“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it’s 1999, central bankers not only don’t take away the punch bowl – they spike it with 200 proof grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn’t really deteriorating, and the entire façade is supposedly validated by all-time highs in the stock market. It’s nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun – Japan. The leaders of this former economic juggernaut have chosen to commit hara-kiri on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn’t enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers – again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn’t need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn – excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world’s central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it’s with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender – Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

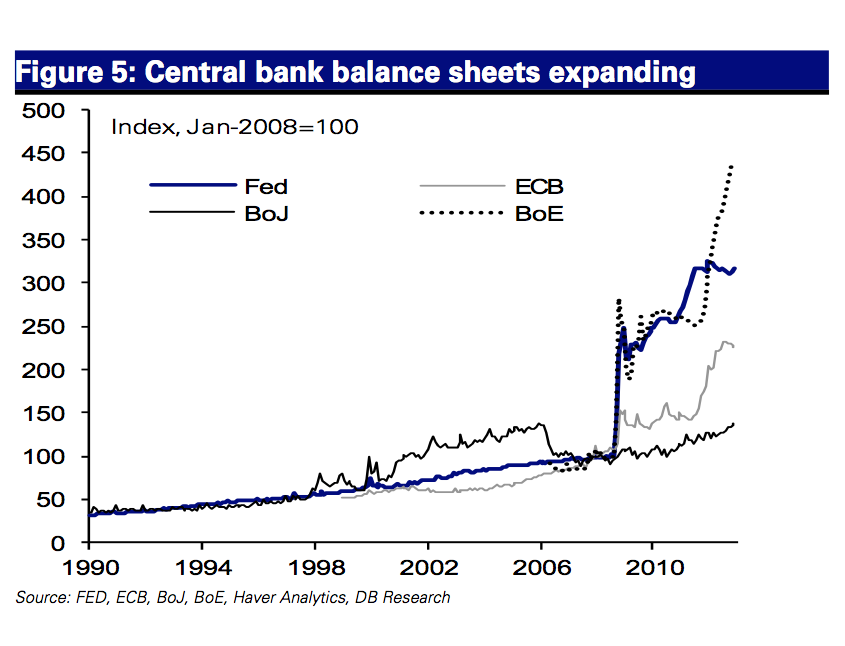

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive “surprise” increase in purchases of bonds and stocks. It wasn’t a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it’s not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn’t even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe’s solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises

Madness in the Land of the Setting Sun

“The Japanese economy is burdened with an unusually bad demographic problem, made much worse by the burdens of insider dealing, crony capitalism, and zombie banks and their corporations. And its greatest burden of all is an elite that serves itself and its friends first and foremost, and that finds a greater kinship with its global counterparts than with the people whose interests it purports to represent.” – Jesse

Despite all of the hot air spewed by the financial media about Abe’s dramatic actions to “revive” the Japanese economy and the liftoff of the Nikkei from its lows, the Japanese stock market was only up 7% in 2014. Of course, if you were a U.S. foreign investor you would have lost 7%, as the Yen fell 14% versus the USD in 2014. It has now fallen by 36% versus the USD since 2012. The 26% stock market gain since early 2013 has been achieved through a 22% debasement in the currency. The German stock market soared in 1923 at the same rate the governmental authorities debased their currency. The utter and complete failure of Keynesianism can be seen in the chart above and the economic data 25 years after the 1990 Japanese stock market crash. They have experienced a 25 year recession because they chose to cover-up the bad debt of their zombie banks, wasted the nation’s wealth on bridge to nowhere projects, and propped up the wealth of the elite ruling class of corporate titans.

The Nikkei closed at 38,916 on December 29, 1989. Twenty five years later it stands at 17,451, still down 55% from its high after a quarter of a century of Keynesian “solutions”. In 1990 the government had about 60 trillion Yen in tax revenues and 69 trillion Yen in general account total expenditures. Now, the government estimates 52 trillion Yen in tax revenues for fiscal 2014 but has more than 95 trillion Yen in expenditures. It wasn’t that long ago when the term “trillion” was an unknown and unnecessary concept. Japanese governmental debt now exceeds 1.2 quadrillion Yen, or $10 trillion at current currency rates. At last year’s currency rates the debt would be $12 trillion. Now you understand the beauty of currency debasement. It theoretically makes your debt less burdensome, until the collapse of your currency system. When confidence dissipates in the ability of Japanese leaders to manage their fiscal affairs, a tipping point will be reached and it will be game over for Japan and their mad Keynesian experiment.

The Japanese society and economy is dying a slow suffocating death. The Ministry of Health, Labor and Welfare reported earlier this week, while Japan recorded 1.0 million births in 2014, or the lowest number in recorded history; this was offset by 1.27 million deaths: also the highest on record.

Japan is in the throes of a demographic death and debt spiral. The politicians add debt at ever increasing levels and because no investor in their right mind would buy debt with negative real yields while the government devalues the currency, the Japanese central bank buys the debt – along with domestic and foreign stocks for good measure. The debt will never be repaid because it can’t. Even a miniscule increase in interest rates would ignite a conflagration of epic proportions, as the interest on the debt would blow the Japanese deficit sky high. Japan has a population of 127 million and at the current fertility rate of 1.4, will be below 100 million by 2045 and below 85 million by 2060. Old people can’t have babies, so this is a virtual certainty. Social programs, debt, and unfunded liabilities need a growing population and positive economic growth in order to be paid and honored. This is an impossibility in Japan. It’s just a matter of time before default and collapse sweep over this once proud empire like the tsunami that struck their shores a few years ago.

