Month: March 2015

GUESS HOW MUCH THIS DUMP SOLD FOR

Deflation, Hyperinflation, Stagflation, and Where We Are Going

Guest Post by Jesse

This is a repost of a column from four years ago almost to the day.

This is where I make the case most explicitly for the stagflation forecast I made in 2005.

Although I add one parenthetical note and some underlining for emphasis, otherwise I did not have to change a word. I could have rewritten a few things a little more smoothly but at this point why bother.

I believe that things are playing out pretty much as I had thought. The ‘top down’ approach to monetary stimulus favored by the Fed and their Banks and their politicians is fostering more inequality and slack aggregate demand while inflating select asset prices, a type of stagflation. The ‘inflation’ component of that has not yet set in yet generally, but is certainly visible to anyone who uses incidental things like healthcare and food.

I think that the same dynamic is playing out in Europe and the UK.

It will end involuntarily in a social dislocation, or by a voluntary reform. Since the oligarchs have apparently not yet been satisfied in their acquisition and looting, they believe that they can keep pushing the envelope for now.

One new area of thought for me now is how China and Russia and a few of their friends will attempt to implement a new regional currency and a global reserve currency with some inclusion or reference to gold, and perhaps silver. That they are leaning into this area is to be found in their own words and actions.

What I am struggling with is how they might do this without exposing themselves to currency manipulation and rigging, which is probably a lot easier to accept as a given now than it was in 2011, although it was certainly occurring before all these market rigging scandals broke. I don’t think a market was left untouched.

I suspect it will center around the terms for the exchange and the valuation or peg. A misstep will open them to the predations of the global hedge funds and the Banks, and the status quo centered on the Dollar.

Continue reading “Deflation, Hyperinflation, Stagflation, and Where We Are Going”

WALL STREET CHIEF ECONOMISTS

AVERAGE AMERICAN FAMILY – 1955 vs. 2015

Why The Mania Is Getting Scary – Central Bankers Are Running A Doomsday Machine

If you need evidence that we are in the midst of a lunatic financial mania, just consider this summary from a Marketwatch commentator as to why markets are ripping higher this morning:

“The dovish comments from both Fed Chairwoman Janet Yellen and People’s Bank of China Governor Zhou Xiaochuan are giving markets a big lift, and in the absence of negative data or news, I imagine this will continue to buoy the markets throughout the session,” Erlam said in emailed comments.

Yellen said gradual hikes are likely this year, but that the central bank will move cautiously……. the PBOC governor said he saw “more room” for China to ease policy if the economy stays soft and inflation continues to weaken.

Its just that frightfully simple. If any of the major central banks anywhere on the planet ease or even hint they might, the robo machines and day traders unleash an avalanche of buy orders and the stock averages jerk higher.

Indeed, Zero Hedge captured the motion succinctly this AM. In keeping with Bernanke’s inaugural blog revelation that 98% of monetary policy consists of “open mouth” operations, the markets leapt upwards on cue. That is, if central banker jaws are flapping, then buy!

What this means is that this third immense financial bubble of the current century will keep inflating until central bankers stop banging the “stimulus” lever or the bubble finally crashes under its own weight. The latter will surely happen, eventually—- and the potential carnage can be readily approximated.

Continue reading “Why The Mania Is Getting Scary – Central Bankers Are Running A Doomsday Machine”

Four “Too Big to Fail/Jail” Banks Threaten to Hold Back Funds to Democrats Over Elizabeth Warren

Guest Post by

Having already proven that their institutions are above the law in the aftermath of the financial crisis, executives at the “Too Big to Fail and Jail” banks have decided it’s time to teach Senate Democrats a lesson. Not being content with trillions in taxpayer backed bailouts to protect and further consolidate virtually all wealth within their oligarch fiefdoms, these bankers are irate at the notion that a commoner would dare criticize their unassailable crony privilege.

However, the worst part of this story, is that while Warren is harsher than most of her completely bought and paid for colleagues, she is still pretty meek when it comes to the big bank oligopoly. In her most misguided position, she doesn’t even support an audit of the largest organized crime institution operating within these United States, the Federal Reserve. Oh and for those of you who will claim the Fed is already audited, think again. Read: The Fed Impedes GAO Audits by Destroying Source Documents.

Thus it seems even Warren’s meager push for reform is simply too much for the thin skinned bailout baby banks to handle. From The Hill:

Four major banks are threatening to withhold campaign donations to Senate Democrats in anger over Sen. Elizabeth Warren’s (D-Mass.) attacks on Wall Street.

