Best of Dennis…

Dennis is still on a short break spending time with his family. He will be back writing very soon, but in the meantime, here’s another article worthy of a re-read in today’s economy. This article was originally posted on August 5, 2021.

Feel Discombobulated, Confused, Distracted and Betrayed? You Are Not Alone

When I finished writing “Whistling Past The Graveyard”, I was furious.

When I finished writing “Whistling Past The Graveyard”, I was furious.

The Federal Reserve prints money at will. Theoretically, congress oversees the Fed – the Fed oversees the banking system, and they have our best interest at heart. While both feign good intentions, in practice they are lining their pockets at the expense of Main Street America.

Fed Chairman Powell weakened the member banks stress tests and gleefully proclaimed they all passed. That enabled major stock buybacks and dividends estimated at $200 billion, well above their earnings.

Before the repeal of the Glass-Steagall Act, banks and investment houses were separated. Banks were smaller and not allowed to cross state lines. They lent money to retail and business customers, earning their profits on the interest rate spread. If a bank failed, the FDIC would protect depositors; stockholders suffered the consequences of their bad decisions. No bank was too big to fail!

Today, major banks and brokerage firms are one in the same. They take huge investment risks. When the Fed talks about Wall Street they are talking about the OWNERS OF THE FEDERAL RESERVE.

Result of the Glass-Steagall Act being repealed

The Fed now prints magic money and funnel it to their owners – major investment houses with bank charters. They invest it, reward their executives with huge bonuses, shareholders with dividends and stock buybacks well in excess of their earnings.

This Wall Street on Parade headline, “After JPMorgan Chase Admits to Its 4th and 5th Felony Charge, Its Board Gives a $50 Million Bonus to Its CEO, Jamie Dimon”, provides a great example.

Meanwhile, congress ignores their responsibility. Why? The Fed prints money to buy government debt; allowing politicians to buy votes.

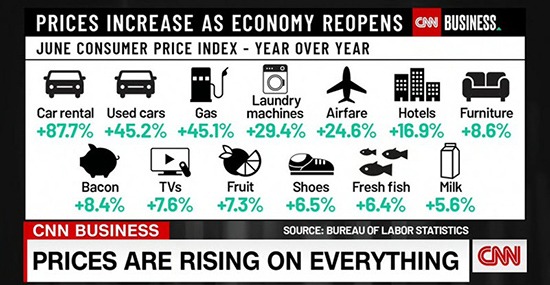

Inflation is looming. CNBC reports (My emphasis)

- President Joe Biden addressed voters who are worried about inflation…arguing that his domestic spending plans would help keep prices low over the next decade.

- The short speech reflected a growing concern among Democrats that rising prices could hurt them in next year’s midterm elections.

- Economists believe the price hikes are only temporary. The question for politicians is, how temporary?”

Temporary??? Prices have gone up; do you think drug, medical care and grocery prices will truly decline? Neither do I…. Main Street will be lucky if rate of inflation slows down a bit.

Pundit Bill Bonner’s article, “Protect Yourself From Inflation” explains:

| “Inflation discombobulates a society. People get confused…distracted. They feel betrayed. They don’t know who to trust or what to believe.” |

Friend Chuck Butler and I regularly hear from readers who are confused, angry, feel betrayed and don’t know who to trust or what to believe. They see prices skyrocketing while the Fed and politicians tell them not to believe their lying eyes – the problem will magically disappear soon.

CNBC spilled the beans about the real concern – midterm elections.

Powell’s concern is protecting Wall Street profits – hoping Main Street does not have a political backlash that might disrupt their money tree.

What are they hiding?

James Jacoby (JJ) narrated a powerful expose on PBS, “The Power Of The Fed”. The entire 53:17 had me glued to my monitor. It is a maddening blockbuster everyone should see.

I spent days reviewing the program, gathering/organizing information for our readers. If there is a misquote, I apologize, I worked hard to get it all right.

JJ’s extensive interviews include current and former members of the Federal Reserve. THEY tell us how terribly corrupt the Fed has become. I will add emphasis to many of the quotes.

He starts with a simple statement:

“I’ve heard that over and over, that we are living through an epic experiment run by the Fed. An experiment that has been dramatically changing the American economy.

…. The way they did it was to literally create new money and use it to buy huge amounts of things like mortgage-backed securities and government debt from banks and other institutions. Their hope was that the lower rates would spark more spending and borrowing throughout the economy.”

