The Federal Reserve raised interest rates another 3/4% and promises more increases until inflation is under control.

The Federal Reserve raised interest rates another 3/4% and promises more increases until inflation is under control.

Yahoo Finance reports:

“Jerome Powell just warned that the US housing market needs a ‘difficult correction’ so that folks can afford homes again:

“Higher interest rates translate to bigger mortgage payments – not good news for the housing market. But cooling down housing prices is part of what needs to be done to bring inflation under control.”

…. Fed Chair Jerome Powell said, ‘….In the housing market (we probably) have to go through a correction to get back to that place.’

…. Those words might sound scary, especially to those who lived through the last financial crisis – where the housing market went through a very, very difficult correction.”

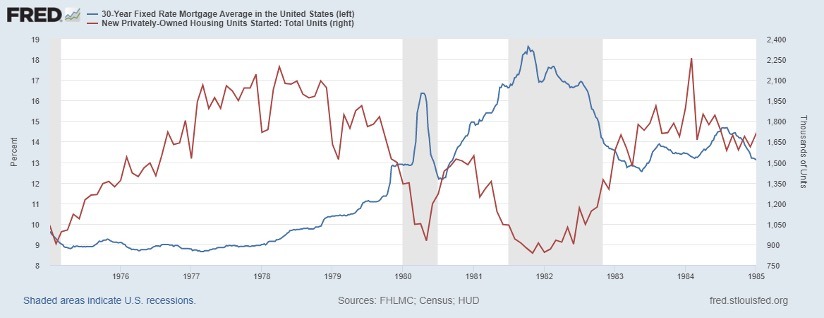

Scary thought indeed for those who lived through the Volcker years with mortgage rates over 18%. The relationship of higher interest rates on the housing market is dramatic.

The blue line is 30-year fixed mortgage rates outlined on the left side. The red line is housing starts, numbered on the right side. In the ’70s, inflation was rising, interest rates were low, and the housing market was booming.

The blue line is 30-year fixed mortgage rates outlined on the left side. The red line is housing starts, numbered on the right side. In the ’70s, inflation was rising, interest rates were low, and the housing market was booming.

Fed Chairman Volcker raised rates in 1979 and mortgage rates climbed into double digits. He cut rates too soon and raised them again.

The rest of the 18% + mortgage rate story…

To get a loan, buyers needed good down payments, coupled with loan origination fees (called points). Lenders charged “points” (some as high as 5%) to write the loan. Buyer and seller not only negotiated the selling price, but also who pays the points to the lender. Sellers likely paid a realtor a 6% commission for finding the buyer (not easy in that tough market) and another 2-3% in points to the lender for giving the buyer a mortgage.

As mortgage rates skyrocketed, housing starts tumbled from around 2.1 million units to approximately 800 thousand. The resale market also got clobbered.

While times were as tough as I have ever seen, the recession was short. Volcker brought inflation under control in about 4 years.

Times have changed

Our current housing debacle is different, thanks to the government’s social engineering and market interference.

President Clinton wanted to make home ownership available to low-income earners. Banks were required to lend a certain percentage of their mortgages to risky, low-income buyers. If they didn’t meet their quotas, they could lose their banking charters.

Defaults rose; banks quickly began complaining. Holding too many risky loans would put them out of business. The government authorized Fannie Mae and Freddy Mac, to buy those loans from the banks.

The Glass-Steagall act was also repealed; investment banks merged with commercial banks. They began packaging loans into funds, peddling them to investors.

The rating agencies flinched, often giving these fund packages higher ratings than they deserved, creating the illusion of safety – lying to unsuspecting investors who bought them at the recommendation of their brokers.

Lenders, making their money through loan origination fees, no longer cared about the creditworthiness of the borrower. That opened the floodgates, no money down – loan for more than 100%, no problem; step right up and get your mortgage! The mortgages were sold, transferring the risk to others.

Things were booming, until it all fell apart in 2008. The movie, The Big Short outlined how corrupt the entire system was (and continues to be).

