Authored by Sven Henrich via NorthmanTrader.com,

President Trump is mocking Warren Buffett for having sold his airline stocks, Druckenmiller crying on TV about having been humbled by the market while every Robinhood retail trader piling into ever more calls is laughing all the way to the bank. The professionals gobsmacked at the complete upside down events in markets compared to any other time in recorded history given the economic backdrop while retail is giddy jumping into any ticker symbol that’s moving, valuations be damned, hey let’s even chase bankrupt companies, why not?

This market is so bullish even bankrupt companies are rallying.$HTZ pic.twitter.com/TPMh0wyay1

— Sven Henrich (@NorthmanTrader) June 5, 2020

Anything goes in the market.

I myself, have been surprised by the recent vertical strength that keeps running from gap to gap to gap.

Sometimes you just have to laugh:

$NYSE chart art. pic.twitter.com/I7Eep3bBCk

— Sven Henrich (@NorthmanTrader) June 8, 2020

On the day of the lows I talked about an awe-inspiring rally coming. Consider me sufficiently awe inspired.

And now the same folks that told people to buy stocks in January and February right before the crash are back out and telling people to buy stocks again except this time at much higher multiples and valuations.

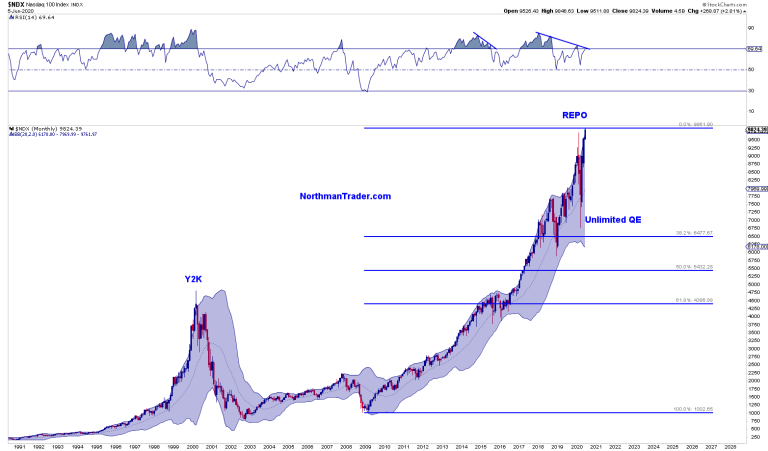

My variant take here which may well turn out to be very wrong: The Fed is setting markets up for another crash. Why? Because they’ve set in motion a stock market mania we have not seen since the 2000 tech bubble. But this time while we’re still in a recession.

And it is a mania and it’s important to recognize this. And like all manias it’ll end badly. The amount of “ever’s” keep building up.

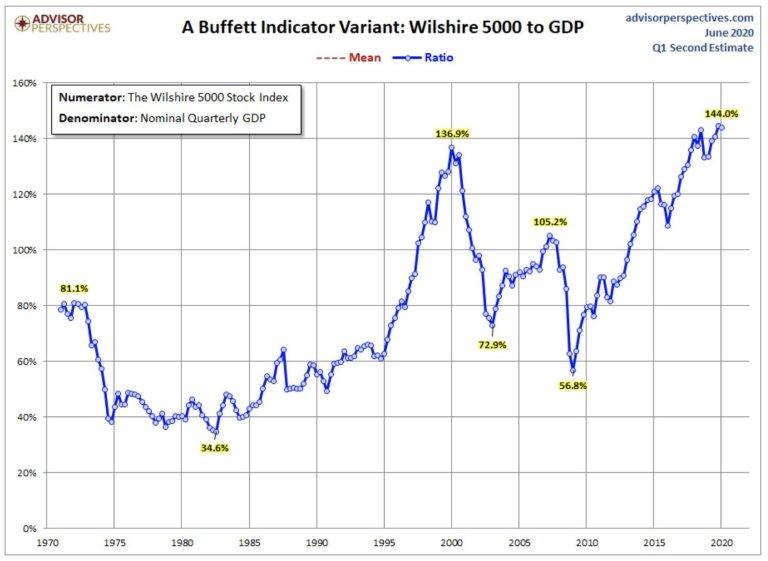

We have the highest market valuations ever (market cap to GDP) 151% on Friday’s close with old GDP data hence the real figure is higher. This chart from the beginning of June:

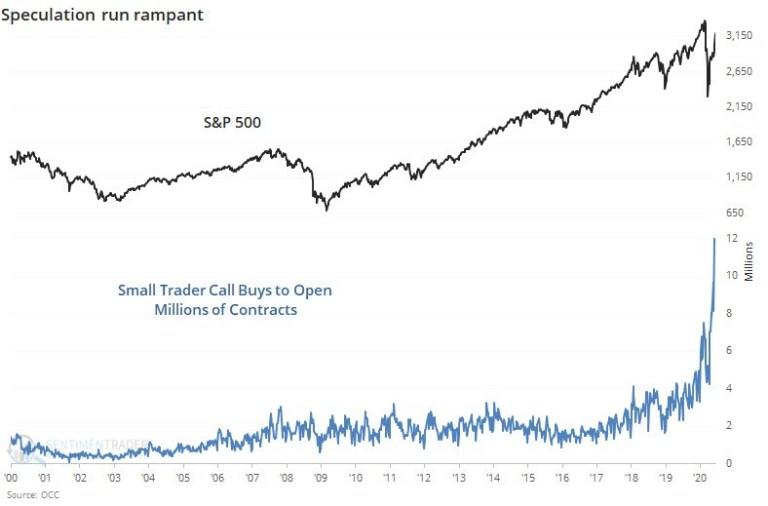

We are seeing the highest amount of speculative call buying ever:

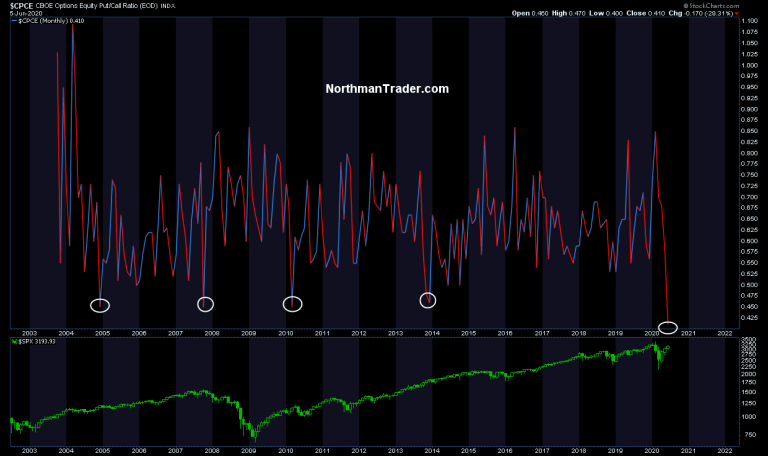

We have the lowest put call ratios ever, meaning everything is one sided and complacent:

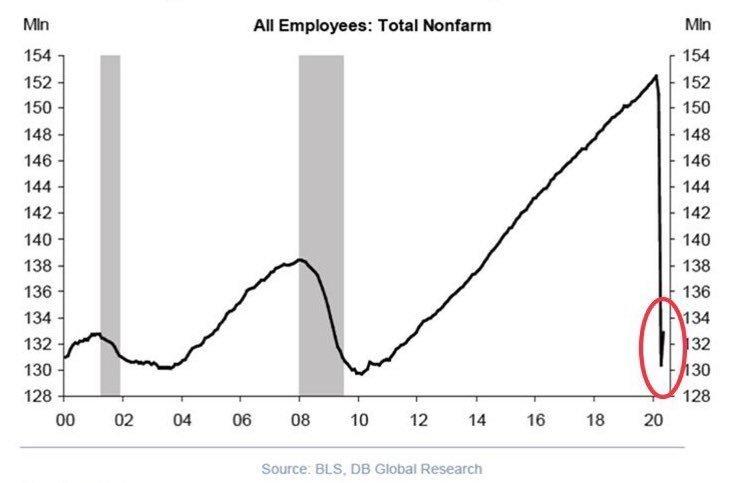

We also have the highest unemployment ever, at least since the post WWII period. The highest unemployment in the post WWII period was 10.8% in 1982.

Friday’s jobs report was as accurate as the Fed’s inflation model. Totally misrepresentative of the real economy as 4.9M unemployed people were counted as employed. 13.3% reported in reality north of 16% and perhaps much higher.

