Authored by Sven Henrich via NorthmanTrader.com,

Since 1900 markets have had their fair share of crashes. Mind you crashes don’t happen that often, in fact crashes are very rare. You know what’s also very rare? A particular party being in power preceding crashes. Every single time, making them the crash party.

Oh don’t start hating on me. This is not a political post, but I know how tribal politics are these days and you say one thing about anyone or party you get hammered. For the record: I’m not a Republican and I’m not a Democrat. Tribalism, parties, clubs, it’s just not in my DNA. I’m an independent or outsider or whatever label fits.

I analyze charts, trends, macro data. And people who have followed me for a long time know I’ve been ranting about the Fed during the Obama administration as much as I am now. So this post has nothing to do with party, but with history and the data is surprising.

First off, what were the big crashes since 1900?

In chronological order:

- The panic of 1907. This is what ultimately resulted in the formation of the Fed to not to let something like this happen again.

- Of course it did as the next crash came in 1929. Then we went on to various recessions, ups and downs and stagnation in markets for decades.

- The next famous crash came in 1987. Black Monday. Over 20% in a swift flush.

- Then of course came the Nasdaq tech crash in 2000 and then of course the great financial crisis in 2008/2009.

All of these periods came on the heels of market excess, massive rallies, vast optimism, and then the busts came.

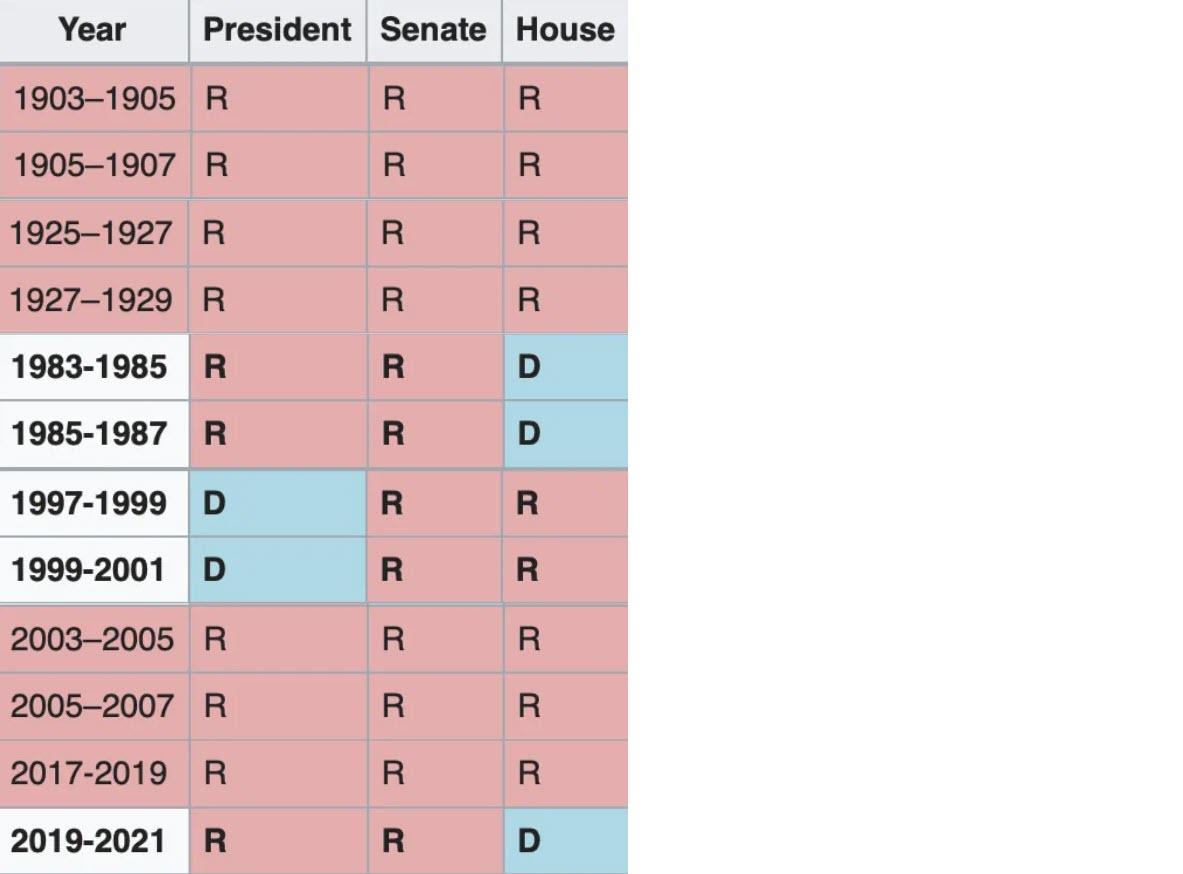

But here’s the weird thing: ALL of these crashes happened following more than 2 years of GOP control of the Senate, or combined with control of the presidency and in one case the House and the Senate but not the presidency:

To appreciate how historical this is: These are also the ONLY times the GOP has had such control. To see the full history visit: Divided Government.

What you will find is that historically there’s a board spread of control with Democrats more often than not controlling both the House and Senate. And yes, there was trouble too once when Democrats controlled everything. 1937 is an example. Big nasty recession during the Great Depression. But that was it really. Real market crashes appear to only occur during GOP led times.

History shows Republican control of government is historically rare and when this control happens for more than 2 years a market crash has occurred every single time.

Don’t yell at me, that’s just the history. If there’s a crash the GOP controlled the Senate for more than 2 years. Every single time. The ONLY time that there was no crash was during the 2 years the GOP controlled the House, the Senate and the presidency in the 2 year period in 1954-1955. But as soon as the Senate is controlled by Republicans for more than 2 years a crash has occurred every single time.

1907, 1929, 1987, 2000, 2008. Sorry GOP fans, but none of these crashes occurred following Democrat control of the Senate or the government at large.

One can speculate as to why that is or whether this is just a giant coincidence. If it is a giant coincidence then one could argue that’s just an extraordinary string of bad luck. If one is to look for correlation one may point to a GOP habit of cutting taxes, promising the moon on growth and markets overheating as a result, creating massive market excess in the process, the unwind of which then results in a crash. I don’t think that argument would hold true in the 2000 scenario, much of this was the technology boom and the Fed adding liquidity in 1999 for Y2k.

But in 1986 Ronald Reagan cut taxes and markets rallied until they crashed in 1987. George Bush cut taxes in 2001 and then again in 2003. Deficits again rose, markets rallied hard into 2007 and then the financial crisis came.

I don’t think any fair minded person can blame the GOP solely for market crashes and I’m not doing that. Major crashes happen as a result of a combination of multiple factors, but all relate to market excess, excess optimism and more often than not artificial financial infusions, be it central banks, tax cuts and heavy deficit spending. And then markets go overboard, disconnect too far from the fundamentals and then set up for a violent reversion which then brings about the recession and/or crash.

I suggest that all these elements are again at play: We’ve had massive tax cuts, have trillion dollars deficits, massive optimism and massively stretched valuations and guess what else: Republicans in charge for over 2 years of the Senate and the presidency. The crash party?

Don’t go around saying I’m calling for a crash. I’m not. History is.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

I didn’t realize the uni-party went that far back. We have not had a true two party system since the fed reserve came into existence under wilson. One might speculate that the two party system died with the civil war. What we see today is the product of a collective party that has played us like a fiddle.

The Progressive takeover of the two worthless parties during the late 1800s pretty much sealed the deal. There were some notable differences before that.

“The Crash Party”

oh! you mean the political party in power during an economic crash! I thought you meant the celebration party that some people will throw when the economic crash finally at long last happens!

Given the choices the Donks are putting out there, I’ll take my chances with the GOP…

Better to have loved and lost.

Stock Trader’s Almanac has some good research on this. The tribal bankers who own the fed prefer Democrats and historically favor them with easier monetary policy. They certainly pulled the rug out from under the GOP by draining liquidity at record rates in ’08 ahead of the election. Maybe it will be different with Trump since he’s Jewish (according to Mark Levin at least.)

That is an interesting proposition for the cause of the GOP curse.

I concur with the thesis, that a crash awaits. I have had the same thought and my reasoning was and is simply ‘excess optimism’. I think that would explain the GOP curse too. I think even the libtards are counting on a victory in the trade war. Two interest rate inversions and so much irrational exuberance: It’s coming. Anyone know how to capitalize on this? Any hedge fund managers here? I will now bet on American stupidity. It’s so steady and true. If you can’t join ’em, beat ’em.

