“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it’s 1999, central bankers not only don’t take away the punch bowl – they spike it with 200 proof grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn’t really deteriorating, and the entire façade is supposedly validated by all-time highs in the stock market. It’s nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun – Japan. The leaders of this former economic juggernaut have chosen to commit hara-kiri on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn’t enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers – again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn’t need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn – excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world’s central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it’s with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender – Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

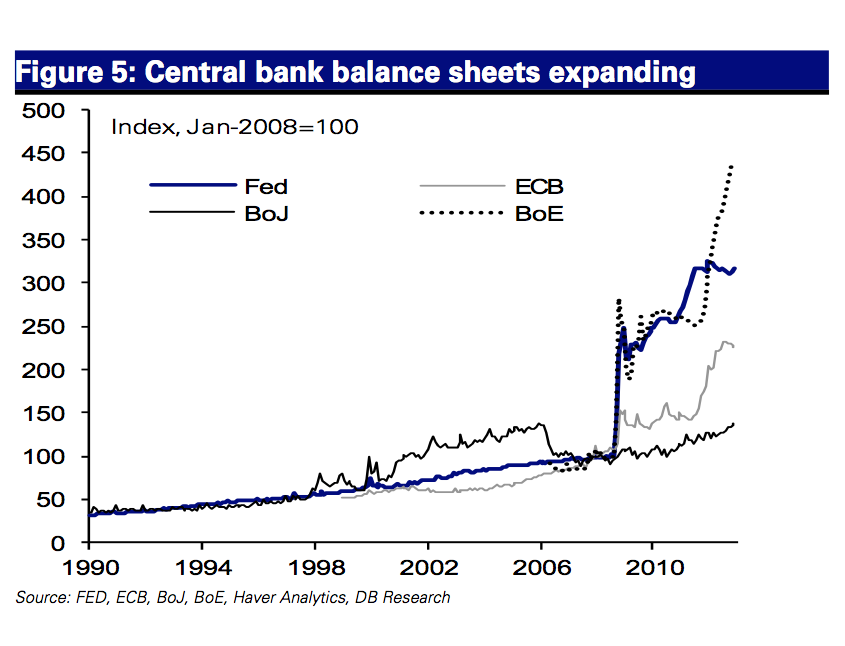

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive “surprise” increase in purchases of bonds and stocks. It wasn’t a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it’s not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn’t even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe’s solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises

Madness in the Land of the Setting Sun

“The Japanese economy is burdened with an unusually bad demographic problem, made much worse by the burdens of insider dealing, crony capitalism, and zombie banks and their corporations. And its greatest burden of all is an elite that serves itself and its friends first and foremost, and that finds a greater kinship with its global counterparts than with the people whose interests it purports to represent.” – Jesse

Despite all of the hot air spewed by the financial media about Abe’s dramatic actions to “revive” the Japanese economy and the liftoff of the Nikkei from its lows, the Japanese stock market was only up 7% in 2014. Of course, if you were a U.S. foreign investor you would have lost 7%, as the Yen fell 14% versus the USD in 2014. It has now fallen by 36% versus the USD since 2012. The 26% stock market gain since early 2013 has been achieved through a 22% debasement in the currency. The German stock market soared in 1923 at the same rate the governmental authorities debased their currency. The utter and complete failure of Keynesianism can be seen in the chart above and the economic data 25 years after the 1990 Japanese stock market crash. They have experienced a 25 year recession because they chose to cover-up the bad debt of their zombie banks, wasted the nation’s wealth on bridge to nowhere projects, and propped up the wealth of the elite ruling class of corporate titans.

The Nikkei closed at 38,916 on December 29, 1989. Twenty five years later it stands at 17,451, still down 55% from its high after a quarter of a century of Keynesian “solutions”. In 1990 the government had about 60 trillion Yen in tax revenues and 69 trillion Yen in general account total expenditures. Now, the government estimates 52 trillion Yen in tax revenues for fiscal 2014 but has more than 95 trillion Yen in expenditures. It wasn’t that long ago when the term “trillion” was an unknown and unnecessary concept. Japanese governmental debt now exceeds 1.2 quadrillion Yen, or $10 trillion at current currency rates. At last year’s currency rates the debt would be $12 trillion. Now you understand the beauty of currency debasement. It theoretically makes your debt less burdensome, until the collapse of your currency system. When confidence dissipates in the ability of Japanese leaders to manage their fiscal affairs, a tipping point will be reached and it will be game over for Japan and their mad Keynesian experiment.

The Japanese society and economy is dying a slow suffocating death. The Ministry of Health, Labor and Welfare reported earlier this week, while Japan recorded 1.0 million births in 2014, or the lowest number in recorded history; this was offset by 1.27 million deaths: also the highest on record.

Japan is in the throes of a demographic death and debt spiral. The politicians add debt at ever increasing levels and because no investor in their right mind would buy debt with negative real yields while the government devalues the currency, the Japanese central bank buys the debt – along with domestic and foreign stocks for good measure. The debt will never be repaid because it can’t. Even a miniscule increase in interest rates would ignite a conflagration of epic proportions, as the interest on the debt would blow the Japanese deficit sky high. Japan has a population of 127 million and at the current fertility rate of 1.4, will be below 100 million by 2045 and below 85 million by 2060. Old people can’t have babies, so this is a virtual certainty. Social programs, debt, and unfunded liabilities need a growing population and positive economic growth in order to be paid and honored. This is an impossibility in Japan. It’s just a matter of time before default and collapse sweep over this once proud empire like the tsunami that struck their shores a few years ago.

