Is it just me, or are the signs of consumer collapse as clear as a Lowes parking lot on a Saturday afternoon? Sometimes I wonder if I’m just seeing the world through my pessimistic lens, skewing my point of view. My daily commute through West Philadelphia is not very enlightening, as the squalor, filth and lack of legal commerce remain consistent from year to year. This community is sustained by taxpayer subsidized low income housing, taxpayer subsidized food stamps, welfare payments, and illegal drug dealing. The dependency attitude, lifestyles of slothfulness and total lack of commerce has remained constant for decades in West Philly. It is on the weekends, cruising around a once thriving suburbia, where you perceive the persistent deterioration and decay of our debt fixated consumer spending based society.

The last two weekends I’ve needed to travel the highways of Montgomery County, PA going to a family party and purchasing a garbage disposal for my sink at my local Lowes store. Montgomery County is the typical white upper middle class suburb, with tracts of McMansions dotting the landscape. The population of 800,000 is spread over a 500 square mile area. Over 81% of the population is white, with the 9% black population confined to the urban enclaves of Norristown and Pottstown.

The median age is 38 and the median household income is $75,000, 50% above the national average. The employers are well diversified with an even distribution between education, health care, manufacturing, retail, professional services, finance and real estate. The median home price is $300,000, also 50% above the national average. The county leans Democrat, with Obama winning 60% of the vote in 2008. The 300,000 households were occupied by college educated white collar professionals. From a strictly demographic standpoint, Montgomery County appears to be a prosperous flourishing community where the residents are living lives of relative affluence. But, if you look closer and connect the dots, you see fissures in this façade of affluence that spread more expansively by the day. The cheap oil based, automobile dependent, mall centric, suburban sprawl, sanctuary of consumerism lifestyle is showing distinct signs of erosion. The clues are there for all to see and portend a bleak future for those mentally trapped in the delusions of a debt dependent suburban oasis of retail outlets, chain restaurants, office parks and enclaves of cookie cutter McMansions. An unsustainable paradigm can’t be sustained.

The first weekend had me driving along Ridge Pike, from Collegeville to Pottstown. Ridge Pike is a meandering two lane road that extends from Philadelphia, winds through Conshohocken, Plymouth Meeting, Norristown, past Ursinus College in Collegeville, to the farthest reaches of Montgomery County, at least 50 miles in length. It served as a main artery prior to the introduction of the interstates and superhighways that now connect the larger cities in eastern PA. Except for morning and evening rush hours, this road is fairly sedate. Like many primary routes in suburbia, the landscape is engulfed by strip malls, gas stations, automobile dealerships, office buildings, fast food joints, once thriving manufacturing facilities sitting vacant and older homes that preceded the proliferation of cookie cutter communities that now dominate what was once farmland.

Telltale Signs

I should probably be keeping my eyes on the road, but I can’t help but notice the telltale signs of an economic system gone haywire. As you drive along, the number of For Sale signs in front of homes stands out. When you consider how bad the housing market has been, the 40% decline in national home prices since 2007, the 30% of home dwellers underwater on their mortgage, and declining household income, you realize how desperate a home seller must be to try and unload a home in this market. The reality of the number of For Sale signs does not match the rhetoric coming from the NAR, government mouthpieces, CNBC pundits, and other housing recovery shills about record low inventory and home price increases.

The Federal Reserve/Wall Street/U.S. Treasury charade of foreclosure delaying tactics and selling thousands of properties in bulk to their crony capitalist buddies at a discount is designed to misinform the public. My local paper lists foreclosures in the community every Monday morning. In 2009 it would extend for four full pages. Today, it still extends four full pages. The fact that Wall Street bankers have criminally forged mortgage documents, people are living in houses for two years without making mortgage payments, and the Federal Government backing 97% of all mortgages while encouraging 3.5% down financing does not constitute a true housing recovery. Show me the housing recovery in these charts.

Existing home sales are at 1998 levels, with 45 million more people living in the country today.

New single family homes under construction are below levels in 1969, when there were 112 million less people in the country.

Another observation that can be made as you cruise through this suburban mecca of malaise is the overall decay of the infrastructure, appearances and disinterest or inability to maintain properties. The roadways are potholed with fading traffic lines, utility poles leaning and rotting, and signage corroding and antiquated. Houses are missing roof tiles, siding is cracked, gutters astray, porches sagging, windows cracked, a paint brush hasn’t been utilized in decades, and yards are inundated with debris and weeds. Not every house looks this way, but far more than you would think when viewing the overall demographics for Montgomery County. You wonder how many number among the 10 million vacant houses in the country today. The number of dilapidated run down properties paints a picture of the silent, barely perceptible Depression that grips the country today. With such little sense of community in the suburbs, most people don’t even know their neighbors. With the electronic transfer of food stamps, unemployment compensation, and other welfare benefits you would never know that your neighbor is unemployed and hasn’t made the mortgage payment on his house in 30 months. The corporate fascist ruling plutocracy uses their propaganda mouthpieces in the mainstream corporate media and government agency drones to misinform and obscure the truth, but the data and anecdotal observational evidence reveal the true nature of our societal implosion.

