Extremely comprehensive review of 2011 from Dave Collum, posted on the Chris Martenson website: http://www.chrismartenson.com/blog/2011-year-review-david-collum/67586

Dave includes me in a prestigious list of truth tellers. I’m not worthy.

Every year, friend-of-the-site David Collum writes a detailed “Year in Review” synopsis full of keen perspective and plenty of wit. This year’s is no exception. Moreover, he has graciously selected CM.com as the site where it will be published in full. It’s quite longer than our usual posts, but by any measure, 2011 offered an over-abundance of ‘business as unusual’ developments to summarize. We hope you enjoy David’s colorful observations and insights, which are very much his own. — cheers, Adam]

Background

Governments gambled on a return to growth solving all the problems. That bet has failed.

—Satyajit Das—

Every December, I write a Year in Review. Last year’s was posted at several sites including Chris Martenson’s [1]. What started as summaries posted for a couple dozen people accrued over 13,000 clicks in total last year. It elicited discussions with some interesting people and several podcasts, including a particularly enjoyable one with Chris [2]. Each begins with a highly personalized survey of my efforts to get through another year of investing. This is followed by a brief update of what is now a 32-year quest for a soft landing in retirement. These details may be instructive for some casual observers. I have been a devout follower of Austrian business cycle theory since the late 1990s and have ignored the siren call for diversification. I vigilantly monitor my progress relative to standard benchmarks. The bulk of the blog describes thoughts and ideas that are on my radar. The commentary is largely stream-of-consciousness with a few selected links that might be worth a peek. Some are flagged as “must see”. Everything else can be found here [3].

So why do people care what an organic chemist thinks about investing, economics, monetary policy, and societal moods? I can only offer a few thoughts. For starters, in 32 years of investing I had only one year in which my total wealth decreased in nominal dollars; whatever I am doing has worked. I also ride the blogs hard, am fairly good at distilling complexity down to simplicity, seem to be a congenital contrarian, and am pretty well connected (for a chemist). I am Joe Sixpack, a 99er of sorts with a growing unease.

Every year I feel like Bill Murray in ground hog day. Issues including the housing crises, hidden inflation (of a kind that even John Williams is not discussing), and interest rates have not disappeared, but I hit them hard last year and will not rehash them. I spoke of civil unrest in 2009 but not 2010. That topic has returned with a vengeance. The temptation to say “I told you so” can be irresistible. I have cordoned off a section to get it out of my system. Ad hominem attacks are reserved for jerks and morons, and I will try to avoid trite phrases of little content. I saw “risk on-risk off” so many times that I thought the Fed had hooked the markets to The Clapper. So let’s quit kicking the can down the road and get started.

Contents

- Background

- Investing

- Just Thoughts

- All the Devils Are Here

- Buffett Takes a Bath

- Precious Metals and Currency Wars

- Energy and Resources

- Europe

- Federal Reserve, Bailouts, and Bank Reflations

- MF Global and Rehypothecation:

- Leverage in a Fractional Reserve World

- Nobody Saw It Coming

- Apocalypse Now—The Sequel: A Casting Call for Colonel Kurtz

- The Constitution and the Fourth Estate

- Where to From Here?

- Books

- Acknowledgement

- Links

Investing

Time for this turtle to come home.

—Mr. Wizard—

2011 in Review.

With rebalancing achieved only by directing my savings, I changed nothing in my portfolio year over year. The total portfolio as of 12/31/11 is as follows:

Precious Metals et al.: 53%

Energy: 14%

Cash Equiv (short duration): 30%

Other: 3%

It was a turbulent year for all hard asset investors, eliciting wild oscillations in my portfolio within a 20% range. An overall return on investment (ROI) of -2% was edged out by the S&P 500 (0%) but bested Berkshire Hathaway (-5%). Precious metals (largely CEF, FSAGX, and physical metals) gyrated throughout the year but finished even over all physical and paper forms (Figure 1). Gains in gold (10%) and silver (-10%) were offset by a drop in the premium of CEF (Central Fund of Canada)—one too many shelf offerings—and profoundly disappointing results for the precious metal equities (-19%). The metals are discussed in detail below.

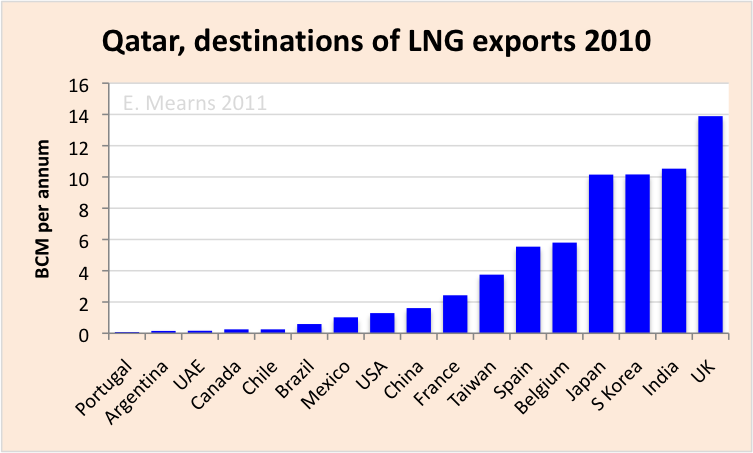

A basket of Fidelity-based energy and materials funds underperformed from -4 to -12%. These are represented emblematically by the XLE spider (1%) and XNG Amex natural gas index (5%) in Figure 2. My own fund foisted upon me by Cornell’s Fidelity connection (FSNGX), although 10% annualized over the decade, was total garbage this year (-7%) relative to its peers. I keep adding to an already chunky position in natural gas equities for reasons discussed in detail last year [1]; a secular global shift toward natural gas should reward patience but this year was pure patience.

These results were buffered by the cash (0%). In addition to the -2% return on investment (ROI), personal savings equivalent to 29% of my gross income added a couple more percent to sneak me into the black (1%) in units of accumulated wealth (vide infra). College tuition and a new car attenuated what would have been a stellar year for savings. Alas, such exceptions seem to appear every year.

Figure 1. Precious metal-based indices (CEF in red, XAU in green, SLV in purple, and GLD in yellow) versus the S&P 500 (in blue) for 2011.

Figure 2. Energy-based indices (XLE in green and XNG in red) versus the S&P 500 (in blue) for 2011.

32 Years in Review.

My imbalanced portfolio changed in decadal rhythms as follows:

1980-88: nothing but bonds (100%)

1988-99: classic 60:40 equities:bonds

1999-2001: cash, precious metals, shorts (minor), tobacco (minor)

2001-2011: cash, precious metals, energy, tobacco (minor)

My total wealth accumulated through a combination of savings and investment as shown in Figure 3. (I blocked out the absolute dollars.) Years ago I chose to exclude physical precious metals from my analysis using classic gold bug logic that I measure them in ounces not dollars. Over the last dozen years, however, I have steadily bought gold (with cash) a couple ounces at a time. I have been prompted to include them in all analyses.

Avoiding 1987 and 2000 equity crashes and capturing the bull market in precious metals proved fortuitous. You can see that 2008 and 2011 were the only down years. Berkshire has dropped five years since 1991.

Figure 3. Total wealth accumulated (ex-housing) versus year of employment. Absolute numbers of dollars have been omitted. Y-axis omitted intentionally.

I monitor progress by what I call a salary multiple, which is defined as the total accumulated investable wealth (excluding my house) divided by annual salary (line 22 of on the 1099 form ex capital gains). Over the 31-year period my salary rose twelve-fold, which I can fairly accurately dissect into a fourfold gain resulting from inflation and a threefold gain (relative to starting salaries of newly minted assistant professors) resulting from increasing sources of income and merit-based pay raises. My accumulated wealth normalized to the moving benchmark of a rising income is plotted versus time in Figure 4. The fluctuations visible in Figure 4 but not in Figure 3 result from income variations. A quick calculation shows that my 12-year accumulation rate beginning 01/01/00, a period in which the S&P returned almost nothing, is annualized at 12%. My five-, ten-, and fifteen-year rate of wealth accrual also beat Buffett’s.

Figure 4. Total wealth accumulated measured as a multiple of annual salary versus years of investing.

Just Thoughts

More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray we have the wisdom to choose correctly.

—Woody Allen—

2011 may prove to be an historical turning point. In 2008 the visionary James Grant asked “Why no outrage?” [4] In the early spring of this year I sensed rage but thought maybe it was only mine. As the year progressed, however, change was in the air and protracted social crises seemed possible. Many issues owing their origins to economics seem to be metastasizing into social movements. One senses winter is coming. With rich irony, Arabs might call it American Spring. Strauss and Howe predicted it in 1996 and would call it a Fourth Turning.