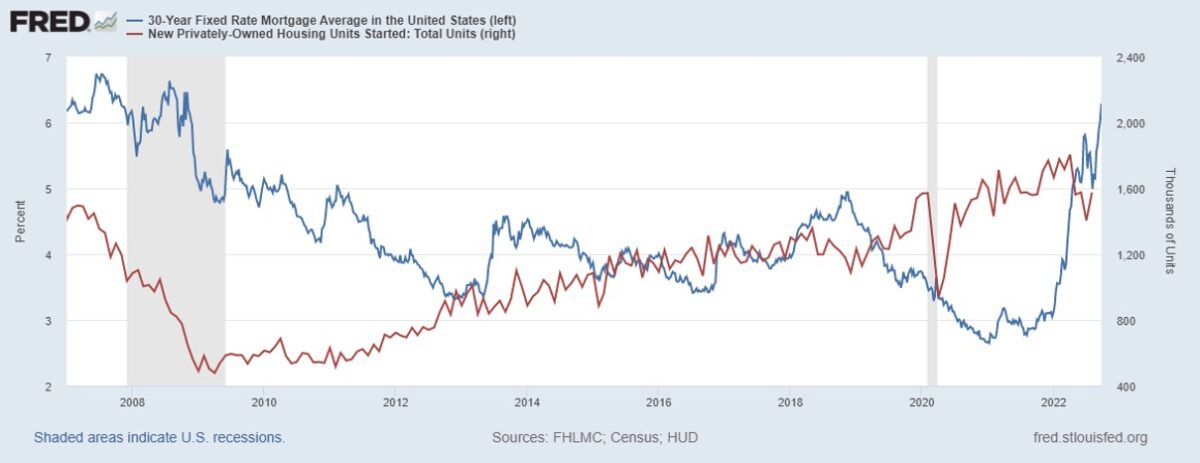

The investment banks, who made and held bad loans, got bailed out (“Too big to fail!”). The Fed cut interest rates to historic lows and started the process all over again. It took a few years until low interest rate mortgages spurred the housing market and prices skyrocketed:

Unlike 2008, the current correction is not a result of delinquent mortgages – yet. During the pandemic the government jumped in to save the day, putting a moratorium on mortgage and rent payment. Borrowers who were getting behind on their payments were no longer counted as delinquent.

Unlike 2008, the current correction is not a result of delinquent mortgages – yet. During the pandemic the government jumped in to save the day, putting a moratorium on mortgage and rent payment. Borrowers who were getting behind on their payments were no longer counted as delinquent.

Today’s mess is caused by out-of-control inflation. Pundit, Bill Bonner summarizes:

“Inflation is always…a political phenomenon. We get inflation when the politicians spend more than they can afford…and then ‘print’ money to fill the gap. It is fundamentally a default to creditors, who get back less than they were promised. For everyone else, inflation is a tax – disguised and delayed – that is levied mostly on the poor and middle classes…and people who don’t know what’s going on.

And right now, the politicians of both parties agree – they want more

of it. Inflation is the source of their wealth and power. It allows them to spend money they don’t have on programs we don’t need.

But they also need a deflationary recession…to provide cover for their renewed inflation, and to keep consumer prices down for the masses as they boost asset prices for the elite.

So, there you have it. Coming down the pike – tightening to cause a crisis; then loosening up to save the world.”

Like Bill Clinton, Fed Chairman Powell, pretending to be Mighty Mouse, promises to save the day – “to where people can afford housing again.”

Like Bill Clinton, Fed Chairman Powell, pretending to be Mighty Mouse, promises to save the day – “to where people can afford housing again.”

Affordable?

What is affordable? Who can afford it? Rising interest rates reduces the number of buyers, increasing available housing inventory – and real estate prices come down.

I wasn’t surprised to see Reuters report:

“(The) Market Composite Index, a measure of mortgage loan application volume,…is now down 64.0% from one year ago. Its Refinance Index fell…was down 83.3% compared to one year ago.”

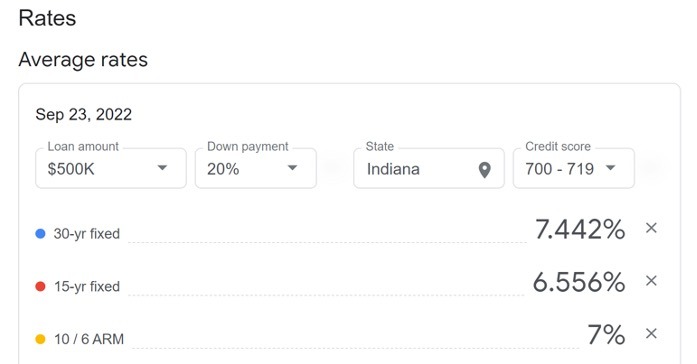

Lending Tree provides a daily graph of current mortgage rates. I typed in $500,000, Indiana, and a 700-credit score. On September 23rd, they reported:

These rates change regularly and are affected by local market, credit score, down payment, and a lot of other factors.

