Nothing to Lose

There is a specter haunting America … and all the developed nations of the world.

It is the specter of a debt revolution.

We left off yesterday talking about how the economy of the last 30 years – and especially that of the last six years – has favored the old over the young.

“Rise up, ye young’uns,” we as much as said, “you have nothing to lose but your parents’ debts.”

We showed how the value of U.S. corporate equity, mainly held by older people, had multiplied by 28 times since 1981. That was no honest bull market in stocks; it was a market sent soaring by an explosion of credit.

But what did it do for young people whose only assets are their time and their youthful energy? Alas, the real economy has increased by only five times over the same period.

Non-financial corporate equity valuation vs. GDP 1980 – 2015, indexed. The gap has never been larger than today, via Saint Louis Federal Reserve Research – click to enlarge.

Non-financial corporate equity valuation vs. GDP 1980 – 2015, indexed. The gap has never been larger than today, via Saint Louis Federal Reserve Research – click to enlarge.

A Grim and Menacing Specter

And when you look more closely at work and wages, the specter grows grimmer and more menacing. Average hourly wages have barely budged in the last 30 years. And average household incomes have fallen – from $57,000 to $52,000 – in the 21st century.

But as our fingers came to rest yesterday, there was one question hanging in the air, like the smoke from an exploded hand grenade: Why? Was this huge shift – of trillions of dollars of wealth from young working people to old asset holders – an accident?

Was it just the maturing of a market economy in the electronic age? Was it because China took the capitalist road in 1979? Or because robots were competing with young people for jobs? Nope… on all three counts.

Industrial robots – not at fault

Industrial robots – not at fault

Photo credit: BMW

First, old people, not young people, control government. Ultra-wealthy campaign funders like Sheldon Adelman and the Koch brothers were all born in the 1930s. The big money comes from wealthy geezers like these, eager to buy candidates early in the season when they are still relatively cheap.

Old companies fund most Washington lobbyists, too. And old people decide elections: There are a lot of them… and they vote. They know where the money is.

Second, the government – doing the bidding of old people – restricts competition, subsidizes well-entrenched industries, raises the cost of employing young people, and directs its bailouts, cheap credit, and contracts to the graybeards.

Third, the credit-based money system increases the profits and prices of existing capital. It encourages borrowing and spending. This rewards the current generation while pushing the costs into the future.

Casino magnate Sheldon Adelson – as we have previously pointed out, he’s the quintessential crony capitalist. To say that the current system has been to his advantage is actually understating things somewhat.

Casino magnate Sheldon Adelson – as we have previously pointed out, he’s the quintessential crony capitalist. To say that the current system has been to his advantage is actually understating things somewhat.

Photo credit: Ethan Miller / Getty Images

Grandparents Prey on Grandchildren

None of this was an accident. None of it would have happened without the active intervention of the old folks, using the government to get what they could never have gotten honestly.

This is not the same as saying they were completely aware of what they were doing and what consequences their actions would have. We doubt the Nixon administration had any idea what would happen after it tore up the Bretton Woods monetary system in 1971.

It was behind the eight ball, fearing foreign governments would call away America’s gold. Few in the White House realized they had made such a calamitous mistake when the president ended the convertibility of the dollar into gold.

And yet it created a world in which parents and grandparents could prey on their grandchildren… for the next 44 years. And it’s still not over. The new credit money – which could be borrowed into existence with no need for any savings or gold backing – was just what old people needed.

Preying grandmother bursting from the attic

Preying grandmother bursting from the attic

Image credit: Universal Pictures

We have estimated that it increased spending by about $33 trillion over and above what the old, gold-backed system would have allowed. That spending lifted the value of the geezers’ assets and increased their living standards.

Meanwhile, the average 25-year-old reporting for work in 2015 can’t expect a single dollar more in real hourly wages than his father did in 1980. The total value of outstanding U.S. corporate bonds was 17% of GDP in 1981. Now, it’s $11.6 trillion – or 65% of GDP. What did corporations use that money for?