All the Devils Are Here

Look what they’ve done to my song, Ma.

—Melanie—

I cannot get that refrain out of my head as I watch the markets. This year the Devils brought us a wealth of nauseating and irritating stories that made you want to hurl (both lunch and laptop.) Here are some of the highlights. Others worthy of elaboration have been allocated their own subsections.

In an op-ed, Joe Nocera (author of a book bearing the title of this section) noted that one guy is in jail as a result of the entire mortgage fiasco: he lied on a liar’s loan. By contrast, Gary Cohn, COO of Goldman Sachs testified to Congress under oath that Goldman went to the discount window only once, for a nominal sum when in reality Goldman went multiple times. I had occasion to ask Joe if Gary would get charged. “No.” Apparently, perjury in Congress is only a crime if you are lying about baseball.

Thanks to Steve Kroft’s 60 Minutes episode we found out that Congress can legally trade on all forms of insider information [5]. (It helps if you write the laws.) The frothy mix of money and politics is simply too awesome to overcome. Congress shirked its stated job of providing leadership by refusing to make even nominal budget cuts. They set up a super committee to make the cuts (and to give the lobbyists a much more focused target for their money cannons.) They failed too. I am sure the money cannons worked.

The NY Bank-Mellon (and, by the cockroach model, many more banks) got caught after a multi-decade crime spree involving back-dating of Forex trades of pension funds—that would be us folks—scalping 0.3% on every trade. I am sure they will be fined pennies on the dollar and not forced to admit guilt.

We found out this year that the SEC destroyed 18,000 files of fraud cases over many years because they were deemed “inactive”, including those emanating from the Madoff case [6]. The magnitude of this blunder, a generous term for absolute corruption, can only be appreciated when you realize that all fraud cases at the SEC are inactive. David Einhorn’s book (Fooling Some of the People; vide infra) includes horrifying tales of SEC corruption. I imagine Markopoulos’ book about Madoff is the Bible on the subject.

There was a brief glimmer of hope. Standard and Poors grew a spine and downgraded US sovereign debt. I am not sure what rating you give to sovereign debt in which the authorities have explicitly stated that they intend to deracinate creditors with inflation, but it certainly is not AAA. Of course, the CEO of S&P was promptly fired, and, in a delicious irony, was replaced by the COO of the completely insolvent Citibank.

In a wondrous moment in journalism, Bloomberg pried over 20,000 documents from the Federal Reserve using the Freedom of Information Act (FOIA). The Federal Reserve fought the suit, but then agreed to “cooperate” with the Supreme Court’s decision. How magnanimous. There emerged a cottage industry to dig nuggets from this treasure trove. We discovered, for example, that most of the $800 billion of Quantitative Easing II, money reputed to boost the US economy, went straight to European megabanks. Matt Taibbi of Rolling Stone described how a few hundred million found its way into the pockets of the wives of two Morgan Stanley executives to purchase distressed assets and shoes. The system sprang into action after Bloomberg’s score and initiated legislation that will allow the Fed to deny a document exists in an FOIA lawsuit if it should prove inconvenient. I guess that’s the FODA (Freedom of Denial Act).

I thought I could get through a year without taking a whack at Alan Greenspan, but I couldn’t let this one go. The Maestro announced that we should burn down houses to alleviate the supply problem. He seems to have forgotten what historians have written about Federally sponsored food destruction programs during the Depression to prop up prices as people went hungry. This clown destroyed lives. Could somebody at least put a sock in his face?

I try to stay non-partisan, but the White House deserves a little scorn. White House pressure to give solar cell company Solyndra $535 million dollars backfired when they went bankrupt. I remember seeing Obama’s speeches and thinking that they were shameless infomercials. I must admit that I like having an intelligent president who formulates full sentences in real time, yet distrusted him from the start for a simple reason: Nobody comes from the Chicago political machine uncorrupted. Once elected, he filled his cabinet with establishment thugs. Chief of Staff Rahm Emanuel then left to become mayor of Chicago and was replaced with the infamous mayor Daley’s son. You can’t make this stuff up.

Hank “The Hammer” Paulson has done a credible job of looking like a good guy, despite his nickname and Goldman roots. There’s no way that an environmentalist and avid bird watcher could be ruthless, right? We found out, however, that Hank had tipped off a bunch of ex-Goldman hedge fund managers about what the Fed and Treasury would be doing. Of course, Hank let guys like Buffett and Gross help design bailouts and then front run them, but a bunch of hedge fund managers? They don’t even have Congressional appointments.

I would be remiss by not noting that the investment bankers got a few IPO scalps. It’s nothing like the glory days, but they came out with Groupon (flush), Pandora (unobtainium-induced flush), and Zynga (nouveau flush). Buyers of GM and AIG, the newest GSEs, got pummeled with 50% losses this year. You should not buy what Wall Street sells.

Forget Bin Laden, we got Rajaratnam! What a score for the authorities—a big-time hedge fund manager making money off leaked secrets. To top it off, he’s a foreigner, so we get a xenophobia boost. And now for the rest of the story. The guy who leaked the information—the guy who should be credited with a massive breach of trust—was Gupta. He’s a foreigner too so why did Gupta get a pass? He works for Goldman (golf clap). One can only wonder how many more breaches of trust can occur before we simply run out of trust.

Paul Krugman knows how to make friends and influence people. He incessantly pleads for another $5 trillion dollars. Please let it go. A 2002 op-ed resurfaced in which Krugman had called for Greenspan to create a housing bubble [7]. OK. It’s not a crime to be wrong (or a buffoon), but somehow they keep publishing his drivel. Krugman also suggested:

If we discovered that space aliens were planning to attack and we needed a massive buildup to counter the space alien threat and really inflation and budget deficits took secondary place to that, this slump would be over in 18 months. [8]

Jeepers Paul: Put down the bong. This box-office-ready variant of Bastiat’s “broken window fallacy” illustrates what a complete Keynesian boob he is. He also waxed philosophically about how the East Coast earthquake in August could have stimulated the economy if only it had done more damage. Why think small? How about global thermonuclear war or an extinction-event asteroid? The earthquake quote is rumored to be a fake, but how would you know? Since socks come in pairs, put one in his face too.

Buffett Takes a Bath

You should thank God [for bank bailouts]…Now, if you talk about bailouts for everybody else, there comes a place where if you just start bailing out all the individuals instead of telling them to adapt, the culture dies.

—Charlie Munger, Berkshire Hathaway—

Let ’em eat Twinkies, Charlie! (but I digress). Warren Buffett (WB) claims he decided to invest $5 billion in Bank of America while taking a bath. Total absurdity aside, the last guy who did his thinking in the bathtub single handedly destroyed the global economy with his bubbles. To pilfer Buffett’s Wright Brothers logic, we should have drowned that guy, but I digress (again).

Buffett lost a little money this year—no big deal—but he took quite a metaphorical bath. WB is possibly the most famous and successful investor of the modern era—a world-class stock jobber, Master of Wall Street, and a hype machine. Come again? Yep. That sweet little old grandfather buying banks while eating ice cream in Dairy Queen in Too Big to Fail is a world-class hoser. In 2009 I caught Buffett in a big lie: he declared a bullishness for equities with interest rates in the basement, completely contradicting his 1999 article in Fortune Magazine declaring that rising interest rates cause secular bear markets in equities [9]. While pondering a blog denouncing this hypocrisy, I discovered Michael Lewis had scooped me by a mere 17 years. In 1992, Lewis’s Temptation of St. Warren excoriated WB; it’s quite a read [10]. I stole Michael’s title, wrote my blog, and moved on [11], but Buffett and the Buffettologists continue to irritate me.

This year WB denounced low taxes on billionaires. Sounds altruistic, but it leaves a bad taste given that his corporate attorneys protect him from taxation while fighting underpayment of Berkshires’ taxes. (Michael Vick denounces dog fighting too.) WB also helped write bailout plans for banks (including Goldman Sachs and Wells Fargo) while scooping up shares of bank stocks (including Goldman Sachs). He’s no Martha Stewart, but this smells. WB defiantly maintains that he couldn’t care less about Berkshire’s share price, yet he spent billions buying Berkshire shares above book value, which smacks of a stock pump (and it worked). He became Obama’s BFF (best friend for you non-teenagers) and then, miraculously, two of WB’s favorite companies, Wells Fargo and Moody’s, somehow managed to slither out of Federal legal actions targeting their peer banks and ratings agencies. It’s good to have friends in high places (and a reputed $10 million dollar lobbying budget.)