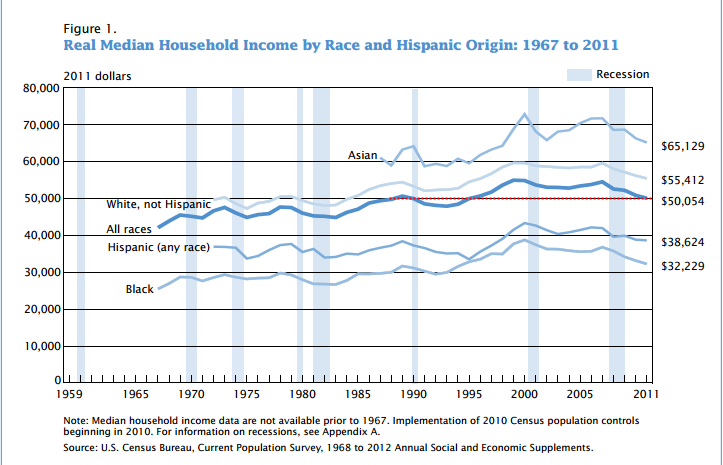

A report by the Census Bureau this past week inadvertently reveals data that confirms my observations on the roadways of my suburban existence. Annual household income fell in 2011 for the fourth straight year, to an inflation-adjusted $50,054. The median income — meaning half earned more, half less — now stands 8.9% lower than the all-time peak of $54,932 in 1999. It is far worse than even that dreadful result. Real median household income is lower than it was in 1989. When you understand that real household income hasn’t risen in 23 years, you can connect the dots with the decay and deterioration of properties in suburbia. A vast swath of Americans cannot afford to maintain their residences. If the choice is feeding your kids and keeping the heat on versus repairing the porch, replacing the windows or getting a new roof, the only option is survival.

All races have seen their income fall, with educational achievement reflected in the much higher incomes of Whites and Asians. It is interesting to note that after a 45 year War on Poverty the median household income for black families is only up 19% since 1968.

Now for the really bad news. Any critical thinking person should realize the Federal Government has been systematically under-reporting inflation since the early 1980’s in an effort to obscure the fact they are debasing the currency and methodically destroying the lives of middle class Americans. If inflation was calculated exactly as it was in 1980, the GDP figures would be substantially lower and inflation would be reported 5% higher than it is today. Faking the numbers does not change reality, only the perception of reality. Calculating real median household income with the true level of inflation exposes the true picture for middle class America. Real median household income is lower than it was in 1970, just prior to Nixon closing the gold window and unleashing the full fury of a Federal Reserve able to print fiat currency and politicians to promise the earth, moon and the sun to voters. With incomes not rising over the last four decades is it any wonder many of our 115 million households slowly rot and decay from within like an old diseased oak tree. The slightest gust of wind can lead to disaster.

Eliminating the last remnants of fiscal discipline on bankers and politicians in 1971 accomplished the desired result of enriching the top 0.1% while leaving the bottom 90% in debt and desolation. The Wall Street debt peddlers, Military Industrial arms dealers, and job destroying corporate goliaths have reaped the benefits of financialization (money printing) while shoveling the costs, their gambling losses, trillions of consumer debt, and relentless inflation upon the working tax paying middle class. The creation of the Federal Reserve and implementation of the individual income tax in 1913, along with leaving the gold standard has rewarded the cabal of private banking interests who have captured our economic and political systems with obscene levels of wealth, while senior citizens are left with no interest earnings ($400 billion per year has been absconded from savers and doled out to bankers since 2008 by Ben Bernanke) and the middle class has gone decades seeing their earnings stagnate and their purchasing power fall precipitously.

The facts exposed in the chart above didn’t happen by accident. The system has been rigged by those in power to enrich them, while impoverishing the masses. When you gain control over the issuance of currency, issuance of debt, tax system, political system and legal apparatus, you’ve essentially hijacked the country and can funnel all the benefits to yourself and costs to the math challenged, government educated, brainwashed dupes, known as the masses. But there is a problem for the 0.1%. Their sociopathic personalities never allow them to stop plundering and preying upon the sheep. They have left nothing but carcasses of the once proud hard working middle class across the country side. There are only so many Lear jets, estates in the Hamptons, Jaguars, and Rolexes the 0.1% can buy. There are only 152,000 of them. Their sociopathic looting and pillaging of the national wealth has destroyed the host. When 90% of the population can barely subsist, collapse and revolution beckon.

Extend, Pretend & Depend

As I drove further along Ridge Pike we passed the endless monuments to our spiral into the depths of materialism, consumerism, and the illusion that goods purchased on credit represented true wealth. Mile after mile of strip malls, restaurants, gas stations, and office buildings rolled by my window. Anyone who lives in the suburbs knows what I’m talking about. You can’t travel three miles in any direction without passing a Dunkin Donuts, KFC, McDonalds, Subway, 7-11, Dairy Queen, Supercuts, Jiffy Lube or Exxon Station. The proliferation of office parks to accommodate the millions of paper pushers that make our service economy hum has been unprecedented in human history. Never have so many done so little in so many places. Everyone knows what a standard American strip mall consists of – a pizza place, a Chinese takeout, beer store, a tanning, salon, a weight loss center, a nail salon, a Curves, karate studio, Gamestop, Radioshack, Dollar Store, H&R Block, and a debt counseling service. They are a reflection of who we’ve become – an obese drunken species with excessive narcissistic tendencies that prefers to play video games while texting on our iGadgets as our debt financed lifestyles ultimately require professional financial assistance.

