“When a government is dependent upon bankers for money, they and not the leaders of the government control the situation, since the hand that gives is above the hand that takes. Money has no motherland; financiers are without patriotism and without decency; their sole object is gain.” – Napoleon Bonaparte

“A great industrial nation is controlled by its system of credit. Our system of credit is privately concentrated. The growth of the nation, therefore, and all our activities are in the hands of a few men … [W]e have come to be one of the worst ruled, one of the most completely controlled and dominated, governments in the civilized world—no longer a government by free opinion, no longer a government by conviction and the vote of the majority, but a government by the opinion and the duress of small groups of dominant men.”– Woodrow Wilson

When you ponder the implications of allowing a small group of powerful wealthy unaccountable men to control the currency of a nation over the last one hundred years, you understand why our public education system sucks. You understand why the government created Common Core curriculum teaches children that 3 x 4 = 13, as long as you feel good about your answer. George Carlin was right. The owners of this country (bankers, billionaires, corporate titans, politicians) want more for themselves and less for everyone else. They want an educational system that creates ignorant, obedient, vacuous, obese dullards who question nothing, consume mass quantities of corporate processed fast food, gaze at iGadgets, are easily susceptible to media propaganda and compliant to government regulations and directives. They don’t want highly educated, critical thinking, civil minded, well informed, questioning citizens understanding how badly they have been screwed over the last century. I’m sorry to say, your owners are winning in a landslide.

The government controlled public education system has flourished beyond all expectations of your owners. We’ve become a nation of techno-narcissistic, math challenged, reality TV distracted, welfare entitled, materialistic, gluttonous, indebted consumers of Chinese slave labor produced crap. There are more Americans who know the name of Kanye West and Kim Kardashian’s bastard child (North West) than know the name of our Secretary of State (Ketchup Kerry). Americans can generate a text or tweet with blinding speed but couldn’t give you change from a dollar bill if their life depended upon it. They are whizzes at buying crap on Amazon or Ebay with a credit card, but have never balanced their checkbook or figured out the concept of deferred gratification and saving for the future. While the ignorant masses are worked into a frenzy by the media propaganda machine over gay marriage, diversity, abortion, climate change, and never ending wars on poverty, drugs and terror, our owners use their complete capture of the financial, regulatory, political, judicial and economic systems to pillage the remaining national wealth they haven’t already extracted.

The financial illiteracy of the uneducated lower classes and the willful ignorance of the supposedly highly educated classes has never been more evident than when examining the concept of Federal Reserve created currency debasement – also known as inflation. The insidious central banker created monetary inflation is the cause of all the ills in our warped, deformed, rigged financialized economic system. The outright manipulation and falsity of government reported economic data is designed to obscure the truth and keep the populace unaware of the deception being executed by the owners of this country. They have utilized deceit, falsification, propaganda and outright lies to mislead the public about the true picture of the disastrous financial condition in this country. Since most people are already trapped in the mental state of normalcy bias, it is easy for those in control to reinforce that normalcy bias by manipulating economic data to appear normal and using their media mouthpieces to perpetuate the false storyline of recovery and a return to normalcy.

