With banks starting to fail, there are some easy and specific things you can do to strengthen your local community’s ability to survive a banking collapse or dollar devaluation.

Use Physical Cash

Why we should pay with cash everywhere we can with banknotes instead of a credit card! – Adapted from Wren Hope Rose’s Viral Fedbook Post

– I have a $50 banknote in my pocket.

Going to a restaurant and paying for dinner with it. The restaurant owner then uses the bill to pay for the laundry. The laundry owner then uses the bill to pay the barber. The barber will then use the bill for shopping.

After an unlimited number of payments, it will remain a $50, which has fulfilled its purpose to everyone who used it for payment, and the bank has jumped dry from every cash payment transaction made…

– But if I come to a restaurant and pay digitally – Credit card and bank fees for my payment transaction charged to the seller are 3%, so around $1.50, and so will the fee of $1.50 for each further payment transaction or owner (re laundry) or payments of the owner of the laundry shop, or payments of the barber etc…..

Therefore, after 30 transactions, the initial $50 will remain only $5 😫 and the remaining $45 will become the property of the banks 🏦 thanks to all digital transactions and fees.

Small businesses need your help, and this is one way to help ourselves too.

Pull small cash draws out at a time and use that instead of tap, credit, etc.

When this is put into perspective, imagine what each retailer is paying every month in fees at 3% per transaction through their POS machine.

If they have, for example, $50,000 in sales & 90% are by Card, they are paying $1500 in fees in ONE Month. $18,000 in a year! That comes out of their income every month.

That would go a long way to helping that small business provide for its family!🏦♥️”

Etienne’s Addition:

There are even more reasons to pay with cash:

- Cash lets business owners keep more of what they make from the lying, thieving, stealing government, which allows them to spend more on their families, church, charities, and with other small businesses in the community.

- The reduction in the organized crime government’s income, in theory, leaves fewer funds available for war, domestic spying, propaganda, indoctrination and all of their other crimes, waste, fraud and abuse BUT, unfortunately, they end up just “borrowing”/printing the money, which is inflationary and stealing the value out of everyone else’s money.

- If everyone were spending more in physical cash, then everyone would have more cash on hand in the event of a “bank holiday” and less for the banks to steal in a “bail-in” (See below for a definition of a “bail-in”) or lose in a collapse.

Use CryptoCurrencies

Cryptocurrencies are non-dollar-denominated money alternatives that compete with US dollars and other “government” issued fiat paper/digital currencies as a store of value and medium of exchange. Bitcoin, Bitcoin Cash, and Dash are some of the best-known examples, but there are other privacy-centric alternatives, such as Epic Cash and Monero, that are not tracking every currency on a public blockchain, as is Bitcoin.

The organized crime banksters like pushing the price up and down with their piles of fiat paper and digital dollars they use to make crypto look “iffy” and volatile. This will continue until a cryptocurrency acquires enough widespread adoption and liquidity, similar to the US Treasury market, where billions can flow in and out without dramatically affecting the price.

Cryptocurrencies offer several advantages for users and merchants in both good times and during a banking crisis or dollar devaluation.

- Your funds are safe from confiscation – Because cryptocurrencies are stored in a cryptographically secure wallet where you hold the keys, YOU are the bank. There is no middleman able to turn over your funds to the IRS, state tax

“authorities”thieves, or for the banks to steal in a “bail-in.” For the uninitiated, a “Bail-In” is a banking industry-created euphemism for when a troubled bank is allowed “by law” to seize a percentage of depositor funds. This has already happened in Greece and Italy, AND Federal Deposit Insurance Corporation (FDIC) officials have already been caught on video discussing the option of bail-ins for potentially troubled US banks. - You are diversified from the $USD. – While cryptocurrencies are denominated and easily spendable in dollar amounts, they are not $US dollars. They essentially trade similarly to foreign exchange on international markets. In the event of a dollar devaluation (or collapse), they could theoretically weather the storm in a “flight-to-quality.”

