The majority of Americans seem OK with just waddling through life, accepting the lies and misinformation blasted from the boob tube and their various iGadgets by their owners, gorging themselves to death on Twinkies and Cheetos, paying 15% interest on their $10,000 rolling credit card balance, and growing ever more dependent on the welfare/warfare state to provide and protect them from accepting personal responsibility for their lives. A minority of critical thinking people have chosen to question everything they see and hear being spewed at us by the propagandist mainstream media, the corporate fascist government, and the powerful banking cabal that has an iron grip upon our throats as they choke the life out of the global economy in their never ending desire for more riches and more power.

The decline of the Great American Empire cannot be attributed to one factor or one bogeyman. There are a multitude of factors, villains, and choices made by the American people that have led to our moral, civil, social, and economic decline. The kabuki theater that passes for our electoral process is little more than a diversion from our imminent fate. Neither candidate for President has any intention of changing the course of the U.S. Titanic. Our rendezvous with destiny has been charted, and there aren’t nearly enough lifeboats. Those who built the ship and recklessly navigated it into a sea of icebergs will be the 1st into the few lifeboats. The leaders we’ve chosen, the choices we’ve made, and our unwillingness to deal with facts and reality have set in motion a disaster that cannot be averted. It’s a shame the majority of Americans have the math aptitude of a 6th grader, because the unsustainability of our empire can be calculated quite easily. Math is hard for Americans, but denial and delusion are easy.

Oddly, a couple of late September days in Wildwood NJ were able to crystalize many of the aspects of our cultural and economic decline in my mind. I should have just enjoyed the 72 degree temperatures, a few beers, and the freedom to read a book on my deck. I wish I was just oblivious to my surroundings, but my weekend in Wildwood NJ was an eye opener. Everywhere I turned I saw something that made me laugh, shake my head in disgust, or wonder how our government could have become so inane, incompetent and out of control. We all generalize based upon our preconceived beliefs, but sometimes what you see is what you get. The weekend started normally with a morning bike ride on the boardwalk with my wife and son to the Hereford lighthouse in North Wildwood. Along the way we passed the usual suspects on the boardwalk: the obese, the tattooed, the pierced, and the blue haired. I wish I was exaggerating, but I saw a dozen hoveround and rascal scooters carrying extremely obese Americans on par with this person:

If I wanted to be politically correct, I’d call the fat asses cruising on their “free” rascal scooters, the weight challenged disabled on their powered mobility enhancement vehicles. You know a trend has become a massive scam, when South Park dedicates an entire show to the shame of obesity and the scooter brigade. The majority of the scooter squad jamming up the boardwalk was less than 50 years old. They weren’t disabled. They were just too obese and lazy to wobble down the boardwalk to the next junk food joint. They were certainly in the right place. The Wildwood boardwalk is home to pizza topped with cheese fries, chocolate covered bacon, fried Oreos, funnel cake topped with powdered sugar, and 64 ounce sugar laced lemonade. The place would make Nanny Bloomberg’s head explode.

We’ve all seen the commercials for the Scooter store urging anyone on Medicare to rush in and get a power scooter or wheelchair “at little or no cost to you”. The entitlement “free shit” mentality permeates our culture. There is a cost and it is over $800 million per year, paid for by the 53% who pay Federal taxes. Records from the Centers for Medicare and Medicaid Services show that the cost of motorized scooters and wheelchairs to the government health service for senior citizens rose 179% between 1999 and 2009, the last year for which full records are available. This data is fascinating as the number of Americans over the age of 65 only increased by 18% over this same time frame. The bill in 1999 was $259 million; in 2009 it was $723 million – and is surely over $1 billion today. This is another billion dollar scam being funded by your tax dollars, but there are no spending cuts possible according to our beloved Congressmen.

