Tag: Jon Corzine

BIDEN KNOWS WHO TO CALL FOR INVESTMENT ADVICE

CULTURE OF IGNORANCE – PART ONE

“Five percent of the people think;

ten percent of the people think they think;

and the other eighty-five percent would rather die than think.”

– Thomas Edison

The kabuki theater that passes for governance in Washington D.C. reveals the profound level of ignorance shrouding this Empire of Debt in its prolonged death throes. Ignorance of facts; ignorance of math; ignorance of history; ignorance of reality; and ignorance of how ignorant we’ve become as a nation, have set us up for an epic fall. It’s almost as if we relish wallowing in our ignorance like a fat lazy sow in a mud hole. The lords of the manor are able to retain their power, control and huge ill-gotten riches because the government educated serfs are too ignorant to recognize the self-evident contradictions in the propaganda they are inundated with by state controlled media on a daily basis.

“Any formal attack on ignorance is bound to fail because the masses are always ready to defend their most precious possession – their ignorance.” – Hendrik Willem van Loon

The levels of ignorance are multi-dimensional and diverse, crossing all educational, income, and professional ranks. The stench of ignorance has settled like Chinese toxic smog over our country, as various constituents have chosen comforting ignorance over disconcerting knowledge. The highly educated members, who constitute the ruling class in this country, purposefully ignore facts and truth because the retention and enhancement of their wealth and power are dependent upon them not understanding what they clearly have the knowledge to understand. The underclass wallow in their ignorance as their life choices, absence of concern for marriage or parenting, lack of interest in educating themselves, and hiding behind the cross of victimhood and blaming others for their own failings. Everyone is born ignorant and the path to awareness and knowledge is found in reading books. Rich and poor alike are free to read and educate themselves. The government, union teachers, and a village are not necessary to attain knowledge. It requires hard work and clinging to your willful ignorance to remain stupid.

The youth of the country consume themselves in techno-narcissistic triviality, barely looking up from their iGadgets long enough to make eye contact with other human beings. The toxic combination of government delivered public education, dumbed down socially engineered curriculum, taught by uninspired intellectually average union controlled teachers, to distracted, unmotivated, latchkey kids, has produced a generation of young people ignorant about history, basic mathematical concepts, and the ability or interest to read and write. They have been taught to feel rather than think critically. They have been programmed to believe rather than question and explore. Slogans and memes have replaced knowledge and understanding. They have been lured into inescapable student loan debt serfdom by the very same government that is handing them a $200 trillion entitlement bill and an economy built upon low paying service jobs that don’t require a college education, because the most highly educated members of society realized that outsourcing the higher paying production jobs to slave labor factories in Asia was great for the bottom line, their stock options and bonus pools.

Instead of being outraged and lashing out against this injustice, the medicated, daycare reared youth passively lose themselves in the inconsequentiality and shallowness of social media, reality TV, and the internet, while living in their parents’ basement. They have chosen the ignorance inflicted upon their brains by thousands of hours spent twittering, texting, facebooking, seeking out adorable cat videos on the internet, viewing racist rap singer imbeciles rent out sports stadiums to propose to vacuous big breasted sluts on reality cable TV shows, and sitting zombie-like for days with a controller in hand blowing up cities, killing whores, and murdering policemen using their new PS4 on their 65 inch HDTV, rather than gaining a true understanding of the world by reading Steinbeck, Huxley, and Orwell. Technology has reduced our ability to think and increased our ignorance.

“During my eighty-seven years, I have witnessed a whole succession of technological revolutions. But none of them has done away with the need for character in the individual or the ability to think.” – Bernard M. Baruch

The youth have one thing going for them. They are still young and can awaken from their self-imposed stupor of ignorance. There are over 80 million millenials between the ages of 8 and 30 years old who need to start questioning the paradigm they are inheriting and critically examining the mendacious actions of their elders. The future of the country is in their hands, so I hope they put down those iGadgets and open their eyes before it is too late. We need many more patriots like Edward Snowden and far fewer twerking sluts like Miley Cyrus if we are to overcome the smog of apathy and ignorance blanketing our once sentient nation.

The ignorance of youth can be chalked up to inexperience, lack of wisdom, and immaturity. There is no excuse for the epic level of ignorance displayed by older generations over the last thirty years. Boomers and Generation X have charted the course of this ship of state for decades. Ship of fools is a more fitting description, as they have stimulated the entitlement mentality that has overwhelmed the fiscal resources of the country. Our welfare/warfare empire, built upon a Himalayan mountain of debt, enabled by a central bank owned by Wall Street, and perpetuated by swarms of corrupt bought off spineless politicians, is the ultimate testament to the seemingly limitless level of ignorance engulfing our civilization. The entitlement mindset permeates our culture from the richest to the poorest. Mega-corporations use their undue influence (bribes disguised as campaign contributions) to elect pliable candidates to office, hire lobbyists to write the laws and tax regulations governing their industries, and collude with the bankers and other titans of industry to harvest maximum profits from the increasingly barren fields of a formerly thriving land of milk and honey. By unleashing a torrent of unbridled greed, ransacking the countryside, and burning down the villages, the ruling class has planted the seeds of their own destruction.

When the underclass observes Wall Street bankers committing the crime of the century with no consequences for their actions, they learn a lesson. When billionaire banker/politicians like Jon Corzine can steal $1.2 billion directly from the accounts of farmers and ranchers and continue to live a life of luxury in one of his six mansions, they get the message. Wall Street bankers are allowed to commit fraud, reaping profits of $25 billion, and when they are caught red handed pay a $5 billion fine while admitting no guilt. No connected bankers have gone to jail for crashing the worldwide financial system, but teenage marijuana dealers are incarcerated for ten years in our corporate prison system. The message has been received loud and clear by the unwashed masses. Committing fraud and gaming the system is OK. Only suckers play by the rules anymore. A culture of lawlessness, greed, fraud, deceit, swindles and scams was fashioned by those in power. Reckless disregard for honesty, truthfulness, fair dealing, and treating others as you would like to be treated, has permeated the beliefs and behavior of our society.

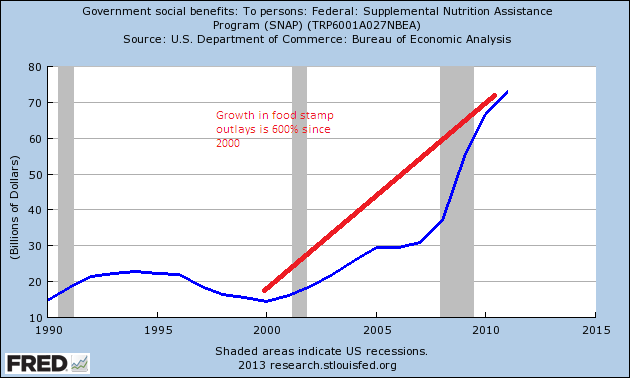

The ever increasing number of people in the SNAP program along with abuses committed by retailers and recipients, the skyrocketing number of people faking their way into the SSDI program, billions of taxpayer dollars lost to Medicare fraud, billions more lost paying out earned income tax credit refunds based on non-existent children, public schools falsifying test scores, students cheating on SAT tests, credit card fraud on a grand scale, failure to report income and falsifying tax returns, and a myriad of other dodges and scams are just a reflection of a moral and cultural collapse. The dog eat dog mentality glorified by the media, with such despicable men as Dimon, Greenspan, Corzine, Clinton, Trump, Rubin, Bernanke and Bloomberg honored as pillars of society, has displaced honesty, compassion, humanity, shared sacrifice, and caring about our descendants. Self-interest, self-indulgence, and a narcissistic focus on what is in it for me today has led to an implosion of trust and an attitude of “who cares” about our fellow man, morality, right or wrong, and the fate of future generations. We ignored the warnings of our last President who displayed courageousness and truthfulness when speaking to the American people.

“As we peer into society’s future, we — you and I, and our government — must avoid the impulse to live only for today, plundering for our own ease and convenience the precious resources of tomorrow. We cannot mortgage the material assets of our grandchildren without risking the loss also of their political and spiritual heritage. We want democracy to survive for all generations to come, not to become the insolvent phantom of tomorrow.” – Dwight D. Eisenhower

The Me Generation has devolved into the Me Culture. While the masses have been mesmerized by their iGadgets, zombified by the boob tube, programmed to consume by the Madison Avenue propaganda machines, enslaved in chains of debt by the Wall Street plantation owners, and convinced by their fascist government keepers that phantom terrorists are hiding behind every bush, they surrendered their freedoms, liberties and sense of self-responsibility. There will always be evil men seeking to control and manipulate the ignorant and oblivious. A citizenry armed with knowledge, critical thinking skills, and moral integrity would not passively submit to the will of a corporate fascist oligarchy. Well educated, well informed citizens, capable of critical thinking are dangerous to rich men of evil intent. Obedient, universally ignorant, distracted, fearful, morally depraved slaves are what the owners of this country want. As the light of knowledge flickers and dies, we sink into the darkness of ignorance.