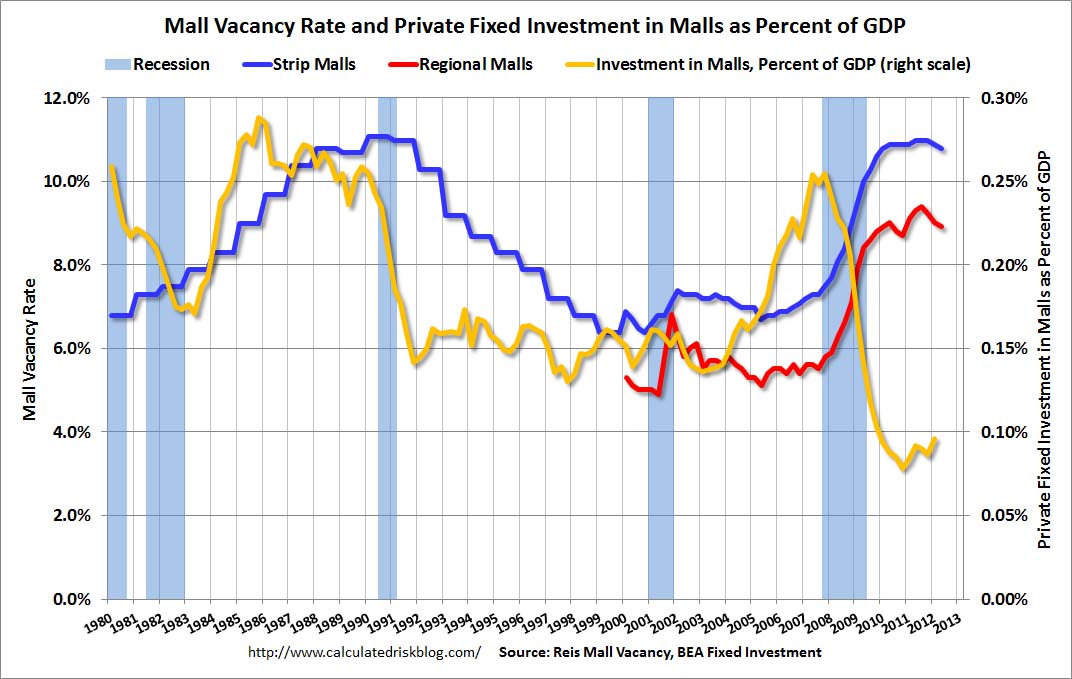

What you can’t ignore today is the number of vacant storefronts in these strip malls and the overwhelming number of SPACE AVAILABLE, FOR LEASE, and FOR RENT signs that proliferate in front of these dying testaments to an unsustainable economic system based upon debt fueled consumer spending and infinite growth assumptions. The booming sign manufacturer is surely based in China. The officially reported national vacancy rates of 11% are already at record highs, but anyone with two eyes knows these self-reported numbers are a fraud. Vacancy rates based on my observations are closer to 30%. This is part of the extend and pretend strategy that has been implemented by Ben Bernanke, Tim Geithner, the FASB, and the Wall Street banking cabal. The fraud and false storyline of a commercial real estate recovery is evident to anyone willing to think critically. The incriminating data is provided by the Federal Reserve in their Quarterly Delinquency Report.

The last commercial real estate crisis occurred in 1991. Mall vacancy rates were at levels consistent with today.

The current reported office vacancy rates of 17.5% are only slightly below the 19% levels of 1991.

As reported by the Federal Reserve, delinquency rates on commercial real estate loans in 1991 were 12%, leading to major losses among the banks that made those imprudent loans. Amazingly, after the greatest financial collapse in history, delinquency rates on commercial loans supposedly peaked at 8.8% in the 2nd quarter of 2010 and have now miraculously plummeted to pre-collapse levels of 4.9%. This is while residential loan delinquencies have resumed their upward trajectory, the number of employed Americans has fallen by 414,000 in the last two months, 9 million Americans have left the labor force since 2008, and vacancy rates are at or near all-time highs. This doesn’t pass the smell test. The Federal Reserve, owned and controlled by the Wall Street, instructed these banks to extend all commercial real estate loans, pretend they will be paid, and value them on their books at 100% of the original loan amount. Real estate developers pretend they are collecting rent from non-existent tenants, Wall Street banks pretend they are being paid by the developers, and their highly compensated public accounting firm pretends the loans aren’t really delinquent. Again, the purpose of this scam is to shield the Wall Street bankers from accepting the losses from their reckless behavior. Ben rewards them with risk free income on their deposits, propped up by mark to fantasy accounting, while they reward themselves with billions in bonuses for a job well done. The master plan requires an eventual real recovery that isn’t going to happen. Press releases and fake data do not change the reality on the ground.

I have two strip malls within three miles of my house that opened in 1990. When I moved to the area in 1995, they were 100% occupied and a vital part of the community. The closest center has since lost its Genuardi grocery store, Sears Hardware, Blockbuster, Donatos, Sears Optical, Hollywood Tans, hair salon, pizza pub and a local book store. It is essentially a ghost mall, with two banks, a couple chain restaurants and empty parking spaces. The other strip mall lost its grocery store anchor and sporting goods store. This has happened in an outwardly prosperous community. The reality is the apparent prosperity is a sham. The entire tottering edifice of housing, autos, and retail has been sustained by ever increasing levels of debt for the last thirty years and the American consumer has hit the wall. From 1950 through the early 1980s, when the working middle class saw their standard of living rise, personal consumption expenditures accounted for between 60% and 65% of GDP. Over the last thirty years consumption has relentlessly grown as a percentage of GDP to its current level of 71%, higher than before the 2008 collapse.

If the consumption had been driven by wage increases, then this trend would not have been a problem. But, we already know real median household income is lower than it was in 1970. The thirty years of delusion were financed with debt – peddled, hawked, marketed, and pushed by the drug dealers on Wall Street. The American people got hooked on debt and still have not kicked the habit. The decline in household debt since 2008 is solely due to the Wall Street banks writing off $800 billion of mortgage, credit card, and auto loan debt and transferring the cost to the already drowning American taxpayer.