A recent report by Medicare’s inspector general also showed that 61% of the motorized wheelchairs provided to Medicare recipients in the first half of 2007 went to people who didn’t qualify for them. (Only people who cannot get around without one are supposed to be eligible.) The inspector general found that Medicare is billed an average of $4,018 for a motorized wheelchair that normally sells for $1,048. As a taxpayer, you will be shocked to find out that people are selling their “no cost” Rascal 600 B mobility scooters on eBay. I’m sure the keen eyed government drones working in the Health & Human Services agency are policing the resale of taxpayer paid for scooters. I find it amusing that scooters have various naming classes, just like BMW and Mercedes. The vast majority of people I see tooling around on their “mobility scooters” are just plain fat. They aren’t over 65 years old. On my Sunday bike ride I was flabbergasted and amused by the sight of a 350 pound woman on a Rascal with the pedal to the metal pulling a 275 pound man in a wheelchair attached by rope. The plague of slow metabolism is sweeping the countryside.

While I was relaxing on my deck reading and trying to blot out the nightmare visions of obese boomers in Rascal formation like German panzers invading Poland, a brand new SUV pulled into the parking lot across the street. After five minutes, the driver’s side door opened and out sidled a four foot five, two hundred and fifty pound female senior citizen in all her girth. She waddled to the back of the SUV and opened the hatch to extract her walker with wheels. She began berating the three hundred pound dude that got out of the passenger side to come and get his walker. Then she motored off towards Laura’s Fudge, while her hubby conserved his energy waiting by the SUV. Minutes later she scooted her way back hauling a sack of fudge. They then trundled off towards the boardwalk, most likely headed for Kohrs Bros for a double dipped fudge ice cream cone or some Boardwalk fries smothered in cheese.

Based upon my unscientific assessment of the people walking on the Wildwood boardwalk, I would conclude that 35% of the people are obese, 40% are overweight by 20 or 30 pounds (myself included), and 25% are in relatively good shape. After checking the government statistics, my assessment appears to be accurate. Who is to blame? The easy answer is to just blame the individual for their lack of self-restraint and inability to contain their impulses. But when you consider that 160 million out of 232 million adults in this country are either overweight or obese, along with 11 million adolescents, there must be something more sinister behind the phenomenon. There is no doubt that a major portion of the blame must be laid at the fat feet of those who could have exercised restraint over their cravings, but the words of master propagandist Edward Bernays provides another factor in the equation:

“If we understand the mechanism and motives of the group mind, it is now possible to control and regiment the masses according to our will without them knowing it.” – Edward Bernays

Bernays reveals a truth that is self-evident to those with critical thinking skills. Sadly, few Americans exhibit any thinking skills whatsoever. Our society has bifurcated into those who control and those who are controlled. The overlord Double Plus Alphas in our society consist of the Wall Street banker cabal, the executives of our mega-corporations, Federal Reserve governors, Washington DC politicians, Federal government apparatchiks, the propaganda experts in the mainstream corporate media, and the secretive billionaire set that manipulate and maneuver behind the scenes. The first step in controlling the Gammas, Deltas and Epsilons, as Aldous Huxley knew in 1931, was to indoctrinate them with propaganda in our government run schools. This mission has been accomplished. The vast majority of school children graduate from the government school system with no ability to think critically or question what has been spoon fed to them as facts. The fascist alliance of corporations and the state begin in the public schools, with product advertisements by corporations now subsidizing school budgets. The road to obesity is paved with chicken nuggets, fries and pizza dispensed by the government schools on a daily basis.

Just as in Huxley’s Brave New World, America has been built upon the principles of Henry Ford’s assembly line—mass production, homogeneity, predictability, and consumption of disposable consumer goods. In the dystopian novel, members of every class, from birth, are indoctrinated by recorded voices repeating slogans while they sleep. Huxley didn’t imagine the power of TV and other mass media outlets to do the same while we are awake. We are bombarded day and night by propaganda from mega-corporations to buy their products. Mass consumption of processed food sold by the likes of multi-billion dollar corporations Kraft, Pepsico, Coca Cola, General Mills, Nestle, and Unilever is the chief cause of the obesity epidemic in America. The few know how to manipulate the many through messaging, repetition and persistently molding the opinions of the feeble minded non-thinking masses. The billions spent by corporations on advertising to convince the masses that eating a Wendy’s Baconator, KFC extra crispy bucket, or Double Quarter Pounder with Cheese, washed down with a two liter Mountain Dew or Cherry Coke, is a tribute to the invisible government running the show. Huxley and Bernays had it all figured out eighty years ago:

“The conscious and intelligent manipulation of the organized habits and opinions of the masses is an important element in democratic society. Those who manipulate this unseen mechanism of society constitute an invisible government which is the true ruling power of our country. …We are governed, our minds are molded, our tastes formed, our ideas suggested, largely by men we have never heard of. This is a logical result of the way in which our democratic society is organized. Vast numbers of human beings must cooperate in this manner if they are to live together as a smoothly functioning society. In almost every act of our daily lives, whether in the sphere of politics or business, in our social conduct or our ethical thinking, we are dominated by the relatively small number of persons…who understand the mental processes and social patterns of the masses. It is they who pull the wires which control the public mind.” – Edward Bernays, Propaganda, 1928

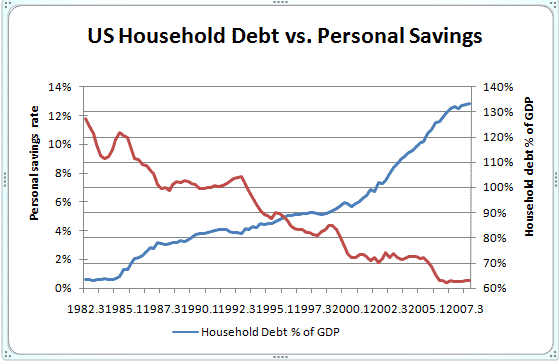

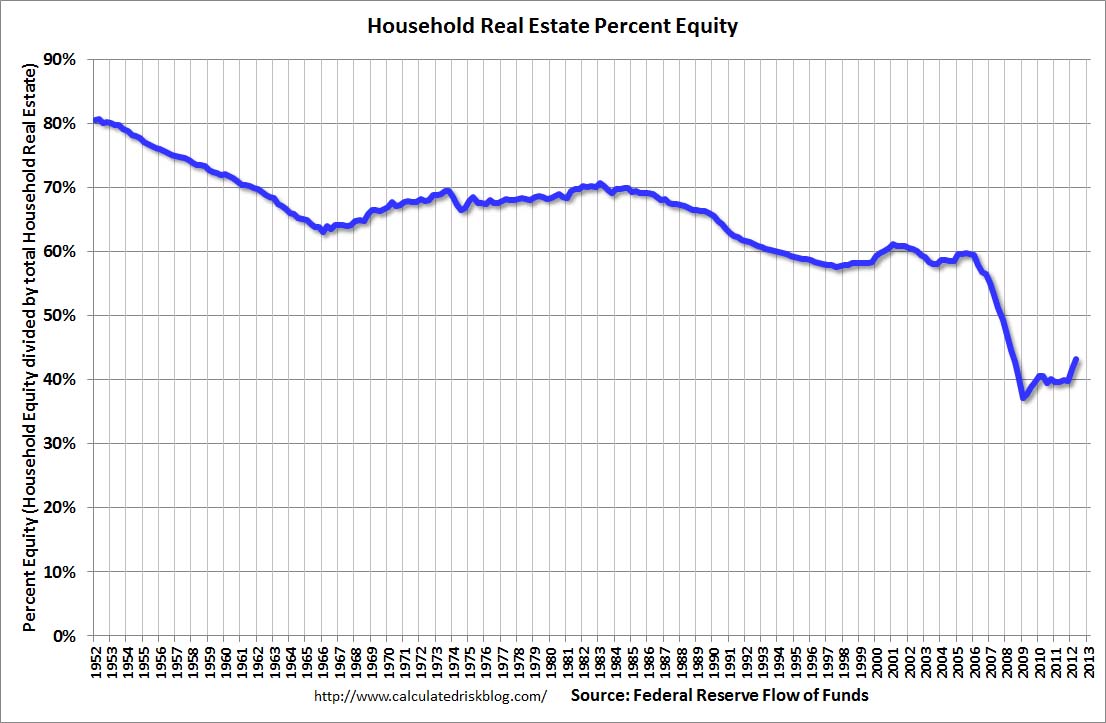

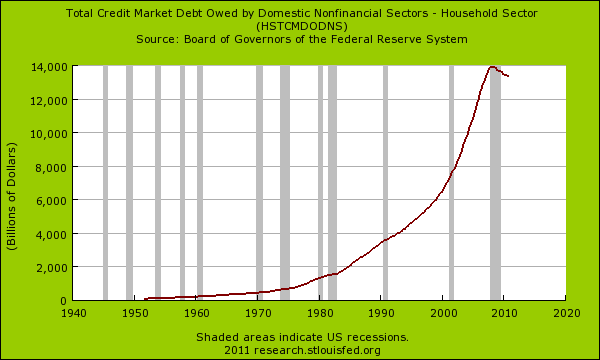

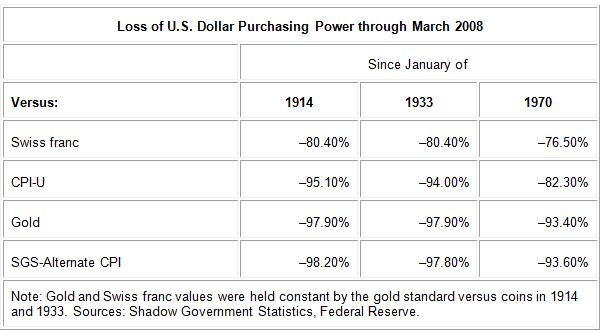

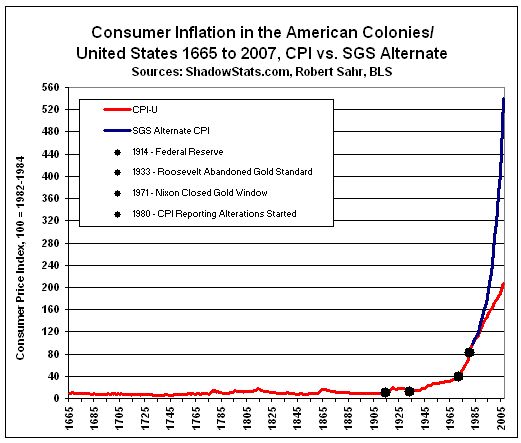

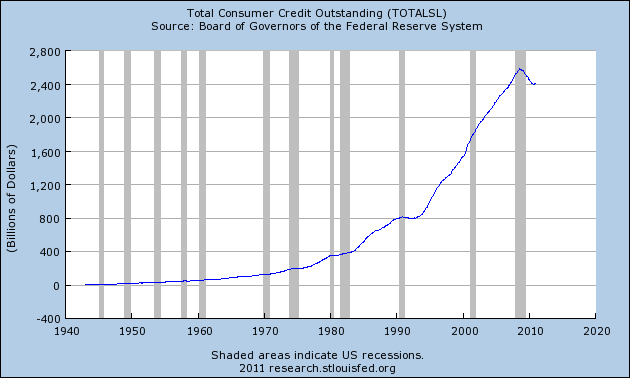