“No people will tamely surrender their Liberties, nor can any be easily subdued, when knowledge is diffused and virtue is preserved. On the Contrary, when People are universally ignorant, and debauched in their Manners, they will sink under their own weight without the Aid of foreign Invaders.” – Samuel Adams

Cult of Ignorance

“There is a cult of ignorance in the United States, and there has always been. The strain of anti-intellectualism has been a constant thread winding its way through our political and cultural life, nurtured by the false notion that democracy means that “my ignorance is just as good as your knowledge.” – Isaac Asimov

“While every group has certain economic interests identical with those of all groups, every group has also, as we shall see, interests antagonistic to those of all other groups. While certain public policies would in the long run benefit everybody, other policies would benefit one group only at the expense of all other groups. The group that would benefit by such policies, having such a direct interest in them, will argue for them plausibly and persistently. It will hire the best buyable minds to devote their whole time to presenting its case. And it will finally either convince the general public that its case is sound, or so befuddle it that clear thinking on the subject becomes next to impossible.

In addition to these endless pleadings of self-interest, there is a second main factor that spawns new economic fallacies every day. This is the persistent tendency of man to see only the immediate effects of a given policy, or its effects only on a special group, and to neglect to inquire what the long-run effects of that policy will be not only on that special group but on all groups. It is the fallacy of overlooking secondary consequences.” – Henry Hazlitt

America’s cult of ignorance, combined with the selfish interests of various constituencies, the character weakness of the people elected to office, a lack of understanding or interest in basic mathematical concepts, and inability to comprehend the long term and unintended consequences of every piece of legislation, have brought the country to the brink of fiscal disaster. But still, the vast majority of Americans, including the supposed intellectuals and economic “experts”, are basking in their ignorance, as the stock market reaches a new high, the local GM dealer just gave them a 7 year $40,000 auto loan at 0% on that brand new Cadillac Escalade, Bank of America still hasn’t foreclosed on their McMansion two years after making their last mortgage payment, and they just received three pre-approved credit card notices from Capital One, American Express and Citicorp. As long as Bennie has our back printing $1 trillion new greenbacks per year, nothing can possibly go wrong. Our best and brightest economic minds are always right:

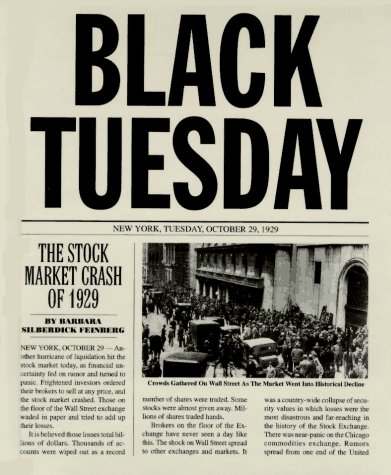

“Stocks have reached what looks like a permanently high plateau.” – Irving Fisher, Professor of Economics, Yale University, 1929

“Many of the new financial products that have been created, with financial derivatives being the most notable, contribute economic value by unbundling risks and shifting them in a highly calibrated manner. Although these instruments cannot reduce the risk inherent in real assets, they can redistribute it in a way that induces more investment in real assets and, hence, engenders higher productivity and standards of living.” – Alan Greenspan – March 6, 2000

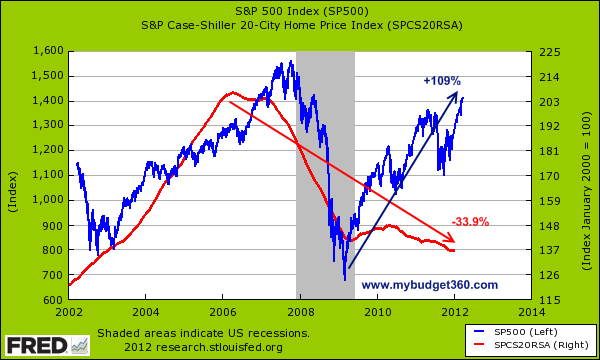

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.” – Ben Bernanke – July 2005

The profound level of ignorance displayed by economists, politicians, business leaders, media personalities, and the average American, regarding the mathematically unsustainable path of our fiscal ship is perplexing to me on so many levels. If the Federal government was a family, the budget ceiling debate would be put into the following terms. Our household earns $28,000 per year, but we spend $38,000 per year and add $10,000 to our credit card balance, which stands at the limit of $170,000. In addition, we owe our neighbors $2 million we don’t have because we promised to pay if they voted for us as Treasurer of our homeowners association. We celebrate our good fortune of getting approved for another credit card with a $30,000 limit by increasing our spending to $39,000 per year. Intellectuals scorn such simplistic analogies by glibly pointing out that the family has a crazy uncle with a printing press in the basement and can pay-off the debt with his freshly printed dollars. And this is where the deliberate and calculated ignorance by the highly educated Ivy Leaguers regarding long term and unintended consequences is revealed. They ignore, manipulate, cover-up and obscure the facts because their wealth, power and influence depend upon them doing so. But ignorance doesn’t change the facts.

“Facts do not cease to exist because they are ignored.” – Aldous Huxley

Nothing exposes the ignorance of various factions within our society better than a debate about budgets, spending, and unfunded liabilities. This is where every party, group, special interest, and voting bloc ignore any and all facts that are contrary to their selfish interest. They only see what they want to see. The fallacies, errors, omissions and mistruths of their positions are inconsequential to people who only care about their short-term self-seeking interests. When I question the out of control spending on entitlements and our impossible to honor level of unfunded liabilities, those of a liberal persuasion lash out with accusations of hating the poor, starving children and throwing granny under the bus. Anyone suggesting we should slow our spending is branded a terrorist by the overwhelmingly liberal legacy media.

When I accuse Wall Street bankers of criminal fraud and ongoing manipulation of the financial markets, the CNBC loving apologists for these felons bellow about the market always being right. When I rail about the military industrial complex and our un-Constitutional invasions of other countries, the neo-cons come out in force blathering about the war on terror and imminent threats. When I point out the horrific results of our government run educational system and how mediocre union teachers are bankrupting our states and municipalities with their gold plated health and pension plans, I’m met with howls of outrage about the poor children. The common thread is that facts are ignored because each of their agendas requires ignorance on the part of their team’s fans.

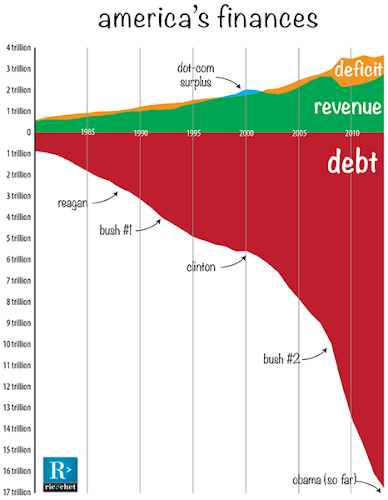

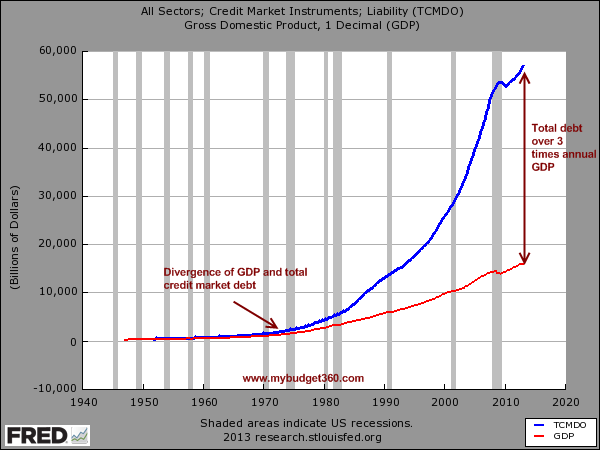

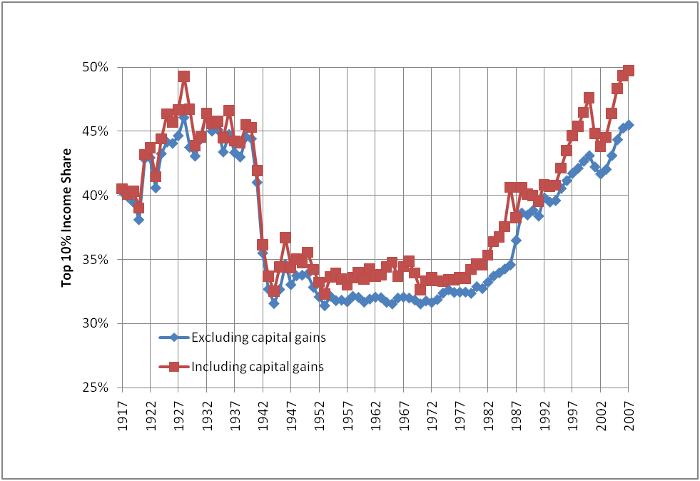

The following chart of truth portrays an unsustainable path. Ignoring the facts will not change them. This isn’t a Republican problem or a Democrat problem. It’s an American problem.