These rates change regularly and are affected by local market, credit score, down payment, and a lot of other factors.

In Arizona, we are seeing a huge influx of California refugees helping to keep our housing prices high. A south Florida realtor reports they are experiencing a similar situation, new residents fleeing high tax states; essentially voting with their feet and relocating. Other states are struggling.

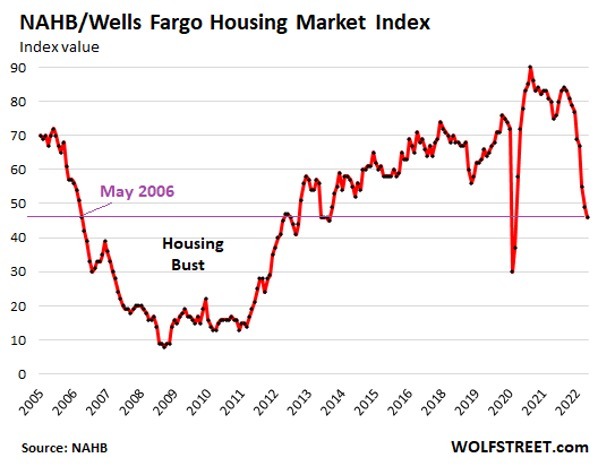

Higher mortgage rates are impacting sellers nationally. Wolf Richter tells us:

“Housing Bubble Woes: Home Builders Cut Prices, Pile on Incentives, amid Plunging Traffic of Buyers, Spiking Cancellations….

Buyer traffic is weak in many markets as more consumers remain on the sidelines due to high mortgage rates and home prices that are putting a new home purchase out of financial reach for many households,” according to the National Association of Home Builders (survey) this morning.

…. With today’s index value of 46, the NAHB/Wells Fargo Housing Market Index is now below where it had been in May 2006, on the way down into the Housing Bust.

Across the US, the cancellation rate among home builders in August jumped to 19%, the highest in years, up from 17.6% in July, and up from 16.5% during the worst lockdown month….”

Raising interest rates to make homes more affordable sounds logical, but what about the cost of money?

