 included: buy an SUV with 0% financing to defeat terrorism; sure we can pay for your drug costs with Medicare Part D; home prices never fall and everyone deserves a house; free market capitalism always works; cutting taxes on the rich will increase tax revenue; they have weapons of mass destruction; debt doesn’t matter; giving bankers $700 billion will save our economy; spending $800 billion will generate 3.5 million jobs; and QE2 will reduce mortgage rates and jump start the economy.

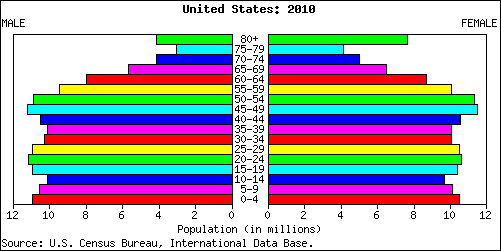

- Our leaders have thrown the Millenial generation under the bus, while promising to never cut Medicare, Medicaid, or Social Security for the 76 million Boomers that make up the largest voting bloc in the country. The collective long-term survival of the country has been cast aside in the name of the selfish desires of the generations in power.

The lack of cultural and civic preparation has been far outdone by the extraordinarily deficient amount of preparation in the economic and military areas. Everyone knows that when you discern tumultuous times are on the horizon, you conserve, save, and marshal your forces for the coming storm. Our leaders needed to level with Americans and tell them the entitlements they were promised could never be honored. Americans needed to ramp up their savings and become more self reliant in preparing for their old age. Federal, state and local governments needed to shift their employees from defined benefit plans to defined contribution plans. Americans needed to pare back their debt and stop over-consuming. The government needed to balance budgets, reform the tax code shifting toward consumption, and reduce entitlement promises. America needed to gird for a possible war whose scale, cost, manpower and casualties would seem impossible in 1996 (every prior Fourth Turning led to all encompassing war). The preparation scorecard for these areas was dreadful:

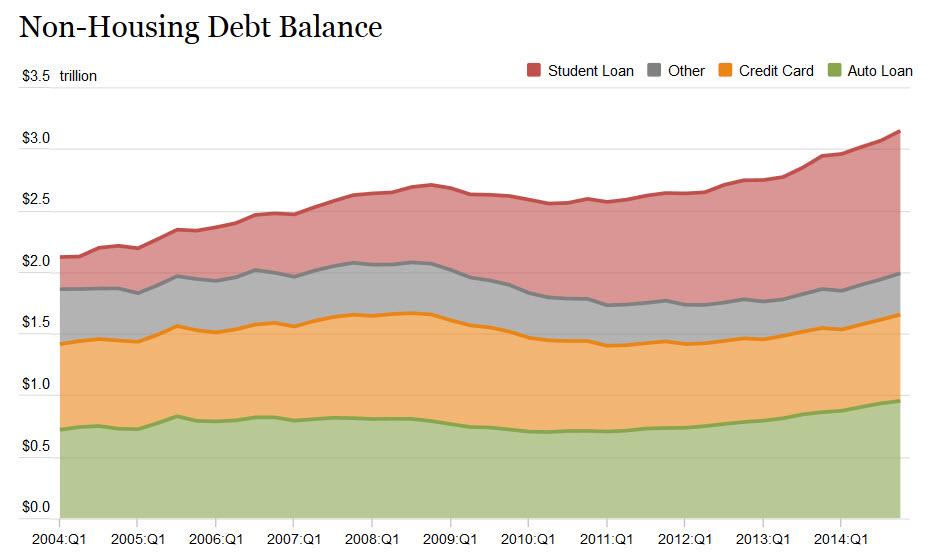

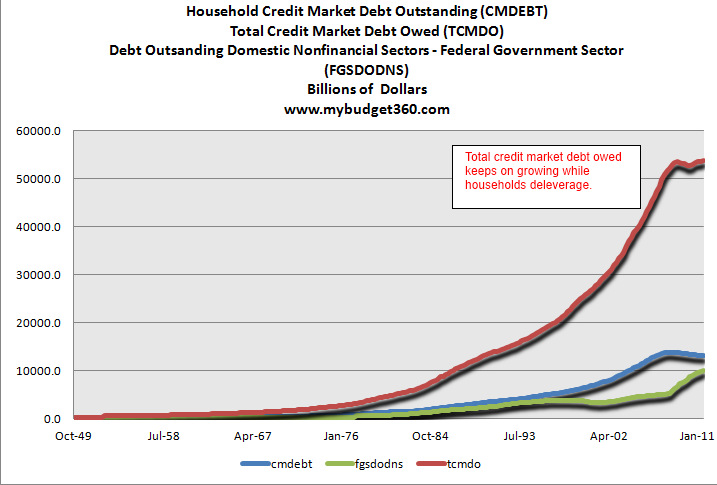

- The most damning data in proving how delusional the government, consumers, businesses and banks has approached the future is the rise in total credit market debt from $18 trillion in 1996 to an all-time high of $52.6 trillion today, or 350% of GDP.