“There are men regarded today as brilliant economists, who deprecate saving and recommend squandering on a national scale as the way of economic salvation; and when anyone points to what the consequences of these policies will be in the long run, they reply flippantly, as might the prodigal son of a warning father: “In the long run we are all dead.” And such shallow wisecracks pass as devastating epigrams and the ripest wisdom.” – Henry Hazlitt

Henry Hazlitt may have written these words six decades ago, but they aptly describe Paul Krugman and the legions of Keynesian apostles whose bastardized interpretation of Keynes’ theory has led us to this fiscal cliff. How anyone can truly believe that borrowing to consume foreign produced goods versus saving and making job creating capital investments is a rational and sustainable economic policy is the height of ignorance. One look at this chart exposes the political party system as a sham. When it comes to the fiscal train wreck, set in motion thirty years ago, the ignorant media pundits peddle a narrative about politicians failing to compromise as the culprit in this derailment. Nothing could be further from the truth. Compromise is what has gotten us to this point. The Republicans compromised and allowed the Democrats to create a welfare state. The Democrats compromised and allowed the Republicans to create a warfare state. The Federal Reserve compromised their mandate of stable prices and preventing financial calamities by inflating away 95% of the dollar’s purchasing power in 100 years, while creating bubbles every five or so years, like clockwork. There are a myriad of facts related to the chart above that cannot be ignored:

- It took 192 years for the country to accumulate $1 trillion in debt. It has taken us 30 years to accumulate the next $16 trillion of debt. We now add $1 trillion of debt per year.

- If the Federal government was required to use GAAP accounting, the annual deficit would amount to $6.7 trillion per year.

- The fiscal gap of unfunded future liabilities for Social Security, Medicare, Medicaid, and government pensions is $200 trillion.

- Using realistic growth assumptions adds another $6 trillion of state and local government unfunded pension benefits to the equation.

- The Federal government has increased their annual spending from $1.8 trillion during Bill Clinton’s last year in office to $3.8 trillion today, a 110% increase. The population has increased by 12% over that same time frame, and real GDP has advanced by 25% since 2000.

- Defense spending has increased from $358 billion in 2000 to $831 billion today, despite the fact that no country on earth can challenge us militarily.

- The average Baby Boomer will receive $300,000 more than they contributed to Social Security and Medicare over their lifetime. Over 10,000 Boomers per day will turn 65 for the next 17 years.

- The Social Security lockbox is filled with IOUs. The funds collected from paychecks over the last 80 years were spent by Congress on wars of choice, bridges to nowhere, and thousands of other vote buying ventures.

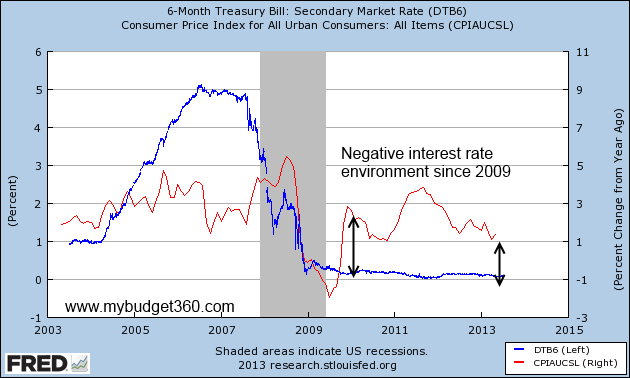

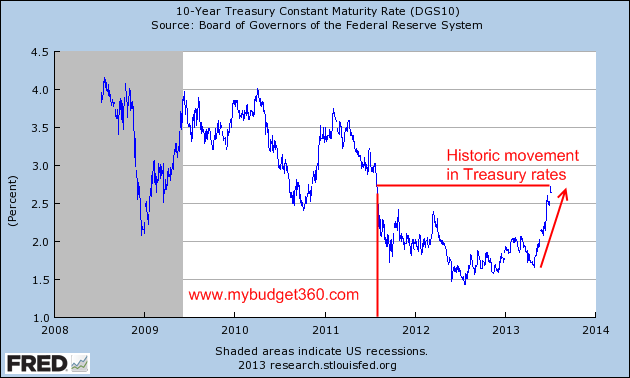

- A normalization of interest rates to long-term averages would double or triple the interest on the national debt and increase our annual deficits by at least 30%.

- Obamacare and the unintended consequences of Obamacare will add tens of trillions to our national debt. The initial budget projections for Medicare and Medicaid showed only a modest financial impact on the financial situation of the country. How did that work out?

- Entitlement spending in 2003 was $1.3 trillion. Entitlement spending in 2008 was $1.7 trillion. Entitlement spending in 2013 was $2.2 trillion. Entitlement spending in 2018 will be $2.8 trillion, as these programs are on automatic pilot.

When you consider the facts in a rational manner, without vitriolic denials, bitter accusations, acrimonious blame, and rejection of the entire premise, you come to the conclusion that we’ve passed the point of no return. Decades of bad choices, bad leadership, bad men in important positions, bad education, bad governance, and bad citizenship have led to bad times. But very few people, across all socio-economic classes, have any interest in understanding the facts or making the tough choices required to save future generations from a life of squalor. We willfully choose to ignore the facts.

“Most ignorance is vincible ignorance. We don’t know because we don’t want to know.” – Aldous Huxley

Our degraded and ignorant society is incapable of comprehending their dire circumstances or acting for the common good of the country. We are a nation on the take. Greed really is good. Everyone needs to play the game. From the top floor corporate CEO suite to the decaying urban wastelands, we have chosen comforting ignorance to uncomfortable knowledge. Our warped form of democracy enriches the few at the top, while dispensing enough subsistence payments to the lower classes to keep them from revolting, while enslaving the middle class in debt and convincing them it’s really wealth. Mencken understood the pathetic impulses of the American populace decades before we reached our point of no return.

“Democracy is a pathetic belief in the collective wisdom of individual ignorance.” – H.L. Mencken

The only way a democracy can survive is if the population is knowledgeable, vigilant, skeptical, educated, individually responsible, self-reliant, moral, capable of critical thinking and willing to accept the consequences of their actions. A nation of takers, fakers and blamers will not last long. We’ve degenerated into a nation of knowledge hating book burners. Our culture of ignorance will lead to the destruction of our culture and the ignorant masses will wonder what happened.

“But you can’t make people listen. They have to come round in their own time, wondering what happened and why the world blew up around them. It can’t last.” – Ray Bradbury – Fahrenheit 451

In Part Two of this examination about our culture of ignorance I’ll explore the roles of technology, family breakdown, government, and propaganda in creating the ignorance that is consuming our system like a mutant parasite. If you are seeking a happy ending, I suggest looking elsewhere.

TRYING TO STAY SANE IN AN INSANE WORLD – PART 2

In Part 1 of this article I detailed the insane solutions proposed and executed since 2008 by our owners as they attempt to retain and further expand their ill-gotten wealth, acquired through fraud, deceit, swindles, and the brilliant manipulation and exploitation of the masses through Bernaysian propaganda techniques. Madness has engulfed the entire world, with a concentration of power in the hands of a few psychopathic financial elite wielding an inordinate and dangerous expanse of power over the lives of the common man. They are a modern day version of Al Capone, except their weapons of choice aren’t machine guns, but a printing press, peddling debt, creating derivatives of mass destruction, and peddling heaping doses of disinformation. The contemporary criminal class wears Hermes suits, Rolex watches and diamond studded pinky rings, drops $500 to dine at Masa in NYC, travels by chauffeured limo, lives in $10 million NYC penthouse suites, occupies luxurious corner offices in hundred story glass towers, and spends weekends hobnobbing with the other financial elite at their villas in the Hamptons. They have nothing but utter contempt for the lowly peasants who depend upon a weekly paycheck to make ends meet. Why work when you can steal $1 or $2 billion from farmers with no consequences?

The willfully ignorant masses are kept at bay by the selling them a false dichotomy of Republicans versus Democrats, conservatives versus liberals, and capitalism versus socialism. The ruling class distracts the public with fake wars on poverty, drugs and terror, while using these storylines to further enrich themselves and keep the public alarmed and frightened. We’ve been “fighting” the wars on poverty and drugs for over four decades and poverty is at record levels, while drugs are easier to obtain than candy in a candy store. The war on terror is nothing more than a corporate arms dealer welfare plan. The end of the Cold War put a real crimp in the bottom lines of Lockheed Martin and the rest of the peddlers of death. 9/11 and the subsequent undeclared wars in Iraq, Afghanistan, Libya and now Syria, with Iran on the horizon, have been a godsend to the bottom lines of the corporations Eisenhower warned about in 1961. In reality, the politicians are interchangeable and bought off by corporate and special interests. The people are sold a fable, and controlled opposition is the fairy tale. They perpetuate the welfare/warfare state that enriches Wall Street, the military industrial complex, the healthcare service complex, politically connected mega-corporations and the corporate media propaganda complex. The American people are given the illusion of choice by their keepers. The system is rigged. The real decisions are made by unelected secretive men who operate in the shadows and use their wealth to direct the decision making of the politicians, government bureaucrats, and corporate entities that benefit from those decisions. Edward Bernays described a society that existed in the 19th Century, 20th Century, and has now grown to immense proportions in the 21st Century:

“Political campaigns today are all sideshows…A presidential candidate may be ‘drafted’ in response to ‘overwhelming popular demand,’ but it is well known that his name may be decided upon by half a dozen men sitting around a table in a hotel room…The conscious manipulation of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country.” – Edward Bernays

The manipulation of the masses has been perfected by the ruling class through decades of corporate mass media messaging the purposeful dumbing down of the populace through government public school education that teaches children how to feel rather than how to think. The conscious manipulation of the masses has been designed to produce obedient non-thinking consumers of corporate products, educated to believe the accumulation of material goods with debt constitutes wealth, to fear whatever the government tells them to fear, and never look up from their iGadgets long enough to actually think for themselves. We are bombarded with Orwellian memes designed to keep us sedated and pliant, as the ruling class pillages the national wealth and expands their power and control over our lives.

