“Still, if you will not fight for the right when you can easily win without bloodshed, if you will not fight when your victory will be sure and not so costly, you may come to the moment when you will have to fight with all the odds against you and only a precarious chance for survival. There may be a worse case. You may have to fight when there is no chance of victory, because it is better to perish than to live as slaves.” – Winston Churchill – The Second World War

A butterfly flapped its wings in Tunisia creating a hurricane that is swirling across the globe, wreaking havoc with the existing social order and sweeping away old crumbling institutions and dictatorships. The linear thinking politicians, pundits and thought leaders have been knocked for a loop. They didn’t see it coming and they don’t know where it’s leading. An examination and understanding of history would have revealed that we have been here before. We were here in 1773. We were here in 1860. We were here in 1929. We are here again. The Fourth Turning has returned in its predictable cycle, just as Winter always follows Fall.

Winston Churchill wrote the definitive history of World War II in 1948. His six volume history detailed the years from the end of World War I through the unconditional surrender of the Axis powers in 1945. Volume I in the series was The Gathering Storm. It covered the second half of the Unraveling and the first ten years of the last Fourth Turning Crisis period. The title fits perfectly with the mood and inevitability of what was destined to occur. All Fourth Turnings resemble Winter, with bitter cold options, biting winds of change, dark days, and destructive storms. The seasons cannot be averted. The Seasons of a year are predictable, as are the seasons of a human life. We’ve entered the Crisis (Winter) season of the latest Saeculum that began in 1946 and will climax sometime around 2025.

“Reflect on what happens when a terrible winter blizzard strikes. You hear the weather warning but probably fail to act on it. The sky darkens. Then the storm hits with full fury, and the air is a howling whiteness. One by one, your links to the machine age break down. Electricity flickers out, cutting off the TV. Batteries fade, cutting off the radio. Phones go dead. Roads become impossible, and cars get stuck. Food supplies dwindle. Day to day vestiges of modern civilization – bank machines, mutual funds, mass retailers, computers, satellites, airplanes, governments – all recede into irrelevance. Picture yourself and your loved ones in the midst of a howling blizzard that lasts several years. Think about what you would need, who could help you, and why your fate might matter to anybody other than yourself. That is how to plan for a saecular winter. Don’t think you can escape the Fourth Turning. History warns that a Crisis will reshape the basic social and economic environment that you now take for granted.” – Strauss & Howe – The Fourth Turning

The generations are aligned in such a way that an event, incident, or individual action that may have been disregarded or ignored ten years ago will now trigger a worldwide conflagration. The Boston Massacre occurred in1770 during Revolutionary Saeculum. Five colonists were slaughtered by British troops. The mood of the generations was not ready for a Crisis. It wasn’t until three years later that the Boston Tea Party ignited a spark that started a revolution. John Brown’s raid on Harper’s Ferry in 1859 was intended to start a revolution. The populace was not ready. One year later, the election of Abraham Lincoln lit the fuse on the most horrific war in modern history. America experienced a sharp depression in 1920-1921. The country did not spiral into a decade long downturn, culminating in a World War that killed 65 million people. The generational dynamic was not aligned in a way that would lead to that outcome. Instead, the roaring twenties commenced. On December 17, 2010 a man committed a seemingly inconsequential act that has ignited a worldwide firestorm.

The spark that has enflamed the planet was struck by a 26-year-old Tunisian with a computer science degree named Mohamed Bouazizi, who unable to feed his family, was not allowed by his government to even get a permit to sell vegetables. Bouazizi publicly doused himself with gasoline, lit a match, and burnt not only his own body, but enflamed the consciousness of a world, and its inhabitants, being obliterated by the corrupt wealthy elites who rule the planet. In less than a month the brush fire started by this 26-year-old Tunisian had incinerated the despotic government of his country and forced its “president-for-life”, Zine El Abidine Ben Ali, to flee the country. The people’s coup in Tunisia, called the Jasmine Revolution, has sent shockwaves across the globe, spreading wildfires of freedom throughout the Arab world. The firestorm started by Bouazizi has brought down Mubarak in Egypt and is lapping at the heals of Gaddafi in Libya. Tyrants throughout the world are quivering with fear. The mood of the people across the globe has turned dark and angry. The political class and media are persistently surprised by the reaction of citizens to events during the Fourth Turning.

Historians William Strauss and Neil Howe documented their generational theory in the 1997 book The Fourth Turning. People who prefer blind ideology and believe human existence is a straight line of progress scorn their work as fantasy and pure prophecy. So called progressives misrepresent the theory as predicting the future because they refuse to accept the fact that large groups of human beings of a similar age and having common experiences react in similar predictable ways. It irritates those with an unwavering belief in human individuality. They prefer to ignore the numerous example of mass hysteria throughout history. In just the last 10 years we have experienced an internet boom and a housing boom that convinced millions of Americans to act simultaneously in a foolish manner . The theory is so logical and measurable that even the most vacuous blond bubble head on Fox News should understand it.

