Authored by Sven Henrich via NorthmanTrader.com,

Many of you know I keep posting charts keeping taps on the macro picture in the Macro Corner.

It’s actually an interesting exercise watching what they do versus what they say. Public narratives versus reality on the ground.

I know there’s a lot of talk of global synchronized expansion. I call synchronized bullshit.

Institutions will not warn investors or consumers. They never do.

Banks won’t warn consumers because they need consumers to spend and take up loans and invest money in markets. Governments won’t warn people for precisely the same reason. And certainly central banks won’t warn consumers. They are all in the confidence game.

Well, I am sending a stern warning: The underlying data is getting uglier. Things are slowing down. And not by just a bit, but by a lot. And I’ll show you with the Fed’s own data that is in stark contrast to all the public rah rah.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Look, nobody wants recessions, They are tough and ugly, but our global economy is on based on debt and debt expansion. Pure and simple. And all that is predicated on keeping confidence up. Confident people spend more and growth begets growth.

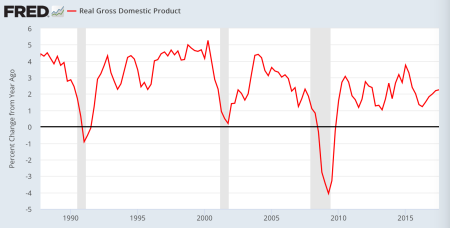

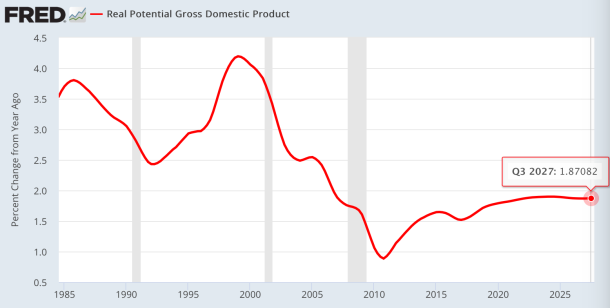

But here’s the problem: Despite all the global central bank efforts to stimulate growth real growth has never emerged. Mind you all this is will rates still near historic lows:

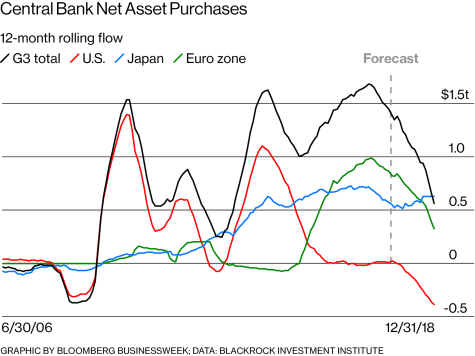

And central banks supposedly are reducing the spigots come in 2018:

I believe it when I see it. In September the FED told everyone they would start reducing their balance sheet in October. It’s November:

September FOMC: The economy is so strong we’ll reduce our balance sheet beginning in October.

It’s November.

How is all that going? pic.twitter.com/R00IMHQsCc— Sven Henrich (@NorthmanTrader) November 11, 2017

I guess we’ll need to give them more time. After all it’s only been almost 9 years.

But let’s get into the actual data, and it’s all from the Fed’s own website.

Here’s what I’m seeing:

Commercial loan growth keeps collapsing and is dangerously close to going negative:

Any way you cut it or slice it this is not a positive development or trend. It’s a slow down.

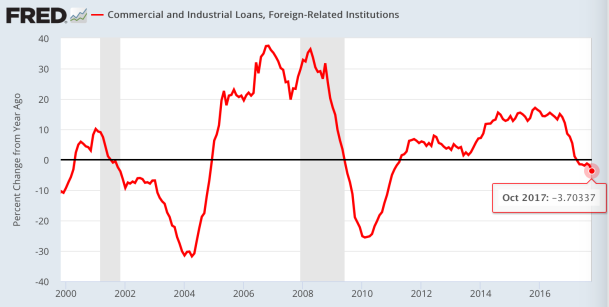

And if you look at the same data for foreign related institutions the trend is already negative:

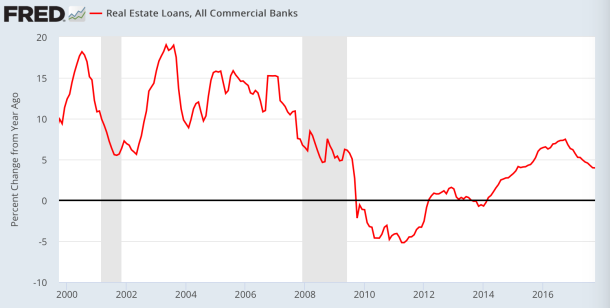

Speaking of loans, here are real estate loans:

Slowing. Actually makes sense, look at home sales growth themselves:

Negative growth.