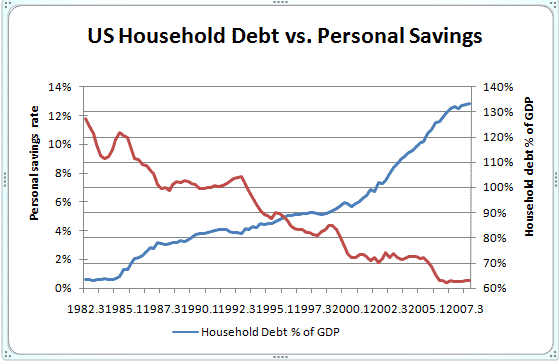

The conscious and intelligent manipulation of the masses by the invisible government Alphas has transmuted citizens into overweight, non-thinking, debt dependent, egocentric consumers. This was not a mistake. The powerful interests used their control over the banking system, media outlets, and political system to lure the willfully ignorant into a debt financed lifestyle through the Federal Reserve created inflation, Wall Street peddled credit cards, auto loans and “creative” mortgages. The manipulators convinced the manipulated that borrowing today to buy houses, cars, bling, tech gadgets, clothing, and fast food was preferable to what previous generations of Americans had done – save to buy things they wanted or needed. This behavior seems to be completely irrational as a people that once saved 12% of their income and carried a moderate amount of debt chose to reduce their savings to 0% and not worry about tomorrow.

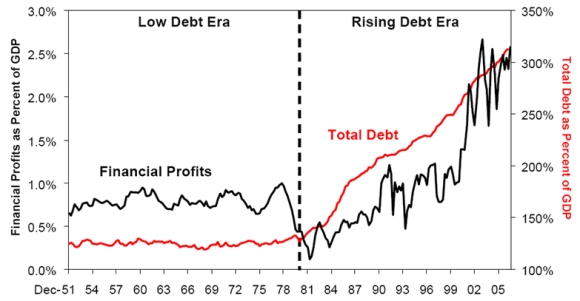

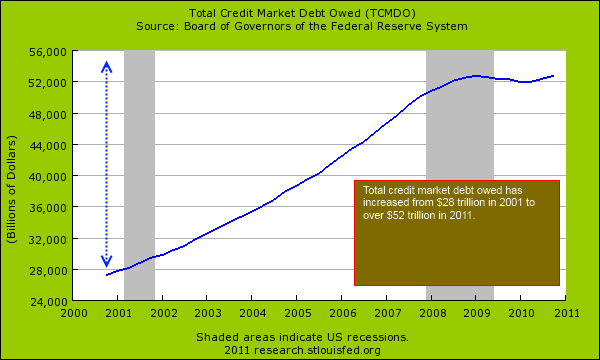

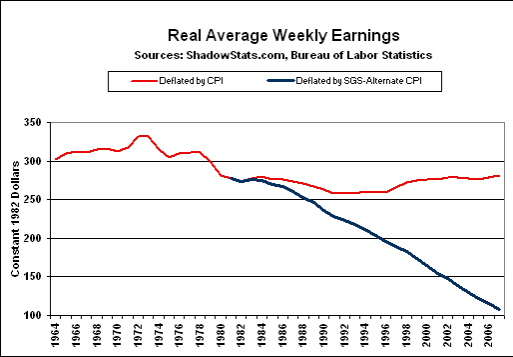

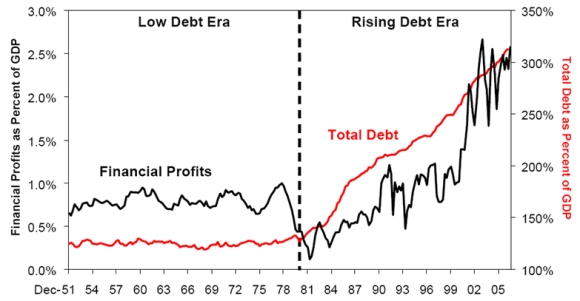

It is easier to understand when you realize who benefitted from this purposeful shift in societal norms. The low debt, high savings, production era from 1950 through 1980 benefitted the working middle class, allowing millions to improve their standard of living. The rising debt, low savings, consumption era, from 1980 through today, benefits the 1% Alphas while impoverishing the middle class and sentencing the lower class to a lifetime of dependent servitude to the state. Who benefitted from debt fueled conspicuous consumption and continues to benefit today? The peddlers of consumer debt on Wall Street and the mega-corporations that convinced Americans they couldn’t live without that 5,500 square foot McMansion, BMW X5, stainless steel appliances, 84 inch 3D HDTV, iPhone 5, diamond encrusted Coach handbag, and thousands of other Chinese made trinkets that pile up in underwater homes across the land, benefitted tremendously. The proliferation of debt resulted in obscene profits for the financial sector, record profits for the mega-corporations that shipped production to Asia in order to take advantage of the slave labor, and three decades of wage stagnation and increasing debt for the average working middle class American.

