John Hussman relentlessly tells the truth, week after week. He details why we are in the current situation. He also proves that Ben Bernanke and the Federal Reserve have broken the law. Criminals need to be incarcerated, whether they have robbed a liquor store at gunpoint in West Philly or whether they have robbed the American citizens with a computer in Washington DC. By the time this Fourth Turning is finished I hope to see Bernanke in cuffs or better yet being led to the gallows.

Hussman is supportive of the Occupy Wall Street movement and provides them with real talking points and real solutions. There is no one more sober and analytical than John Hussman. He’s not a socialist hippie, as the MSM likes to portray the protestors. He knows that Wall Street has screwed the American middle class. He has proved that Wall Street has screwed the middle class. His solutions are reasonable and implementable. They are just unacceptable to the super rich ruling elite and their puppets in Washington DC.

The result will be class war.

Talking Points for the “Occupy Wall Street” Protesters

John P. Hussman, Ph.D.

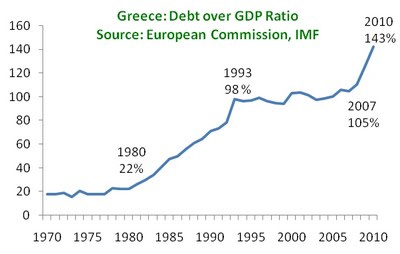

Just a note – by the end of last week, Greek 1-year yields had surged to 144%. European leaders have shifted from promising to prevent a Greek default to promising instead to ensure that European banks are well capitalized. Here, I would repeat that it is essential for policy makers to make a distinction between liquidity and solvency. Banks that are solvent, and countries that are solvent, should be within the ring-fence, in the sense that it is sensible for policy makers to follow Bagehot’s Rule – freely provide liquidity, but only at high rates of interest, and only to the solvent and well-collateralized. Those institutions and countries that are not solvent should not be “saved” by using public funds to make private bondholders whole. The proper policy is to restructure, not bail out, the debt of banks and countries that have no reasonable prospect of paying off those obligations.

It remains in the best interest of Greece to default, and to leave the euro so it can depreciate its currency, but if it is going to default, it would be well-advised to default big. The only way to get new international capital after a default is for Greece to clear out enough of its legacy obligations that investors reasonably expect it to make good on any new funding they might (eventually) provide.

Talking Points for the “Occupy Wall Street” Protesters

We’re all for a good peaceful protest. As long-time readers know, I’ve been an adamant critic of the bailouts of mismanaged financial institutions, as well as various illegal policy actions that have been pursued by the Fed since the financial crisis began in 2008. Undoubtedly, there is good and bad on Wall Street, and we know a lot of smart, well-meaning financial advisors who go to work every day with the goal of improving the financial security of their clients, who do careful research, avoid speculation, and provide a service to others through their profession. A functioning economy needs to allocate capital effectively, and there Wall Street can be essential.

Unfortunately, over the past 15 years or so, the basic function of the financial markets has been corrupted into what I’ve grown to view as a self-serving carnival of speculation, where many participants are interested in nothing except getting the next rally going at public expense, regardless of how badly market signals are distorted, how recklessly capital is misallocated, or even whether what they do has any positive effect on the economy or the country (some of the sleazier ones even have their own shows on basic cable).

There is no single source of this transformation. Part of it is a remnant of the dot-com and technology bubbles, when market valuations moved to nearly triple the historical norm, and investors began to view perpetual market advances and high returns as a birthright. The subsequent decade of zero overall returns for the stock market largely reflects a reversion to more normal (but still cyclically elevated) valuations.

