by Allen Marshall, Defiant Living

Years ago, I had occasion to get to know Jason Ohler, a professor at the University of Alaska and a former student and protégé of Marshall “The medium is the message” McLuhan. Like McLuhan, Jason realized that technology is more than just a tool: It represents a tradeoff. We see the things that it gives us, but we’re often not aware of the things it takes away.

As an example, think about what television gives us, and what it takes away (paraphrased from “Taming the Beast: Choice and Control in the Electronic Jungle”):

- Television introduces us to new ideas that stimulate our imaginations; but at the same time, it robs us of our ability to imagine.

- Television allows us to experience cultures worldwide from the comfort of our homes; but at the same time, it obliterates cultures by blanketing them with misleading and irrelevant images of who they are.

- Advertising on television allows us to get free programs, many of which are enlightening and help us understand who we are; but at the same time, it limits interpretations of reality to what those advertisers are willing to pay for.

- Television provides a meta-perspective, documenting our changing times so that we might better understand our world; but at the same time, it accelerates the pace of change to a rate faster than can be responsibly assimilated.

So television gives but it also takes away, just as a car increases how far we can travel but allows our legs to grow weak from lack of use.

Like your television or your car, credit is also a kind of technology. And beyond a vague sense of foreboding when we have too many bill payments, most people seem to treat it like any other technological tool, as a boon to their lives that allows them to do things they couldn’t do before. But what if we look at the tradeoffs that credit represents?

Credit gives us freedom of choice – but it also enslaves us

Credit allows us to pull our future purchasing power into the present, meaning we have resources we wouldn’t otherwise have. If we’re broke and our car breaks down, we can use that credit to buy a new one, get the current one repaired, or at least get a rental car while we plan our next move. And if we’re cash-poor, credit means we don’t have to buy the cheapest products: We can buy the good-for-us salad rather than the one-dollar fast food meal.

But using that credit means we have an obligation to pay back the money we borrowed, and then some. It means we have to work, even if we hate our jobs. The things you bought with credit become anchors, preventing you from making many choices in the future.

Credit allows us to buy things we want now – but it also increases the price of those things

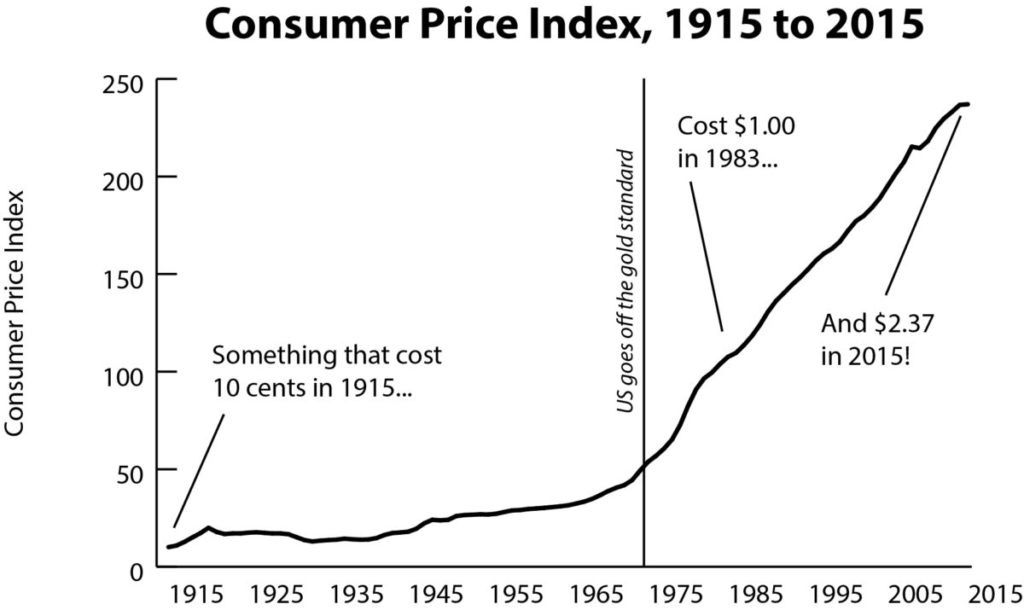

Credit allows us to acquire more than we otherwise could. But what happens when demand increases, and the number of goods remains the same? Prices go up. Consider what happened to prices once we really opened the floodgates on credit, when we officially left the gold standard (chart from “How You Got Screwed”):

Credit gives us instant gratification – but it also destroys the ability to plan long-term

When you can have anything you want the moment you want it, the old habits of saving up for something (or, god forbid, doing without) tend to fade away. This shows up most noticeably in our widespread failure to plan for retirement. As The Fool website reports, “According to the U.S. Census Bureau’s data, the typical American’s net worth at age 65 is $194,226. However, removing the benefit from home equity results in that figure plummeting to just $43,921.”