The Japanese people get it and are not cooperating with the authorities by spending money they don’t have, while the ruling class reaps the benefits of free money and stock market gains and they are left with declining real wages and high inflation for food and energy which must be imported. The debt can only be paid through real tax increases or stealth tax increases through inflation. The Japanese people realize Abenomics is a farce and continue to hoard their remaining wealth, preparing for the cataclysm which beckons. They know how bankers and politicians treat their constituents. The little people will be thrown under the bus with welfare and social benefit cuts, while the ruling class will be left unscathed and further enriched. The nation will have gone full cycle, from extreme poverty after World War II to a global economic powerhouse by 1990 and back to a broken nation when this charade of debt collapses.

The Abe government’s latest plan is the same plan used for twenty five years. I guess they never read Einstein’s quote about insanity. They have delayed their sales tax increase, are cutting corporate tax rates with the hope the corporations will pay their workers more money. How has that worked out in the U.S.? Japanese corporations will build cash reserves, buy back their own stock, pay corporate executives bonuses, and leave their workers to fend for themselves. The government will spend tens of billions on more shovel ready projects benefiting the connected corporations. The banks will pretend they aren’t insolvent. And the Bank of Japan will just buy all the debt, debase the currency, and prop up the Japanese and U.S. stock market. That’s what they’ve been instructed to do by their authoritarian American oligarch masters. If they can just drive the Japanese Yen down to 140, the Wall Street banking cabal can drive the S&P 500 up another 20%.

Booms brought about by credit expansion ALWAYS end in a contractionary bust. It’s just a matter of when. The level of mal-investment in Japan, Europe, China and the U.S. during the boom created by central bankers is almost incomprehensible in its scale of absurdity. The only beneficiaries have been bankers, corporate insiders, politicians, and shadowy billionaires hiding in plain sight. The illusory boom has already impoverished the working class and the coming bust will invoke civil unrest, social chaos and war.

“Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump. The boom squanders through mal-investment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment.” – Ludwig von Mises

Live by the Debt, Die by the Debt

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous.” – Ludwig von Mises

Abenomics may be benefitting corporate insiders, bankers and politicians, but not the working class or senior citizen savers. Real wages declined by 4.8% in December, the largest decline since 1998. As the Keynesians have implemented every Krugman recommendation for the last five years, real wages have relentlessly declined for 30 months in a row. But at least they have created double digit inflation in everyday living expenses like food and energy. The Japanese Misery Index (unemployment plus inflation) now stands at levels last seen in 1981. Mission accomplished Abe.

The common Japanese folks have been so enraptured with the Abenomics, they drove the national savings rate negative for the first time since 1955. The savings rate is now negative 1.3%. Krugman sees this as a huge success as the peasants have to draw down their savings to pay for sushi and heat. At least the government got a greater cut with the increased sales tax. Imported inflation is curing that excessive saving “problem” which Krugman and his Keynesian cohorts believe is holding the Japanese economy back. They ignore the fact that Japan experienced its phenomenal economic growth in the 1970’s and 1980’s when the national savings rate was between 15% and 25%.

Those not polluted by Ivy League business school dogma realize savings leads to capital investment and healthy economic growth. Low savings and rising debt are a symptom of a diseased consumption based economy which cannot be sustained. The elderly are being forced to use their savings to survive and the workers can’t save when their real wages continue to decline. With huge labor slack (1.12 jobs available for every person seeking a position) and the government stopping at nothing to “achieve” inflation, real wages will continue to fall, exacerbating the downward spiral and portending the final ruin.

Yields on Japanese debt with maturities less than four years are now negative. And that is before taking into account inflation that has averaged 2.7% over the last year. An investment in Japanese short term debt is guaranteed to produce a negative 3% return. And if you are a foreign investor you get the benefit of losing more money due to the plunging Yen. There will be no one other than the Bank of Japan foolish enough to buy Japanese debt from this point forward. The warped thought process of Japanese leaders and financial journalists is summed up in this quote from Bloomberg last week:

The Bank of Japan this month maintained its unprecedented stimulus as Governor Haruhiko Kuroda’s battle to stoke inflation faces challenges from tumbling oil prices. The central bank plans to boost the monetary base at an annual pace of 80 trillion yen ($666 billion), it said in a statement.

Only a central banker could see a huge drop in oil prices as a negative for the people of Japan who import all of their oil. Keynesians actually believe a consumer spending less for energy is an undesirable outcome. This is why common folk hate central bankers.

The Japanese housing market has plunged to 2009 levels despite 35 year mortgage rates being cut in half since 2009. If borrowing at 1.56% for 35 years can’t revive their housing market, maybe they should just give the houses away. With a rapidly aging population, middle aged workers seeing their real wages falling, and less young people entering the workforce, the Japanese housing market is DOA at any interest rate.

One of the main purposes of devaluing your currency is to spur exports of products produced by your manufacturers. Japan ran trade surpluses for decades, but has now run trade deficits for 29 consecutive months. Their trade deficits have averaged more than $8 billion per month in 2014 – another feather in the cap of Abenomics. Foreign investors have lost faith in Abenomics and the Keynesian dogma which has plagued Japan for twenty five years. Abe has no strategy other than to roll out more stimulus plans, hand more money to Japanese banks and corporations, and have the BOJ buy all of the debt supporting these plans, while buying stocks in Japan and the U.S. for good measure. Foreign investors are fleeing. Inflows were down 94% in 2014. Foreign investors ran for the exit in November selling 387 billion Yen worth of stocks.

Purchases of the nation’s shares through mid-December by investors outside Japan were less than a tenth of the 15.1 trillion yen they bought last year. Japanese Trust banks, which trade on behalf of pension funds, have added 2.7 trillion yen, after being bullied into buying stocks by Abe and his central banker cronies. These same Trust banks had rationally dumped about 4 trillion yen of equities in 2013. Japanese individuals, who see the writing on the wall, were net sellers for a fourth straight year. The surprise (not to Yellen) easing on October 31 temporarily brought the Wall Street traders into the market for its initial surge, but they have since exited stage left. The only entity stupid enough to invest in Japanese bonds or stocks is the Japanese government.