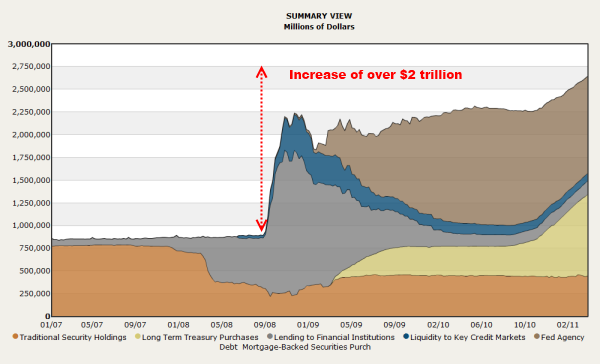

The financialization of America was a conscious decision by the oligarchs. They controlled the issuance of credit. They controlled the currency and level of inflation inflicted upon the masses. They controlled the corporations selling consumer goods on credit. They controlled the Congress, courts, and government agencies with their deep pocket lobbying and buying of influence. Lastly, they controlled the media messages and molded the opinions and tastes of the masses through their Bernaysian propaganda techniques perfected over the decades. In one of the boldest and most blatant acts of audacity in world history, the Wall Street/K Street oligarchs wrecked the world economy in their insatiable thirst for profits, shifted their worthless debt onto the backs of taxpayers and unborn generations, threw senior citizens and savers under the bus by stealing $400 billion per year of interest from them, and enriched themselves with bubble level profits and bonus payouts. Meanwhile, median household income continues to fall, real GDP is stagnant, true unemployment exceeds 22%, and 47 million people are living on food stamps.

The propaganda being flogged by the oligarchs since 2009 is the supposed deleveraging by the American consumer and trying to convince the ignorant masses to resume borrowing and spending. It’s working. Consumer credit outstanding is at an all-time high of $2.73 trillion as the Federal government has dished out billions in student loans to 50,000 University of Phoenix MBA aspirants sitting in their basements quivering with anticipation of on-line graduation and future six figure job with Goldman Sachs. The Feds have also added the impetus to the “strong” auto sales through their 85% TARP ownership of Ally Financial by doling out 7 year 0% auto loans to subprime borrowers in urban enclaves around the country. The oligarchs aren’t worried about these loans being paid back, because they are reaping the profits today. The future losses will just be foisted onto the taxpayer, as always. Total credit market debt of $55 trillion now exceeds 350% of GDP. The National Debt of $16.2 trillion will exceed $20 trillion in 2015 no matter who wins the Presidency in November. The oligarchs adapt and control whoever occupies the White House. It is essential for our owners to keep debt growing at an exponential rate or the Ponzi scheme collapses.

Narrow minded ideologues want a simple answer to a complex interaction of generational, cultural, economic, political, and criminal factors that have conspired to put the country into a predicament that, at this point, will inevitably lead to economic collapse. The truth is the American people have learned to love their servitude. They have willfully chosen ignorance over truth. They’ve chosen to believe what their keepers have instructed them. They’ve chosen to trust the storylines generated by the corporate media rather than think critically and question everything. They’ve chosen obesity and sickness over health. They’ve chosen debt financed faux wealth over savings based real wealth. They’ve chosen safety and security over liberty. They’ve chosen dependency over self-reliance. These choices were aided, abetted and promoted by the Alphas through their ability to manipulate and control the unthinking masses. Huxley understood the power of propaganda and brainwashing decades before it was perfected by our owners.