Strauss & Howe have been able to break Anglo-American history into 80 to 100 year (a long human life) Saeculums going back to 1435. Each Saeculum has four generations at different stages of their lives. A turning is an era with a characteristic social mood, a new twist on how people feel about themselves and their nation. It results from the aging of the generational constellation. A society enters a turning once every twenty years or so, when all living generations begin to enter their next phases of life. Like archetypes and constellations, turnings come four to a saeculum, and always in the same order. In 1997, Strauss & Howe knew when the next Fourth Turning would begin:

The next Fourth Turning is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire. The very survival of the nation will feel at stake. Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II.” – Strauss & Howe – The Fourth Turning

They did not predict events that would ignite the next Fourth Turning. It was how the generations reacted to the events that mattered. The generational constellation is now in the once every 80 year alignment that will lead to chaos, violent change, the sweeping away of the existing social order, and likely war. Strauss & Howe answered why this would happen fourteen years ago:

“What will propel these events? As the saeculum turns, each of today’s generations will enter a new phase of life, producing a Crisis constellation of Boomer elders, midlife 13ers, young adult Millennials, and children from the new Silent Generation. As each archetype asserts its new social role, American society will reach its peak of potency. The natural order givers will be elder Prophets, the natural order takers young Heroes. The no-nonsense bosses will be midlife Nomads, the sensitive souls the child Artists. No archetypal constellation can match the gravitational power of this one – nor its power to congeal the natural dynamic of human history into new civic purposes. And none can match its potential power to condense countless arguments, anxieties, cynicisms, and pessimisms into one apocalyptic storm.” – Strauss & Howe – The Fourth Turning

I believe my generation is about to experience a rendezvous with destiny. Each generation’s life experiences have prepared them for this hour and the trials that await them. The mood of the country has shifted darkly into a crisis mode. The mainstream media pundits and progressive politicians try to put a positive spin on today’s events, when anyone with the ability to think can see that things will get severely worse in the next ten years. Trust in our institutions, politicians, corporate leaders, media and social order is disintegrating.

It’s a Matter of Trust

“An initial spark will trigger a chain reaction of unyielding responses and further emergencies. The core elements of these scenarios (debt, civic decay, global disorder) will matter more than the details, which the catalyst will juxtapose and connect in some unknowable way. If foreign societies are also entering a Fourth Turning, this could accelerate the chain reaction.” – Strauss & Howe – The Fourth Turning