With a Shiller PE ratio exceeding 30 and future stock losses virtually guaranteed, the Government Pension Investment Fund, the world’s largest manager of retirement savings with 130.9 trillion yen in assets, pledged on Oct. 31 to more than double its target allocation for domestic shares. That means they will be buying another 9.8 trillion Yen of Japanese stocks. Not to be outdone, the Bank of Japan unveiled an expansion of its asset-purchasing program, including tripling investments in exchange-traded funds to about 3 trillion yen a year. The announcement on October 31 had one purpose and one purpose only – to create a stock market rally. It worked.

The Japanese market soared by 18% in a matter of days. The Japanese .1%, bankers, corporate insiders, government apparatchiks, and Wall Streeters in the know were the only beneficiaries. Only 6% of households in Japan own any stocks. The ruling elite continue to reap the rewards, while the average person sinks further into despair and impoverishment. The Japanese boom ended twenty five years ago. The boom was illusory. The rapidly aging Japanese populace will not do the bidding of their masters. After a 25 year recession they are despondent and dispirited. They don’t trust or believe their government and banking leaders. Death by Keynsian hari kari will finish off this once great economic powerhouse.

“The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration.” – Ludwig von Mises

As Goes Japan, So Goes the World

Japan just happens to be ahead of the curve on the path to collapse. Europe isn’t far behind. In a shocking turn of events, it seems a bad debt problem cannot be solved by issuing more bad debt. The country which kicked off the EU financial crisis and their round of credit expansion – Greece – is imploding again. Greece, with a 26% unemployment rate, government debt to GDP of 175%, a budget deficit equal to 12% of GDP, and incapable of making their debt payments, had 3 year bonds yielding just over 3% in September. Today they yield 12%. I wonder who invested in Greek bonds at 3%. The Greek stock market had gone up by 170% since mid-2012 because their future was so bright. It has now fallen by 60% in the last nine months. Greece was a basket case bankrupt country in 2012. It is more bankrupt today. The mal-investment in Greece, aided and abetted by Goldman Sachs, created a false boom that is going bust. When it inevitably collapses it will take down many European banks and plunge Europe into depression.

Maybe that is why German 2 year bond yields have plunged into negative territory.

Maybe that is why 2 year bond yields in Switzerland, Finland, Netherlands, Austria, Denmark, France, Belgium, and Ireland have all gone negative in the last month. Those 2 year Ukrainian bonds sure look tempting at a 29% yield. What could possibly go wrong?

European country GDP rates are barely above 0%. Germany is headed into recession as Obama’s Russian sanctions have no impact on the U.S., but destroy economies in Europe. France, the 2nd biggest economy in Europe, has seen their 10 year yields plunge from 2.5% to 0.9% over the course of 2014, while their jobless rises unrelentingly to new highs. These are sure signs of a Keynesian inspired economic recovery.

With Japan in a depression, Europe in a recession, China experiencing a slow motion real estate collapse, Russia headed into recession, Brazil in recession, and all Middle East oil producing countries ($500 billion decrease in oil revenues in 2015) headed south, the U.S. is the prettiest horse in the glue factory. You can ignore the dramatic flattening of the yield curve and the plunge in 10 year treasury yields from 3% to 2.1% over the course of 2014. We’ve got Obamacare spending and military spending to pump up our GDP and the Federal Reserve to pump up our stock market. Mortgage applications at 15 year lows, new home sales at previous recession lows, real median household income 9% lower than 2008, 19% of all households on food stamps, real unemployment exceeding 15%, and the real nasty aspects of Obamacare about to hammer businesses and individuals, all add up to a fantastic year ahead for our welfare/warfare empire of debt.

The global economy is imploding. Stock markets do not reflect the economic circumstances of the average person in Asia, Europe or the U.S. Governments across the globe have been captured by banking, corporate and military interests. They have used their power to subsidize rich elite oligarchs at the expense of the common people. Their weapons have been debt, control of interest rates, ability to rig stock, bond and currency markets, and media propaganda to convince the masses these criminal actions have actually benefited them. The people are beginning to realize government is not their friend. Trusting the government to solve the problems they created which led to the 2008 worldwide financial collapse, is insane. They have saved their .1% benefactors, while impoverishing billions. Now that their “solutions” are failing again, they will use real weapons wielded by soldiers, police and prison guards to enforce their decrees and self-serving laws. The year of consequences may have finally arrived. The people versus their governments is crystallizing as the impending chaotic clash which will turn violent, bloody and vicious. Your freedom will depend upon the outcome.

“It is important to remember that government interference always means either violent action or the threat of such action. The funds that a government spends for whatever purposes are levied by taxation. And taxes are paid because the taxpayers are afraid of offering resistance to the tax gatherers. They know that any disobedience or resistance is hopeless. As long as this is the state of affairs, the government is able to collect the money that it wants to spend. Government is in the last resort the employment of armed men, of policemen, gendarmes, soldiers, prison guards, and hangmen. The essential feature of government is the enforcement of its decrees by beating, killing, and imprisoning. Those who are asking for more government interference are asking ultimately for more compulsion and less freedom.” – Ludwig von Mises

YOU MAY ALSO LIKE

What a start for 2015

I have faith in the fed, politicians, and bankers. They wouldn’t leave us hanging, would they……?

Fifty years from now, this time period will become a standard teachable example of how not to run an economy.

This world wide debt bubble will be settled on the battlefield, mode of payment will be the blood of youth.

[img [/img]

[/img]

On the Insert tab, the galleries include items that are designed to coordinate with the overall look of your document. You can use these database sql books galleries to insert tables, headers, footers, lists, cover pages, and other document building blocks. When you create pictures, charts, or diagrams, they also coordinate with your current document look.