Use Gold, Goldbacks and Physical Silver

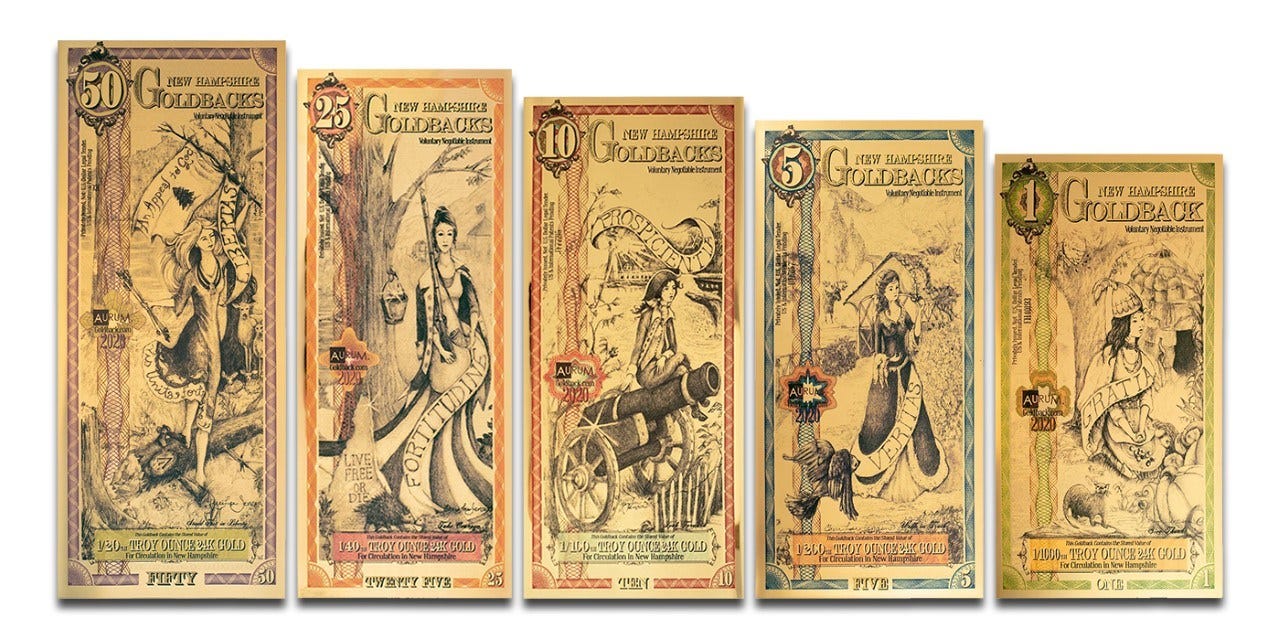

Goldbacks are a new form of currency that makes gold flexible and spendable. Each note varies in size and thickness and contains a fixed amount of 24K Gold. This bill series honors New Hampshire and is popular with the Free State Project.

Gold and Silver are monetary metals with a 5,000+ year history of serving as money. The banksters themselves settle their debts using gold and silver through the Bank of International Settlements. Gold and Silver are not debt instruments like physical and digital dollars and can’t be devalued through the printing press. There are coin shops and gold brokers in almost every city on the planet that does the business of exchanging gold and silver for local currencies.

Cryptocurrencies offer a number of advantages for users and merchants in both good times and during a banking crisis or dollar devaluation.

- Your funds are safe from confiscation (but not theft) – Because you are storing some of your wealth in physical gold and silver in your own home or business, your funds are safe from tax collection and bank “bail-ins” but less protected from “freelance socialism” (I.E. Theft), so you must take precautions to hide or securely store precious metals.

The U.S. Mint’s Bullion Coins are denominated in dollar amounts I.E. the one-ounce silver eagle is denominated as $1, and the one-ounce gold walking liberty is $50 even though the actual value is the spot price of silver/gold ($21.92 and $1918.66 respectively as of this writing March 15th,2023 in addition to $10-15+ premiums you will need to pay PER COIN)

- You are diversified from the $USD. – While Goldbacks and U.S. bullion coins like the American Eagle series are denominated in amounts like $1, $5, etc. that is not their actual value. The value fluctuates with the price of gold on the international market. A $1 US Goldback has 1/1000th of an ounce of 24K gold in gold (about $1.91 at spot price) and retails for about $4. The lowest price I have seen for bulk purchases is $366 for 100 $1 Goldbacks.

“Junk Silver” Coins are pre-1965 U.S. Quarters, Dimes, and Half-Dollars that were 90% Silver. They are still widely available today and are used for barter and as a hedge against inflation. They trade for the amount of physical silver in each coin which varies from day to day but is easily calculable using online calculators like the one at Coinflation.com. For example, a pre-1965 mercury or Roosevelt dime is worth about $1.57 in pure silver,r while a pre-1965 quarter is worth about 3.94 cents as of March 15th, 2023. Expect to pay a few percentage points when buying and lose a couple when selling them at a coin shop or dealer.

