It is not easy to destroy the greatest empire in the history of mankind. The 20th Century was the American Century, but as with all empires, the combination of hubris, monetary debasement, imperial overreach and delusional overconfidence have set in motion the inevitable downfall of the American Empire. The policies, decisions, beliefs, and institutions implemented over decades have led the country to the threshold of financial disaster. Based on my observations, a catastrophic combination of demographics, fiat currency debasement, titanic levels of debt, smothering taxation, power in the hands of the few and Wall Street greed have led us to peak Empire. It will be downhill from here as we experience collapse, revolution and ultimately, retribution for the guilty and presumed guilty. I have already addressed the Baby Boomer generation’s contribution to our current plight, to the delight and accolades of Boomers across the land in For a Few Dollars More – Part One. The Boomers were a victim of their size and the timing of their arrival on the scene of empire collapse. Their delusions of debt based wealth and me first attitude could not have been satiated without the creation of the Federal Reserve and the institution of the personal income tax in 1913.

“When a man’s got money in his pocket he begins to appreciate peace.” – Joe – Fistful of Dollars

“Every town has a boss.” – Joe – Fistful of Dollars

In the Old West of the 1800’s, before the creation of the Federal Reserve, money in your pocket meant gold or silver. If Joe were to repeat that line today, he would change it slightly:

“When a man thinks he’s got money in his pocket he begins to appreciate the good things in life like McMansions, BMWs, government provided retirement, government provided healthcare, and delusions of ever increasing wealth.”

Man made inflation is a glorious invention for the men who invented it. For the people who deal with it every day, not so much. Joe knew that every town had a boss. If you didn’t know who the boss was in the United States of America before 2008, you know now. Ben Bernanke and the Federal Reserve Bank of the United States is the boss of this town.

Crony Capitalism Pays for the Cronies

Without Federal Reserve intervention in the financial markets since September 2008, the biggest banks in the world would have entered bankruptcy liquidation. The U.S. economy would have experienced a 10% to 20% fall in GDP. The unemployment rate would have soared above 15%. The stock market would have fallen 70%. Wealthy bondholders and stockholders would have seen their wealth cut in half. Incumbent politicians would have all been thrown out of office. The richest Americans, constituting the ruling class, would have borne the brunt of the pain.

In a true capitalist system, organizations and people who assumed too much risk and made poor decisions would have failed. But the United States does not have a capitalist system. We have a corporate fascist economic system where a small cartel of bankers, military weapons suppliers, and mega-corporations set the agenda for the country through their complete capture of politicians and the mainstream corporate media. At the height of the crisis in 2008, President George Bush revealed whose side he chose:

“I’ve abandoned free-market principles to save the free-market system, to make sure the economy doesn’t collapse. I feel a sense of obligation to my successor to make sure there is not a, you know, a huge economic crisis. Look, we’re in a crisis now. I mean, this is — we’re in a huge recession, but I don’t want to make it even worse.”

George Bush was born with a silver spoon in his mouth. He was not trying to save the free-market system, because we didn’t have a free market system. He was saving his fellow billionaires under the cover of saving the average American. Bush knew as much about saving our economic system as he knew about when to declare mission accomplished in Iraq. He turned the task of saving the free market system over to his multi-billionaire Goldman Sachs Secretary of Treasury Hank Paulson and the real boss of Washington DC, Ben Bernanke. These noble American patriots proceeded to save the top 1% richest Americans on the backs of the American middle class. They did it under the guise of keeping the country out of a Depression. Those who committed the crimes and destroyed the worldwide financial system not only didn’t get punished, they were enriched by the actions of Paulson and Bernanke. This entire sordid chapter in the history of the American empire from 2008 until the imminent collapse, sometime before 2015, will leave future historians dumbfounded at the utter insanity and foolishness of the decisions that were made during the death throes of the empire. Not only did George Bush not save the free-market system, but he drove a stake thru its heart.