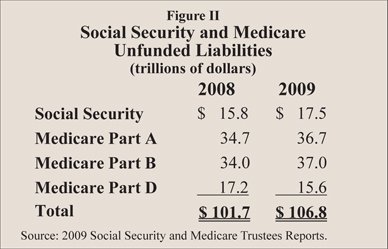

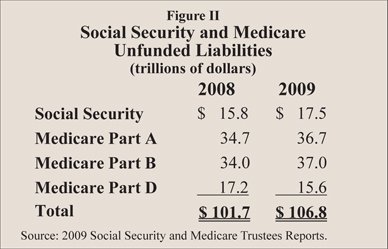

- Rather than level with people and explain that entitlement promises could not be fulfilled, a supposedly fiscal conservative Republican President added another $15 trillion unfunded liability to our $100 trillion obligation.

- Our current socialist president rammed through a national healthcare bill that will filter 30 million people into the system and will add in excess of $1 trillion of unpaid for costs, further burying the hopes and dreams of our youth under a mountain of un-payable obligations.

- Americans, who used to save 10% of their disposable income, were only saving 5.5% in 1996. Rather than prepare for the future by saving more, they put their faith in housing values growing 10% per year for infinity, and let their savings rate drop below 1% by 2005. The current level of 4.9% is not sufficient and is reflected in the fact that two-thirds of all workers have less than $50,000 in total savings.

- States have unfunded pension liabilities approaching $3 trillion, with the Federal government carrying a $1 trillion pension liability. Unfunded liabilities are really future tax increases on unborn generations.

- The one area that seemed under control in the late 1990s was budget deficits. Budget surpluses in the late 1990s turned into $1.5 trillion annual deficits today and as far as the eye can see. The national debt at 95% of GDP has past the point of no return.

- The price for a barrel of oil was $12 in 1998. Rather than take advantage of this Indian summer and creating a plan to transition from depleting oil to other energy sources, our leaders did nothing. The American people bought massive SUVs, minivans and pickups and moved further into the suburban countryside, miles from civilization. The bumpy plateau of peak oil has arrived and oil prices have ranged between $70 and $140 a barrel for the last few years. We will long for these prices in a few short years.

- Rather than conserving our military forces and preparing for a future major confrontation we have overextended our limited forces, spent $1.2 trillion on wars of choice, killed 7,300 American soldiers, and wounded another 43,000 soldiers.

The complete lack of preparation, indeed the choice to actively do the opposite of prepare, has insured this Fourth Turning Crisis will be that much more destructive.

“History offers no guarantees. If America plunges into an era of depression or violence which by then has not lifted, we will likely look back on the 1990s as the decade when we valued all the wrong things and made all the wrong choices.” – Strauss & Howe – The Fourth Turning

Retribution

“The refusal of the political class to imposes losses on large bank creditors since the collapse of Lehman Brothers and Washington Mutual in 2008 illustrates the extent to which the financialization of the western industrial economies has turned into a gradual coup d’état by the banks and the global speculators who dominate their client base.” – Chris Whalen

“We’re not moving toward Hitler-type fascism, but we’re moving toward a softer fascism: Loss of civil liberties, corporations running the show, big government in bed with big business. So you have the military-industrial complex, you have the medical-industrial complex, you have the financial industry, you have the communications industry. They go to Washington and spend hundreds of millions of dollars. That’s where the control is. I call that a soft form of fascism — something that’s very dangerous.” – Ron Paul

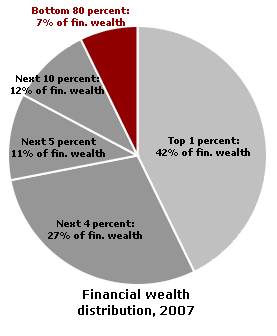

As the average American continues their epic struggle to stay afloat in these turbulent times it is clear to those with critical thinking skills, like Chris Whalen and Ron Paul, that the game is rigged in favor of those with enormous wealth and power. There is no doubt the levers of government and finance have been seized by a super rich minority of men, willing to use all means necessary to increase their wealth and power at the expense of those they consider lowly expendable peasants. The myth perpetuated by those in control of the system is that everyone in America has ample opportunity to move up the ladder, even as they push the ladders away from the parapet surrounding their castle.