The Japanese people get it and are not cooperating with the authorities by spending money they don’t have, while the ruling class reaps the benefits of free money and stock market gains and they are left with declining real wages and high inflation for food and energy which must be imported. The debt can only be paid through real tax increases or stealth tax increases through inflation. The Japanese people realize Abenomics is a farce and continue to hoard their remaining wealth, preparing for the cataclysm which beckons. They know how bankers and politicians treat their constituents. The little people will be thrown under the bus with welfare and social benefit cuts, while the ruling class will be left unscathed and further enriched. The nation will have gone full cycle, from extreme poverty after World War II to a global economic powerhouse by 1990 and back to a broken nation when this charade of debt collapses.

The Abe government’s latest plan is the same plan used for twenty five years. I guess they never read Einstein’s quote about insanity. They have delayed their sales tax increase, are cutting corporate tax rates with the hope the corporations will pay their workers more money. How has that worked out in the U.S.? Japanese corporations will build cash reserves, buy back their own stock, pay corporate executives bonuses, and leave their workers to fend for themselves. The government will spend tens of billions on more shovel ready projects benefiting the connected corporations. The banks will pretend they aren’t insolvent. And the Bank of Japan will just buy all the debt, debase the currency, and prop up the Japanese and U.S. stock market. That’s what they’ve been instructed to do by their authoritarian American oligarch masters. If they can just drive the Japanese Yen down to 140, the Wall Street banking cabal can drive the S&P 500 up another 20%.

Booms brought about by credit expansion ALWAYS end in a contractionary bust. It’s just a matter of when. The level of mal-investment in Japan, Europe, China and the U.S. during the boom created by central bankers is almost incomprehensible in its scale of absurdity. The only beneficiaries have been bankers, corporate insiders, politicians, and shadowy billionaires hiding in plain sight. The illusory boom has already impoverished the working class and the coming bust will invoke civil unrest, social chaos and war.

“Credit expansion can bring about a temporary boom. But such a fictitious prosperity must end in a general depression of trade, a slump. The boom squanders through mal-investment scarce factors of production and reduces the stock available through overconsumption; its alleged blessings are paid for by impoverishment.” – Ludwig von Mises

Live by the Debt, Die by the Debt

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous.” – Ludwig von Mises

Abenomics may be benefitting corporate insiders, bankers and politicians, but not the working class or senior citizen savers. Real wages declined by 4.8% in December, the largest decline since 1998. As the Keynesians have implemented every Krugman recommendation for the last five years, real wages have relentlessly declined for 30 months in a row. But at least they have created double digit inflation in everyday living expenses like food and energy. The Japanese Misery Index (unemployment plus inflation) now stands at levels last seen in 1981. Mission accomplished Abe.

The common Japanese folks have been so enraptured with the Abenomics, they drove the national savings rate negative for the first time since 1955. The savings rate is now negative 1.3%. Krugman sees this as a huge success as the peasants have to draw down their savings to pay for sushi and heat. At least the government got a greater cut with the increased sales tax. Imported inflation is curing that excessive saving “problem” which Krugman and his Keynesian cohorts believe is holding the Japanese economy back. They ignore the fact that Japan experienced its phenomenal economic growth in the 1970’s and 1980’s when the national savings rate was between 15% and 25%.

Those not polluted by Ivy League business school dogma realize savings leads to capital investment and healthy economic growth. Low savings and rising debt are a symptom of a diseased consumption based economy which cannot be sustained. The elderly are being forced to use their savings to survive and the workers can’t save when their real wages continue to decline. With huge labor slack (1.12 jobs available for every person seeking a position) and the government stopping at nothing to “achieve” inflation, real wages will continue to fall, exacerbating the downward spiral and portending the final ruin.

Yields on Japanese debt with maturities less than four years are now negative. And that is before taking into account inflation that has averaged 2.7% over the last year. An investment in Japanese short term debt is guaranteed to produce a negative 3% return. And if you are a foreign investor you get the benefit of losing more money due to the plunging Yen. There will be no one other than the Bank of Japan foolish enough to buy Japanese debt from this point forward. The warped thought process of Japanese leaders and financial journalists is summed up in this quote from Bloomberg last week:

The Bank of Japan this month maintained its unprecedented stimulus as Governor Haruhiko Kuroda’s battle to stoke inflation faces challenges from tumbling oil prices. The central bank plans to boost the monetary base at an annual pace of 80 trillion yen ($666 billion), it said in a statement.

Only a central banker could see a huge drop in oil prices as a negative for the people of Japan who import all of their oil. Keynesians actually believe a consumer spending less for energy is an undesirable outcome. This is why common folk hate central bankers.

The Japanese housing market has plunged to 2009 levels despite 35 year mortgage rates being cut in half since 2009. If borrowing at 1.56% for 35 years can’t revive their housing market, maybe they should just give the houses away. With a rapidly aging population, middle aged workers seeing their real wages falling, and less young people entering the workforce, the Japanese housing market is DOA at any interest rate.

One of the main purposes of devaluing your currency is to spur exports of products produced by your manufacturers. Japan ran trade surpluses for decades, but has now run trade deficits for 29 consecutive months. Their trade deficits have averaged more than $8 billion per month in 2014 – another feather in the cap of Abenomics. Foreign investors have lost faith in Abenomics and the Keynesian dogma which has plagued Japan for twenty five years. Abe has no strategy other than to roll out more stimulus plans, hand more money to Japanese banks and corporations, and have the BOJ buy all of the debt supporting these plans, while buying stocks in Japan and the U.S. for good measure. Foreign investors are fleeing. Inflows were down 94% in 2014. Foreign investors ran for the exit in November selling 387 billion Yen worth of stocks.