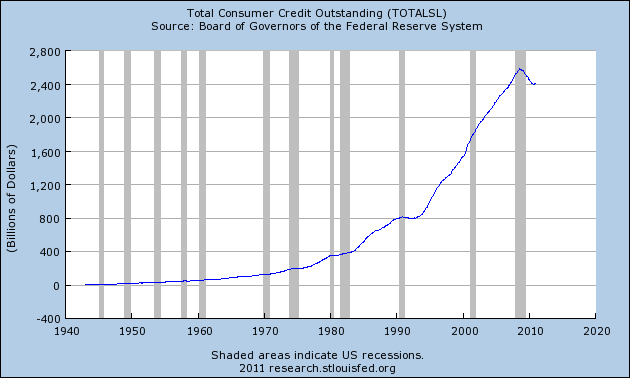

To boil the entire 2008 financial collapse down to one word, it would be: DEBT.

Three decades of ever increasing levels of consumer, corporate, and government debt eventually led to an unprecedented implosion. It was as predictable in 2008, to those who understand the fiat monetary system, as it was to Ludwig von Mises decades ago:

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

Federal Reserve – Destroyer of Worlds

The 2008 crash and the 1929 crash were manmade disasters. Alan Greenspan and Ben Bernanke created the atmosphere and conditions that led to the risk taking by bankers, home buyers and consumers. Monetary expansion, excessively low interest rates, the Greenspan/Bernanke Put, disinterest in regulation, and pandering to politicians allowed the party to get out of control. Taking away the punch bowl never crossed their mind. The Federal Reserve is controlled by the major Wall Street banks. These banks were partnerships until the 1980s, with partners personally liable for the actions of their banks. Excessive risk taking meant possible personal bankruptcy. Once they became corporations, excessive risk meant excessive compensation for the executives, with the downside being borne by the shareholders.

But that wasn’t enough. The executives were large shareholders, so they convinced the Federal Reserve to bail their corporations out whenever they made bad bets. It was a sweet deal if you were a banker. Knowing their lackeys at the Fed had their back, the goliath Wall Street banks used their power and wealth to convince the SEC to waive the 12 to 1 leverage rules so they could leverage their balance sheets 40 to 1. This meant that a 5% loss in their capital and they would be insolvent. The Harvard MBA CEO titans of the financial world created the housing bubble through their creation of fraud inducing mortgage products, a bewildering array of derivative products that even their MBA geniuses didn’t understand, and betting against the derivatives they were selling to their clients. When this toxic brew of fraud and debt exploded in their faces, the value of the assets on their books plunged by 30% to 40% in 2008 and 2009. The 10 biggest financial institutions in the country were effectively bankrupt. An orderly bankruptcy liquidation that wiped out the bondholders, stockholders and top executives was the solution to excessive risk taking and failure.

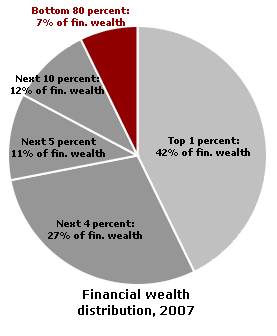

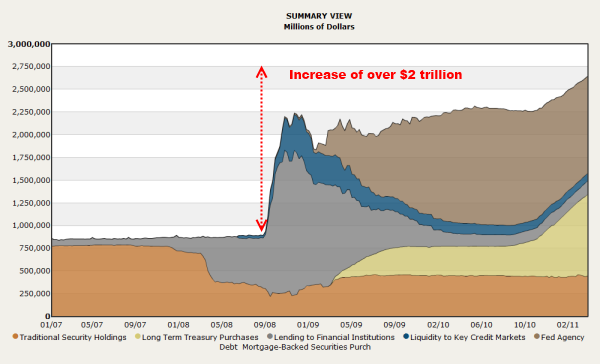

This was an unacceptable solution to the billionaire class that owns half the financial wealth in the country. The President was a multi-millionaire. The Treasury Secretary was a billionaire. There were 250 millionaires in Congress. The top executives of the banks that own and control the Federal Reserve are multi-millionaires. The owners and talking head pundits of the mainstream media are all in the billionaire/millionaire class. The cover story used to bilk $700 billion from middle class taxpayers into the coffers of Wall Street mega-banks was that if we didn’t hand over the loot, the financial system would collapse and a Great Depression would ensue. Every program, policy, and rule change that has been rolled out since September 2008 by the Federal Reserve, Treasury, and Congress has benefitted billionaires, bankers, and politically connected corporations. The Federal Reserve has printed over $2 trillion out of thin air to save the billionaires that have been pillaging the middle class for decades.

