Authored by John Mauldin via MauldinEconomics.com,

Let’s address an elephant in the room: the rapidly expanding federal debt. Each annual deficit raises the total debt and forces the Treasury to issue more debt, in hopes someone will buy it.

The US government ran a $343 billion deficit in the first two months of fiscal 2020 (October and November), and the 12-month budget deficit again surpassed $1 trillion. Federal spending rose 7% from a year earlier while tax receipts grew only 3%.

No problem, some say, we owe it to ourselves, and anyway people will always buy Uncle Sam’s debt. That is unfortunately not true.

Foreign Treasury Buyers Are Turning Away

The foreign buyers on whom we have long depended are turning away, as Peter Boockvar noted:

Foreign selling of US notes and bonds continued in October by a net $16.7b. This brings the year-to-date selling to $99b with much driven by liquidations from the Chinese and Japanese. It was back in 2011 and 2012 when in each year foreigners bought over $400b worth. Thus, it is domestically where we are now financing our ever-increasing budget deficits.

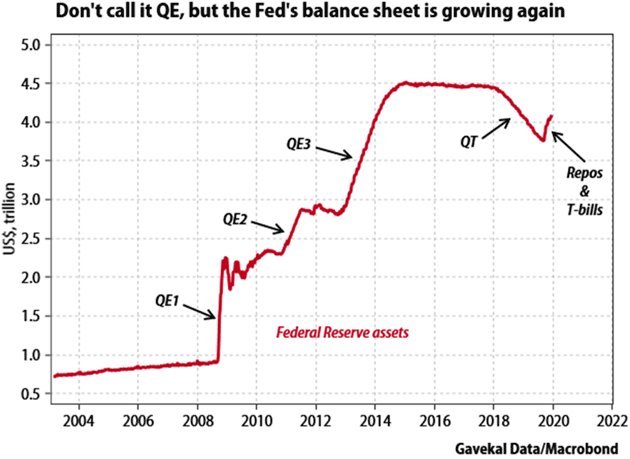

The Fed now has also become a big part of the monetization process via its purchases of T-bills which also drives banks into buying notes. The Fed’s balance sheet is now $335b higher than it was in September at $4.095 trillion. Again, however the Fed wants to define what it’s doing, market participants view this as QE4 with all the asset price inflation that comes along with QE programs.

It will be real interesting to see what happens in 2020 to the repo market when the Fed tries to end its injections and how markets respond when its balance sheet stops increasing in size. It’s so easy to get involved and so difficult to leave.

Declining foreign purchases are, in part, a consequence of the trade war.

The dollars China and Japan use to buy our T-bills are the same dollars we pay them for our imported goods. But interest and exchange rates also matter. With rates negative or lower than ours in most of the developed world, the US had been the best parking place.

But in the last year, other central banks started looking for a NIRP exit. Higher rate expectations elsewhere combined with stable or falling US rates give foreign buyers—who must also pay for currency hedges—less incentive to buy US debt.

If you live in a foreign country and have a particular need for its local currency, an extra 1% in yield isn’t worth the risk of losing even more in the exchange rate.

I know some think China or other countries are opting out of the US Treasury market for political reasons, but it’s simply business. The math just doesn’t work.

Especially when President Trump is explicitly saying he wants the dollar to weaken and interest rates go even lower.

If you are in country X, why would you do that trade? You might if you’re in a country like Argentina or Venezuela where the currency is toast anyway. But Europe? Japan? China? The rest of the developed world? It’s a coin toss.

The Fed began cutting rates in July. Funding pressures emerged weeks later. Coincidence? I suspect not.

The Fed Started Monetizing Debt

It sure looks like, through QE4 and other activities, the Fed is taking the first steps toward monetizing our debt. If so, many more steps are ahead because the debt is only going to get worse.

As you can see from the chart below, the Fed is well on its way to reversing that 2018 “quantitative tightening.”

Luke Gromen of Forest for the Trees is one of my favorite macro thinkers. He thinks the monetization plan will get more obvious in early 2020.

Those that believe that the Fed will begin undoing what it has done since September after the year-end “turn” are either going to be proven right or they are going to be proven wrong in Q1 2020. We strongly believe they will be proven wrong. If/when they are, the FFTT view that the Fed is “committed” to financing US deficits with its balance sheet may go from a fringe view to the mainstream.

Both parties in Congress are committed to more spending. No matter who is in the White House, they will encourage the Federal Reserve to engage in more quantitative easing so the deficit spending can continue and even grow.