Credit allows us to have new things – but it also encourages a throwaway culture

Back in the olden days, people tended not to throw things away at the first hint of wear. Clothes got mended; appliances got repaired. But today, we’re much more likely to throw things out and buy new, depleting our resources and filling our landfills.

Credit allows businesses to grow – but it also allows bad choices and prevents creative destruction

Credit today is the lifeblood of business, essential for starting up, managing cash flow, and underwriting new initiatives. But it also allows businesses that are not financially viable to keep going, preventing the market from clearing. Tesla, for example, has never made a profit and probably won’t for the foreseeable future, but it survives through stock sales and debt issuances. Netflix is in the same boat. Keeping companies alive on credit prevent the kind of creative destruction that clears the market, allowing viable companies to fill those spaces.

Credit allows us to tap into the labor of others – but it also allows us to forego self-sufficiency

When we have more purchasing power, we tend to look for ways to make our lives easier. As a result, we may order takeout food rather than cook for ourselves, or we may hire painters rather than lose a weekend painting a room. All that outsourcing allows our skills to atrophy, or never even develop in the first place, making us more dependent on others to do the things we no longer are able to do.

Is it worth it? That’s a value judgment. Credit is just a tool, and it can be used well or used poorly. But it would help all of us if people fully understood the tradeoffs they were making when using credit, rather than just accepting it as a purely good thing in their lives.

my moniker is Credit, and I have not paid interest since 1989.

Saving and investing compounds money for you.

Borrowing and spending compounds money for them.

If I save $10 a month for ten years, how much will I have? $1500 to $2000 as an estimate, $1400 in today’s dollars as an estimate.

If I borrow $800 for a gizmo and repay $10 a month, what will I have? Zero money and a worthless fully depreciated whatever it was I bought.

Gee, I wonder which scenario is best?

Gee, I wonder which scenario most poor sheeple will choose.?

Gee, I wonder which scenario aspirational rich will choose?

This is a major reason why sheeple have no net worth, and are always crying poor, and complaining about the rich.

“Saving and investing compounds money for you.

Borrowing and spending compounds money for them. ”

You being one of the “them” that gets your money compounded.

Anon – oh, yes, you better believe it. Why would I be on the losing side of that equation? I prefer to win.

There are only two choices with no middle ground. Obviously, Lipoh made the correct choice. “Compound On”, Lipoh.

“Saving and investing compounds money for you.”

It certainly did, but not after Obama and ZIRP.

That is where the investing, as opposed to just saving, part comes in. Stocks. Land. Businesses. Etc. It is harder, for sure. If nothing else, put it in Berkshire Hathaway. Buffett is generally a conservative investor, and his company plods along pretty successfully. Even if you hate him, you have to give him that.

The world is full of folks that have not saved and invested for such reasons. They for sure never accumulate wealth. Savers and investors usually do.

Stupid as it sounds, I was so determined to get out of debt that I never really considered what it would be like to finally be out of debt. My biggest realization on becoming debt free? How cheap it is to live. When I add up all of my expenses…..taxes, various insurance, utilities, food, clothing, pets, a few luxuries etc add up to less than $2000/month. If I really tried I could reduce that number even further and if I got rid of my dogs I could bring it under $1500/month. My wife could pay that with one paycheck. That means all my pay and the rest of her pay is excess to our monthly needs. It’s being dumped into retirement of course but wow! It’s been a real eye opener.

Debt is bad ummmkay! It really is worth the effort to put every spare penny towards extinguishing it as quickly as possible. Sure, the 3-5 years that the average American would need to go all in on becoming debt free sucks ass but those few years are an easy trade when you realize what you gain out of the deal.

IS – our life without dogs would be much poorer. If I eat, they eat. If I get medical attention, they do. I insure their health same as I do any other member of the family. We fund no kill shelters. Etc.

Not everyone feels the same, of course, but dogs are special to me and mine.

And woe be to anyone trying to do them harm. They feel the same about us.

The mighty boerboel:

[img [/img]

[/img]

I agree. That’s why we spend well over $200/mo on their meds and food. They are sources of endless fun and a near continuous advertising to would be thieves to move the fuck on. They’re also our early warning system. They make us laugh everyday too. I love ’em to death!