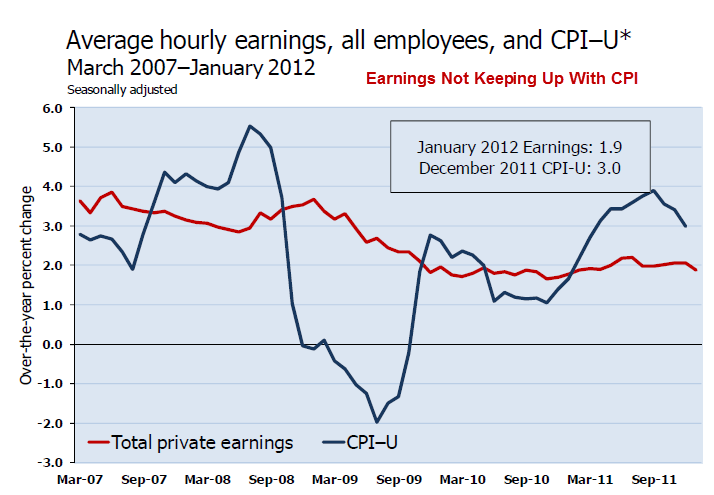

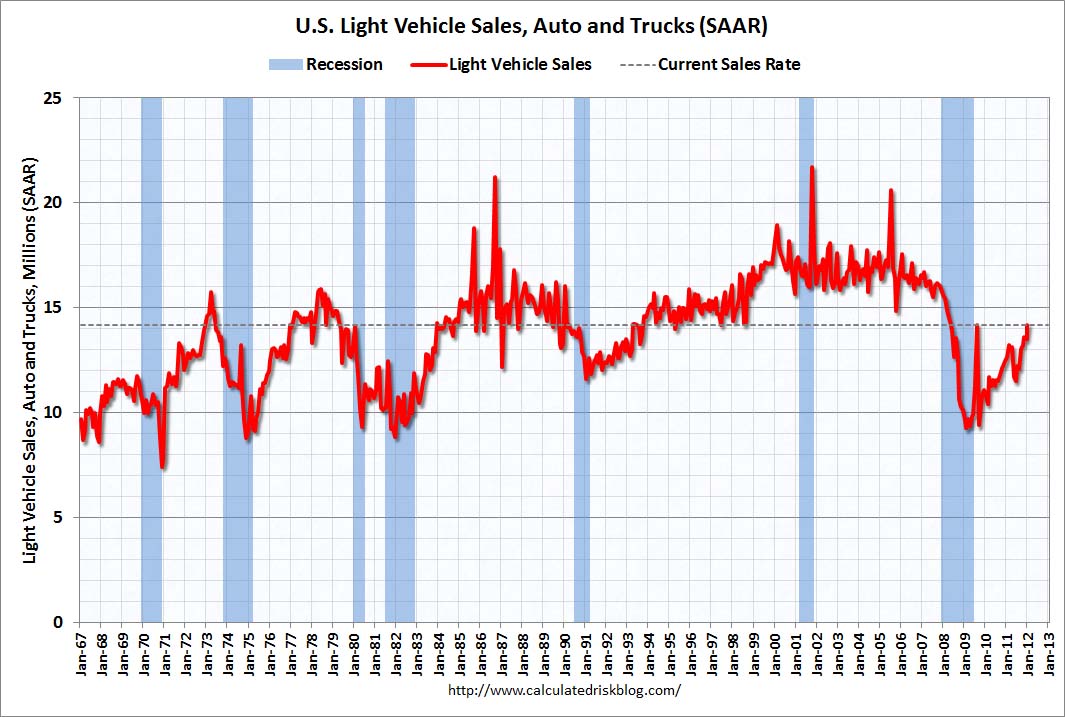

The Federal Reserve bought $1.25 trillion of toxic mortgages from Wall Street, allowed these banks to borrow at 0%, threatened the FASB into suspending mark to market accounting so banks could fake the value of their loans, instructed banks to rollover commercial real estate loans as if they weren’t really worth 40% less than the value on their books, and rolled out $600 billion of QE2 in order to create a stock market rally, benefitting their billionaire constituents. The $800 billion stimulus program was shoveled to the corporate friends (contributors) of Congressmen across the land. Cash for Clunkers benefitted government owned car companies. The home buyer tax credit and changing loss carry back rules benefitted mega home builders. Every one of these deeds enriched bankers and billionaires while further impoverishing the working middle class. Real middle class wages continue to fall, unemployment remains near record levels, real inflation in food and energy is running above 10%, senior citizens haven’t gotten a Social Security increase in two years, savers are getting .25% on their savings, home prices continue to fall, and future generations will be stuck with the bill for the billionaire bailout.

