Is humanity forming en-masse? for lo, tyrants tremble, crowns grow dim,

The earth, restive, confronts a new era, perhaps a general divine war,

No one knows what will happen next, such portents fill the days and

nights;

Years prophetical! the space ahead as I walk, as I vainly try to

pierce it, is full of phantoms,

Unborn deeds, things soon to be, project their shapes around me,

This incredible rush and heat, this strange ecstatic fever of dreams

O years! – Years of the Modern– Walt Whitman

The great American poet Walt Whitman wrote these words in 1859. Whitman was trying to peer into a future of uncertainty. He was sure the future would be bleak. He had visions of phantoms. Maybe he saw the 600,000 souls who would lose their lives in the next six years. Whitman had captured the mood of a country entering the Fourth Turning. He didn’t know what would happen, but he felt the beat of war drums in the distance. Whitman did not have the benefit of historical perspective that we have today.

There have been three Fourth Turnings in American History. The American Revolution Fourth Turning ended in 1794 with the Crisis mood easing with the presidency of George Washington. Whitman didn’t realize that, 64 years after the previous Fourth Turning, the mood of the country was ripe for revolution and the sweeping away of the old order. When the stock market crashed in 1929, 64 years after the exhausting conclusion to the Civil War Fourth Turning, Americans didn’t realize the generational constellation was propelling them toward a new social order and a horrific world war. It is now 66 years since the conclusion of the Depression/WWII Fourth Turning. All indications are that the current Fourth Turning began in the 2007 – 2009, with the collapse of the housing market and the ensuing financial system implosion.

I find myself vainly trying to pierce the veil of events yet to be. The future is filled with haunting phantoms of unborn deeds which could lead to renewed glory, untold death and destruction, or the possibly the end of the great American experiment. Walt Whitman captured the change of mood in the country with his poem. History books are filled with dates and descriptions of events, battles, speeches and assassinations. What most people don’t understand is Fourth Turnings aren’t about events, but about the citizens’ reaction to the events.

The Boston Massacre did not start the American Revolution Fourth Turning, but the Boston Tea Party did. John Brown’s attack on Harper’s Ferry did not start the Civil War Fourth Turning, but the election of Abraham Lincoln did. World War I did not start the Great Depression/World War II Fourth Turning, but the 1929 Stock Market Crash did. The 9/11 terrorist attack did not start latest Fourth Turning, but the Wall Street induced housing/financial system collapse did. In each instance, the generations were aligned in a manner that would lead to a sweeping away of the old civic order and a regeneracy with the institution of a new order. Old Artists disappear, Prophets enter elder hood, Nomads enter midlife, Heroes enter young adulthood—and a new generation of child Artists is born.

One hundred and fifty years ago this week Fort Sumter was bombarded by upstart revolutionaries attempting to break away from an overbearing Federal government based in Washington D.C. Exactly four years later the butchery and death concluded dramatically with Robert E. Lee surrendering to Ulysses S. Grant at Appomattox and the assassination of Abraham Lincoln by John Wilkes Booth at Ford’s Theatre. For the next four years we will celebrate the 150th anniversary of various battles that marked the Civil War. What people will not consider are the similarities between that tumultuous period in our history and the period we are in today. Fourth Turnings are marked by different events but the same mood of upheaval, anger and fury.

As Strauss & Howe note in their book, the morphology of a Fourth Turning follows a predictable pattern:

- A Crisis era begins with a catalyst – a starting event (or sequence of events) that produces a sudden shift in mood.

- Once catalyzed, a society achieves a regeneracy – a new counter entropy that reunifies and reenergizes civic life.

- The regenerated society propels toward a climax – a crucial moment that confirms the death of the old order and birth of the new.

- The climax culminates in a resolution – a triumphant or tragic conclusion that separates the winners from losers, resolves the big public questions, and establishes the new order.

