While all eyes have been focused on GameStop and a handful of other heavily-shorted stocks as they exploded higher under continuous fire from WallStreetBets traders igniting a short-squeeze coinciding with a gamma-squeeze, the last few days saw another asset suddenly get in the crosshairs of the ‘Reddit-Raiders’ – Silver.

On Thursday, we asked “Is The Reddit Rebellion About To Descend On The Precious Metals Market?” … One WallStreetBets user (jjalj30) posted the following last night:

Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation.

Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at 1000$ instead of 25$. Link to post removed by mods.

Why not squeeze $SLV to real physical price.

Think about the Gainz. If you don’t care about the gains, think about the banks like JP MORGAN you’d be destroying along the way.

…

Tldr- Corner the market. GV thinks its possible to squeeze $SLV, FUCK AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. FUCK THE BANKS.Disclaimer: This is not Financial advice. I am not a financial services professional. This is my personal opinion and speculation as an uneducated and uninformed person.

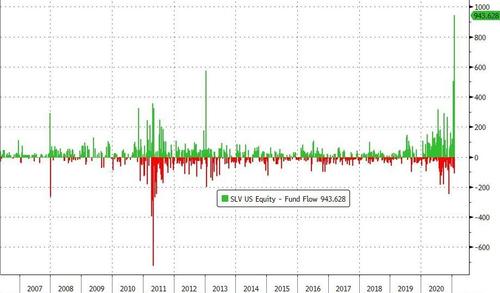

…and judging by the unprecedented flows into the Silver ETF (SLV) they just got started…

SLV saw inflows of almost one billion dollars on Friday, almost double the previous record inflow for this 15 year-old ETF.

Source: Bloomberg

Which helped prompt a spike in SLV off Wednesday’s lows of over 11% (and note that every surge in price was mimicked by gold, but gold was instantly monkey-hammered lower after the spike).

Source: Bloomberg

And judging by the asset flow, SLV has room to run here…

Source: Bloomberg

Just as short-interest in the ETF has been building…

Source: Bloomberg

This surge came after Reddit user ‘TheHappyHawaiian’ posted the following thesis on buying silver noting that “the worlds biggest short squeeze is possible and we can make history.”

‘TheHappyHawaiian’ cites two reasons to buy – The Short Squeeze and Fundamentals.

The short squeeze:

Buy SLV shares (or PSLV shares) and SLV call options to force physical delivery of silver to the SLV vaults.

The silver futures market has oscillated between having roughly 100-1 and 500-1 ratio of paper traded silver to physical silver, but lets call it 250-1 for now. This means that for every 250 ounces in open interest in the futures market, only 1 actually gets delivered. Most traders would rather settle with cash rather than take delivery of thousands of ounces of silver and have to figure out to store and transport it in the future.

The people naked shorting silver via the futures markets are a couple of large banks and making them pay dearly for their over leveraged naked shorts would be incredible. It’s not Melvin capital on the other side of this trade, its JP Morgan. Time to get some payback for the bailouts and manipulation they’ve done for decades (look up silver manipulation fines that JPM has paid over the years).

The way the squeeze could occur is by forcing a much higher percentage of the futures contracts to actually deliver physical silver. There is very little silver in the COMEX vaults or available to actually be use to deliver, and if they have to start buying en masse on the open market they will drive the price massively higher. There is no way to magically create more physical silver in the world that is ready to be delivered. With a stock you can eventually just issue more shares if the price rises too much, but this simply isn’t the case here. The futures market is kind of the wild west of the financial world. Real commodities are being traded, and if you are short, you literally have to deliver thousands of ounces of silver per contract if the holder on the other side demands it. If you remember oil going negative back in May, that was possible because futures are allowed to trade to their true value. They aren’t halted and that’s what will make this so fun when the true squeeze happens.

Edit for more detail: let’s say there’s one futures seller who gets unlucky and gets the buyer who actually wants to take delivery. He doesn’t have the silver and realizes it’s all of a sudden damn difficult to find some physical silver. He throws up his hands and just goes long a matching number of futures contracts and will demand actual delivery on those. Problem solved because he has now matched the demanding buyer with a new seller. The issue is that the new seller has the same issue and does the exact same thing. This is how the cascade effect of a meltup occurs. All the naked shorts trying to offload their position to someone who actually has some silver. My goal is to ensure that I have the silver and won’t sell to them until silver is at a far higher price due to the desperation.