Some of it went into capital investment that made companies more productive and more profitable. But much of it went where you would expect it to go: to buy back shares… to acquire other companies at inflated prices… and to pay off executives as the value of their share options went up!

Who did this benefit? Mostly people over 50. Government debt is even worse. Unlike most personal debt, it doesn’t go to the grave with the person who borrowed it. It sticks around to burden the next generation – who got nothing from it.

Federal debt over time … after Nixon defaulted on US gold obligations, it started going parabolic, via Saint Louis Federal Reserve Research – click to enlarge.

Federal debt over time … after Nixon defaulted on US gold obligations, it started going parabolic, via Saint Louis Federal Reserve Research – click to enlarge.

Federal debt in 1980 was less than $1 trillion. Today, it is $18 trillion. That money was used to fund federal programs – few of which provided any benefit to young people. An accident? A mistake? Partly. But old people must have known what they were doing.

He sure looks like a suspect …

He sure looks like a suspect …

Photo via Pinferest.com / Author unknown

Their lobbyists asked for the spending. Their politicians voted for it. Their companies enjoyed the revenues. And they pocketed much of the money. When the economy threatened a correction, they demanded more credit on easier terms to keep the money flowing. And when their credit balloon popped in 2008, they whined to the feds to protect their ill-gotten gains.

Honest capitalism? Not if they could prevent it. Creative destruction? Not on their watch. Pay for what you get? Not if they could put the bills on the next generation.

Young people of the world, unite!

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners. Bill Bonner founded Agora, Inc in 1978. It has since grown into one of the largest independent newsletter publishing companies in the world. He has also written three New York Times bestselling books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

I’m a very late Baby Boomer.

Those who are in their 80’s and 90’s, nearing the end of their lives, are the ones who (among the general population) made out like bandits on this.

They retired at 60, or 62 and lived quite comfortably on the nearly-free medical care, the prosthetic hips/knees, the not-too-shabby Social Security payments added to the not-yet-phased-out corporate pensions.

Or if they were cops, firefighters or state workers, they retired at 55 and made out like KINGS.

But an Empire of Debt is also an Empire of Illusions.

Debt on a scale this large allows people to think they can have their cake (I own lots of wealth, in the form of IOU’s) and eat it, too (I can then borrow a lot, issuing my own IOU’s, and live very high on the hog.)

Debt makes people think they don’t need to save. (Entitlements are a form of debt, don’t you know?)

Debt makes firms let their capital maintenance fall off.

Debt substitutes for capital formation, so none forms.

Never in recorded history has there been such an EXPECTATION of future wealth, all based on IOU’s, not on vibrant manufacturing and exciting innovation.

People look at tens of TRILLIONS of dollars of IOU’s and think it represents wealth.

It does…as long as only a tiny fraction of people convert those IOU’s to spendable money and then buy a boat, a vacation home or a side of beef with it.

If more than a tiny fraction of people “cash out,” the wealth begins to evaporate as the market price falls, just as it has for bonds all year long. All it takes is a change in mass psychology, and no one seems to notice that at first.

This is the tiniest early trickle of the coming Biblical Flood.

Once it gets up some velocity in a year or three, the total of perceived wealth residing in IOU’s will be accelerating downward at 32 feet per second-squared.

The meat of the Baby Boom will be hit with a loss of expected wealth on a scale like each person’s own Hindenburg blew to smithereens in their back yard. All the windows of their house will be glass shards, and all those old folks will be flat on the floor, cut to ribbons (metaphorically.)

This is coming. On this I’m pretty confident.

IOU-wealth is going to disappear, leaving I-hold-title-to-wealth more valuable than ever. The trick is to figure out what kinds of wealth in which to hold title, given that any wealth that is VISIBLE is apt to be targeted by taxing/seizing Authority doing AARP-voters’ bidding.

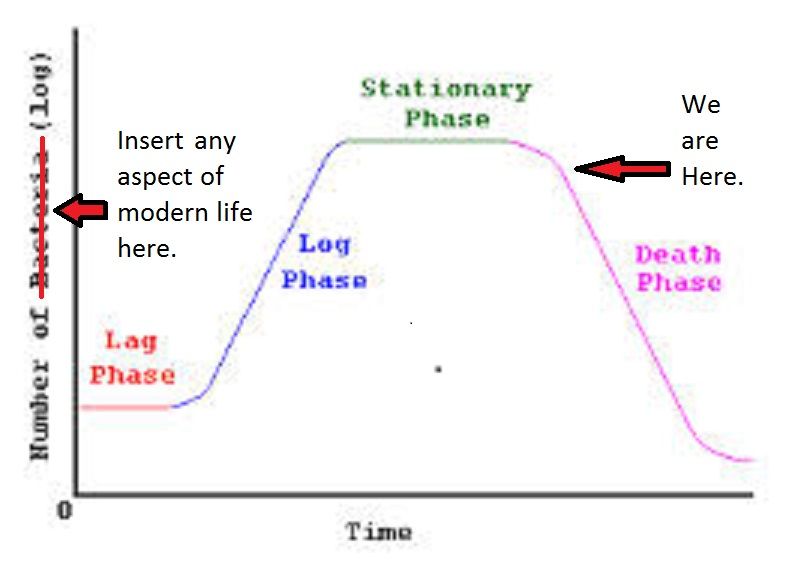

I will repost a simple graphic that Explains Everything You Gotta Know about our current situation.

[img] [/img]

[/img]

DC, there was a study published a couple of days ago that your commentary reminded me of:

http://www.wkrg.com/story/29051525/reality-bites-for-boomers-unable-to-work-in-retirement-new-study-unveils

Not so sure I buy into this premise. I’m going to try to reread this tonight, see if I can get bills point.

dc.sunsets—very poignant comment. So, right in many ways.

bea lever–Someone else agrees with me on the me, Me, ME generation. The gimme generation The entitled Boomer generation.

I call the generation the grew up in the great depression and made it their life’s work to make up for their childhood deprivation with abject materialism, the greedy generation, who are mostly gone. But they passed on their sins to the Boomer generation.

Nothing is free in this world. Everything has a cost and a risk. Thoughtful planning means thinking about the consequences of your actions, thinking about others instead of only yourselves and what’s in it for me.

Like Rome and the Nazis, where plunder and the thievery, increased your standard of living, the US of A engaged in financial rape, for resources, of third world countries and anyone who they did business with. Like Rome and Hitler, any resistance to being pickpocketed resulted in your being up to your a** in jackbooted thugs.

Empires are expensive to run. Guns and Butter needs a lot of money. Where did the US of A get the money? They stole it by taking the purchasing power of the money thru inflation and borrowed the rest without any intention of ever paying it back.

Well, actions have consequences. They call it ‘the chickens coming home to roost”.

One last note, the truth is, debt is never passed on to future generation, but is always paid in present time by those who incur it. Baby Boomers, the piper is at the door and wants to be paid for your dance, so, dig deep into your pensions, bank accounts, retirement funds, and the value of your money. It was a great party while it lasted..

DC: You analysis is good but even retarded investors know that most bonds are junk now (bonds are bombs) and their fall is because everyone (not just baby boomers) wants something safer. Besides if 80% of trades are by HF computer algorithms, how can you blame just us old geezers (we are much better with hot rods, guns and tractors; what about those younger go-go professional NYC digital thieves that never get their hands dirty or sweat?).

I agree that people who retired in the 80,s and 90,s are better off than anyone who is retiring now or into the future.My father pointed this stuff out to me. I am just trying to appreciate how good I have it right now before the economy collapses and life becomes much harder. I sure hope Hillery backs out so i don’t have to listen to her cackle for months that will seem like years.

yahsure—Don’t worry about listening to Hillary’s crackle. She’s the silent candidate, like Silent Cal. If she did give an interview, the questions about Benghazi, shredding documents, Bill and her foundation would be fourth coming and an embarrassment to answer.

The Clintons stonewall and lie, hoping that time will erase the thoughts from the minds of the public. Some truth to that. Making a pig’s ear into a silk purse.