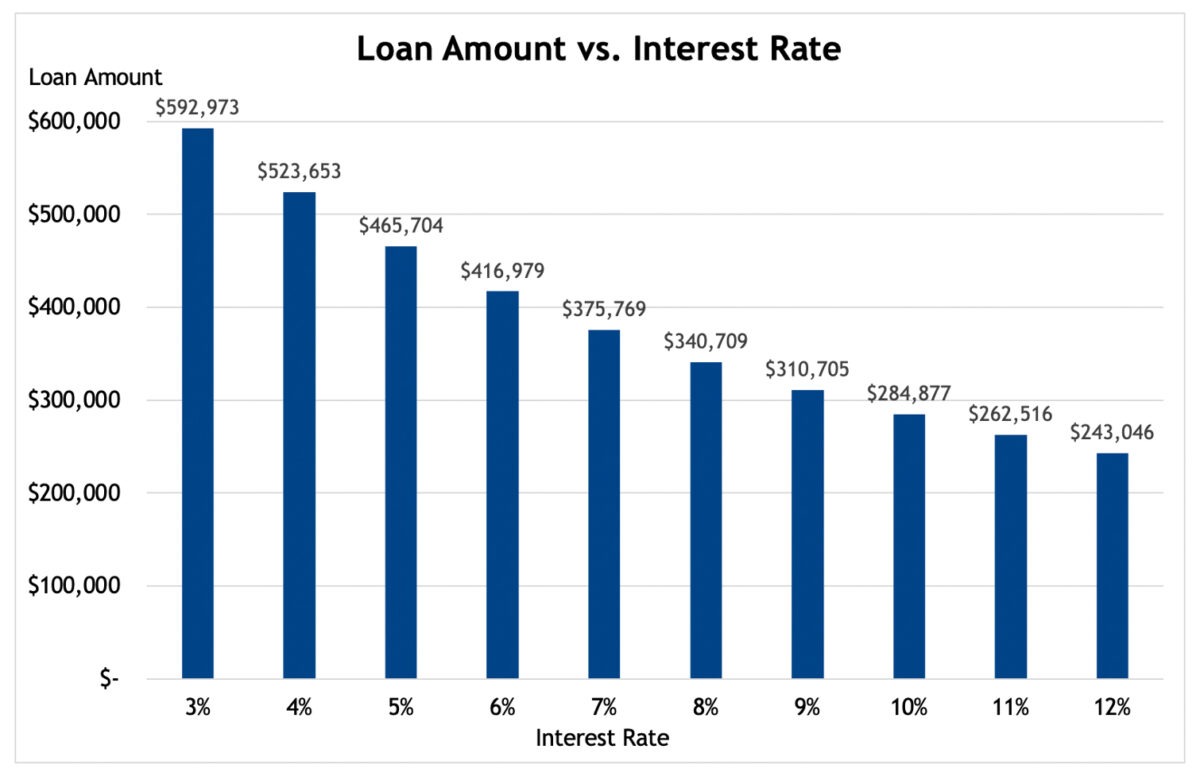

Let’s assume a well-qualified buyer, with an adequate down payment, feels they can afford a monthly payment of $2500/month. How big a mortgage can they get?

In January, 3% interest rates qualified them for a $592,973 mortgage. As interest rates have gone above 7%, $2,500/month gets them $375,769. Still want to borrow $592,973? It will cost you 58% more, $3,945/month.

In January, 3% interest rates qualified them for a $592,973 mortgage. As interest rates have gone above 7%, $2,500/month gets them $375,769. Still want to borrow $592,973? It will cost you 58% more, $3,945/month.

The 3% rates were NOT free market rates. Buyers should have jumped at it and locked in the rate for 30 years.

The Fed vows to continue to raise rates until they “break” inflation. Currently, the Fed funds rate is 3-3.25%. Many predict the rate to increase to 4.5-5%, which will raise mortgage interest rates much higher. At 10%, the $592,973 mortgage will cost $5,205/month, double what it was in January 2022.

Waiting for rates to come back down to “the good old days of 3-4%” is taking a big risk. The Fed stopped buying government and corporate debt.

The biggest debtors are going to be competing for funds in a free market, meaning real savers lending them money, not the Fed printing fake money.

As the government and corporate America begins rolling over their debt, sucking up most of the available capital, getting a mortgage will become even more expensive. Yes, real estate prices will come down, but much of that cost savings will be captured by the banks in the form of higher interest.

Should you buy now or wait?

If you want a new home, and require a mortgage, things are going to get worse – and may stay that way for some time. Get a good mortgage at today’s rates and refinance later, if/when rates come down.

If you are a cash buyer, be patient, some real bargains are on the horizon.

| “Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not [happen] in our lifetimes and I don’t believe it will.”

— Former Fed Chairperson Janet Yellen 2017 |

Despite their denials, the Fed is political. I’ve heard whispers that Powell realizes he can’t bring inflation under control before the mid-term elections. We are seeing Fed forecasts for things to return to normal in late 2023. Unlike Volcker, Powell is raising rates slowly and is likely to drag us into stagflation. Until interest rates are higher than borrowing/lending rates, progress will be very slow.

I anticipate the Fed will do something before the 2024 presidential election, even if it is the exact wrong thing to do.

For more information, check out my website or follow me on FaceBook.

For more information, check out my website or follow me on FaceBook.

Until next time…

Dennis

“Economic independence is the foundation of the only sort of freedom worth a damn.” – H. L. Mencken

Affiliate Link Disclosure: This post contains affiliate links. If you make a purchase after clicking these links, we will earn a commission that goes to help keep Miller on the Money running. Thank you for your support!

Stupidity at all levels. The recession that is bound to happen due to not only the current inflation but the rising rates will decimate certain job segments. Which in turn will mean LESS buyers regardless of house price.

AND…the rising cost to heat the damn house, light the damn house, insure it, bring water and sewer to it…all of these things are NOT calculated into the ‘cost’ of the mortgage but rest assured will make things very unaffordable.

This is all done on purpose to cause a bust cycle to the very wealthy can buy up bargain price homes and rentals, hold them, sell high in 10 years, and start all over again.

Let’s say you had a kid who wanted to (and could) buy a house. Who you rather he buy it in 2021 or in 2023-2024?

Step One.