Purchases of the nation’s shares through mid-December by investors outside Japan were less than a tenth of the 15.1 trillion yen they bought last year. Japanese Trust banks, which trade on behalf of pension funds, have added 2.7 trillion yen, after being bullied into buying stocks by Abe and his central banker cronies. These same Trust banks had rationally dumped about 4 trillion yen of equities in 2013. Japanese individuals, who see the writing on the wall, were net sellers for a fourth straight year. The surprise (not to Yellen) easing on October 31 temporarily brought the Wall Street traders into the market for its initial surge, but they have since exited stage left. The only entity stupid enough to invest in Japanese bonds or stocks is the Japanese government.

With a Shiller PE ratio exceeding 30 and future stock losses virtually guaranteed, the Government Pension Investment Fund, the world’s largest manager of retirement savings with 130.9 trillion yen in assets, pledged on Oct. 31 to more than double its target allocation for domestic shares. That means they will be buying another 9.8 trillion Yen of Japanese stocks. Not to be outdone, the Bank of Japan unveiled an expansion of its asset-purchasing program, including tripling investments in exchange-traded funds to about 3 trillion yen a year. The announcement on October 31 had one purpose and one purpose only – to create a stock market rally. It worked.

The Japanese market soared by 18% in a matter of days. The Japanese .1%, bankers, corporate insiders, government apparatchiks, and Wall Streeters in the know were the only beneficiaries. Only 6% of households in Japan own any stocks. The ruling elite continue to reap the rewards, while the average person sinks further into despair and impoverishment. The Japanese boom ended twenty five years ago. The boom was illusory. The rapidly aging Japanese populace will not do the bidding of their masters. After a 25 year recession they are despondent and dispirited. They don’t trust or believe their government and banking leaders. Death by Keynsian hari kari will finish off this once great economic powerhouse.

“The boom produces impoverishment. But still more disastrous are its moral ravages. It makes people despondent and dispirited. The more optimistic they were under the illusory prosperity of the boom, the greater is their despair and their feeling of frustration.” – Ludwig von Mises

As Goes Japan, So Goes the World

Japan just happens to be ahead of the curve on the path to collapse. Europe isn’t far behind. In a shocking turn of events, it seems a bad debt problem cannot be solved by issuing more bad debt. The country which kicked off the EU financial crisis and their round of credit expansion – Greece – is imploding again. Greece, with a 26% unemployment rate, government debt to GDP of 175%, a budget deficit equal to 12% of GDP, and incapable of making their debt payments, had 3 year bonds yielding just over 3% in September. Today they yield 12%. I wonder who invested in Greek bonds at 3%. The Greek stock market had gone up by 170% since mid-2012 because their future was so bright. It has now fallen by 60% in the last nine months. Greece was a basket case bankrupt country in 2012. It is more bankrupt today. The mal-investment in Greece, aided and abetted by Goldman Sachs, created a false boom that is going bust. When it inevitably collapses it will take down many European banks and plunge Europe into depression.

Maybe that is why German 2 year bond yields have plunged into negative territory.

Maybe that is why 2 year bond yields in Switzerland, Finland, Netherlands, Austria, Denmark, France, Belgium, and Ireland have all gone negative in the last month. Those 2 year Ukrainian bonds sure look tempting at a 29% yield. What could possibly go wrong?

European country GDP rates are barely above 0%. Germany is headed into recession as Obama’s Russian sanctions have no impact on the U.S., but destroy economies in Europe. France, the 2nd biggest economy in Europe, has seen their 10 year yields plunge from 2.5% to 0.9% over the course of 2014, while their jobless rises unrelentingly to new highs. These are sure signs of a Keynesian inspired economic recovery.

With Japan in a depression, Europe in a recession, China experiencing a slow motion real estate collapse, Russia headed into recession, Brazil in recession, and all Middle East oil producing countries ($500 billion decrease in oil revenues in 2015) headed south, the U.S. is the prettiest horse in the glue factory. You can ignore the dramatic flattening of the yield curve and the plunge in 10 year treasury yields from 3% to 2.1% over the course of 2014. We’ve got Obamacare spending and military spending to pump up our GDP and the Federal Reserve to pump up our stock market. Mortgage applications at 15 year lows, new home sales at previous recession lows, real median household income 9% lower than 2008, 19% of all households on food stamps, real unemployment exceeding 15%, and the real nasty aspects of Obamacare about to hammer businesses and individuals, all add up to a fantastic year ahead for our welfare/warfare empire of debt.

The global economy is imploding. Stock markets do not reflect the economic circumstances of the average person in Asia, Europe or the U.S. Governments across the globe have been captured by banking, corporate and military interests. They have used their power to subsidize rich elite oligarchs at the expense of the common people. Their weapons have been debt, control of interest rates, ability to rig stock, bond and currency markets, and media propaganda to convince the masses these criminal actions have actually benefited them. The people are beginning to realize government is not their friend. Trusting the government to solve the problems they created which led to the 2008 worldwide financial collapse, is insane. They have saved their .1% benefactors, while impoverishing billions. Now that their “solutions” are failing again, they will use real weapons wielded by soldiers, police and prison guards to enforce their decrees and self-serving laws. The year of consequences may have finally arrived. The people versus their governments is crystallizing as the impending chaotic clash which will turn violent, bloody and vicious. Your freedom will depend upon the outcome.

“It is important to remember that government interference always means either violent action or the threat of such action. The funds that a government spends for whatever purposes are levied by taxation. And taxes are paid because the taxpayers are afraid of offering resistance to the tax gatherers. They know that any disobedience or resistance is hopeless. As long as this is the state of affairs, the government is able to collect the money that it wants to spend. Government is in the last resort the employment of armed men, of policemen, gendarmes, soldiers, prison guards, and hangmen. The essential feature of government is the enforcement of its decrees by beating, killing, and imprisoning. Those who are asking for more government interference are asking ultimately for more compulsion and less freedom.” – Ludwig von Mises

YOU MAY ALSO LIKE

Admin says; It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction.