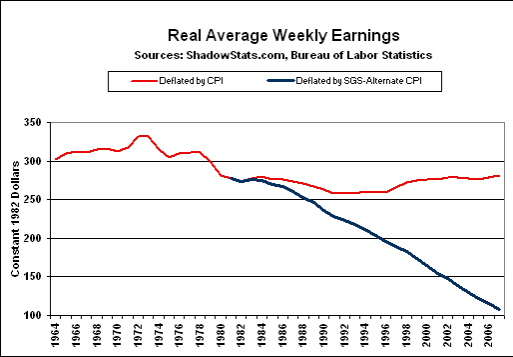

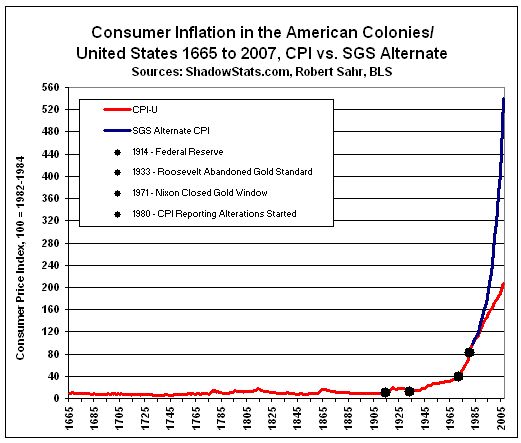

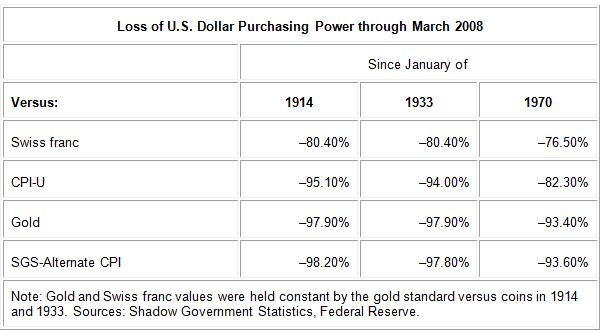

The standard of living for the average American continues to fall. Real household income is lower than it was in 1999. The only reason it increased in the 1980s and 1990s was the huge influx of women into the workforce. Two earners were needed to try and maintain a constant standard of living. Real average weekly earnings are lower today than they were in 1970, even using the government bastardized CPI calculation that has been so massaged since 1982 that it has only resulted in a happy ending for government bureaucrats at the BLS. Calculating the CPI exactly as it was calculated in 1980 reveals the truth of what the Federal Reserve has wrought on working class America, a drastic decrease in their standard of living. The insidiousness of Federal Reserve created inflation has sucked the life out of the middle class and enriched the cocktail party class.