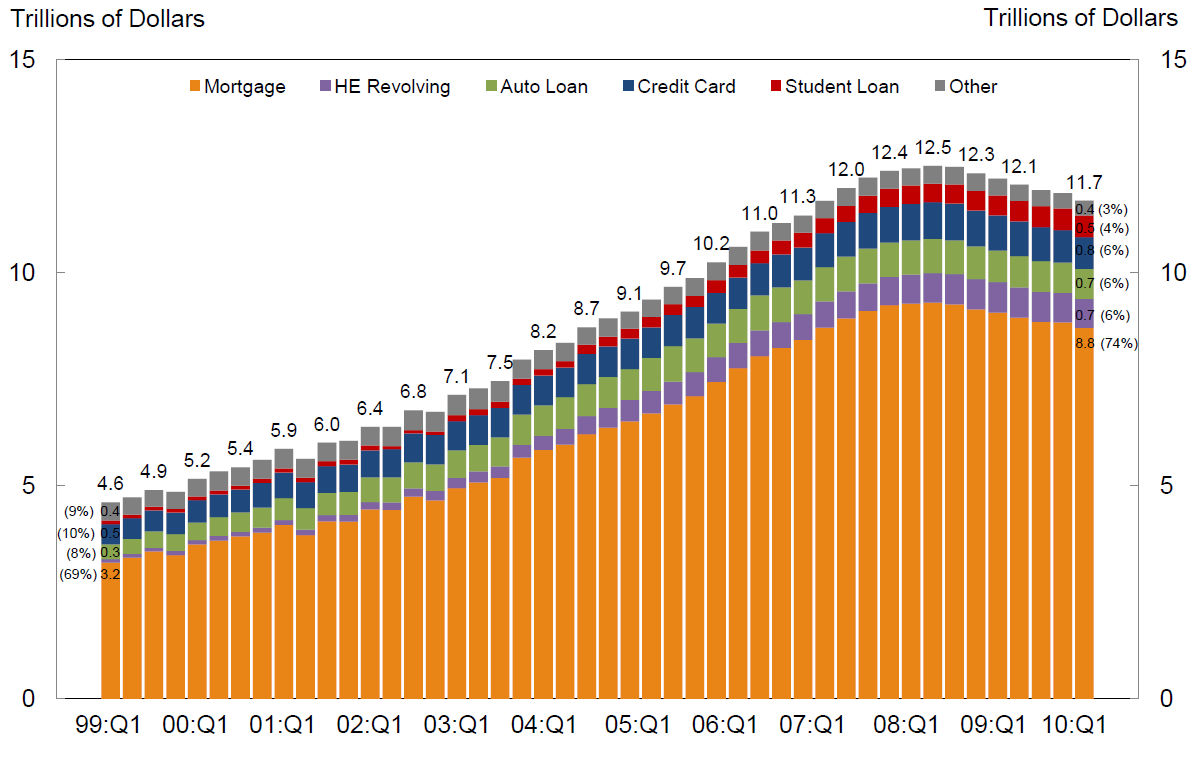

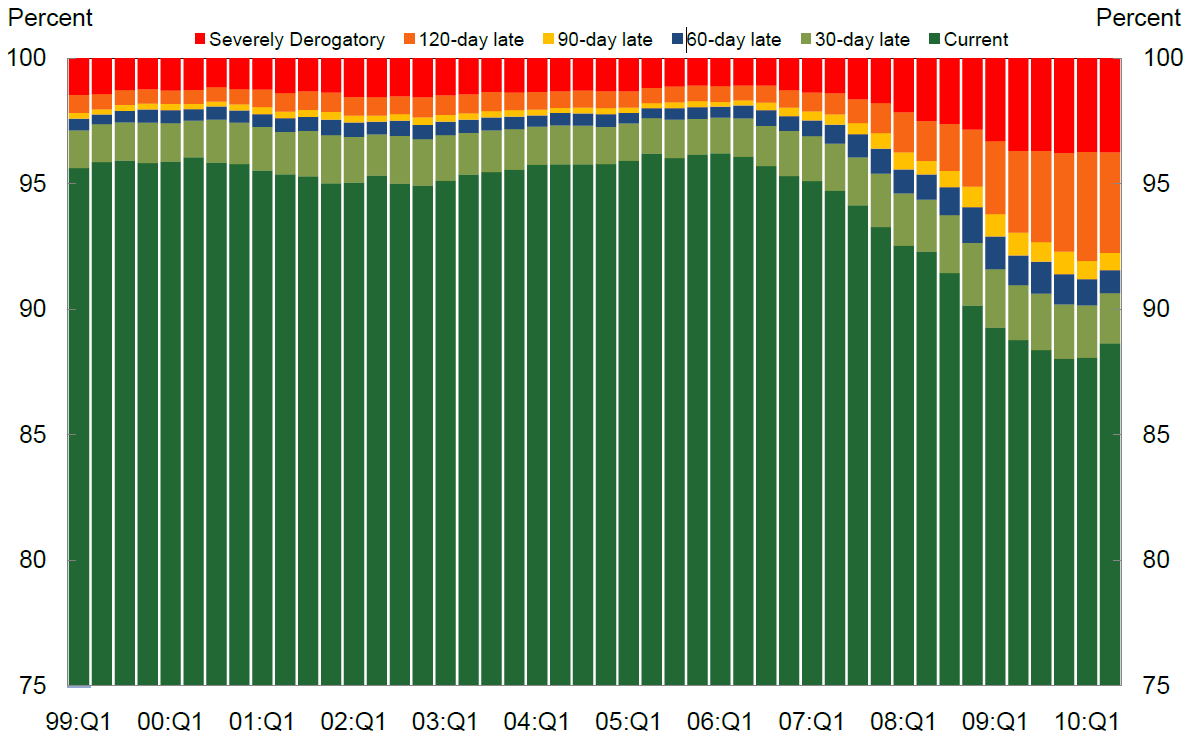

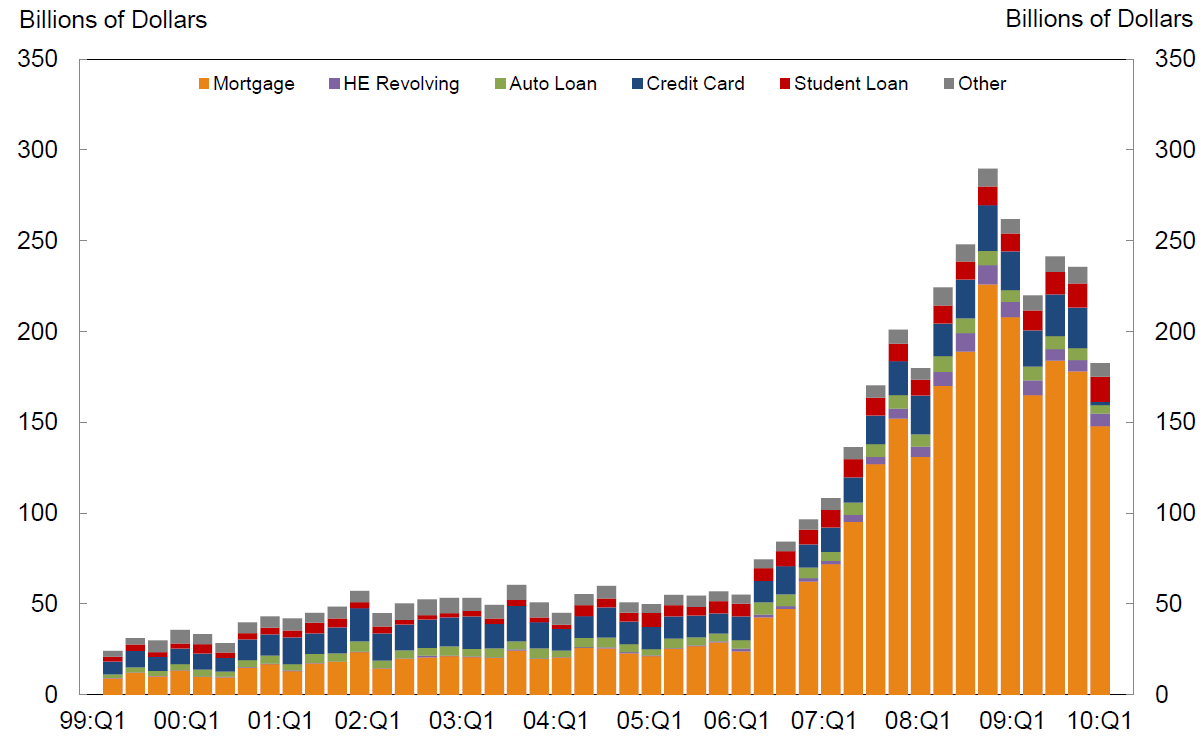

The initial spark that ignited this Fourth Turning was the collapse of the housing market, which began in 2005 and continues today. Home prices collapsed, the fraudulent mortgage loans blew up in the faces of the Wall Street banks that birthed them, and millions of delusional Americans lost their houses in foreclosure. The cascading impact of this implosion brought the American empire of debt to its knees. On September 18, 2008 the U.S. financial system came within hours of complete collapse, as described by Congressman Paul Kanjorski on CPAN:

“On Thursday (Sept 18), at 11am the Federal Reserve noticed a tremendous draw-down of money market accounts in the U.S., to the tune of $550 billion was being drawn out in the matter of an hour or two. The Treasury opened up its window to help and pumped a $105 billion in the system and quickly realized that they could not stem the tide. We were having an electronic run on the banks. They decided to close the operation, close down the money accounts and announce a guarantee of $250,000 per account so there wouldn’t be further panic out there.

If they had not done that, their estimation is that by 2pm that afternoon, $5.5 trillion would have been drawn out of the money market system of the U.S., would have collapsed the entire economy of the U.S., and within 24 hours the world economy would have collapsed. It would have been the end of our economic system and our political system as we know it.”

The implosion of the financial system was created by the actions of the Wall Street financers that have been looting the country for decades. They created mortgage products (no doc, liar loans, Alt-A, negative amortization) designed to encourage people to commit fraud. They purposely promoted this massive fraud because they had perfected the art of derivatives. The issuers of these fraudulent mortgages bore none of the risk from their guaranteed default. They packaged them into MBOs and MBSs, bought AAA ratings from Moodys, and shilled them to pension managers, insurance companies, municipalities, states, and