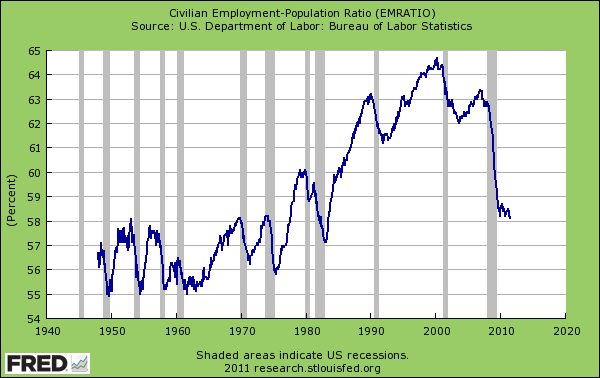

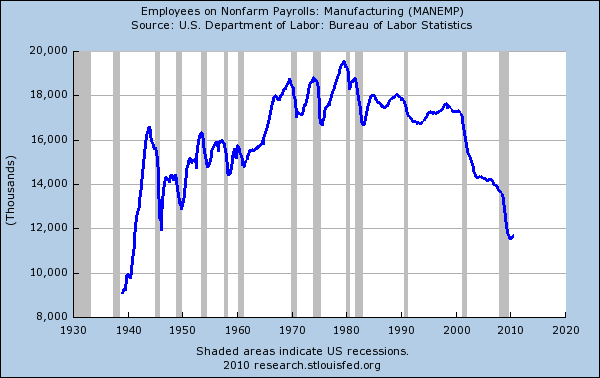

Another part of this transformation is due to the activist policies of Federal Reserve, which has continually attempted to short-circuit every instance of short-term economic discomfort by distorting the menu of investment returns (e.g. zero interest rate policies) in an effort to provoke investors to accept fresh speculative risk. Ironically, the long-term effect of distorting market signals has been to drive good, potentially productive capital into wholly unproductive uses – the housing bubble being a prime example. As a result, real U.S. gross domestic investment has not grown at all since 1998, and the portion financed by domestic U.S. savings has collapsed, so much of the new capital we’ve accumulated is owned by foreigners.

Undoubtedly, one of the greatest rhetorical victories of Wall Street has been to successfully plant in the minds of the public the idea that some financial institutions are simply “too big to fail,” and that the “failure” of “systemically important” institutions will result in global financial meltdown and Depression. The reality is much different.

So, with the hope of providing the Occupy Wall Street protesters with some talking points, what follows are some perspectives that might be useful in framing the issues that we are facing as an economy.

1) “Failure” only means that corporate bondholders don’t get every penny

Background: When Wall Street talks about the “failure” of a bank or other financial institution it means the failure of the company to pay off its own bondholders. It does not mean that depositors, counterparties or other bank customers lose money (See Recession, Recovery, and the Ring-Fence ). A bank is essentially a big portfolio of assets, about 70% which are typically financed by depositors, customers and other liabilities, about 20% by the bank’s own bondholders, and about 10% with the capital of the bank’s stockholders. In a typical bank “failure,” the bank is taken into receivership by regulators, the liabilities to stockholders and bondholders are cut away, the remaining package of assets and liabilities is sold as a single entity to some other firm (or can be reissued to investors as a new company), the old bondholders get the proceeds of that sale, and the stockholders are wiped out. When investors willingly take a risk, and buy the stocks and bonds issued by an institution that goes on to mismanage its business, this is the appropriate outcome. Depositors and customers typically don’t lose a penny (See the section on “How to Restructure A Major Bank” in Not Over By A Longshot ).

If public funds are provided during a financial crisis, and it cannot be clearly demonstrated that the institution is solvent, the funds should be provided post-failure, as senior loans to a restructured institution where shareholders and existing bondholders have already been subject to losses. The interest rate should be relatively high, to encourage replacement of public funds with private ones. With few exceptions, when public funds are used to avoid major restructuring and shield private investors from losses, the result is almost inevitably a larger, less transparent, and more recklessly managed institution.

The same is true for government or “sovereign” debt. When Wall Street talks about “failure” of Greece, for example, it means failure of Greece to pay off its own bondholders. In trying to avoid this failure, Greece is instead forced to impose extreme austerity and depression on its citizens. From the standpoint of those citizens, Greece has already failed them painfully. Those are the choices – let bad debt “fail” or force depression on innocent citizens.