Besides the whole concept of the Fed being a problem, the GOP likes to cut taxes, which is great, but they never offset by cutting government spending.

the thinking is that cutting taxes will expand the economy which will result in increased revenue without raising taxes.

likely that worked at one time, but the ever-increasing debt load of the fiat debt dollar nullifies this effect.

OK, Boomer. I wasn’t sure what I was supposed to believe on that.

Usually, it is federal policies (including the Fed) that cause a crash.

In ’99, Al Gore put the squeeze on Microsoft because they thought they could avoid the DC games and nobody would come after them. Once the feds started looking into monopoly charges, they wised up and started buying politicians to protect their nests. This fight helped usher in the dot.com bust and showed Gates that he could not become a billionaire without lining a few pockets in D C.

Jan 2007, SanFranNan took over as Speaker and started doing all she could to slow the economy so her friend Felonia could wrap up the presidential election. Of course, this was before the magic negro showed up to ruin Felonia’s plans. The housing bust was mostly due to federal housing policies that dated back to the days of Peanut and pushed by B J. W came to town with his ownership society and the market went as high as it could before running out of fuel.

The growth we are seeing now is driven by the fed and like all other bubbles, it will come crashing down at some point. The question is when

Exactly.. this article is very shallow on cause and effect. We know the Fed and globalists ultimately control the market. We also know people vote their wallets. Lastly we know the Dims use these “crises” to further socialist agendas which further elite power… seems clear to me why crashed happen before elections…2020 may be very interesting.

Magic Negro! that cracked me up.

Less a fan of Rush than me, aye?

Those are entertaining references. ‘Days of Peanut and pushed by BJ.’ You say that like it’s a bad thing. Peanut allergies are overblown.

Has Trump got any experience with bankruptcies ?

Might be why Trump was (s)elected..

annuit coeptis novus ordo seclorum <——==Apollyon lives

The Bankers, You know, The folks that call the shots will be the countries downfall. Apparently they are not that bright. Just greedy.

No doubt they are greedy, but let’s look at the scorecard. $Trillions siphoned off the economy and directed into their pockets. They can pull off fraud after fraud, and pay pennies on the dollar when caught, and for the most part have avoided jail or any kind of personal consequences for violating the law (at least since Bill Black cracked their skulls after the S&L crisis.) They somehow wrangled the privilege to create money out of thin air, then loan it to us at interest. Periodically they burn down the casino, usually when too many rubes are winning at the roulette wheel, but only once they’ve personally cashed out. Not only all this, but they’ve made the monetary system so convoluted that the average joe sixpack has no clue just how deeply he’s getting screwed on a daily basis. Guess I’m saying that they seem pretty smart to me.

Where’s the raw-raw ’cause we’re still awesome? Where’s the narrative validation? Dayz b stoopid ‘cuz wez b smart. What you wrote is so profoundly logical I almost wish I wrote it.

This is called data mining. It is interesting, but it is data mining. It’s difficult to understand what the author is saying about 1954-1955, but it sounds to me like his theory didn’t work during that period, so he dismisses it and leaves it off his chart. Same with 1937. Oops.

Why would Republican control of the Senate cause a crash as opposed to Republican control of the House or Presidency? No reason. But the author’s theory only works when there is Republican control of the Senate. The theory only works sometimes with the House or Presidency. In other words, it is random. Data mining.

The fact is the cause of each crash is different and distinct:

1929 – Extreme leverage and speculation, Horrendous monetary policy.

1937 – Not really a crash, just extreme volatility during the Depression.

1987 – Not really a crash. Essentially a one day event with a quick recovery.

1973 – Inflation, Vietnam, Watergate, Arab Oil Embargo.

2000 – Internet Stock Bubble, Long Term Capital Management.

2008 – Sub-prime mortgages, Real estate speculation, Loose credit.

Interestingly, the author neglects to mention two other crashes: 11/69 to 5/70 (-36%) and 11/80 to 8/82 (-27%). Dems were in charge. Data mining.

There was not wild speculation, over-valuation or crazy optimism before 1973 or 2008. In fact, there was massive pessimism in 1973. Data mining.

Maybe there will be a crash in 2020. I don’t know. My crystal ball is broken. As always, there is no shortage of risks out there. But if it does crash, it will not be because the Republicans controlled the Senate for two years.