little old ladies. Then they bet against their own products with credit default swaps. Their greed and avarice was so extreme, they leveraged their own balance sheets 40 to 1 and then bought their own toxic waste. When their MBA created models proved to be defective, the entire house of cards collapsed. Strauss and Howe anticipated a financial catalyst related to immense levels of debt would trigger the next Fourth Turning:

It is unlikely that the catalyst will worsen into a full-fledged catastrophe, since the nation will probably find a way to avert the initial danger and stabilize the situation for a while.

After the near collapse of the financial system in September 2008, the authorities took unprecedented actions to avert a Second Great Depression. Henry Paulson, the Goldman Sachs U.S. Treasury Secretary, who had warned his own staff that a Wall Street derivative disaster would happen, immediately reacted like a former Wall Street CEO. He convinced his Harvard MBA boss, George W. Bush, that the only way to save the country was to fork over $700 billion to the Wall Street banks that created the manmade disaster. When Congress initially voted down this banker bribe, Wall Street showed who was boss by crashing the market by 777 points in one day. The bought off politicians in Washington DC then towed the line and passed TARP.

The two and one half years since September 2008 have set the stage for a far worse catastrophe. The Obama administration jammed an $800 billion pork filled stimulus bill down the throats of America, along with home buyer tax credits, loan modification programs, and a healthcare plan that will crush small businesses. The politicians, government bureaucrats, and mainstream media corporate mouthpieces proclaim that their wise and prompt actions averted a Second Great Depression. The government solutions used to “stabilize” the situation have wrought unintended consequences and planted the seeds of further pain and suffering to come. A summary of what has happened in the last few years is in order:

- On September 18, 2008 the National Debt stood at $9.66 trillion. Today it stands at $14.16 trillion, a 47% increase in 2 1/2 years.