Conform; Stay Asleep; Do Not Question Authority; Obey; Consume; Reproduce; Submit; Watch TV; Buy; Follow; Doubt Humanity; No New Ideas; Feel, Don’t Think; Fear; Accumulate; Honor Apathy; Believe Experts; Surrender; Spend; No Independent Thought; Win; Want More; Hate; Succumb To Desire; Yield To Power; Choose Safety Over Liberty; Choose Security Over Freedom

This insane world was created through decades of bad decisions, believing in false prophets, choosing current consumption over sustainable long-term savings based growth, electing corruptible men who promised voters entitlements that were mathematically impossible to deliver, the disintegration of a sense of civic and community obligation and a gradual degradation of the national intelligence and character.

Are You Sane?

“A sane person to an insane society must appear insane.” – Kurt Vonnegut – Welcome to the Monkey House

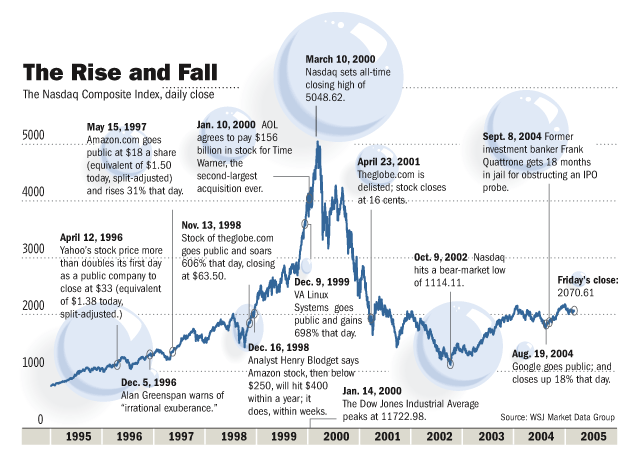

Vonnegut and Huxley’s social commentary reveals a basic truth that societies and human beings have been prone to bouts of madness over the course of decades and centuries. Humans are a weak species, susceptible to the vagaries of greed, lust, gluttony, wrath, sloth, envy and pride. The seven deadly sins are in full bloom today, as the American empire descends through Dante’s inferno of reality TV, celebrity worship, religious zealotry, adulation of wealthy titans, military conquest and worship of false idols. Over the centuries humans have gone mad over tulips, farm land, stocks, and real estate. The easily duped American populace has been victimized by multiple bubbles bursting since the creation of the Federal Reserve in 1913. The contention that a central bank run by private banking interests would promote a safer financial system and a stable currency is laughable. The Federal Reserve and the bankers who control it have created three stock bubbles, the largest housing bubble in history, a bond bubble and the mother of all debt bubbles, while destroying 95% of the dollar’s purchasing power in the last 100 years.

There is a common denominator in all the bubbles created over the last century – Wall Street bankers and their puppets at the Federal Reserve. Fractional reserve banking, control of a fiat currency by a privately owned central bank, and an economy dependent upon ever increasing levels of debt are nothing more than ingredients of a Ponzi scheme that will ultimately implode and destroy the worldwide financial system. Since 1913 we have been enduring the largest fraud and embezzlement scheme in world history, but the law of diminishing returns is revealing the plot and illuminating the culprits. Bernanke and his cronies have proven themselves to be highly educated one trick pony protectors of the status quo.

Greenspan’s easy money policies, manufacturing of negative real short term interest rates, regulatory malfeasance and unspoken promise to bail out Wall Street whenever their excessive risk taking threatened to burn down the financial system, led to 50% stock market crash in 2000/2001, a 40% plunge in national home prices, and another 55% stock market crash in 2008/2009. While Ivy Leaguers Bernanke, Paulson, Hubbard, Krugman, and Bush were too obtuse or too blinded by their ideology to recognize the fraudulent housing and stock market bubbles, honest clear thinking men like Robert Shiller, John Hussman, and Ron Paul recognized the bubbles well in advance and understood the consequences to the average American.

“Like all artificially-created bubbles, the boom in housing prices cannot last forever. When housing prices fall, homeowners will experience difficulty as their equity is wiped out. Furthermore, the holders of the mortgage debt will also have a loss.” – Ron Paul – 2003

What Ron didn’t realize was the peddlers and packagers of fraudulent mortgage debt on Wall Street would walk away unscathed when the bubble they created popped. Trillions of net worth was vaporized due to the policies, solutions, and programs designed and implemented by Bernanke and his Wall Street co-conspirators. The losses should have been borne by those who made the loans. Instead they were borne by the American taxpayer and future unborn generations. David Stockman, in his no holds barred book about the Wall Street and K Street crony capitalist criminals, rails against the Federal Reserve led rescue of the profligate destroyers of capital markets:

“At the end of the day, this trillion-dollar infusion of capital and liquidity from the public till had a single overarching effect: it nullified in its entirety the impact of Mr. Market’s withdrawal of a similar magnitude of funding from the wholesale money market. So the very monetary distortion – the availability of cheap overnight funding in massive quantities – upon which the Wall Street financial bubble had been built had now been recreated at the lending windows of the Fed, FDIC, and the US Treasury.

The opposite path of liquidating the Wall Street bubble was eschewed, of course, not only because it would have meant massive losses to speculators in the stock and bonds of Goldman Sachs, Morgan Stanley, JP Morgan, and the remaining phalanx of the walking wounded. Crony capitalism also triumphed because in muscling the system during the white heat of crisis, Wall Street had plenty of intellectual cover. The fact is, mainstream economists of both parties were trapped in a Keynesian dead end, proclaiming that the solution to the crushing national debt load which had actually triggered the financial crisis was to pile on more of the same.

Accordingly, banks which were “too big to fail” couldn’t be busted up, since they were allegedly needed to shovel more credit onto already debt saturated household and business balance sheets. Likewise, speculators who should have suffered epochal losses during the meltdown were resuscitated by Fed-engineered zero interest rates in the money market, thereby quickly reviving the same massively leveraged “carry trades” in commodities, currencies, equities, derivatives, and other risk assets which had brought on the crisis in the first place.” – David Stockman – The Great Deformation – The Corruption of Capitalism in America

The working middle class was forced at gunpoint to bail out billionaire bankers who had been fraudulently inducing feeble minded dupes and trailer trash to purchase $500,000 McMansions with negative amortization no doc subprime mortgages, while bullying appraisers into inflating appraisals, buying off the rating agencies, selling the toxic derivatives to their clients, and then shorting the very same derivatives. They subsequently committed foreclosure fraud by robo-signing legal documents. Describing these modern day Shylocks as heartless, cruel, lecherous, avaricious demons understates the vileness and contemptibility of their nature. Ben Bernanke and Hank Paulson blatantly lied to the depraved, gutless members of Congress and to the easily hoodwinked fearful American public about the threat of our financial system collapsing unless the Wall Street banks were saved. This false storyline is still peddled today and believed by millions of willfully ignorant crony capitalist devotees. The financial system wasn’t going to collapse. The stock prices of JP Morgan, Goldman Sachs, Citigroup, Bank of America, AIG, Morgan Stanley, GE, and Wells Fargo were collapsing. The wealth of the financial elites that run the country was in peril. The depositors in these banks wouldn’t have lost a penny, but the shareholders and bond holders would have been wiped out. The personal wealth of Dimon, Mack, Lewis, Prince, Immelt, Blankfein and the other titans of finance took precedence over the rule of law and the negative consequences of excessive risk taking and control fraud.

True free market capitalism embraces the concept of creative destruction. Poorly run companies fail and are replaced by well-run companies. Bankruptcy law worked perfectly during the liquidation of Washington Mutual. The orderly liquidation of the Too Big to Trust Wall Street banks would have resulted in billions of bad debt being discharged, with the losses being borne by the executives who mismanaged the banks and the investors who were foolish enough to fund the disastrous schemes perpetrated by those executives. The FDIC would have kept depositors whole. The privatization of illicit bank profits from 2002 through 2007 and the socialization of the 2008 through 2010 bank losses are proof that we are experiencing a warped, immoral, crony capitalism that enriches the well-connected and impoverishes the working middle class. Our political, economic and financial systems have been captured by corporate and special interests. This corruption will prove fatal, as the vested interests destroy the system through their myopic greed. We’ve allowed a small cadre of malevolent men to gamble away the nation’s future with impunity from all laws, regulations and any sense of morality, under the guise of capitalism. These men and the nation will pay a high price for these transgressions. The punishment will fit the crimes.

