Guest Post by Nick Giambruno

For thousands of years, gold has always been mankind’s hardest money.

That is all set to change in a few days, and most people have no idea.

“Hardness” does not mean something that is necessarily tangible or physically hard, like metal.

Instead, it means “hard to produce.” By contrast, “easy money” is easy to produce.

The best way to think of hardness is “resistance to debasement,” which helps make it a good store of value—an essential function of money.

Would you want to put your savings into something somebody else can create without effort or cost?

Of course, you wouldn’t.

That would be like storing your life savings in arcade tokens, airline frequent flyer miles, or central bank confetti.

What is desirable in a good money is something that someone else cannot make easily.

For example, imagine the price of copper going 5x or 10x.

You can be sure that would spur increased production, eventually expanding the copper supply. Of course, the same is true of any other commodity.

That’s why there is a famous saying in mining: “The cure for high prices is high prices.”

The dynamic of higher prices incentivizing more production and ultimately more supply, bringing prices down, exists with every physical commodity. However, gold is the most resistant to this process.

That supply response is why most commodity prices tend to revert around the cost of production over time.

This dynamic is even more profound with money.

When an asset acquires monetary properties, the natural reaction is for people to make more of it—A LOT more.

This is known as the “easy money trap.”

For over 5,000 years, gold has been the hardest asset, the most resistant to the easy money trap.

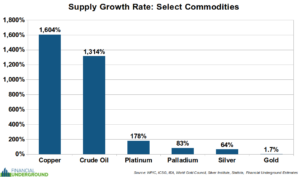

Hardness can be quantified by the supply growth rate, the new supply produced in a year divided by the existing stockpiles.

The lower the supply growth rate, the harder the asset.

Historically, gold has been mankind’s hardest asset with the lowest supply growth rate, which is why it has always been the best money.

The World Gold Council estimates there are 6.8 billion ounces of mined gold globally, and annual production averages around 117 million ounces.

That means gold’s supply growth rate is around 1.7% (117 million / 6.8 billion), which has been relatively consistent for many years.

In other words, no matter how hard humans try, they can’t increase the gold supply by more than 1-2% each year, a trivial amount.

In the chart below, we can see the supply growth rate of various physical commodities.

No other physical commodity comes close to gold’s low supply growth rate and resistance to debasement.

Monetary commodities such as gold and silver have relatively low supply growth rates. On the other hand, industrial commodities have high supply growth rates.

A high supply growth rate means new production can easily influence the overall supply—and prices.

Annual production for industrial commodities can sometimes far exceed existing stockpiles, which means the supply growth rate is more than 100%. That’s because stockpiles for industrial commodities are low as industrial processes constantly use them up.

For example, according to the International Copper Study Group, annual copper production is around 21.9 million tonnes, and stockpiles are around 1.4 million tonnes. In other words, new annual copper production is more than 15 times the amount of existing stockpiles.

Copper stockpiles are so low relative to new production because industrial processes constantly consume them, which means new annual production is an enormous factor in copper prices.

Here’s the bottom line.

It’s not desirable for an asset to function as a store of value if its price is hostage to the whims of ever-changing industrial conditions.

That’s why it’s a big problem for an asset with a high supply growth rate to serve as a store of value, an essential function of money.

Three things can explain gold’s extremely low supply growth rate of 1.7%.

First, gold is indestructible; it doesn’t decay or corrode. That means that most of the gold people produced even thousands of years ago is still around today and contributes to the current stockpiles.

Second, gold has a history of thousands of years of production, unlike other metals like platinum and palladium, which humans have mined for only a couple hundred years.

Third, unlike copper and other metals, industrial processes don’t deplete a large portion of gold’s stockpiles.

These three factors make gold’s existing stockpiles so large relative to new production.

That means nobody can arbitrarily increase the overall gold supply, which helps make it a neutral store of value. It’s what gives gold unique and unmatched monetary properties among other metals.

Before I move on, it’s important to clarify that hardness is not the same as scarcity; They are related concepts but not the same thing.

For example, platinum and palladium are scarcer than gold but not hard assets. Annual production is high relative to existing stockpiles.

Unlike gold, stockpiles of platinum and palladium have not been built up for thousands of years, and industrial processes consume a large portion of them. It’s the primary reason why new supply can easily rock the market.

Because of their high supply growth rates, platinum (178%) and palladium (83%) are not suitable as money. Their high supply growth rates indicate they are primarily industrial metals, which corresponds to how people use them today. Almost nobody uses platinum and palladium as money.

Here’s the main point.

Hardness is the most important characteristic of a good money. All other monetary characteristics are meaningless if the money is easy for someone to produce.

That’s why the history of money is the hardest asset always winning and why gold has always reigned supreme.

But now gold has a serious competitor…

The Hardest Money the World Has Ever Known

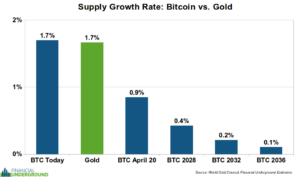

Today, the daily Bitcoin production is around 900 new BTC per day or 328,500 BTC per year.

There are currently about 19.67 million BTC in existence right now.

That means Bitcoin’s supply growth rate today is about 1.7% (328,500 / 19.67 million), which is equal to gold’s.

According to its fixed protocol, we know precisely how Bitcoin’s supply will grow in the future.

A key feature is that the new supply gets cut in half every four years, which causes Bitcoin’s hardness to double every four years.

The process where Bitcoin’s new supply is cut in half every four years is known as the “halving.”