People around WB didn’t help his image either. His long time partner, Charlie “Let ‘Em Eat Cake” Munger, certainly displayed a tin ear with his quote. David Sokol, WB’s anointed heir apparent at Berkshire, got caught getting a little on the side to supplement his ample wealth. Of course, you can’t have Buffett’s clone look like a crook so his career at Berkshire was vaporized. Legendary hedge fund manager Michael Steinhardt beat Warren like a rented mule in a must-see interview on CNBC [12]. He said WB “conned the press”, is “thoughtless”, a “snow job”, and even implied dishonesty while WB’s pregnant groupie listened in stunned silence. When pressed about the Sokol affair, Steinhardt indicated that “it is not common for Buffett to get caught.”

Steinhardt also touched a topic that has me conflicted. Buffett and Gates have pooled their gargantuan empires—resources accrued from the miracles of American capitalism—into a single tax exempt organization of unprecedented scale (Catholic Church aside). One lobe of my brain says they are free to do as they please; another thinks that American capital should be plowed back into American soil for the next generation. I keep thinking about a strip-mining metaphor. In any event, a tax-exempt organization will be allocating this massive pile of capital for eternity (or maybe not). Let’s hope it does so efficiently and for good causes.

Precious Metals and Currency Wars

Gold standard supporters are lunatics and hacks

—Nouriel Roubini—

Precious metals were in a Utopian bull market for almost a decade. The early bulls lounged poolside, taking the occasional dip and enjoying returns in the high teens. It was a leisurely path to wealth. Predictably, the speculators showed up, a few at first but then in number, forcing repeated chlorine charges of the pool. The high frequency traders began playing digital Marco Polo, causing raucous turbulence. Now the market is anything but leisurely. I miss the sane days when only crazy people bought gold.

The volatility, however, is not just the traders. There were some serious shenanigans at the Chicago Mercantile Exchange (CME). They are charged with maintaining orderly markets, but apparently fell waaaay behind the curve. Five margin hikes on silver in eight days isn’t orderly; it’s a drive-by shooting. Just days later, the new Shanghai metals exchange jumped in with its own margin hike, triggering a 15% flash crash. Mysterious put buying on low volume in the wee hours of the morning while most of Asia was on extended vacation elicited serious gold sell offs. To ensure that commodity traders across the board got the memo, 60 million barrels of oil were released from the strategic petroleum reserve for no apparent reason. (Does anybody believe that actual oil entered the market place?) The message was clear: metals and commodity bulls will be dealt with severely. Those without a position in metals are braying that the bull market is over and have been energized by recent precipitous drops. Others see the margin hikes as an effort to allow an orderly retreat for big-money shorts. There may have been some serious collateral damage, however. I suspect that some of MF Global’s problems may have started from this forced selling.

So where are we, heading back to the barbequed relic era for gold or taking a pause that refreshes? I labor over this question without a definitive answer, but I suspect that we are somewhere in the middle of a secular bull. The damage looks minor when placed in perspective (Figure 5). The retail customer is not yet in the game; I have dozens of smart colleagues who listened to me squeal for a dozen years without ever buying an ounce of gold. My local coin dealer still has only 2 or 3 steady buyers kept on speed dial. Sometimes he can’t move even a couple of ounces of gold. Japan is offering gold coins with the purchase of government bonds, placing gold at the status of a free toaster oven. In what was a spectacular Twitter flame war between Rickards and Roubini, Roubini launched his “lunatic” quote (vide supra). One intrepid reporter denounced gold, indicating that “gold is unbacked whereas the dollar is backed by the US government.” (I blew a snot bubble on that one.) The symptoms of a blow-off top are absent.

Meanwhile, the supply-demand stats look great. HSBC estimates that only 0.14% of investable assets are precious metals whereas Sprott says 0.75%. Both are far cries from the 5% target of traditional portfolio theory. Central banks are buyers after decades of selling. India, Korea, Mexico, Russian, and Vietnam were visibly active. (Rumors abound that big buyers are going straight to the miners, rendering the Comex increasingly irrelevant.) Chavez repatriated his gold to Venezuela, presumably to avoid rehypothecation (vide infra). Jim Rickards is in Northern Europe at this moment discussing similar repatriations. Why would any sovereign state keep their gold elsewhere? The 500 lb gorilla, however, is China. They are rumored to have 1,000 tons of gold with a target of 8,000 tons. How do they buy 7,000 tons? They bid for it like everybody else. Chinese citizens have been encouraged to save using gold (a defacto gold standard and covert accumulation). Although the gold bugs in the US occasionally discuss confiscation, I think the Chinese proletariat are the ones being set up. Last but not least, we have charlatans running the central banks of the world. When they say they are going to debase their currencies to help their banking friends, I take them seriously.

Figure 5

With timing that would make Robert Shiller proud, Jim Rickards published Currency Wars, a carefully reasoned description of past and future mercantilism and currency debasement. The oddest thing about a currency war, however, is that you are said to win if you inflict the most damage to your own currency. This is akin to circling the wagons and shooting inward. To stretch the wild west metaphor a little further, I am reminded of the classic scene in Blazing Saddles when the sheriff (Bart) points his gun at his own head and threatens to shoot himself if anybody moves. As the logic goes, everybody debases their currency to make exports cheap and imports expensive. Of course, consumers pay up, but nobody cares about consumers. Even the Swiss—the Swiss!—debased the Swiss franc by 10% in one Draconian swoop to energize sales of army knives. I have no doubt that this form of mercantilism is driven by greed and avarice of politically connected special interest groups. Those who do not directly benefit but sign off on the ideas (economists and journalists) are cranks in my opinion. (I am not completely sure if that passes for an ad hominem attack.)

I must pay lip service to the precious metal equities. Starting in late 2010, equities and metals began diverging quite markedly as evident in Figure 1. Some argue it’s GLD sopping up demand, which I suspected at the outset was the reasoning behind its creation. My best guess, however, is that some big money players began placing spread trades by going long metals-short equities. If so, this gap will eventually narrow. Many bulls assert that the equities are dirt cheap, should be levered heavily to metal price, and will eventually soar (possibly all the way to the moon!) Despite a chunky position in these equities, I am not so sanguine. I aggressively bought tobacco stocks in early 2000 with p/e’s in the mid single digits and dividend yields of 8-12%. (My best bottom call ever paid for a college education.) The gold stocks do not look dirt cheap by that standard. The notion that there is gold in them thar hills (i.e., assets in the ground) is meaningless if these miners can’t get it out profitably. The darker possibility is that the equities are foreshadowing a downturn in the metal price. I don’t take that too seriously because markets seem pretty damned myopic.

I can’t exit a discussion of metals without talking about silver, a bi-curious metal with both industrial demand and pornographic appeal for precious metal investors. (I have spittle dribbling down my chin as I type.) The world-renowned CPM group says that annual industrial demand (approximately 900 million ounces) exceeds mine supply by 200 million ounces. The shortfall is made up from above-ground bullion stashes accrued through the millennia and from recycling. Gold-silver price ratios of 16:1 are often cited targets based on 1:16 ratio of gold and silver in the Earth’s crust. The above-ground stashes, however, tell a very different story. Smart guys like Sprott and Martenson are now quoting 1:1 ratios of accessible above-ground supplies (1-2 billion ounces of each). It was claimed by a highly reliable source (the internet) that the global above-ground silver stash has not been this low since the 13th century. Here is the money line: an estimated 14 billion ounces of silver bullion in 1900, bullion accrued over millenia, has been gutted by 90% in one century. As we crank out solar cells, cell phones, and any other electronic devices (all of which demand silver), I gotta figure silver will have its day in the sun. (Catch that solar cell pun?) I lack the bravado to pray for dips; perpetually rising prices suit me just fine. Economic malaise or not, price discovery is coming. (OK. That was the last Game of Thrones play on words.)

Energy and Resources

The stone age didn’t end because we ran out of stones.

