Continue reading “THIS DAY IN HISTORY – OPEC enacts oil embargo – 1973”

Continue reading “THIS DAY IN HISTORY – OPEC enacts oil embargo – 1973”

Tag: oil embargo

THIS DAY IN HISTORY – OPEC enacts oil embargo – 1973

The Arab-dominated Organization of Petroleum Exporting Countries (OPEC) announces a decision to cut oil exports to the United States and other nations that provided military aid to Israel in the Yom Kippur War of October 1973. According to OPEC, exports were to be reduced by 5 percent every month until Israel evacuated the territories occupied in the Arab-Israeli war of 1967. In December, a full oil embargo was imposed against the United States and several other countries, prompting a serious energy crisis in the United States and other nations dependent on foreign oil.

Continue reading “THIS DAY IN HISTORY – OPEC enacts oil embargo – 1973”

My Reasons For The Pardons

Hey Guys! Look what I found. After seeing the story about the FOIA request of the WJC FBI files I thought I’d do some digging. And it’s times like these that I appreciate the internet. It doesn’t take long to find original articles from the early 2000’s still on the internet.

New York Times, Feb. 18, 2001

By: William Jefferson Clinton

Because of the intense scrutiny and criticism of the pardons of Marc Rich and his partner Pincus Green and because legitimate concerns have been raised, I want to explain what I did and why.

First, I want to make some general comments about pardons and commutations of sentences. Article II of the Constitution gives the president broad and unreviewable power to grant ”Reprieves and Pardons” for all offenses against the United States. The Supreme Court has ruled that the pardon power is granted ”[t]o the [president] . . ., and it is granted without limit” (United States v. Klein). Justice Oliver Wendell Holmes declared that ”[a] pardon . . . is . . . the determination of the ultimate authority that the public welfare will be better served by [the pardon] . . .” (Biddle v. Perovich). A president may conclude a pardon or commutation is warranted for several reasons: the desire to restore full citizenship rights, including voting, to people who have served their sentences and lived within the law since; a belief that a sentence was excessive or unjust; personal circumstances that warrant compassion; or other unique circumstances.

IRAN IS BIG

Another good article from http://www.theoildrum.com/. Some interesting charts and maps. The first chart shows that Iran produced 6 million barrels of oil per day in the 1970s. The Islamic revolution and the brutal war with Iraq resulted in a collapse of their oil production. It has barely reached 4 million barrels per day since the early 1990s. They are unable to ramp up production due to sanctions and the lack of technological expertise. More than 60% of their exports go to the far east. China, Japan and India will not be happy if Israel and the U.S. decide to teach Iran a lesson.

I’ve always been geographically challenged. I never realized the size of Iran. Take a really good look at that map. Iran dominates the Middle East. Take a long hard look at the Persian Gulf and the Strait of Hormuz. Approximately 15 oil tankers per day, carrying 34% of the world’s oil supply, must traverse a 6 mile wide traffic lane. Imagine what would happen to worldwide oil prices if this Strait was shutdown. The Iranians aren’t stupid. This is their trump card.

Imagine how many soldiers it would take to subdue a country this large. Cruise missiles and B1 bombers aren’t going to defeat Iran. We’d just be killing thousands of innocent Iranians. The neo-cons like Gingrich and Romney act like taking out Iran will be a piece of cake. When have the neo-cons ever been wrong? The sanctions and embargoes are designed to force Iran to do something stupid. They will be attacked no matter what they do. The unintended consequences will likely lead to the next phase of this Fourth Turning.

Iran – Possible Implications of an Oil Embargo

Posted by Euan Mearns on December 6, 2011 – 6:30am

Does Thursday’s announcement that the EU is considering to ban oil imports from Iran epitomise the draining of power from west to east? The big winners here will be China and India, who do not fear rising Iranian influence and who will gladly soak up any additional oil exports they may have to offer. However, ending this small dependency upon Iranian oil imports in Europe (Figure 2) does clear the way for military action without the need to ponder the immediate consequences on oil imports.

Figure 1 Iran displays export land traits where growing domestic consumption is eating into the oil available for export that has been declining slowly since 2003. Data from BP. Y-axis is barrels per day (1000s). Balance = production less consumption which is a proxy for net exports. Production = crude+condensate+NGL whilst consumption may include refinery “gains” and bio-fuel. In many countries there is also an active two-way trade in crude and refined products.

In a week where the UK embassy in Iran was overrun and the two countries are breaking off diplomatic ties, on the back of heightened concern about Iran’s nuclear weapons program and an unexplained explosion at an Iranian missile launching site, the EU has decided to flex its muscles and to ban Iranian oil imports. The big winners here are the other countries importing oil from Iran – Japan, China, India and South Korea. Does the EU really believe that in today’s extremely tight oil market that oil sanctions against Iran will worry them in the least?