The powers that be are desperately attempting to keep this unsustainable, dysfunctional debt choked scheme from disintegrating by doling out more subprime auto debt, subprime student loan debt, low down payment mortgages, and good old credit card debt. It won’t work. The consumer is tapped out. Last week’s horrific retail sales report for August confirmed this fact. Declining household income and rising costs for energy, food, clothing, tuition, taxes, health insurance, and the other things needed to survive in the real world, have broken the spirit of Middle America. The protracted implosion of our consumer society has only just begun. There are thousands of retail outlets to be closed, hundreds of thousands of jobs to be eliminated, thousands of malls to be demolished, and billions of loan losses to be incurred by the criminal Wall Street banks.

The Faces of Failure & Futility

My fourteen years working in key positions for big box retailer IKEA has made me particularly observant of the hubris and foolishness of the big chain stores that dominate the retail landscape. There are 1.1 million retail establishments in the United States, but the top 25 mega-store national chains account for 25% of all the retail sales in the country. The top 100 retailers operate 243,000 stores and account for approximately $1.6 trillion in sales, or 36% of all the retail sales in the country. Their misconceived strategic plans assumed 5% same store growth for eternity, economic growth of 3% per year for eternity, a rising market share, and ignorance of the possible plans of their competitors. They believed they could saturate a market without over cannibalizing their existing stores. Wal-Mart, Target, Best Buy, Home Depot and Lowes have all hit the limits of profitable expansion. Each incremental store in a market results in lower profits.

My trip to my local Lowes last weekend gave me a glimpse into a future of failure and futility. Until 2009, I had four choices of Lowes within 15 miles of my house. There was a store 8 miles east, 12 miles west, 15 miles north, and 15 miles south of my house. In an act of supreme hubris, Lowes opened a store smack in the middle of these four stores, four miles from my house. The Hatfield store opened in early 2009 and I wrote an article detailing how Lowes was about to ruin their profitability in Montgomery County. It just so happens that I meet a couple of my old real estate buddies from IKEA at a local pub every few months. In 2009 one of them had a real estate position with Lowes and we had a spirited discussion about the prospects for the Lowes Hatfield store. He assured me it would be a huge success. I insisted it would be a dud and would crush the profitability of the market by cannibalizing the other four stores. We met at that same pub a few months ago. Lowes had laid him off and he admitted to me the Hatfield store was a disaster.

I pulled into the Lowes parking lot at 11:30 am on a Saturday. Big Box retailers do 50% of their business on the weekend. The busiest time frame is from 11:00 am to 2:00 pm on Saturday. Big box retailers build enough parking spots to handle this peak period. The 120,000 square feet Hatfield Lowes has approximately 1,000 parking spaces. I pulled into the spot closest to the entrance during their supposed peak period. There were about 70 cars in the parking lot, with most probably owned by Lowes workers. It is a pleasure to shop in this store, with wide open aisles, and an employee to customer ratio of four to one. The store has 14 checkout lanes and at peak period on a Saturday, there was ONE checkout lane open, with no lines. This is a corporate profit disaster in the making, but the human tragedy far overrides the declining profits of this mega-retailer.

As you walk around this museum of tools and toilets you notice the looks on the faces of the workers. These aren’t the tattooed, face pierced freaks you find in many retail establishments these days. They are my neighbors. They are the beaten down middle class. They are the middle aged professionals who got cast aside by the mega-corporations in the name of efficiency, outsourcing, right sizing, stock buybacks, and executive stock options. The irony of this situation is lost on those who have gutted the American middle class. When you look into the eyes of these people, you see sadness, confusion and embarrassment. They know they can do more. They want to do more. They know they’ve been screwed, but they aren’t sure who to blame. They were once the very customers propelling Lowes’ growth, buying new kitchens, appliances, and power tools. Now they can’t afford a can of paint on their $10 per hour, no benefit retail careers. As depressing as this portrait appears, it is about to get worse.

This Lowes will be shut down and boarded up within the next two years. The parking lot will become a weed infested eyesore occupied by 14 year old skateboarders. One hundred and fifty already down on their luck neighbors will lose their jobs, the township will have a gaping hole in their tax revenue, and the CEO of Lowes will receive a $50 million bonus for his foresight in announcing the closing of 100 stores that he had opened five years before. This exact scenario will play out across suburbia, as our unsustainable system comes undone. Our future path will parallel the course of the labor participation rate. Just as the 9 million Americans who have “left” the labor force since 2008 did not willfully make that choice, the debt burdened American consumer will be dragged kicking and screaming into the new reality of a dramatically reduced standard of living.

.png)

Connecting the dots between my anecdotal observations of suburbia and a critical review of the true non-manipulated data bestows me with a not optimistic outlook for the coming decade. Is what I’m seeing just the view of a pessimist, or are you seeing the same thing?

A few powerful men have hijacked our economic, financial and political structure. They aren’t socialists or capitalists. They’re criminals. They created the culture of materialism, greed and debt, sustained by prodigious levels of media propaganda. Our culture has been led to believe that debt financed consumption over morality and justice is the path to success. In reality, we’ve condemned ourselves to a slow painful death spiral of debasement and despair.

“A culture that does not grasp the vital interplay between morality and power, which mistakes management techniques for wisdom, and fails to understand that the measure of a civilization is its compassion, not its speed or ability to consume, condemns itself to death.” – Chris Hedges

Admin check out this article you might want to post.

http://westernrifleshooters.blogspot.com/2010/07/bracken-cw2-cube-mapping-meta-terrain.html

Admin, what you’re seeing in fly over country has always been the case. West Virginia still looks like West Virginia. There’s no question there’s a middle class crisis. While a few boomers may have saved enough for retirement by striking it rich, SS hit the red this year, Medicare costs are sky rocketing, and Helicopter Ben has lifted off to save the banks.