Representatives from financial powerhouses Citigroup, JPMorgan, Goldman Sachs and Bank of America recently met in Washington and discussed the growing hostility towards big business within the Democratic ranks, according to a Reuters report Friday.

Bank officials cited Warren and Senate Banking Committee ranking member Sherrod Brown (Ohio) as the two main lawmakers leading the charge against them. But the banks have not agreed on how to respond together, with each firm making its own decision on donations, Reuters reported.

Thoughts from the Frontline: Living in a Free-Lunch World

Thoughts from the Frontline: Living in a Free-Lunch World

By John Mauldin

“Everyone is a prisoner of his own experiences. No one can eliminate prejudices – just recognize them.”

– Edward R. Murrow, US broadcast journalist & newscaster (1908 – 1965), television broadcast, December 31, 1955

“High debt levels, whether in the public or private sector, have historically placed a drag on growth and raised the risk of financial crises that spark deep economic recessions.”

– The McKinsey Institute, “Debt and (not much) Deleveraging”

The world has been on a debt binge, increasing total global debt more in the last seven years following the financial crisis than in the remarkable global boom of the previous seven years (2000-2007)! This explosion of debt has occurred in all 22 “advanced” economies, often increasing the debt level by more than 50% of GDP. Consumer debt has increased in all but four countries: the US, the UK, Spain, and Ireland (what these four have in common: housing bubbles). Alarmingly, China’s debt has quadrupled since 2007. The recent report from the McKinsey Institute, cited above, says that six countries have reached levels of unsustainable debt that will require nonconventional methods to reduce it (methods otherwise known as defaulting, monetization; whatever you want to call those measures, they amount to real pain for the debtors, who are in many cases those least able to bear that pain). It’s not just Greece anymore. Quoting from the report:

Seven years after the bursting of a global credit bubble resulted in the worst financial crisis since the Great Depression, debt continues to grow. In fact, rather than reducing indebtedness, or deleveraging, all major economies today have higher levels of borrowing relative to GDP than they did in 2007. Global debt in these years has grown by $57 trillion, raising the ratio of debt to GDP by 17 percentage points (see chart below). That poses new risks to financial stability and may undermine global economic growth.

This report was underscored by a rather alarming, academically oriented paper from the Bank for International Settlements (BIS), “Global dollar credit: links to US monetary policy and leverage.” Long story short, emerging markets have borrowed $9 trillion in dollar-denominated debt, up from $2 trillion a mere 14 years ago. Ambrose Evans-Pritchard did an excellent and thoroughly readable review of the paper a few weeks ago for the Telegraph, summing up its import:

Continue reading “Thoughts from the Frontline: Living in a Free-Lunch World”

Will Gold Win Out Against the US Dollar?

Will Gold Win Out Against the US Dollar?

By Louis James

It is an essential impossibility to solve problems created by excess debt and artificial liquidity with more of the same. That’s our credo here at Casey Research, and the reason why we believe the gold price will turn around and not only go higher, but much, much higher.

While fellow investors around the world may not agree with gold-loving contrarians like us, they are buyers: gold is up in euros and almost everything else, except the dollar.

The dollar’s rise has been strong and seems all but unstoppable. But look at it in big-picture terms, as in the chart below, and ask yourself how sustainable the situation is.

I’m skeptical of reading too much into such charts. A peak like the one in the early 1980s would certainly take the USD much higher, and for several years to come. But still, this is an aberration. It’s not the new normal, but rather the new abnormal.

How The Fed Has Failed The Nation (In One Chart)

Submitted by Charles Hugh-Smith of OfTwoMinds blog,

There is only one way to end the financial tyranny of the Federal Reserve – abolish it, and put an end to the predatory pathologies of its policies.

Stand Up for Indiana!

Guest Post by Patrick J. Buchanan

In what has been called the “Catholic moment” in America, in the late 1940s and 1950s, Catholics were admonished from pulpits to “live the faith” and “set an example” for others.

Public lives were to reflect moral beliefs. Christians were to avoid those “living in sin.” Christians who operated motels and hotels did not rent rooms to unmarried couples.

Fast forward to 21st-century America.

Indiana just enacted a law, as have 19 other states, to protect the rights of religious people to practice their beliefs in how they live their lives and conduct their businesses.

And the reaction? Nearly hysterical.

The head of the NCAA, the founder of Apple, chief executives of SalesForce and Yelp, Martina Navratilova, Larry King, Miley Cyrus and other celebrities are rushing to express their shock.