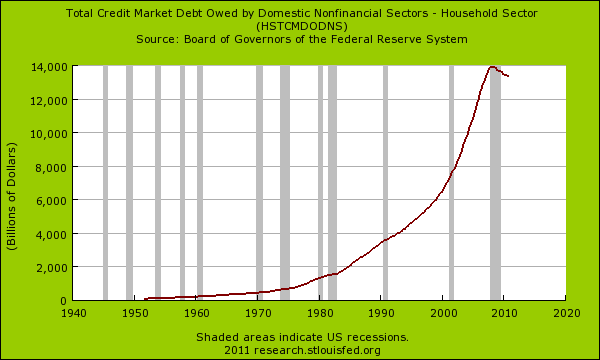

The stealth transfer of wealth from the working middle class to the richest in our society was done through convincing the middle class that buying things with debt made you richer. This delusion was sold by the billionaire owned corporate mainstream media and peddled by billionaire bankers to the masses through credit cards, “creative” mortgage products, easy access to home “equity”, auto leases, and easy financing products. Only in a society where a fiat currency could be printed by a central bank with no requirement that it be pegged to an anchor such as gold, could such a staggering amount of debt be accumulated.

Delusions of Debt

The bill that has been rung up is in the form of a national debt that has increased by $4.6 trillion since September 2008, a 48% increase in two and a half years. Over this same time frame real GDP has increased by $200 billion, a 1.6% increase in two and a half years. Over this same period, the Federal Reserve has tripled their balance sheet by adding $2 trillion of debt. Think about this for one second. The leaders of the great American empire have burdened future generations with $6.6 trillion of new debt and increased the Gross Domestic Product by $200 billion. Is this a good return on investment? Did the 30 million unemployed and underemployed Americans benefit? Did the 45 million people on food stamps benefit? Did the 11 million households who are underwater in their mortgage benefit? Did the 3 million people who lost their homes in foreclosure since 2008 benefit? Are Americans paying twice as much for groceries and gasoline benefitting? Did the Tunisians, Egyptians, and other poor people around the world benefit?

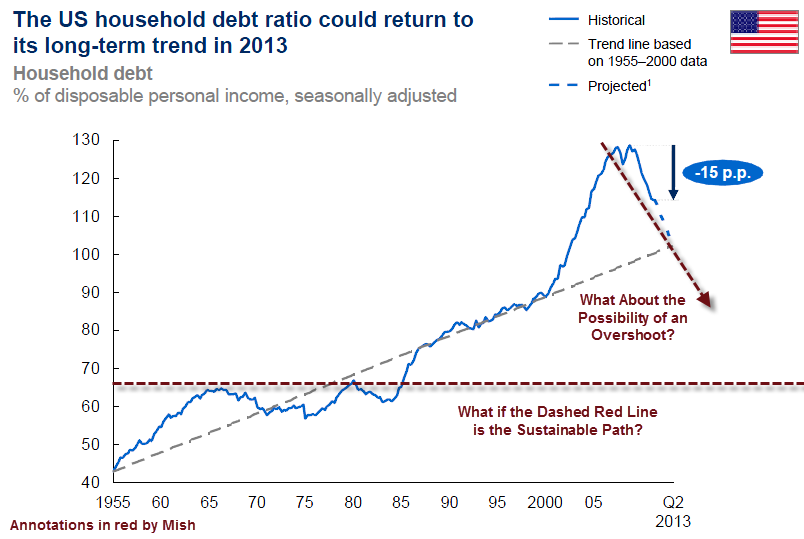

The answer to all these questions is NO. The only beneficiaries have been bankers, billionaires, mega-corporations and the politicians who were bought off by these greedy traitors to the Republic. Anyone with an ounce of sense knows the country got into this mess due to the issuance of mountains of debt that was un-payable based upon any reasonable assessment of future cash flows to service the debt. Consumers could never have increased their wages enough to pay off the credit card, mortgage, home equity, student loan, and auto debt they accumulated since 1980. The government could never collect the amount of taxes needed to pay for the $100 trillion of entitlement promises they have made over the last four decades. By 2008 we had reached peak debt delusion.

The only questions that remained were how would the debt be defaulted on and who would bear the brunt of the default. The Federal Reserve Chairman and the U.S. Treasury Secretary rolled out a master plan that revolved around convincing the masses they were being saved, while actually enriching their masters on Wall Street. Their PR machine and captured mouthpieces throughout the mainstream media and in Congress spun the fear mongering message of Depression if the mega-banks were not handed trillions of taxpayer funds.