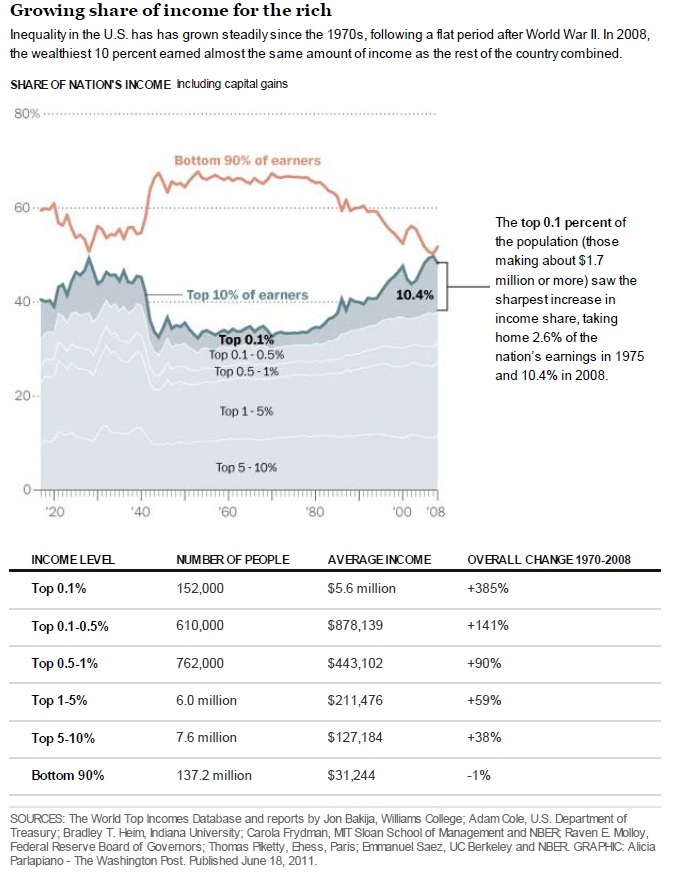

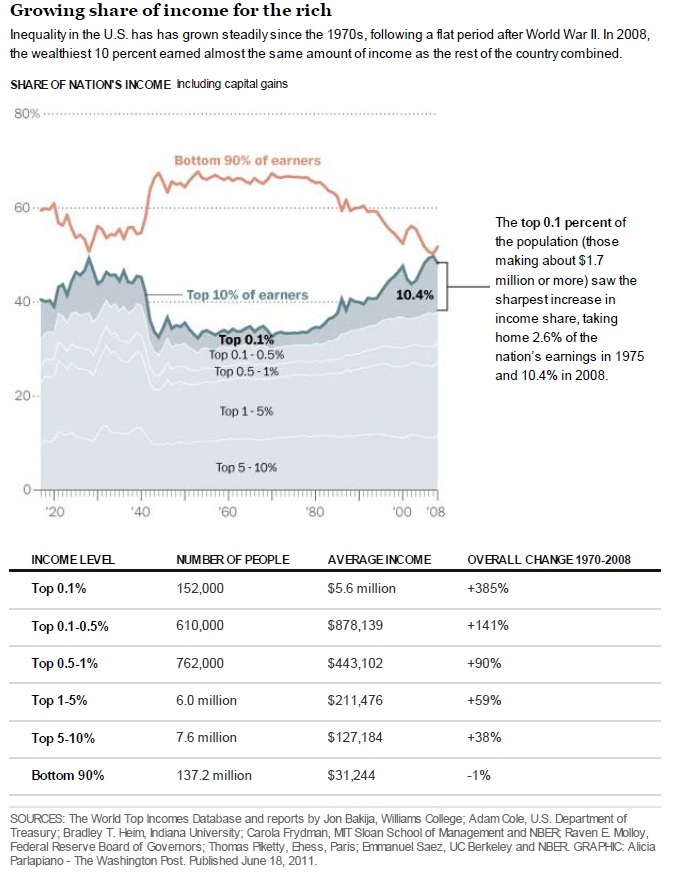

The talking points of the super rich, which are pounded into the brains of slumbering Americans, are they pay all the taxes, create all the jobs, create all the wealth, and drive innovation. The facts say otherwise. The super rich aren’t creators, they are destroyers. The top 0.1% richest Americans didn’t get rich by creating new companies and letting their entrepreneurial talents shine. These 152,000 people, with an average income of $5.6 million per year are overwhelmingly executives at large corporations, banks, law firms, and real estate firms. These people account for 68% of the richest of the rich. Entrepreneurial creators and producers account for less than 10% of the richest Americans. The executives that make up the 68% are masters of creating debt, wealth for themselves by peddling debt to the middle class, and creating jobs in China and India by outsourcing U.S. jobs.

