If you think a $1 trillion infrastructure boondoggle and allowing mega-corps to repatriate trillions in overseas funds tax-free is going to Make America Great Again, you are delusional. Hussman provides some inconvenient truth.

Guest Post by John P. Hussman

“My advice would be that several principles should be taken into account as you make these judgments. First of all, the economy is operating relatively close to full employment at this point, so in contrast to where the economy was after the financial crisis, when a large demand boost was needed to lower unemployment, we’re no longer in that state. CBO’s assessment is that there are longer-term fiscal challenges; that the debt/GDP ratio at this point looks likely to rise as the baby boomers retire and population aging occurs; and that longer-run deficit problem needs to be kept in mind. In addition with the debt/GDP ratio at around 77%, there’s not a lot of fiscal space should a shock to the economy occur; an adverse shock that did require fiscal stimulus.

“I think what’s been very disappointing about the economy’s performance since the financial crisis, or maybe going back before that, is that the pace of productivity growth has been exceptionally slow: the last 5 years, a half percent per year; the last decade, one and a quarter percent per year. The previous two decades before that were about a percentage point higher, and that’s what ultimately determines the pace of improvement in living standards. So my advice would be as you consider fiscal policies, to keep in mind and look carefully at the impact those policies are likely to have on the economy’s productive capacity, on productivity growth, and to the maximum extent possible, choose policies that would improve that long-run growth and productivity outlook.”

Janet Yellen, 11/17/16 testimony to the Joint Economic Committee

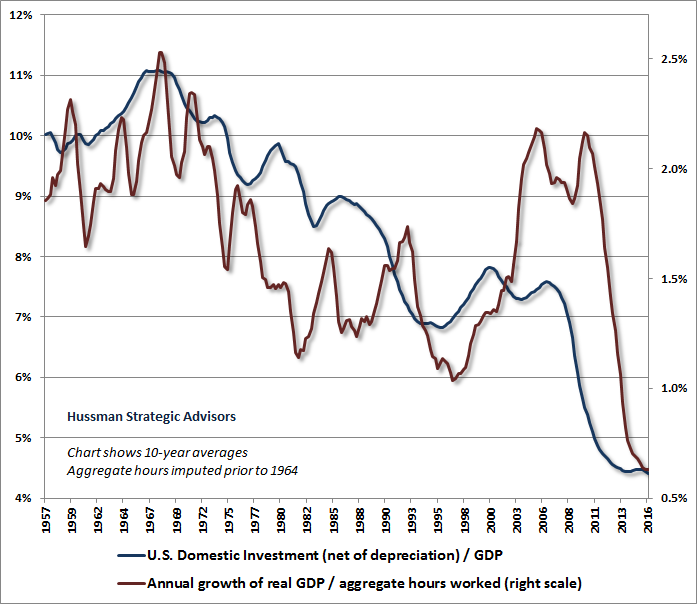

I have to say that of all of Janet Yellen’s discussions since taking the position of Fed Chair, last week’s comments to the Joint Economic Committee struck me as the most lucid. Perhaps it’s only because they align with my own economic views on the critical role of productive investment (see last week’s comment Judging Economic Policy), but it also appears that since the Fed is now on a course of slow normalization of monetary policy, Yellen has less need to justify the continuation of a reckless policy on the basis of empirically unsupported arguments. The slow growth in productivity noted by Yellen has been paced by weakness in U.S. real gross domestic investment. We’ve actually observed zero growth in U.S. real gross domestic investment over the past decade, compared with growth of about 4.5% in the half-century prior to 2000. The chart below expands on the one I presented last week, showing U.S. domestic investment (after depreciation) as a share of GDP, compared with the growth in real output per labor hour.

While the markets appear convinced that substantial infrastructure spending is forthcoming, the existing policy discussions remain quite vague, and the focus strikes me as all wrong. As other observers have correctly emphasized, the U.S. lacks enough skilled labor in the heavy construction sector to actually implement large-scale infrastructure spending projects on the scale being discussed, unless foreign firms were recruited to implement them. As for energy-related projects, my impression is that sucking the last vestiges of fossil-stored sunlight out of the ground using more technically-advanced straws is less of an investment than a reflection of stunted vision, given that unlimited amounts of convertible sunlight are, and will be, available as long as humanity exists. Not that a Republican-led Congress that leans to the fiscally conservative side would be likely to approve massive new spending in any of these areas, but even if it did, the first dollar would not likely be spent until well into 2018.

Meanwhile, though it’s widely suggested that repatriating corporate cash held abroad would lead to a huge expansion of new investment, this idea runs into two problems. First, major corporations already have ample access to funding for any project they could reasonably consider. Even if cash is held overseas, it’s rather easy for corporations to effect interest-rate swap transactions that effectively make the funds available domestically (invest cash held abroad to receive floating-rate interest, borrow funds domestically and pay a fixed rate, enter an interest-rate swap that pays floating and receives fixed, and it’s as if you’ve instantly brought your money home).

Moreover, providing tax breaks to corporations to repatriate funds is nothing new. The U.S. did the same thing in 2004. Rather than creating jobs, the funds were largely used for corporate stock buybacks, acquisitions, dividends and bonuses, while the top corporate beneficiaries actually cut jobs and decreased research spending. So let’s encourage productive investment, particularly where those investments relieve binding economic constraints, expand capacity in useful and sustainable directions, carry spillover benefits for others in the economy, require those who use public funds to have their own capital also at risk, and are likely to produce substantial economic benefits per dollar spent. But let’s not squander a great opportunity for a pro-investment fiscal agenda by imagining that the economy will benefit from massive loosely-conceived infrastructure projects or tax breaks that rely on misleading economic and financial arguments for their public support.

Over the past couple of weeks, the financial markets have been jostled by wide dispersion across economic sectors and security types based on thin evidence about potential economic policies. My sense is that investors are exuberant to have a new theme, any theme, other than watching the Federal Reserve. From a monetary policy front, my view remains that the primary effect of Fed policy in recent years has been to encourage speculative yield-seeking. My own argument in favor of normalizing policy is not that the economy is “overheating” or that inflation is a risk, but primarily that deviations from systematic policy have no economic benefit and impose substantial costs on the economy over horizons that are longer than the Fed seems to contemplate (see Failed Transmission: Evidence on the Futility of Activist Fed Policy for detailed evidence on this point). That said, I do think it’s worth noting that even if CPI inflation was to run at an underlying rate of 2% in the coming months, the year-over-year inflation rate in the CPI will hit 2.4% by February, and 2.5% by March, simply as a result of how the existing CPI figures work.

As for the post-election theme-chasing, we observe that across many asset classes, reliable measures of investor sentiment have been driven to extremes of optimism (equities, the U.S. dollar) and pessimism (bonds, foreign currencies). Within equity market action, we also see wide internal dispersion, which remains consistent with underlying risk-aversion among investors, at valuations that remain obscene from a historical perspective. While we’re hearing historically uninformed references to the extended bull markets of the 1980’s and the 1950’s, the most reliable market valuation measures are presently over four times their 1950 and 1982 levels. The effect of politics on full-cycle and 10-12 year market outcomes is negligible, compared with the impact of valuations. Over shorter segments of the market cycle, election results do have the capacity to affect investor sentiment (particularly preferences toward risk), so a focus on the quality of market action will remain important. Near-term, my impression is that much of the recent market response is overdone, and that the markets are vulnerable to decided reversals in the opposite direction of recent trends. As I noted last week, extreme valuations already establish the likelihood of near-zero 10-12 year S&P 500 total returns, and a 40-55% market decline over the completion of the current cycle. The extended speculation in the recent half-cycle was rooted in monetary distortion and risk-seeking that is now unwinding, and we continue to expect the completion of this cycle within the natural course of action and reaction.

As for the near-term market return/risk classification, last week’s shift toward increased internal dispersion and greater equity market bullishness shifted our estimated market return/risk classification from a relatively neutral outlook back to hard-negative. That will change as valuations, market internals, and other factors do, and we’ll align our outlook with new evidence as it comes.

On the economic front, the overall profile of coincident and leading measures remains consistent with a low-level churn, not far from levels that have historically been associated with recessions, but not yet breaking down to levels that would raise immediate concerns. I’ve always emphasized that recessions are periods where the mix of goods and services demanded by the economy becomes misaligned with the mix of goods and services currently being supplied. In this context, high inventory/sales ratios, flat-lining year-over-year real growth rates, and expanding dispersion in the financial markets between various sectors and security types strikes me as a warning sign rather than a sign of optimism for the U.S. economy. Again, there will be little fiscal spending impact until 2018. To the extent that any is coming, it will exert its effect over time, while financial conditions will have a more rapid effect. Rather than focusing on sectors such as banks, infrastructure, pharma, and transports, my impression is that investors should be watching the bond markets, particularly if corporate and low-grade bonds join or exceed the deterioration in Treasury debt.

A final comment. I’ve long believed that if we are incapable of having peace in ourselves, we will be incapable of having peace in the world. I think that’s true on every side, but because it’s possible to appeal to both the best and worst in humanity, I also believe that leadership matters. As we discover the cabinet members and nominees who may comprise our next administration, we should be attentive to whether they reflect character and peace in their countenance, words and actions. Great leaders are remembered as those who call, as Lincoln did in his first inaugural address, on the “better angels of our nature.” They don’t wait for others to do the same, but instead lead by example. All of us have the choice to listen to those better angels of our nature, or to instead be seduced by appeals to the worst elements within us. History records how long it takes us to choose well.

Both in domestic and international conflicts, it’s possible to recognize our shared humanity, and to address the concerns, perceptions and even suffering of each other, in ways that are consistent with our own security and legitimate interests, but without adopting the language of “enemy.” Much of the distress of our nation and our world has been the result of needless war, of injustice, of incivility, and of financial greed masquerading as economic promise. If we aren’t discerning, we will have respite from none of it.

Good article. Couple minor points: I don’t recall Trump proposing a tax holiday (to repatriate foreign earnings) so much as cutting the corporate tax rate so that those earnings don’t accrete overseas (and so that the US is generally more competitive with other countries where businesses could be domeciled). Cutting the corporate rate has been agreed to by most everyone – including Obama – but it’s never been accomplished because Dems want to extract something in exchange. Hussman posits that companies can borrow against their foreign-held cash, but neglects to acknowledge the attendant currency exchange risk.

If extracting fossil fuels is unworkable over the medium term and solar energy is more economically viable, then those facts will be borne out without any push/pull from government. Let government not favor any energy source and let the chips fall where they may. As low interest rates have caused capital misallocation, tax credits distort markets. End tax credits and convoluted mandates like CAFE standards. The solution to high prices is high prices.

I’m sure Hussman has an IQ of 200, but bloviating with 5,000 words makes me want to vomit.

“So let’s encourage productive investment, particularly where those investments relieve binding economic constraints, expand capacity in useful and sustainable directions, carry spillover benefits for others in the economy, require those who use public funds to have their own capital also at risk, and are likely to produce substantial economic benefits per dollar spent.”

Isn’t specificity great.

He’s spot on about the skilled labor sector, America’s skills have atrophied over the last couple of decades.

“First of all, the economy is operating relatively close to full employment at this point”

What a load of bullshit. He’s drinking the same Kool-Aid as Obama.

As far as skills and productivity – when you ship all the jobs overseas, thus no jobs here, and then you import migrants and give them all this welfare – how fucked up is that? This certainly dilutes productivity.

I know die makers, tool makers, welders, machinists – highly skilled people who’s entire sector has been decimated by shipping the jobs overseas. And you’re talking about the lack of skilled labor?

We’ve been raped. Let’s hope Trump can turn it around.

Yeah, you know those people, as do I, and their skills have atrophied over the last 30 years.

The world has undergone a massive shift in industrial ability with the rise of better robots/electronics/logistics and the fucking internet.

So that guy who last worked doing tool-and-die work or some other high skilled job is at a distinct disadvantage in that his long haul trucking job he’s been doing for the last 15 years has completely let his skillset fade to a shadow of what is should be.

“and their skills have atrophied over the last 30 years” Yes, when they can’t use them.

“The world has undergone a massive shift in industrial ability with the rise of better robots” There are still smaller businesses (I’m talking 100 – 200 employees) that it is not economical to use robots. They have all been put out of business by large companies moving jobs to China.

I have a client that gets laminate furniture made in China – they still do it by hand – it’s just that they work for cheap. AAMOF – much of it has to be slightly reworked cause of mistakes – like legs not being level.

Agreed on all points.

Right on Dutchman!!! Gimme a choice between American made tools or Chinda junk, I always go with the best!! Automated CNC machined tools made overseas, just can’t come close to a tool and die maker’s “years of experience” in the good ol USA. What a waste !!!

If you look at a lot of the hand tools – they are cast – no forged.

Re. “full employment”: that is part of first two paragraphs which are Hussman citing Janet Yellen.

Do you understand the concept of quotes? Yellen said that drivel, not Hussman.

To say that the American People are fully employed is pure nonsense and a buy in to the Obama Administrations convenient lack of acknowledgement of the 92 Million Americans (the deplorables?) who are unemployed. They just don’t count. If the author ever looked at the employment reports that come out the vast majority of the employment is in retail and food sevice. The entire article is bloviated hogwash.

Not the entire article is bloviated hogwash. He’s right about the stock market being overvalued.

“Full employment” is part of first two paragraphs which are Hussman citing Yellen.

The last two paragraphs are pretty good, judging as a woman.

The nomenclature of high finance strung together was difficult

to penetrate. The full employment statement is BS, And the Fed?

Specifically Yellen quotes? Thumbs down.

Hussman didn’t say it dumbass. Yellen did.

“First of all, the economy is operating relatively close to full employment at this point, ……………”

When the economy is operating at nearly full employment wages start spiraling upwards as employers engage in vigorous competition to wrestle employees away from each other.

That means average wages outpace inflation by a large amount.

I’m not seeing that happening.

So maybe those employment figures need redefinition, sort of like the polls in the last election did.

“Full employment” is part of the first two paragraphs which are Hussman citing Yellen.

Wow.. lots of reading comprehension issues today…

WAY TO LONG!!!

As far as employment. We probably are at full employment. When you pull 20TRILLION fiat dollars of consumption forward. There is very little work that still needs to be done. We are fat, overweight and out of breath.

Can we now pull another 20TRILLION forward? Doubt it.

Nearly full employment…. seriously…???

No…fucking… seriously…???

I mean … how can we take this seriously???

Seriously shaking my head…

Yellen said it, not Hussman.

OK so reading comprehension… not my most marketable skill.

In the words of Emily Litella “Never mind ” (Seriously)

Whether Yellen thinks we are near full employment or Hussman thinks we are near full employment, it’s still a symptom of how out-of-touch the speaker is.

“As other observers have correctly emphasized, the U.S. lacks enough skilled labor in the heavy construction sector to actually implement large-scale infrastructure spending projects on the scale being discussed, unless foreign firms were recruited to implement them.”

Bullshit! Construction is one owner, five engineers / surveyors / draftsmen, one accountant, four heavy machinery operators and a couple dozen shovel-pushers! You can build a shopping center with about that, or even less if they’re good and driven. If you need a dam / power plant / nuke plant / major chemical facility you need more, in about the same proportions: maybe a few more or less designers, purchasing / admin / accounting types, etc. but in about the same proportions, and the shovel-pushers (unskilled labor) should outnumber everyone else by a good factor. Otherwise your project team is top-heavy. Other weightings might be necessary depending on the project: a road-building job needs more heavy equipment operators, a chemical plant needs pipefitters and controls technicians, but the idea is the same: to build you need one central authority to decide questions, several design / engineering types to keep it logical, organized and modern, a _few_ administrators to track the money and logistics of getting everything bought and delivered, and a whole lot of folks who can take instructions and make it happen at the individual level.

We are not short of engineers, we are short of people who are willing to employ, pay and cooperate with engineers. We are not short of skilled trades, we are short of people who will employ, pay and cooperate with skilled trades. We have who we need to get it done: we are short of entrepreneurs, industrialists and producers who are willing to do it.

And even THEY are there, but unwilling to take risks for no reward, with EPA, OSHA, DOT and everyone else looking over their shoulders with regulations and fines ready, but no understanding of ecology, reality or business at all. Why would I even try to build a new chemical facility in the US when a single accident, equipment failure or even sabotage can lead to enormous fines and jail time? Right now I am consulting on a new small plant to make a new food product. The poor fools want to build it in California! We have reached the point where we are ready to stand on the conference table and start shouting: GET AN ENVIRONMENTAL CONSULTANT AND START WORKING ON THE PERMITS NOW! Yes, we know you won’t start up before 4Q 2017! Start NOW, you may already be behind and you cannot start up without those permits! Bunch of damn Ph.D.’s with no industrial experience among them, great at inventing chemistry but clueless outside that box ….

/rant off

Can someone tell me how the debt/GDP can be only 77%?

I believe that number includes only federal debt, and backs out from the federal debt the government debt held by Social Security. It does not include unfunded liabilities, or business, individual, or local government debt. It’s the most flattering debt to GDP ratio available.

Really suspect that American made product is cheaper to produce and is going to last longer and at less maintenance cost. One needless expense with buying overseas product is that the shipping has to be added in and that the product is sold here at a US price so the importer and multi-national corporation make the profit not the skilled though nationalistic American worker. The American consumer tax-payer losses again because the overseas product has to be purchased twice because of poor quality and longevity. One example of millions is where the American refrigeration repairman where he walks by the old and “outdated” American made refrigerator in the garage to get to the kitchen to fix the new foreign made refrigerator. Or due to ill-thought out government regulations where the new water-conserving clothes washers take less water but produce more lint, run twice as long consuming twice the electricity, and require “High-Efficiency” detergents. Or where the new front-loading washers leak but the old models rely on the commonsense version of gravity keeping the water in the tub. Not so slowly, for the past 30 years, the US has been going down the drain in a hand-basket.