—Sheikh Ahmed Zaki Yamani, former OPEC oil minister. —

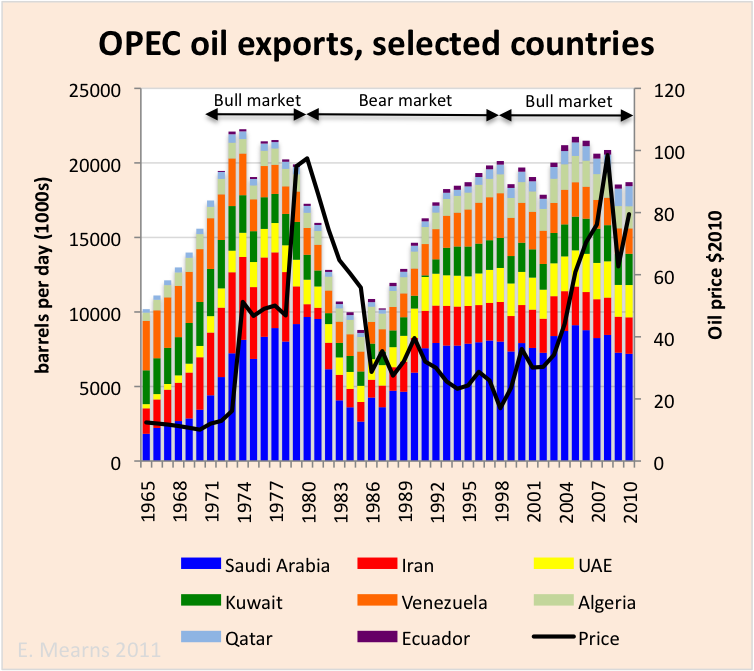

That’s a pithy phrase with no content—a duck-filled platitude—by an evasive oil minister. It is also a refuge for simpletons. I have been pondering an impending resource depletion—a profoundly consequential global event—for years now, a quest that began with the simple notion of hedging inflation. I am essentially done studying the problem and am sitting back waiting for it to play out. To those not up to speed, there are numerous books and blogs on “peak oil”. The premier presentation is Chris Martenson’s Crash Course [13]. If you don’t have three hours to listen to a vivid description of a civilization-changing process, try his one hour seminar [14]. If you don’t have an hour, then, by all means, put down this document and focus on something important. There were a few contributions to the debate this year that caught my eye. Robert Hirsch, author of The Hirsch Report presented to Congress, recently discussed our complete failure to respond to depletion-based risk [15]. Legendary money manager Jeremy Grantham wrote several reports pleading with his investors and society at large to pay attention [16]. To those who hang on Daniel Yergin’s soothing words, many believe he has lost a step or two since his glory days as author of The Prize.

I have also wondered how one will distinguish two distinctly different causal relationships: (1) a geologically mandated reduction in energy output imparting an economic malaise, and (2) an economic malaise causing decreased energy consumption. One might expect that geological constraints should cause energy prices to rise in the face of economic stagnation. The noise, however, will be deafening. Claims of evil speculators, dastardly Arabs, and stagflation will certainly precede the awareness that we are having trouble getting oil. There may also be subtle hints like when the Saudis cut production this year claiming a glut in the market while prices were rising. Does the massive spread between the price of WTI and Brent (up to $25 a barrel) have any information in it? I asked several prominent geologists and market strategists, and they were completely dismissive of WTI as an indicator of demand; Brent reflects world oil price. Of course, the media focuses on the WTI because it makes oil look cheaper.

I am pessimistic about alternative energy sources: Biofuel will destroy the soils (unless ocean-based); solar is going to be a monstrous scaling problem exacerbated by razor thin energy margins; nuclear looked promising until Fukushima set the industry into meltdown (possibly for decades); tar sands are brutal on the environment with only moderate energy margins. I am wildly bullish on natural gas-based equities as discussed extensively last year [1]. I would like gains now, but patience will be necessary as society re-engineers for a natural gas-intensive world. I hasten to add that fracking will only postpone, not eliminate, the energy depletion issues.

Europe

If they are lucky they will manage to [push back the Greek default] for say three years. That will give the banks and insurance companies time to unload this debt—sell it off to national banks and the European Central Bank—so that when the default comes it won’t bring down the private banks and private insurance companies.

—Martin Feldstein, Former Fed Governor—

Preliminary attempts to clean it up fail as they only transfer the mess elsewhere.

—Wikipedia on the bathtub ring in The Cat in the Hat—

There is so much written on Europe it is hard to imagine adding more. I am with Kyle Bass [17] and every other bright bulb in this game: Europe must write down their debt. Of course, Greece got most of the headlines at first, but Greece has been in a perpetual default since the first debt jubilee implemented by Solon in the 7th century BC. In this most recent chapter, Goldman did their Jedi mind tricks (currency swaps) to help Greece get into the whole Euro currency regime (and repatriate some serious drachma to 85 Broad Street). That any banks ever lend to Greece is the epitome of moral hazard; these bankers should be euthanized not bailed.

Several years ago I incorrectly predicted that Spain would be the first Club Med collapse. Their real estate market was levered to the hilt, and there seems to be no Spanish translation for “mark-to-market”. I first realized they could become the Rubes of Europe—no small feat—when US banks sold toxic assets to Santander, one of Spain’s megabanks. I doubt Santander was chosen because it was so well capitalized. Some Spanish bankers probably got some personal doubloons (pocket change) for signing off on that deal. Spain is coming.

Will the monetary and fiscal cavalries save the Euro and, by proxy, Europe? Europe spent 2011 in the “buy the rumor-sell the news” mode, except there were only rumors, and the burst of confidence was always short lived. The authorities kept drawing Maginot Lines in the sand. It seems unlikely that Europe can save itself given that those needing the bailouts are precisely those expected to contribute handsomely to the bailouts. Some of the ideas were almost laughable. It was suggested that the EFSF (European Fubar Slush Fund), a piddling few hundred billion Euros largely funded by insolvent states, could be levered. The circularity of this reasoning is dizzying. They tried to ban debt downgrades (and world hunger). The Kabuki theater called “bank stress tests” offered a few minutes of stability and a great punch line: Megabank Dexia got the highest grade of all Eurobanks…and then went from hero to zero (bailed). Serious dysfunction seemed to emanate from the desire to avoid a “credit event”, a euphemism for cascading failures of credit default swaps (CDSs) that would circumnavigate the globe. (In 2008-09, US investment banks briefly delayed credit events by, quite literally, denying their existence.) Successfully negating the protection offered by CDSs may prove a cunning strategy to destroy the global CDS market. Good riddance.

It would be unreasonable to hope for a prompt solution. The swat team charged with putting together the first Basel Accord took 18 years to get all the signatures during a period of relative calm. Coordinated actions in Europe are largely restricted to military campaigns.

What about help from outside to save the Euro? A concerted intervention by a consortium of central banks bought them some time. There have been discussions of the International Monetary Fund (IMF) fronting the money. That would be largely us, fellow Americans. There was a suggestion that the UK might help, but Prime Minister David Cameron told the rest of Europe to take a hike because the UK is flat broke. He’s not very popular, but his reasoning seems sound. The Federal Reserve is publicly saying they will not bail out Europe (again), but they’ll try (again) because they’ve got bazookas, printing presses, and a “yen” for the kinky.

Oliver Sarkozy (the brother of Merkozy) says European banking system is 4-fold bigger than the US banking system, requiring a 4 trillion bailout (0.80 Krugmans). Australian authorities told its bankers to get ready for a collapse. Europe is starting to look like the board game Risk in which players are trying to get each others’ cards. (Risk players know all too well that nobody ever wins in Europe.) Greece should ignore its bribed politicians and do a total write down. Selling assets is for drug addicts and wusses. Heaven knows Greece’s credit rating couldn’t drop lower. The nuclear option occurs when Germany opens the rumored warehouses of printed Deutschmarks and heads for the hinterlands. Aside from some Slavic carnage, Europe has been militarily calm for 60 years. The previous 3500 years, however, have been relentless tribal warfare. Bright guys are starting to speak in hushed tones of a pan-European conflict again. It could get interesting in a catastrophic sort of way. Analysts might practice typing in fetal position.

Federal Reserve, Bailouts, and Bank Reflations

We’re creating money because there’s not enough money in the economy.

—Rudolf von Havenstein—

I was just kidding: That wasn’t said by Havenstein of Weimar fame but rather by Mervyn King—Mervyn King!—current head of the Bank of England! What does this have to do with the Fed? They all suffer the Keynesian affliction. We are so doomed, but let’s refocus.

The Federal Reserve has really been up to no good, using the global economy as a gigantic laboratory for their cockeyed experiments. Unlike some sealed virology lab, these guys release mutant strains into the wild hoping for some positive effect. For starters, the Fed expanded the dual mandate of maximizing bank profits and triggering rampant inflation to include a third mandate of pumping asset markets. And, of course, Ben Bernanke hails from Princeton. Academics should not be allowed to handle sharp objects or run heavy machinery (like a printer) let alone be put at the helm of the global economy. This is folly at its finest.