Figure 2 Table from a worthy article on Iranian oil and demographics posted on Crude Oil Peak details the countries importing oil from Iran in 2008. The four EU countries to be affected by any embargo will be Italy, Spain, Greece and France. Given that Greece and Spain are already in recession and that Italy and France are heading in that direction, it seems likely that their oil consumption will already be on the wane and that losing these relatively small amounts of Iranian imports will have little consequence.

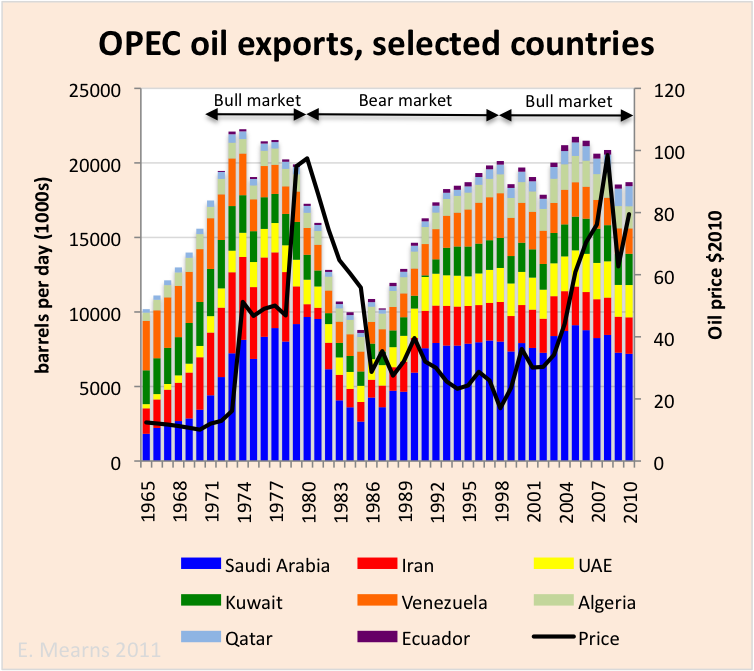

Figure 3 OPEC net exports (production consumption balance from BP) showing the importance of The Gulf states.

With the risks of armed conflict against Iran increasing with every week that passes it is important to grasp what this may mean for global oil markets. Two end points seem to exist. The first is where “the West”, i.e. NATO or some other looser alliance ± Israel launches a cruise missile attack (conventional) against Iran’s nuclear facilities. destroying them. In that eventuality Iran, with current leadership, would be unlikely to ever again export oil to “the West”, but since at that point The West will not be importing any oil from Iran this would not matter.

Figure 4 Iranian oil infrastructure, setting in the Arabian or Persian Gulf and the linch pin location of The Straights of Hormuz. Map from Wikipedia.

The second more extreme scenario is that armed conflict spreads, compromising oil exports through the Straights of Hormuz. Oil exports from Saudi Arabia, Kuwait, The United Arab Emirates (UAE), Qatar, Iraq and Iran all pass through Hormuz. Data is not available for Iraq, but exports from Saudi, Kuwait, UAE and Qatar stood at around 12,805,000 bpd in 2010. The global net export market stood at around 35,173,000 and so these 4 countries alone account for around 36.4% of the global export market (excluding Iraq and Iran). Should these exports cease, albeit temporarily, the oil price will go through the roof, causing severe trauma to the global economy, including China.

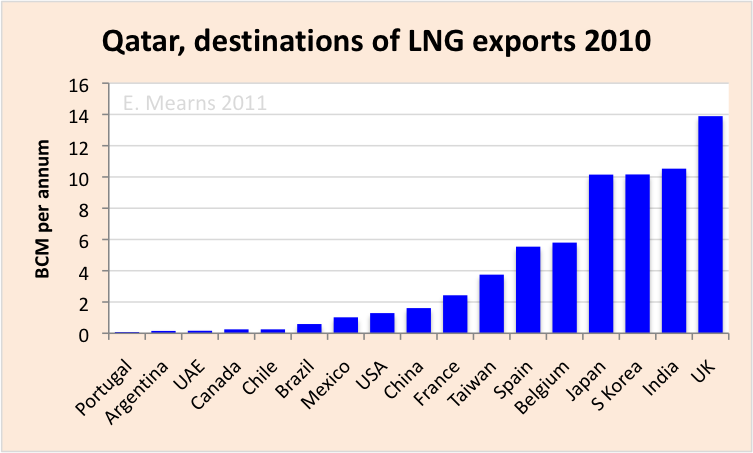

In addition, there are significant liquefied natural gas exports from Qatar that pass through Hormuz on a daily basis. According to BP, Qatar exported around 96 BCM of gas in 2010 (Figure 5) to the countries shown in Figure 6. In Europe, the UK, Spain, and Belgium would be most affected by disruption to LNG supplies from the Gulf whilst in Asia, India, S Korea, and Japan would be most affected. This highlights the increasingly exposed nature of OECD energy supplies where electricity supplies may be threatened by armed conflicts on the other side of the world.

Figure 5 Production / consumption balance for natural gas in Qatar.

Figure 6 Destinations of LNG exports from Qatar in 2010.