The average income of the 137 million people that sit at the bottom of the income pyramid has declined by 1% since 1970. The people at the top of the pyramid saw their average income rise by 385%. Was this because they worked harder? No. It was because they used their existing wealth to buy politicians and pay lobbyists to write laws, create loopholes, reduce regulations, and alter the tax code in their favor. This was not a conspiracy. It was human nature. Humans are driven by greed and fear. Lusting for power and wealth is a common human frailty. Those who are able to acquire wealth and power through their superior abilities and intellect are usually driven individuals. It is built into their DNA to seek more wealth and power. There are 310 million Americans and based on the chart below, only 1.5 million would be classified as very rich or extremely rich. Many of these people associate in the same circles. This incestuous relationship is what breeds the growing inequality in our country. The game is rigged in favor of these 1.5 million people because they run the corporations, occupy the halls of Congress, peddle the debt products to the bottom 90%, and use their mass media to control the message to the under-educated, over-medicated, gadget distracted masses.

The problem with humans is they always push the envelope too far. The rich and powerful have methodically accumulated more wealth and more power since their glorious coup in 1913 with the creation of the Federal Reserve and the personal income tax. They have used inflation and the tax code to further their agenda. The rate of their pillaging has waxed and waned over the last century as the mood of the country has oscillated during the five turnings between crisis and triumph. The rate of looting has accelerated in the last thirty years as their false message of free market capitalism, lower tax rates for the rich, and the issuance of unparalleled amounts of debt was bought hook line and sinker by the American public. Their plundering of the national wealth reached a sickening crescendo in the last ten years, as their internet bubble was replaced by their housing bubble, which has been replaced by their debt bubble of immense proportions. As the middle class has been impoverished, 30 million people are unemployed or underemployed, senior citizens have been sacrificed at the altar of Wall Street and 45 million people are forced to use food stamps, the top 1% has done fabulously. They continue to rake in a greater proportion of the national income every year. In 2009, in the midst of an epic financial crisis, the number of millionaires in the United States soared by 16% to 7.8 million as despair and hopelessness spread across the land and fearful Americans were railroaded into bailing out the bankers that initiated the crisis and believing the Obama’s Keynesian solutions would actually trickle down to them.

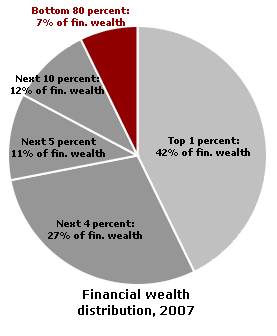

As the game approaches its inevitable termination those in control have become increasingly audacious and frantic in their attempts to embezzle what remains of middle class wealth. The anger and disillusionment grows by the day. The mood of the country darkens like the sky before an approaching blizzard. The intensity and violence during a Fourth Turning hastens as events spiral toward a climax. The extreme actions taken by those in power since September 2008 have set in motion a chain of events that will lead to civil war. The powerful elite in government (Bush, Paulson, Bernanke, Congress) chose to bail out the powerful elite on Wall Street (Blankfein, Dimon, Pandit, Lewis) on the backs of the American middle class. TARP, QE1, QE2, and the $800 billion stimulus package were all created by the ruling elite to benefit the ruling elite, who control the vast amount of financial wealth in the country. Savers and seniors have been thrown under the wheels of a Lamborghini driven by the profligate Wall Street gamblers.

Average Americans feel betrayed by politicians, bankers and corporate America. The Tea party movement is a reflection of that anger. Fourth Turnings always sweep away the old order and replace it with a new order. The old order isn’t ready to be swept away, but their time is coming. The U.S. economic model is unsustainable and is guaranteed to collapse in the near future. Those in power are trying to engineer a controlled collapse, but they will lose control just as they did in 2008. Panic and depression will ensue. Vast amounts of wealth will be destroyed. When the middle class realizes they have been screwed again by Wall Street and K Street, and they no longer have anything left to lose, they will lose it.