The silver market is much larger than GME in terms of notional value, but there is very little physical silver actually readily available (think about the difference between total shares and the shares in the active float for a stock), and the paper silver trading hands in the futures market is hundreds of times larger than what is available. Thus when they are forced to actually deliver physical silver it will create a massive short squeeze where an absurd amount of silver will be sought after (to fulfill their contractually obligated delivery) with very little available to actually buy. They are naked shorting silver and will have to cover all at once and the float as a percentage of the total silver stock globally is truly miniscule.

The fundamentals:

The current gold to silver ratio is 73-1. Meaning the price of gold per ounce is 73 times the price of silver. Naturally occurring silver is only 18.75 times as common as gold, so this ratio of 73-1 is quite high. Until the early 20th century, silver prices were pegged at a 15-1 ratio to gold in the US because this ratio was relatively known even then. In terms of current production, the ratio is even lower at 8-1. Meaning the world is only producing 8 ounces of silver for each newly produced ounce of gold.

Global industry has been able to get away with producing so little new silver for so long because governments have dumped silver on the market for 80 years, but now their silver vaults are empty. At the end of WW2 government vaults globally contained 10 billion ounces of silver, but as we moved to fiat currency and away from precious metal backed currencies, the amount held by governments has decreased to only 0.24 billion ounces as they dumped their supply into the market. But this dumping is done now as their remaining supply is basically nil.

This 0.24 billion ounces represents only 8% of the total supply of only 3 billion ounces stored as investment globally. This means that 92% of that gold is held privately by institutions and by millions of boomer gold and silver bugs who have been sitting on meager gains for decades. These boomers aren’t going to sell no matter what because they see their silver cache as part of their doomsday prepper supplies. It’s locked away in bunkers they built 500 miles from their house. Also, with silver at $23 an ounce currently, this means all of the worlds investment grade silver only has a total market cap of $70 billion. For comparison the investment grade gold in the world is worth roughly $6 trillion. This is because most of the silver produced each year actually gets used, as I have mentioned. $70 billion sounds like a lot, but we don’t have to buy all that much for the price to go up a lot.

**If the squeeze happens, it would be like 40 years worth of their gains in 4 months **

The reason that only 8 ounces of silver are produced for every 1 ounce of gold in today’s world is because there aren’t really any good naturally occurring silver deposits left in the world. Silver is more common than gold in the earth’s crust, but it is spread very thin. Thus nearly every ounce of silver produces is actually a byproduct of mining for other metals such as gold or copper. This means that even as the silver price skyrockets, it wont be easy to increase the supply of silver being produced. Even if new mines were to be constructed, it could take years to come online.

Finally, most of this newly created silver supply each year is used for productive purposes rather than kept for investment. It is used in electronics, solar panels, and jewelry for the most part. This demand wont go away if the silver price rises, so the short sellers will be trying to get their hands on a very small slice of newly minted silver. The solar market is also growing quickly and political pressure to increase solar and electric vehicles could provide more industrial demand.

The other part of the story is the faster moving piece and that is the inflation and currency debasement fear portion. The government and the fed are printing money like crazy debasing the value of the dollar, so investors look for real assets like precious metals to hide out in, driving demand for silver. The $1.9 trillion stimulus passing in a month or two could be a good catalyst. All this money combined with the reopening of the economy could cause some solid inflation to occur, and once inflation starts it often feeds on itself.

What to buy:

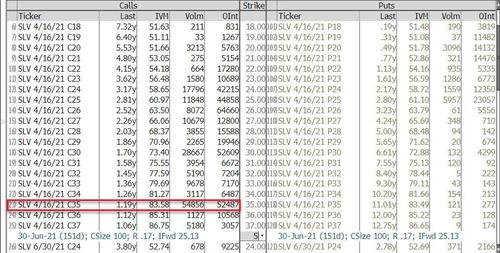

I will be putting 50% directly into SLV shares, and 50% into the $35 strike SLV calls expiring 4/16.

This way the SLV purchase creates a groundswell into silver immediately that then rockets through a gamma squeeze as SLV approaches $35.

Price target of $75 for SLV by end of April if the short squeeze happens.

Edit: for the part of your purchases going into shares, some people recommend PSLV because they think SLV might start lying about having the silver in their vault. Or that the custodian will be double counting, ie claiming that the same silver belongs to multiple people (banking on the fact that people wont all try to get their silver at once). So if you buy SLV shares and calls, that’s great. But I think it could be prudent for us to buy options in SLV (no options on PSLV) and shares in PSLV. It all depends on how paranoid you want to be. There is a lot of paranoia in the precious metals world.

