Authored by Philip Verleger via Oilprice.com,

Albert Einstein once wrote that “the definition of insanity is doing the same thing over and over again and expecting different results.” Were he alive today, he would be repeating the line to anyone who would listen, especially the reporters on cable news channels such as CNBC. He might add that the world’s policymakers always approach oil market disruptions in the same way: predicting there will be no impact on prices.

Einstein would then point out that the policymakers are consistently wrong. A hefty price boost has followed every disruption.

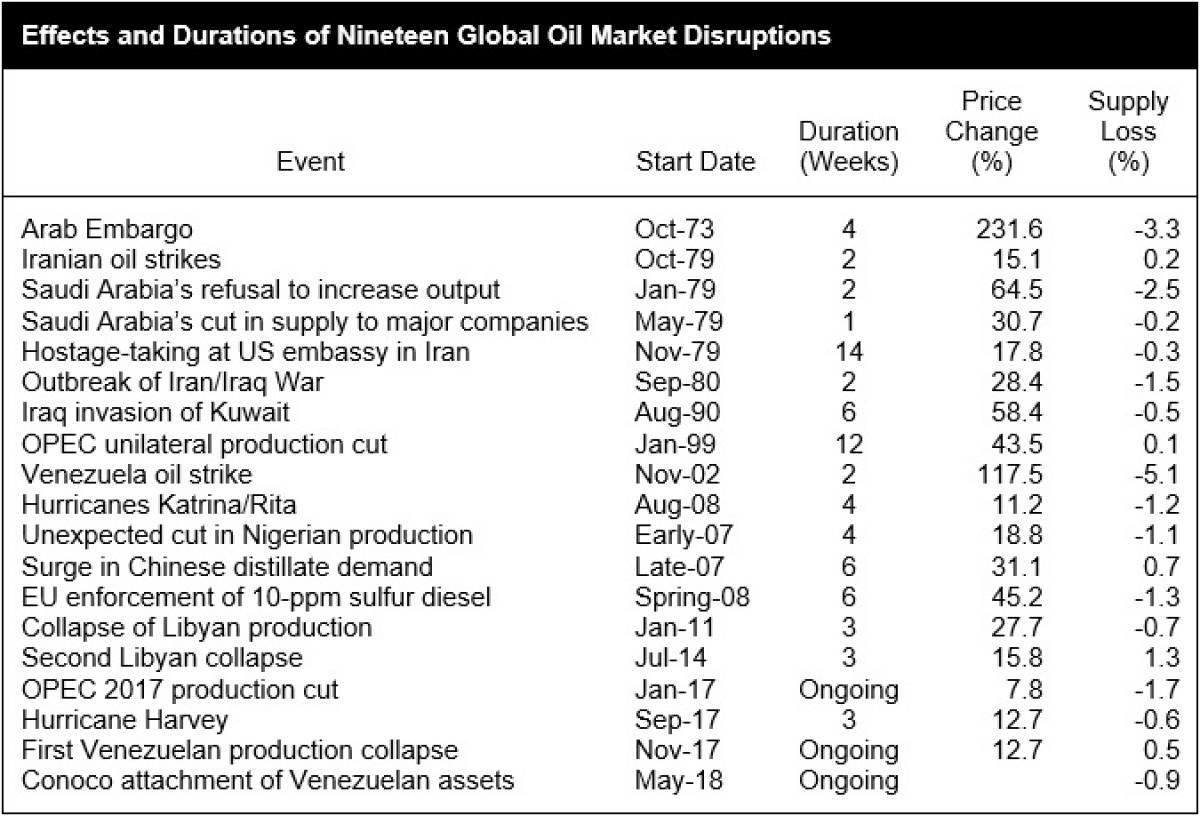

The world has experienced nineteen oil market disruptions over the last forty years. In a paper published in March 2018, I chronicled these events and noted that the maximum price increase was predictable. Last Monday, Secretary of State Mike Pompeo initiated the twentieth disruption. The consequences are projected here.