Strauss & Howe describe the normal sequence:

This Crisis morphology occurs over the span of one turning, which (except for the U.S. Civil War) means that around fifteen to twenty-five years elapse between the catalyst and the resolution. The regeneracy usually occurs one to five years after the era begins, the climax one to five years before it ends.

The catalysts are relatively easy to identify, but the point of regeneracy is more subtle and harder to grasp.

Fiery Moment of Death & Discontinuity

“Like nature, history is full of processes that cannot happen in reverse. Just as the laws of entropy do not allow a bird to fly backward, or droplets to regroup at the top of a waterfall, history has no rewind button. Like the seasons of nature, it moves only forward. Saecular entropy cannot be reversed. An Unraveling cannot lead back to an Awakening, or forward to a High, without a Crisis in between. The spirit of America comes once a saeculum, only through what the ancients called ekpyrosis, nature’s fiery moment of death and discontinuity. History’s periodic eras of Crisis combust the old social order and give birth to a new.” – Strauss & Howe – The Fourth Turning

The catalyst for the American Revolution was the Boston Tea Party. The catalyst for the Civil War was the election of Abraham Lincoln. The catalyst for the Great Depression was the 1929 Stock market crash. The catalyst for the current Crisis was the housing/financial system collapse. The catalyst is an event that terminates the brooding mood of the Unraveling and unleashes the fury of a Crisis. The three previous Crisis periods in American history were driven by different events, but similar generational dynamics. By closely examining the dynamics and threats that were facing the country during these previous Crisis periods, we may be able to peer into the murky fog of the future and make out the phantoms of events to come. What we know for sure is every previous Crisis had an economic and fairness dimension that provided the initial spark, triggering a series of events that eventually led to an all encompassing war for survival.

American Revolution – The economic dimension that led to the onset of the American Revolution can be summed up in the rallying cry of the colonists, “No Taxation, Without Representation.” The British felt that the colonies were created to be used in the way that best suited the crown and parliament. The French & Indian War left the British Empire deeply in debt. They responded by demanding more revenue from the colonies. The British Parliament continued to pass taxation Acts which became increasingly onerous to the independent minded American colonists:

- Sugar Act – 1764

- Currency Act – 1765

- Stamp Act – 1765

- Townshend Acts – 1767

- Tea Act – 1773

The increasing levels of taxation and control resulted in the formation of Committees of Correspondence and the Sons of Liberty. Samuel Adams, Thomas Paine and the other firebrands led the movement for independence. The colonists grew increasingly angry with the heavy handedness and harshness of the British Monarchy. These incidents and actions solidified the mood for independence:

- Quartering Act – 1765

- Boston Massacre – 1770

- Intolerable Acts – 1774

As you can see there were years of economic and political turmoil before the Boston Tea Party catalyst event ignited the revolution. The mood of enough citizens had shifted as the generational alignment no longer allowed for compromise. In the end, the increase of economic restrictions and limiting of freedom led to the revolution. As a side note, a Fourth Turning does not need a majority to be initiated. Only one-third of the colonists actively supported the rebellion.

American Civil War – The economic dimension that drove the dynamics of the Civil War related to the Southern agrarian society based upon growing cotton and the rapidly industrializing North with its cities and manufacturing prowess. The invention of the cotton gin led to many more plantations in the South depending solely on cotton to support their way of life. Cotton farming required vast amounts of cheap human labor, and slaves fit the bill. Abolitionists in the North had the moral high ground as Southern plantation owners treated human beings as property. Attitudes became more intense after the publication of Uncle Tom’s Cabin, the Dred Scott Decision, and the John Brown raid on Harper’s Ferry. The issue of slavery had been boiling beneath the surface since the adoption of the US Constitution. Various compromises had been struck over the years to keep the issue at bay:

- Missouri Compromise

- Compromise of 1850

- Kansas – Nebraska Act

These economic and human rights issues became wrapped in the mantle of states’ rights and the struggle between the Federal government and State governments. The battle reached back to the earliest days of the Republic between Jefferson and Hamilton. Many felt that the new constitution ignored the rights of states to continue to act independently. They felt the states should still have the right to decide if they were willing to accept certain federal acts. This resulted in the idea of nullification, whereby the states would have the right to rule federal acts unconstitutional. The federal government denied states this right. With the election of Abraham Lincoln, the Southern states saw a man who was against slavery, believed in a strong Federal government, and supporter of the industrial North. The years of compromise were over. The firebrand prophet generation took control in Washington DC and Richmond Virginia. A fight to the finish was unavoidable.

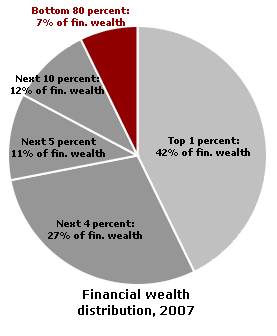

Great Depression/World War II – The economic dimension that drove the onset of this Crisis was the unbridled greed and speculation of Wall Street banks. The easy money policies of the Federal Reserve, formed in secret and voted into existence on Christmas Eve with many members of Congress not present created the Roaring 20’s. While farmers struggled to survive on the drought stricken plains and the average person lived a hard scrabble existence, the banking elite reaped obscene profits, with the top 1% sucking 23.9% of all the national income – the highest level in U.S. history.

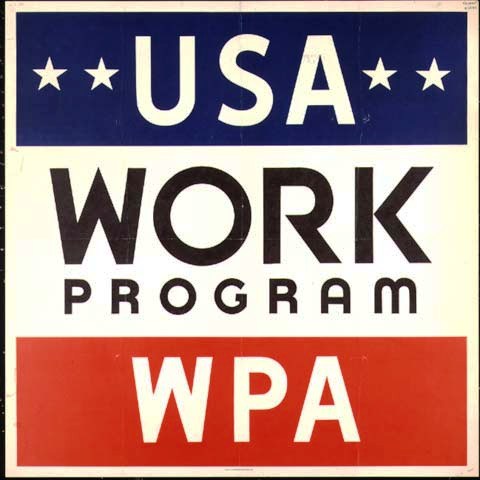

The 1920’s were a time of cultural decay, decadence and disillusionment. This mood was reflected in F. Scott Fitzgerald’s The Great Gatsby. As we know too well, every boom eventually goes bust. The bust came in October 1929, with a stock market crash. Stockholders lost $40 billion. The market dropped 89% over a two year period. By 1933, 11,000 of the 25,000 banks in the US had failed. These were mostly small regional banks. The major NY banks such as JP Morgan and Mellon became more powerful. The artificial interference in the economy by the Federal government and Federal Reserve was a disaster prior to the Depression, and government efforts to prop up the economy after the crash of 1929 only made things worse. Passage of the Smoot-Hawley tariffs spread the depression around the world. The economic hardship in Germany led to the election of Adolf Hitler and set the stage for a future war that would kill 65 million people. FDR’s New Deal programs crowded out private industry and resulted in unemployment staying at levels exceeding 15% for an entire decade. Keynesian government spending prolonged the depression and put into place social programs that set in motion the debt bomb that threatens the country today.

Force Advancing with Irresistible Power

I see not America only, not only Liberty’s nation but other nations

preparing,

I see tremendous entrances and exits, new combinations, the solidarity

of races,

I see that force advancing with irresistible power on the world’s stage,

(Have the old forces, the old wars, played their parts? are the acts

suitable to them closed?)

I see Freedom, completely arm’d and victorious and very haughty,

with Law on one side and Peace on the other,

A stupendous trio all issuing forth against the idea of caste;

What historic denouements are these we so rapidly approach?