Alternate options:

- buying physical silver; this also works but you pay a premium to buy and sell so its less efficient and you take fewer silver ounces off of the market because of the premium you pay

- going long futures for February or March; if you are a rich bastard and can actually take physical delivery of 1000s of ounces of silver by all means do so. But if you simply settle for cash you are actually part of the problem. We need actual physical delivery, which is what SLV demands and is why SLV is the way to go unless you are going to take delivery

- miners; I don’t recommend buying miners as part of this trade. Miners will absolutely go up if SLV goes up, but buying them doesn’t create the squeeze in the actual silver market. Furthermore, most silver miners only derive 30-50% of their revenue from silver anyways, so eventually SLV will outperform them as it gets high enough (and each marginal SLV dollar only increases miner profits by a smaller and smaller percentage)

Details on SLV physical settlement:

When SLV issues shares, the custodian is forced to true up their vaults with the proportional amount of silver daily. From the SLV prospectus:

“An investment in Shares is: Backed by silver held by the Custodian on behalf of the Trust. The Shares are backed by the assets of the Trust. The Trustee’s arrangements with the Custodian contemplate that at the end of each business day there can be in the Trust account maintained by the Custodian no more than 1,100 ounces of silver in an unallocated form. The bulk of the Trust’s silver holdings is represented by physical silver, identified on the Custodian’s or, if applicable, sub-custodian’s, books in allocated and unallocated accounts on behalf of the Trust and is held by the Custodian in London, New York and other locations that may be authorized in the future.”

‘TheHappyHawaiian” ends with a call to (financial) arms:

Join me brothers. Lets take silver to the moon and take on the biggest and baddest manipulators in the world.

Please post rocket emojis in the comments as desired.

Disclaimer: do your own research, make your own decisions, everything here is a guess and hypothetical and nothing is guaranteed, not a financial advisor, I have ADHD and maybe other things too.

Bear case: silver does tend to sell off if the broader market plunges so it’s not immune to broad market sell off. It’s also the most manipulated market in the world so we are facing some tough competition on the short side

Interestingly, ‘TheHappyHawaiian’ dropped this update on 1/29:

Due to the manipulation and collusion of citadel, hedge funds, and brokers to change the rules and rig the game in their favor. Who likely knew ahead of time and bought puts right before and calls at the bottom, GME is too important to abandon still. SLV is still my next play but GME needs to go to $1000 and these people need to go to jail.

However, judging by the massive physical premiums for silver we are seeing this weekend at APMEX…

… and JM Bullion…

…there are more than a few who are already rotating to SLV from GME.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

This time they’re playing with central banks.

I believe the central banks will squash them.

What would stop whatever brokerage they want to execute their trades from going full Robinhood on them?

Anything is possible. But, this last week has showed that when little guys work together, they can make life miserable for the evil Wall Street motherfuckers.

Best of luck to them, I’ve been waiting for someone to bust The Morg.

Robinhood has 50 funds with limits on them. SLV is limited to one share. I don’t think if the paper silver gets to $1000 per troy ounce I can go down to the corner silver store and sell a roll for that price even with the vig they take .

JMBullion selling out on the cheaper silver of all types. I’d go in for physical but not paper. They can print the paper.

I just placed an order for 1 share of SLV on Robinhood. Get the high cotton ready.

You go!

RH reduced restricted list to 8. SVL off list. Increased order to 5 shares. Need more Cotton

We can do this! Just keep swimming!

Where did the 1 negative come from!!???? I’m on your ass mf.

Down voted you Jim because I don’t want miserable for Wall St. I want fucking terrifying with a hefty dose of severely painful unlubed anal, for these demons.

If only they understood that the real problems are centered in D.C., not just in NYC. Specifically at the Federal Reserve and with the banking monopoly that the government protects.

How Soros broke the bank of England…..

https://www.investopedia.com/ask/answers/08/george-soros-bank-of-england.asp

He had help. He works for lucifer and is one of his edomites.

motley-

Soros is a front man for the Rothschilds……same thing.

He is Satan’s son.

Give em time. Its about time the populace other than conservatives realize WE HAVE OWNERS!

Its a trap …

Yup…..

Millennials can’t even pay rent or move out into the world, yet they are going to pull off the epic short squeeze? Comedy hour starting early?