Historically, halvings and their massive supply shocks have catalyzed eye-popping Bitcoin bull markets, in which the price has skyrocketed 10x (or more).

The next time Bitcoin’s supply growth will be cut in half is on or around April 20. That’s when the new daily Bitcoin production will drop from 900 to 450 BTC.

But this coming halving will be very different…

That’s because Bitcoin’s hardness will be almost twice that of gold’s when that happens, as its supply growth rate will drop to around 0.9%.

That’s how Bitcoin will soon become the hardest money the world has ever known. And it will keep getting harder as its supply growth rate approaches zero.

For thousands of years, gold has always been mankind’s hardest money. That is all set to change in days, and most people have no idea.

I think now is the time to get positioned for this unique moment in monetary history.

That’s exactly why I’ve just released an urgent PDF report revealing three crucial Bitcoin techniques to ensure you avoid the most common—sometimes fatal—mistakes.

Check it out as soon as possible because it could soon be too late to take action. Click here to get it now.

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

Harder still to spend crypto when the lights go out, good luck.

The lights only go out after the plans of the rulers come to naught. Deus Vult.

AND!…”THEIR LIGHTS WILL GO OUT’ THE “MOMENT” THEY ATTEMPT THIS MADNESS!!!

The Ecstasy of Gold (Live) – Ennio Morricone Orchestra – YouTube

A stirring piece of music … RIP, Ennis Morricone … and Susanna Rigacci makes it even more beautiful.

https://www.youtube.com/@luna422422/videos

WAIT, UNTIL “SILVER” IS EXPOSED AS BEING THE “REAL LIFE SAVIOR” FROM BIG PHARMA’S POISONS!

THEN WILL “GOLD” BE PUT INTO ITS PROPER “PLACE”…SECOND PLACE!

SILVER “PRESERVERS”, THE BODY…SO THAT THE GOLD CAN PRESERVER THE “MIND”!!!…AND THE BANKER’S ALREADY “UNDERSTAND” THIS “FACT”!

Goldbacks!

Bitcoin is still fiat backed by nothing but hopium. When the first emp attack comes, all your ones become zeros.

And when the planet explodes then…

When the planet explodes, all it’s gold, mined or not, will still exist. It will just be much more fungible.

Give me a fcukin break…you can pimp Bitcoin to the ends of the world it’s still nothing more than digital fiat…hard asset my ass. All you digital millionaires feel free to pile on…not my problem.

Bitcoin has a price, but doesn’t have a value

The hardness of Tulipcoins with their purposeful created “difficulty” to find a fitting block,

is more like mining gold and then throwing it into an active volcano to make the remaining gold “harder.”

Also reminds me of a clown long ago on ZH, that tried to sell that Tulicoins are worth so much because of all the energy put in for ‘mining’ them…. but no matter how persistently I asked, he couldn’t explain to me how the owner could get the energy out of his bitcoin again!

Somebody tell Nick that BTC isn’t money. Why is it that so many people talk about money yet do know what money is?

What the author of this post doesn’t mention, either because he doesn’t understand it himself or because he is being deceptive, is that even though the total supply of Bitcoin is limited, the total supply of cryptocurrencies is not. There are already literally more than 23,000 competing cryptocurrencies, many of which are just as good as or better than Bitcoin. The only reason Bitcoin is currently the most expensive is because it was one of the first, and the first to become popular. But that won’t always be the case. Eventually the supply of greater fools who are willing to exchange cash for ones and zeros with no intrinsic value will be exhausted. And even before that happens it is likely that many of those fools will realize that they can speculate in those other cryptocurrencies much more cheaply than they can speculate in Bitcoin. Once that happens, Bitcoin will rapidly approach its intrinsic value of zero.

Your reply is typical of the ignorant comments about Bitcoin on this site.

No rebuttal? Just checked in to call others ignorant? GFY.

As long as the power is on…..

Gold and silver are going up steadily. Silver getting ready to hit $30. Gold $2500+. Kilo bars are running right at a grand.

Well. Certainly explains brandon’s 81+ million votes.

” When an asset acquires monetary properties, the natural reaction is for people to make more of it—A LOT more.”

EVEN THE “CREATURE’S” WHO INVENTED “FART-MONEY” ALREADY KNOW IT SCAM…UNDERSTAND???

“PERPETUATION OF DEBT” IS THEIR REAL GOAL…TO CREATE “ABSOLUTE POWER & CONTROL”…REMEMBER???

REMEMBER: HUMANITY WAS NEVER “FOR-SALE” FOLKS

The supply of cryptos is infinite, new digital nothings coming out every week LOL.

About as hard as the shite that is coming from you cakehole Giambruno

I see btc as a joint bank account. The only important number is the market cap (balance). If your other account holders decide to go to other banks, the balance drops. The coins are shares in the pot. Buy in low, sell high. Repeat if it pleases you.

Most big deals I have done over the last decade have used the currencies ‘word of honor’ and ‘good name’. The deal is done on a promise to pay, what ever final currency is used to settle the debt is determined later.

Precious metals, at 84:1 I’ll take the pail of silver, thanks.

Investing in Bitcoin is the same as investing in the King’s new clothes. With gold, there is a tangible asset. With Bitcoin there is wishful thinking.

You are free to buy Bitcoin, or any cryptocurrency, or not buy it.

I think the best way to explain Bitcoin to people who don’t understand it, or don’t want to understand it, is that in the simplest form, it’s just a payment system like Visa or MasterCard. That is where it’s underlying value lies.