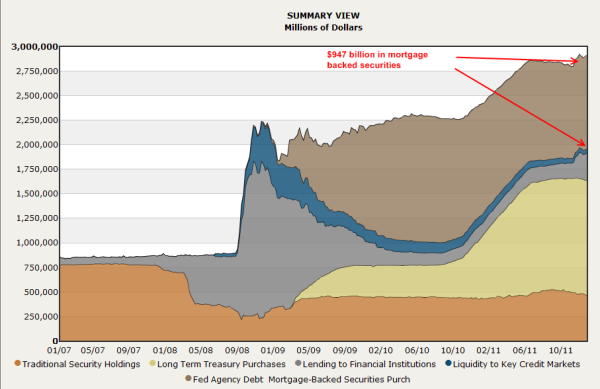

“People of privilege will always risk their complete destruction rather than surrender any material part of their advantage.” – John Kenneth Galbraith – The Age of Uncertainty

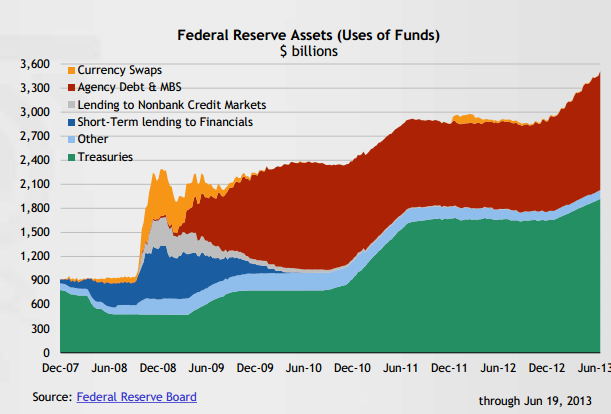

The chart below reveals the criminal plan as implemented by Bernanke, the Obama administration and the Wall Street banks. Instead of allowing insolvent financial institutions to fail, $700 billion of taxpayer funds were syphoned from the economy and handed to them. Bernanke has since stuffed their coffers with another $2.4 trillion he printed out of thin air. The purpose of this insane transfer of national wealth from the people to the parasites was not to help Main Street. Forcing the FASB to allow these criminal bankers to mark to unicorn rather than mark to market, buying their toxic mortgages, and providing billions in free money was done to cover-up the fact they are insolvent. Their balance sheets and the Federal Reserve balance sheet are choking on bad debt. The ongoing foreclosure/rent to own scam was designed to drive up home prices and allow the bankers to exit their toxic mortgages with a profit. The criminally insane bankers have used the trillions in excess funds to syphon off billions in stock market gains, with assurances from Ben that QE to infinity will always be there. They know if their gambling leads to losses, Ben will come to the rescue.

The purpose of banks was supposed to be to lend money to businesses and consumers so they could make long-term investments that helped expand the economy. These Wall Street cretins didn’t loan money to people and businesses in the real world. It was much easier to generate risk free returns and program their HFT supercomputers to buy, buy, buy. By driving real interest rates below zero for the last four years, Bernanke has stolen $400 billion per year from senior citizens living on the edge and transferred it to bloodsucking bankers. Anyone with money in a bank account is losing money. This was designed to force muppets back into the stock market where they will be fleeced for the third time in the last thirteen years.

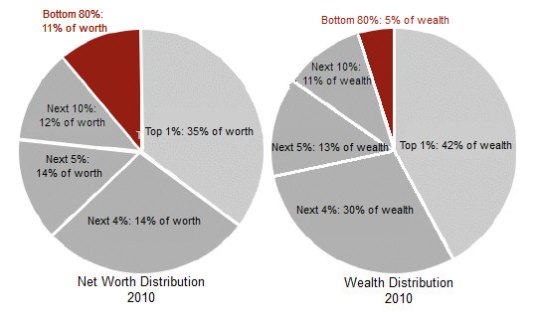

Bernanke’s rescue measures have been a smashing success for the .1%. Wall Street is generating record levels of profits and paying out record levels of bonuses to themselves for a job well done. The stock market is at an all-time high, while the middle class is eviscerated by relentless inflation in energy, food, healthcare, clothing, tuition, rent and taxes. Reality does not match the propaganda touted by the financial elite. Ask the 47.7 million people on food stamps.

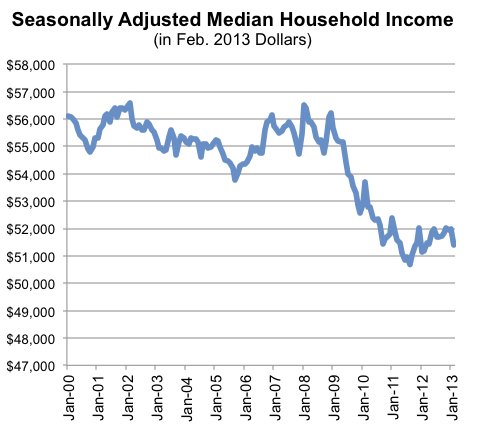

The economic recovery narrative propagated by Wall Street paid economists, Wall Street controlled media pundits, and Wall Street bought off politicians is nothing but unmitigated bullshit. True unemployment, that doesn’t falsely exclude the unemployed who have thrown in the towel, is north of 20%, with youth unemployment exceeding 40%. The “solutions” implemented by our owners have led to a 10% collapse in the median household income since 2008. If the middle class is seeing their real incomes decline, while their living expenses are rising by 5% per year, how can the economy be recovering? It can’t. Bernanke’s banker welfare program and Obama’s $1 trillion deficits, along with accounting fraud and under-reporting of inflation, have produced the illusion of recovery.

Dimitri Orlov summarizes our modern financial system and sets the table for the coming collapse:

“The main tools of modern finance are mystification, obfuscation and hypnosis. What is different now is that all the governments have already shot all of their magic bailout bullets. The guilty parties are still at large, richer than they were before this crisis and probably thinking that the next crisis will make them even richer.” – Dimitri Orlov – The Five Stages of Collapse

The questions that must be answered are: How did we allow this to happen? Are we blameless? Can our course be reversed?

Time to Look in the Mirror

“The America of my time line is a laboratory example of what can happen to democracies, what has eventually happened to all perfect democracies throughout all histories. A perfect democracy, a ‘warm body’ democracy in which every adult may vote and all votes count equally, has no internal feedback for self-correction. It depends solely on the wisdom and self-restraint of citizens… which is opposed by the folly and lack of self-restraint of other citizens. What is supposed to happen in a democracy is that each sovereign citizen will always vote in the public interest for the safety and welfare of all. But what does happen is that he votes his own self-interest as he sees it… which for the majority translates as ‘Bread and Circuses.’

‘Bread and Circuses’ is the cancer of democracy, the fatal disease for which there is no cure. Democracy often works beautifully at first. But once a state extends the franchise to every warm body, be he producer or parasite, that day marks the beginning of the end of the state. For when the plebs discover that they can vote themselves bread and circuses without limit and that the productive members of the body politic cannot stop them, they will do so, until the state bleeds to death, or in its weakened condition the state succumbs to an invader—the barbarians enter Rome.” – Robert A. Heinlein

Robert Heinlein has been dead for twenty five years. He wrote these words decades ago. His vision of a state bleeding to death is being played out as we speak. Ben Franklin had an inkling the Republic we were given would not be sustained. The success of our nation hinged upon the wisdom, self-restraint, morality, and civic mindedness of its citizens. Our form of governance was never perfect. Nothing is perfect. Adam Smith’s free market capitalism was based upon true competition, but with an underlying moral code. The rule of law meant something. Those who stole, cheated or broke the law were punished. Bankers and their usurious machinations were frowned upon. They were tolerated as a necessary evil, but they certainly weren’t admired and celebrated. When their greedy schemes to loot the populace went too far, a courageous leader would step forth and rout out the vipers and thieves:

“You are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out.” – Andrew Jackson

Bankers gained more power after the Civil War as oil was discovered, the country grew rapidly, and the robber barons built their fortunes on debt and the backs of the poor. But still, there were leaders like Teddy Roosevelt who stood up to the banking and corporate interests. The die was finally cast in 1913 with the introduction of the income tax, the creation of the Federal Reserve and allowing the people to directly elect their Senators. A century of central banking has led to: a century of war; a century of currency debasement; a transformation from a hard-working, saving, producing society into an irresponsible, debt based spending, consuming society; and the degradation of our society into a mob of egotistical techno-narcissists, who have chosen bread and circuses over freedom, liberty and self-reliance. At first it happened gradually, but accelerated rapidly once Nixon removed the last vestiges of control over greedy bankers, corrupt politicians, and gluttonous voters. The transformation from an industrious nation of savers into a slothful nation of consumers has reached its zenith. Financialization Nation has been built on a pyramid of debt. The youth of today have been left with an un-payable debt burden and as Bill Bonner points out, the endgame will likely be violent and bloody:

“That’s a heavy burden. It is especially disagreeable when someone else ran up the debt. Then you are a debt slave. That is the situation of young people today. They must face their parents’ debt. Even serfs in the Dark Ages had it better. They had to work only one day out of 10 for their lords and masters. As it stands, young people in the U.S., Europe and Japan are expected to work their whole lives to pay for things their parents and grandparents consumed decades earlier.