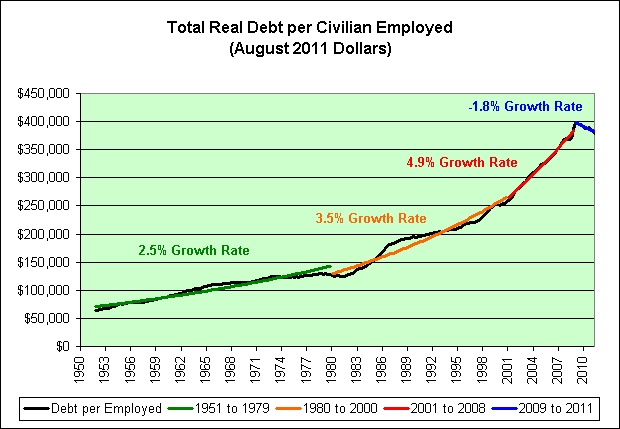

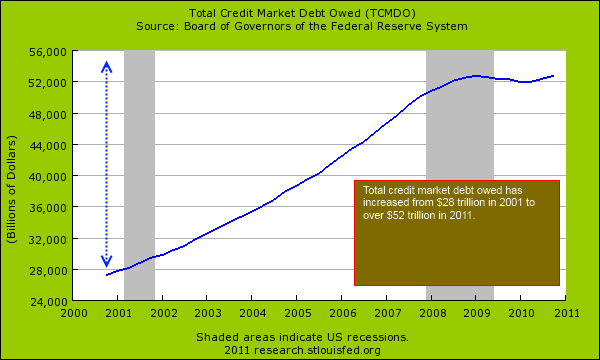

The proof of what did not happen is borne out in the chart below, showing the total credit market debt in the U.S.at $52.6 trillion, $200 billion higher than it was in 2008. If those who had collected billions in fraudulent profits while using unprecedented levels of debt were rightfully required to take responsibility for the catastrophe they caused, the debt levels would have dropped dramatically. The losses would have been borne by those responsible. The economy would have taken a body blow, all Americans would have been hurt, and many billionaires would have become millionaires or even paupers. The debt would have been written off and lessons would have been learned. The remaining banks (there are 8,000 others besides the 10 who control 50% of the deposits) would have followed traditional risk mitigation methods and the economy would have recovered.

But, as you can see, debt was not written off. No bankers were harmed during the making of this fake recovery. No criminal bankers were prosecuted. No government drones took responsibility for their failure. While the masses were distracted by stimulus packages, mortgage moratoriums, Obamacare and reality TV, the debt was shifted from the criminally negligent banks to you. The proof is right on the Federal Reserve website for all to see:

- Financial institutions reduced their debt from $17.1 trillion in 2008 to $14.2 trillion today.

- The Federal & state governments increased their debt from $8.7 trillion in 2008 to $11.9 trillion today.

- The GSEs (Fannie, Freddie, Sallie) increased their debt from $3.2 trillion in 2008 to $6.4 trillion today.

- Corporations increased their debt from $7.0 trillion in 2008 to $7.4 trillion today.

- Household debt declined from $13.8 trillion in 2008 to $13.4 trillion as the Federal Reserve backstopped the write-off of $600 billion of bad debt by the banks.

Over $6 trillion of toxic debt was shifted from the insolvent financial industries to the middle class taxpayers under the guise of “Saving the System”. Bad debt does not become good by shifting it to taxpayers. The story line about Americans embracing austerity is false. Household debt rose from $8 trillion in 2000 to $13.8 trillion in 2008, a 72% increase, and has declined by 3% due to write-offs, not austerity.

Champion of the Middle Class

By extending the debt, shifting it to the taxpayer and pretending it is payable, the Federal Reserve and your government have chosen, to use its weapon of choice since inception in 1913 – INFLATION, to default on the debt. It is not a new tactic, it is their only tactic.