And inevitably, in order to sell for a profit, someone still needs to buy. Eventually the numbers get high enough that nobody wants to climb higher….especially when you realize that its all a sideshow anyway, and nobody will be getting ANY physical anything for their hard-earned welfare money.

Some of them are really too clever for their own good.

Precisely why I wonder if China’s getting in on this game. We’ve been battling a currency war(to the best of my knowledge) for well over a decade. Perhaps more.

Will it be wise for those relying on pensions etc ?(None here)

Could this have an ending nobody can live with?

Hi Ho Silver…shoot, shot, shit this is fun to watch…no matter what happens…plus I have a friend of a friend…who knows a guy with a couple of monster boxes of $12 dollar silver from last March’s DIPPITY DO DA DIP ready to be shipped backed at the right time!

Yea…buddy…he told me everyone would get new shoes if JP Morgan gets a cut artery.

But, he would donate all his potential profit to a worthy cause (charity begins at home) just to pour some serious salt into their open bleeding Bankster wound.

What a BS.When silver dipped to 12. 50,nobody could buy it at this price.Bullion banks were able to sell it at 20$ ,IF AVAILABLE.

Heck fire, don’t use salt. That would only help future healing and act as an antiseptic, even though it would sting, a lot.

Give ’em a big dose of Coumadin to prevent clotting and platelet formation. Let them get cold and sleepy all the while taunting them.

Let ’em bleed out and see the ghosty white face appear.

Then you can hang ’em for all to see.

Being snowed in might be fun next week.

.

The silver market is a whole other ball game compared to one company stock. If the e-trading kids out there think they can take on central banks, let them. It will be a hard fight I don’t think they’re ready for, especially when the trading platforms out there have already indicated they’re not willing to encourage market volatility for the benefit of small account holders. They will shut down apps, servers, and networks to win and the whales will be involved.

Besides, any real squeeze would temporarily drive the retail premiums on the secondary market through the roof. If you own any mining stocks there may be a nice short-term window to sell. My mediocre shares gained on Friday imply from rumor control. The fundamentals of the company have improved but I don’t see $50 or even $100 silver prices anytime soon.

SLV contracts won’t be settled in physical and will only re-affirm what a lot of stackers out there already know. The game is rigged and metal stacks shouldn’t be a get rich quick scheme, but an alternative form of off the books savings insurance.

Silver- Obviously we missed the fact that minnies have a great deal of savvy in the markets. The Rothschilds aka…JPMorgan/Chase…aka all other Rothschild banks which are major shareholders in the FED missed it too. All us old geezers need to give them some room and watch it all unfold.

Sometimes God bestows special powers to beat the Goliath.

I was laughing my ass off all week about the vulture Gamestop shorts who got leveled. That was karmic justice dealt to greedy people and well-deserved. I told a friend you have to be crazy to be short or long in this volatile environment.

If there is a positive opportunity I definitely won’t hesitate to take advantage of selling shares at a profit, then converting the paper to metal. I don’t play margin or options. The ONLY time I went short it literally scared the hell out of me and I closed after three days.

That was when Dick Fuld was running Lehman Bros. Didn’t want to risk more as Fed discount window money was flying everywhere during the RE meltdown.

Didn’t the Hunt Bros try this?

Maggie here is one angle to the dangle from 2018 from two pundits still in play:

mark… be sure to look at what Wombatron, below, posted.

Yes, and they were handed their shorts as in underwear….Trying to play ball in a corrupted ballgame where the owners control and manipulate it at will is a no win game. You can’t fight them on their turf, they can simply pull the cord if it gets too rough.

All they have to do is declare a “force majeure.” Covid or bloodthirsty pro-lifers in DC would likely pass muster for a declaration of it with the MSM propaganda mouthpieces. These fuqueres have more parachutes than the 82nd AB.

The Hunts tried to “corner the market.”

If I recall SLV can issue unlimited shares by just obtaining more Silver. The Morgue could “loan” them a half billion ounces which would result in a half billion more shares. Jumping on an etf with an open ended or potentially limitless number of shares is far different from a stock with a fixed or nearly fixed number.

IF ONE MUST PLAY THIS GAME: DO NOT DO IT WITH PSLV!!!!!!!!! It is a really good, well run etf. The problem is the Canadian Government will withhold taxes on US citizens as PSLV is a Canadian entity. There is an IRS form 301 or 302(?) which allows some kind of tax treatment under some tax treaty that offsets or refunds. I did one of these years ago so my details are probably off a bit, so check with a CPA first.