Of course, there is a cost to any financial crisis, which is “contagion” where the failure of one institution or government calls others into question. The main way to contain this is to follow the century-old “Bagehot’s Rule” – lend freely, at high rates of interest, but only to institutions that are solvent and able to provide collateral for the loans. When policy makers behave as if every institution, solvent or not, is within the ring-fence, or that some institutions are simply “too big to fail,” saving these institutions comes at enormous costs, because true economic losses that should properly be taken by private investors are instead forced upon the public.

Keep in mind that money is fungible – not all losses are taken directly by the institution that created them. Many of the losses that should have been borne by banks were instead assumed by Fannie Mae and Freddie Mac. This allowed TARP to seem largely successful even while hundreds of billions of public funds are still being spent to bail out Fannie and Freddie. Recent efforts by government overseers of Fannie Mae to claw back these losses from the banking system are appropriate, but they also demonstrate how easy it is for private institutions to transfer their mistakes onto the public balance sheet.

2) The Federal Reserve’s purchases of Fannie Mae’s and Freddie Mac’s debt obligations were illegal

Background: Beginning in 2009, the Federal Reserve began buying nearly $1.5 trillion in obligations of Fannie Mae and Freddie Mac, both which were insolvent and in government receivership. The Fed justified these purchases by appealing to Section 14.2 of the Federal Reserve Act, which allows the Fed to purchase securities which are a “direct obligation of, or fully guaranteed as to principal and interest by, any agency of the United States.” Now, Ginnie Mae, the financing arm of the Federal Housing Administration (FHA) is a bona-fide government agency. So there would have been no legal problem if the Fed had purchased Ginnie Maes. In contrast, however, Fannie Mae and Freddie Mac were not, and are not, U.S. government agencies. Nor are the obligations held by the Fed “fully guaranteed as to principal and interest” by the U.S. government. At best, the obligations of these GSEs have implicit and informal backing, as any member of Congres will tell you, and simply taking a failing institution into conservatorship doesn’t confer government backing to its debt. In fact, the stop-gap measure enacted by Congress during the crisis only provides temporary backing for the obligations of Fannie and Freddie maturing by the end of 2012. Very simply, the Fed broke the law by buying Fannie and Freddie’s debt.