:max_bytes(150000):strip_icc():format(webp)/ranch-1950ad-3205122-crop-58fcf7603df78ca159b2950b.jpg)

Step Two.

Step Reset.

You’ll be happy!

I have to say in the right spot I could be happy with that hut!

I am looking for a new(new to me) home with minimum 20 acres,last couple of years has been a joke with bidding wars ect.

I am a cash buyer and feel I am in the drivers seat now in regards to buying,and….,it all crashes before hand then it just didn’t matter!

Tis a crazy world!

Morbid,have seen 40 acres with home for less then 400,that said,best o luck with sale.

As I have said,in drivers seat and as a carpenter can work with a standing home ect.

Thus,most I will pay is 500 and it better have more acreage then I initially listed with a home/workshop!

I feel as time moves on I will have many more choices.

Location, location, location. south east Kansas will get you what you want easily, except for hills, mountains trees and streams, like the PNW has.

I really don’t know how people live that close to each other. If you can’t piss off yout front porch without offending the neighbors, they’re too damn close.

Also the fed

How the hell are you going to afford a house if you have no job and none are available.

That’s not part of the Fed’s legal mandate.

Neither is “price stability”.

Think of the theft involved in intentionally devaluing every dollar extant world-wide by a minimum of 2% (really 6%) year after year.

How did the Germans end Weimar?

“The Nazis came to power in Germany on 1933, at time when its economy was in total collapse, with ruinous war-reparation obligations and zero prospects for foreign investment or credit. Yet through an independent monetary policy of sovereign credit and a full-employment works program, the Third Reich was able to turn a bankrupt Germany, stripped of overseas colonies it could exploit, into the strongest economy in Europe within four years, even before armament spending began. “

Henry C K Liu

World Order, Failed States and Terrorism

PART 10: Nazism and the German economic miracle

http://henryckliu.com/page105.html

“ World War II ended the “depression.” The same Bankers who in the early 30’s had no loans for peacetime houses,food and clothing, suddenly had unlimited billions to lend for Army barracks, K-rations and uniforms! A nation that in 1934 couldn’t produce food for sale, suddenly could produce bombs to send free to Germany and Japan!… Germany issued debt-free and interest-free money from 1935 and on, accounting for its startling rise from the depression to a world power in 5 years. Germany financed its entire government and war operation from 1935 to 1945 without gold and without debt, and it took the whole Capitalist and Communist world to destroy the

German power over Europe and bring Europe back under the heel of the Bankers. Such history of money does not even appear in the textbooks of public (government) schools today. ”

Sheldon Emry

Billions For Bankers, Debts for the People

https://archive.org/details/Billions20for20the20bankers

Well, you start by going after the folks who caused the problem.

Here is proof you can win. https://www.altcoopsys.org/wp-content/uploads/2017/04/Edward_Holloway-How_Guernsey_Beat_The_Bankers.pdf

Some examples:

https://duckduckgo.com/?q=hooverville&t=ffab&iar=images&iax=images&ia=images

Inflation didn’t rob you of your wealth. . It’s still here . It was simply automated.

…into someone else’s pocket.

I bought my first house in 1979 @ 18% interest rate. it was 48000$. I think the payment was about 609$ a month with taxes and insurance on 30 year loan. In Stockton Ca

I’d rather have a low-priced home with a high interest rate than a high-priced home with a low interest rate. You could pay off a ton of that 48k with a second job, a side hustle, renting a room, or more OT. You only have 48k to cover.

On the other hand, you could have a 3% mortgage on a 700k home. 700k ain’t gonna be affected by OT or a paper route.

Additionally, at 18 percent, you have the reasonable hope of refinancing when rates come down. That ain’t gonna happen at 3%

$48k in 1979 is $196k today.

a $200k side hustle?

that’s a lot of hustle.

Every times the government helps with affordable housing the rents go up. Insanity!

“Insanity is doing the same thing, over and over again, but expecting different results.”

San Fransisco has solved the problem with affordable housing for the previously homeless. A new home for only $61,000 dollars. Though the homes are tents.

San Francisco represents perhaps the greatest failure of governance in the country, and with this failure comes enormous waste, inefficiency, and dysfunctional politics. Beginning with providing tent living for the homeless, which costs about $61,000 per individual per year. This is not a typo.

With that kind of government thinking we are all doomed!

“that kind of government thinking”

Is there any other kind?

“government thinking” is an oxymoron.