It gets worse. Much worse.

Let’s look at the consumer.

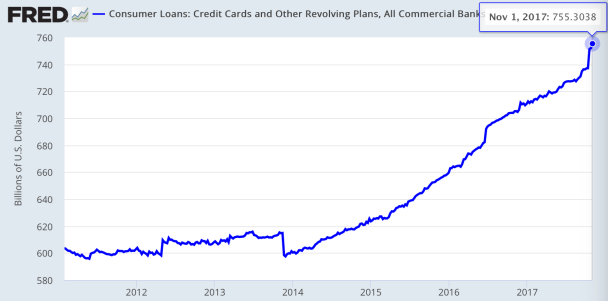

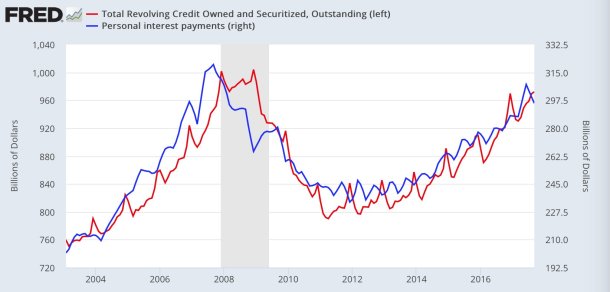

Loaded up on debt as we know, but piling into revolving high interest debt. You know, credit cards and such:

Why is this bad if all this global synchronized growth is supposedly going on? Because consumers are struggling big time and this debt expansion could be a sign of emerging desperation on the side of some consumer. People are subsidizing their spending needs with high interest debt.

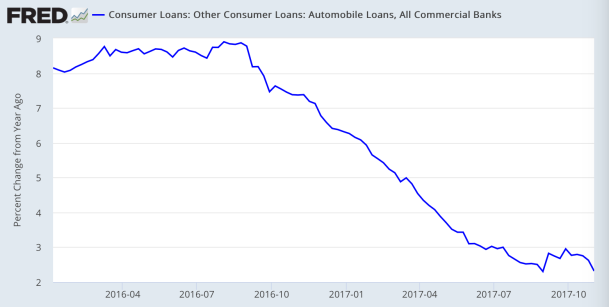

Certainly consumer loans are not growing:

No they’re slowing and they’re heading toward negative at this pace.

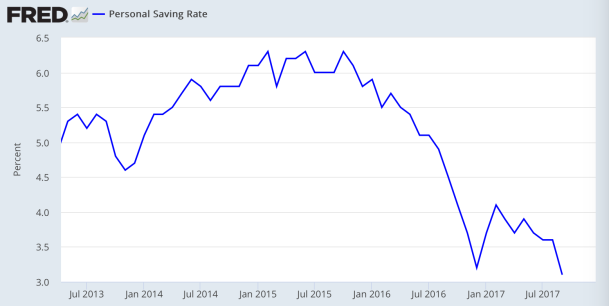

Maybe consumer are saving? Nope, they’re not, the savings growth rate is dropping. Hard:

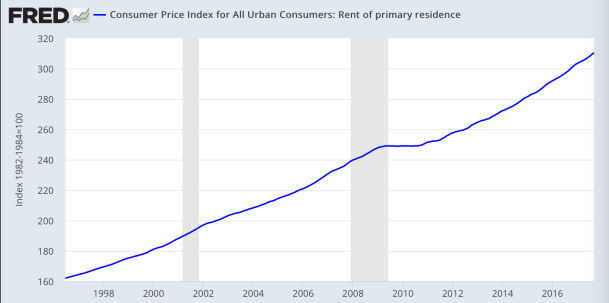

The Fed keeps insisting there’s no inflation. Could it be that consumers are disagreeing?

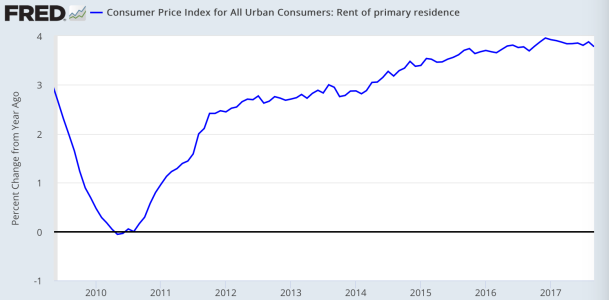

After all rent is their largest expense line item:

CPI for primary residences has been hovering near 4%.