The other issue might be profit. Silver profits and Gold too are taxed not at cap gains but Collectible rates which were 25% last time I had to declare such profits. I usually do anything weird in IRA’s to avoid such regs.

Actually in the US, I believe that gold/silver profits are treated as INCOME, whatever your rate might be. Not that I respect that BS. Any rise in prices is a DIRECT RESULT of their destruction of the dollar, not any true gain. Just saying. But since my horrible boat accident I really don’t worry about those things.

Pretty sure they are treated as collectible sales which is of course ridiculous on its face. Like I said, check with a CPA because the difference could be significant.

Yes, it is taxed as a collectible. Although the actual rate depends on how long you held it and what your income bracket is. Here’s a basic guide: https://www.jmbullion.com/investing-guide/taxes-reporting-iras/capital-gains/

Physical has a LONG WAY TO GO to get to any sense of normality of where it should be. I’ll be watching with great anticipation. They say $1000 an ounce which is likely completely unrealistic. 1/4 of that would please this guy tremendously. Destroy the shorts and paper market and physical will finally be able to see the light of day.

I will cheerfully sell my SLV position for $50 per. The all-time high isn’t much more than that although the Dollars probably bought a lot more in both previous $50~spikes.

In mid-March USLVF(3X Long) spiked down to the low 20s. 4 months later it spiked near 260. Closed around 150 the next day.

It has been yo-yoing between 80 & 150 since late Sept, now at 132.00. 27 pt rise in the last 3 days.

Monday should be interesting. Dr Market is watching with trepidation.

Can’t speak…laughing so much…

Delete my post. Whatever..

OMG… I laughed. That is spectacular!

Ha that is wild. My accountant just called me…we are buds as well…anyway he has been in on this just for grins…now he is a player…I’m just a macro long term physical kinda guy.

But…I will take profit if the opportunity presents itself…the old fashioned way.

One well aimed smooth stone has worked before, and he had four more ready for the brothers???

I love this. If there is anything these sick, twisted, greedy assholes cannot stand, it is humor. It is their kryptonite.

WOW

Silver would need to rise by nearly $480 to liquidate JP Morgan’s billions of short positions. The retailers have proved their worth by shorting wall street forcing them on the back foot, it can extend that sentiment by pushing the silver price now. The silver market is so heavily shorted that a $1 price rise in Silver’s price liquidates nearly $200 million worth of short positions.

The problem is that they got bloodthirsty and started chopping everyone’s heads off, not just the aristocrats.

Remember when the market dumps people sell PM’s to cover their shorts so PM’s go down.

Those prices go back up eventually…especially for the REAL (not paper) stuff. But they also sell lots of other things too. The crash in 29 wasn’t just because of some bad trades. It too was because of massive margin buying, lots of margins to cover, and the mass sale of GOOD companies to cover the losses on the shit they were speculating on. The contagin certainly can spread. Malinvestment MUST eventually be cleared. Sound, good companies are the ones that survived the 20s and will be the ones to survive this inevitable mass disaster.

This would be a necessary step for the great reset. This would be a necessary step to take down the banksters and cabal. There is more forces at work than reddits. Time will tell if its the good guys or bad guys. But it will be a wakeup call for anyone who is aware of the corruption, but willing to accept it cause your portfolio is so fat. Im ready for the boomers to get pissed….we need you guys.

No. If you spend some time on WSB reading, the only ones hyping SLV are not the trusted old guard. I would even venture the ones hyping SLV are plants and there are very few of them. Probably ones with SLV positions that are underwater right now.

AMC is the next one they seem to be targeting and that is just because they can’t afford GME shares anymore. Sadly there is going to be a lot of new investors that learn what a P&D is the hard way. They are lambs running with the wolves right now.

DirtpersonSteve

“Due to unprecedented demand on physical silver products, we are unable to accept new orders until the markets resume trading Sunday Evening”

This is in the banner at the place I buy pm’s from. Border Gold usually has sufficient supplies that they can mail your order out the day payment is received. I bough silver about two weeks ago when they just had a shipment in and now half their stocks are out. Be great if it actually does take off… certainly not gonna complain and I will take the money when it looks to have peaked.

None of this affects me because I have no paper silver or gold and I won’t be selling any precious metals. I’m keeping it for when the economy collapses and will use only for emergency purposes or to hold onto for future generations of the family.