The next recession, whenever it happens, will bring a $2 trillion+ deficit, meaning a $40+ trillion-dollar national debt by the end of the decade, at least $20 trillion of which will be on the Fed’s balance sheet. (My side bet is that in 2030 we will look back and see that I was an optimist.)

Sometime in the middle to late 2020s, we will see a Great Reset that profoundly changes everything you know about money and investing. Crisis isn’t simply coming. We are already in the early stages of it.

I think we will look back at late 2019 as the beginning. This period will be rough but survivable if we prepare now. In fact, it will bring lots of exciting opportunities.

* * *

I predict an unprecedented crisis that will lead to the biggest wipeout of wealth in history. And most investors are completely unaware of the pressure building right now. Learn more here.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

the 1920’s STARTED and ended with depressions. History repeat or rhyme?

Most folks don’t know about the depression of 1920-1921. Stocks dropped 47%. One of the sharpest drops in the shortest time in US history

That be true. Too bad more people don’t do a compare / contrast of the 1920-21 depression with the 1929-45 Great Depression. Or, pay attention why one was so short (and previous depressions) and why the Great Depression took so long to resolve.

Yes, let’s NOT have the 2020’s start as the 1920’s did – the depression of 1920-21 was sharp, but short, as it was the last depression that the US gov’t did NOT intervene. The depression starting in 1929 lasted as long as it did because the US gov’t DID intervene and NOT let market forces allow a correction as previous depressions had. [at least from an “Austrian Economics” point of view] James Grant did a nice treatment of the 1920-21 Depression, and Murray Rothbard did a “Austrian Economics” point of view of the first few years of the “Great Depression” starting in 1929. Recommend both.

Government intervention caused the ’08 recession and then additional intervention turned it into the Great recession.

whatever you’re going to do with dollars, you might want to do it now.

Why the worry about the debt? It’s just numbers inside a computer that can easily be erased.

True but all other positive numbers inside a computer will be erased as well…that is why I am into, and believe in all forms of hard assests…in your hands, and no debt.

“and no debt”

the tribe controlling our federal government has assigned you all the debt they think they need to claim all your property and you.

I can’t control the hive tribe gman, but, I can control my life…and no personal debt has been a constant comfort, and has payed big dividends.

This is true. But freedom from personal debt does not end the matter. To the extent that you are visible to the IRS and other taxing entities and that you buy goods and services in the open market, then your property, both real and personal; your income, both earned and passive; and your transactions in the marketplace are collateral for the trillions of debt-money lent to the government by the hive-tribe bankers.

Perhaps you missed the hold it in your hands bit.

“It’s just numbers inside a computer that can easily be erased.”

the numbers will never be erased. they will be enshrined in law and enforced in permanent total confiscations of all real property in the united states, including all its citizens in permanent serfdom. anything that escapes will be declared “terrorist” and eliminated. “the silver is mine, and the gold is mine.” “the nation that will not serve you shall be destroyed.”

gman,

Piss on their numbers, their tyrannical government, and them.

Four words buddy!

SELF-SUFFICIENT

Able to maintain oneself and family without outside aid: capable of providing for one’s family needs, a self-sufficient farm.

DEFIANCE

The act or an instance of defying, disposition to resist: willingness to contend or fight.

HOPE

To cherish a desire with anticipation: to want something to happen or be true, hopes for an abundant life with God’s blessings.

four words back at you.

“low collateral damage bomb”

Yep, the debt-bomb is mathematically impossible to stop, and has been for some time. Both parties know this, and this is why the GOP has pretty much stopped yapping about it, or trying to cut a meaningful amount of spending. They know the only option is to ride it out as long as they can, and then there will be a Great Reset. I suspect that HiLIARy was supposed to oversee this had she won, and that would have been the final selling-out of the USA. The Powers-that-Be would very much like to cause a recession to get rid of the OrangeMan, but it will spiral out of control if they do. Maybe a “debt jubilee” would be the best course (just print-off 20T in digital money for federal debts, and declare all other debts null and void), but anyway it goes, a lot of groups of people (savers, pensions, 401K holders, mutual funds, etc) are gonna get screwed like never before, and we will all be suffering in a lot in The Greatest Depression.

“debt jubilee”

never happen. the entire purpose of the entire federal reserve debt dollar system is to generate debt, then enforce confiscations. they want it all, and us.

Confiscation – that makes sense.

Hey, one can hope, right? LOL

Greed? Say it ain’t so.

According to the Simpsons Hillary is going to be in the oval office after Trump.