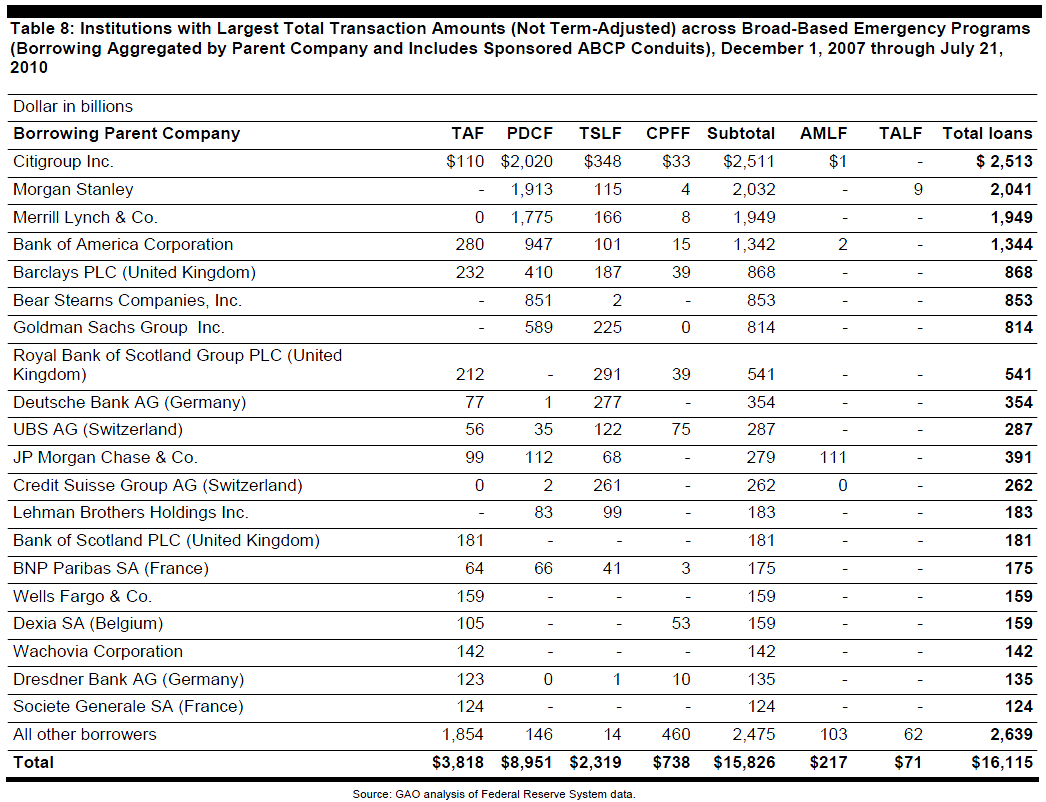

3) Creating shell companies to buy Wall Street’s bad assets is not “discounting,” and was therefore also illegal

Background: In 2008, the Federal Reserve created a set of off-balance sheet shell companies called “Maiden Lane” to buy undesirable long-term assets of Bear Stearns and other financial companies, justifying the purchases by appealing to Section 13.3 of the Federal Reserve Act. But if you actually read Section 13, it is clear that under the law, “discounting” means (as it has always meant) providing short-term liquidity by essentially providing a check-cashing service for obligations that are short-dated, well-collateralized, and promptly collectible (See also Outside the Oval / The Case Against the Fed ). The Fed’s creation of the Maiden Lane companies to purchase bad assets was, and remains, illegal under the language and intent of the Federal Reserve Act.

Keep in mind that we have only three branches of government: the executive, the legislative, and the judicial. The Federal Reserve is not an independent fourth branch of government, but operates under the legislation of Congress and therefore cannot be “independent” of Congressional control. While nobody wants monetary policy to be “politicized” in the sense of Congress telling the Fed what policy actions should be taken and before which election, it is quite a different matter to require the Fed to operate within the law. Here, Congress could use some encouragement.

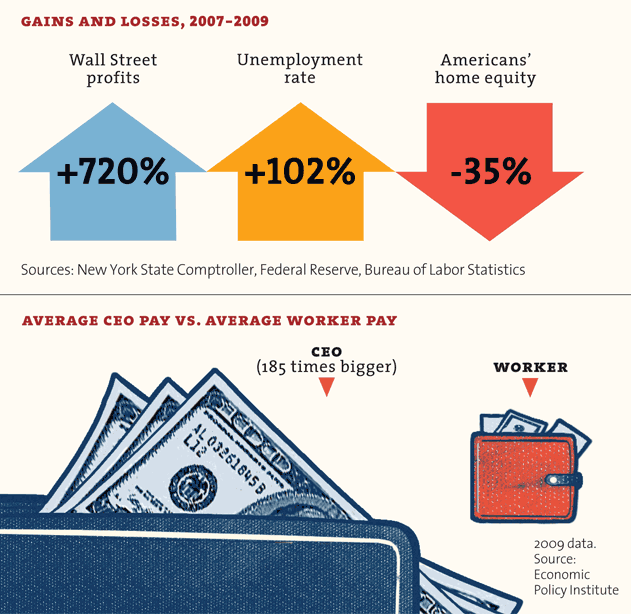

4) The skewed distribution of wealth in the U.S. is worsened by policies that misallocate capital and divert public funds to bail out investments that have already gone bad.

Background: If you think about the “standard of living” in a country, you can roughly define it as the amount of goods and services that individuals are able to consume in return for their work. If you think about the “productivity” of a country, you can roughly define it as the amount of goods and services that individuals are able to produce for their work. Clearly, over the long-term, the productivity and the standard-of-living of a country go hand in hand. The best way to create both, over the long-term, is for an economy to build a stock of productive capital (inventions, new technologies, plants, equipment, public infrastructure, etc), and human capital (labor skills, education).

Still, even a generally productive economy can produce a skewed distribution in the standard of living enjoyed by its citizens. In a competitive and undistorted economy, the distribution of wealth is determined by the ability of each individual to a) provide a useful service, b) distribute the services they provide over a large number of “units”, and c) maintain the scarcity of what they provide.