Bank reflation is a euphemism, which loosely translated means save the banks at the expense of everybody else. When it is declared that the banks either must recapitalize or have been recapitalized, there is no large mattress from which this money comes. Existing money is already on bank balance sheets. They are being called upon to contract credit, which is a death spiral because of the debt-money supply paradox, or central banks will be forced to create more. Just ask Mervyn. Krugman may be right; we may not have inflation right now…but we will…and then he will be wrong.

Here’s my biggest gripe in a nutshell. The Fed, whether it’s a wholly owned subsidiary of the banking cartel or not, is charged with protecting the banking system. Period/full stop. The banking system is global. Period/full stop. Ergo, one does not even know if the Fed’s actions are in the best interest of the United States. Period/full stop. What is to prevent them from sending trillions to Europe, Asia, or any faraway place because bankers got themselves in trouble? Absolutely nothing; they do it relentlessly. (They even sent the missing pallets of $100 dollar bills to Iraq for Christ’s sakes!) Bloomberg’s FOIA suit showed how far off the reservation they had strayed, pumping in at least $7.7 trillion. Bernie Sanders claims the audit shows $16 trillion. The Levy Economics Institute claims numbers approaching $30 trillion. We keep hearing that we made money on the bailouts, including from General Motors! That’s an OMG/LOL/WTF all rolled into one. The $700 billion TARP was put on display for public consumption. It was designed to be paid back in the light of day. The rest of the money entered the system covertly. They saved GM during the crisis by pooling their ample toxic assets, named it Ally Bank, and bailed it. GM cost us a fortune. Bankruptcy lawyers saw alternative strategies and better outcomes as described in an Econtalk interview [18]. They are selling off assets and declaring profits (like junkies selling blood), but have a balance sheet filled with dregs. Bank of America recently dumped its enormous derivatives book into its banking subsidiary to assist the Fed with another profitable bailout in the near future. Hussman outlined in vivid detail the illegality of a number of Fed’s asset purchases [19]. (Stephen Roach had done so years earlier, but neither Stephen nor I could locate the link.)

Occasionally there is higher brain function at the Fed. Governor Poole expressed angst when they attached low interest rates to a distant date on the calendar:

I would describe the [Fed] decision on August 9 as being simply unprincipled. I know of no article, paper – professional paper in the last 25 years, 35 years perhaps, that would justify this approach to policy. All the academic research, including research within the Federal Reserve makes policy dependent on the state of the economy, not the state of the calendar. So I’m flabbergasted, makes no sense to me. [20]

We the People are suffering Stockholm Syndrome in which we are empathizing with our captors, the banking cartel. The Feds, by offering free and unlimited capital, render our hard-earned capital of no value in the market place while concurrently setting us up for destructive inflation. The 0% interest rates are placing the burden squarely on the backs of savers. The losses due to what Carmen Reinhart called “financial repression” [21] have been estimated at $400 billion per year on the treasury debt alone (not to mention secondary costs stemming from other artificially low rates). I could come to terms with such squanderous bailouts if the flaws in the system had been corrected, but they haven’t and won’t in the foreseeable future. As it stands, the diligent will continue to fund the indolent. It is oppressive, wrong, and, in the long term, destructive. An independent Federal Reserve has gone rogue with no safeguards.

Incisive journalist Evan Ambrose-Pritchard of the Telegraph asked, what will bring the bankers to heel? There is no answer yet. On an early morning Squawkbox, Joe Kernan said to Fed Governor Bullard, “I think you guys should read the Hippocratic Oath a few times.” Indeed.

MF Global and Rehypothecation: Leverage in a Fractional Reserve World

We’re pretty darn f***ed.

—Christina Romer—

John Corzine and the MF Goldman MF Global story is big and getting bigger. Although it is an Enron-scale collapse, it reminds me more of the Refco bankruptcy—IPO in August/bankrupt in October. Unlike Refco, the Wall Street crime families are having a very difficult time burying this story because Corzine is one of the Godfathers. At first it appeared that MFG stole investors’ assets to cover its assets, but soon we were introduced to the previously arcane word “rehypothecation.” To understand this let’s begin with a definition:

hypothecate: To pledge an asset as collateral on a loan without the lender taking possession of the collateral. It especially applies to mortgages: the borrower hypothecates when he/she pledges the house as collateral for payment of the mortgage [22]

Rehypothecation is simply using the same collateral again (and again) for different loans. They are now telling us that everything at MFG may have been legal. I think there is at least one illegal part. JPM anointed itself super senior creditor by confiscating a billion or so, including allocated gold bars. Blogger Bruce Krasting may have been the first to detect their little ploy in the form of suspect reverse wire transfers [23]. (It is merely an optics problem that JPM sold the assets to George Soros.) Some are saying that claw backs will correct this, but I am not convinced.

Isn’t “rehypothecation” just a shell game or Ponzi scheme by another name? Of course, but it’s also the foundation of fractional reserve banking and our increasingly fractional reserve world. Banks used to keep large reserves but with the advent of the Federal Reserve (spawned in the wee hours of December 24th in 1913), banks began shrinking reserves and relying heavily on the lender of last resort. Insurance companies are also fractionally reserved by design. The majority of pension funds are grotesquely underfunded, representing big promises backed by a very small reserves. CDSs are simply credit insurance backed by the good faith and credit of large banks [sarcasm off] whereas others are backed by two guys named Vinnie and Guido. There are still gobs of synthetic CDOs (an estimated bazillion dollars worth) backed by three mortgages in Camden, NJ that have been in default for years. The Comex is a fractional reserve gold storage (backed 2.5% against claims). The prospective for the gold ETF (GLD)—I read it—indicated that the gold is stored “in lots of places, don’t worry, shutup” (although not quite in those words.) There must be some serious hypothecating going on there too. Does anybody seriously believe a bunch of broker-dealers could sit on a pile of bullion without selling it repeatedly? Bob Pisani of CNBC recently toured the GLD gold stash, assuring investors the gold is safe and sound. Zero Hedge noted that the serial number on the bar he proudly displayed was not listed in GLD’s inventory [24].

The MF Global story is very damaging to the public psyche. It showed us that no collateral—not even fully allocated gold bars—is safe in the hands of broker-dealers. When creditors raced for the exits, the politically connected grabbed the loot and ran out the back door, leaving depositors to fend for themselves. (Depositors become junior creditors in this event.) This smash-and-grab tactic is not new. US banks did it to the Europeans during the 08-09 crisis by transferring billions out of German banks in the dead of night. You would be a fool to assume this risk is unique to MFG, and investors are catching on. I diversified my assets in 2006, not by asset class but rather by brokerage in a buckshot pattern, avoiding those active in proprietary trading.

Looking across society you see more promises than assets, setting us up for wild asset grabs going forward. This administration was handed a disastrous economy and given a political mandate for change. Instead, they followed Neville Chamberlain’s lead by appeasing the banks to assure “prosperity and peace in our time.” It’s not working this time either.

Nobody Saw It Coming

Experience is a wonderful thing. It enables you to recognize a mistake when you make it again.

—anonymous—

From my investing portfolio you can see that I smelled something and got out of harm’s way. Rummaging through my email box I found an email dated 5/6/02 sent to Rick Sherlund, founder of Goldman Sachs software group. I am succumbing to the dreaded blogger’s disease, the undeniable urge to yell “I told you so!” You can skip this part because it is ten years old, but I think it is a rather extraordinary document from a rank amateur and one that I am quite proud of.

The exchange began when I briefly expressed concerns, which prompted Rick to ask:

“There have always been gold bugs and doom and gloom types and they are right in pointing out the risks, but what is it if you put this in a balanced or most likely perspective that we should be most concerned about?”

My unredacted response was as follows:

Date: Mon, 6 May 2002 11:42:02 -0700

To: “Rick Sherlund” <[email protected]>

From: “[David Collum]” [email protected]

Subject: Re:

In response to your questions, I worry most about debt, how it has been spread throughout the system, the mechanism by which it will get unwound, and whether the whole notion that one can insure against interest rate risk through derivatives is even a theoretically sound construct (let alone practically sound). Let me summarize what bugs me in general and then try to get at what’s got me jumpier than usual at the end. (In the mean time, I enjoy consolidating my ideas, the non-scientific writing, and pretending to know what I’m talking about…which isn’t new.)

