Guest Post by Nick Giambruno

In the past, central banks could say—with some credibility—that they could counteract rising prices by hiking interest rates.

For example, in 1981, former Fed Chair Paul Volcker took interest rates north of 18% to tame inflation.

However, such a move is not an option today.

That’s because federal debt is so extreme that even a return of interest rates to their historical average would mean paying an interest expense that would consume more than half of tax revenues. Interest expense would eclipse Social Security and defense spending and become the largest item in the federal budget.

According to even the government’s own crooked inflation statistics, which understate the problem, price increases recently soared to 40-year highs.

That means a return to the historical average interest rate will not be enough to reign in inflation—not even close. A drastic rise in interest rates is needed—perhaps to 10% or higher.

Remember, the last time inflation was this hot, the Fed needed to raise rates beyond 18% to get the situation under control.

If that happened today, it would mean that the US government is paying more for the interest expense than it takes in from taxes. In other words, Washington would pay for its interest expense by printing money, which could invite hyperinflation.

In short, the Federal Reserve is trapped.

Raising interest rates high enough to dent inflation would bankrupt the US government.

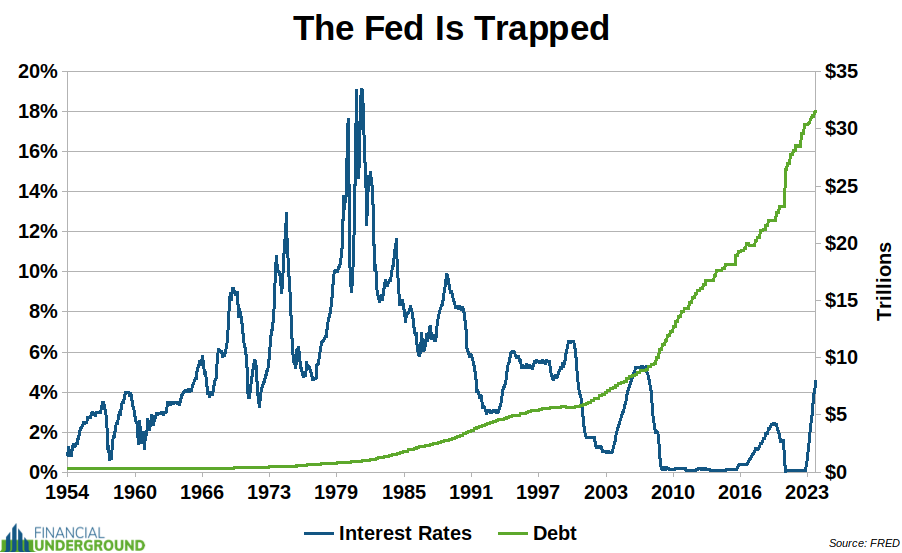

We can see this dynamic in the below chart of the federal debt and the federal funds rate, the Federal Reserve’s primary benchmark interest rate. The higher the federal debt, the harder and more painful it becomes to raise interest rates.

Note how relatively low the federal debt was in the late ‘70s and early ‘80s, the last time a drastic increase in interest rates was needed to combat out-of-control inflation. Then compare it with the debt level today.

In short, the US government is fast approaching the financial endgame. It needs to raise interest rates to combat rampant inflation… but can’t because it would cause its bankruptcy.

Here’s the bottom line…

The Fed has no choice but to give up its interest rate hiking charade soon and engage in ever-increasing currency debasement. I suspect we’ll see this happen in 2023.

The Big Picture

The past couple of weeks, I have focused on what I believe to be the most important investment trend of 2023—rampant currency debasement.

Let’s piece together the main points to see the Big Picture…

Indicator #1: Rigged government statistics understate the actual effects of inflation.

Indicator #2: The US has entered an inescapable political-inflation cycle where a majority of voters demand policies that create more inflation.