The Federal Reserve has slowly and methodically destroyed the American middle class through relentlessly printing more money and purposefully creating inflation, since its reprehensible creation in 1913. For the last three decades only one voice in the wilderness of Washington DC has fought this banking cabal.

“Since the creation of the Federal Reserve, middle and working-class Americans have been victimized by a boom-and-bust monetary policy. In addition, most Americans have suffered a steadily eroding purchasing power because of the Federal Reserve’s inflationary policies. This represents a real, if hidden, tax imposed on the American people.

From the Great Depression, to the stagflation of the seventies, to the burst of the dotcom bubble last year, every economic downturn suffered by the country over the last 80 years can be traced to Federal Reserve policy. The Fed has followed a consistent policy of flooding the economy with easy money, leading to a misallocation of resources and an artificial “boom” followed by a recession or depression when the Fed-created bubble bursts. In conclusion, Mr. Speaker, I urge my colleagues to stand up for working Americans by putting an end to the manipulation of the money supply which erodes Americans’ standard of living, enlarges big government, and enriches well-connected elites, by cosponsoring my legislation to abolish the Federal Reserve.” – Ron Paul – Sept 10, 2002

His colleagues in Congress did not stand up to the Federal Reserve in 2002. Instead, they cheered them on as Greenspan’s ultra loose monetary policy led to the greatest housing bubble in history and a financial collapse unparalleled in human history. As the collapse was hurdling down the track in 2006, Representative Paul once again rose in protest against an organization that is rapidly destroying the American dream.

“The coming dollar crisis is not likely to be “fixed” by politicians who are unwilling to make hard choices, admit mistakes, and spend less money. Demographic trends will place even greater demands on Congress to maintain benefits for millions of older Americans who are dependent on the federal government.

Faced with uncomfortable financial realities, Congress will seek to avoid the day of reckoning by the most expedient means available – and the Federal Reserve undoubtedly will accommodate Washington by printing more dollars to pay the bills. The Fed is the enabler for the spending addicts in Congress, who would rather spend new fiat money than face the political consequences of raising taxes or borrowing more abroad.

The irony is that many of the Fed’s biggest cheerleaders are the same supposed capitalists who denounced centralized economic planning when practiced by the former Soviet Union. Large banks and Wall Street firms love the Fed’s easy money policy, because they profit at the front end from the resulting loan boom and artificially high equity prices. It’s the little guy who loses when the inflated dollars finally trickle down to him and erode his buying power. Someday Americans will understand that Federal Reserve bankers have no magic ability – and certainly no legal or moral right – to decide how much money should exist and what the cost of borrowing money should be.” – Ron Paul – July 11, 2006

The dollar crisis is upon us. Congress and President Obama are avoiding the day of reckoning. The Federal Reserve is enabling profligate spending by politicians, while at the same time enriching their masters on Wall Street. Everything being done in Washington DC seems to be the exact opposite of what should be done. I think the fable of the scorpion and the frog describes our situation best. The scorpion asks a frog to carry him across a river. The frog is afraid of being stung, but the scorpion argues that if it stung, the frog would sink and the scorpion would drown. The frog agrees and the scorpion stings the frog during the crossing, dooming them both. When asked why, the scorpion points out that this is its nature. The Federal Reserve is printing money, creating inflation, enriching billionaire bankers, and dooming the country to certain collapse because that is its nature.

My intentions have been foiled again. I realize that my attempt to put our current economic predicament into perspective will now need to be a five part series. . For a Few Dollars More addressed the Baby Boomer impact on America’s decline. A Fistful of Dollars examined how the Federal Reserve’s actions over the last few decades have impoverished the middle class and has placed the country at the brink of collapse, The Good, the Bad, and the Ugly will address the nefarious creation of a central bank and the implementation of a personal income tax in the dreadful year 1913. Outlaw Josey Wales will scrutinize the looting of America by a small group of powerful, connected, super rich men lurking in the shadows, but pulling the strings on our puppet politicians. Lastly, Unforgiven will detail the impending collapse of our economic system and the retribution that will be handed out to the guilty.

I can’t wait to see how it ends.