I just hang the bones and leftovers of those would be thieves out front. Boerboels do not bark much. I have only heard the oldest ever bark twice in his life. Their presence comes as a silent and pants-shitting surprise to those that have not been properly introduced.

They do not welcome those they do not know. Those they do, they are just big friendly lap dogs. I own the house. They own and protect anyone and anything inside or around it. Good dogs! (Pretty sure you would not want to spank a child around them. You want to keep that arm?)

My wife and I will never live without a dog again.

It is just as satisfying to see your bank account grow as it is to purchase some piece of crap. It’s just a matter of looking at things differently.

Exactly! I was amazed at the transformation my wife made. She always wanted to spend money so I got her to agree to avoiding that for a year and instead I put money aside just for her to use any way she wanted. At the end of the year it was several thousand dollars. When I handed it to her it blew her mind and then she announced that she’d rather have the cash than spend it and she blew my mind. Been smooth sailing ever since.

I like the security that money buys. Knowing you can replace anything at anytime with no sweat is quite a feeling.

[img [/img]

[/img]

Thanks Kokoda! Yup, that is like my boerboels, more or less.

IS – by the way, good job getting out of debt. Well done indeed.

Thanks. The drudgery of getting it done really sucked but we came out of it with enormous discipline and a very real sense of “needs” versus “wants” that will serve us well the rest of our lives. It’s very satisfying.

Please allow me to share this with you, in reference to owning a dog(s). Last week we closed on 3.72 acres of land, identical to a tract we purchased last year. The cost, $10,000. I tossed and turned a couple of nights attempting to justify writing a check for ten grand. Then it dawned on me. My dog, rescued from the pound, is 12 years old and we have owned him for ten of those years. During those ten years we have spent at least, and this is a conservative estimate, $10,000 on said dog. Just two weeks ago the teeth cleaning bill, including extracting two teeth, and popping something called an anal gland, cost nearly $350.00. The dog maybe has 5 more years at the most, and will continue to cost at least $1000 annually, and then who knows how much to euthanize and dispose of the body. Furthermore if I did not have the television then I would never have seen the commercial about the County Pound desperately needing to find homes for dogs. Actually, I firmly believe advertisements are nothing short of Racketeering and should be punishable under the RICO Statutes, along with veterinarians. But that doesn’t absolve my complicity in the destruction of more than $10,000 of hard earned money on an animal that has no worth whatsoever. Owning pets, the last refuge of a failed financial plan. Harsh, but true, thanks.

Ooooo, really good “info/insight”! Been a “McLuhan-file” since the early ’70s. Yup, like so many other “empires” that relegated themselves to “history’s ash-heap”, “Murkaa” has let the “reality bandwagon” get completely “over the hill/outta site”, i.e. having no longer any “reference point”. Everything has become “relative” to the “lib-turd’s” “replacement idiocracy”. And “credit/debt-enslavement” is [perhaps one of] the best examples of said. Best be a get’n WAY away from those future desperate zombie “coasters” and citYzens. One can only hope that the roving armed gangs or teams of gov knuckle-draggers will tak’em down before they show up outside your digs wanting in. May the Lord have mercy on the . . . [already] S-I-M-P-L-F-I-E-D, GATHERed/GROUPed, GUNned , GARDENed and PROVISIONed – on a “portion” of inland, arable, RURAL, UN-encumbered/UN-addressed GROUND – REPENTED REMNANT[s], fulfilled in daily fellowship of collaborative PRODUCTIVE enterprise and the opportunity to assist/gather other REPENT[ing] in greater need. And as such . . . relieved, humbled and thankful for sight of One’s salvation BEFORE having – unknowingly – “run out One’s clock”.

Credit cards aren’t such a bad thing if you just consider and treat them the same as cash. We’ve never paid a dime in interest on a credit card, and they have relived us of the need to carry large sums of cash around. We also like the big cash back check we get from our card each year. The funny thing about paying off all your debts and paying 100% of your credit card bill each month is that your credit rating collapses. No big deal if you never borrow money again anyway.

I went to get a new credit card recently from a new supplier, as it has a good exchange rate system when travelling. Getting it authorized was like pulling teeth. Seems I have no rating. My bank would loan me any amount instantly, as they know me, but they do not have the low fee travel card. But the new bank could not get their heads around the fact I owe nothing, and have not for years. I told them in the end to piss off, it was too much trouble. Then they gave me the card. Go figure.

Serious questions in regards to the chart:

From 1915 to 1983 = 68 years and inflation caused by credit (if that is what the chart is supposing)

= 1,000%.