Indicator #3: Central planning doesn’t work. The Fed can’t save the day any more than the State Planning Committee of the USSR could.

Indicator #4: Inflation is the only way for the US government to manage its impossible debt load.

Indicator #5: The Fed has no choice but to give up its interest rate hiking charade soon.

The big picture is clear.

Rampant currency debasement is a trend I think you can bet on in 2023.

Investment Implications

The trajectory is indeed troubling.

The coming currency debasement could be unlike anything we’ve ever seen before. That’s terrible news for the US dollar and the other confetti currencies.

Unfortunately, there’s little any individual can practically do to change the course of this unstoppable trend.

Most people save their monetary energy in fake money that someone else can make without effort.

These are the people that will get wiped out.

Currency debasement has financially wiped out countless millions throughout history. But you don’t have to be one of them.

The good news is that you can turn lemons into lemonade. By making the right financial moves, you can not only avoid crippling losses but actually benefit from inflation.

The key is to own free-market monetary alternatives like gold and Bitcoin for long-term savings and the companies that produce them for speculative upside.

Fiat currencies are the liability of the governments that issue them. Therefore, they require trust and confidence that the governments behind them will act competently and honestly. That’s not a bet I want to take for any government.

On the other hand, gold and Bitcoin are the only monetary assets that are not simultaneously someone else’s liability. They have no counterparty risk.

When confidence in fiat currencies is lost, I expect an ocean of capital to flow to better forms of money like gold and Bitcoin.

Gold and Bitcoin are “hard money,” which means they are “hard to produce.” That desirable monetary characteristic makes them resistant to debasement, making them excellent long-term stores of value.

There are some necessary clarifications.

First, you’ll want to own physical gold, not an ETF or other paper derivatives.

The best way to do that is to purchase widely recognized gold bullion coins, like the Canadian Maple Leaf or the American Eagle.

I recommend avoiding numismatic or collectible coins. They are more complicated, can have significant premiums, and present an opportunity for you to get ripped off if you don’t know what you’re doing. Instead, keep it simple and stick to the widely recognized bullion coins.

You should hold your physical gold bullion in your own possession or a private non-bank vault in a wealth-friendly jurisdiction like Singapore, Switzerland, or the Cayman Islands. Never put your gold in a bank’s safe deposit box. They will be among the first targets if and when governments decide to confiscate private wealth.

Silver

Gold coins are generally inconvenient to use for small transactions. Silver coins are more practical.

That’s why having a limited amount of physical silver is helpful for emergency spending needs—no more than 100 one-ounce widely recognized silver bullion coins. The Canadian Silver Maple Leaf and the American Silver Eagle are good options.

The idea is to have some spending cash in extreme circumstances where banks, ATMs, and the internet all go offline. For example, having some silver coins might be essential to buy groceries in such a situation.

It’s worth emphasizing that having more silver coins than needed for emergency spending is not optimal. Gold coins (and Bitcoin) are far better for savings.

Bitcoin

As it relates to Bitcoin, there are some necessary clarifications.

Hold your Bitcoin on your own self-custody wallet, never on an exchange or with another 3rd party.

Do not use leverage, try to trade, or fall for yield schemes.

Use dollar cost averaging and have a four-year time horizon to tame the volatility.

Avoid altcoins—cryptocurrencies other than Bitcoin.

Speculative Opportunities

Gold, silver, and Bitcoin mining stocks are the best way to get speculative upside to the underlying megatrend of rampant currency debasement.

Think of investing in a mining stock like a leveraged play on gold, silver, or Bitcoin. Even a tiny change in the price of the underlying commodity can have an enormous impact on the profits of a miner.

For example, suppose it costs $1,000 for a gold miner to produce an ounce of gold.

If gold prices fall 10% to $900, the company loses $100 on each ounce.

If the gold price instead rises 10% to $1,100, then the gold miner is making a $100 profit on each ounce.