Fact is we are in a historically disastrous environment:

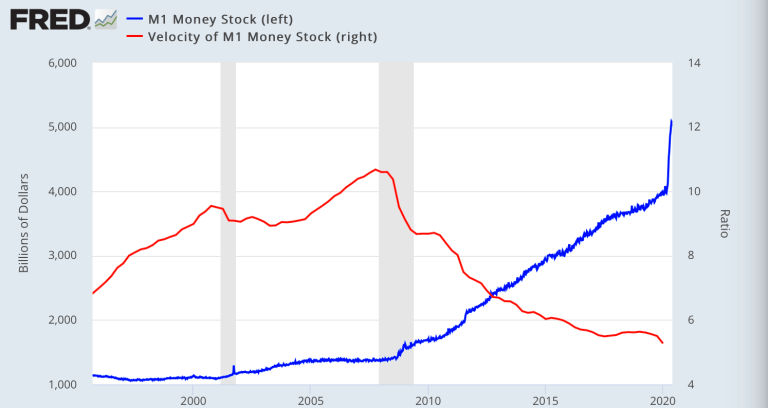

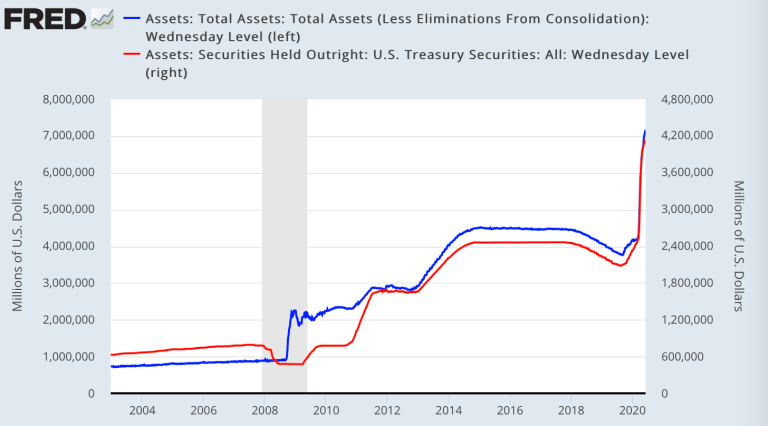

And of course we are witnessing the largest deficit (approx. $4 trillion) and monetary intervention ever:

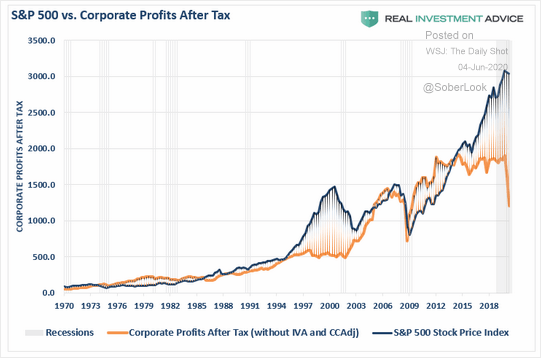

The largest disconnect from corporate profits ever, even worse than during the 2000 bubble:

$SPX is now farther disconnected from its 50MA than pretty much ever before:

One one of the highest extensions above the 50MA by $SPX ever.

Ever is a long time. pic.twitter.com/MYE6Gn6gSZ— Sven Henrich (@NorthmanTrader) June 8, 2020

The only precedence for this was in 2009. Then markets retraced to the 50MA and then rallied on from there to new highs. Back then it took years, perhaps this time it will take weeks. Who is to say in this environment.

My point here: The combination of all of these factors has contributed to the largest dislocation we’ve ever seen only perhaps rivaled by the Nasdaq bubble of 2000:

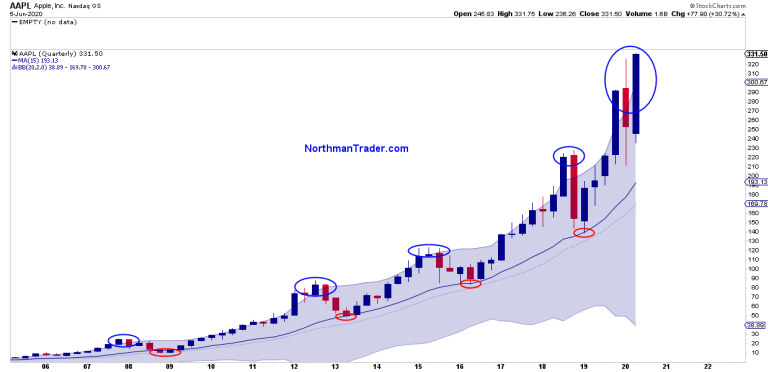

Except now we have trillion dollar market cap companies that trade at massive forward multiples and are experiencing unseen multiple expansion during a time when there is little revenue or earnings growth. And it’s just not this year. It all started in 2019 and has now extended into 2020.

And that’s the definition of a mania. Exuberant embracing of a vertical stock market rally by a majority of people of stock market valuations that are entirely unrealistic and untethered from the economic reality on the ground. A complete disregard for risk and markets that move vertically in one direction.

And of course the cheerleading. “We’re back” Jim Cramer celebrated a miscalculated jobs report on Friday. Trump celebrated the biggest jobs gain ever, when the real unemployment rate actually went north of 16% and reality is a bounce is to be expected off of a disastrous historic shut down, it’s not an accomplishment.

But the cheerleading trophy goes to, who else, Larry Kudlow, celebrating a soaring stock market and declaring himself a winner:

The same person that declared the cornonavirus contained before it killed over a 100,000 people. That same person the said “we’re killing it on the economy” only a few months before it collapsed.

I know it’s an election year and they have to cheerlead. The polls are looking terrible for Trump and I think he starts recognizing it as he complained on twitter last night. More and more traditional Republicans are getting vocal in not supporting him. Last week it was James Mattis and other generals that rebuked him, including his former chief of staff John Kelly, and this weekend it was George Bush, Romney, and Colin Powell.

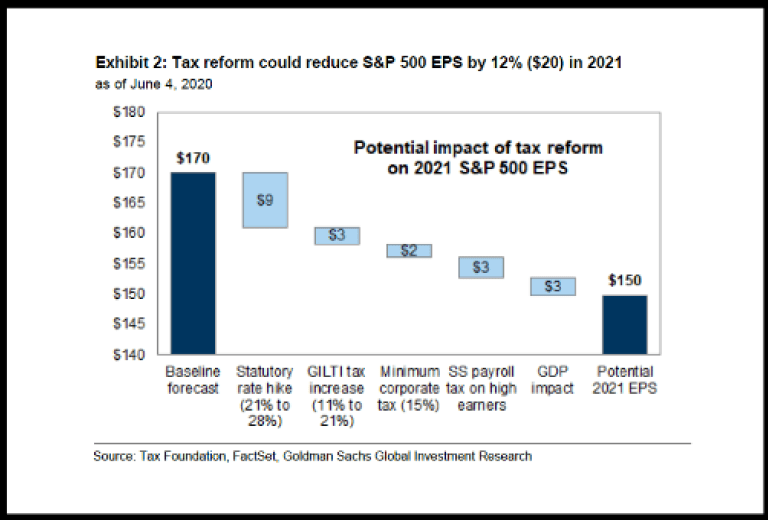

It all reeks of desperation and I keep coming back to this point: What happens when markets suddenly price in a Democratic win in November? The tax landscape would change drastically. Stocks already massively stretched would have to contend with further reductions in after tax earnings outlooks.

And Goldman Sachs is crunching the numbers on the impact:

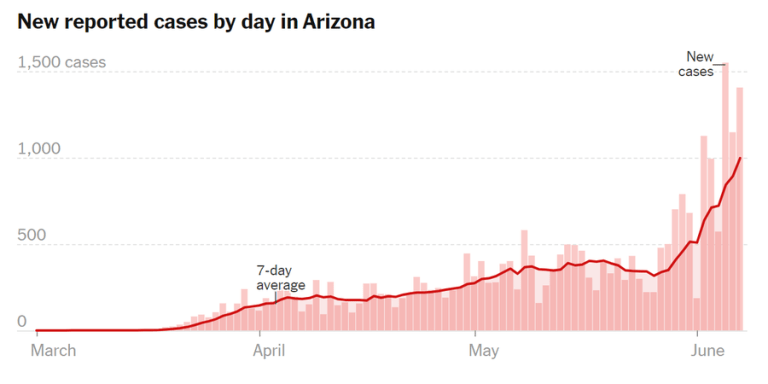

Also: Reopening everywhere, but tell me, where is the evidence of a drastic reduction in Covid cases? Yes a slow down in key states following lockdowns, but also a massive increase in many others. Newsflash: The virus hasn’t gone away, it’s migrating. Fact is the number of new infections worldwide continues to increase. While deaths have been decreasing in aggregate I also will have to point out that this is what you would expect due to the lockdowns and social distancing measures. B eclear: Cases are rising in many states, take Arizona as an example:

But Covid is largely ignored now as a risk factor despite the fact that this Sunday saw the highest new infections globally yet.

While infections have slowed down dramatically in many states we can thank shutdown measures and social distancing. Well, those measures are out the door now:

UK:

Police is beating the protesters in England too! London protest goes violent…#BlackLivesMatter #protests pic.twitter.com/THtZdAgRVy

— Hamid Taheri (@Hamid_Taheri1) June 6, 2020

US:

LA TODAY!!!!! #BlackLivesMattters #GeorgeFloyd pic.twitter.com/Cy5CJU5Lh0

— Ron Kurokawa (@ronkurokawa) June 8, 2020

So you tell me.

The virus is not gone, the numbers are bigger than ever and now we’re entering a new phase. I seriously doubt there is any political will to shut down the economy again. I don’t know what will happen with reinfection rates, but if this virus (which has shown itself to be active in warm climates as well, think Arizona) is reasserting itself we will know in the next few weeks.

Also in the next few weeks: Earnings reports, you know, reality checks.

As it stands markets and individual stocks are stretched to the hilt:

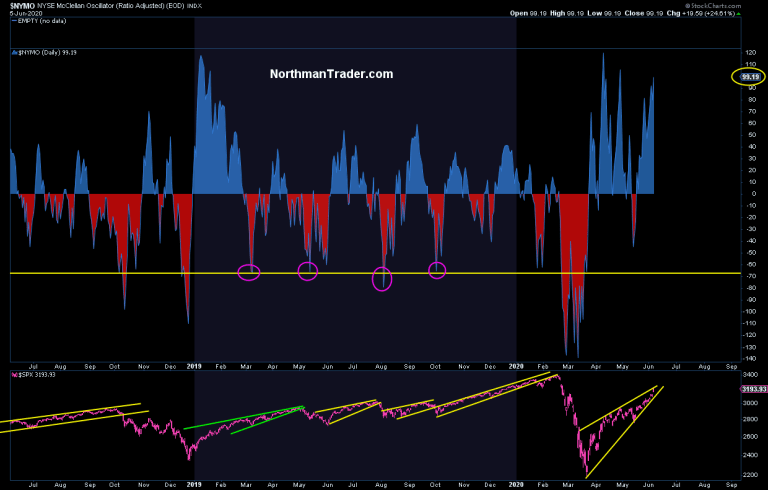

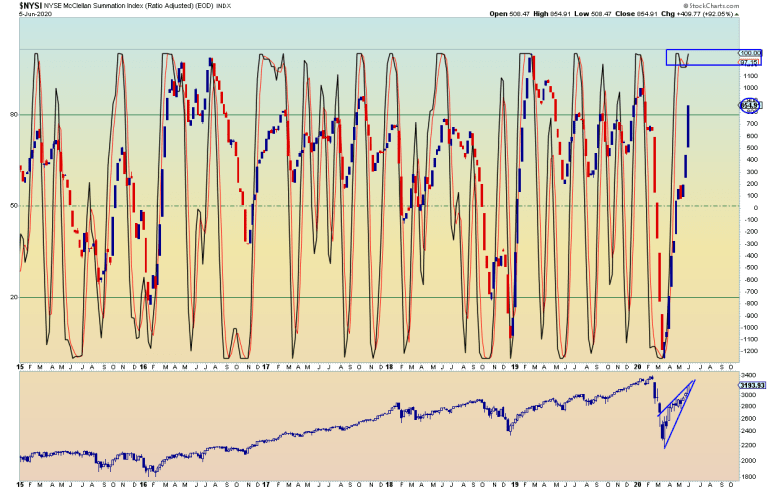

100 $NYMO again on Friday:

$NYSI continuing to scream overbought:

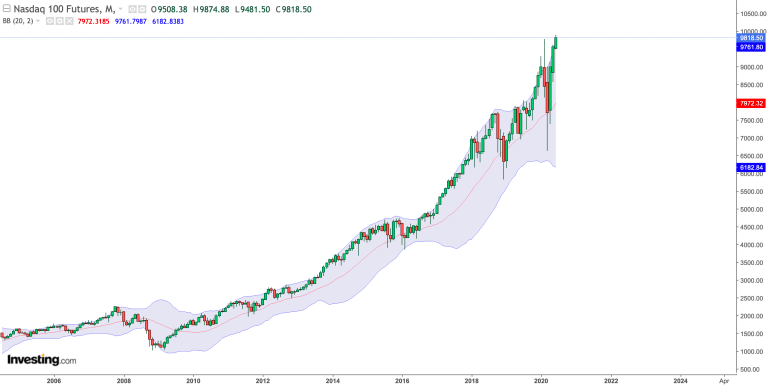

And massively stretched charts reflecting no economic reality with tech taking the cake with new all time highs far above the upper monthly Bollinger band again:

Manias are reason defying by definition and they can go farther than anyone expects.

Too strong is the draw and chase of the Fed put is which advertised as delivering $SPX turning green for the year this week:

“Look for the S&P 500 to turn positive for the year with a boost from the Fed in the week ahead”

That’s sentiment at the moment and probably the most frustrating aspect of a mania. The most reckless look the most right and the most reasonable the fools for not chasing or trying to fade.

FOMO thanks to POMO.

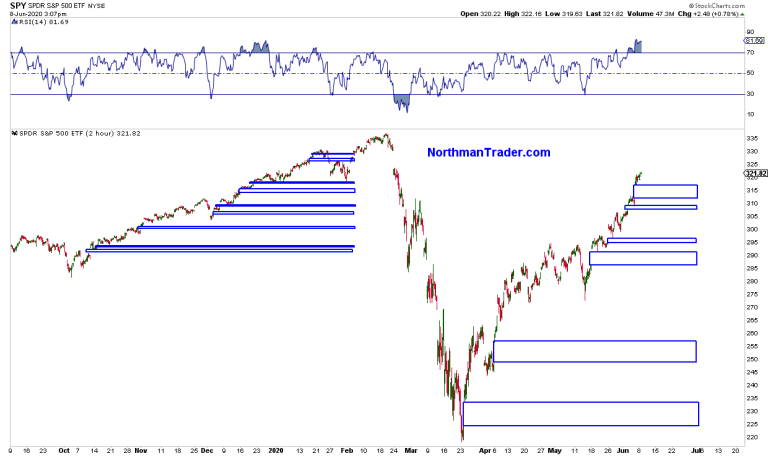

Will they go straight for that 3300+ gap from February? I can’t say, I suppose in an environment where nothing fundamental matters anything can happen.

This week Powell will add more programs and perhaps yield curve control. Every aspect of these markets is manipulated at the moment and every tiny dip is relentlessly bought as it is in any mania.

Yet the size of the dislocations continue to strengthen the sell case and indeed the number of open gaps are increasingly looking to be the achilles heel of this market, never mind historic valuations.

Remember the non stop gaps in Q4 of last year leading to the top in February 2020? They all look like child’s play compared to the ones we have now:

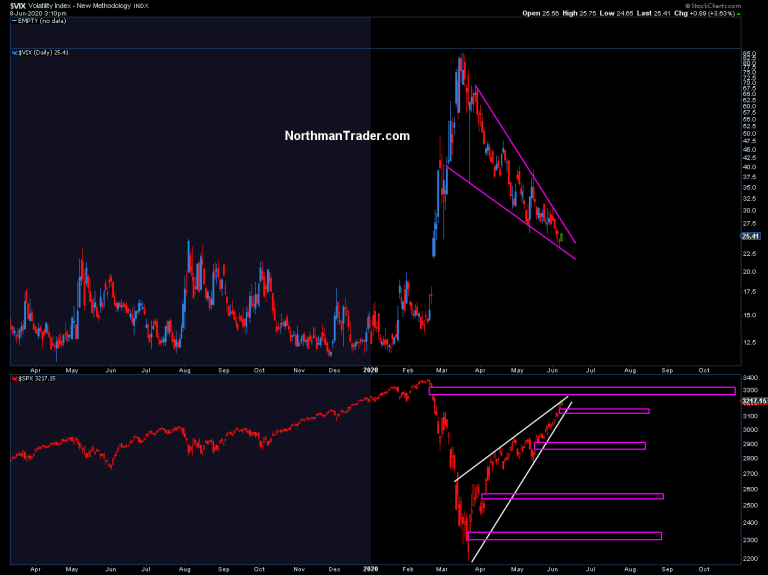

And guess what? All those gaps last year when the market seemed invincible? All of them filled. This market has some gap filling to do, especially in context of a $VIX that looks to want to party again at some stage:

Look, I’ve always said in recent months that this is all about control, can the Fed control the market equation? For now it clearly has, but it’s created a bloated pig of a market as a result.

And this pig is now big and fat and any sizable reversion can in itself shake the very confidence and optimism the Fed has sought to propagate. The Fed is peddling a fantasy, a fantasy that says money and wealth can be created out of thin air with nothing of substance needed to back it up, no growth, no earnings, none of that.

My premise: Markets and the economy can’t live on multiple expansion alone, but this is what the market ran on in 2019 and it is what it is running on again.

Like Druckenmiller I’ve been surprised at the vertical nature of this move, but unlike him I don’t attribute it to the reopening optimism, I attribute it only to one thing: A stock mania created by an overzealous Fed that is trying to save the economy, but in process has created the largest asset bubble of our time, and with that they put in the conditions in place that markets could be faced with another crash. I may well be wrong on this, but the circus like atmosphere in context of historic valuations, optimism and giddiness along with bears crying are exactly the type of conditions that have ended bear market rallies in previous periods of history.

To think it’s different this time is to count on it being different this time. Well, in one aspect it already is different this time: The first stock mania inside of a recession. Not discounted far below at all time highs, but rather sitting on top of the largest disconnect between the economy and the stock market ever. Inside of a recession no less.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

If you look at the top-performing stocks it will give you a laugh. Car companies?

Aren’t shareholders the first to lose everything in a bankruptcy? For future historians this will be a key indicator of how fucked up the markets were in 2020. If there were any markets left this would be a glaring signal to short the entire market. Another one: I heard an interview this morning where a former broker was saying he knows a 12-year-old who is buying stocks on Robinhood because all his friends are. That’s better than the old Kennedy shoeshine tale.

Where did the jeenyusses at The Fed and Treasury think all the helicopter money was going to go?

It went into the big casino so the tools of The Evil Fuckers could again drink the lion’s share of the blood straight from the gaping, sucking chest wound of the economy created by the CoVid-19(84) plandemic.

So, the market is being manipulated but not his/her feelings about the Corona?

interesting that Sven continues to (correctly) peg alot of the baloney and manipulation in the financial markets and employment numbers, but receives as straight gospel the ‘new’ coronavirus BS

I’ve watched him a few times. IMHO, his calls have been poor throughout this uptrend. Analysts like him have no capacity to include an entity like the Fed in their thinking, models, etc.

I understand that Robin Hood, etc. are new to the market, and a new phenomenon. But, what has been occurring since 19 March isn’t happening because 20 year old’s are buying 100 shares with their $1200 gov check.

I’ve never heard of this guy except to see his Twitter stuff here recently and I’ve been in the markets for decades. It is quite simple. There isn’t anywhere else for the money to go where after everything goes kerwhump, there is a possibility of retained value. These clowns rail on and on about high multiples. Some are, some aren’t yet they usually fail to mention that a US government bond is going at multiples over 100 with no possibility of growth that is present in a stock. Additionally the USD index which tracks the Dollar is down 5% in the last couple of weeks. In layman’s terms, the Dollar is worth 5% less so if a stock was $100 and is now $105 nothing has changed but the value of the fiat in which it is denominated. The market might double or triple but if the Ivy League shitheads double or triple the money supply it represents nothing but running in place. The wild options market is those folks who have seen it all before and are just gaming the anticipated moves.

Oh, I should also mention that even if the fiat inflates double or triple and represents nothing but running in places the dirty bastards will still tax the amount of increase caused by the running in place. Have at least ten percent of your assets in Gold and Silver. More if you can swing it.