Boycotts of Indiana are being demanded. Tweeted Hillary on her now-empty server: “Sad this new Indiana law can happen in America today. We shouldn’t discriminate against [people because] of who they love.”

The culture war has come to Indiana, and all these folks are eager to be seen as standing tall with the LGBT revolution. But what are they actually saying?

Are they saying that Christian bakers, photographers and florists may not refuse to provide their services at same-sex weddings? Are they saying that hotel owners who deny rooms to unmarried couples or for homosexual liaisons should be prosecuted for being faithful to their moral code?

How are we supposed to punish Christians for sinning against liberalism? Will jailing be necessary, or caning, or just depriving them of their livelihood?

FREEDOM*

FIRST RESPONDERS

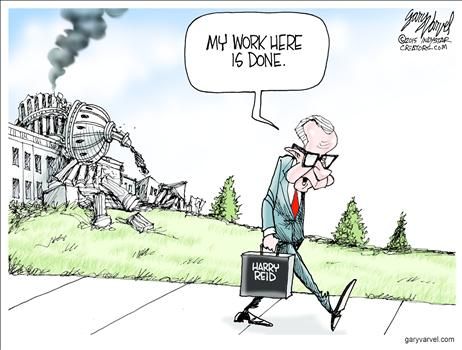

SOMETHING ABOUT HARRY

License to Kill

Guest Post by Dmitry Orlov

|

| Jakub Rozalski |

The story is the same every time: some nation, due to a confluence of lucky circumstances, becomes powerful—much more powerful than the rest—and, for a time, is dominant. But the lucky circumstances, which often amount to no more than a few advantageous quirks of geology, be it Welsh coal or West Texas oil, in due course come to an end. In the meantime, the erstwhile superpower becomes corrupted by its own power.

As the endgame approaches, those still nominally in charge of the collapsing empire resort to all sorts of desperate measures—all except one: they will refuse to ever consider the fact that their imperial superpower is at an end, and that they should change their ways accordingly. George Orwell once offered an excellent explanation for this phenomenon: as the imperial end-game approaches, it becomes a matter of imperial self-preservation to breed a special-purpose ruling class—one that is incapable of understanding that the end-game is approaching. Because, you see, if they had an inkling of what’s going on, they wouldn’t take their jobs seriously enough to keep the game going for as long as possible.

The approaching imperial collapse can be seen in the ever worsening results the empire gets for its imperial efforts. After World War II, the US was able to do a respectable job helping to rebuild Germany, along with the rest of western Europe. Japan also did rather well under US tutelage, as did South Korea after the end of fighting on the Korean peninsula. With Vietnam, Laos and Cambodia, all of which were badly damaged by the US, the results were significantly worse: Vietnam was an outright defeat, Cambodia lived through a period of genocide, while amazingly resilient Laos—the most heavily bombed country on the planet—recovered on its own.

QUOTES OF THE DAY

You say we [reporters] are distracting from the business of government. Well, I hope so. Distracting a politician from governing is like distracting a bear from eating your baby.

P. J. O’Rourke

No drug, not even alcohol, causes the fundamental ills of society. If we’re looking for the sources of our troubles, we shouldn’t test people for drugs, we should test them for stupidity, ignorance, greed, and love of power.

P. J. O’Rourke

Giving government money and power is like giving car keys and whiskey to a teenage boy

P.J. O’Rourke

If you think health care is expensive now, wait until you see what it costs when it’s free.

P.J. O’Rourke

The Democrats are the party that says government will make you smarter, taller, richer, and remove the crabgrass on your lawn. The Republicans are the party that says government doesn’t work and then they get elected and prove it.

P.J. O’Rourke

In comparative terms, there’s no poverty in America by a long shot. Heritage Foundation political scientist Robert Rector has worked up figures showing that when the official U.S. measure of poverty was developed in 1963, a poor American family had an income twenty-nine times greater than the average per capita income in the rest of the world. An individual American could make more money than 93 percent of the other people on the planet and still be considered poor.

P.J. O’Rourke

When buying and selling are controlled by legislation, the first things to be bought and sold are legislators.

P.J. O’Rourke

The founding fathers, in their wisdom, devised a method by which our republic can take one hundred of its most prominent numbskulls and keep them out of the private sector where they might do actual harm.

P.J. O’Rourke

Politics should be limited in scope to war, protection of property, and the occasional precautionary beheading of a member of the ruling class.

P.J. O’Rourke

The whole idea of our government is this: If enough people get together and act in concert, they can take something and not pay for it.

P.J. O’Rourke