Of course they are all tied together and the Federal Reserve bank is orchestrating the show. That’s why deficits don’t matter!! It’s a fools game to apply standard accounting rules and principles to the global financial system when the Federal Reserve bank is playing different game.

The US deficit is 18 trillion, ten years from now it may be 40 trillion. Is the 18 trillion going to be payed off, hell no it won’t. So what’s the difference between 18 and the 40, there is no difference, the debt is unserviceable.

This system will stay in place until some major player uses it’s military to unseat the Bankers pulling the strings. So forget the numbers, nothing changes until the war starts.

How’s Russia doing? The Bankers decided they needed to be bitch slapped a little so they drop the price of oil and in doing so Russia will be on her knees in short order. That’s how the game is played, it’s all smoke and fucking mirrors.

So someone please tell me why charts and numbers matter in this game of financial domination where the Bankers write the rules and manipulate every aspect of the global financial system.

Answer is–> THEY DONT

The deficit will continue to rise year after year until a World War starts. Time will prove me correct! So don’t study the numbers they mean nothing, they’re a distraction. Study the players on the stage that’s where the detonation of this rigged system will take place. Mr Putin may be the guy to pull the pin, time will tell.

Carry on………..

They work in Firefox.

I hate Google anyway.

ATHENS WE HAVE A PROBLEM

Greek Bonds Tumble As Report Sees “Decisive Victory” For Syriza

Submitted by Tyler Durden on 01/06/2015 10:45 -0500

The Greek 3Y-10Y yield curve is back over 400bps inverted this morning as bond (and stock) prices re-tumble following a new reports. As The FT reports, forecasting group Oxford Economics says it has carried out an “in-depth” analysis of opinion polls ahead of Greece’s snap general election on January 25, which shows that the radical Syriza party is on course to win a “clear mandate” to push through anti-austerity policies. Will German worry now?

The Greek yield curve has moved even more inverted…

As The FT reports,

[Oxford Economics] analysis shows that Syriza’s support is sufficient to secure a workable majority in Greece.The report says:

36% of the final vote is the approximate threshold beyond which a strong anti-austerity government is plausible. Syriza’s performance has been consistent with this in each of the last 20 opinion polls, and over 40% of the vote on average in the last five.

The report, written by Oxford Economics’ Gabriel Sterne, points out that the ruling New Democracy party could close the gap, if a tactic pays off to portray the election as effectively a referendum on an exit from the euro.

But Mr Sterne adds:

But the binary (in or out) nature of the vote decision may also help Syriza to achieve a decisive victory by squeezing out smaller parties (eg. Independent Greeks), as voters herd to the big two.

And as Reuters adds, Syriza’s leader Tsipras has warned Draghi that is QE is undertaken, it must include buying Greek bonds…

Greek leftwing opposition leader Alexis Tsipras said the European Central Bank (ECB) could not exclude Greece if it decides to move to a full “quantitative easing” program to stimulate the euro zone’s faltering economy.

…

Tsipras said he hoped ECB President Mario Draghi would decide to go ahead with the program and said Greece could not be shut out, as some economists and politicians from countries including Germany have suggested.

“Quantitative easing by the ECB with direct purchases of government bonds must include Greece,” Tsipras said.

…

In a speech laced with barbs against German Chancellor Angela Merkel and finance minister Wolfgang Schaeuble, Tsipras said his party would roll back many of the austerity policies imposed by the bailout “troika”.

“Austerity is both irrational and destructive. To pay back debt, a bold restructuring is needed,” he said.

* * *

I’m one of those who usually reads articles but doesn’t comment. That being said, after your “crickets” comment, I wanted to chime in by saying that I thought it was a very well-written article. I don’t really understand economics, but what you wrote made sense in some weird way so that I even recommended it to my husband, who understands economics better than I. He’s constantly lamenting that one can’t create debt out of thin air.

And like some others commented, I’ve been waiting for the next crash since the last one. I wish we could just get it over with.

By the way, I recently received some confirmation based on an explanation of “shmittah” that the next crash will happen by September of this year. Have you heard of that?

Anne

My crickets comment was not looking for accolades. I want the articles to spur a discussion like the give and take llpoh and SSS had. There are shades of truth in most of the comments made. They provide more substance and nuance to the original article. They provide points and counter-points that I hadn’t considered. I post stuff to get discussions going.

Martin Armstrong has a cycle model that shows a major blow up in the 3rd quarter of this year.

Garbage in, Garbage out.

“Most Americans have no real understanding of the operation of the international money lenders. The accounts of the Federal Reserve System have never been audited. It operates outside the control of Congress and manipulates the credit of the United States.” — Sen. Barry Goldwater

In reply to Ann. Statistically we are already over half way towards our next crash from our last one in 2007/08. The GDP per capita (how rich we are individually) of most, if not all, the European countries is way below the pre-crash levels attained in 2007 still. We are in the middle of the good times, believe it or not ! My advice is to enjoy this time.

The government’s very, very last resort will be to print money out of thin air (unlike QE which is still borrowed money) as a way out of their underfunded liabilities and their out of control debt/GDP levels. This always leads to a currency devaluation. Always. This reduces debts and savings in equal measure in real terms. In effect transferring money from saver to debtor.

As always, Japan is the trail blazer here. Where they tread, we will follow.