Start, though, with the energy policy insanity. In each of the disruptions since 1973, I have noted the following regarding government officials.

State Department representatives always say something like “the US Department of State remains in contact with our partners to reduce the risk of supply disruptions. There is sufficient oil supply in the global markets that countries can access.”

OPEC officials always spout some version of “the oil market remains well-supplied, with the recent price driven by geopolitics, not fundamentals.”

Nothing has changed. Last week Reuters offered this quote from the State Department’s Brian Hook, the person running the Iran sanctions program:

“There’s roughly a million barrels per day (bpd) of Iranian crude (exports) left, and there is plenty of supply in the market to ease that transition and maintain stable prices,” said Brian Hook, U.S. Special Representative for Iran and Senior Policy Advisor to the Secretary of State, speaking in a call with reporters.

Meanwhile, Saudi energy minister Khalid al-Falih told Financial Times that Saudi Arabia would not boost production immediately, adding that “the market is ‘well supplied’ and inventories continue to rise despite the sanctions against Iran’s oil exports.”

Mark Twain is thought to have said that “history does not repeat, but it rhymes.” In this case, it repeats. Policymakers have learned nothing in forty years.

The table below lists the nineteen market disruptions. I prepared it in 2018 at a time when Conoco had just used an award of $2 billion granted against Venezuela to seize the latter’s assets in Curacao and when production in Nigeria suffered a disruption. For each event listed, the table shows the start date, the duration, the maximum price increase associated with it, and the percentage loss in supply.

(Click to enlarge)

