Guest Post by The Zman

Way back in the olden thymes, “the media” was the local newspaper, news radio and the evening news on the television. My father would read the paper every evening after dinner, while my mother would watch the evening news. Once in a while my mother would put on the radio and listen to the news channel, but that was rare. If the people in charge wanted to get the attention of the peasants, they had to do it in those small windows when people paid any attention to the news.

We live in a different age, but it is a very new age. We are saturated with media. Young people have no frame of reference so they just assume it has always been thus, but our modern mass media culture is one of those rare things that is truly new. It really was not so long ago when it was easy to be entirely uninformed about the world. It took great effort to be well informed. That’s not to say we are all worldly cosmopolitans, but the world is literally at our fingertips. More important, media is everywhere and it hard to escape it.

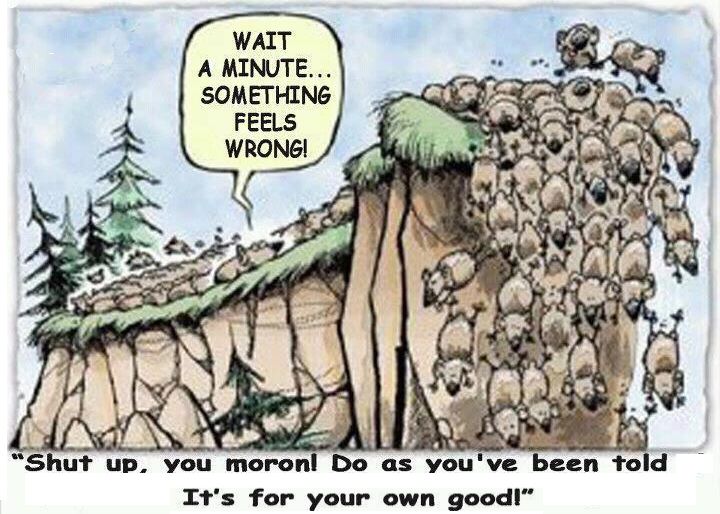

This newness means that the people in charge have struggled to put it to their uses. Buying off a few newspaper publishers was easy. Controlling the three TV networks required hardly any effort at all. A free wheeling mass media with millions of bloggers, podcasters and small outlets is a different task. Rounding up the farm’s bull is a hard job, but rounding up all the barn cats is actually much tougher. The former can get you killed, but the latter has a maddening number of variables.