Many of us thought the big nations states are subject to the same consequences for debt and reckless spending as the rest of us. Since 2008 we have been proven wrong time and time again. What many realize now is that countries like Japan (and its big brother America) are NOT subject to economic consequences. Their gigantic military machines, intelligence infiltration and wiretapping blackmail operations prevent any collapse from happening.

Like Don Corleone having all the politicians in his pocket, and 100 made men surrounding his compound, no one will challenge the current paradigm until a competing faction feels strong enough to do so. The collapse is being delayed indefinitely by the brute force of millions of individuals willing to do ungodly acts in the name of the status quo.

Also there are many, many people who are complicit in maintaining the current situation. They are not just the “.1%” as stated. Common people will sell their souls for peanuts just as willingly as oligarchs. The local news anchor who peddles PC language to please her boss. The two bit lawyer who pushes a harassment lawsuit for some freak who would rather collect than work. The computer geek who programs components used in weaponry that kills people he will never have to see. The public school teacher who works for the weekend, knowing the union has her back. The goofoff of a tradesmen who secures a town contract milking taxpayer money in lieu of competitive pricing.

Many of these people know the prosperity meme is bullshit. But what’s wrong with bullshit if it puts another car in your garage or a swimming pool in your backyard?

“Martin Armstrong has a cycle model that shows a major blow up in the 3rd quarter of this year.”

Howard Gold of marketwatch had this to say:

“I do see deeper corrections ahead, and this bull market is definitely getting long in the tooth. So 2015 may have more volatility and more modest gains than 2013 and 2014 did, but I see no bear market in U.S. stocks. At least not this year.”

The only way to not have a market implosion is to keep monetizing debt, it’s the only ammo they have left. The propped up market only benefits a few .01%ers, this shit is starting to catch up, fast.

Of course Marketwatch is now claiming that low oil prices will hurt the rebounding housing market, so take their advice or alleged wisdom with a huge grain of salt.

card802

More specifically, marketwatch says that crashing oil prices will negatively impact home-price appreciation

http://www.marketwatch.com/story/crashing-oil-prices-to-hit-home-appreciation-2015-01-06?link=MW_popular

Admin – I understand what the old spook was trying to say, I think. He was voicing a bit of respect for the people of the country. I generally believe most folks are kind, generous individuals. And I like them individually.

But fact is, they are getting exactly what they want and deserve. I well remember the rapturous applause for Obama matched with adulatoryfacial expressions. Hillary will get the same. The majority of dickheads want these assholes as their leaders.

And when you combine that with the way the people behave re their personal fiscal responsibilities – ie gimme shit now on my credit card, or gimme free shit, etc., their is but one conclusion to be made:

By and large Americans are total mental imbeciles who deserve exactly what they are getting and will get.

I am never going to absolve them of their responsibilities in this. Yes the wolvs are taking advantage of their stupidity, and I do hot like the wolves, either. But I nderstand it is the natural order of things – wolves eat sheep. And the sheep are too damn stupid to know it is even happening.

LLPOH

Many people want to blame it all on a bad guy when there are multitudes. They never want to take any blame themselves. I fall on your side when it comes to the average American. We are all personally responsible for our lives and our actions or in-actions. Infantile is an apt description for a large swath of Americans. When you have an arrogant, hubristic, evil few at the top and a majority of docile sheep among the masses, you get what we have now. I do believe their hubris will result in their downfall and the common people will revolt when their free shit stops flowing.

Admin – those Greeks have balls the size of coconuts: “hey, I want total forgiveness of all my debt, which I am not going to pay, and by the way, you fucks need to buy more of my bonds, which you need to forgive as well, as I won’t pay those either.”

I am starting to think that the Greeks may be cut loose this time. They are gonna sink like a rock.

Speaking of infantile …. oldie but a goodie

Llpoh

Blow me.

Stuck – you saying you voted for Obama? Damn, that is so disappointing.

Are you fucking SERIOUS??? NO!! I did not vote Obongo.

I just think you should blow me.

What’s it going to take to establish a new reserve currency? Bretton Woods has become a bad joke.

Stuck – you are trying to move up from hand jobs, then. Very ambitious of you.

However, you should set your sights higher than an old, butt-ugly Indian (I really must emphasize the butt-ugly part).

I am honored you would consider me, but unfortunately I do not like chicken. I prefer fish – especially tuna. Nothing beats the way nice, fresh tuna tastes on the end of your tongue, all juicy and warm.

I understand that bb swings from both sides of the plate, and does dual duty out of the back of his Fedex van. And we all know he works cheap. Give him a call. I am sure he would be willing.

For the record, hara kiri is a vulgar term. Seppuku is the polite term, The difference is between cow shit and manure.

LLpoh

I was just testing you. You said, ” I generally believe most folks are kind”, and I wanted to see if a mere “blow me” would turn you into a mean Injun. Almost worked, but you suddenly became a Don Rickles.

Admin and Llpoh

Look you two, shitting all over the mental acuity of the American middle class may be somewhat accurate, but it is not useful. You both have forgotten an important factor in this middle class blame game equation. Education, or the lack thereof.

It is quantifiably provable that key metrics of success in K-12 education started to slide rapidly in the mid-to-late 1970s. Let’s just say “about two generations ago.” Now, what the fuck did you expect to come out of this pipeline? Competitors for the Nobel Prize for physics and chemistry?

The vast majority of kids, probably north of 90%, have NO say in where or how they are schooled, with “how” being the most important. Playing in the school band or taking Mexican-American studies gets you nowhere. Mastering English and math? Well, you know the answer.

Certainly, poor education does not apply to probably even the majority of the under-40 crowd, but it does apply to enough tens of millions to make a huge negative impact on the economy and explain the multitude of bad decisions made by these people. Admin calls it mentally infantile. I have a better word ……. ignorant. And it largely doesn’t need to be that way.