- The country is running $1.5 trillion annual deficits and will continue to do so for the foreseeable future.

- The States are running cumulative budget deficits of $130 billion in FY11 and expect deficits of $112 billion in FY12. This is leading to conflicts with unions, higher taxes and mass layoffs of government workers.

- The working age population has risen by 5 million, while the number of employed Americans has declined by 6.5 million. The true unemployment rate http://www.shadowstats.com/alternate_data/unemployment-charts has risen from 12% to 22%.

- In September 2008 there were 30.8 million Americans on food stamps. Today there are 44 million Americans on food stamps (14% of the U.S. population), a 43% increase in 2 1/2 years. The annual cost has risen by $37 billion, a 100% increase in 2 1/2 years.

- Real inflation http://www.shadowstats.com/alternate_data/inflation-charts bottomed at 5% in early 2009, but has accelerated to 9% today, with further increases baked in the cake.

- Gasoline prices bottomed out at $1.61 per gallon in January 2009 and have risen to $3.54 per gallon today, a 120% increase in just over two years.

- Households have lost $6.3 trillion of real estate related wealth since the peak of the housing market. Home prices have fallen for six straight months.

- Almost 3 million homes have been lost to foreclosure since 2007.

- There are 11.1 million households, or 23.1% of all mortgaged homes, underwater on their mortgages today, with rates above 50% in Nevada, Arizona, California, and Michigan.

- Fannie Mae and Freddie Mac were taken over by the US government and have lost $170 billion of taxpayer funds so far. Losses are expected to reach $400 billion. Along with the FHA, they continue to prop up a dead housing market with more bad loans.

- The Federal Reserve balance sheet in September 2008 consisted of $895 billion of US Treasury bonds. Today it totals $2.55 trillion of toxic mortgages bought from Wall Street banks and Treasury bonds being bought under QE2.

- The Federal Reserve and the Treasury Dept. intimidated the FASB into allowing Wall Street banks to account for worthless mortgage and real estate loans as fully collectible. Magically, insolvent banks became solvent – on paper.

- The Dow Jones was 11,700 in late August 2008 and today stands at 12,000. The Dow has risen 84% from its March 2009 low. The top 1% wealthiest Americans own 40% of all the stocks in America, so they are feeling much better.

- In late 2007, a risk averse senior citizen could get a 5% return on a 6 month CD. Today, after two years of no increases in their Social Security payments, a senior citizen can “earn” .38% on a 6 month CD.

- The Federal Reserve lowered interest rates to 0% in order to allow the Wall Street banks to borrow for free and earn billions without risk.

- Over 300 smaller banks have been closed by the FDIC, with losses exceeding $50 billion. There are another 900 banks on the verge of insolvency, with estimated future losses of $100 billion.

- The Federal Reserve initiated QE2 in November 2010, purchasing $70 billion per month of Treasury bonds and attempting to create a stock market rally. They have succeeded in creating a tsunami of energy, food, and commodity price inflation across the globe, sparking revolutions among the desperately poor in the Middle East.

- Wall Street banks “earned” record profits of $19 billion in 2010 after nearly destroying the worldwide financial system in 2008 and raping the American taxpayer in 2009.

- No Wall Street executive has been prosecuted for the fraudulent actions committed by their banks.

- Wall Street banks handed out $43.3 billion in bonuses in 2009/2010 for a job well done. The average Wall Street employee received a $128,000 bonus in 2010. In 2008, the year they crashed the financial system, they still doled out $17.6 billion in bonuses.

- The median household income in 2007 was $52,163. Today the median household income is $46,326, an 11% decline in three years. Real average weekly earnings are lower today than they were in 1971.

It is clear from the list above that the oligarchic players that wield the power in this country have chosen to prop up their tottering structure of debt-created-wealth on the backs of the working middle class. The people who have been screwed and continue to be screwed are growing angry and distrustful, as anticipated by Strauss & Howe:

“But as the Crisis mood congeals, people will come to the jarring realization that they have grown helplessly dependent on a teetering edifice of anonymous transactions and paper guarantees. Many Americans won’t know where their savings are, who their employer is, what their pension is, or how their government works. The era will have left the financial world arbitraged and tentacled: Debtors won’t know who holds their notes, homeowners who owns their mortgages, and shareholders who runs their equities – and vice versa.”