Japanese Stocks Tumble 350 Points From Friday Highs, JPY 119 Handle, WTI Crude Hits $51 Handle

Submitted by Tyler Durden on 01/04/2015 20:33 -0500

USDJPY tumbles to a 119 handle briefly before Japan opened to its normal JPY-selling spike temporarily lifted the pair ‘off the lows’. This drop dragged stock futures lower with Nikkei 225 tumbling over 350 points from its Friday trading highs. Oil prices continue to slide (WTI now with a $51 handle) and EURUSD is bouncing back from its precipitous decline earlier in the evening. S&P futures were down almost 10pts but have recovered about half their losses.

The New Year Hangover Hits Japanese stocks…

[img [/img]

[/img]

Good News for the United States and King Dollar!

No, The United States Will Not Go Into A Debt Crisis, Not Now, Not Ever,!

(If you read the headline and thought “Well, yeah”–feel free to skip this post.)

If there’s one article of faith in Washington (and elsewhere), it’s the idea that the United States might get into a debt crisis if it doesn’t get its fiscal house in order.

This is not true.

The reason why it’s not true is because we live in a fiat currency system, where the United States government can create an infinite number of dollars at no cost to meet its obligations. A Treasury bill is a promise that the government will give you US dollars–something that the United States government can produce infinitely and at no cost.

That’s the reason why interest rates on United States debt have only gone down even as the debt has ballooned. That’s the reason why Great Britain has very low rates on its debt despite having very high debt-to-GDP. That’s the reason why Japan has an astounding debt-to-GDP ratio and still enjoys some of the lowest rates ever. Investors have bet for so long that there would be a run on Japanese debt and have ended up so ruined that in financial circles that trade is called “the Widowmaker”. (Here’s a more detailed analysis by my former colleague Joe Weisenthal at Business Insider.)

Well, what about Argentina? Argentina had to default on its debt because it had pegged its currency to the US dollar. It wasn’t sovereign with regard to its currency since it had to maintain its currency’s peg. It wasn’t Argentina’s debt that caused it to default, it was its currency peg.

What about Greece? Same thing. Greece hasn’t used its own currency for ten years. Of course it’s going bankrupt.

Does it seem that strange that governments can’t run out of money?

You don’t have to take my word for it. How about Alan Greenspan? He said (PDF): ”[A] government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit”

But waaaaaaait, you shout, what about inflation? If the government prints money like crazy, won’t that create inflation?

Well, in theory, yes. But probably not. Why is that? Because the US has an even bigger advantage than just being sovereign in its own currency (hi Greece), it also holds the reserve currency. The US dollar is the main currency that is used in most international transactions, it is held by all of the world’s central banks, and so forth.

Why is this important? Well, another way to define inflation is to say that the supply of a currency gets out of whack with its demand: too much currency chasing too few people who want to hold it, and so its value drops. Well, when you have the reserve currency, the demand for your currency is always going to be extremely strong. There’s always going to be tons of people, all around the world, who want to use US dollars, because their transactions are conducted in US dollars. (And it’s highly unlikely that this will change soon–being the reserve currency has a network effect, meaning everyone uses the dollar as the reserve currency because everyone else uses it, creating a self-reinforcing cycle that’s extremely hard to break.)

In other words, while in theory printing tons of money could create inflation, in practice demand for the dollar is so high–and for structural reasons that have very little to do with how the US economy is doing at a particular point in time–that it’s hard to imagine a circumstance under which the US government would have to print so much that it would cause significant inflation.

And even if it did–well, for all the bad memories we have about it, the Stagflation of the 1970s was many things, but it was not Greece. Life in the 1970s was still relatively okay, despite the stagflation. That is to say, even in the extremely unlikely event that the government had to print so much money to get out of its debt that it caused moderate inflation, it still would not be a debt crisis of the kind that Greece and Spain are under right now. (Hyperinflation, meanwhile, is even less of a danger, since in recorded history it only happens in cases of not just reckless money printing, but also extremely serious exogenous shocks such as war, regime change, etc.)

Why am I writing this?

After all it’s already common knowledge among economists, Fed officials, and an increasing number of sophisticated investors.

Maybe so, but it’s still not common knowledge among politicians and among the general public. A lot of people still think that the US is under some risk of one day becoming like Greece, and it’s distorting our public debate.

It’s especially distorting it on the Right, where hysteria about deficits, and debt, and becoming like Greece has reached a fever pitch. Paul Ryan, especially, has framed his entire message on entitlement-cutting on the flawed premise that the US needs to cut its entitlement or it will suffer a debt crisis. This message, in turn, has infected broad swathes of the conservative movement (including very smart people in it), a movement that I consider myself a member of and want to see in strong intellectual health. But very few liberals–certainly no Democratic elected officials that I’m aware of, certainly not the President and the Vice President–are disputing the premise that the US is in any danger of a debt crisis.

In future posts, I will try to look at what the conservative movement can do to move past the idea of the debt crisis, and what it means.

Pascal-Emmanuel Gobry

Well ….. now that’s confusing.

A “Final Collapse Brought about by Credit Expansion” versus “No Debt Crisis for The United States”

This sums up what I taught my students about economics.

All the criminals did is make the next crash worse by pulling forward what little demand was left.

It seems this article could have been filed under the Fourth Turning Library, it would certainly fit. So much to look forward to, such interesting times. Yipee!!……I’m off to stick my head back in the sand, later.

KABOOM!!!!

http://www.zerohedge.com/news/2015-01-05/citi-next-aig-70-trillion-reasons-why-citigroup-and-congress-scrambled-pass-swaps-pu

Europe’s last great bubble deflates

By Michael A. Gayed

Published: Jan 5, 2015 1:04 p.m. ET

“We consume our tomorrows fretting about our yesterdays.” – Persius

Europe is in big trouble, not because of the amount of stimulus that may or may not come from the ECB. No, folks. Europe is in big trouble because the Last Great Bubble — faith in central banks to solve all problems — is bursting. The narrative will no longer be about how much stimulus Draghi does, but rather the realization that no amount of stimulus is actually working to boost reflation.