SSS

I did not get an education from school. I got an education because I wanted one. I passed required courses and got good grades because that was what was required. School has virtually nothing to do with getting educated. If I’ve used 5% of what I learned in school over my life, I’d be surprised. What I did was read books in my spare time. I read history. I read the classics. I read dystopian novels. I read anything I could get my hands on. This had nothing to do with school. It’s called curiosity and a desire to learn. It is virtually non-existent in the vast majority of INFANTILE America who spend their time facebooking, twittering, instagraming and watching the Kardashians.

Your Norman Rockwell vision of America is false. The people you describe are few and far between. Most of them are on this site. The oligarchs deserve a major portion of the blame, but the infantile masses allowed them to gain this power. You reap what you sow.

SSS – the state of education is indeed appalling. My freshman child just got straight A’s, and said college was easier than high school, and the average freshman was dense as a lump of lead.

The English prof had my kid – and I kid you not — grading papers and tutoring the other kids in the class. My kid asked, naturally – WTF?! How am I supposed to do my own work/learn anything if I am spending my time doing that?! The prof said do not worry about it, just help them, grade the papers, and I will give you an A. Unbelievable. My kid transferred out at end of semester to hopefully a more rigorous program, even tho the original one was well regarded. 80% of the freshman class had to take remedial math. And by remedial I mean these kids could not manage Algebra 1.

It is a catastrophe, and parents are letting it happen. That a prof thinks it is ok to use my child as an assistant is beyond belief, and shows how dysfunctional the system is.

I blame the parents. This is the first time in US history that a generation will be less educated than the previous. That is quantitative. It is even worse when considered qualitatively.

Son of a bitch, this stuff pisses me off. How can people be so stupid?

Great blog post, great comments. Got here from LewRockwell.com.

If only more people visited zerohedge and LewRockwell . . . . and the links that follow therefrom . . .

The zillion dollar question is “when?”

I’ve read and agreed with gloom and doom for decades, all the while having to acknowledge, with Sensetti, that “when” is not now. I have to admit that the levitators are smart, quick on their feet, always ready to meet a new crisis with another asset class to boost, another source of leverage, always, somehow, more debt. Somehow, the system persists.

So, what will be the trigger that precipitates a mortal loss of confidence in the infinite fiat dollar?

More importantly, when?

And one more thing, Admin and Llpoh, how about the tens of millions of “mentally infantile” among us, young and old, who have used their limited educational skills and NOT made bad decisions? They work hard, care well for their families, drive (and sometimes fix) clunkers, don’t take out payday loans or visit pawn shops, and don’t buy shit they can’t afford. Stuff like that.

They’re out there. They don’t have a fucking clue about quantitative easement, but they do know their electric bill just jumped $15 a month and their water bill $5 a month. They may not understand WHY (new EPA rules?), but they do understand they’re paying more money for the basics.

And through absolutely no fault of their own, life got just that much harder.

Llpoh –

One room school houses were very effective in part because all 8 or 9 grades were taught in the same room; that meant that quick kids in some subject would sit in on the next grade’s lessons while slow kids would be told to listen up now while the teacher was covering their slow subject with the younger grade’s lessons. Lots of penalty/reward motivation in that context.

Admin, Kate Upton would be real nice maybe a little Jennifer Lawrence ,too.

SSS – life is not fair. Any thought that life was meant to be easy was in error.

The folks you mention will be better off than their equivalent competition. That does not mean their lives will not be brutally hard. That is the nature of life – you have to do whatever is necessary to put bread on the table and survive.

Almost everyone thinks they should be able to work 40 hours at a job (the whole idea of jobs pisses me off, as it effectively shunts responsibility for people’s livelihoods onto magical producers of “jobs”, and said producers then come under attack for being rich, for being abusive, for damaging the environment, etc ad infinitum.) and live a nice life and go home to a big TV, nice house, good medical facilities and great education for your offspring, and a nice fat pension when they turn 65.

What a joke. It is not going to happen. At least not for much longer. There is not enough being produced to pay for the promises. Too few are producing too little and there are far too many parasites.

SSS – good intentions and doing the responsible thing will no longer be enough. That is the most unfortunate of things.

Admin – What an excellent job! Who says these little Pennsylvanian boys can’t write! I hope people spread this article far and wide on the Internet. I know I will. Spot on! Thanks, Admin.

Xbacksideslider – most teachers today cannot teach one grade or subject, much less multiples thereof.

Llpoh

I share your disdain for our nation’s educational system. It is corrupt and largely, but not totally, ineffective.

I am a small town boy, born and bred. I love small town America. I have visited all 50 states, many of them extensively, and lived in 8. Without exception, my life experience tells me that there are a great majority of Americans who are just really damn fine, down-to-earth people.

From the employees of a mom-and-pop restaurant in North Dakota to a one-man show at the Pueblo Indian roadside shack selling pine nuts in Colorado, I love these people. I know that they will likely never live the Life of Riley, and they probably do, too. It’s just that they are not angry, nor perhaps even content. But they are ……. good people.

You just can’t beat that. And seeing them get hosed by Wall Street and DC makes me see red.

Xbacksideslider

Your question of “when” has been hashed out a thousand times on sites such as these.I used to think the answer was when the cabal had stolen every last penny their hot little hands could heist. Now I think they have planned something to combine their getaway with moving us into a new paradigm.The phoenix rising from the ashes of the old, complete with wonderous things . The destruction of the final stage will be a bumpy ride. Should we be in a hurry as some have indicated ? Are you ready to endure the horrors of a final turning? I am more than a little anxious.