How to Use Gold/Goldbacks and Silver to Help Protect Your Community from a Dollar Devaluation / Currency Collapse

- Use Gold/Goldbacks and Silver for Gifts, Tips, and Barter – The more $ USD alternatives circulating and held in your community, the better diversified the community will be to a $US dollar devaluation or collapse.

- I am the owner of a technology consulting firm, and for years I gave my clients engraved silver Christmas tree ornaments starting when silver was about $9 an ounce. Silver soared to $50 an ounce at one time (today, it is $21.92), and my clients remembered and appreciated the prescience of the gift. When was the last time a business gave you a Christmas gift that appreciated in value?

- I buy one-dollar Goldbacks in packs of 100, which I distribute as tips to restaurant servers, valets, and hotel maids. With the restaurant servers and valets, I ask if they want Gold or Paper, which leads to an interesting discussion, and they always want Gold. With hotel maids, I will leave some cash and some Goldbacks.

- Instead of toxic GMO and sugar candy at Easter, I put silver bullion coins and junk silver coins in Easter eggs for my nieces and nephews, knowing that I am diversifying them out of the US Dollar while simultaneously giving them a lesson in investing and precious metals.

- I started giving my kids their $ 10-a-week allowance in Bitcoin when Bitcoin was $230 a coin after a chance dinner with crypto angel investor Roger Ver in 2015, who eloquently explained what was happening in the space.

- I am in a mutual aid society, and the members frequently trade and barter with each other using junk silver and precious metals.

- When exhibiting at conferences and Liberty events, I sell my book “Government” – The Biggest Scam in History… Exposed! for physical silver, Goldbacks, and crypto in addition to the rapidly depreciating fiat paper tickets of a bankrupt empire.

This ends the free preview. What is Behind the Paywall This Week?

Nickels! – What is the big deal about Nickels? Hint: It is the only current US coin that is actually worth its weight in physical metal. In fact, a nickel is worth significantly more than five cents…

What is the cheapest way to buy silver bullion coins without paying $10-20 premiums PER COIN?

Who has the best deal on Goldbacks?

How to diversify your grandkids into precious metals and skip two generations of estate taxes!

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

This is why Visa MasterCard and American Express are such good companies.

After you have paid off your debt you might want to consider buying some of these stocks.

As a former bartender untraceable cash tips are appreciated!

Is your name AOC?

It appears to be ACA.

Never tip a service person, give them a non-taxable gift!

I’ll give em’ a tip…

Ok, maybe the whole thing

Janet Yellen Just Poured Lighter Fluid On Every Small Bank In America

What in the world was she thinking? When a bailout was hastily arranged for uninsured depositors at Silicon Valley Bank and Signature Bank, the implication was that the same thing would be done for uninsured depositors at any other banks that failed. But now U.S. Treasury Secretary Janet Yellen is telling us that is not actually what will happen. She just admitted that depositors at a failed bank will only be protected if officials determine that a “failure to protect uninsured depositors would create systemic risk and significant economic and financial consequences”. So that means that depositors at big banks are likely to be protected and that depositors at small banks are much less likely to be protected. In other words, Janet Yellen just poured lighter fluid on every small bank in America…

She just put a target on every single small bank in America, and so now uninsured deposits will likely get pulled out of those banks at a rate that is absolutely breathtaking.

She is a barely functional idiot.

The “BIGS”, Rothschild banks will be protect while smaller chartered regionals can GFT. That is what she is really saying.

Pre 1983 pennies are 97% copper, not 3% like today. They’re worth around 3¢. A nickel is worth just over 6¢. Used to be 8¢+. Kyle Bass bought $1MM and sold them to a Mexican smelter, made around $150K.

Of course the banks want you to use credit/debit. THEY charge a surcharge on every purchase. Every merchant has to make up that difference in higher costs to YOU. The inflationary spiral just goes up and up. A local microbrewery/restaurant ONLY accepts plastic…they say to protect their employees from potential theft, etc. Screw them. We don’t go there. The only thing I like about plastic is that you get a 30 day free loan from the bank. We have NEVER carried a balance on a card, regardless of how much we have charged. Love the free loan. But I fully agree and use cash whenever possible. I get a discount at the dentist and several other places by paying cash. THEY KNOW.

we ALWAYS offered a 5% discount for using cash in our business.

(a) cash will be phased out after CBDC is rolled out. Not at first , later down the road.