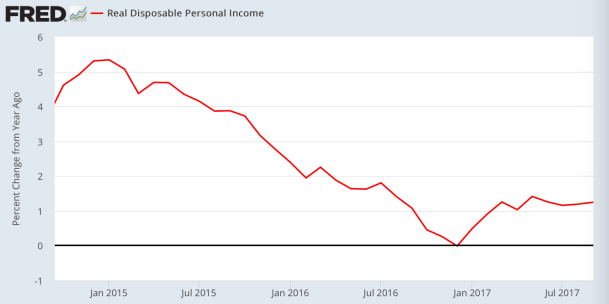

That’s perhaps ok if your real wages are keeping up, but clearly real disposable income growth is meandering:

Where’s the expansion?

Well it’s in personal interest payments and debt:

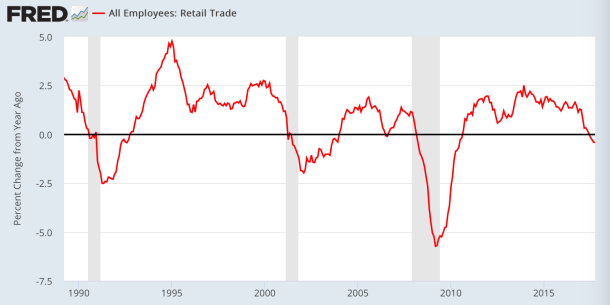

It’s certainly not in the auto sectors or real estate. How about retail?

Here’s a chart to get your attention:

Negative growth in retail employees. The last 3 times this growth rate went negative we went into a recession.

The reason for this trend is not an unknown: Record store closings as part of the retail apocalypse. Don’t worry, $AMZN will take care of the dead retail ghosts walking out there. Right?

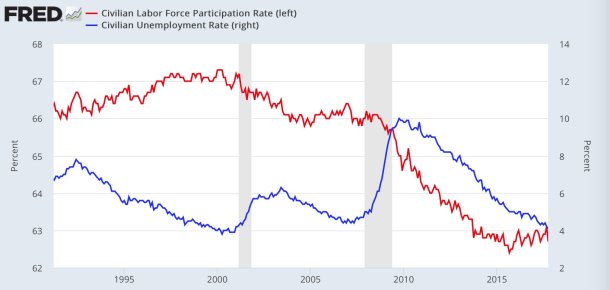

I know the narrative is record low unemployment, but know this is fuzzy math. There used to be a relationship between the unemployment rate and the labor participation rate. No any more:

Many of the reasons are structural of course, but that doesn’t change reality. Yes the labor participation rate improved slightly since 2015, but it’s slowed down in growth again.

So here we are, near the end of 2017 and markets are at record highs and synchronized growth is all the rage.

The data points above tell a very different tale and there is a mismatch in narrative, one which the yield curve so aptly summarizes:

So something’s off folks.

We just had almost $5 trillion in global central bank intervention since the February 2016 lows when central banks panicked.

Make no mistake, growth, as it appears, is bought for and market levels are bought for with easy money, loose financial conditions and low rates, just look at the $DAX if you don’t believe me:

$DAX outside reversal week.

Note the entire construct is manufactured and maintained with low yields.#TINAtillithurts pic.twitter.com/0tg1NMFl8k— Sven Henrich (@NorthmanTrader) November 10, 2017

‘TINA’ (there is no alternative) till it hurts.

Our own growth expansion story is still a big question mark at best.

Industrial Production is still below 2015 levels:

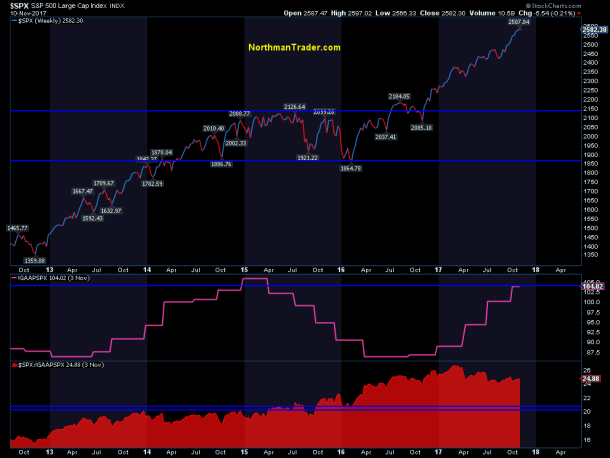

GAAP earnings have recovered (as they should have with record central bank intervention and the loosest financials conditions in place), yet market prices have undergone through significant multiple expansion since then:

But don’t worry. Tax cuts will bring about a nirvana of growth. I’ve outlined my thoughts on the subject in Tax Cut Scam.

Perhaps all this magic growth will come.

If it is, the Fed’s own website doesn’t appear all that confident:

Which is odd for an organization in the confidence business.

The public narrative is saying synchronized global expansion. The charts above say otherwise.

The are saying: Caution. Slow Down.