Why no one seems to be disturbed by the behavior of German bunds is beyond me. Despite record-low yields, economic growth simply isn’t there. The mechanism for stimulus is simply broken. Remember the narrative of how a weak euro would save Europe?

700trillion is a number impossible to comprehend.

One quibble: US national debt on January 20, 2009 was about $10.6 trillion. Now it is north of $18.1 trillion. President Teleprompter has managed to add $7.5 trillion, not $5 trillion, to the nation’s credit card in only six years. What a legacy.

I was referencing the plateau in total credit market debt in mid 2010. Obama added $5 trillion from that point onward. The sentence wasn’t referencing from the start of his administration.

I work my ass off writing this article and nothing but the sound of crickets. Is it too long? Too boring? Too realistic?

Should I add pictures of Kate Upton’s boobs?

Interesting article and right on the marks. One has to ask regarding all this evil. “Will there be a Day of Reckoning?”

See link below:

http://graysinfo.blogspot.ca/2014/12/will-there-be-day-of-reckoning.html

@Admin I found it very informative… answered more than a couple of questions I’ve had about the “derivatives” issues.

However, this article is shorter and doesn’t answer as much but does have a nice picture of Dolly’s cleavage: http://johngaltfla.com/wordpress/2015/01/04/the-ddds-that-terrify-the-federal-reserve/

I like your article better… [/img]

[/img]

[img

Because I HAVE cleavage.

“I work my ass off writing this article and nothing but the sound of crickets. … ” —- Admin

I think possibly it’s because people don’t give a shit about the Japs. I posted a link and brief comment about the second nuke shutdown in Ukraine, and that it has the potential to be worse than fuckyoushima, and it got 3 votes. Maybe people are still recovering from xmas/New Year extravaganza. As for me, I went to bed around 11AM due to a big big splitting headache. Just got back up.

“The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie.” –Admin

Maybe it’s that. Only it’s worse than a movie. Obama dines in a Hawaiian restaurant that charges up to $500,000 membership. Oreo slaps sanctions on N Korea for the Sonygate … when he surely must fuckin know by now they didn’t do it … everyone else does. The last news item I heard before turning off the tube and taking a nap was about the tens of thousands of new regs. And it’s only January 5th.

Surreal barely covers it. Fuck this fucken shit. My head wants to explode.

I don’t do predictions very often, but I think this article calls for one.

2015 will be the year of the Q word.

As in quadrillion.

*carefully swaddles crystal ball*

Admin

It’s a great article. As I was reading it, I wondered how many hours you had to use up to produce it, and appreciating your willingness to keep trying to enlighten your readers.

I think we all must be getting numb to current economic gyrations. We know the whole shebang is gonna blow, but it seems to be taking an infernal amount of time for the wick to burn. Also it is more than sobering to contemplate the big war that will commence one of these days. We’re left to kind of scan the horizon, looking for the rising dust that precedes the four horsemen that are on their way. The markets are noticeably down today, but, ho hum, PTB will be certain to restore the rise to infinity tomorrow. As you said, it feels like a Fellini movie.

Do you know a soul who feels positive about the immediate future? Who looks forward to a prosperous 2015? A sense of quiet dread seems to have taken hold everywhere, I suspect even in the halls of power. Within them proceeds a race to clamp us all down before we go nuts and turn on them.

Back to your article: you and others warn and warn and explain and explain, but the collapse doesn’t happen. Karma takes its time. Japan has been a basket case for decades but still carries on. The Turning is so slow to get going.

I don’t normally comment, but since you’re concerned about the crickets, I decide to offer some thoughts.

The piece, like everything you write, is dead-on. The Mises quotes are perfect and the information and analysis are both on-target. Yes, it’s long, but it’s all good information.

The problem is that yo have two audiences – people who have taken the red pill, and people who have taken the blue pill. And this piece isn’t ideal for either.

For the red pill folks, most of your writing offers new things to think about – your pieces on retail, or how the Fourth Turning is playing out in real life. In contrast, I think Japan is common knowledge. Anyone up to speed already knows that they’re a bug in search of a windshield. so it feels like old ground.

For the blue pill folks, it’s just too heavy. My wife is a blue pill taker, and while I send her some things, I couldn’t send her this – she’d never try to tackle it just because of the time commitment.

Not intending to criticize – very grateful for what you do. Just wanted to respond to your question.

This stuff is like deer in the headlights for me. Some days I’m so frozen with dread I can’t think and I can’t work, too much info, too much I just don’t and never will comprehend, even though I want to comprehend.

If Japan defaults, if Greece defaults, if half of the EU defaults, if oil continues its slide, obamacare nightmare, taxes, currency wars, riots, the end of US$ reserve status.

Everything is like a domino, one falls and it affects another domino, they start falling faster and faster. I just hope the end of the domino chain doesn’t culminate in a mushroom cloud.

In honor of AWD who would have made 10 comments on this thread, I’m throwing in Kate’s boobs.

[img [/img]

[/img]

Talk about a deer in the headlights! Frozen with a smirk.

Thanks, I needed that.

ADMIN

Outstanding article, it’s a crying shame most Merikans can’t read this article and understand the information provided. They will suffer from their own stupidity. I am hedged every way come Sunday for the outcome of this debt debauchery and decay. I only give my household a 50/50 chance at best of survival. Japs don’t have a prayer.

I think KU is way too involved with her boobs.