Let’s see. Deny a young person work and you deny him a career. Deny him a career and you deny him a way to support a family. Deny him a family life and who knows what happens? Will today’s young people accept their lot… and remain in docile debt servitude their whole lives? Or will they rise up and burn T-bonds in public spaces… rampage down Wall Street… and perhaps hang Ben Bernanke in front of the New York Federal Reserve?” – Bill Bonner

The pyramid of debt was built brick by brick over the last century, as an unelected, secretive, unaccountable cabal of private banker pharaohs has controlled the currency of the nation and worked on behalf of the vested corporate and banking interests that control the country. Shortly after its devious creation in 1913, they enabled Woodrow Wilson to wage a war he promised to keep the nation out of. The central bank’s easy money policies during the 1920s led to an unsustainable credit driven boom in stocks, bonds and real estate. As usual, their belated monetary tightening was too late to avoid the 1929 Crash. Federal Reserve and government intervention after the crash prolonged the Depression for over a decade. The Crash of 1929 proved once again that bankers could not be trusted. Their insatiable greed and reckless thirst for more and more riches required checks on their ability to destroy our economic system. The 38 page 1933 Glass-Steagall Act made sure commercial banking was kept separate from investment banking (gambling), keeping the productive activity of helping businesses grow isolated from the parasitic activity of speculation. This clear, concise, understandable law kept bankers from destroying the lives of millions for 66 years, until a bipartisan screw job repealed the law and unleashed the kraken upon the unsuspecting public. Bernanke’s QE to infinity driven stock market gains over the last few years are reminiscent of another historic time, and this story also hasn’t reached its ultimate climax.

“A major boom in real stock prices in the U.S. after ‘Black Tuesday’ brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937, and a third crash. Speculative bubbles do not end like a short story, novel, or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.” – Robert Shiller

The destruction of Europe, Russia and Japan during World War II and the Bretton Woods system that made the USD supreme across the world kept the economic peace for the next quarter century. A confluence of events in the late 1960s and early 1970s set the stage for the ultimate collapse of our faith based monetary system. LBJ’s Great Society welfare programs and our disastrous foray into Southeast Asia began the insane welfare/warfare dynamic that has required more and more debt to sustain. Nixon realized the debt expansion needed to pay for an ever expanding state could never be achieved with the Bretton Woods/gold pegged currency system. In 1971 Nixon unilaterally canceled the direct convertibility of the USD to gold. It ushered in the era of freely floating currencies, relentless inflation, financial bubbles, debt accumulation, consumerism, and the rise of the corporate/fascist propaganda state. Using government supplied CPI statistics, the dollar had lost 75% of its purchasing power between 1913 and 1971. Since 1971 it has lost 83% of its remaining purchasing power. And Ben Bernanke has the guts to publicly state his worries about the ravages of deflation.

The years 1913 and 1971 will be seen by future historians as infamous dates when marking the decline of the great American empire. Prior to 1971, the New York Stock Exchange barred the public listing of investment banks. After the exchange repealed this ban, the large investment banks (Lehman Brothers, Morgan Stanley, Merrill Lynch, Goldman Sachs, Bear Stearns) converted from partnerships, where the senior employees owned the company and were responsible for all of its liabilities, profits and losses, into publicly owned corporations, where executives’ incentives become aligned with outside shareholders, who demanded short-term profits and higher stock prices at the expense of long term sustainability. The partnership structure provided a mechanism of restraint, self-control, fiscal responsibility and cautiousness. If the bank failed, the partners’ net worth would be wiped out. Their incentives were for the long-term sustainability of the business and they were discouraged from taking undue risks that might produce huge short term profits, but might also destroy the firm. Shame and a sense of responsibility to fellow partners was a strong deterrent to obscene risk taking. The unholy combination of allowing investment banks to go public and repealing Glass Steagall in 1999, created a greed driven uncontrollable Too Big To Control brutish monstrosity consuming the world in its desire for more. It will only be stopped when it chokes to death while gorging on what’s left of the middle class.

The citizens, formerly known as the hard working American middle class, must accept their share of responsibility for the desperate circumstances we face. Some are guiltier than others, but we only need look in the mirror to find the culprits in allowing the bankers, politicians, military industrial complex, mass media and vested corporate interests to gain control over our country. The introduction of the credit card by Wall Street bankers as a must have for every citizen in the early 1970s coincided with the inflationary demons unleashed from Pandora’s Box by Nixon and the Federal Reserve, along with the peak of cheap U.S. oil production. Thus began four decades of real wages declining and consumer debt soaring. A nation of people that believed in saving before purchasing were given the freedom to spend money they didn’t have. The statistics paint a picture of a society gone mad:

- Credit card debt grew from $5 billion in 1971 to $856 billion today, a 17,000% increase in forty-two years. GDP rose from $1.2 trillion to $16.6 trillion, a mere 1,400% increase. Real GDP only grew by 300%. Wages have grown from $600 billion to $7 trillion, a 1,200% increase. Real disposable personal income per capita grew from $17,200 to $36,800, a 200% increase.

- Non-revolving debt (auto, student loan) grew from $127 billion in 1971 to $1.98 trillion today, a 1,600% increase.

- There are over 600 million credit cards in circulation within the U.S. and Americans charged over $2.1 trillion last year.

- Over 40% of Americans carry a balance on their credit card from month to month, with an average balance of $8,200 and an average interest rate of 13%.

- 40% of all low and middle income households must rely on their credit cards to pay basic living expenses like rent, mortgage, utilities, groceries, real estate taxes, income taxes, along with their “needed” iPhones, HDTVs, bling, stainless steel appliances, and tattoo artwork.

- Wall Street banks have written off over $300 billion in credit card debt since 2008 (and passing the bill to taxpayers), while bilking their customers out of $60 billion per year in late fees and overdraft fees.

Despite the storyline of austerity, consumer credit outstanding has reached an all-time high of $2.84 trillion because Bernanke and his Wall Street puppeteers require perpetual debt expansion to keep their Ponzi scheme alive. Federal government dispensation of loans to subprime student borrowers has helped mask the true unemployment rate and Federal government doling out of subprime auto loans through Ally Financial and their crony Wall Street partners has created a fake auto recovery. The Blackrock/Wall Street “rent to own” faux housing recovery was designed by our owners to lure clueless math challenged dupes back into the housing market. Our entire economy is nothing but a confidence game at this point.

The four decade long orgy of debt couldn’t have ensued if our currency had remained linked to the barbaric relic – gold. The apologists and lackeys for the vested interests scorn and ridicule the notion of our economic system being burdened with any checks or balances. This is where the interests of those in power and those being ruled have coincided, as a fiat based monetary system allowed unlimited spending to keep the welfare/warfare state growing, enriching the crony capitalists, deepening the power of the state, and providing the masses with foreign made trinkets, baubles, corporate logoed clothing, techno-gadgets, and pimped out financed wheels. The concepts of self-restraint, discipline, saving for a rainy day, prudence, discretion, and deferred gratification are rarely displayed in modern day America. In a case of mass delusion, Americans have convinced themselves to live for today, recklessly ignore their futures, irresponsibly spend money they don’t have on things they don’t need, neglect their civic duty towards future generations, choose ignorance over knowledge, and vote for spineless politicians who promise them entitlements that are mathematically impossible to honor. The public’s foolish attitude towards debt accumulation matches the arrogance of our gutless intellectually dishonest leaders.

“When people pile up debts they will find difficult and perhaps even impossible to repay, they are saying several things at once. They are obviously saying that they want more than they can immediately afford. They are saying, less obviously, that their present wants are so important that, to satisfy them, it is worth some future difficulty. But in making that bargain they are implying that when the future difficulty arrives, they’ll figure it out. They don’t always do that.” – Michael Lewis – Boomerang

The manner in which our leaders are governing the country and citizens are living their lives can only be considered normal in relation to residing in a profoundly abnormal society. The American Dream of having the opportunity for upward mobility through educating yourself, working hard, accumulating wealth methodically by spending less than you earn, and reaching your full potential as a caring loving human being has been replaced by a perverted nightmare where we run on a hamster wheel for our entire lives trying to achieve the new American dream of accumulating throw away material goods, working to make the payments for McMansions, SUVs, stainless steel appliances, and iGadgets you rent from bankers, while driving yourself into an early grave by consuming mass quantities of processed poison and the stress created by trying to achieve the lifestyle sold to us by Madison Ave. maggots, Wall Street shysters and the mainstream media propagandists. The corporate fascists tell you what to believe, which “enemy” to fear, how you should look, what to eat, what drug to take for the illnesses caused by the food they lured you to eat, the kind of house you need to impress your friends and family, and the car you need to drive to impress your neighbors. As George Carlin aptly pronounced: “It’s called the American Dream because you’d have to be asleep to believe it.” – either asleep or insane.