Thank you! I’ve been looking for a long time for an article that summarized why the global economy is going to go kaplow, that I can send to my smart but uninitiated friends. This is the closest thing to that I’ve seen.

What would make it even better for that purpose is more historical comparisons and more following the consequences through to the projected end. (And maybe less Japan and less stock markets–the latter, as you say, are largely irrelevant to the real economy except as a misleading indicator.)

“Schooled” and “Educated” are 180 degrees apart and I imagine for most of the “schooled” individuals “education” seems redundant – they don’t know what they don’t know and they don’t care.

Curiosity is a trait – I don’t think that can be forced onto anyone.

Education is a choice.

Admin

…and we are soon to reap the whirlwind.

“Your Norman Rockwell vision of America is false.”

—-Admin @ SSS

Speaking of Rockwell, who was often sneered at by critics as an illustrator and not a painter, my wife and I attended an exhibit of his original paintings. Place was jam packed. His work was simply awesome. This from Wiki ……

“The 2013 sale of Saying Grace for $46 million (including buyer’s premium) established a new record price for Rockwell.”

Illustrator, my ass.

SSS

The sales price of his painting tells you everything you need to know about how warped our society has become and the value of things. He’s rolling over in his grave knowing how far this country has fallen.

Olga – “they don’t know what they don’t know” is very accurate, and your comment that you can’t force “curiosity” onto anyone is interesting. Admin called it “curiosity and a desire to learn”.

Where does that come from? What makes one person curious and the other not? We know it doesn’t come from the education system because there are many highly educated people who are full of book knowledge, but are not thinkers. They do not connect dots, see similarities. Maybe it’s just INTJ-type people who really see, in which case we’d better watch our backs when this all falls apart because they’ll (TPTB) be coming after us.

I am well read in psychology (not that I understand it all, and I’m not talking about the psychobabble stuff). In fact, I believe it is the one subject that should be mandatory over all others in school. We certainly know TPTB use it in behavioral economics. Bernays seemed to think it was very important, and indeed it is. Those of us on this site know that people are being “herded,” that fear and other techniques are used to get them to move. Psychopaths (most of our current leaders) are well versed in what motivates people; they make it their business to know, all the while knowing you haven’t got a clue what they’re doing.

One thing I have learned is “intellectual growth does not occur apart from emotional growth; the two are intertwined”. Creative and curious people are not conformists (the one thing that gets hammered into you by most parents and the school system). If you live in a loving and free environment where you are free to explore, yet feel physically/psychologically/emotionally safe, you will be curious and creative, you will question things (which is exactly what TPTB don’t want).

I don’t know how to go about changing this, yet I believe that most people are holding greatness just below the surface. It’s there; it’s just been stifled, and stifled so much that they just follow the herd.

Admin – great that you pointed out that all of the central banks are colluding, acting in concert. The media try to portray that each country is acting separately and it’s just a big coincidence when one takes over the moment another one stops. Yeah, right! You can’t fool Admin!

T4C, thanks, I just watched Princes of Yen in its entirety. Totally reinforces my comment that the Centeral Banks control, and manipulate Counties and markets.

Just like the case of Greece. What do the charts and numbers mean?

Answer is–> Absolutely fucking nothing!!

The Centeral Banks will either prop Greece up or they will take them down. The fundamentals are meaningless. The only relevant conversation about the future of Greece will take place around a table at the ECB. The decision made at that table will determine the future of Greece.

You would be correct to extrapolate the above paragraph to ALL Countries and Markets, well almost.

[img [/img]

[/img]

‘Twas I above

This- “Admin – great that you pointed out that all of the central banks are colluding, acting in concert.”

Are they colluding and acting in concert, or are they largely(wholly?) a single entity, no collusion necessary, at least in the west under the Rothschild Banner. A perennial mystery for most, who exactly owns them?

@T4C = I have a couple friends coming over to watch it tonight – thanks.

@ back – I do think it’s an INTJ thing – I work with a building full of licensed engineers, MBAs and assorted other highly degreed individuals and for the most part they are a most incurious group of people. The can talk about people, they can talk about things, but either they can’t or won’t talk about ideas. They can ALL talk about last night’s game. I suspect I read more in a month then they read in a year.

@SSS – I saw that Rockwell show a few years ago – he was an amazing artist but perhaps helped (enabled?) a Nation to cling to a self-perception that wasn’t always deserved. The “Rockwellian Spell”

His well-known The Problem We All Live With, made in 1964 for the interior of Look—three years after the event it depicted—shows in sympathetic detail the entrance of a young, black schoolgirl into a desegregated school, escorted by National Guards, the brutal epithet “NIGGER” scrawled in the background, a blood-red splash of rotten tomato behind her, as if she is just one step ahead of the mob. In its own way, it is as homiletic as his earlier work, but of a different world (partly because, Rockwell remembered, the Post had editorially mandated that African Americans only be shown in service-industry roles);

Do they really want to hear about Rockwell’s disdain for his hypochondriac mother, about his trip to England to secure a safe abortion for his second wife in pre-Roe U.S., his dependence on pills to control his anxiety, his 1962 admission that, “I was born a white Protestant with some prejudices which I am continuously trying to eradicate”? Likely not, because to learn about the actual Rockwell is to undo the power of the “Rockwellian” spell.

http://www.slate.com/articles/arts/books/2013/11/norman_rockwell_biography_deborah_solomon_s_american_mirror_reviewed.html

So now the question is? If we can keep printing,What will actually cause the collapse?

Your article was good. The last few weeks have me seeing nothing but stuff on TV about how great everything is! The markets to housing.Jobs. Obama is coming to Phoenix and will talk about how to get more people into houses. With what jobs? And what jobs that are in Phoenix, the wages don’t meet the cost of housing at all.

