Guest Post by Simon Black

For almost a year now, I’ve been advising you that gold production is plunging…

By itself, declining gold production isn’t a huge deal.

It takes hundreds of millions of years for minerals to form deep in the earth’s crust… but humans only need a few decades to extract it.

That’s why mining companies need to constantly explore for new deposits.

And that’s where the problem comes in… mining companies haven’t been exploring.

Large mining companies have been cutting their exploration budgets for years. By the end of 2016, exploration budgets hit an 11-year low.

Part of the reason for the decline in exploration has been the stagnant gold price and general, investor disinterest toward the gold mining sector.

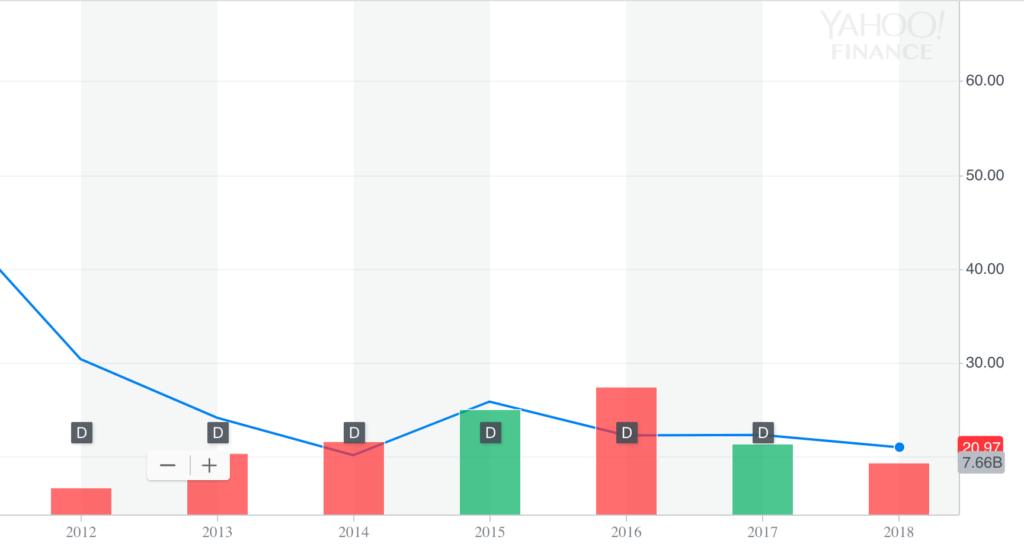

If you look at a chart of the Gold Miners ETF (GDX), the price hasn’t gone anywhere for five years.

And gold prices have likewise languished; today’s price of $1,290 per ounce is down 30% from the 2011.

To fight the tough times, miners slashed their exploration budgets.

That means, when the demand for gold picks up again (which I think we’re starting to see now), there won’t be enough gold supply.

You don’t have to just take my word for it…

Pierre Lassonde, the billionaire founder of gold royalty giant Franco-Nevada and former head of Newmont Mining –

If you look back to the 70s, 80s and 90s, in every one of those decades, the industry found at least one 50+ million-ounce gold deposit, at least ten 30+ million ounce deposits, and countless 5 to 10 million ounce deposits.

But if you look at the last 15 years, we found no 50-million-ounce deposit, no 30 million ounce deposit and only very few 15 million ounce deposits.

So where are those great big deposits we found in the past? How are they going to be replaced? We don’t know.

Lassonde isn’t the big gold player warning about the falling gold production. You can read some other warnings in this piece I wrote in July of last year.

One of the legends we quoted was Ian Telfer, chairman of Goldcorp, who told the Financial Post:

“If I could give one sentence about the gold mining business … it’s that in my life, gold produced from mines has gone up pretty steadily for 40 years. Well, either this year it starts to go down, or next year it starts to go down, or it’s already going down… We’re right at peak gold here.”

If gold production is peaking, and the mining companies aren’t spending money to find new deposits, that means one thing… when demand picks up, we’ll see a wave of consolidation in the industry.

Mining companies will be forced to acquire one another in order increase their production and meet a rising gold demand.

These consolidations are already happening. Literally just today, Telfer’s $8.5 billion Goldcorp was acquired by Newmont Mining for $10 billion.

This isn’t the first deal like this: back in September, Barrick Gold bought Randgold Resources in a $6 billion deal.