So for example, professional football players earn more than teachers not because playing football has more virtue, but because professional football players are among a very small group, and distribute their “services” over millions and millions of spectators, each which implicitly pays a few cents to each player per game. Mark Zuckerberg at Facebook is able to distribute his services across hundreds of millions of users, each which implicitly pays him a tiny amount by viewing advertising. Bill Gates distributed his services over every computer that ran Windows, while the factory workers who built those computers were each able to distribute their skills over a smaller number of units. Teachers represent a large professional group, but are typically able to distribute their services over a limited number of students, each which implicitly pays a portion of their family’s income to the teacher. One-on-one aides tend to earn less, despite often being extremely skilled, because in order for them to earn a high income, their earnings would have to capture much of the income of their single student’s family.

The distribution of wealth has become increasingly skewed as trade has become more globalized and technology has allowed the innovations of a single person to be spread across millions of consuming “units.” At the same time, the economic emergence of China and India has brought forth literally billions of new workers who dilute the scarcity of the existing labor force. An economy where capital is scarce, protectable, and can easily be distributed over numerous units, while labor is plentiful, homogeneous and can only be applied to a smaller number of units, is an economy that is prone to an enormously skewed distrbution of wealth.

This process takes on a grotesque character when it becomes possible for a company to distribute its impact over a very large number of units, and government policy protects that ability even when the impact of the company reflects not skill but ineptitude. This is essentially what has happened with the “too big to fail” institutions. Despite inflicting massive damage on the economy, they are afforded a protected status that allows them to extract “rents” that don’t reflect the cost they have imposed. From that standpoint, the Occupy Wall Street protests are a welcome reflection of public frustration over Washington’s slavish coddling of reckless financial institutions.

Policy Responses

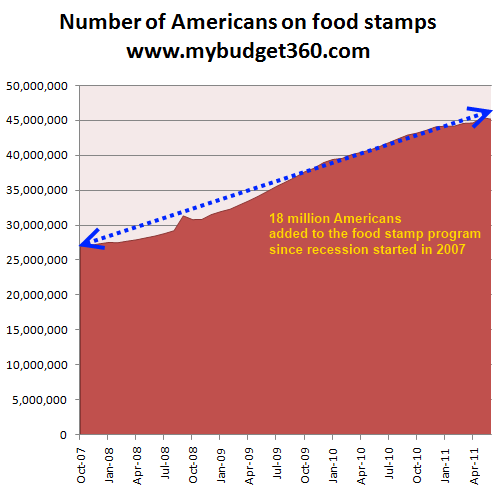

The proper way to address the present economic imbalances is pursue policies that encourage the restructuring of bad debt, the allocation of public funds and private savings to productive investment and new research, the accumulation of education and labor skills (“human capital”) to allow workers to capture a greater share of their own productivity, and the continuation of social safety nets to ease the economic adjustments that are necessary in a deleveraging economy. In my view (which not everyone will like), this requires:

Monetary policies that abandon the constant pursuit of new financial bubbles, which distort investment opportunities and misallocate capital;

Housing policies to coordinate the restructuring of mortgage debt for homeowners capable of servicing a restructured mortgage (we’ve advocated breaking the mortgage into a lower principal loan plus a right of the lender to a portion of future appreciation), and unfortunately, foreclosure for homeowners unable to service even a restructured mortgage, with associated losses being taken by lenders;

A return to a reasonably smoothed form of mark-to-market accounting (say, 3-year averaging) so that financial institutions cannot let a bad loan book deteriorate while still reporting those loans at amortized cost.

A requirement that banks hold a significant amount of their capital in the form of mandatorily convertible debt, so if the assets deteriorate, the debt converts to equity immediately and provides a capital cushion against losses without risking default to senior bondholders. Yes, this will result in a slightly higher cost of capital to the banks, but it is a reasonable alternative to more intrusive forms of regulation.