(b) Bitcoin/Crypto will be declared illegal as any form of legal tender just as you cannot print your own money as legal tender now.

(c) You will most likely be selling gold back as you need digital money much as the folks in India do now with regard to Rupees. Keep your private gold/silver transactions for goods and services on the QT and only sell PM’s back into the system for your own benefit as they will confiscate digital for what ever reason they deem useful to TPTB.

Talk of gold confiscation is BS, they asked people to volunteer to sell their gold to the government cheap in 33, it was not confiscated. The government turned around and almost doubled the price of gold after everyone had lined up to sell.

You can always hammer your boullion into gold bracelets if push comes to shove. I had to laugh when the article said crypto can’t be confiscated (or stolen)….har, har.

BL,

Yeah good point; the FED isn’t going to allow competing digital currencies.

I think there is a common denominator with the 3 banks that have recently failed…they all were heavily involved with crypto(?). I know 2 of them were.

The fools were heavily invested in so-called “safe” longer term bonds and crypto backed by nothing but BS promises from the crypto shills.

Remember, those “safe” bonds are still derivatives tied to interest rates set by a Fed, run by a regime that gives less than two shits about its own citizens – the REAL source of faith and credit claimed by the government.

Yep, because illegal is not exactly confiscation… you can always turn it into jewelry and hide it under your mattress. …reeeee

ha ha ha…Hoover was a baaaad man.

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Treasury and financial institutions from redeeming dollar bills for gold, established the Exchange Stabilization Fund under control of the Treasury to control the dollar’s value without the assistance (or approval) of the Federal Reserve, and authorized the president to establish the gold value of the dollar by proclamation.[1][2]

A year earlier, in 1933, Executive Order 6102 had made it a criminal offense for U.S. citizens to own or trade gold anywhere in the world, with exceptions for some jewelry and collector’s coins. These prohibitions were relaxed starting in 1964 – gold certificates were again allowed for private investors on April 24, 1964, although the obligation to pay the certificate holder on demand in gold specie would not be honored. By 1975, Americans could again freely own and trade gold.

Numerous individuals and companies were prosecuted related to Roosevelt’s Executive Order 6102. The prosecutions took place under the subsequent Executive Orders 6111,[8] 6260,[9] 6261[10] and the Gold Reserve Act of 1934.

There was a need to strengthen Executive Order 6102, as the one prosecution under the order was ruled invalid by Federal Judge John M. Woolsey, on the grounds that the order was signed by the President, instead of the Secretary of the Treasury as required.[11]

The circumstances of the case were that a New York attorney named Frederick Barber Campbell had one deposit at Chase National Bank of over 5,000 troy ounces (160 kg) of gold. When Campbell attempted to withdraw the gold, Chase refused, and Campbell sued Chase. A federal prosecutor then indicted Campbell on the following day (September 27, 1933) for failing to surrender his gold.[12] Ultimately, the prosecution of Campbell failed, but the authority of the federal government to seize gold was upheld, and Campbell’s gold was confiscated.

Which shows the logic of not putting personal trust in any financial institution backed by the legal power of a government that will confiscate personal property by legislation.

Actual, real live, no BS silver coins are “junk silver” ??? WTF . . . Oh and crypto is muy bueno!!! I have some 1915 El Estado de Chihuaha peso banknotes they became as worthless as crypto-crappo is going to be soon!!!

” So at the end of the day, there is no preventable financial crisis. What there are amounts to a systematic financial travesty that goes back to the hideously low money market regime that the Fed maintained since the eve of the financial crisis back in 2008, coupled with the evil of deposit insurance, both de jure and de facto.”

So let me see if I understand this. Nickels are a good thing to hoard because they are predominantly copper mixed with nickel content, but dimes, quarters and halves, which are predominantly copper, clad with nickel, and have been accepted as money now for over 50 years is not worth maintaining as our money system? Seems to me some people have went to a lot of trouble, knowingly or not, to undermine our specie.

Now I wonder who would not want us having a working specie in place when they pull the rug on fiat and go to a cbdc?

It is interesting that while doing due diligence, that I learned even the lowly copper clad zinc penny cost 3 cents to make. Which explains why a zinc washer cost more than a penny.

Sometimes I wonder if we aren’t our own worst enemies. Unfortunately it seems we may pay dearly for it.

Use bank created credit money and save your cash…it may actually have some value after the banks go bang.

“Gentlemen! Gentlemen! There’s a solution here that you’re not seeing…”