“There will be, in the next generation or so, a pharmacological method of making people love their servitude, and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies, so that people will in fact have their liberties taken away from them, but will rather enjoy it, because they will be distracted from any desire to rebel by propaganda or brainwashing, or brainwashing enhanced by pharmacological methods. And this seems to be the final revolution.” – Aldous Huxley

The saddest part of this episode of the Decline & Fall of the American Empire reality show is the continued delusion of the majority of the populace, as their desire for material goods and fair share of the entitlement pie outweighs their sense of obligation to their children and grandchildren. Their chosen ignorance is fulfilled through their attachment to their personal digital ignorance gadgets and supported by what passes for government education. The truth is obscured and hidden under waves of triviality, reality TV, and data manipulation by our government masters. The dystopian nightmare that engulfs our country has thus far resembled Huxley’s vision of a shallow populace easily distracted by consumerism, pleasure seeking, cultural trivialities, and a never ending ability to be distracted by meaningless minutia. Orwell’s darker vision of surveillance, captivity, information control, authoritarianism and pain will become the norm once the existing social order falls.

“What Orwell feared were those who would ban books. What Huxley feared was that there would be no reason to ban a book, for there would be no one who wanted to read one. Orwell feared those who would deprive us of information. Huxley feared those who would give us so much that we would be reduced to passivity and egotism. Orwell feared that the truth would be concealed from us. Huxley feared the truth would be drowned in a sea of irrelevance. Orwell feared we would become a captive culture. Huxley feared we would become a trivial culture, preoccupied with some equivalent of the feelies, the orgy porgy, and the centrifugal bumblepuppy. As Huxley remarked in Brave New World Revisited, the civil libertarians and rationalists who are ever on the alert to oppose tyranny “failed to take into account man’s almost infinite appetite for distractions.” In 1984, Orwell added, people are controlled by inflicting pain. In Brave New World, they are controlled by inflicting pleasure. In short, Orwell feared that what we fear will ruin us. Huxley feared that our desire will ruin us.” – Neil Postman – Amusing Ourselves to Death

I despair for my country that has chosen to eat, amuse and borrow itself to death. But my despair is deepest for my children and their future. The greed, corruption, myopia, selfishness, and disregard for the well-being of future generations by current and past generations has left a barren and bleak landscape for my children. The Huxley vision of America consuming and amusing itself to death is coming to a painful conclusion, as the limits of a fiat currency and debt based lifestyle become evident. Those in power are preparing the masses for a more Orwellian vision of America when they are forced to pull the plug on the existing paradigm. The Patriot Act, NDAA, military exercises in our cities, militarization of local police forces, warrantless surveillance of our communications, searches and seizures in our airports and train stations, purchase of millions of rounds of ammo by government agencies, implementation of drone technology, camera surveillance, attempts to control the internet, manipulation of economic data, and executive orders allowing the President to take over all commerce while imprisoning citizens indefinitely without charges, are the next step in our descent into a dictatorship of tears.

The question is whether we will stand idly by, fiddling with our gadgets, tweeting about Honey Boo Boo, or will we regain our sense of duty to the future generations of this country. The manipulators are powerful, rich, connected and FEW. Those being manipulated, controlled, and abused are MANY. There will be a revolution in this country whether you like it or not. The existing social order will dissolve during the next fifteen years. What replaces it is up to us. George Carlin described what our owners want.

“Politicians are put there to give you that idea that you have freedom of choice. You don’t. You have no choice. You have owners. They own you. They own everything. They own all the important land, they own and control the corporations, and they’ve long since bought and paid for the Senate, the Congress, the State Houses, and the City Halls. They’ve got the judges in their back pockets. And they own all the big media companies so they control just about all the news and information you get to hear.

They’ve got you by the balls.

They spend billions of dollars every year lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else. But I’ll tell you what they don’t want—they don’t want a population of citizens capable of critical thinking. They don’t want well informed, well educated people capable of critical thinking. They’re not interested in that. That doesn’t help them. That’s against their interest.”

What do “We the People” want?