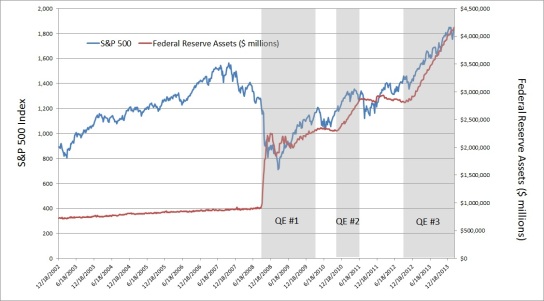

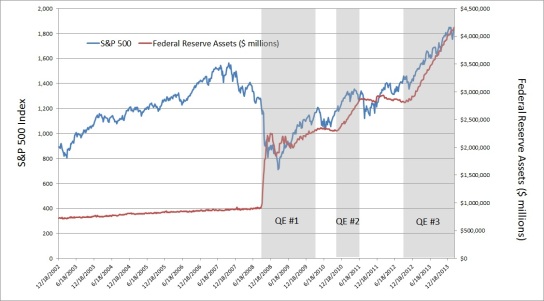

This is how feckless politicians and government apparatchiks are able to add $2.8 billion per day to the national debt; a central bank owned by Too Big To Trust Wall Street banks has been able to create $3.3 trillion out of thin air and pump it into the veins of its owners; and government controlled agencies report a declining unemployment rate, no inflation and a growing economy, without creating an iota of dissent or skepticism from the public. Americans want to be lied to because it allows them to continue living lives of delusion, where spending more than you make, consuming rather than saving, and believing stock market speculation and home price appreciation will make them rich are viable life strategies. Even though 90% of the population owns virtually no stocks, they are convinced record stock market highs are somehow beneficial to their lives. They actually believe Bernanke/Yellen when they bloviate about the dangers of deflation. Who would want to pay less for gasoline, food, rent, or tuition?

Unless you are beholden to the oligarchs, that sense of stress, discomfort, feeling that all in not well, and disturbing everyday visual observations is part of the cognitive dissonance engulfing the nation. Anyone who opens their eyes and honestly assesses their own financial condition, along with the obvious deterioration of our suburban sprawl retail paradise infrastructure, is confronted with information that is inconsistent with what they hear from their bought off politician leaders, highly compensated Ivy League trained economists, and millionaire talking heads in the corporate legacy media. Most people resolve this inconsistency by ignoring the facts, rejecting the obvious and refusing to use their common sense. To acknowledge the truth would require confronting your own part in this Ponzi debt charade disguised as an economic system. It is easier to believe a big lie than think critically and face up to decades of irrational behavior and reckless conduct.

What’s In Your GDP

“The Gross Domestic Product (GDP) is one of the broader measures of economic activity and is the most widely followed business indicator reported by the U.S. government. Upward growth biases built into GDP modeling since the early 1980s, however, have rendered this important series nearly worthless as an indicator of economic activity. The popularly followed number in each release is the seasonally adjusted, annualized quarterly growth rate of real (inflation-adjusted) GDP, where the current-dollar number is deflated by the BEA’s estimates of appropriate price changes. It is important to keep in mind that the lower the inflation rate used in the deflation process, the higher will be the resulting inflation-adjusted GDP growth.” – John Williams – Shadowstats

GDP is the economic statistic bankers, politicians and media pundits use to convince the masses the economy is growing and their lives are improving. Therefore, it is the statistic most likely to be manipulated, twisted and engineered in order to portray the storyline required by the oligarchs. Two consecutive quarters of negative GDP growth usually marks a recession. Those in power do not like to report recessions, so data “massaging” has been required over the last few decades to generate the required result. Prior to 1991 the government reported the broader GNP, which includes the GDP plus the balance of international flows of interest and dividend payments. Once we became a debtor nation, with massive interest payments to foreigners, reporting GNP became inconvenient. It is not reported because it is approximately $900 billion lower than GDP. The creativity of our keepers knows no bounds. In July of 2013 the government decided they had found a more “accurate” method for measuring GDP and simply retroactively increased GDP by $500 billion out of thin air. It’s amazing how every “more accurate” accounting adjustment improves the reported data. The economic growth didn’t change, but GDP was boosted by 3%. These adjustments pale in comparison to the decades long under-reporting of inflation baked into the GDP calculation.

As John Williams pointed out, GDP is adjusted for inflation. The higher inflation factored into the calculation, the lower reported GDP. The deflator used by the BEA in their GDP calculation is even lower than the already bastardized CPI. According to the BEA, there has only been 32% inflation since the year 2000. They have only found 1.4% inflation in the last year and only 7.1% in the last five years. You’d have to be a zombie from the Walking Dead or an Ivy League economist to believe those lies. Anyone living in the real world knows their cost of living has risen at a far greater rate. According to the government, and unquestioningly reported by the compliant co-conspirators in the the corporate media, GDP has grown from $10 trillion in 2000 to $17 trillion today. Even using the ridiculously low inflation BEA adjustment yields an increase from $12.4 trillion to only $15.9 trillion in real terms. That pitiful 28% growth over the last fourteen years is dramatically overstated, as revealed in the graph below. Using a true rate of inflation exposes the grand fraud being committed by those in power. The country has been in a never ending recession since 2000.