I see men marching and countermarching by swift millions,

I see the frontiers and boundaries of the old aristocracies broken,

I see the landmarks of European kings removed,

I see this day the People beginning their landmarks, (all others give

way;)

Never were such sharp questions ask’d as this day,

Never was average man, his soul, more energetic, more like a God,

Years of the Modern– Walt Whitman

Walt Whitman foresaw vast armies on the march and old orders being swept away by the historic denouements that were rapidly approaching. But even he couldn’t have foreseen the butchery and tragic deaths of over 600,000 men in the next four bloody years. The economic dimensions of the current Crisis were foreseeable at least a decade before the Crisis arrived. The Federal Reserve, under the “wise” supervision of former Ayn Rand disciple Alan Greenspan, progressively blew one bubble after another through its easy money policies. The Greenspan Put allowed the Wall Street vampire squids to suck the life out of the American economic system without fear of being harpooned for taking financial system endangering leveraged bets. The financial oligarchs used their influence, power and vast wealth to repeal Glass-Steagall, capture and buy off the rating agencies, neuter the SEC and other regulatory agencies and place their executives in high level government positions. The ruling wealthy elite again matched their peak take of the national income, just as they did in 1928.

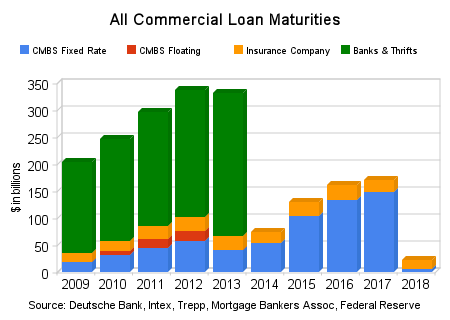

The debt, fraud and lack of financial regulation that catalyzed the near collapse of the worldwide financial system in 2008, 63 years after the end of the last Fourth Turning, have not been purged from the system. In fact, those in power have decided more debt, accounting fraud and financial ignorance is the path to recovery for America. The issues which will be the driving forces during this Crisis are clear to anyone with their eyes open:

- A National Debt the will approach $20 trillion by 2015 and has already surpassed 90% of GDP, the point of no return.

- Annual deficits exceeding $1.5 trillion and equal to over 10% of GDP.

- The unfunded promises made by slimy politicians over decades for Medicare, Medicaid and Social Security exceeds $100 trillion and can never be paid.

- A military industrial complex that controls Congress, is fighting three wars, occupies hundreds of bases throughout the world and spends $1 trillion per year, seven times more than any other country in the world.