From 1983 to 2015 = 32 years and inflation caused by credit = 237%.

Q1: Does this mean the rate is slowing down?

Q2: I’m missing a calculation?

Q3: At the rate calculated from 83′ to 2015 what will the CPI be in 2051?

Inflation has been grossly underestimated by the government in the last few decades because they don’t want to pay the real number on the COLA for Social Security and other items. Real inflation has been at least 5%/annum during that period, and often more.

Nothing is unmitigated. That includes generalizing us•ery, which is a net-net loser (no matter how good the indulgence feels to the heavily emotional). As in ‘Television introduces us… it robs us….’

Did “we” leave the gold standard?

Credit “gives” instant stratification. And slow-cook karma.

Culture encourages throwaway thinking. Hive mind. Herds & mobs. Swarm intelligence. Haha.

Malinvestment mama. Destructive destruction.

Tap in – that’s what blood-sucking proboscises do.

Credit is more often the illusion of purchasing power. But outsourcing’s fulcrum is “what is my time worth?” A subjectively objective thing.

Specialization, division of labor, are lovely. I did lots of things myself, when I had more time than $. Having to spend time for lack of $, may be necessary, but it’s no unmitigated boon.

Time is gold. Gold is gold. But “we” gave up the golden ghost. And the seventies became radically different from the 60’s. It’s still the 70’s. Disco\nnect is dead; long live disco. Look at all those scientologists tearing up the dance floor. ☻

Credit (largely), & fiat, is alchemy. Lead is, remains, lead. Bullets are lead. Bulletheads are lead. Hollowpoints. And the larger calibers lead the littler ones.

Credit has been an income substitute for many years. The bill will be coming due shortly, I think.

[img [/img]

[/img]

The mean net worth of Millennials is 3,000–So they are paying the price.

Getting out of debt is ALMOST always sound advice, but it may not be in this particular economic climate. We could probably pay off all our debt except the mortgage tomorrow. But considering that in the next crisis there must either be huge deflation or hyperinflation it makes more sense to keep cash and gold and pay 0% loans off slowly. Yes…i know they’re idiotic and will ultimately be catastrophically destructive…but for this small window in time they exist and if you’re smart they can work to your advantage. The alternative is to get out of debt and save paper fiat in ridiculously over-leveragef banks and other financial institutions. I could save for 30 years to get to that magic million dollar mark only to find a million dollars won’t buy a loaf of bread.

I recognize the hard earned wisdom of many on thhis thread but worry it fits in to the category of fighting the last war.

The Queen of the Underbrush and I have been debt-free for awhile now. The peace of mind that comes with it is worth every sacrifice we made and everything we did without. About six months ago, The Queen left her job of 13 years. Management had begun to suck so bad that the stress was affecting her health. Naturally, she was concerned about finances, but she also wanted to be able to take some time to figure out what she wanted to do next. She made a good living and my business was just taking off, so I told her I’d crunch some numbers and we’d decide how long we could realistically go without her working. A few days later, we sat down and I told her, “Honey, both of us could sit on our asses, eat bonbons, and watch TV for the next three years before we even had to consider you working again.”

The look on her face was priceless. So, since then she has been doing what makes her happy. She does a lot of Church stuff, takes care of our granddaughters, and anything else that strikes her fancy. Another cool thing is that we have given more to charitable causes lately than we ever have and we always seem to have more than we started with. I’m only half joking when I tell people that the longer The Queen is unemployed, the more money we have.

Debt is slavery. The amount of debt one is willing to carry is directly proportional to the level of personal enslavement one is willing to accept. If you want to be more free, stop putting money in the pockets of those who would have you “wake up homeless on the continent your fathers conquered.”

hat tip to T. J.

The wisest man I know always says “There’s two kinds of people: people who understand compound interest and people who pay compound interest”.

My wife and I paid off our mortgage 3 years ago. Her car is 15 years old, my truck is 35 and my motorcycle (commuting transportation- even with registration, insurance and maintenance it saves thousands per year in fuel and wear and tear on the truck, not to mention my sanity) is 5 years old. We use one credit card and never carry a balance.

It’s extremely satisfying to realize how little we could live on. Cable tv will be the next thing to go.

I shuddered, but didn’t say anything, when my daughter and son-in-law bought a house last year. The price would leave me sleepless, were I to be the one paying for it. But I realize that’s just my advancing age thinking. It was probably the same for my parents looking at me and my wife when we were starting out.

I truly fear for their long term future, though. This circus can’t continue indefinitely.