General Concerns

(1) Mortgages and Refi’s. I see a lot of potential defaults in the housing market. Fannie and Freddie are growing an enormous portfolio and are moving toward the sub-prime loan market during a time of decaying economic fundamentals. Everybody rants about the refi’s being good for the economy (including the Fed) when, to me, Fannie and Freddie look like very dangerous institutions. I’m beginning to spot more main-stream thinkers articulating this concern as well. As a segway to the next point…

(2) “Short-term” Personal Debt. The “average family is looking at a $50K salary and $9K on the credit cards (on top of shrinking home equity). The resilient consumer is akin to the avalanche that has not yet fallen; it looks very tranquil. It is mathematically impossible, however, for the consumer to keep accruing debt. The average family — the heart of the bell curve — must either abruptly stop spending or declare bankruptcy (or both). I don’t think either of us can imagine the total sense of futility and denial these guys are feeling right now. I’ve got a grad student with $10K on his credit card and he keeps spending. The “resilient consumer” is on a bungee jump in which we have no idea how elastic (or strong) the bungee cord is. It is amazing to me that decades after invention of the credit card, personal debt generation has not yet plumbed some sort of equilibrium; it just keeps growing as a percentage of income.

(3) Corporate Debt. As some of these big telcos and other conglomerates start drawing down their lines of credit, the potential for a severe banking problem strikes me as quite high. Is JPM a sitting duck? Maybe. If a financial crisis like the one you guys wrote a big check for in 1998 picks up speed, JPM will be up to their butts in problems. As more corporates (WCOM) head to junk status, forcing re-balancing of bond portfolios, it seems to me that a clamp down on liquidity problems should intensify. (This may already be starting if statements by JPM are an indicator.) A number of seemingly stable companies (like GE) are, in principle, stabilizing their short-term interest rate risk (and investor jitters) by moving into the long term debt market. Best case scenario is that they have a drag on their profits for a long, long time. The problem appears to be trickier than that, however. Bill Gross has been pointing out that at least some (including GE) are doing some pretty dicey-looking derivatives trading to undue this shift and re-assume considerable interest-sensitive risk.

(4) Balance of trade. This is the hardest for me to grapple with. But if one follows the seemingly simple premise that a change in sentiment on the dollar and dollar-denominated assets could cause the foreigners to look elsewhere to put their wealth, interest rates will rise. Then we will find out what really is interest rate sensitive. Some (including Roach) suggest that the balance of trade is at levels that have historically proven to be prefaces to currency disasters. The international perspective on the value of the dollar and the possibility of a fairly large decrease naturally leads to the next topic…

(5) Inflation. As I put all this together, it is hard maintain some semblance of an outline since it is so connected. With that said and quite contrary to popular (almost universally held) opinion, I think inflation is here in a big way. The model for inflation that I find to be most credible (almost a truism) is the three-stage model: (1) rising money supply, (2) increased prices, and (3) increasing interest rates. Inflation is really stage 1 — money creation decreasing the value of existing currency. Where this money goes is a very different story. The latter two stages — rising prices and rising interest rates — are consequences. Stage 1 inflation is undeniable; all metrics of money creation point to serious inflation over the 1990’s. I’ll go a step further and suggest that stage 2 inflation (rising prices) is not under control at all either. The numbers coming out of the Fed look fictitious to me. Measuring cost per gigahertz and gigabytes, hedonic adjustments for consumption changes, and an emphasis on a basket of goods that are weighted toward imports don’t paint an accurate picture. (The motivations for why the distortions are intentional would be long, but keeping inflation-adjusted costs on federal payouts under control would be near the top of the list.) I believe that if you simply do a smell test on the cost of living, you find it’s higher than we are being told. I bet you health care costs alone account for >1% per year price increases. Salaries at the university rose 8% last year. Certainly the cost of the most important asset of all, shares of publicly traded corporations, are outrageous using numerical measures. (I stress numerical measures to distinguish them from evaluations based on optimistic projections and just plain old wishful thinking.) I think the bond guys are seeing inflation.

(6) Derivatives. The model of any insurance is to spread the risk of acute, but localized, events over a broader swath. As long as the event is local and not too bad, the system works well. The problem is that financial crises don’t have to be localized and certainly don’t have to stay small. LTCM put the system in jeopardy, causing you guys to bail them out “or lose billions of dollars in the bond market” (to quote a famous tech analyst aka you). The system seems more fragile now (especially looking at the absolute numbers on the notional value of derivatives.) Everybody seems to be insuring everybody. It’s like a group of neighbors collectively pooling their money to self-insure against floods. The banks raved about how derivatives saved their butt after the Enron fiasco; who’s butt got scorched? Any model based on a cataclysmic financial event would have to be centered on derivatives. I should add that I do not subscribe to a model based on an abrupt change (unless you call 1-3 years abrupt). I do, however, believe that this summer might be more interesting than some.

(7) Hidden costs. Any one of a number of items will put a long term drag on earnings including: options expensing, accountants getting religion, debt servicing, reversals in pension plan returns, and a slow recovery.

(8) Confidence. I own two stocks. I have fished around preferred shares, small caps, limited partnerships, commodities etc. etc. looking for investments. I see credible looking investments that I don’t buy. The harsh reality is I don’t trust what I’m seeing. I know what you’re thinking; “Of course you don’t, you’ve become a total whack job.” This is true. However, I think the average investor is catching on as well. Spitzer is gonna do damage. Buffett, Greenspan, and Gross are all going after options as being a consequence of distortions of earnings resulting corporate greed. Joe six-pack is getting an ear full now. (Joe Sixpack includes a lot of money managers who were not smart enough to get out of the Joe Sixpack classification.) The distorted realities are gonna be hard to hide as companies like WCOM and TYC sporting single digit p/e’s on the Yahoo stock board head for the toilet.

(9) The Dollar. Lord knows I don’t understand this one. I can say that dollars and dollar denominated assets look awful to me during a period of enormous money growth.

(10) Greenspan and rates. To loosely quote Gross: Greenspan is toast. He can’t raise rates to fight inflation without triggering liquidity problems. Gross suspects there are some key trigger points at some pretty low Fed rates. If inflation finally shows up on the radar screens to the point where even the paid economists can see it, we have potential for crises that will not be curable by Greenspan’s favorite toy — loose monetary policy. I’m not sure Greenspan can handle it. If you follow Buffet’s reasoning, you can understand bull and bear markets by simply watching interest rates. We are at record lows. The rate cuts have not done anything. (Worse yet, they may have done wonders and what we have now may be the result.) Historians will write a very different chapter about Greenspan than is currently being written (unless I’m wrong, of course!).

(11) Avoiding recessions. To the extent that recessions purge excesses, you can’t avoid them. Greenspan’s monetary policy is akin to a drunk with a whopping hangover taking a few drinks. It’s akin to providing stimulus to revitalize a 24-hour long Roman orgy. It’s akin to…enough similes. The recession of late purged nothing of consequence thanks to AG. I think we will discover that the bone rattling economic events of last year were not “the big one” because the pressures were not released. That is not the good news. I believe that we will begin to come to this conclusion within a few months. My concern is that we will finally test the stability of all the debt instruments described above simultaneously. Either Greenspan is flunking Econ 101 by trying to avoid the unavoidable or he sees big problems (of his own creation) and can’t fess up without exacerbating them. His efforts to achieve a soft landing, while explicitly designed to be non-Japan-like at the outset, may be quite Japan-like in the best-case (soft-landing) scenario. The Austrian economists would argue that there are a lot of ways to purge booms (sharply or slowly), but if you integrate under curve they all inflict the necessary pain.

(12) Event risk. This is a straw-man risk. I fully concede the long term consequences of non-financial events on the financial markets appear to be irrelevant. (They can act as catalysts, however, accelerating certain inevitable outcomes.)

What’s different right now? Why do I feel jumpy? This was a tough question that may have illustrated my official transcendence from bear to whack job. Here’s my best answer.

(1) Gold is rising. Gold is an irrelevant commodity as long as the price stays low. I am not a gold bug, but do believe that a rising gold price has practical and psychological consequences. It also may be a canary in the coal mine.

(2) The corporate problems in companies like WCOM — supposedly real, big-cap companies — seem unabated. I suspect that disruptions in the debt market must be glaring at this point. JPM is tightening its lending best I can tell. Greenspan has no tricks left. (Of course, he can start buying equities as one of the other Fed governors suggested. Then I’m gonna join a militia.)