“Normal is getting dressed in clothes that you buy for work and driving through traffic in a car that you are still paying for – in order to get to the job you need to pay for the clothes and the car, and the house you leave vacant all day so you can afford to live in it.” – Ellen Goodman

Our profoundly abnormal society of materialistic zombies, who mindlessly obey the commands and marketing messages of the financial elite, has staked their futures and the future of the country on the wisdom and brilliance of an Ivy League academic who never worked a day in the real world, didn’t spot the largest fraudulent housing bubble in world history, and whose unlawful acts as Federal Reserve chairman have enriched the banking whores who destroyed the country and impoverished what remains of the dying middle class. It’s the height of insanity for the American people to trust these crooked high priests of finance to cure a disease they spread with their immoral, traitorous policies over the last century. Bernanke and his lackeys, in a desperate last gasp gamble to prolong their fiat currency pillaging of the peasants, have rolled the dice with QE to infinity, accounting fraud, and further enrichment of their corporate masters.

“Viewed as a religious cult, modern finance revolves around the miracle of the spontaneous generation of money in a set of rituals performed by the high priests of central banking. People hang on the high priests’ every word, attempting to divine the secret meaning behind their cryptic utterances. Their interventions before the unknowable deity of global finance assure them of economic recovery and continued prosperity, just as a shaman’s rain dance guarantees rain or ritual sacrifice atop a Mayan pyramid once promised a bountiful harvest of maize.” – Dimitri Orlov – The Five Stages of Collapse

Bernanke will eventually roll craps. When he does, the collapse will be epic and 2008 will seem like a walk in the park. In Part 3 of this article I will speculate on the timing, scope and consequences of the coming collapse. It’s not going to be a happy ending, especially for the existing social order.

TRYING TO STAY SANE IN AN INSANE WORLD – PART 1

“I mean—hell, I been surprised how sane you guys all are. As near as I can tell you’re not any crazier than the average asshole on the street.” – R.P. McMurphy – One Flew Over the Cuckoo’s Nest

“Years ago, it meant something to be crazy. Now everyone’s crazy.” – Charles Manson

“In America, the criminally insane rule and the rest of us, or the vast majority of the rest of us, either do not care, do not know, or are distracted and properly brainwashed into acquiescence.” – Kurt Nimmo

I have to admit to being baffled by the aptitude of the Wall Street and K Street financial elite to keep their Ponzi scheme growing. I consider myself to be a rational, sane human being who understands math and bases his assessments upon facts and a sensible appraisal of the relevant information obtained from trustworthy sources. Of course, finding trustworthy sources is difficult when you live in a corrupt, crony-capitalist, fascist state, controlled by banking, corporate and military interests who retain absolute control over the mainstream media and governmental propaganda agencies. Those seeking truth must pursue it through the alternative media and seeking out unbiased critical thinkers who relentlessly abide by what the facts expose. This is no time for wishful thinking, delusions and fantasies. In the end, the facts are all that matter. As Heinlein noted decades ago, the future is uncertain so facts are essential in navigating a course that doesn’t lead you to ruin upon the shoals of ignorance.

“What are the facts? Again and again and again – what are the facts? Shun wishful thinking, ignore divine revelation, forget what “the stars foretell,” avoid opinion, care not what the neighbors think, never mind the un-guessable “verdict of history” – what are the facts, and to how many decimal places? You pilot always into an unknown future; facts are your single clue. Get the facts!” ― Robert A. Heinlein

Facts are treasonous and dangerous in an empire of lies, fraud and propaganda. It is maddening to watch the country spiral downward, driven to ruin by a psychotic predator class, while the plebs choose to remain willfully ignorant of reality and distracted by their lust for cheap Chinese crap and addicted to the cult of techno-narcissism. We are a country running on heaping doses of cognitive dissonance and normalcy bias, an irrational belief in our national exceptionalism, an absurd trust in the same banking class that destroyed the finances of the country, and a delusionary belief that with just another trillion dollars of debt we’ll be back on the exponential growth track. The American empire has been built on a foundation of cheap easily accessible oil, cheap easily accessible credit, the most powerful military machine in human history, and the purposeful transformation of citizens into consumers through the use of relentless media propaganda and a persistent decades long dumbing down of the masses through the government education system.

This national insanity is not a new phenomenon. Friedrich Nietzsche observed the same spectacle in the 19th century.

“In individuals, insanity is rare; but in groups, parties, nations and epochs, it is the rule.”

The “solutions” imposed by the supposed brightest financial Ivy League educated minds and corrupt bought off political class upon people of the United States since the Wall Street created 2008 worldwide financial collapse are insane and designed to only further enrich the crony capitalists and their banker brethren. The maniacs are ruling the asylum. John Lennon saw the writing on the wall forty five years ago.

“Our society is run by insane people for insane objectives…. I think we’re being run by maniacs for maniacal ends … and I think I’m liable to be put away as insane for expressing that. That’s what’s insane about it.” – John Lennon, Interview BBC-TV (June 22, 1968)

The world is most certainly ruled by a small group of extremely wealthy evil men who desire ever more treasure, supremacy and control, but the vast majority of Americans have stood idly by mesmerized by their iGadgets and believing buying shit they don’t need with money they don’t have is the path to happiness and prosperity, while their wealth, liberty and self-respect were stolen by the financial elite. Our idiot culture, that celebrates reality TV morons, low IQ millionaires playing children’s sports, egomaniacal Hollywood hacks, self-promoting Wall Street financers, and self-serving corrupt ideologue politicians, has been degenerating for decades.

“We are in the process of creating what deserves to be called the idiot culture. Not an idiot sub-culture, which every society has bubbling beneath the surface and which can provide harmless fun; but the culture itself. For the first time, the weird and the stupid and the coarse are becoming our cultural norm, even our cultural ideal.” – Carl Bernstein -1992

The examples of our national insanity are almost too vast to document, but any critical assessment of what we’ve done over the last one hundred years reveals the idiocracy that has engulfed our collapsing empire.

The Madness of Crowds

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.” – Charles MacKay – Extraordinary Popular Delusions and the Madness of Crowds

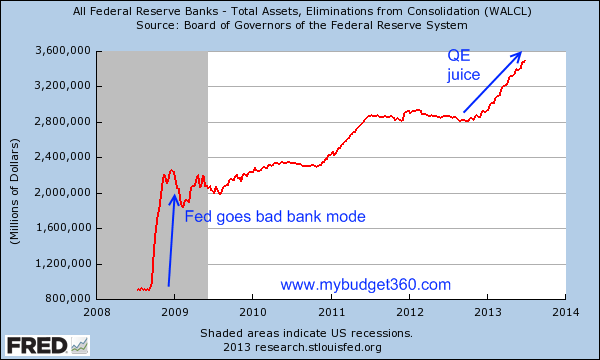

We have become a nation that seamlessly goes mad every five years in pursuit of some new delusionary fantasy sold to us by the ruling class, only to see those dreams shattered like a wooden ship on the reef of reality. You can never underestimate the power of human stupidity. Ben Bernanke and his Federal Reserve cronies have printed $2.6 trillion of new money out of thin air since September 2008 in order to prop up their Wall Street owners, who had engineered the largest control fraud (mortgage debt/housing bubble) in world history, recklessly gambled in their ravenous appetite for sordid profits, and drove their firms into insolvency. It took the Federal Reserve 95 years to accumulate a balance sheet of $900 billion of safe U.S. Treasuries.

They have insanely quadrupled their balance sheet in the last 5 years by accumulating toxic mortgage debt from Wall Street banks and purchasing the majority of new Treasury debt being issued to fund the Federal government’s insane trillion dollar annual deficits. Bernanke, the corporate media, government apparatchiks, and captured political class act as if this is normal, when it is clearly the act of a desperate ruling class in its final death throes. Bernanke has leveraged his balance sheet 60 to 1. Lehman and Bear Stearns were leveraged 30 to 1 when they collapsed. The 100 basis point move in rates over the space of two months has resulted in Bernanke losing $200 billion and effectively wiping out his $55 billion of capital.

Of course, in a corrupt regime accounting fraud is encouraged and applauded by the status quo. Just as the spineless accountants on the FASB buckled to threats from Bernanke and Paulson in early 2009 and reversed the requirement that assets be marked to market so the felonious Wall Street banks could fraudulently hide their insolvency, the Federal Reserve has decided their losses don’t matter. The Federal Reserve classifies their losses as an asset. Don’t you wish you could classify your 401k losses and your home value losses as an asset? The tapering bullshit storyline is just another attempt to distract the masses from focusing on the fact that Bernanke will never stop expanding his balance sheet because if he stops the financial system will collapse in a catastrophic implosion. The Ponzi scheme will continue until loss of faith leads to a scramble away from the U.S. dollar.