Suppose the price of gold rises a further 9% to $1,200. The miner’s profits don’t just go up by 9%. They double—from $100 to $200 per ounce.

Suppose the price of gold doubles from $1,000 to $2,000 an ounce. The miner’s profits don’t just double. They go up ten times.

That’s how mining stocks offer incredible speculative upside.

A similar dynamic is at work with Bitcoin and Bitcoin miners… but on steroids. That’s because Bitcoin miners are producing something that is not just scarce but absolutely scarce. Bitcoin is the only commodity where higher prices cannot induce more supply, eventually lowering prices.

That means the only way Bitcoin can respond to an increase in demand is for the price to go up. Unlike every other commodity, increasing the supply in response to increased demand is not an option.

That’s why the business of Bitcoin mining can be even more profitable than that of other commodity producers.

When we see explosive moves in Bitcoin, we see even more explosive moves in Bitcoin mining stocks.

Here’s the bottom line.

The trend of rampant currency debasement—which is already well underway—could be an enormous catalyst for Bitcoin.

That’s why I just released an urgent PDF report.

It details how it could all unfold soon… and what you can do about it. Click here to download the PDF now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“Gold and Bitcoin are ‘hard money,’”

Bitcoin is hard money? Really?

I hope that’s a typo, and he meant to say silver.

This boob says not to have more than 100 ounces or about $2,200 or $2,300 of Silver to use as money for small purchases. I don’t know where he lives but that would last most of us a few weeks at best.

Crypto is still a joke. I am supposed to believe we have SHTF economic and currency collapse but the electric grid without which there is no redemption or expending of BTC, is going to work just fine?

Gold and Silver do not depend on a third party promise to pay. BTC requires a whole lot of monkeying around in addition to a third party promise to provide electricity at both ends of a transaction. When you spend the BTC it is also a taxable event if it increased in value since purchase.

This author is incorrect. The Fed does not set rates, the market does and the FED follows. The FED will only abandon rate hikes if the market abandons increasing rates. Increasing market rates are a result of increasing risk of default. Otherwise, the rest of his commentary is spot on . Buy some gold and silver and mining stocks and don’t forget the ammo, liquor and popcorn.

The Fed sets the rates that drive the other rates. And those rates are based on the magic trick of no inflation. In the end, and when the inflation lie can no longer be told, the market decides how valuable or not the fiat currency is worth.

Everything is going to go short term maturities. The public won’t lend the government long term. The only buyer long term for US treasuries will be the Fed. So the Fed will in effect be monetizing the debt.

As peoples purchasing power won’t keep up with wages they will spend less of the devalued currency and prices of non necessities will come down. Bravo ! Deflation in things people don’t need , inflation in things people need.

So Inflation of 20% in things people need . Minus 18 % deflation in things they don’t need. Equals the FEDS 2% inflation target.

Except that the BS … excuse me … BLS has spent 40 years doing their best to exclude “things people need” from their CPI calculations.

These articles are tiresome. Gold will be a nice payment to a warlord to get you out of a country. Otherwise, not so useful. Read real-life collapse stories like those Amin had posted here or books like Surviving the Economic Collapse about Argentina in 2001.

Your life becomes about barter—What you have or what you can do for people. All money is useless, not just fiat currency. What can you trade for at the neighborhood trading post that will inevitably pop up?

Bitcoin? Hard pass. Silver..yes. Also…guns, ammo, livestock, land…all worthy investments, at least to me.

The banking cabal isn’t about to let you use a competing digital currency.

Forget BitCoin. It’s not amenable for transactions and uses too much energy.

Only get/keep 100 ozs of silver…hysterical.

A bottle of Jack Daniels will soon get you almost anything you want or need. A case will buy you a little more time.

After accumulating PM’s for over a decade and advocating to friends and family to do the same I’ve come to realize that, sadly people are fucking retards and they will go down in flames as a result of their normalcy bias. The old saying about leading a horse to water…