Historic low interest rates dramatically changed the American economy, particularly 401k and retirement plans.

JJ interviewed William Cohen (WC), writer and former banker – Richard Fisher (RF), former head of the Dallas Fed (2005-15) – Andrew Huzar (AH), a former Fed employee put in charge of the bailout and Mohamed El-Erian (MEE), now chief economic advisor, Allianz:

JJ: Is this something that had ever been attempted before?

AH: No. …. This was an incredible collapse of the fundamental structure of the US economy in a very short period of time, and uh, we were building the plane while we were flying it.

JJ: The idea of lowering interest rates and…quantitative easing was basically pulling out all the stops to make it cheaper to borrow.

WC: Basically, by making money…suddenly…abundant, and cheap, and easy to get, they just flooded the zone with capital. .… Easy money…trillions of dollars of easy money. Like the greatest experiment in easy money in history.

JJ: QE was an experimental way for the Fed to inject money into the financial system and lower long-term interest rates.

RF: It’s almost like alchemy, you can create money out of thin air if you are the central bank.

JJ: How was that viewed inside of the board room, was that seen as success?

RF: Yes, it validated what we thought would happen….

| When you drive interest rates down all the way out, it forces investors into taking bigger steps on the risk spectrum. Cheap money is the fuel for a financial speculator…. |

JJ: What Fisher and other former Fed insiders told me is that the stock market rally was no accident. By design, the Fed’s QE program effectively lowered long-term interest rates, making safer investments like bonds less attractive and riskier assets like stocks more attractive.

MEE: The Fed is the one institution that has a printing press in the basement and there is no limit on how much it can use.

JJ: El-Erians’ firm helped advise the Fed on its QE experiment. He told me the expectation was that the low interest rates and QE would have a strong effect…on the wide economy.

MEE: That was the theory. In practice, the Fed was very successful in moving asset prices. It was much less successful in moving the economy. And the result of that is we got the largest disconnect ever between Main Street and Wall Street – between the economy and finance.

JJ: One of the problems was the banks were holding on to a lot of the money, instead of making it available to borrowers.

The immediate impact was driving investors (particularly retirees needing income), insurance companies, 401k, and pension funds to take unwanted risks – while losing (worry free) interest income they thought they could count on. By design, quality bonds and CDs would not pay a reasonable return.

Wall Street wins, Main Street loses

Low interest rates saved the banks and government trillions in interest costs while seniors and savers lost trillions in interest they counted on to pay their bills.

Consumer advocate Ralph Nader penned “An open letter to (Fed) Chairwoman Janet Yellen”:

“We are tired of this melodrama that exploits so many people who used to rely on interest income to pay some of their essential bills. Think about the elderly among us who need to supplement their social security checks every month.

….figure out what to do for tens of millions of Americans who, with more interest income, could stimulate the economy by spending toward the necessities of life.”

When Yellen was the Fed Vice Chair she told an International Investment Conference:

“As many observers have argued, an environment of low and stable interest rates may encourage investor behavior that could potentially lead to the emergence of financial imbalances that could threaten financial stability.

…. At present, we see few indications of significant imbalances.

…. A sustained period of very low and stable yields may incent a phenomenon commonly referred to as “reaching for yield,” in which investors seek higher returns by purchasing assets with greater duration or increased credit risk.

…. The Federal Reserve is carefully monitoring financial indicators for signs of potential imbalances and is assessing the extent to which leverage is currently employed by investors, particularly where some of the potentially amplifying factors I just discussed may be present.”

Yellen became Fed Chair and further lowered interest rates while bailing out risky shadow banks, foreign banks, hedge funds and other high-risk investment types. The loss of safe interest income for retirees Nader outlined was dismissed as “collateral damage”.

She is now Treasury Secretary, working closely with the Fed. Perhaps she is still “carefully monitoring”….

| “I believe that banking institutions are more dangerous to our liberties than standing armies.”

— Thomas Jefferson |

The Fed’s policy provided the fuel. Wall Street commandeered much of the money for their high-risk investments at the expense of Main Street.

The real experiment?

| How much money can the banks and political class siphon from hard-working citizens before they revolt? |

Their real concern is the public raising hell during an election year, which might force the government to do its job and crack down on the Fed.

Bill Bonner is right, I feel betrayed! This is the tip of the iceberg. More to follow…

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

“Before the repeal of the Glass-Steagall Act, …”

The True wonder of this Act? HOW did they get it to pass? It’s almost as if this has happened. Before.