Your normalcy bias is telling you this is impossible. Your government tells you we have only experienced a recession from the third quarter of 2008 through the third quarter of 2009. So despite experiencing two stock market crashes, the greatest housing crash in history, and a worldwide financial system implosion the authorities insist we’ve had a growing economy 93% of the time over the last fourteen years. That mental anguish you are feeling is the cognitive dissonance of wanting to believe your government, but knowing they are lying. It is a known fact the government, in conspiracy with Greenspan, Congress and academia, have systematically reduced the reported CPI based upon hedonistic quality adjustments, geometric weighting alterations, substitution modifications, and the creation of incomprehensible owner’s equivalent rent calculations. Since the 1700s consumer inflation had been estimated by measuring price changes in a fixed-weight basket of goods, effectively measuring the cost of maintaining a constant standard of living. This began to change in the early 1980s with the Greenspan Commission to “save” Social Security and came to a head with the Boskin Commission in 1995.

Simply stated, the Greenspan/Boskin Commissions’ task was to reduce future Social Security payments to senior citizens by deceitfully reducing CPI and allowing politicians the easy way out. Politicians would lose votes if they ever had to directly address the unsustainability of Social Security. Therefore, they allowed academics to work their magic by understating the CPI and stealing $700 billion from retirees in the ten years ending in 2006. With 10,000 baby boomers per day turning 65 for the next eighteen years, understating CPI will rob them of trillions in payments. This is a cowardly dishonest method of extending the life of Social Security.

If CPI was calculated exactly as it was computed prior to 1983, it would have averaged between 5% and 10% over the last fourteen years. Even computing it based on the 1990 calculation prior to the Boskin Commission adjustments, would have produced annual inflation of 4% to 7%. A glance at an inflation chart from 1872 through today reveals the complete and utter failure of the Federal Reserve in achieving their stated mandate of price stability. They have managed to reduce the purchasing power of your dollar by 95% over the last 100 years. You may also notice the net deflation from 1872 until 1913, when the American economy was growing rapidly. It is almost as if the Federal Reserve’s true mandate has been to create inflation, finance wars, perpetuate the proliferation of debt, artificially create booms and busts, enrich their Wall Street owners, and impoverish the masses. Happy Birthday Federal Reserve!!!

When you connect the dots you realize the under-reporting of inflation benefits the corporate fascist surveillance state. If the government was reporting the true rate of inflation, mega-corporations would be forced to pay their workers higher wages, reducing profits, reducing corporate bonuses, and sticking a pin in their stock prices. The toady economists at the Federal Reserve would be unable to sustain their ludicrous ZIRP and absurd QEfinity stock market levitation policies. Reporting a true rate of inflation would force long-term interest rates higher. These higher rates, along with higher COLA increases to government entitlements, would blow a hole in the deficit and force our spineless politicians to address our unsustainable economic system. There would be no stock market or debt bubble. If the clueless dupes watching CNBC bimbos and shills on a daily basis were told the economy has been in fourteen year downturn, they might just wake up and demand accountability from their leaders and an overhaul of this corrupt system.

Mother Should I Trust the Government?

We know the BEA has deflated GDP by only 32% since 2000. We know the BLS reports the CPI has only risen by 37% since 2000. Should I trust the government or trust the facts and my own eyes? The data is available to see if the government figures pass the smell test. If you are reading this, you can remember your life in 2000. Americans know what it cost for food, energy, shelter, healthcare, transportation and entertainment in 2000, but they unquestioningly accept the falsified inflation figures produced by the propaganda machine known as our government. The chart below is a fairly comprehensive list of items most people might need to live in this world. A critical thinking individual might wonder how the government can proclaim inflation of 32% to 37% over the last fourteen years, when the true cost of living has grown by 50% to 100% for most daily living expenses. The huge increases in property taxes, sales taxes, government fees, tolls and income taxes aren’t even factored in the chart. It seems gold has smelled out the currency debasement and the lies of our leaders. This explains the concerted effort by the powers that be to suppress the price of gold by any means necessary.