I find this interesting: https://www.elsaelsa.com/astrology/uranus-enters-taurus-may-15-2018-financial-instability/

Tuesday, May 15th, 2018, Uranus will enter Taurus. This is bound to be an eventful day for several reasons.

First, it’s an outer planer changing signs. Next there is a new moon in Taurus on the same day. These two events happening within a couple of hours of each other, right before the stock market opens.

I mention the stock market because Taurus rules finance. Uranus destabilizes whatever it comes in contact with. Reversals are common. It’s no stretch to imagine a person witnessing or suffering a reversal of fortune at this time. Uranus will conjunct Mercury in Taurus which suggests the strong possibility of shocking news.

I am at a loss for words.

“Uranus will enter Taurus” Well I’d say it’s better than a Taurus in Uranus.

I think you may be on to something.

“Captain, it appears that Taurus has entered Uranus. Can you confirm that Sulu?” “OH MY!”

What about Money Velocity, the Baltic Dry Goods Index, Retail Gas/diesel Sales…never mind.

Maybe the bull will find all the diamonds?

https://www.popsci.com/uranus-neptune-diamond-rain

It is absolutely possible not to lie. Rule number one, don’t do things that you think that you would have to lie about. Rule number 2, your life is not an open book to the entire world. Everyone is not entitled to know all that there is to know about you. Tell them that. Rule number 3, Don’t talk to prying busy bodies.

Black Pigeon alleges that the U.S. is attempting to destabilize Europe, without a shred of evidence, because there is none. Quite the contrary.

In Response to Black Pigeon @Navyhato – Andrea Iravani

Saudi Arabia has a real problem. Runaway maids.

40 % of their maids run away:

I guess that 40% of the men with maids are rapists:

http://www.arabnews.com/saudi-arabia/news/865861

I see these articles all the time. Listen, if fundamentals mattered, this whole scam would have collapsed a long time ago. Yet, amazingly, on Monday morning – another gap up open on the S&P, which can be manipulated (at midnight or 1:00am west coast time like clockwork BTW some “buyer” comes in and purchases a HUGE amount of futures). However, what would normally happen if the market rejected that would be a swift sell off shortly after cash open. THAT is the problem, there is not a sell off. The sheep (hedgefunds, mom and pop investors, fund managers etc.) like clockwork, BUY THE FRAUD. Willingly.

The reason why markets are manipulated by the central bankers is because THEY ARE ALLOWED TO. There is not a central bank in the world that can manipulate a market the size of the NYSE, DAX, NASDAQ etc. IF the market does not want to believe. They can “help” the process, but can’t drive it. The problem is that the reach for yield without the thought of consequences is powering this. One day reality WILL happen, and when it does, it will be a case of literally the weight of the bullshit, overpowering the weight of “believe”. You simply will have a ratio of believers vs. reality that tips the other way. Once the cascade begins, get the hell out of the way. HFT (high frequency trading) is really only effective to day trading, very little more. It causes flash crashes, but those don’t last. Yes, they can stop your heart, but the wise trader knows that a price that is unreasonably low emerges, and is released from the “circuit breaker” it becomes an opportunity. Media = stupid and uninformed.

I trade the markets on a very regular basis, and you can see (literally) there are big blocks of stock SOLD in quantity at these gap opens of feel good unicorn farts. Those are the logical, thinking people that see the problems. Then, you see the stupid, come marching in like a stampede of dumb money, just buying and buying. Most of this is no doubt corp execs buying their own stock with borrowed money. Why not? They get the bonus, there stock gets a pump, and if you are an employee or LONG TERM shareholder, you get the shaft.

The warning sign, however that IS coming, and DOES matter is the High Yield market tipping over. That is the LIFE BLOOD of all of this. These buybacks will not happen (dumb money) if they cannot borrow at a low rate. Why? No money, of course. If you literally have to pay for the money, with real interest rates, the cost benefit of buying more stock, with expensive money goes away. Want to time the market downturn? Follow HYG, (high yield growth ETF) That is your barometer. NOTHING else matters. Classic ponzi. HYG monitors the “marks” and the market is the ponzi. All ponzi’s end the same way – no more marks.

I’m expecting to close on my father’s house this week. I’m cash/PM rich & debt free. My preps could use a topping up which I skipped last week but apart from that, be it death or financial Armageddon, I’m as ready as I can be.

I’ll still be doing my part to boost the economy though by purchasing a Kimber Micro 9 or a Sig P938 or maybe a S&W Shield for summer carry over the next few weeks.

APEC Members Have Egg Fu Yong on Their Faces – Andrea Iravani

Our Allies Barbecue People, But Our Military Interrogates the People Before They Are Barbecued – Andrea Iravani

The Monsters Behind the Mad Men – Andrea Iravani