This is exactly what you’d expect to see in an era where gold miners are acquiring each other and consolidating their production.

And all of this should be quite favorable for gold prices over the long-term.

Now, at least for me, gold has never really been an investment. I don’t trade paper currency for gold, hoping to trade gold back for more paper currency down the road.

Instead, gold for me has always been always a hedge against all the risks in the world that just don’t make sense.

And there are plenty of those:

The US debt is now nearly $22 trillion and growing at more than $1 trillion a year.

Interest rates across the world’s other largest economies– Europe and Japan– are still negative. China is rapidly slowing.

Governments around the world, it seems, are in a coordinated effort to destroy paper money and inflate their massive debts away.

Meanwhile, interest rates are slowly rising from the bottom, putting the huge stock and bond rally of the past decade at risk.

All of these are very prudent reasons to own gold.

And with today’s news, we’ve now seen several of the largest gold miners in the world spending a combined $16 billion to increase their gold reserves. They’re admitting there’s a big shortage of the metal. And this trend is just getting started.

If I choked my chicken everytime I read a “gold’s about to rocket” article, since the last high point in 2011, then the world would be covered in splooge.

Gold is not a mineral. It is an element. It is not created in the earth. What the world has is finite supply unless a gold rich asteroid hits.

Meaning, the more rare, the higher the value. So buying gold is worth it for that reason alone.

Diamonds are the opposite. Diamond are plentiful but the diamond miners repress the supply, making it seem as if they’re rare. They’re really junk stones, but people buy the propaganda and marketing. I’d rather have a ruby, emerald or sapphire any day.

Which is why Russia and China and the BRICS nations are dumping T-Bills and replacing them with gold.

If the U.S. started buying gold and converted to a gold standard again, gold would skyrocket and the American economy would rebound like mad, on a sound financial footing. Of course, the Federal Reserve would have to go by the wayside. Good luck with that.

When it costs $1,300 to simply extract a single ounce of Gold from the ground, what will it sell for?

When Gold is $13,000 an ounce what will a loaf of bread sell for?

I own gold and silver, but I wouldn’t own stocks in either. If you don’t have it in hand, it’s not yours. Same with paper gold and silver.

One day – and nobody knows when – the economy is going south, and the only people that will have anything of value are those that own gold and silver (and land, if they can keep it). Just ask those who lived through hyperinflation in the Weimar Republic.

The US has gone completely batshit insane.

Americans used to fight Nazis and Commies, but have now become Nazis and Commies.

Americans are simply unable to see hypocrisy or understand unintended consequences.

Americans say Obama was an asshole for destroying the US with wars, debt, and tyranny, but then they turn around and scream Trump is a holy god for supporting wars, debt, and the police state.

Americans think the government can magically rule by decree.

Americans say tyranny only affects others and that they are immune from the police state.

Americans insist freedom only benefits other people.

Americans want the government to ban saggy pants and smoking, but then they are puzzled why prisons are overcrowded.

Americans demand that the government start a trade war, but then they are stunned when prices rise and no one wants US exports.

Americans say tiny homes must be illegal, but then they baffled why homelessness and housing costs increase.

Americans beg for welfare and then they are shocked that the US debt is growing.

Americans want the government to have regulations and high minimum wages, but then they are dumbfounded why there are no jobs.

Americans want the government to start endless wars, but then Americans do not understand why the world hates the USA and why there are refugees, terrorism, and tyranny.

Anyone who loves wars, debt, and tyranny is considered to be normal and anyone who supports peace, balanced budgets, and freedom is called a nutjob and racist and is banned, gets an IRS audit, gets arrested, or is killed.

The entire country seems to be committing suicide.

WTF?

Grant Williams lays it out here in this 33 minute SUPERB presentation on “A World of Pure Imagination”,

that the Banksters have us in the biggest Stock Market Mania of all time. Why the Yellow Dog has survived for all of the thousands of years, not necessarily skyrocket, just endure. Argentina bonds look great for sure. “Never give a sucker an even break.”

https://stansberrystreaming.com/presentations/grant-williams.html

“Up on the Madison Fork the Wasichus had found much of the yellow metal that they worship and that makes them crazy….” (Black Elk, from Black Elk Speaks, 1932)

http://www.thejzone.com/blackelkspeaks_2002.html#1932edition