“Hillary is going to be in office”

if they can generate enough fraudulent ballots, sure. personally I’d like to see AOC, she’ be a hoot!

just saw a short article about aoc –she’s hated by state/local politicos in new york & ny is losing a congressional seat after the 2020 census,guess who is going to be redistricted?

Every dollar no longer needed by some foreign entity will find its way back to the US. That means dollars long sequestered OUTSIDE the US will then compete in the dollar market INSIDE the US. If that’s not a recipe for price inflation, then I don’t know what is.

Add in the morons at the FED printing like there’s no tomorrow and price inflation is baked in the cake.

Got green pieces of paper with dead presidents on them – get rid of that as soon as possible. Trade it for tangible goods of all kinds.

Just don’t hold too much green paper. Up front, cash will be valuable in a crisis, but that will fade fast. It’s a strategy between how much to hold for bargains when people need cash and then the cash going towards its intrinsic value of toilet paper soon thereafter. No one has that figured out.

“That means dollars long sequestered OUTSIDE the US will then compete in the dollar market INSIDE the US.”

dunno. most dollars are in fact parked outside of the united states. and most physical currency (in value) is in the form of $100 bills outside the united stats. when it’s time to repatriate all that, not sure there will be much to buy.

hey, some fun facts:

physical currency in paper bills: $5300 per united states resident (but over half of that is in $100 bills held outside the united states)

physical currency in coinage: $143 per united states resident

I’m outside the US and convert as much US and local cash to PM’s as possible. I don’t trust anyone’s funny money.

When I purchase PM’s, that cash finds its way back to the US eventually. More and more individuals are dumping gov’t script for PM’s, land, and other goods.

It’s just a matter of time till price inflation hits.

Either massive inflation or just a debt default – it seems the only 2 ways that this will end. Neither will be pleasant.

You are reading my mind!

“No one has that figured out.”

some people have. most that have don’t talk about it.

Mauldin says, “The next recession, when ever it happens will bring a $2 Trillion + deficit, meaning a $40 trillion – dollar national debt by the end of the decade.”

Right now the dollar; that is, the Federal Reserve Note we use, so I am told is worth 2 cents in real money. Anyone who remembers what these notes bought in 1960 realizes that a candy bar cost 5 cents back then and the same candy bars costs $1.80 today.

Today the national debt is around 23 trillion dollars; that is federal reserve notes. This same debt today in real money backed by gold is 460 billion.

So who is blowing smoke about the seriousness of the debt? Mauldin.

This government can easily pay this debt off in real money. There is far more value in gold in the ground under federal lands than this puny debt we have. FRNs are about worthless and when the reset comes this worthless paper money will be replaced with real money.

Sometimes I think Mauldin is a snake oil salesman. And the snake oil is the FRN.

The best thing that can happen to this country is when we ditch the FRN. It has served it’s purpose well since the national emergency of June 5, 1933.

” There is far more value in gold in the ground under federal lands than this puny debt we have.”

“I’ll gladly pay you in gold someday for an F35 figher plane today” ….

“It has served it’s purpose well since the national emergency of June 5, 1933”

don’t you mean since 1913? in any case it hasn’t served its real purpose yet, that will happen when the defaults and confiscations kick into high gear. you’ll see the cops and troops support that with a will, because 1) their pensions will depend on it and 2) there will be nowhere else to go.

Look up House Joint Resolution 192 of June 5, 1933 and you will find out the role of the FRN in the bankruptcy of the US.

All debts will be easily paid off when gold becomes money again and again competes with the FRN. In the reset when you begin to be paid in gold backed currency you will easily be able to pay off your debt. As gold becomes worth more against the FRN and gold can again become currency to pay off debts a relief will begin across the land.

What affect will this have on asset prices?

When everything resets value will remain the same. Inflated assets? What made them inflate? Can gold cause something to inflate? Surely not. Gold is stability. Why does a 5 cent candy bar of 1960 cost $1.80 today? The currency depreciated and the economists call it inflation. It is the same with all assets.

Everything is going to be just glorious . The total end of our way of life and a future where we are ruled over by low IQ nigger types. See…. just glorious

Does it have to be low IQ niggers??

“Does it have to be low IQ niggers??”

As opposed to what?

I think that ‘low IQ niggers’ is

simply redundant.

Rather like ‘lying corrupt

politician’.

We should have at least until after the 2020 election. Gotta make things look good to get elected again.

Unless the ’20 election is the lynch pin as the ’08 election was.

I prefer to believe we are living in the Garden of Eden…but we just don’t know it, yet.