(3) Issues number (1)-(11) noted above would be highly manageable problems and easily placed in a “balanced perspective” if they occur in relative isolation. However, it seems (“feels”) like they are coming to a head simultaneously. The risks are highly correlated. This is why economic models based on Gaussian curves fall apart right when you need them the most and you get your butt whipped by fat tails.

In conclusion, you may stop talking to me when I tell you this, but key events that turned me bearish include:

(1) In 1997, you said during reunion weekend that companies not yet starting their y2k fixes may be too late. (Now there was a chapter I’d like to forget.) That was the moment that I began looking at the market through a different lens. (2) In 1998 (or 99), we discussed the LTCM crisis and you explained to me why you guys bailed them out. I saw an analogy with the Cuban Missile crisis that I couldn’t shake; another ratchet clicked. As an aside, in that same conversation, I suggested that going off the gold standard may have sent us on a long slow descent into a monetary mess. I believe the garbled grunt you made was an agreement at least with the principle.

Since then, I have been trying to understand the market as a series of interconnected parts constituting either (1) a complex web with great stability, or (2) a house of cards with great fragility. I guess it depends on how you look at it.

So here we are nearly three pages further and ten years later: Is it true that nobody saw this coming? Let’s put this notion to rest. And with that as a segue, many are seeing the next phase of this crisis coming too…

Apocalypse Now—The Sequel: A Casting Call for Colonel Kurtz

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final or total catastrophe of the currency system involved.

—Ludwig von Mises—

Precious few people were taking cover in 1999 nor even in 2006. That is not true today. The old doomers (James Grant, Doug Noland, Bill Bonner, Kevin Phillips, David Tice, Stephen Roach, Doug Cliggott…) have largely not changed their views. Thanks to the detailed analysis of Joe Nocera and Bethany McLean in All the Devils Are Here we find that even the old guard within the ratings agencies and mortgage lending machines saw it coming (and then were sent to pasture.) They also describe how Fed Governor Gramlich tried, albeit unforcefully, to alert Greenspan and remind us how Josh Rosner was all over the subprime crisis in the late 90’s.

There is a gaggle of new Prophets of Doom speaking apocalyptically, and they have some serious street creds. There are measured voices, like that of Mohammad El-Erian, quietly telling us the future will be downsized. But in this putative sequel to Apocalypse Now, who should play Colonel Kurtz, the quirky character driven to the point of madness by the horror of it all? The rogues gallery is listed below. The links are worth a click.

Kyle Bass, Founder and CEO of Hayman Capital. Kyle would have been featured in Lewis’s The Big Short, but Lewis thought he was way too Kurtz-like and left him on the cutting room floor. Lewis recanted in Boomerang, featuring Bass’s dire view of the sovereign debt crisis. A 2011 panel discussion is a must-see, inspiring one my colleagues to start accumulating gold that day [17]. (I was viewer #302; there have been 100,000 now.)

Ann Barnhardt, CEO of commodities trading firm Barnhardt Capital Management. Ann raised some eyebrows when she returned all of her clients money explaining that MF Global has shown that their money is no longer safe in the system. An interview reveals she is livid but not nuts [25].

Charles Biderman, CEO of TrimTabs. The CEO of a company best known for following the flows of money within asset classes previously had announced that the Fed overtly propped the market. This year he announced that the European bank collapses will be accompanied by a “…spiral type collapse of the equity markets, probably with prices approaching the March 2009 lows” [26].

Dylan Ratigan, CNBC. Dylan is the only mainstream network guy willing to call out the liars and felons and crooks (oh my) for their misdeeds [27]. I think he is currently casting for the role of Howard Beale in the sequel to Network.

Paul B. Farrell, Marketwatch and former Morgan Stanley. Paul is the real deal, the original Colonel Kurtz, Paul Craig Roberts’s twin separated at birth. He has morphed from mainstream Wall Street guy to a character out of Road Warrior. His writings at Marketwatch are not for the feint of heart [28].

David Rosenberg, Gluskin Sheff and ex-Merrill Lynch. As one of the big-gun economists on Wall Street, “Rosie’s” casual claims that we are currently in the middle of another Depression are provocative [29].

Larry Lindsey, former Federal Reserve Governor. In a recent interview on CNBC, Larry broke from the script when he noted that the US debt problem places us “about three years behind Italy” in the race to economic and monetary collapse [30]. (I also remember his ramblings in Fed minutes from years ago muttering about Greenspan’s screwy thinking with phrases like “we shall see”.)

Niall Ferguson, Harvard’s market historian and author of Ascent of Money. Niall warns of the coming collapse of the American Empire using vivid Thomas Cole metaphors [31]. He also warns that British Empire analogies—an interminable slide into endless tea parties—is optimistic, instead preferring a short-duration collapse as often happens in metastable systems.

Kenneth Rogoff, Harvard economist and author of This Time It’s Different. As the world’s most well known expert on sovereign defaults, one must pause when Professor Rogoff questions the durability of capitalism [32].

David Stockman, Reagan’s Director of Office and Budget Management. As Reagan’s wunder kid and current Wall Street insider, David witnessed the entire American boom. He now tells an altogether different story of debt and degradation [33].

Jim Quinn, TheBurningPlatform.com and asset manager. Jim is a militant predictor of societal unrest and the onset of a crisis phase and proponent of Strauss and Howe’s thesis in The Fourth Turning. (My review of the book is there [34]).

Paul Craig Roberts, Former Assistant Secretary of the Treasury under Ronald Reagan. (See Paul B. Farrell.) This Paul has been writing of the decline in the American Empire for years [35].

Jeremy Grantham, Founder of GMO. Jeremy, one of the white-haired visionaries with $150 billion under management, sees a host of problems, including low equity prices and dire resource shortages. His resource analyses are must reads [16].

Ray Dalio, Founder and CEO of Bridgewater Associates. The camera shy manager of one of the largest hedge funds in the world painted a particularly bleak picture for Charlie Rose [36].

Chris Whalen, managing director of Institutional Risk Analytics and author of inflation. Chris is a brilliant credit and bank analyst. He suggests both privately and publicly that we may be setting up for a pan-European armed conflict [37].

Felix Zulauf, participant at the elite Barron’s Round Table. Felix sees 2012 ushering in multiple departures from the Euro, civil unrest, possible revolutionary behavior, and excessive money printing, all described in a King World News interview [38].

The Durden Octuplets, Zero Hedge. Another hat tip to the multiple personalities at Zero Hedge. These guys are miles ahead of the mainstream media, offering a unique window into the world of finance and politics—a must-track site for all [39].

James Howard Kunstler, author and peak oil theorist. Jim is a prolific author with an eye on resource depletion and societal decay [40]. With remarkable dexterity and unique irreverence, he has wrapped his ample brain around the financial consequences.

The e-Trade Baby. In a sea of talking Bernank Bears and Hitler parodies, I found this e-Trade Baby (spoof) to be particularly poignant [41].

The Constitution and the Fourth Estate

I have a right, even a duty, to resist, with violence or civil disobedience. You should pray I choose the latter.

—The Great Debaters—

Government is a living, breathing organism that exists to perpetuate itself. There is nothing that says evolution must create a pleasing government better suited to individual liberties. History paints an altogether different picture. Possibly the single largest selection pressure is money. It has always bought political favor. When our government was a few percent of GDP and the industrialists were buying favors while building a nation, government had little power to wield. When money commandeers the machinery of a huge government, however, you have a monstrously expensive and intractable problem.

We should be particularly nervous as money commandeers the press. The media is a critical mechanism by which we transmit freedom of speech: it is an essential tool of a democracy. Mainstream media has collapsed like a dream sequence in Inception. Fox News gets a disproportionate share of the blame. The blogosphere discovered that Roger Ailes’s formulated his plan for Fox News in the 1970’s. It sounds very Orwellian but so what? Different news agencies are privately owned and, consequently, have different angles. The problem I see is that they all appear to be captured. With a remarkable regularity, The Daily Show includes montages in which the different news anchors parrot identical talking points. A severe affliction that first appeared during the 2008 presidential election—Ron Paul Blindness—continues unabated. He’s rocking in Iowa—some claim he’s leading at this moment—but the press want no part of it. Both he and Howard Dean do not fit somebody’s image of a viable candidate. Only journalists with editorial control seem to provide a fair treatment. I find credible news comes from some of the most unlikely sources: Russia Today, Al Jazeera, Asia Times, the London-based Telegraph, Zero Hedge, Rolling Stone, Vanity Fair, and, of course, The Daily Show. That’s pathetic. Thank God for the internet.