The 1%, in the meantime, continue to do quite well, as does the government sector, at least until declining revenues related to unemployment and declining sales catches up by the end of this fiscal year. They’re already behind in collections in my state. The feds, on the other hand, can borrow and spend until they can’t. They will be the last to wake up to the unmitigated disaster waiting to unfold on the American people.

On the other hand, it still doesn’t hurt to be the international heavy weight in a global currency war. It sucks to get caught in the middle or the losing end. Since we will end up with 100% of GDP attributed to public sector spending, the feds need to get busy printing SNAP cards and hiring TSA employees.

It’s only a shame the big box chains drove out all the mom and pop businesses. At least the landscape would have been a bit more interesting.

This well-written article reads like a modern-day John Steinbeck novel. It’s been 73 years since The Grapes of Wrath was written and this article accurately demonstrates the plight of today’s Tom Joad. While technology may be linear, civilization is cyclical.

2005

[img [/img]

[/img]

2012

[img [/img]

[/img]

Towamencin Village Shopping Center

11 Spaces Available

[img]http://looplink.metrocommercial.com/xnet/mainsite/HttpHandlers/attachment/ServeAttachment.ashx?FileGuid=A7DA73C3-B6BF-4A06-988A-1AD8AE60EBFC&Extension=jpg&Width=0&Height=0&PadImage=True&DisableVisualWatermark=OToyOTo0NiBQTXxBN0RBNzNDMy1CNkJGLTRBMDYtOTg4QS0xQUQ4QUU2MEVCRkM%3D&ClipImage=False&ExactDim=-1&UseThumbnailAsOriginal=False[/img]

I’m currently visiting the SF bay area. Even with the excessive regulation and taxation here in the late great state of californica the Lowes and Home Depots are doing well, judging by the packed parking lots. But then you see the masses of Mexican green card holders (or not) trying to wave down a $5 hourly wage (or less) as you exit the parking lot and it makes you wonder how real the facade really is. It might be that the more affluent areas will be the last to be hit; the cancer working it’s way in from the outskirts, slowly metastasizing as it goes.

We sure are seeing the effects of communism spreading across the face of America. Franklin Roosevelt sure didn’t do this country any favors about preserving the intent of our forefathers. To understand what is happening today one may want to read the book, “The Iron Curtain Over America” By John Beaty, Wilkinson Publishing Company 1952.

Texas is doing fairly well, not as many empty store fronts as before.

I went to the 60 year anniversary of the local Catepillar dealer here in Houston this weekend. It was a big deal and the CEO of Catepillar came down from Illinois to speak. His name is Bob O-something, a real nice guy, very approachable.

There was a great video of this dealership from its earliest days to the present, detailing all the projects, roads and buildings built with Cat machines. Basically, every single structure in Houston, Texas, used this company’s products in their construction. This dealership was started by 4 guys who got the capital together, a few bank loans and then developed their business. Granted they started before HIPPA, OSHA, Obamacare, the EPA, blah blah, but they have been able to negotiate all these changes and still be successful.

Hell, yes, WE BUILT THAT, I thought as I stood there.

The CEO’s speech was very interesting. He acknowledged the difficulties of 2008 and was very frank about the upcoming “storm” he saw on the horizon. Cat has moved 3 huge factories to Texas and I got the real impression that the HQ was next.

I don’t know where I’m going with this, other than to say, that this event reminded me of how great things have been done in American in the past , how the parasites are trying to destroy it with their million stupid regs, and how pitiful our industrial might has become in the meantime.

“a reflection of who we’ve become – an obese drunken species with excessive narcissistic tendencies that prefers to play video games while texting on our iGadgets as our debt financed lifestyles ultimately require professional financial assistance.”

The best sentence in the whole piece. Human beings have been reduced to the equivalent of cattle or sheep; their only job in life is to consume, no, over-consume as much as possible, get as fat as possible, get in debt as much as possible, indulge in pride (narcissism), and be as lazy as possible. Boobus Americanus doesn’t deserve to be saved, they should be harvested and slaughtered, and they will be.

I’ve been seeing it for over a decade now. Amazingly, it seems to keep growing worse, even after you believe that the worse has had to already happened.

Empty stores, empty homes, empty parking lots.

I have, and continue to, ask myself…

Where have these people moved too? Is anyone tracking elementary enrollments to see where the families are going?

Where are these people working? How are they still paying for their lives?

Empty parking lots just remind me that when I look around and see any sign of life, it is increasing nothing more than proof of state employment and additional consumer debt.

Michigan is the same as it has been ever since free federal $$$$ started pouring in, those connected to the stream are doing pretty well (while crying like bitches if anyone tries to show them math and pull back their free shit), those that aren’t are slowly, but surely, fading away.

When I used to hear about the demise of the middle class, I thought, no way(!) would “we” allow it to happen. What I didn’t realize is that it wouldn’t come with a fury and a bang, but that we would just slowly fade away and disappear without even a eulogy.

Except here, and a couple other places, Mr. Quinn is writing the eulogy one enlightened article at a time.

Happy Monday all.

Centrlal Texas is the temporary beneficiary of shifting demographics as people from areas like yours and many others like it move here in pursuit of jobs and lower taxes. In the long run climate change and water shortages may reverse that trend, but for the moment things look far better here than what you’re describing.

I have not been off the mountain for a year, I think I would be even more surprised than I was last year with the lack of retail activity….

survivingsurvivalism.com

I know the feeling. I walk into Home Depot or Lowes and see more employees than customers. I tell my wife, “this ain’t gonna last long”. I also noted who the employee’s were. Like you said, guys I used to work with. Its not just Home Depot and Lowes though, a lot of places I go I see middle aged people that are obviously working a job they are over qualified for. My take is that the biggest bubble of all time, the oil bubble, is starting to collapse. Its not the sole reason why, but it will become more dominant as we move forward. All the jobs they were created because of the cheap energy are now starting to become irrelevant. And then we will see the downside of the exponential function. That ain’t going to be pretty.