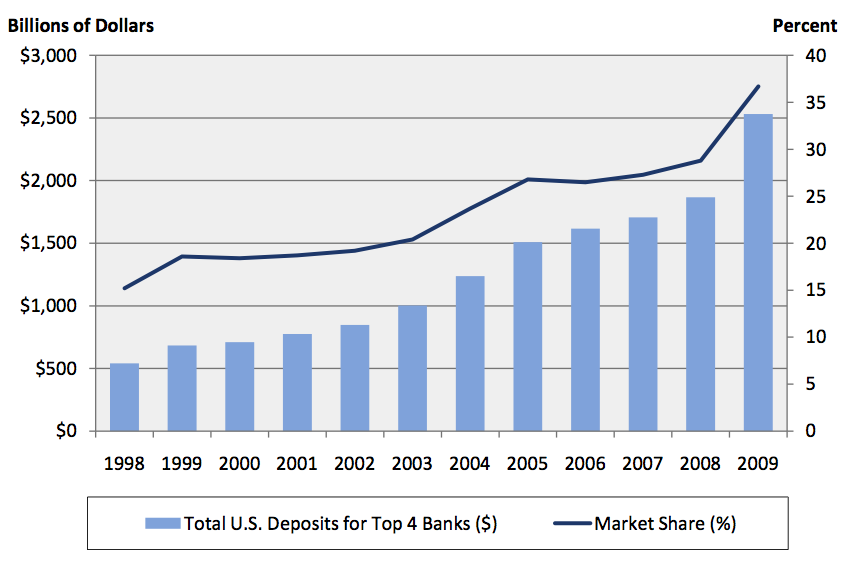

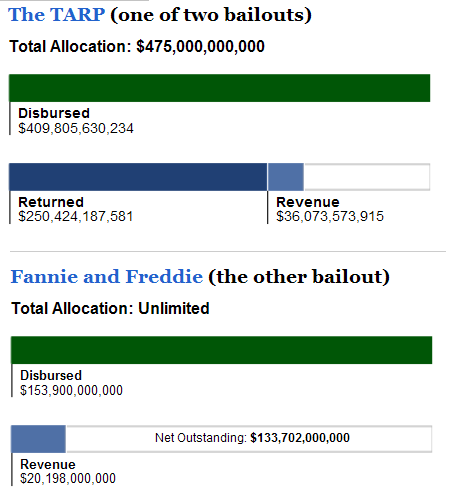

- A financial industry debt peddling complex that has gained control over the government and media to such an extent they have been able to rape and pillage the American people for three decades, convincing regulatory agencies to allow them 40 to 1 leverage, crashing the financial system through a massive mortgage/derivatives fraudulent ponzi scheme, threatening the American people into giving them $4 trillion of taxpayer money, paying themselves hundreds of billions in bonuses for a job well done, and then insisting on lower taxes for their corporations and the rich oligarchs who inhabit these towers of evil in downtown Manhattan.

- Wealthy elite who use their existing wealth to control Congress, the media and the financial debt peddling industry, abscond with 25% of the national income and control 42% of the financial wealth in the country. At the same time real wages of middle class Americans have been stagnant for 4 decades, real unemployment exceeds 20%, 45 million people need food stamps to make ends meet, and real inflation on the things middle class Americans need hovers around 10%. The gap between the Haves and Have Nots has never been greater.

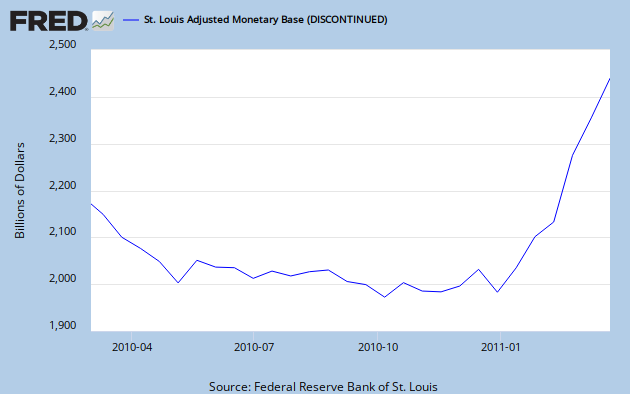

- The Federal Reserve has boxed itself into a corner and will be unable to extricate itself with its only weapon – the printing press. It has tripled the size of its balance sheet to $2.7 trillion, with at least half of the “assets” consisting of toxic worthless mortgages bought from their Wall Street masters. 0% interest rates for two and a half years, QE1 and QE2, and allowing banks to fraudulently report the value of their loans have failed to jumpstart the economy. Come June of 2011 they will be faced with a dilemma – PRINT or DIE. If they stop buying U.S. Treasury debt, interest rates will go up dramatically. If they keep printing to buy U.S. Treasury debt, the dollar will continue to fall and inflation will accelerate from its already high level.