The welfare class will only riot if their EBT cards stop working and the monthly welfare direct deposit ceases. It’s the critical thinkers in the middle class that will lead a revolution. There are 250 million guns owned by Americans. With this amount of firepower and millions of Americans with nothing left to lose, those attempting to retain power will be at a distinct disadvantage. I believe armed vigilantes will hunt down those responsible for the destruction of the American economy and invoke their own justice. Their gated communities and penthouse suite doormen will not protect them. No politician, banker, or corporate executive will be safe. Some will escape in their Lear jets to foreign lands, but the rest of the world will be equally chaotic and unsafe for those who committed crimes against humanity. Innocent people will die. Deserve will have nothing to do with it. The very existence of our country will hang in the balance.

Atonement

“The seasons of time offer no guarantees. For modern societies, no less than for all forms of life, transformative change is discontinuous. For what seems an eternity, history goes nowhere – and then it suddenly flings us forward across some vast chaos that defies any mortal effort to plan our way there. The Fourth Turning will try our souls – and the saecular rhythm tells us that much will depend on how we face up to that trial. The saeculum does not reveal whether the story will have a happy ending, but it does tell us how and when our choices will make a difference.” – Strauss & Howe – The Fourth Turning

“Don’t think you can escape the Fourth Turning the way you might today distance yourself from news, national politics, or even taxes you don’t feel like paying. History warns that a Crisis will reshape the basic social and economic environment that you now take for granted. The Fourth Turning necessitates the death and rebirth of the social order. It is the ultimate rite of passage for an entire people, requiring a luminal state of sheer chaos whose nature and duration no one can predict in advance.” – Strauss & Howe – The Fourth Turning

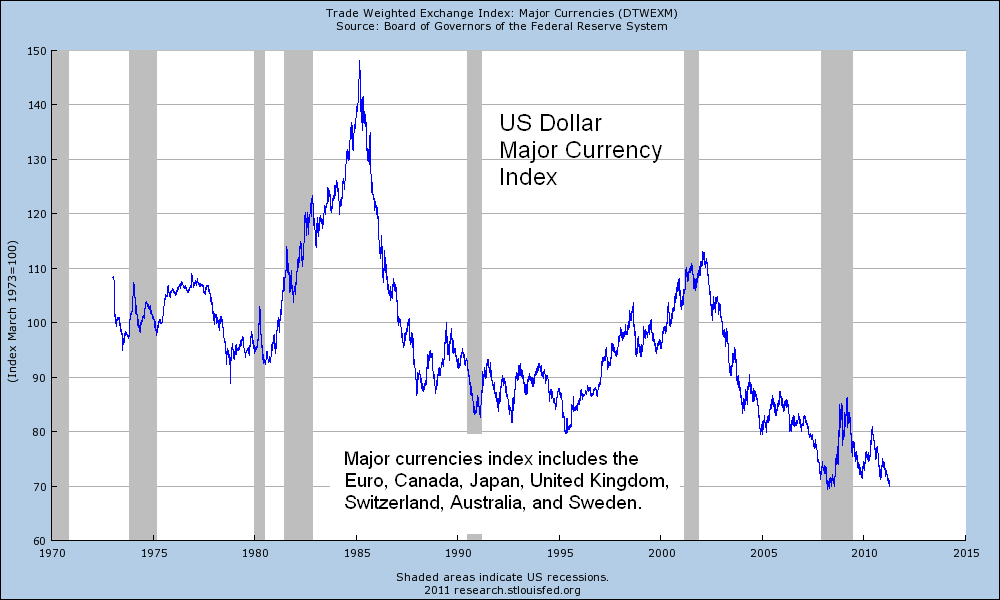

No one can predict the exact events (debt ceiling, Euro collapse, Middle East war) that will propel this Fourth Turning. But, the underlying drivers are clear: public debt, private debt, banker coup, military overreach, corporate fascism, Federal Reserve created inflation, an oil dependent society with depleting oil and rampant corruption across all levels of government. The fingers of instability grow longer as we add $4 billion per day to the national debt. A grain of sand will fall on the wrong part of the sand pile triggering a collapse of our currency. The event is unknown, the timing unclear, but the destination is certain. A dollar collapse will trigger a surge in interest rates, which will be fatal to our debt bloated society. Every previous Fourth Turning involved revolutionary aspects. The American Revolution and Civil War were wars of revolution. The stirrings of revolution were rampant in the early 1930s, with a plot foiled by General Smedley Butler. The New Deal was a response designed to quell discontent among the masses. Enough people are becoming aware of who to blame for the ills in our society that Henry Ford’s prediction is ever closer to being realized:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before morning.”