The other consideration here has to do with the following facts:

55,000 manufacturing facilities have closed in the U.S.

8,000,000 jobs have been shipped overseas

We’ve had 15 years or more of $500,000,000,000 trade deficits, and so have shipped $8 trillion dollars out of the country.

WTF did you think was going to happen? A long, slow economic contraction now leading to depression for tens of millions. The signs are everywhere, 50% of the population getting money from the government, SNAP, more people getting on disability than getting jobs.

Our economy has been gutted, the guts cut out, so the 1% could get even richer. We’re going to be lackeys to our owners, debt serfs. Every idiot bought the “service economy” storyline 25 years ago, and even that is drying up.

Oh, and notice on the graph, Asians have a median income almost $10k higher than whites. Considering that’s where most of our money and jobs went, it’s not surprising. Asians have beat us. Just look around, the products, Wal Mart, Dollar stores, the cars, the only stores left open sell 90% Chinese crap.

Well written article. The only class prospering from this rigged system are the super wealthy. My wife is an elementary teacher for a public school and she got a 2% salary increase this year. The necessities one has to live on is rising much higher than 2% due to inflation and people wonder why the middle class continues to shrink. This is a sad situation.

We live below our means so we are fortunate to be in a good position in comparison to others. My wife was telling me the other day she doesn’t know how some of her co-workers make it financially. If you have a family, a house, 2 cars, 2 kids, and both parents have 2 middle class jobs, you are still struggling to make it each month.

The Fed is the main reason why the middle class continues to shrink and until we address this problem, the middle class will continue to shrink. The game is rigged. Only a small percentage of Americans understand what is really going on. Most of those that don’t know what is going on probably wouldn’t have the means to protect themselves financially even if they were informed.

Ive been seeing this stuff since 08.There are some brand new commercial buildings that have never been used. A month ago i went to Phoenix and needed something so i remembered a walmart along a major road.When i got there it was closed.I was amazed there was a no brand name grocery store in its place.

This is the new normal.Closed commercial propertys and empty houses in neighborhoods.

Everyone looking to make money has driven up housing propertys to a crazy level.Theres nice homes down the street that people want three hundred thousand for.The homes are reall worth mabe seventy grand.The crappier homes here are going for one hundred thirty thousand and are really worth thirty five thousand.Not to mention there are no jobs here.

Prtrbd:

They are busy, but not BUSY a la ’04

I estimate 40% of work is for gov workers, 40% for property management, 10-20% for professionals and such. Give or take…

SF high-end will always be fine, but that is the big money folks.

I was thinking along the lines of this article as I passed the Metro mall Saturday. Some cars but maybe 25% capacity in the lots. Great article….

Declining net energy = declining economic activity. The trend will continue.

Sell your crap on eBay, learn a trade, live local, and enjoy life Stucky-style.

I see it all the time: Best Buy is like a morgue, my local Vons stocked to the brim with food and a/c cranking with one lane open and 3 shoppers in the entire store. My last trip to Home Depot was interesting with about 10 guys in orange vests standing around and the only register open was the self-checkout lane. I know of two local shopping mall areas that were born in the boom but have never been completed and have zero tenants, who is eating those lease bills?

matt

You are eating those lease bills through ZIRP, TARP, and QE to infinity.

Good article … enough that I was starting to get a little hopeful we might see a way out.

Then I read comments like, “We sure are seeing the effects of communism spreading across the face of America. Franklin Roosevelt sure didn’t do this country any favors …”

Then I realize that we truly are doomed.

It is time to pin the tail on the donkey–Virtually all of the powerful individuals who have brought this situation about have a union–It is called the Council on Foreign Relations. The members of this organization of the wealthy elite : Greenspan, Bushes. Clintons, Cheney, Soros, Rubin, Summers, Biden, Welch, Rockefellers, have taken away the protections of smaller people/investors by repealing Glass-Steagall, and building the derivative fiasco among other rip offs such as High Frequency trading, and the elimination of the trading Uptick rule.

These people have brought about the transfer of 40% of middle class wealth to the wealthy elite which was only equal to a negligible 2% increase for the elite–certainly not a needed increase.

These elites own the big banks that own the FED. Their lusts for wealth and power are destroying the lives hundreds of millions of families worldwide. It is time that citizens become aware of how their lives are being affected and by who.

Admin, I see you haven’t lost your mojo, but you’re being way too pessimistic.As soon as we bomb Iran into submission and recapture total control of all the oil reserve in MENA,we’ll be back in high cotton.You’ll see.

Check the front page of Drudge for more info.

The global war drums are just getting crunk up….won’t be long now.

“I happen to believe that eventually we will have a systemic crisis and everything will collapse. But the question is really between here and then. Will everything collapse with Dow Jones 20,000 or 50,000 or 10 million? Mr. Bernanke is a money printer and, believe me, if Mr. Romney wins the election the next Fed chairman will also be a money printer. And so it will go on. The Europeans will print money. The Chinese will print money. Everybody will print money and the purchasing power of paper money will go down.”

Marc Faber

This is not a new trend…it has been trending this way for decades. The only new thing about it is that it coincides with a major downturn in the local as well as the global economy. Its causes are “all of the above” plus that image in the mirror – we have convinced ourselves over-consumption is the way to go and we have over-borrowed to do it.