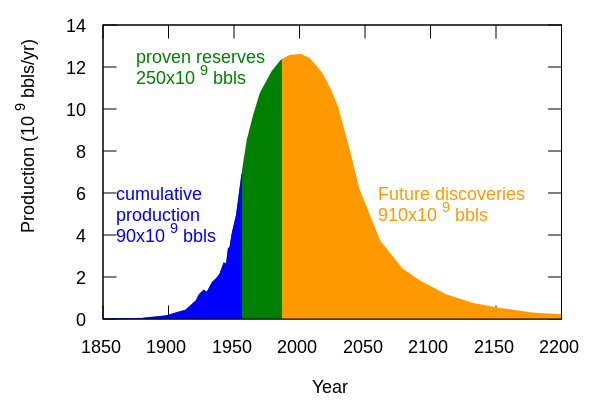

- The biggest wildcard among the Fourth Turning catalysts is Peak Oil. The modern industrial world is completely dependent upon cheap accessible oil. Globalization, consumerism, suburban sprawl, food production and distribution, and all means of transportation are dependent upon cheap abundant oil. Peak world oil production has occurred. Demand will outstrip supply going forward at an ever increasing rate. Various levels of chaos will ensue as the realization of this fact becomes evident to everyone.

- The peak oil scenario will mix with the toxic brew of religion. The centuries old war between Christianity and Islam has been gaining strength over the last three decades. The revolutions spreading across the Middle East will not die down. They will intensify and create havoc for the existing despotic regimes. The new regimes will not be friendly towards the U.S. The combination of peak oil, with the fact that 56% of the world’s oil reserves are controlled by Muslim countries in the Middle East provides an unsettling backdrop for the U.S., which controls less than 2% of the world’s oil reserves.

- The technological complexity and interconnectedness of people across the world is a danger and a possible boon to civilization. Our entire world is dependent upon computers and networks to run our infrastructure, defense, commerce, and everyday lives. Armies, naval ships, and massed confrontation will be made obsolete by cyber warfare. Computer hackers will be able to do more damage to a country in minutes than armies could do in years of traditional warfare. The trillions the US spends on aircraft carriers, fighter jets and tanks will be wasted. The positive side of technology has been realized in its ability to organize people to fight oppression and government propaganda. Likeminded people have been able to use technology to seek and reveal the truth.

The initial stage of this Fourth Turning has run its course. The catalyst was easy to recognize. The issues that confront the nation over the next twenty years are clear. What is completely unclear to me is how our fractured society achieves a regeneracy – a new counterentropy that reunifies and reenergizes civic life. The regeneracy usually occurs one to five years after the Crisis era begins. This means that the country would need to reunify and begin to confront our challenges by 2013. Regeneracy began with the Declaration of Independence during the American Revolution. Regeneracy began with Abraham Lincoln demanding the enlistment of 500,000 men after the Battle of Bull Run. Regeneracy began with FDR’s New Deal programs in 1933 during the Great Depression. What will begin the Regeneracy this time?

Something Wicked This Way Comes

“Decisive events will occur – events so vast, powerful, and unique that they lie beyond today’s wildest hypothesis. These events will inspire great documents and speeches, visions of a new political order being framed. People will discover a hitherto unimagined capacity to fight and die, and to let their children fight and die, for a communal cause. The Spirit of America will return, because there will be no other choice. Thus will Americans reenact the great ancient myth of the ekpyrosis. Thus will we achieve our next rendezvous with destiny.” – Strauss & Howe – The Fourth Turning

The storyline promulgated by the mainstream linear thinking opinion leaders is the economy is recovering, the banking system is sound, the stock market is booming, buying a house is a great investment, inflation is below 2%, jobs are being created, and consumers have regained their confidence and spending power. This message is hammered home on a daily basis by the corporate run mainstream media. It is patently false and the thinking members of the American public know it. The economic condition of the country is rapidly deteriorating. While politicians posture and lie to the citizens, the fissures in our financial system grow wider. As of today, regeneracy and unification behind one common national purpose seems light years away. Strauss & Howe speculated in 1997 about potential events that could spur events during the next Fourth Turning. One of their possible scenarios looms in the near future:

- An impasse over the federal budget reaches a stalemate. The president and Congress both refuse to back down, triggering a near-total government shutdown. The president declares emergency powers. Congress rescinds his authority. Dollar and bond prices plummet. The president threatens to stop Social Security checks. Congress refuses to raise the debt ceiling. Default looms. Wall Street panics.