The continuing foreclosure crisis has proven that the financial industry’s sole purpose in creating subprime loans, liar loans, Alt-A loans and packaging them into tranches with fake AAA ratings to be sold off to whatever sucker they could find was to enrich themselves with no care about the future consequences. The owners of the debt can’t prove they own the debt. Lawsuits clog up the court system. Deadbeats occupy houses for longer than two years without making a mortgage payment. Wall Street has created so many complex confusing financial products in their greedy thirst for fees that Harvard MBAs can’t even figure out the mess they have created. The $1.4 quadrillion of outstanding derivatives is truly a weapon of mass worldwide destruction waiting to be triggered. The fraudulent actions of Wall Street, the lies told to the American people by government bureaucrats about the solutions needed, the overstep and obfuscation committed by Ben Bernanke, and the propaganda fed to the masses by the corporate mainstream have destroyed the remaining trust in our institutions. Distrust grows by the day, as Strauss and Howe foresaw in 1997:

“As the Crisis catalyzes, these fears will rush to the surface, jagged and exposed. Distrustful of some things, individuals will feel that their survival requires them to distrust more things. This behavior could cascade into a sudden downward spiral, an implosion of societal trust.”

The growing distrust of financial and governmental institutions was reflected in the angry and sometimes violent town hall meetings with Congressmen during the healthcare debate. An angry on-air rant by financial reporter Rick Santelli ignited the Tea Party movement that eventually swept dozens of candidates into office in a Republican landslide in the 2010 mid-term elections. Societal trust in promises made by politicians is ripping apart. The entitlement benefit promises can’t be kept. Senior citizen and government union beneficiaries are angry. Younger generations don’t want to be left with debt so older generations can have comfortable 25 year retirements. Taxpayers don’t want to pay higher taxes to support gold plated healthcare and pension plans for government union workers. The decades of compromise, denial, apathy and lethargy are over. The mood of the country has changed dramatically. Survival of the country is at stake.

Volcanic Eruption

“America’s short-term Crisis psychology will catch up to the long-term post-Unraveling fundamentals. This might result in a Great Devaluation, a severe drop in the market price of most financial and real assets. This devaluation could be a short but horrific panic, a free-falling price in a market with no buyers. Or it could be a series of downward ratchets linked to political events that sequentially knock the supports out from under the residual popular trust in the system. As assets devalue, trust will further disintegrate, which will cause assets to devalue further, and so on. Every slide in asset prices, employment, and production will give every generation cause to grow more alarmed. With savings worth less, the new elders will become more dependent on government, just as government becomes less able to pay benefits to them.” – Strauss & Howe – The Fourth Turning

The country has withstood the initial onslaught of this latest Fourth Turning. The Great Devaluation resulted in a 50% stock market crash and a 30% decline in home values. Rather than allowing home values to fall to their fair value, the government used tax credits and loan modification programs to prop up home prices. Rather than liquidating insolvent Wall Street banks in an orderly bankruptcy, the government and Federal Reserve chose to use accounting gimmicks and borrowed taxpayer funds to save those who had taken excessive risks and reaped hundreds of billions in profits. The government has systematically “adjusted” every economic statistic in order to paint the most optimistic view possible. Unemployment, inflation, government debt, and GDP are all manipulated in the most positive light.

Many people understand that you cannot solve a debt problem by issuing more debt. They understand that politicians have overpromised Social Security and Medicare benefits to the tune of $100 trillion. They understand that if you cover 30 million more people in your healthcare system, it will cost hundreds of billions more. They understand that mega-corporations have shipped their manufacturing jobs overseas, and they aren’t coming back. They understand spending $800 billion per year, policing the world, fighting two wars of choice, with hundreds of military bases across the globe is unsustainable. They understand that running $1.5 trillion deficits will eventually result in a collapse of the U.S. dollar. They understand that an individual or a country cannot borrow their way to prosperity. The U.S. government is essentially bankrupt and dependent upon Ben Bernanke’s printing press to keep up the appearance of solvency.

Fingers of tension and instability run through every aspect of American society. Pressure is building beneath the surface. The last year and a half have proven to be a liquidity driven lull. The appearance of stability does not mean our situation has stabilized. The actions of those in power have created a vastly more dangerous scenario for the next decade. The volcano is erupting and the lava is flowing along the channels of distress, as described by Strauss & Howe:

Imagine some national (and probably global) volcanic eruption, initially flowing along channels of distress that were created during the Unraveling era and further widened by the catalyst. Trying to foresee where the eruption will go once it bursts free of the channels is like trying to predict the exact fault line of an earthquake. All you know in advance is something about the molten ingredients of the climax, which could include the following:

- Economic distress, with public debt in default, entitlement trust funds in bankruptcy, mounting poverty and unemployment, trade wars, collapsing financial markets, and hyperinflation (or deflation)

- Social distress, with violence fueled by class, race, nativism, or religion and abetted by armed gangs, underground militias, and mercenaries hired by walled communities

- Political distress, with institutional collapse, open tax revolts, one-party hegemony, major constitutional change, secessionism, authoritarianism, and altered national borders

- Military distress, with war against terrorists or foreign regimes equipped with weapons of mass destruction

Strauss & Howe did not predict specific events that would occur during the next Fourth Turning. As trained historians and economists, they simply analyzed the environment created by our leaders over the last few decades. If the thought leaders in the country had not been blinded by their ideological biases, they would have seen that the next Fourth Turning Crisis would be channeled by un-payable debt obligations, reckless financial schemes, religious ideology, political corruption, class warfare, foreign conflicts, and terrorism. The molten ingredients are travelling along the channels outlined above. What happens next is anybody’s guess.

