As precious metals accelerated higher in the last few days, we joked (kinda) on Twitter that the surge in momentum would soon become a magnet for the new trading gurus manning their desks at home – whether in China or Chinatown – and send it to new all time highs.

All gold needs to hit 2,500 is for China’s momentum maniacs or the Robinhooders to start chasing it

— zerohedge (@zerohedge) July 22, 2020

One day later, it’s happening as Robinhood users flood into the gold and silver ETFs. For SLV, the number of RH users holding the ETF has surged from around 15,000 to 20,000 in the last few days…

… making it the 16th most popular pick on Robinhood as of the past 24 hours.

In GLD, we have seen less of a sudden surge so far, but the higher it goes the more RH users are buying with over 28,000 now holding the gold ETF…

And in typical Robinhood fashion, every dip is being furiously bought:

Does this spell disaster for the rally in precious metals? With momo chasers piling in at the margin? Well it didn’t seem to hurt TSLA…

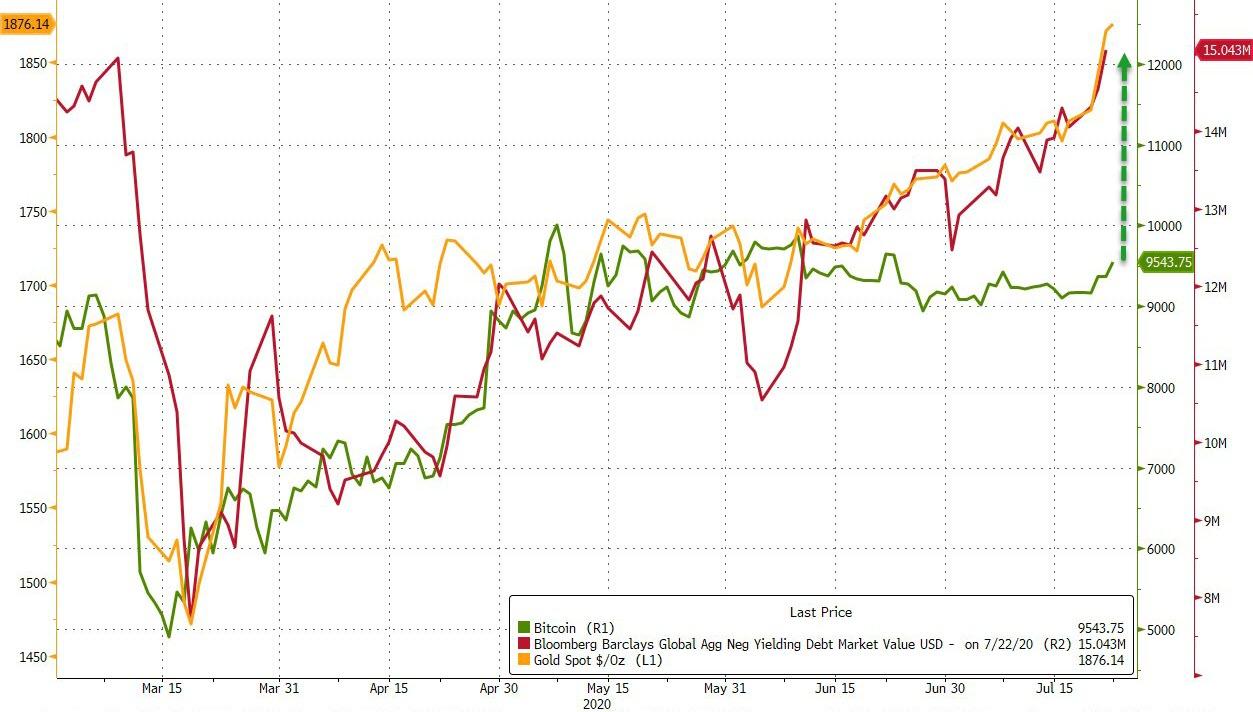

And besides, there are plenty of fundamental drivers for re-allocation into precious metals (as opposed to the vapor underlying TSLA’s acceleration), including the resurgence in global negative-yielding debt…

The question is, will CNBC cheer the retail participation in gold and silver as loudly as they celebrate the millennials buying the most expensive stock market ever?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Paper products are only good for ass wiping, Dear John letters and starting fires.

Yup.

If they don’t have physical possession of their metal, but bought metal exposure via an ETF,

they have nothing more than a promissory note.

So, too, the paper claims outstanding to actual physical ounces of metal are ridiculous.

With gold, it is something like 100:1

When the music stops, and demands to take possession are tallied, there’ll be far too many

players who can’t find the chair they paid for.

Sorry but I just sold some of my “paper” SLV and CEF for dollars and bought a real truck. The same as when I sold my physical except I didn’t report to IRS.

I’ve owned physical off and on for 20 years as well and used to make the same argument as you. However it’s nearly impossible to live on the road internationally and possess physical products anymore. I can’t fly into many countries with gold coins. Also depending on your net worth it’s difficult to own physical products (silver). I’d need a warehouse or backhoe to store it. I sold my house and bought silver ETFs. Silver will double in the next couple of years and my Former house will be cut in half.

If we ever get to the point where physical product is the only means of exchange then we have bigger things to worry about. It may happen soon. Lead may prove to be a better metal investment.

To the moon Alice!!!

That’s all I’m invested in and it’s the bare minimum. There’s really no safe haven markets because they’re all irrational.

If the day trading Muppets are piling into metal stocks willy-nilly without doing the financial research they will take some short-term losses. Some mining companies haven’t made a profit for a couple years. They’re running on debt and production is low. The jump over $20 helps put many struggling companies in the black but the next stop is $25.

When my stock shares roll into profitability I will be selling and rolling it back into physical metal to backstop my savings.

This is worth the time on many levels…good PM pill for some.

https://www.youtube.com/watch?v=9PczCHe51W4&t=149s

An old friend called me up today, she was my secretary from 93 to 2000 and knew in 1999 I had had many heavy deliveries of PMs sent to my work address. She is super worried and said her husband is clueless about what is going on. She thinks all their money is going to go poof! After she told me where it is, she could be right.

She wants to buy some PMS, but doesn’t know where to go, what to buy, who to trust, etc.

She also had a lot of gun and prep questions…and then we got into Bible Prophecy.

A lot of people are starting to wake up.

Going to do everything I can to help her get ready. Her husband is a great guy…obviously with zero situational awareness…but I bet he wears a mask everywhere.

This is a follow-up to your excellent post:

http://news.goldseek.com/GATA/1595587562.php