Hey admin. Liquor that is 100% alcohol, is 200 proof (in the US). If you find liquor that is 200% alcohol, let me know because the only thing that appeals to me after reading this article is getting and staying drunk until the whole 4th turning concludes.

This shit never seems to end, I’m fucking worn out, I just wish the doom would get-it-the-fuck-over-with so we can move on to the next era. My whole life has been the fucking unravelling and now this damned never-ending crisis, at the rate things are going I completely understand why one might refer to Nomads as “lost generation”. Fucking hell, I can’t take this shit any more, haven’t had even a taste of the goodness, just a never ending pile of socio-political-economic shit. Endless.

Pass me the 200% alcohol please – or do the fucking .1% Bankster shitheads have complete control of that as well?

Fuckin A.

Thank you Admin for enlightening me on a few things I didn’t know/forgot.

@Sensetti, you quote this article by – what I’m going to assume – an uber statist, are you doing it just to provide the opposite view, or as something you believe?

Yes, yes, yes, we “can’t” default. Money can be printed, yada, yada, yada. Been hearing this ever since I first realized where we are headed.

I have a couple questions for Pascal-Emmanuel Gobry the author. He states, “The reason why it’s not true is because we live in a fiat currency system, where the United States government can create an infinite number of dollars at no cost to meet its obligations. ”

Which does work until the day the countries that supply our way of life decide they don’t like it.

And contrary to Mr. Gobry’s viewpoints, they have ALREADY signed treaties, agreements and contracts to cut us out with more than half the world. As an aside, the half they now have currency agreements with is the same half that SURPASSED the West economically a couple years back.

So Dear Statist Apologist Gobry wishes to believe that China and the rest of our vendors worldwide, will HAVE to continue to value our cash at what we say?

bwaaaaahahaaaaa

Farking tool is going to be in for one helluva surprise. Gotta ask how it was that GB lost the reserve status when all they simply had to do was print more fiat?

Whatever, Admin and others do a great job of pointing out the reality that corruption and debt cannot continue on infinitely, especially when we figure out that we no longer manufacture much of any import to our daily needs.

I’m sure China will continue selling us items below cost and letting us set the value of our dollars too. Forever more. Just like it’s 1995 and they haven’t barely started their industrial production for import yet.

Exactly the same. No worries. My ass.

Bad stuff has been visible in the distance for years. I’m sure Obama signing the Small Arms Treaty is in no way indicative of the fact that our government sees the writing on the wall, even as our fellow sheeple refuse to look.

Happy Farkin’ New Year. I predict it isn’t going to be the same as the old, at all.

My only quibble with this article is the author’s consistent confusion of Keynesian fiscal stimulus with central bank monetary activities. The former provides economic stimulus directly to the common people, while “quantitative easing”, like Abenomics, provides it solely to the financial sector and large corporate entities. Massive fiscal stimulus under the New Deal, ultimately raised to sufficient levels with the mobilization for WWII, brought the US economy out of depression. If, in 2008, there had been massive financial reform and a debt jubilee combined with a massive fiscal stimulus it could have set the economy on a solid footing for at least the first half of the 21st century. We didn’t do that and so now a massive crash is inevitable.

Massive fiscal stimulus under the New Deal did not bring the US out of depression. The country was in depression through WWII. The New Deal kept the recovery from occurring. You are a moron. You don’t consider Obama’s $800 billion porkulus plan as massive fiscal stimulus? Go back to the Krugman blog at the NYT. I should really require an IQ test for comenters to weed out low IQ Keynesians.

As Japan Opens, Nikkei 225 Down Over 500 Points From Overnight Highs – Below 17,000

Submitted by Tyler Durden on 01/05/2015 19:42 -0500

UPDATE: Nikkei 225 Futs lose 17k – trading 16,985

Time for some GPIF asset re-allocation and spuriously repititive headlines about Abenomics, 3rd Arrows, growth, anti-deflation, or some such bollocks (as they say in Japan). For now, JGB Futures are at all-time record high prices, USDJPY sits back under 119.50, and Nikkei 225 Futures are holding just above the crucial 17k mark – down over 500 points from last night’s highs.

“I work my ass off writing this article and nothing but the sound of crickets. Is it too long? Too boring? Too realistic?”

Sheesh, comments whore… No, I read it, took me about 30 minutes and then had nothing to add or argue. That isn’t a sign of disinterest for readers, it means you are a good writer when you leave no gaps for people to add to the commentary.

On the content of the article I am on the side of SAH, we know it is going to blow and I am worn out. A stock market crash, a depression, or a correction I can deal with. It would actually be welcomed so I can be a more productive person. Most people know now the economy is running on fumes but we have no idea where the bottom will be when the fat lady finally sings. We can’t move forward as a country onto something better until the decaying institutions are out of the way.

Excellent article and tells it like it is. Unfortunately, most Americans believe whatever the Washington propaganda machine tells them, aided and abetted by a clueless media that is enslaved to the current administration. As long as everyone on the taxpayer dole keeps getting their monthly check, they don’t care what’s going on around them. That amounts to at least half of the country at this point.

When the collapse comes, everyone will wake up and the finger-pointing will start. I concluded years ago that it’s too late to save our republic. All we can do now is be prepared for a depression that will make the 1930s look like the good old days.

Admin- Thanks for the article, very entertaining and informative. I knew things were bad in Japan, but I honestly came away a bit shocked at both the depth and duration of their Keynesian madness. I have yet to come across an article that lays it all out as succinctly as SAYONARA.

Victory in WWII has apparently allowed the United States to set up financial buffers, Japan will clearly collapse first(thrown under the bus), followed by Germany(Euro) on the present course. Both events will lend strength to the Dollar and its Reserve status.

Challenge to that Reserve Status(Sensetti Post) has surfaced and is metastasizing; BRICS, SCO, BRICS Associates, MINT. Largely countries whom: ” Japan experienced its phenomenal economic growth in the 1970’s and 1980’s when the national savings rate was between 15% and 25%.( from the Article)” are not ignoring this crucial fact.