|

Living Expense

|

Jan-00

|

Mar-14

|

% Increase

|

|

Gallon of gas

|

$1.27

|

$3.51

|

176.4%

|

|

Barrel of oil

|

$24.11

|

$100.00

|

314.8%

|

|

Fuel oil per gallon

|

$1.19

|

$4.07

|

242.0%

|

|

Electricity per Kwh

|

$0.084

|

$0.134

|

59.5%

|

|

Gas per therm

|

$0.712

|

$1.078

|

51.4%

|

|

Dozen eggs

|

$0.97

|

$2.00

|

106.2%

|

|

Coffee per lb

|

$3.40

|

$5.20

|

52.9%

|

|

Ground Beef per lb.

|

$1.90

|

$3.73

|

96.3%

|

|

Postage stamp

|

$0.33

|

$0.49

|

48.5%

|

|

Movie ticket

|

$5.25

|

$10.25

|

95.2%

|

|

New car

|

$20,300.00

|

$31,500.00

|

55.2%

|

|

Annual healthcare spending per capita

|

$4,550.00

|

$9,300.00

|

104.4%

|

|

Average private college tuition

|

$22,000.00

|

$37,000.00

|

68.2%

|

|

Avg home price (Case Shiller)

|

$161,000.00

|

$242,000.00

|

50.3%

|

|

Avg monthly rent (Case Shiller)

|

$635.00

|

$890.00

|

40.2%

|

|

Ounce of gold

|

$279.00

|

$1,334.00

|

378.1%

|

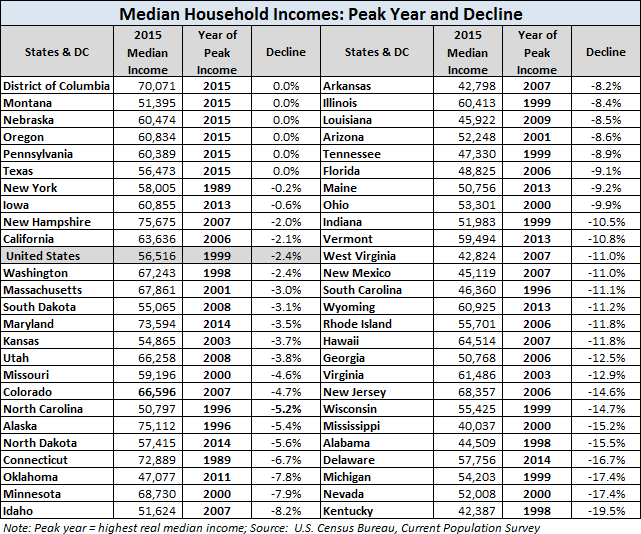

Mother, you should not trust the government. There is no doubt they have systematically under-reported inflation based on any impartial assessment of the facts. The reality that we remain stuck in a fourteen year recession is borne out by the continued decline in vehicle miles driven (at 1995 levels) due to declining commercial activity, the millions of shuttered small businesses, and the proliferation of Space Available signs in strip malls and office parks across the land. The fact there are only 8 million more people employed today than were employed in 2000, despite the working age population growing by 35 million, might be a clue that we remain in recession. If that isn’t enough proof for you, than maybe a glimpse at real median household income, retail sales and housing will put the final nail in the coffin of your cognitive dissonance.

The government and their media mouthpieces expect the ignorant masses to believe they have advanced their standard of living, with median household income growing from $40,800 to $52,500 since 2000. But, even using the badly flawed CPI to adjust these figures into real terms reveals real median household income to be 7.3% below the level of 2000. Using a true inflation figure would cause a CNBC talking head to have an epileptic seizure.

The picture is even bleaker when broken down into the age of households, with younger households suffering devastating real declines in household income since 2000. I guess all those retail clerk, cashier, waitress, waiter, food prep, and housekeeper jobs created over the last few years aren’t cutting the mustard. Maybe that explains the 30 million increase (175% increase) in food stamp recipients since 2000, encompassing 19% of all households in the U.S. Luckily the banking oligarchs were able to convince the pliable masses to increase their credit card, auto and student loan debt from $1.5 trillion to $3.1 trillion over the fourteen year descent into delusion.