A major increase in government-sponsored research in basic sciences (as opposed to huge pick-the-winner bureaucratically-awarded grants to companies like Solyndra). Recall that research and innovations coordinated through government initiatives such as the Advanced Research Projects Agency (which largely originated the internet), the National Science Foundation, and the National Institutes of Health have been the basis for much of the industry that has built upon that foundation;

Continuous investment in public infrastructure – although the long lead times simply to obtain permits for major projects largely rules out much near-term stimulative effect from the Administration’s proposed Jobs Bill even if it were enacted immediately;

Efforts among workers to increase their own protectable level of scarcity, ideally through increased education and labor skills, but if necessary through collective bargaining in industries that are reliant on locally-sourced employees (understanding, however, that this alternative also has the effect of reducing employment);

Incentives for capital investment and R&D such as tax credits and immediate expensing of new investment;

Tax policies that reduce distortions by applying a sufficient but relatively constant tax rate to every dollar of income regardless of the source (wages, profits, financial gains), with large exclusions at initial income levels – essentially taxing all dollars and all people according to the same rules, broadening the tax base by including all forms of income and avoiding the need for class warfare;

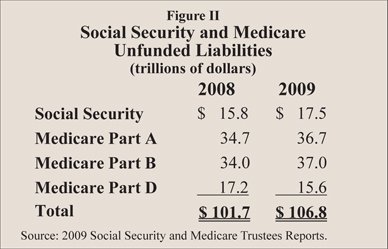

Broadening the tax base but substantially reducing the tax rate on Social Security and Medicaid (which are a larger tax burden than the income tax for 75% of American families) and applying that lower rate to all forms of income – not just wage income. This would stop the regressive treatment of payroll workers, which exists only to perpetuate what economist Alvin Rabushka has called “the fiction that Social Security is a retirement insurance program in which contributions are linked to benefits, rather than what it is — a transfer of income from workers and the self-employed to retired people.”

Again, long-term improvements in living standards require improvements in productivity, through the accumulation of capital, inventions, education and labor skills. The reason that wages are lower in developing countries is primarily because Americans are blessed to have an economy that has a legacy of accumulating productive investment and educating its workers. If we allow those advantages to slide, by misallocating investments, and diverting public funds from research, development, education and infrastructure in order to bail out reckless speculations gone bad, there is no inherent reason why other countries cannot rise to economic dominance. It’s our choice. We have far too great a need for productive investment than to use our scarce resources to bail out poor stewards of capital who gambled the nation’s savings and look to the government to make them whole.

Market Climate

As of last week, the Market Climate in stocks remained negative, with our economic measures still solidly anticipating an oncoming recession. Strategic Growth and Strategic International remain tightly hedged. Strategic Total Return continues to hold about 18% of assets in precious metals shares, accounting for the majority of day-to-day fluctuations in the Fund, with an average duration of about 1.5 years in Treasury securities, and less than 5% of assets in utility shares and foreign currencies.

As a final note, the chart below updates one of our composite measures of U.S. economic activity, reflecting a broad set of ISM and regional Fed surveys. While the slight uptick in a few of these survey measures has been the basis of a strikingly premature “all clear” attitude taken on by Wall Street analysts, the fluctuation has been entirely negligible, and represents a tiny fraction of typical random month-to-month noise. It is equally important to recognize that the ISM indices tend to lag our Recession Warning Composite and our broader ensemble models (and also lag ECRI’s measures) by nearly 13 weeks, while payroll employment demonstrates a slightly greater lag. Given that the earliest signal – the Recession Warning Composite – deteriorated at the beginning of August, the October ISM, and even more likely the November reading, is really the window of concern. Suffice it to say that the recent evidence is generally more confirming than contradictory of recession concerns.

Why are such people called “poor”? Because they meet the arbitrary criteria established by Washington bureaucrats. Depending on what criteria are used, you can have as much official poverty as you want, regardless of whether it bears any relationship to reality.

Why are such people called “poor”? Because they meet the arbitrary criteria established by Washington bureaucrats. Depending on what criteria are used, you can have as much official poverty as you want, regardless of whether it bears any relationship to reality.