Personally, i get the feeling that the Uber wealthy are all preparing for a collapse. They are just doing what they can to put it off while they pack and move. Others are setting themselves up for some kind of strange agenda 21 government after the collapse. Using the failure of our current system to explain why their way is better. No matter that their Cloward and Piven strategy helped bring about many of our problems. The onslaught of green programs and programs on TV that are funded by the elite. More fear based programing to bring about the desired effect of people almost begging to be controlled by the government or some program. I dont know what is worst,The terrorist crap or the end of the world climate change crap. Keep up the good work admin!

The Problem We All Live With

Great article, Jim. Like others, I have nothing to add… you’ve confirmed that Japan is going to be one of the major tipping points for a global economic meltdown. I’ve kept watching for Krugman to admit his gloating over the massive stimulus was wrong (he said it should have been larger), but he only released another of his infamous “victory laps.”

Like so many things, those of us who are aware knew all this was coming. Now that the S has HTF, I’m just buckling down and trying to control my own little world. The collapse began some time ago, and all the events of the past few months are following along right on schedule… just as in other turnings, there isn’t one, huge event, but rather series of them over time that demonstrate just how society is forcing outdated institutions to fall apart. History will piece them all together, in retrospect, but no one should doubt that we are already in full-scale collapse.

Just look at the responses to police brutality. To the terrorist attack in Paris. The increasing nationalism in countries all over the world, wanting to be rid of U.S./outside influence and especially anti-immigrant sentiment. It’s all fourth turning stuff, and it’s all going to end up leading to total war, as it always has. There will be ratcheting up and down along the way, in one location but not another, but the end result will be the same… complete destruction of what doesn’t work and (hopefully) replacement with something that will.

Thinker

My next article will be a Fourth Turning update. The tentative title is:

2015 – Fourth Turning Crisis Deepens; Wars on the Horizon.

It should be a real laugh-fest.

Looking forward to that!

Excerpts

Economic Terrorism Against Russia Intensifies

The Russian ruble fell a further 7% Monday. What is the “reason” cited in the Corporate media for this latest, further plunge in its “value” (i.e. exchange rate)? An “economic report” which shows that Russia’s economy is shrinking. Here we see the pattern of the economic terrorism perpetrated by the One Bankexposed.

In the case of the attack on Greece, because it shares a currency with other European nations; the One Bank could not use currency-manipulation as its tool of destruction (as it is presently doing against Russia). Instead, it launched its economic terrorism at the debt market of Greece.

Supposedly, according to the propaganda machine; the real “culprit” for India’s current-account deficit was (surprise! surprise!) India’s gold imports. As soon as India’s government succumbed to blackmail, and blocked its gold imports, the rupee (magically) began to rise in value, and the “current-account crisis” dissipated.

http://www.zerohedge.com/news/2015-01-07/economic-terrorism-against-russia-intensifies

“The sales price of his (Rockwell’s) painting tells you everything you need to know about how warped our society has become and the value of things. He’s rolling over in his grave knowing how far this country has fallen.”

—-Admin @ SSS

Bullshit. For centuries, here and abroad, the wealthy have ALWAYS been the top patrons of the arts. It’s big money chasing big money when it comes to private ownership of a famous painting or sculpture or whatever. Ergo, sales prices keep climbing.

Now, stop trying to pick a fight with me. You should know the ending by now. Heh.

How SSS views cops.

The infantile masses crying for their bottle.

“For those with compunctions about not paying their debts, recall how much compunction the banks and the government had about reaching into taxpayer pockets when banks’ speculative, highly leveraged business models fell apart in 2008. How much compunction have they demonstrated since as the central bank has promulgated a microscopic rate regime to artificially lower the banks’ cost of funding, while eliminating the return on honest savings? The banking system is just as speculative and leveraged now as it was in 2008, and even more concentrated. Global debt is over 40 percent higher.” Robert Gore

The Rothschild comment above got me poking around looking into their story, unbelievable. Rothschild’s power and place in the financial inter-workings of the world would be an interesting topic.

One surrounded in subterfuge, lies, and mystery.

Great article, as usual… but do agree people have become jaded, even the “bulls” are bored with these completely backstopped markets and economies

It will take a surprise event outside of the control of the elite to rock this boat, which is becoming more impossible as their control spreads … a natural catastrophe, a surprise military insurrection or mutiny against the Fed or Congress would do it, but seems highly unlikely

BTFD is the play until then, though $20 trillion US debt might get the ball rolling again, that may be 3-4 years off yet!

Without the fall of the petrodollar… Without the start of WWIII…. Without the rise of another U.S. civil war….. Without a complete repudiation of the Federal Reserve charter…. Without the disassembly of the Federal government…. Without defending our borders and valuing the definition of a natural born citizen… Without the return of Glass Steagall act and the jailing of the top 10,000 bankers…. Without a return to the truth of the U.S. Constitution and of We, the People…. We are doomed to live in the matrix and the fiat game will continue even if the dollar ends.

The rise of a completely digital currency is already being queued up as the great answer for the failings of a paper fiat system. Our fate, as serfs, will be sealed then because all measures and fruits of your labor will be entirely in their hands. This fourth turn is for all the cookies. It’s not about hanging onto your weath, but about whether we regain our freedom and have the ability to pass on these values and rights onto the next generation. They, TPTB, are trying to wear down the fortitude of the critical and free thinkers to drain us of our vigilance and our fight and, based upon some of the above comments, they are winning. They can and will keep this crappy debt currency going for longer then any of us want because its freaking exhausting trying to stay ahead of it. Stay true and keep your head in the marathon!