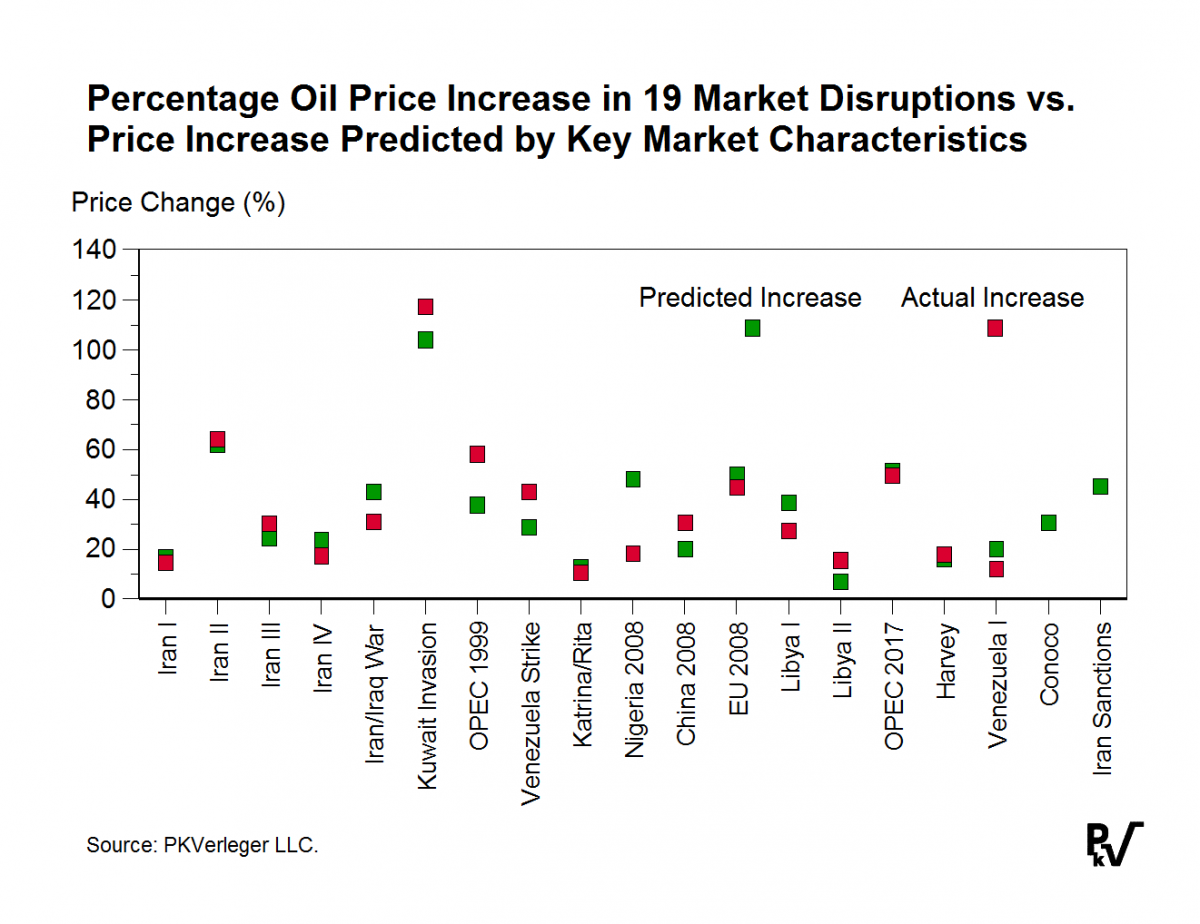

I took these data and developed a model that predicted the price increase associated with seventeen of the nineteen disruptions, excluding the Arab Embargo and the Conoco attachment of Iranian assets. The model explained seventy percent of the price variation. The graph below compares the actual and predicted price changes for each disruption.

(Click to enlarge)

I note here that I based this model on results published in 1982 in Oil Markets in Turmoil, a book I wrote while teaching at Yale. The volume provides a quantitative approach to evaluating oil market disruptions.

The findings from the model indicate that the current disruption will likely cause prices to increase sixty-six percent at their peak. Roughly speaking, Brent will rise to between $114 and $126 per barrel.

This conclusion results from my calculation that the present episode will take roughly two percent of supply from the market.

The reduction will come from falling Venezuelan production, which is also subject to US sanctions, the declining Iranian exports, and a modest cut in Libyan exports.

The latest issue of The Economist warns that “the risk of an oil price shock is increasing.” The editors are correct.

Thinking of the Einstein quote above, I end by paraphrasing the title of a great book by Carmen Reinhart and Kenneth Rogoff: “This time will not be different.”

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Ordered up a tank fill.

What’s to worry about, solar and wind accounts for at least 2.5% of our energy needs, when the wind is blowing and the sun shining…..God forbid we have nuclear power and domestic pipelines and new exploration permits (CA, NY, PA shale, etc.) are so triggering. What could possibly go wrong?

God Emperor Trump will fix it ! The economy is the bestest greatest ever !

“The all-items inflation rate represents everything people spend money on: haircuts, plane tickets, medical care, clothes — you name it. But, that number is puffed up by the pesky necessities — food and energy. So those two categories are discarded when calculating the core inflation rate.” (exert from article / bankrate.com)

“The latest issue of The Economist warns that “the risk of an oil price shock is increasing.” The editors are correct.”

That’s a good one……the Rothschilds are correct !?

If only God Emperor Trump would DO something to help the poor people of Venezuela……..FREEDOM……! Might even be able to help MAGA at the same time. Conoco would probably help with the oil reserves !

Oh, I hope God Emperor Trump and his Texan Paytriot Mouthpiece Alex Jones can fix everything…..

annuit coeptis novus ordo seclorum-It’s all planned…..isn’t there an article somewhere about “The War on Cash”?

I can’t wait for God Emperor Trump to ‘lock her up’ and ‘build that wall’….those pesky Russian colluders…..but I’m sure he will get right on with it after the greatest, biggest, best, run-away election in all the history of the whole world !

“Time is the fire by which we burn” !

Easy to tell you’re a Hillary voter….

Easy to tell you’re an uninformed fool !

annuit coeptis novus ordo seclorum- I broke my long held tradition of NOT voting just to vote for the lying POS that’s in there now. No difference between the two…….just to little dweebs like you, maybe. Run on over to ‘Q’ on 8 chan, trust the plan !

I forgot more than you know. Is your hair green, or blue ?