The economic distress worsens for the average American every day. The recovery propaganda circulated by the power elite through the mass media is a fraud. Only those with wealth and power have recovered. The middle class sinks further into poverty and despair. Unemployment remains at Depression levels and the entire economic faux recovery rests with Ben Bernanke’s printing press. The only question that remains is whether the United States experiences a deflationary collapse or a hyper-inflationary collapse. The country is currently experiencing stagflation as the things we need (energy, food, clothing) inflate, while wages stagnate and our home values deflate. Bernanke and his minions at the Federal Reserve will choose inflation as their poison because it will allow their banker masters to pilage the remaining wealth of the middle class before the final collapse of the U.S. dollar.

Social distress has manifested itself over the last year in Arizona as the illegal immigration issue has turned violent, with State government and Federal government in conflict. The social welfare net is being strained through the payment of billions in unemployment compensation, food stamps, and other welfare programs. When this net breaks, all hell will break loose in the decaying urban Mecca’s. Political distress is at historic levels as the Tea Party battles liberals and its own neo-con Republican establishment. States are refusing to implement the Federally mandated Obamacare. Governors are battling teacher’s unions, firemen unions, and police unions in an effort to regain control of their out of control budgets. The 2012 elections could prove to be a tipping point for the country.

Military distress is already extreme, even before a major conflict is thrust upon the country. The two wars of choice in the Middle East have drained trillions from the treasury of a declining empire. The all volunteer military has been stretched to the breaking point. The multi-billion dollar high tech weaponry has proven useless against “terrorists” who fade into mountains until they can strike again. As revolution erupts across the Middle East, the U.S. is helpless and has no credibility, as they have propped up the thugs and dictators who are slaughtering their people. The daily intensification of volcanic eruptions across the globe is clearly evident to all but the most linear thinkers. We’ve entered the Fourth Turning and there is no turning back.

Prophecy or Destiny

“Soon after the catalyst, a national election will produce a sweeping political realignment, as one faction or coalition capitalizes on a new public demand for decisive action. Republicans, Democrats, or perhaps a new party will decisively win the long partisan tug of war. This new regime will enthrone itself for the duration of the Crisis. Regardless of its ideology, that new leadership will assert public authority and demand private sacrifice. Eventually, all of America’s lesser problems will combine into one giant problem. The very survival of the society will feel at stake, as leaders lead and people follow. The emergent society may be something better, a nation that sustains its Framers’ visions with a robust new pride. Or it may be something unspeakably worse. The Fourth Turning will be a time of glory or ruin.” – Strauss & Howe – The Fourth Turning

The election of Barack Obama in 2008 did not usher in a sweeping political realignment of the country. The actions he has taken in the last two years have maintained the status quo. The financial industry complex, military industrial complex, and big pharma complex are stronger and more powerful today than they were in 2008. The 2010 midterm elections were a decisive rejection of Obama’s policies. Those who think he will be re-elected in 2012 are not seeing the big picture. Previous Fourth Turnings have ushered in strong dominating Prophet (Boomer) leaders who used any means necessary to bring the country through the Crisis. Wishy washy politically calculating compromiser leaders do not cut it during a time of intense Crisis. The number of vulnerable Democratic Senators up for re-election in 2012 virtually insures that Republicans will control both houses of Congress in 2012. A legitimate 3rd Party candidate does not appear to be on the horizon. The onset of phase two of the economic meltdown will determine the next President of the United States.

Before the 2012 elections, I expect a violent downturn in our economic fortunes spurred by a continued fall in real estate values, generating more debt losses for the financial industry, and a loss of confidence in the U.S. fiat currency, as our foreign creditors balk at lending more money to an already insolvent empire that is incapable of taking corrective budgetary actions. The resulting economic turmoil, crashing stock market, rising interest rates, and massive unemployment will lead the nation to seek a strong, decisive, authoritative leader who will boldly lead the country through the remainder of the Crisis. Will it be Newt Gingrich, Mitt Romney, Chris Christie, or a Lincoln like figure who hasn’t even entered the national stage yet? This question is unanswerable today. But, the country will turn to someone with answers. Strauss and Howe clearly state how important the next 10 to 15 years will be:

“Decisive events will occur – events so vast, powerful, and unique that they lie beyond today’s wildest hypotheses. These events will inspire great documents and speeches, visions of a new political order being framed. People will discover a hitherto unimagined capacity to fight and die, and to let their children fight and die, for a communal cause. The Spirit of America will return, because there will be no other choice. Thus will Americans reenact the great ancient myth of the ekpyrosis. Thus will we achieve our next rendezvous with destiny.”

