Guest Post by Francis Marion

Prologue:

Please note that food prices in the territories have always been unreasonably high due to isolation. In the early 80’s I lived for a short time near the border of Alberta and the North West Territories. A medium pizza could run you upwards of 20 bucks Canadian or more in the small community I resided in…. that was 30 years ago.

We have been through this before.

The provinces are now feeling the pinch as well with the collapsing dollar. Anything bought and paid for by retailers in US$ has seen inflation of roughly 30% in the past year and a half. This includes some domestically produced product – which when bought is ironically paid for in US$ and sold in CAD.

I have seen cauliflower here for as high as $9.00 CAD a head. A box of ammo that was $10.00 a year ago is now $13.00 to $14.00

Fuel has stayed relatively expensive even with declining oil prices. A litre of regular grade fuel will run anywhere from .85 cents CAD per litre to 1.05 CAD per litre.

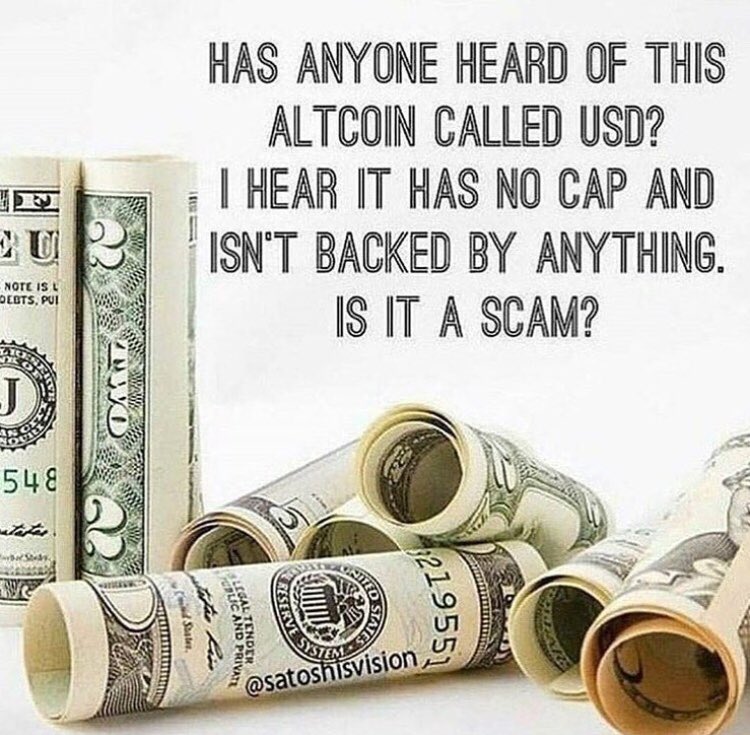

I believe this is what is eventually in store for the US $ as it slowly but surely loses it’s reserve currency status. I am not a huge believer in hyper inflation but inflation – and I would add an uncomfortable level of it – is on the horizon.

Welcome to our world.

Canadians Panic As Food Prices Soar On Collapsing Currency

Submitted by Tyler Durden on 01/13/2016 23:18 -0500

It was just yesterday when we documented the continuing slide in the loonie, which is suffering mightily in the face of oil’s inexorable decline.

As regular readers are no doubt acutely aware, Canada is struggling through a dramatic economic adjustment, especially in Alberta, the heart of the country’s oil patch. Amid the ongoing crude carnage the province has seen soaring property crime, rising food bank usage and, sadly, elevated suicide rates, as Albertans struggle to comprehend how things up north could have gone south (so to speak) so quickly.

The plunging loonie “can only serve to worsen the death of the ‘Canadian Dream'” we said on Tuesday.

As it turns out, we were right.

The currency’s decline is having a pronounced effect on Canadians’ grocery bills.

As Bloomberg reminds us, Canada imports around 80% of its fresh fruits and vegetables. When the loonie slides, prices for those goods soar. “With lower-income households tending to spend a larger portion of income on food, this side effect of a soft currency brings them the most acute stress” Bloomberg continues.

Of course with the layoffs piling up, you can expect more households to fall into the “lower-income” category where they will have to fight to afford things like $3 cucumbers, $8 cauliflower, and $15 Frosted Flakes.

As Bloomberg notes, James Price, director of Capital Markets Products at Richardson GMP, recently joked during an interview on BloombergTV Canada that “we’re going to be paying a buck a banana pretty soon.”

Have a look at the following tweets which underscore just how bad it is in Canada’s grocery aisles. And no, its not just Nunavut: it from coast to coast:

Continue reading “CANADA – THE NEW ARGENTINA”