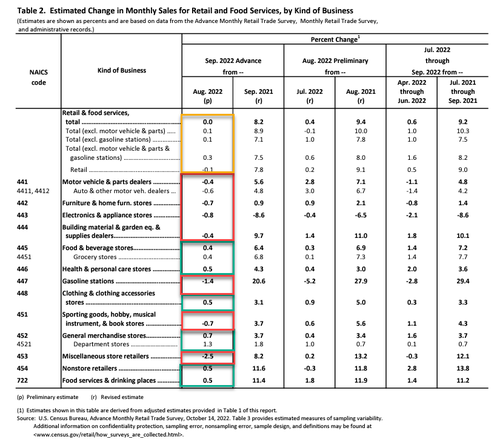

US retail sales were expected to rise 0.2% MoM in September but instead were disappointedly unchanged. On a year-over-year basis, retail sales (nominal) rose 8.2%, the weakest since April

Source: Bloomberg

Ex-Autos and Ex-Autos and Gas both rose more than expected (+0.1% vs -0.1% exp and +0.3% vs +0.2% exp respectively). On a YoY basis, core retail sales rose 6.6%., exactly in line with Core CPI’s 6.6% YoY rise…

The control group – which feeds directly into GDP – rose 0.4% MoM (above the +0.3% expectation).

Under the hood, motor vehicles sales were down, food & beverage up, gas stations down, and miscellaneous store retailers down hard…

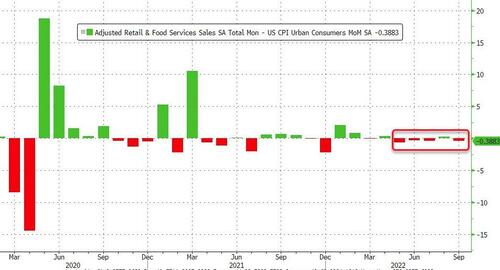

And finally, we remind readers that retail sales data is nominal – i.e. not adjusted for inflation. While we know very well that adjusting headline retail sales by headline CPI is not apples to apples, it is a good rough guide to what is really going on…

Source: Bloomberg

This means the ‘real’ retail sales in September fell for the 4th month of the last 5… “strong consumer”?

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

And the stock market is up again . All based on reality not rigged at all.

Surging garage sales and barter system/black market starting to make an impact.

I’m being serious. This is why cash will go away soon.

Higher % of traceable monetary transactions being diverted to services.

There is no strong consumer anymore. Paychecks are simply not keeping up to inflation. Previously, credit was used to fill the gap. Now that interest rates are soaring, credit is also much more expensive, just like consumer goods have become. So now, consumers are stuck between a rock and a hard place. This comes as no surprise to anyone. Any post-covid economic “pop” has been crushed like a bug.

Buying less shit (non-essentials) is bad for the consumer purchase-driven economy. But …

… buying less shit will make you a better and happier person!!

Embrace minimalism.

Screw that… I need as much plastic cheap shit from china that my garage will hold, and everything must run on batteries too… I demand it…

…”Embrace minimalism”…

…or accept it, because it is going to be shoved down everyone’s throat and rammed up everyone’s ass from now on.

With credit card balances at all time highs, I would suspect a lot of people have hit their credit limits and simply cannot buy anymore. I would also expect that banks are beginning to get nervous and are scaling back credit limits for people who have very high debt. As home equity declines, so does the collateral that acts as a safety net.

It makes no sense to me to spend so much money on interest, but for a few years when I was really poor, I did it.

Yeah, with inflation somewhere around 20% in reality one would expect retail sales to be up (in an operating economy) around that amount, just staying even, and if the economy is expanding more than that amount. If stated inflation is true retail sales would have to be up 8.5 ish percent YoY to just stay even. Of course all the information our benevolent overlords allow to be disseminated is one hundred percent true and accurate, one hundred percent of the time.

Some loans may not be repaid. Queue up the bailouts.