The use of Mises quotes throughout is spot on. Thank you for the intro years ago, also Acton, and my absolute fave Hayek. I just finished his Road to Serfdom, which I saw on your Xmas selection list and my Honey got me for Christmas, thank you, (sorry she did not order it through your site, ill work on it) it has changed my perceptions in fundamental ways, as TBP has continually done since Years of the Modern.

My favorite from the Article:

“The people versus their governments is crystallizing as the impending chaotic clash which will turn violent, bloody and vicious. Your freedom will depend upon the outcome.”

Beautifully stated wake up call, education and action are immediately necessary, sadly, a great many have no interest in either. Your oft used quote ” its impossible to get a man to believe something when his pay check depends on him not believing(close)”, seems appropriate now more than ever. Kool Aid tastes good.

A Great Clash is brewing.

Admin – Very worthwhile article, thanks. The blue pill crowd fails to understand that while the US still has the advantage of having the world’s predominant reserve currency, US interdependence upon global markets is far greater than ever before. We may be the prettiest nag in the glue factory, however, we are eyeball deep in the glue. When the dominos fall the US stock markets will not escape the impact because regardless of the growing chatter about “Jubilees”, the debt bomb will have to be addressed.

@Nobody, yep ignore the actual words of our American Treasurer (which he said in about ’38, I don’t feel like looking it up again, but you surely should expand your education beyond what they taught us in Time Magazine and HS American History), when he told the President that the spending DID NO GOOD.

Ignore the fact that our industrial competitors were being wiped out by war.

Ignore the fact that our debt levels were miniscule compared to the past 30 years of can-kicking and Keynesian spending.

But really, please, ignore the BIGGEST fact that in the 30’s and 40’s our industrial bases were FULL of factories, jobs, resources, innovation, creators, and entrepreneurs.

The 2015 American economy is EXACTLY like it was in the late 30s.

Hell, all we need is a war to get rid of these pesky problems.

Oh yeah, we might also need China (and the majority of the world that has sold them the rights to natural resources, including our OWN government) to keep shipping us toilet paper, blue jeans, insulin, antibiotics, silicone chips, LED screens and 70% of the processed food you see in grocery stores.

Success from Keynes’ theories are surely right around the farkin’ corner.

Good luck with that. Good luck.

Everclear is a brand name of rectified spirit sold by American spirits company Luxco. It is bottled at 151-proof (75.5% ABV) and 190-proof (95% ABV).

TE- Yeah, it definitely helped the United States greatly that our whole country wasn’t destroyed by the war and we had the best seat at table for reconstruction negotiations. We benefited from the ruins of Europe after the war. We were the only ones who had an intact economy and infrastructure.

As you may (or may not ) be aware, the Aussie dollar has lost 20% against the greenback in the last 6 months. A talking head on the TV explained that the reason was that USA currently is growing at 5%, while Australia around 2+%.

Where do they get this 5% figure from?

Is it the every growing US stock market?

The growth in big pharma/ med insurance from Obamacare?

Is the military industrial growth the reason?

Nothing I read in places like Zero Hedge explains it…

It doesn’t look like middle America is growing at 5% – housing values down – wages down, etc.

Say Admin, I’m with Steph. I read the entire great article and really didn’t have any questions. Fukushima will take care of Japan eventually (and maybe the West Coast….then I’m toast)!

I don’t give a fuck about Japan, but I do care about my country. Here’s where Admin falls short on this and many previous economic analyses ………

“The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses ….. ”

—-from the article

“Mentally infantile masses” are the key buzzwords. Just explain to me how Joe and Jane Sixpack are supposed to keep track of credit derivatives, home mortgage default rates, the Federal Reserve balance sheet, the U3/U6 unemployment rate and all the rest of that shit while raising a family. Here’s the answer: THEY DON’T, AND THEY’RE NOT SUPPOSSED TO KEEP TRACK.

The fucking economy, national and international, has gotten so goddamned complex that even you must admit that it’s a challenge to understand. Yet you call our lesser educated Americans mentally infantile masses.

You KNOW and I know that Joe and Jane Sixpack are getting royally hosed by these fuckers on Wall Street and DC. Inflation. Virtually zero interest. Rising utility bills. Flat or falling wages. Increased taxes. And a host of other factors you have written about.

Just don’t call Joe and Jane “mentally infantile.”

If the .1 percent are drinking 200 proof alcohol, they are drinking some seriously expensive shit. The reason is that anything over 192 proof is impossible to distill, and must be made by different methods – ie. you cannot ferment and distill 200 proof alcohol.

Admin – the working class did a fine job pillaging their own wealth. The had a once in ten generations chance to create/hang on to some wealth after the second world war, up until around 1980 or 1990 or so. But what did they do? They squandered their wealth and their opportunities on lifestyle – TVs, new cars, vacations. They hocked their homes for these things, and convinced themselves that the booms would go on forever. Oops.

The middle class is, was, and always will be an illusion. The powerful are stripping away what little wealth was accumulated by the middle class, but no matter what, it was unsustainable. The sheep are for shearing, and are now being sheared.

Time and again I post this little factoid, as it in and of itself is the reality. The US has 5% of the world’s population, but consumes 25% of the world’s resources. That is unsustainable.

Why? There are only 3 options.

First, the rest of the world is allowed to consume equal to that of the US, which would mean that overall world consumption of energy, material, etc. would have to increase by 5 times. The world – ie. earth – cannot sustain that.

Second, the status quo would need to remain – the rest of the world will not allow the US to forever be master and they the slaves, and so that reality too cannot be sustained.

Or finally, option number 3, which will come to pass, as we are seeing, is that US consumption and standard of living will fall, dramatically, and the rest of the world standard will rise, modestly. There are simply no other options.