The event necessary to cause a regeneracy in this country will need to be on an epic scale. Based upon a review of the foreseeable issues confronting our society it is clear to me that a worse financial implosion will strike before the 2012 presidential election. It may be triggered by a debt ceiling confrontation, the ending of QE2, a panic out of the USD, hyperinflation, a surge in oil prices, or some combination of these possibilities. The ensuing collapse of the stock and bond markets will remove the last vestiges of trust in the existing financial system and the government bureaucrats who have taken taxpayer dollars and funneled them to these Wall Street oligarchs.

The economic chaos will likely lead to a Republican landslide in the 2012 election. A Boomer Prophet with a reputation for fixing financial disasters (aka Mitt Romney) would be given a mandate to fix the economic system. All generations will realize that generational promises made cannot be fulfilled. People of a libertarian mindset, like me, will not be happy with the turn of events. In a chaotic scenario, the Federal government is likely to assume even more power than they have today. The American people will be fearful and angry. If the financial criminals on Wall Street are brought to justice, the chances of a unified populace will increase. A drop in everyone’s standard of living would be acceptable, as long as the rich shared equally in the burden. If the super wealthy oligarchs retain their power, a fracturing along class lines would become a distinct possibility. Social unrest, riots, and violent protests along the lines of the current situation in the Middle East could develop. Then a question of military use against the civilian population becomes paramount to what would happen next.

Amidst the financial chaos will be the ever present peak oil issue. The increasingly high prices and imminent shortages of supply will exacerbate the pain for the American people. The current War on Terror is really a cover for keeping American troops in the Middle East as a forward vanguard to keep the oil flowing. The U.S. consumes 7 billion barrels of oil per year and will use all means necessary to keep it flowing. With a Boomer Prophet leader invoking American manifest destiny, it is likely we will intervene to protect Saudi Arabia, Iraq, and Kuwait in the name of democracy. A terrorist incident in the U.S. would provide convenient cover for further intervention in the Middle East. As with most wars the unintended consequences will overwhelm the best laid plans of politicians and generals. Further U.S. intervention into an already exploding Middle East will likely spur a larger conflict between Islam and Christianity. Ground zero could shift to Europe as millions of Muslims have settled there and will not react positively to western powers siphoning oil from Islamic countries in the name of Christianity. History has taught us that Fourth Turnings end in all out war. The outcome of wars is always in doubt.

“History offers more sobering warnings: Armed confrontation usually occurs around the climax of Crisis. If there is confrontation, it is likely to lead to war. This could be any kind of war – class war, sectional war, war against global anarchists or terrorists, or superpower war. If there is war, it is likely to culminate in total war, fought until the losing side has been rendered nil – its will broken, territory taken, and leaders captured. And if there is total war, it is likely that the most destructive weapons available will be deployed.” – Strauss & Howe – The Fourth Turning

“Each of the last three American Crises produced moments of extreme danger: In the Revolution, the very birth of the republic hung by a thread in more than one battle. In the Civil War, the union barely survived a four-year slaughter that in its own time was reagrded as the most lethal war in history. In World War II, the nation destroyed an enemy of democracy that for a time was winning; had the enemy won, America might have itself been destroyed. In all likelihood, the next Crisis will present the nation with a threat and a consequence on a similar scale.” – Strauss and Howe – The Fourth Turning

It may be 150 years since Walt Whitman foresaw the imminent march of armies, visions of unborn deeds, and a sweeping away of the old order, but history has brought us right back to where we started. Immense challenges and threats await our nation. Will we face them with the courage and fortitude of our forefathers? Or will we shrink from our responsibility to future unborn generations? The drumbeat of history grows louder. Our rendezvous with destiny beckons.