At a more micro level, a number of stories caught my libertarian eye and rubbed some nerves raw:

(1) A number of us read former money manager Martin Armstrong’s monetary missives hand published from jail. He was freed this year. Martin was held for a contempt of court charge for 7 years, 5.5 years beyond the legal limit. As he was about to be sprung free, he was finally charged with the original crime (which he seems to have been guilty of) and incarcerated for another 4 years. I would have dismissed the details as internet legend if it had not been told by Pulitzer Prize winning journalist Gretchen Morgenson [42].

(2) A wingnut named Bernard von NotHaus was arrested in 2009 and his assets confiscated because he dared to mint silver coins and recommended people use them for legal tender. This was not counterfeiting, only competition…but not anymore. He was convicted and faces up to 15 years in prison [43]. Utah and several other states, however, have picked up and advanced the ball by passing precious metal legal tender laws. I believe there are significant tax benefits (no gains on inflationary appreciation) when using gold as legal tender, which causes angst in the Halls of Power.

(3) Sergey Aleynikov was given an eight year sentence for stealing software that netted him precisely $0 [44]. His 2009 arrest within hours after the theft must have set a record for the FBI. The real crime was heinous: he stole the software from Goldman. At his arraignment, Goldman’s attorney requested Sergey be held without bail, asserting that he could “use the software to manipulate markets.” That was a world record for the fastest confession from a non-defendant.

(4) Spyware showed up in the Nasdaq to monitor trades. There have been no indictments; it’s all just Wall Street hijinks (or somebody is Too Big to Jail.)

(5) The highest court in Indiana ruled that a guy could not defend himself against a forced, warrantless entry into his house. How does one distinguish the authorities from the criminals?

(6) JP Morgan donated $4.6 million to the police department in NYC just as the Wall Street protests picked up speed. They are taking cues from Roman emperors who would immediately bribe the Praetorian Guard to insure allegiance.

(7) Louisiana banned cash transactions for used goods. If you remove cash from the system, every transaction will go through banks mandatorily. I’m sure they’ll keep the fees low (or not). All snickering aside: Cash is a civil liberty. It was protected in metallic form under the constitution until 1933, at which point the Supreme Court decided restricting the money supply infringed upon the civil liberties of the money printers.

(8) The Senate passed a law by a vote of 91:9 to allow US citizens to be detained indefinitely without trial if they are suspected to be involved in terrorist activities. The House passed it subsequently. Let me be blunt here: the perpetrators of this law are treasonous. They should be tried with full access to the courts. If you lock me up for saying this, you had best throw away the key. Jefferson was credited with the following:

The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants.

I am well aware that fertilizing the tree of liberty is not a resume-boosting career path and not easy for us old guys.

Where to From Here?

Never in the history of the world has there been a situation so bad that the government can’t make it worse.

—Henry Morganthau Jr., 1939—

We have a massive global debt problem that will take years to unwind. Some think it is a zero-sum game, but I disagree. The World is blanketed with people fully aware of what has been promised to them but oblivious to their share of the tab. The average tax payer in the US, for example, is unaware that they owe $30,000 simply to pay off the state pension liabilities to some average tax payers. Larry Kotlikoff, the undisputed World’s expert on unfunded liabilities, estimates there are $211 trillion [45]. This is approximately $2 million per taxpayer. Do you think taxpayers have budgeted for that one?

Let’s go off shore. Billions of nouveau capitalists in the emerging world are expecting the American Dream, but who will provide all those goods and services? Americans? The problem is one of a massive misalignment of perception and reality on a global scale. Years ago I wrote a blog on this and believe that it still rings true [46]. This impending deleveraging will occur in the face of massively aging populations in the industrialized world. Demographic shifts are considered a profound determinant of future economic activity.

The student loan crisis may seem small when compared with these global issues, but it’s a big one for us. The current graduates are starting out in a hole from which it will be difficult to exit. Discharging debts seems distasteful, but so do decades of undischargeable debt with ballooning penalties hanging over a large portion of a generation. I worry, however, about the select group of really brainy folks expected to change the world. Think Steve Jobs. Some will be forced to work for corporations to get a paycheck and “three squares a day” rather than forge off into the great unknown and create wealth on monstrous scales. How many of those guys do you need to divert down a more conservative path before you hurt the economy? Possibly just a couple.

The democratization of the markets provided a cornerstone to this malaise we face. We replaced defined benefit plans with defined contribution plans, which, in conjunction with the wildly popular index funds, moved both the risk and oversight responsibility from titanic pension managers to countless millions of individuals. This sounds great so far, but there was nobody of any clout to watch the store. The shareholders have, in practice, no say whatsoever over corporate governance. This, I believe, is the root cause of the considerable corporate malfeasance. CEOs began stacking corporate boards with friends and boards appointed their friends as CEOs, all sharing the one common belief that compensation, not returns to shareholders, should be maximized. It opened the floodgates of greed and avarice. I had occasion to present this blasphemous notion to John Bogle—the creator of index funds—and he agreed. Knock me over with a feather.

Wealth disparity (for want of a better term) is at record levels. Of course, even mention of that will cause those with wealth to fear an imminent government-based wealth redistribution that can’t possibly work well (because government can’t possibly work well.) There are pragmatic issues independent of moral concerns, however, that should not be dismissed. A well-oiled economy distributes wealth in ways that may seem unfair to some but are efficient. I suspect there are hallmarks—characteristic distributions—that are emblematic of growing wealth and prosperity. A decades-long growing disparity is probably not one of those hallmarks. The clock is ticking.

The populace is beginning to wake up to this reality. Unrest began with one incredibly flammable Tunisian. While on foreign shores, we gave it cute names like “Arab Spring”. When unrest migrated to London it became decidedly less refreshing. Social change has now washed up on US shores superficially as Occupy Wall Street (OWS). At its inception, OWS appeared almost comical, but somehow it simply would not go away despite efforts to dismiss it by those attempting to preserve the status quo. Take a volatile mix of young adults—the demographic at the center of all revolutionary social movements—add a little pepper spray, stir it with some Billy clubs, post videos on YouTube, and you have the beginnings of social upheaval. OWS is said to be a highly disjointed group with no common denominator or even well-formulated gripes. I completely disagree. Admittedly, some are asking to be relieved of pain from self-inflicted wounds, but there is one theme: They all perceive that the system has become decidedly unfair. It’s not about equal opportunity; wealth and power necessarily accrue disproportionate opportunities. We all work hard to give our kids an edge. It is about a perceived absence of opportunity for a growing segment of the population. It would be incorrect to do a head count at street level and conclude the movement is small. Millions are watching from the comfort of their homes and offices in what I believe is silent support. This movement could get legs as it percolates up through the social strata.

Figure 6

Strauss and Howe’s predicted Fourth Turning crisis phase may have arrived. But there is already a nasty mood in the air. Watch the following soccer video [47]. The hooligan runs around the field and, when grabbed by the police, gets roughed up a little. The players and fans beat the tar out of the police. Something has changed. Some think maybe it started on 9/11. This may be true for Iraqis, but not for us because we dusted ourselves off and moved along. Others say it was the financial crisis. Closer but that is still not quite right. I think the societal rollover occurred when the financial crisis arrived and abated, yet absolutely nothing changed. We are in a big hole as illustrated by US employment stats in Figure 6. If this recovery stalls, promptly unplug all fans.

To reduce my concerns to traders jargon, I look at the S&P 500 over decades and ask: Is that a head and shoulders formation? Is that just an equity index, or is there something more ominous lurking? One should be concerned because traders know that a head and shoulders eventually gives way to knees and toes (knees and toes).

Books

An educated mind can entertain a thought without accepting it.

—Aristotle—

For those who made it this far—avid readers to say the least—I’d like to offer thoughts on what books shaped my thinking. Despite an overdose on crisis books for over a decade (beginning with crisis foreshadowing books), I succumbed to the temptation a few more times. The following are the notable ones:

All the Devils Are Here: The Hidden History of the Financial Crisis by McLean and Nocera.

This is a particularly poignant slice through this interminable crisis by describing the slow, methodical mutations that morphed the key players—the ratings agencies, mortgage brokers, investment banks, politicians, and GSEs—into destructive forces. It offers a great view of the mortgage world. McLean and Nocera deftly illustrate how any barrier can be removed or corrupted given enough political influence, financial resources, and persistence. One also realizes, however, that regulation and enforcement would be like enforcing drug laws at Woodstock.

Fooling Some of the People All of the Time by David Einhorn.