When you get your head around this unprecedented decline in household income over the last fourteen years, along with the 50% to 100% rise in costs to live in the real world, as opposed to the theoretical world of the Federal Reserve and BLS, you will understand the long term decline in retail sales reflected in the following chart. When you adjust monthly retail sales for gasoline (an additional tax), inflation (understated), and population growth, you understand why retailers are closing thousands of stores and hurdling towards inevitable bankruptcy. Retail sales are 6.9% below the June 2005 peak and 4% below levels reached in 2000. And this is with millions of retail square feet added over this time frame. We know the dramatic surge from the 2009 lows was not prompted by an increase in household income. So how did the 11% proliferation of spending happen?

The up swell in retail spending began to accelerate in late 2010. Considering credit card debt outstanding is at exactly where it was in October 2010, it seems consumers playing with their own money turned off the spigot of speculation. It has been non-revolving debt that has skyrocketed from $1.63 trillion in February 2010 to $2.26 trillion today. This unprecedented 39% rise in four years has been engineered by the government, using your tax dollars and the tax dollars of unborn generations. The Federal government has complete control of the student loan market and with their 85% ownership of Ally Financial, the largest auto financing company, a dominant position in the auto loan market. The peddling of $400 billion of subprime student loan debt and $200 billion of subprime auto loan debt has created the illusion of a retail recovery. The student loan debt has been utilized by University of Phoenix MBA wannabes to buy iGadgets, the latest PS3 version of Grand Theft Auto and the latest glazed donut breakfast sandwich on the market. It’s nothing but another debt financed bubble that will end in tears for the American taxpayer, as hundreds of billions will be written off.

The fake retail recovery pales in comparison to the wolves of Wall Street produced housing recovery sham. They deserve an Academy Award for best fantasy production. The Federal Reserve fed Wall Street hedge fund purchase of millions of foreclosed shanties across the nation has produced media proclaimed home price increases of 10% to 30% in cities across the country. Withholding foreclosures from the market and creating artificial demand with free money provided by the Federal Reserve has temporarily added $4 trillion of housing net worth and reduced the number of underwater mortgages on the books of the Too Big To Trust Wall Street banks. The percentage of investor purchases and cash purchases is at all-time highs, while the percentage of first time buyers is at all-time lows. Anyone with an ounce of common sense can look at the long-term chart of mortgage applications and realize we are still in a recession. Applications are 35% below levels at the depths of the 2008/2009 recession. Applications are 65% below levels at the housing market peak in 2005. They are even 35% below 2000 levels. There is no real housing recovery, despite the propaganda peddled by the NAR, CNBC, and Wall Street. It’s a fraud.

It is the pinnacle of arrogance and hubris that a few Ivy League educated economists sitting in the Marriner Eccles Building in the swamps of Washington D.C., who have never worked a day in their lives at a real job, think they can create wealth and pull the levers of money creation to control the American and global financial systems. All they have done is perfect the art of bubble finance in order to enrich their owners at the expense of the rest of us. Their policies have induced unwarranted hope and speculation on a grand scale. Greenspan and Bernanke have provoked multiple bouts of extreme speculation in stocks and housing over the last 15 years, with the subsequent inevitable collapses. Fed encouraged gambling does not create wealth it just redistributes it from the peasants to the aristocracy. The Fed has again produced an epic bubble in stock and bond valuations which will result in another collapse. Normalcy bias keeps the majority from seeing the cliff straight ahead. Federal Reserve monetary policies have distorted financial markets, created extreme imbalances, encouraged excessive risk taking, and ruined the lives of working class people. Take a long hard look at the chart below and answer one question. Was QE designed to benefit Main Street or Wall Street?

The average American has experienced a fourteen year recession caused by the monetary policies of the Federal Reserve. Our leaders could have learned the lesson of two Fed induced collapses in the space of eight years and voluntarily abandoned the policies of reckless credit expansion, instead embracing policies encouraging saving, capital investment and balanced budgets. They have chosen the same cure as the disease, which will lead to crisis, catastrophe and collapse.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises