Only a few days after Trump’s inauguration ceremony, the U.S. National Debt will creep across the important psychological barrier of $20 trillion.

It’s a problem that’s been passed down to him, but it certainly puts the incoming administration in a difficult place. The debt is burdensome by pretty much any metric, and the rate of borrowing has exceeded economic growth pretty much since the late 1970s.

How Trump deals with this escalating constraint will be a deciding factor in whether his administration crashes and burns – or ends up re-positioning America for greatness.

Donald Trump’s $20 Trillion Problem

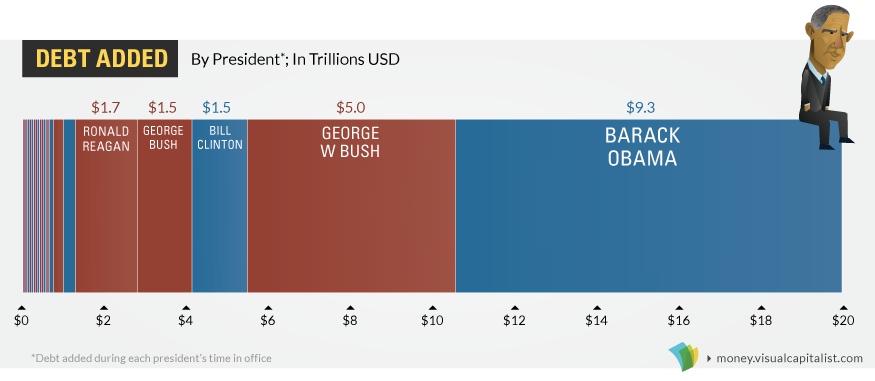

Partisans will squabble about who added what to the mounting debt, but the reality is that none of that really matters. Both parties have kicked the can down the road for the last 40 years, and that has culminated in the current situation:

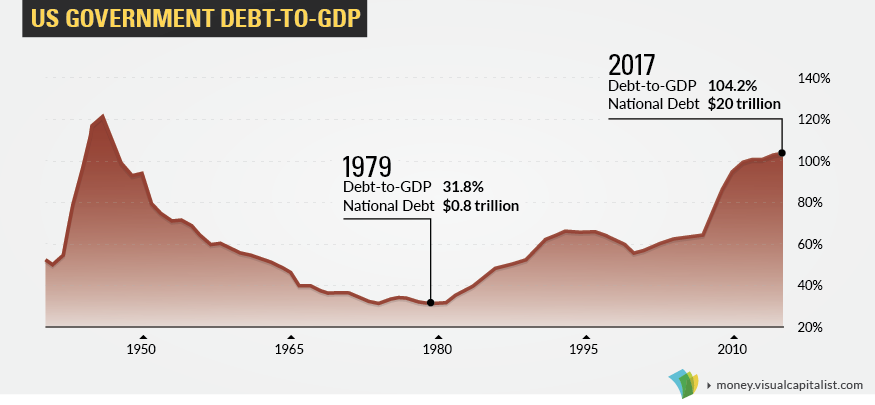

Back in 1979, the debt-to-GDP ratio was a modest 31.8%, and the federal government only had an outstanding tab of $826 billion. Fast forward to today, and the perpetual borrowing has added up.

The debt-to-GDP is now 104.2%, with the total debt burden nearing the $20 trillion mark.

In absolute terms, the debt is the highest it has ever been. Using the common measure of debt-to-GDP, the debt is the highest it’s been in 70 years. The last time it soared past the 100% mark was during the final year of WWII.

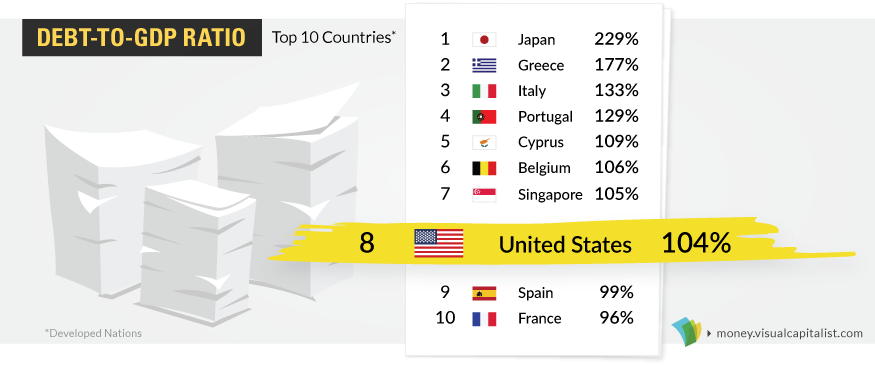

Granted, the situation isn’t as bad as Greece, Cyprus, or Japan – but it’s getting there:

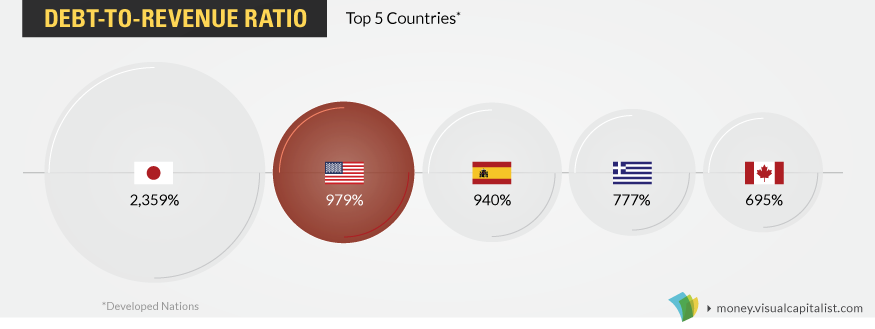

In terms of debt-to-revenue, a measure that compares the national debt to the amount of taxes taken in by the federal government, the U.S. has the 2nd highest debt out of 34 OECD countries:

On a “per person” basis, each person in the U.S. owes $61,300 – the second highest in the world. Per taxpayer, however, that amount balloons to $167,000.

Changing Rhetoric

So what does Trump think of all this debt business? It’s hard to say, because his rhetoric has changed.

At the start of his campaign, he made it clear that debt would be a top issue for his administration. In February 2016, Trump said that the U.S. was becoming a “large-scale version of Greece” and that tackling the debt would be “easy” with a more dynamic economy. In April 2016, he said he could pay off the debt after eight years in office.

This rhetoric aligns with the official GOP platform, which says that the national debt has “placed a significant burden on future generations”, calling for a “strong economy” and “spending restraint” to pay it down.

But since then, Trump’s views may have changed.

His most recent economic plans include $1 trillion in infrastructure and $5 trillion in tax cuts – and they could increase debt by anywhere from $5.3 to $11.5 trillion. He’s also said that the U.S. will never have to default because it can simply “print money”.

How Trump will choose to deal with the debt is a big question – and only time will tell if his actions will make America great again.

About the Money Project

The Money Project aims to use intuitive visualizations to explore ideas around the very concept of money itself. Founded in 2015 by Visual Capitalist and Texas Precious Metals, the Money Project will look at the evolving nature of money, and will try to answer the difficult questions that prevent us from truly understanding the role that money plays in finance, investments, and accumulating wealth.

Hogwash. Its not 20 trillion. That number merely speaks to the “interest-owed”, on the US credit card. The “Principal” has not been paid down, since Andrew Jackson.

The True damage an international, English-based, Central Banking Cartel has projected, while claiming as “Assets”, on their books, is 1200 trillion, 20 times the combined “Gross”, of every country, on the planet.

In other words: 20 years of projected GDP of every country, combined.

The 1200 trillion are predicated upon inter-bank, insurance frauds, that are, in turn, listed as owing to “Naked Short Sale Bets”, Americans will default on their “mortgages”, once the Brexit is delivered, as coup-de-gras, to what remains of “American Sovereignty”.

The “REMICs” are empty and the Cartel will not admit it, for to do so, proves their present, “Insolvent” condition.

http://www.marketwatch.com/story/this-is-how-much-money-exists-in-the-entire-world-in-one-chart-2015-12-18

In other words any $ we have is just a paper/electronic notation.

And no one can eat an abandoned mall, a mining stock, or a

promise to pay.

Some smarties are talkin’ about physical gold and silver coins or

bars. They will explode !! in value. Great. In the meanwhile what

is going to be sold as food? and if there is food for sale? can you use

a fifty $ coin to buy a bag of flour?

Default , Default, and Default.Then he should take back control of the currency from the Federal reserve.Do what Hitler did.Between 1933( When Hitler took control of the German money) – 1940 Germany became a super power.Google it .You will know the reason Hitler is so slandered the way he is. World war two was really fought over which nations and banks would control the currency’s of the world.Google it.

What search term would I google?

“Why was Hitler slandered”?

“Hitler’s war against the Federal Reserve” “The real reason WWII was fought.”

“German economic changes from 1933 to 1940.”

Just for the hell of it I went & looked this up.It looks like a bunch of anti jewish, neonazi garbage.

However,the German economy did recover somewhat-any ideas on what caused it?

What do you think the full ramifications of a default will be?

A total collapse of the derivatives market, and the resulting disappearance of every dollar (and most foreign) denominated assets (that means everything other than real property becomes zero balance) would be one minor one, IMO, but I’m sure there are others of more impact I’m not able to anticipate.

We don’t know what Ryan and Trump will do. I trust Trump way more than Ryan – who blasted through the sequestered limits for no good reason. Trump’s proposal for taxes called for elimination of all deductions except mortgage interest (limited) and charitable deductions. Largely unnoticed is that he was calling for elimination of deductibility of State and local taxes – which would (rightly) hit high tax “blue” states hardest. Could that more than offset a reduction in nominal rates? Sure. To be determined. $1 trillion over ten years for infrastructure is nothing. I suspect we’d get more bang from $100 billion spent by Trump than $500 billion spent by Obama or Clinton. A 1% increase in interest rates will cost $200 billion per year for debt service. Hurry up and get the Wall built, because that’s the easy (and cheap) part.

I read that he is considering adopting the budget plan of the Heritage Foundation which will cut 10 trillion dollars from the national budget over ten years. The corporation for public broadcasting would be privatized. Eliminate National Endowment for the Arts and for the Humanities entirely. Defund Planned Parenthood. An immediate 10% slash to the budget and let hiring freeze until 20% of the federal workforce is gone. I hope this budget includes defunding the UN, cutting WAY BACK our funding of NATO, and ending any foreign aid to the Palestinians.

TrickleUp – I am 100% in favor of every item in your comment. In addition, Trump himself will likely participate in arm-twisting and constant jaw-boning, as he should, to reduce the price paid by the gov’t for hundreds of billions in purchasing, leasing, and coach fare travel mandated for Executive branch routine travel. FedGov could do a lot more with fewer people if the hardware and software are brought up to 21st century standards. THAT contract could use some serious negotiating skill to avoid that billion dollar boondoggle the previous admin got itself into with the first lady’s college friend raping the American taxpayer twice for shoddiness and incompetence.

The Rubicon has already been crossed.

Two things: Report “M3”, truant since before the phony, “Financial Crisis” and let’s see where the bodies are.

Then, report any and all, “derivatives”, as listed, in the DTC and DTCC, each owned and being concealed by, the intentionally-mislabeled, “Federal Reserve”, neither federal, nor, possessing ANY reserves.

The inter-bank, criminal frauds, are Legion, from LIBOR through opening phony accounts… HSBC engineered specially-made boxes, for teller windows, that way, the terror and drug cartels could max their mule-packing capacity.

These criminal debts are NOT some quaint “keynesian”, “deficits-don’t-matter” and they aren’t equally-absurd, “unfunded liabilities”. These debts are owed to pure graft as criminal through-and-through, hence We The People need never foot that bill.

Expose these Filth yesterday.

M3 = money supply…criminal thug bankers…etc.

“hence We The People need never foot the bill.”

Sounds good on paper!

But…we can not eat paper, guess we’ll have to grow our own food,

and like Russian peasants, live on cabbage and onions. Maybe some

potatoes.

The Fed will gaily “print” and the Politicians will foolishly borrow to avoid any serious defaults that could hurt TPTB’s exploitation (called “investments” by the MSM). That will inevitably cause hyperinflation; even 30% sudden inflation will break most American’s budgets and cause chaos.

NEWS FLASH*******

One hour after Trump was sworn in as president, he signed an executive order to increase the Mortgage Insurance rate on borrowers for home loans an additional $500 per year.

Score one for the banksters. Mortgage insurance is just a bankster shake down and Trump just made it bigger.

Care to provide anything to back that up, Bea? He killed a program obongo tried to jam through on the way out that would federally subsidize motgage insurers. Home prices need to drop. A lot. Not subsidizing home prices will help speed that up.

Star- This rate hike starts 01/27/2017, will add approx. 5k to homebuyers mortgages until they reach the 20% threshold.

http://www.veteranstoday.com/2017/01/21/it-begins-trump-raises-mortgage-insurance-rates-costing-home-owners-500-a-year/

Info was sourced from .gov.

No, B, he didn’t.

This is what he signed, and it basically removed an Obama low income freebie aimed at giving federally guaranteed mortgages to those who can’t afford a mortgage, not increasing all mortgage insurance rates.

http://www.cbsnews.com/news/trump-suspends-obama-fha-mortgage-insurance-premium-cuts-first-time-homebuyers/

This is a part of what he said he would be doing, as was the Obamacare XO he signed.

B,

the lonely and disenfranchised and the very poor = those unable

to provide the 20% value down on a home purchase/mortgage.

Apparently Gordon Duff prefers we all subsidize the mortgage industry

and the feckless buyer. Maybe he would have preferred the Hil. as he

twists facts to defame Trump.

BTW, I looked at the cutest small home in the village priced at 29K.

Futz with the seller and say you agree on 27K for the place. Less than

6K down and mortgage insurance is off the table.

Excuse me for being a fiscal conservative, but I think 20% down is good

business. Without that down-payment the buyer would be better off

living renting or living with family. Other people’s homes should not be

up to me to subsidize, and not up to you either.

HUD mortgagee letter ML 2017-07 (issued 1/20/17, signed by an Obama appointee) suspended (not rescinded) ML 2017-01 issued on 1/9/17 which had cut FHA mortgage insurance for new loans disbursing >1/27/17. “Score one for the banksters” is nonsensical. FHA mortgage insurance goes to HUD. Maybe Trump just wanted to wait to assess the wisdom of cutting FHA mortgage insurance. They could, of course, cut it sharply while also reducing financial risk to HUD by tweaking the automated underwriting system to be more conservative. Leave it to the media to slam Trump for stalling on a mortgage insurance cost reduction – which just leaves it where it was on 1/8/17.

Cutting mortgage insurance rates exposes taxpayers to HUD/FHA bailouts since it puts them in a riskier financial position that is less likely to cover their costs.

Trump did right by this, it is a part of what he promised.

Generally speaking, if the MSM doesn’t like something government is doing it is a good thing that they are doing it.

I/W- There are 7 private mortgage insurance companies that are publicly traded companies.

EDIT: If you don’t consider United Guarantee (part of AIG) banksters….I can’t help you!

There’s no private mortgage insurance on FHA loans. Private mortgage insurance is for conventional loans. This is all about FHA loans. To keep HUD safe from financial risk you can change the cost of FHA mortgage insurance or you can tweak the programming of FHA automated underwriting (lowering debt ratios, raising minimum credit scores, etc.).

“One hour after Trump was sworn in as president, he signed an executive order to increase the Mortgage Insurance rate:”

Wrong.

Since you’re so ignorant and quick to belittle President Trump, who may have a better grasp on this than you, I’m not even going to try to explain the facts about rescinding Barry’s last minute fuck you to the American people and our New President just unraveling another Bad, Short-sighted and Vindictive against the American public decision by shitty golfer wanna – be.

If you hurry, you can just make it to DC to join your sisiters in-the-street.

We should have given sheep the vote.

The debt hasn’t been a problem in, like, forever. Why should it be a problem now?

I’m a firm believer in kicking the can down the road …. cuz, that seems to be working just fine. Make Debt Cool Again. (I think that’s pronounced em-dih-cah.)

Stucky, you do understand that it was not the Weimar Debt per se that caused the Mark to crash in German in 1923 (when a one Mark item went up 1 trillion Marks); it was all the fiat Mark currency that had been extorted by the Allies, printed by Germany, and then sent to France, England etc in boxes that returned and was spent in Germany that caused prices to skyrocket. It will be the huge increase in the amount of dollars (M3 which the BLS no longer reports) that was printed by Obama (and soon Trump) that will cause hyperinflation one day soon which will make a $1 item cost $1,000,000,000 and kills the dollar’s worth (and turns U.S. into a Venezuela). Like in elementary Physics, what goes up the most comes down the hardest…

We have been looted.

The debt is peanuts. It is the $200 trillion in unfunded liabilities that is gonna hurt. Govt pensions, SS, Medicare, Medicaid – boy howdy, bend over because it is coming.

Theoretically, couldn’t Trump and Congress come out one day at say, 8:00 am, and announce “As of right now, we have digitally printed 20 trillion and paid all debts in full. Derivatives are hearby shut down and null and void. We are now rolling out a new currency, and whatever all citizens’ accounts had in them as of 7:59 will credited with a proportional amount of the new currency.” ??

Stucky says:

January 21, 2017 at 3:54 pm

The debt hasn’t been a problem in, like, forever. Why should it be a problem now?

I’m a firm believer in kicking the can down the road …. cuz, that seems to be working just fine. Make Debt Cool Again. (I think that’s pronounced em-dih-cah.)

__________________________

The debt hasn’t been a problem because the dollar is backed by US military hegemony and remains the world reserve currency. Once that sweet gig ends, the shit will hit the fan. Zero interest rates haven’t hurt either. Imagine what the deficit would be if interest rates went Volcker again…cat’s and dogs…living together, mass hysteria!!

Bea Lever

PMI (private mortgage insurance) is required when a conventional home loan is used to buy or refi a house, and a borrower makes a down payment of less than 20%. If the homeowner defaults, the insurance policy get “cashed”, and the bank gets paid for its losses.

I’m pretty sure you know that. So, why are you upset with what Trump did?

1) If people don’t like it, then they should just fucken wait to buy a house until they have 20%.

2) FACT: Buyers with less than 20% down default much much more often than people with 20% or more. In some areas of the country up to 300% more often. It’s all about equity … folks with equity will normally do ALL THEY CAN to not default. Folks with minimum equity don’t give a shit about leaving others holding the bag.

Again, I don’t understand why this bothers you ….. except maybe to get in a gratuitous dig against Lord Donald.

Answer the fucking question Bea!!!