As to the major culprit, the Cat CEO implied it best…he is moving to Texas to escape taxes and regulations that are strangling his company. Taxes and regulations are responsible for moving the jobs out of the country. It appears to be too late to reduce regulations or even taxes enough to cure the problem.

Hoard some junk silver, food, and supplies. It is going to be a long and cold winter.

I’ve been saying the same about the unsustainability of unbridled consumption since 2004. Back then I witnessed people with no down payment, no savings and no income verification buy Cape Cod style homes in North Jersey for $450,000 and up. They would have 2-3 kids and $800/month in SUV leases sitting in the driveway. By 2008 it was foreclosure and eviction-and they were STILL employed! The damned banks just handed them 100-125% mortgages-even allowing them CASH OUT WITH THE PURCHASE! Then those absurd loans were bundled into mortgage backed securities, rated AAA investment grade and sold to the public. And the thieves who perpetrated this farce walked away with BILLIONS! No wonder here about cause/effect-this occurred long after our manufacturing base went into decline. Fast forward to today-these once happy homeowners have been unemployed for 3 years now. They and their children have moved in locally with mom, dad, aunt, uncle etc and continue to send their larva to the same schools. One guess who the schmuck is stuck with the 70% property tax increases that pay for the schools. Yours truly.

Austin, TX is booming. The malls and home improvement stores are packed on the weekends, the traffic sucks and there is a thriving urban core.

I don’t see what you see. Perhaps the lesson here is that economics is local.

The only answer is to become one of them. Live below you means, and buy dividend paying stocks. You will be a part of the problem but at the same time profit from it. It may all still melt down, However you may end -up better than your non-divided receiving neighbor. I would suggest a better currency to be getting your dividends from. I work at a grocery store so not the best person to take advise from, just throwing in my opinion. If you start young the idea might just be crazy enough to work.

The FED is NOT responsible for all the bubbles (as you suggest).

– Before the crash of 1873 there wasn’t a FED and the US was NOT on a gold standard but there still was a bubble.

– Before 1929 the US was on a gold standard and there was a FED and there still was a financial bubble.

– Pull up a chart of the Debt to GDP ratio since 1945. Then you’ll see that from about 1950 up to say 1973 the Debt to GDP ratio remained flat. After 1973 that ratio started to take off. Not because of Nixon who took the USD off the gold (exchange) standard. But because the US started to use Fannie Mae & Freddie Mac to sell mortgage backed securities to foreigners.

Willy2

Crawl back into your hole. False storylines don’t cut it on TBP.

Balzytch says: “Asians have beat us. Just look around.”

No, the communists (Bolsheviks) have beat us. We may have to hi-tail it to Asia to get out of their grip.

McCarthy was right.

Willy: Pull the crack out of your pipe and put this in to smoke it:

“Financial Bubbles” in the gold standard era were caused by wars. They issued far more bills of credit. Financial “busts” in the gold standard era were caused by the discontinuing of printing or, as would often happen, holders of bills of credit would call bullshitz on the fractional reserve ponzi.

Big difference, Willard. Look at the dates again there RumpleNardskin.

“Willy2” Shut your mouth ! TOO much stupid is coming out of it !

I was in a Lowes last week returning an item ; and the clerks were talking among themselves. I asked if I had heard right. They confirmed and complained that the manager was receiving a $20,000.00 bonus…………

“Austin, TX is booming. The malls and home improvement stores are packed on the weekends, the traffic sucks and there is a thriving urban core”

Most or all college towns are thriving. Student loan cash, more than $1 trillion of it, results in commerce baby, spend, spend, spend!

Great, great article. Well written!

“When you look into the eyes of these people, you see sadness, confusion and embarrassment. They know they can do more. They want to do more. They know they’ve been screwed, but they aren’t sure who to blame.”

I feel for these people. They must be scared for their families. We are at the beginning of Great Depression 2, and they don’t even know it.

Answer me this: has there ever been an ongoing, one-hour weekly TV drama about Wall Street, about bankers, about the world of finance? There have been shows about everything else (law, war, government, crime, the wealthy), but I can’t recall there ever being a show about bankers.

How have they avoided our scrutiny, especially when they control our lives?

Somebody has been hitting the Ambien.

Balzytch – “Asians have a median income almost $10k higher than whites. Considering that’s where most of our money and jobs went, it’s not surprising. Asians have beat us. Just look around, the products, Wal Mart, Dollar stores, the cars, the only stores left open sell 90% Chinese crap.”

I read somewhere (correct me if I’m wrong and, no, DON’T STOMP ON ME) that 60% of all exports out of China were from American-owned manufacturers working out of China. Chinese workers are being used for cheap labour, and they’ll be lucky if they can breathe in a few year’s time from all the pollution.

Chinese who come to the West most of the time do not go into trades, become school teachers, etc. They prefer becoming dentists, doctors, accountants (the highest paying professions). Therefore, it doesn’t surprise me that their median income is higher. They seldom go into social services. Their families look down on those jobs.

Once China is used up (their wages become too high), the manufacturers will move elsewhere and we’ll have crap coming from another country. The people must put an end to this and refuse to buy products not made in America.

40% of our economy is now financialization; parasite banksters feeding off the rotting, debt-ridden corpses of what’s left of the workforce.

ZIRP wipes out interest income for savers, turning everyone into consumers. Consumers produce nothing, and are more than willing to go into massive debt to do so. A consumer society only benefits the rich, and those that produce the crap we consume (China, Korea, Japan).

Banksters crashed our economy in 2008, were bailed out, and continue to get bailed out. What little saving and home equity the muppets had was wiped out. It’s all a great trick, by those ruthless rich folks and bankstas, to get all your money, with what’s left going to taxes to support the FSA and criminal politicians.