I will slowly get to the stuff re Japan.

SSS – you seem to think that the US people should bear no responsibility for knowing what is happening.

All the things you have mentioned, save perhaps the interest rate, is a reflection of the unsustainable standard of living going through an inevitable collapse.

The mentally infantile masses have allowed themselves to be conned into believing that the US middle class is a permanent entitlement, that SS and govt pensions will always be there, that health care in old age will be there, and that all of the US goodies will continue even in the face of billions of Asians wanting their share of the bounty.

Yes the sharks are ripping into them – that is what sharks do. But the mentally infantile masses let it happen, willingly. Those dickheads wanted Obama, and got him. Great! Next they are going to get a double helping of Hillary. Oh boy, won’t that be grand.

Not everyone with families made bad choices – you did not, Admin did not, etc. Those that did do not get to absolve their stupidity because they were busy raising families.

No one expects them to be financial analysts, but for fuck sake, those imbeciles elected Obama and are going to elect Clinton, by the look of it. That is just too stupid for words. They are getting exactly what they asked for and deserve.

The endgame is inevitable, but it need not have been the crash landing that is coming.

Llpoh, do you really think that the Repubs are different to the Dems?

They are both owned by Wall Street and the Tribe that own it.

Elizabeth Warren might be cut from a different cloth, but she has zero chance of becoming POTUS.

The article was far too long.

one of many such articles all saying the same thing.

Most of us know this already.

It just needs to be got across to the politicians.

You critise Japan with its Abenomics (correctly) then go on to say that QE in the USA has worked.

Digby

Your comprehension skills are on par with a retarded monkey if you think I said that QE has worked in the US.

I can’t help it if you have the attention span of a gnat and needed to get back to facebook and twitter before completing the article.

Again, I really need an IQ test to weed out the idiot commenters.

There seems to be a common misconception in the blogosphere that says that outstanding debt can not be repaid.

97% of money is created as debt. This money circulates and stays in the system. Hence ALL debt can be repaid. Just a mathematical fact. End of. The trouble is that this money is being accumulated by the rich at the top of the pyramid and all those at the bottom of the pyramid no longer have the money to pay down their debts.

Money rises up the pyramid while debts sink to the bottom of the pyramid.

Solution: Make the rich pay down the debts.

However the Rich are very powerful. Hence, what the central banks are doing now is just adding an another bottom layer to the pyramid, to extend the Ponzi scheme for a little longer.

Ed

Ronaldo – you dickhead, I said no such thing. I simply pointed out how stupid the sheeple are and used as an example that the sheeple elected a numbskull like Obama and will follow that with Hillary, which may well be the coup de grace.

And you, you moron, present Warren as an alternative. You have the IQ of a fucking turnip.

Digby – I have not had a chance to carefully read the article, but if Admin said QE worked, then I will be stunned. I suspect you are gonna get your dumb ass kicked. Bend over and lube up, big boy.

Whatever Japan does to its economy is academic after what TEPCO’s managers did to its environment. Just a further reason why those who know nothing about technology should be denied any involvement, let alone control over it. Fukushima is the Challenger disaster writ large.

Yes, it is a well thought out and researched piece, sir. I read it on ZH before coming over to your house to comment. Most of the sheep out there will never be able to get it, though… just too stupid. I did see a comment over on ZH under the Jeff Gundlach interview that I thought sums up the current state of the world-decline nicely by someone posting as MD4:

“NO ONE ever mentioned–let alone–predicted–a major decline in oil (or any other commodity) as recently as a year ago. They are all in decline right now (2014-2015).

These people (big-player investors) are not in touch with the rails along the ground. They’re assessing from the first-class cars on this train.

You really don’t have to have fancy educations, offices, or Wall Street employers to understand this. In fact, it’s a hindrance.

The remains of a postwar economic order, hammered out at Bretton Woods, are gone. No one policed national imbalances anymore, and eventually, no one cared about them. Simultaneously and eventually, enormous hordes of cheap labor spilled onto the world stage two decades ago, making outsourcing of western middle class economies (and incomes) inevitable.

Receiving nations dependent upon exports to outsourcing nations for growth eventually train wreck, when lost income leads to sharp declines in an outsourcer’s ability to consume. Temporarily, easy credit mimickes lost income in the middle class until, still reeling from the real loss in income, new debt becomes its own hell, and intensifies that loss, making consumption, on which most economies are based, much harder to maintain.

Global decline owing to demand decline is our present stage.

What’s hard to understand about all of this?”

Growth in economic output is coming to an end and will go negative in the medium term. Debts levels mirror GDP. Therefore as GDP declines so will debt. Debts will be paid back in a devalued currency.

The current deflation we are seeing is temporary and is due to every one fighting for their jobs/market share. ie wages are falling, prices of discretionary goods are falling. Once the weak players have been flushed out, currency devaluation will pick up speed and become evident.

There is nothing central banks can do to stop GDP from peaking and then declining. Energy production and oil production in particular is THE driving force and the central banks round the world cannot print energy resources.

To follow on from my last comment.

Paying back debt is deflationary (because money is taken out of the system). Therefore the best way to devalue the currency (to enable people to pay back their debts) is to create money debt free (helicopter money) or to devalue the currency directly (New dollar = 100 Old dollars)

Notice that I get few thumbs up or thumbs down for my comments. I have little faith that the general public will ever understand a) money creation or b) role of energy in driving economic output c) that the planet is finite.

Great article. Long, but full of good information.

A suggestion: Use Discus or something similar for comments. There is no threat hierarchy on this site and that makes trying to read an entire conversation very difficult. Actually it prevents having a real conversation.

Admin – Your Subscribe Articles and Comments links at the top of the page generate error pages on Google Chrome. Can’t subscribe!