An uprising against the super rich and their banking cartel partners in crime is in the cards over the next ten years. Our society has degenerated and has been ransacked by sociopaths in suits as Jesse from Jesse’s Café Americain so eloquently states:

“Not all sociopaths wield knives and knotted cords. Some wear suits, and are exceptionally intelligent and articulate, obsessively driven, and are able to use and undermine the law and the rules for their advantage, like weapons. It is never about the win, never about the money. It is about the kill, the expression of their hatred, about elevating themselves with the suffering of others. Bind, torture, kill. Not only with ropes and knives, but also with power and money, and the subversion of law. Lawlessness is their addiction, their will to power.

When societies become lax and complacent, these sociopaths can possess great political power through great amounts of unprincipled money. And over time they become almost anti-human, destroyers of all that is good, all that is life, all that offends their insatiable sickness with its goodness. They twist the public against itself, and turn a broad sweep of society into their killing grounds. This is the undeniable lesson of the last century. There are monsters, and they walk among us.”

Human beings are a flawed species. We are often driven by emotion rather than reason. We are easily convinced of things we want to be convinced about. Those with superior intelligence often take advantage of those with inferior intelligence. We are prone to mass hysteria and believing things that, in retrospect, were utterly ridiculous. We can be swayed by fear and greed in alternating degrees of delusion. History teaches us that this time isn’t different. We’ve experienced depression, war and social upheaval on an epic scale three times since the founding of this country. With only three data points it is tough to discern patterns that would reveal exactly how this Fourth Turning will play out. But it is apparent to me that each Fourth Turning alternates between a mostly external struggle and a mostly internal struggle. The American Revolution was a struggle against an external oppressor – Great Britain. The Civil War was an internal struggle between the industrial North and the agrarian South. The Depression/World War II struggle was mainly against an external threat – Germany, Japan, and Italy.

The Fourth Turnings that centered upon an external threat ended with a glorious High. The Civil War Fourth Turning resolution felt more like defeat, with the country exhausted, bitter and angry. All indications are this Fourth Turning will be mainly an internal struggle between the ruling class of bankers, business elites, and politicians and the downtrodden middle class. The lying, cheating, fraud, theft and other wrongs committed by those in power will need to be atoned for. The generational dynamics in place will drive the reactions of the country moving forward. We have been badly led. A vast swath of the populace has lived beyond their means. The existing system is unsustainable. The Boomer generation does not want to yield on their perceived entitlements. The Millenial generation will be saddled with un-payable debts. Generation X is caught in the middle of this generational struggle. The huge imbalances in our society have built up over decades like flood waters behind a weakening levee. When the levee breaks the existing order will be swept away in the raging torrent that will follow.

The ruling class will be stripped of their unseemly acquired wealth; the Boomer generation will be scorned for their reckless disregard for future generations and stripped of their entitlements; Generation X will resign themselves to a lower standard of living, knowing full well by doing so, their children will not be saddled with crushing levels of debt; Millenials will have borne the burden of the revolution and violence which will be inevitable as the ruling class fights to retain their dominating position in society. Darkness descends upon our land. Storm clouds gather on the horizon. We’ve all played a part in the catastrophe that lies before us. Everyone in our crumbling society will need to atone for its sins, whether they deserve to or not. Will Munney was not an innocent man, but he ultimately atoned for his sins by digging deep into his soul and finding the strength and fortitude to fight the evil establishment. Each generation’s rendezvous with destiny awaits. There are no guarantees. The myth of American Exceptionalism will not protect us from the choices we’ve made. God will not shield us from the consequences of our actions. The American Empire hangs in the balance. As the ghosts of Roman emperors whisper – Glory is fleeting.

“The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it.” – Strauss & Howe – The Fourth Turning

“History offers no guarantees. Obviously, things could go horribly wrong – the possibilities ranging from a nuclear exchange to incurable plagues, from terrorist anarchy to high-tech dictatorship. We should not assume that Providence will always exempt our nation from the irreversible tragedies that have overtaken so many others: not just temporary hardship, but debasement and total ruin. Losing in the next Fourth Turning could mean something incomparably worse. It could mean a lasting defeat from which our national innocence – perhaps even our nation – might never recover.” – Strauss & Howe – The Fourth Turning