Pass the Ambien…

“The vampire squid, stabbing it’s tentacles into anything that smells like money” ?__SQUARESPACE_CACHEVERSION=1319929813795[/img]

?__SQUARESPACE_CACHEVERSION=1319929813795[/img]

[img

Balzytch – also re the Chinese: $120 BILLION has left China in the last year (by Chinese citizens). A lot of this money is corrupt money (from payoffs, bribes, fraud, ponzi schemes). If you are a member of the Communist Party (which only 75 million of the Chinese people are) and you are running the State Owned Enterprises, you are in a position to make some serious buck.

China is a kleptocracy, and the West only looks different. As we go down, notice how our kleptocracy is tightening the screws on us.

So take some of those debt-laden FRNs and trade a few of them for bitcoins. You can actually own your own money again.

It’s really painful to watch people only complain about the evil paradigm we’re forced to live with rather than take an active step, no matter how small, to undermine the evil fcks.

@Administrator: Excellent article but the FED is not responsible for creating bubbles. In order to get the money/credit out the door of the FED, the FED needs speculators that want to speculate with leverage (consumer credit, mortages, commercial loans etc.) and that requires rising asset prices. Do you want to go long Apple with leverage when that stock is tanking ?

CPI is lower than in that graph because one of the components in CPI is OER. The government wonks assume the OER is still rising but in the real world rents are falling. So, CPI overstates inflation. If one would substitute OER with the Case Shiller index then in 2009 & 2010 CPI would have turned negative.

What the FED should have done is increase reserve requirements.

I see the same happening in the region I live. This year more shops have closed than in 2009, 2010 and 2011 combined.

I’m seeing almost 8,000 reads of your article on ZH. Awesome.

Two Willy’s works for the government, Bureau of statistics and propaganda.

James,

Whenever I read these retailer financial reports / expectations I always think of Perniller and her band of merry men @ IKEA. A bigger group of morons would be hard to throw together. Then I think of the management when I worked at Kmart – wow!

Retail attracts them & all the Admins of the world don’t do any good if they don’t listen to them.

Willy

The deflation debate is over. Did you hear Bernanke last week? Your response above is completely backwards. The Fed manipulates interest rates which increases credit/money supply which creates speculation which creates higher asset prices.

In regard to the CPI, your correct the numbers are manipulated. Where you are wrong is that the CPI is overstated. It is the opposite. Have you been to the grocery store lately or filled up your car? We are experiencing an inflation rate far higher than the CPI.

I suggest you study this blog for awhile. You will become informed with the truth. Turn off CNBC and read the Creature from Jekyll Island in addition to the daily articles and comments on here. You will eventually see that you are confused.

I grew up in Plymouth Meeting during the salad days IMO. Graduated from Plymouth Whitemarsh SR High, Class of ’72. Helped organize the first Earth Day ever. Even back then development seemed out of hand, driven by a hyper-ventilating panic of greed and avarice. A race to pave every open piece of land. And if you owned a farm that some developer coveted and didn’t sell fast enough you would be burned out. Philadelphia and the surrounding townships use to be arson capitals back in the 50s and 60s. The “Italian Land Mafia” developers were called.

Even back then we didn’t much like the change we were seeing. Couldn’t see how it could possibly be sustained. We wondered how anybody could hate the past, and open land, and farms so much as to destroy everything. Back then you were living out in the rurals, while still being only a half hour away from Philadelphia.

My dad graduated from Penn in ’59. We lived in Plymouth Meeting before the Mall went in in 1966. There was still a lot of open land in the ’60s. You would have a housing development and a farm right next to each other. Then one day the farm would disappear, replaced by another hundred or so brand new homes. Use to be orchards before the Plymouth Meeting Mall went in. Hard to believe that Germantown Pike use to be a two lane road. My friend and I use to take our 22-rifles down for walks in the woods, the fields and deserted orchards that would become the mall. When the mall went in, it had air-conditioning (back in the days when not many homes did (including our schools). Use to walk to the mall just to cool off.

The family moved away in 1974. I go back every ten years (in 1984, 1995, 2005). Each visit the place keeps going more and more down hill. There was a large feed that had horses in it. The year after we moved away the field replaced with a new road and 17 new homes. Hardly any open land left. Norristown has been taken over by a hispanic population. It breaks your heart.

Thank you for your well written article. Glad to know I wasn’t some grumpus trying to live in the past like I was often accused of. Compared to how things are today, my childhood was a paradise.

Willy:

Do you differentiate between investment and speculation? I’m curious.

I see you speaka my language, so let’s discuss the Law Of Demand. Your explanation says that by demanding credit for speculation, a supply of money is created? Or is the supply of money created the fuel to create speculation?

What is the flow variable for wealth? Is saving “speculation” or investment? By creating endless money as demanded by the government increase or decrease private saving? Government saving?

Back to 101 for you.

You are very deep in your research and I see the same things, especially in Florida. New York seems to be back to normal, but individuals like yourself and I are shut out of the mainstream media. OWS lacked focus which if they had depth of perception and were more aware of writers like you, John Williams and others, maybe the public would have a third political party to choose from as only 60% of the population partakes in voting. A third party of the people, by the people and most importantly for the people would win in a 40/30/30 split. JFL.

I’m not Stucky(above) but I do live mostly like him. Don’t need shit anymore.

Admin: great article. One issue I didn’t see you mention was that in 1971 the median household income was often from one bread winner while the spouse (mom?) stayed at home to help raise the little ones. Ffwd to ’01 now families need TWO!!! rats running the race while the kids are being raised by aftercare

Another fantastic article, Admin! Congrats!

Stock Market action so far is teling us that the collapse has yet to get underway.