Since the infamous creation of the Federal Reserve by a secretive cabal of bankers and politicians in 1913, the ultimate destination of the American empire was set. Every fiat currency in world history has collapsed. Our entire system has been based on infinite exponential growth. The fallacy of American exceptionalism has been built on an underpinning of pure stupid luck and the issuance of more and more debt. The American empire grew to epic proportions due to the discovery of cheap easily accessible oil in the late 19th century and the physical and economic destruction of Europe, Russia and Japan during World War II. The accumulation of debt was fairly moderate during the glory years after World War II, but began to accelerate after the fateful year of 1971 when U.S. oil production peaked and Tricky Dick Nixon removed the last vestiges of restraint from central bankers and politicians by closing the gold window. With the shackles removed from the wrists of corruptible knaves and shysters, America’s future depended upon the wisdom, honesty and financial acumen of Washington politicians and Wall Street financers. Once the citizens realized they could vote for more bread and circuses, our ultimate demise was set in motion. A nation that had produced real annual growth of 4% during the 1950’s and 1960’s has seen a steady decline for the last four decades.

The term pushing on a string describes the Quantitative Easing (literally money printing) and Keynesian debt financed pork spending efforts of our increasingly frantic owners. The insanity of what we’ve done since 1971 is almost too crazy to comprehend. In the first 182 years of our existence the leaders we elected to steward the nation accumulated $400 billion of national debt. By 1981, unleashed from any semblance of spending control, the politicians and bankers had added another $600 billion of debt, a 150% increase in 10 years. By 1991 our beloved leaders had added another $2.6 trillion of debt, another 160% increase in 10 years. By 2001 another $2.2 trillion had been accumulated, only a 60% increase due to the end of the Cold War and a one-time tax surge from the Dot.com stock bubble. Bush’s worldwide War on Terror, expansion of the police state, tax rebate stimulus idiocy, and expansion of the welfare state (Medicare Part D) drove the national debt up by another $2.2 trillion in just eight years, a 40% increase.

The insane amassing of debt since 2008 has put a final nail in the coffin of the ridiculous Keynesian theory, as the Federal government has increased annual spending by 35% over the last five years and the economy is still moribund. Our fearless leaders have driven the national debt from $7.8 trillion to $16.7 trillion in less than five years, a 110% increase. The country continues to add $2 to $3 billion of debt per day. Consider how insane it is that we now accumulate more debt in half a year than we did cumulatively over the first 182 years of our existence as a country. And our elected, or should I say selected, leaders, cheer on the intellectually bankrupt academics like Bernanke whose only solution to every crisis is to print moar and then lie to the American people about his true purpose, act as if annually spending $1 trillion more than we collect while knowing there are over $200 trillion of unfunded promises to fulfill is a reasonable and realistic way to manage the national finances. Any sane person knows our current path will lead to ruin. When you need to issue new debt in order to honor old debt, the end is in sight.

The multitude of insane responses to a financial crisis created by a few greedy psychopathic bankers will be looked upon by historians with contempt and scorn. Future generations will wonder “What were they thinking?” Trillions in wealth were vaporized due to the actions of a small secretive league of highly educated, egocentric psychopaths whose warped sense of morality led them to pillage the wealth of the nation through fraudulent financial products, bribing regulatory agencies, stabbing clients and competitors in the back, and peddling lies, propaganda and misinformation to the public through their captured media mouthpieces. Not only haven’t any predator bankers been thrown in jail, but these villains have grown their parasitic entities to enormous proportions while paying themselves obscene billion dollar bonuses. Jon Corzine stole $1.2 billion directly from the accounts of his customers to cover his gambling losses and he remains free to laze about in one of his five gated mansions. The largest banks on earth have been caught red handed forging mortgage documents, rigging LIBOR, front running the muppets with non-public economic information, insider dealing, and using their HFT supercomputers to manipulate the markets at their whim. Government spy agencies regularly use the U.S. Constitution like toilet paper while accumulating electronic dossiers on every citizen in the country. The rule of law does not exist for the ruling class.

Only in a world gone insane would we be celebrating Wall Street generating all-time high profits through the use of accounting fraud and Bernanke filling their coffers with trillions of interest free money while bilking senior citizens out of $400 billion per year of interest income through his dastardly ZIRP “save a Wall Street banker” scheme. Bernanke has stolen close to $2 trillion from the bank accounts of little old ladies since 2008 and given it to Jamie Dimon, Lloyd Blankfien and the rest of the Wall Street scumbags. While Wall Street and the crony capitalist mega-corporations report record profits, Main Street is left with 5 million less full-time jobs than they had in 2007 and a real unemployment rate exceeding 20%. While the government has insanely reported a recovering economy since mid-2009, the food stamp rolls have grown from 33 million to 47 million. The ruling class cheers the record highs in the stock market that overwhelmingly benefit the top .1% because they are the .1%. Meanwhile, the average schmuck out in the hinterlands is paying double the price they were paying for gas in 2009 and their everyday living costs are rising by greater than 5% annually. Luckily for the financial elite, the average American would rather watch Honey Boo Boo than try to understand the evilness of Federal Reserve created inflation. The economic recovery storyline is obliterated by the fact that real household income is still 9% below its 2008 peak and amazingly 8% below its 2000 level.

Since the 2009 low, the household net worth of the wealthiest 7% has grown by 28%, while the other 93% have seen their net worth decline by a further 4%. The profits accrue to those who run the show, buy the politicians, write the laws, command the media propaganda machine and control the currency. As a sane person in this insane world I’m flabbergasted that there is virtually no outrage at the perpetrators of these crimes against humanity. Americans have earned the moniker – ignorant masses. Bread and circuses have won the day in our declining empire. The oligarchs thank you.

The blame doesn’t rest solely on the shoulders of the evil men running the show. They have only done what we allowed them to do. From top to bottom our society has hopped on the crazy train. The lack of national morality, sense of civic duty, inter-generational responsibility, and willful ignorance regarding sensible financial policies has led us to a tipping point. Decades of feckless self-serving political leadership making entitlement promises they could never honor to win votes, combined with a parasitic financial class peddling debt to millions of witless, narcissistic, math challenged, materialistic morons, has left the country in debt up to its eyeballs with no escape other than cataclysmic default. Michael Lewis documents the bleeding out of our society in his recent book:

“The people who had the power in the society, and were charged with saving it from itself, had instead bled the society to death. The problem with police officers and firefighters isn’t a public sector problem; it isn’t a problem with government; it’s a problem with the entire society. It’s what happened on Wall Street in the run-up to the subprime crisis. It’s a problem of taking what they can, just because they can, without regard to the larger social consequences. It’s not just a coincidence that the debts of cities and states spun out of control at the same time as the debts of individual Americans. Alone in a dark room with a pile of money, Americans knew exactly what they wanted to do, from the top of the society to the bottom. They’d been conditioned to grab as much as they could, without thinking about the long-term consequences. Afterward, the people on Wall Street would privately bemoan the low morals of the American people who walked away from their subprime loans, and the American people would express outrage at the Wall Street people who paid themselves a fortune to design the bad loans.” – Michael Lewis – Boomerang

The insanity of our debt accumulation in relation to our pathetic economic growth is clearly evident to even an Ivy League educated economist or a bubble headed CNBC anchorwoman. Since 1971 nominal GDP has grown by a factor of 14. Over this same time frame total credit market debt (household, corporate, government) has grown by a factor of 32. Real GDP (even using the fraudulent BLS manipulated CPI) has only expanded by a factor of 3.5 since 1971. The exponential growth model is clearly failing, with debt going hyperbolic, while GDP has stagnated.

Since 2007 real GDP has gone up $500 billion while total credit market debt has gone up by $6 trillion. Only an insane society would allow itself to be convinced by the perpetrators of the financial crimes that collapsed our economic system that accelerating the level of debt in our system will resolve the dilemma of Too Big to Trust banker insolvency. Transferring the immense losses of greedy sham capitalist gambling addicts from their insolvent balance sheets onto the balance sheets of the taxpayer has allowed the criminals to retain and expand their wealth, while sovereign states shift the pain and suffering onto the backs of the sinking middle class. This is a worldwide phenomenon perpetuated by central bankers at the behest of their crony capitalist co-conspirators. They call it capitalism when the scams, dodges and swindles work and the profits accrue to the schemers. When the gamblers and extreme risk addicts roll craps they use their crony capitalist connections, bought with blood money, to socialize their losses. The game is rigged and your owners don’t care about your hopes and dreams or your children’s future. They care about their own wealth and lifestyles of luxury. When the richest 300 people in the world have a greater net worth than the poorest 3 billion people on earth, a sane person realizes a chaotic end of the existing social order beckons.

“All over the world people borrowed vast sums of money they could never repay. The honest toting up, and taking, of the losses is being delayed. There’s a reason for this. The bad debts are owed, largely, to big banks. The big banks (even bigger than they were at the start of this crisis) and the people who own them enjoy a wildly disproportionate amount of political influence. And so, even now, five years into this mess, we remain at the mercy of the failed financial institutions that sit at the center of our capitalism. Geithner & Bernanke, along with their European counterparts, are doing everything in their power to prevent banks from failing. But the effect of this new financial order is bizarre: capitalism for everyone but the capitalists. Ordinary workers remain fully exposed to the increasingly harsh collisions in the marketplace while the highest paid financial elites ride protected by a passenger airbag.” – Michael Lewis – Boomerang