John Hussman presents the facts. What you do is up to you.

Fed-induced speculation does not create wealth. It only changes the profile of returns over time. It redistributes wealth away from investors who are enticed to buy at rich valuations and hold the bag, and redistributes wealth toward the handful of investors both fortunate and wise enough to sell at rich valuations and wait for better opportunities. There won’t be many, because rising prices also encourage overconfidence in a permanent ascent. Few investors are capable of enduring the discomfort of being on the sidelines for very long if a speculative market proceeds further without them.

Based on valuation methods that have maintained a near-90% correlation with actual subsequent market returns not only historically but also in recent decades, we presently estimate 10-year nominal total returns for the S&P 500 Index averaging just 2.3% annually. It is worth remembering that these same methods indicated the likelihood of 10-year S&P 500 total returns averaging 10-12% annually in late-2008 and early-2009 (our 2009 insistence on stress-testing against Depression-era data was not based on valuation concerns). Moreover, our current estimates of prospective S&P 500 total returns are negative on every horizon shorter than about 7 years. Meanwhile, corporate bond yields and spreads are near record lows, Treasury bill yields are near zero, and the 10-year Treasury bond yield is just over 2.7%. Our friend James Montier at GMO correctly calls this a “hideous opportunity set.”

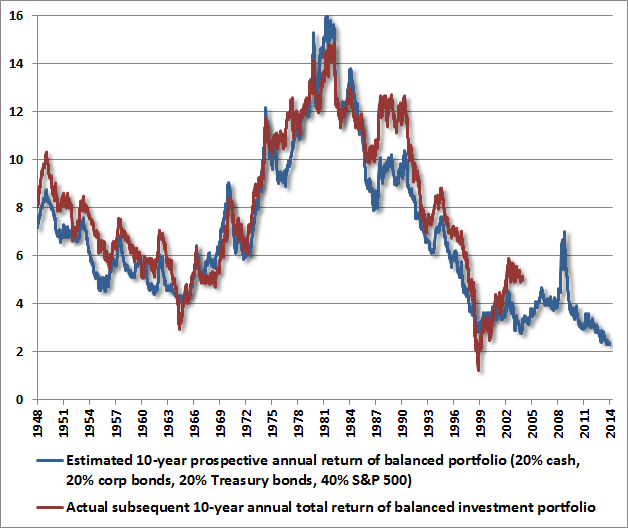

To give an indication of how hideous the opportunity set of both short- and long-horizon investors has become as a result of quantitative easing and Fed-induced speculation, the chart below shows the estimated return of a balanced portfolio that assumes an allocation of 20% in Treasury bills, 20% in corporate bonds, 20% in Treasury bonds, and 40% in the S&P 500. We currently estimate that the prospective 10-year return on such a balanced portfolio is now at the lowest level in history, at just over 2% annually. The process of driving security prices higher and prospective long-term returns lower has been greatly satisfying over the short-run. The future will be a mirror image, as it was following other historic speculative episodes.

Read John Hussman’s full fact filled letter

For the chart challenged, let me explain the implications.

The blue line is a prediction. The red line is what actually happened over the next 10 years.

It sure looks like the blue line has been a damn good forecaster for the last 75 years.

It is currently predicting a NOMINAL annual return of 2% for a conservative well diversified portfolio over the next ten years.

If you disregard the fake BLS inflation numbers, you know annual inflation is at least 5%. Therefore, you are likely to get a real annual return of NEGATIVE 3% for the next ten years.

That should do wonders for the financial condition of the millions of retiring Boomers.

Admin ,you just don’t get it .I want you to think about what you don’t get about investing.I will come back later and help all the investment challenged folks like you.Love bb

Hmmmmmmm.

And Walmart released the news that the last reduction in SNAP was the reason the company’s comparable-store sales were negative -0.4% and they worry about a skills shortage? How smart do you need to be to work at Walmart?

The graduate with a science degree asks, “Why does it work?”

The graduate with an engineering degree asks, “How does it work?”

The graduate with an accounting degree asks, “How much will it cost?”

The graduate with an liberal arts degree asks, “Do you want fries with that?”

Liquidate all equities, short stocks( esp dividend payers), take physical delivery on as much gold/silver as you can store.When in doubt buy Hussman funds regardless of market direction.

3 Year performance

HSGFX -15.1%

SPY + 52.5 with dividends reinvested

High hedge cost + high fees + perpetual bearish sentiment = PPP ( piss poor performance )

I guess no wants.my secrets of investing in this economy.Ok ,you.can all go fuck yourselves and I will keep.my secrets to myself.

Jesus Christ bb don’t go away mad…….

Card ,I not mad but I am frustrated.