I’m convinced that decisive events will transpire over the next decade that will push our country to the brink. The country is on an unsustainable path and we will either crash and burn or take the actions needed to avert catastrophe. Vast powerful events on an incomprehensible scale await. Events as farfetched as a Weimar like hyperinflationary economic collapse, the detonation of a nuclear bomb in a major American city, the secession of one or more States from the Union, the collapse of our oil based economy due to peak oil and/or revolution and turmoil in the Middle East, or a worldwide pandemic, will become not only realistic, but probable. Are these events any more improbable than a 9.0 earthquake, leading to a 33 foot high tsunami wave, which triggers nuclear meltdowns at two separate nuclear power plants? If you had outlined that scenario a week ago, you would have been classified as a crazy prophet of doom.

At this point in time, it doesn’t seem possible that a communal cause could rejuvenate the Spirit of America in a manner that would lead me to be willing to fight and die or send my three sons to fight and die. An imminent threat, such as the Axis Powers during World War II, the North and South seeing each other as a threat during the Civil War, or the threat from a foreign empire during the American Revolution, does not appear evident today. The war on terror is a concept, rather than a real war. The absence of a known foreign adversary makes me think that the conflict could center on our own soil between Americans. Strauss and Howe point out that history does not offer much hope in avoiding armed conflict during this Fourth Turning:

“History offers even more sobering warnings: Armed confrontation usually occurs around the climax of Crisis. If there is confrontation, it is likely to lead to war. This could be any kind of war – class war, sectional war, war against global anarchists or terrorists, or superpower war. If there is war, it is likely to culminate in total war, fought until the losing side has been rendered nil – its will broken, territory taken, and leaders captured.”

When it comes to what kind of armed confrontation, how about all of the above? The wealth distribution of the country is more heavily skewed to the “Haves” versus the “Have Nots” than any time in history. The austerity measures that are being proposed on the backs of the middle class and senior citizens, while ultra-rich bankers have been bailed out and allowed to continue pillaging the countryside, will surely lead to class conflict. Generational warfare between the Boomers who want what they are “owed” and younger generations stuck with the bill will flare up in the coming years. The country has become so ideological that it can be easily split into Red States and Blue States. Could this ideological divide result in the country splitting into two or three independent countries? Would the Federal government use the armed forces to maintain one country? It happened before.

The war on terror concept has been in place for the last ten years and has resulted in draining the Treasury of trillions, exhausting our limited volunteer forces, and creating more terrorists than existed on September 10, 2001. The revolutions sweeping across Northern Africa and the Middle East are not cause for celebration in Washington DC. American foreign policy has centered on supporting thugs, despots, and dictators across this region with financial aid and weapons. The aid was absconded and sent to bank vaults in Switzerland. The weapons are being used to kill the poor revolutionaries across the region. Two American backed dictators have been deposed thus far, with Yemen likely to follow. Our allies in the region are falling with lightening speed. The loss of Saudi Arabia would portend dire consequences for the U.S. If the Middle East oil spigot is turned off, the American way of life will wither and die.

The myth of American Exceptionalism will not protect the country from the revolutionary tsunami that is sweeping the globe. America was not chosen by God as the country that would lead the world for eternity. The hubris and overreach of the American empire has bankrupted the nation. Greed, corruption and arrogance are not limited to North African dictatorships. Crony capitalism supporting a vast military empire, financed by a banker controlled Federal Reserve has failed. Its failure will become clear as the Fourth Turning intensifies and sweeps away the old order. Who or what replaces the old order is unknown. Much will depend on the generations and their response to the Crisis.

Bad Moon Rising

Robert Strauss and Neil Howe had no interest in trying to predict the future. As historians, they wanted to understand how the past could give clues to what would happen in the future. They discovered a pattern of behavior by generational archetypes across centuries of Anglo-American history. They identified the issues that would drive the next Fourth Turning. They predicted the timing. The accuracy of their prophecy thus far, has been uncanny. The rhythms of history continue. The outcome of this Crisis is unknowable, but there is most certainly a bad moon rising.

Thus might the next Fourth Turning end in apocalypse – or glory. The nation could be ruined, its democracy destroyed, and millions of people scattered or killed. Or America could enter a new golden age, triumphantly applying shared values to improve the human condition. The rhythms of history do not reveal the outcome of the coming Crisis; all they suggest is the timing and dimension. – Strauss & Howe – The Fourth Turning

I see the bad moon arising.

I see trouble on the way.

I see earthquakes and lightning.

I see bad times today.

Don’t go around tonight,

Well, it’s bound to take your life,

There’s a bad moon on the rise.

I hear hurricanes ablowing.

I know the end is coming soon.

I fear rivers over flowing.

I hear the voice of rage and ruin.

Hope you got your things together.

Hope you are quite prepared to die.

Looks like we’re in for nasty weather.

One eye is taken for an eye.

Credence Clearwater Revival – Bad Moon Rising