Finch: Why are you doing this?

Evey Hammond: Because he was right.

Finch: About what?

Evey Hammond: That the world needs more than just a building right now. It needs hope.

The dialogue above occurred at the end of the dystopian movie V for Vendetta. It is a tale of revenge and restoring hope among citizens who had chosen safety and security over freedom and liberty. Even though this movie was fictional and adapted from a comic strip, its message and warnings should be heeded. Millions of middle class citizens in the U.S. sink deeper into despair every day. Day by day hope is being lost that the future for our children will be better than our past. The political, financial, and corporate leaders of our country are intellectually and morally bankrupt. The major Wall Street banks are bankrupt. Social Security is bankrupt. Medicare is bankrupt. The whole damned world is bankrupt. Anyone with an unbiased view of our planet would conclude that we are in unfathomable danger. The list of impending catastrophic issues that will blow up the world for millions in the U.S. and across the globe is virtually endless:

U.S. Debt

- The national debt is currently $14.6 trillion, up from $5.7 trillion in 2000. It took over 200 years to accumulate the first $5.7 trillion of debt and only 11 years to tack on another $8.9 trillion.

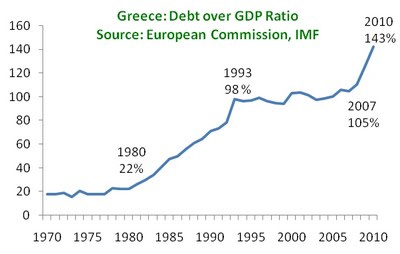

- With the new $450 billion jobs package proposed by President Obama, the deficit in FY12 will likely exceed $1.8 trillion, or 12% of GDP. Greece’s 2010 deficit was 10.5% of GDP.

- Kenneth Rogoff and Carmen Reinhart in their book This Time is Different: Eight Centuries of Financial Folly, using data from 44 countries over 200 years, concluded that once a country’s national debt exceeds 90% of GDP, the economy stagnates and ultimately makes that country vulnerable to a debt crisis. The U.S. national debt as a percentage of GDP is currently 97% and will reach 107% in 2012. This does not count state and local debt, Fannie Mae and Freddie Mac debt, and the unfunded liabilities for Social Security and Medicare. We are at the same place Greece was in 2007. But we’re no Greece, right? This time is different.

- Total credit market debt of $52.5 trillion is 3.5 times GDP, versus a long-term leverage ratio of 1.6. This is called living well above your means on borrowed money. We have a long way down before we reach the bottom of this mountain of debt.

- Despite the rhetoric out of Washington D.C. by the thieves and knaves about cutting deficits, the National Debt is on course to increase by $9 trillion in the next 10 years. It will reach $20 trillion by 2015.

Entitlements

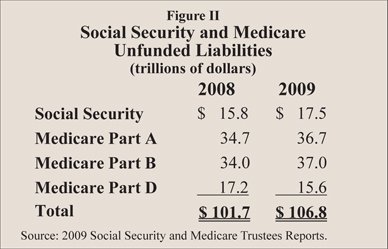

- The commitments made by politicians over decades in order to get elected have resulted in unfunded liabilities for Social Security and Medicare exceeding $100 trillion.

- In 1980, just 11.7% of all personal income came from government transfer payments. Today, 18.0% of all personal income comes from government transfer payments. Wages and salaries paid by private industries totals $5.5 trillion per year, while wages paid by government total $1.2 trillion and social welfare payments from the government total $2.3 trillion. Only ten years ago wages and salaries from private industries totaled $4.1 trillion, while government wages were only $800 billion and welfare payments totaled $1.1 trillion. In ten years the percentage increases paint the true picture:

- Private wages & salaries increased 34%

- Government wages & salaries increased 50%

- Government social welfare transfer payments increased 109%

- Despite the rhetoric from politicians, there is no lock box and there is no cash in the Social Security fund. John Mauldin summed it up nicely: “Social Security funds are an entry into a government accounting book that don’t really exist except as an IOU. Politicians of all stripes have used the Social Security money to pay for other government expenses. Those funds were even counted to offset the deficit, although now that Social Security is no longer in a surplus that has gone away.”

- This year, about 3.3 million people are expected to apply for federal Social Security Disability benefits. That’s 700,000 more than in 2008 and 1 million more than a decade ago. Today, about 13.6 million people receive disability benefits through Social Security or Supplemental Security Income. Last year, Social Security detected $1.4 billion in overpayments to disability beneficiaries, mostly to people who got jobs and no longer qualified, according to a recent report by the Government Accountability Office, the investigative arm of Congress.

Employment

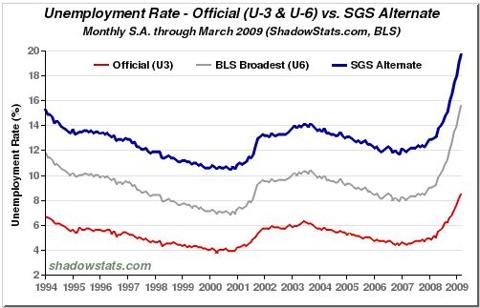

- The official unemployment rate in the U.S. is 9.1% with 14 million people unemployed. The true unemployment rate, taking into account discouraged workers, part time workers who want a full time job, and people who have dropped out of the work force, is above 20%, or 31 million people.

- It now takes the average unemployed worker in America about 40 weeks to find a new job.

- Even after a supposed recovery, there are approximately 7 million less people employed today than there were in 2007.

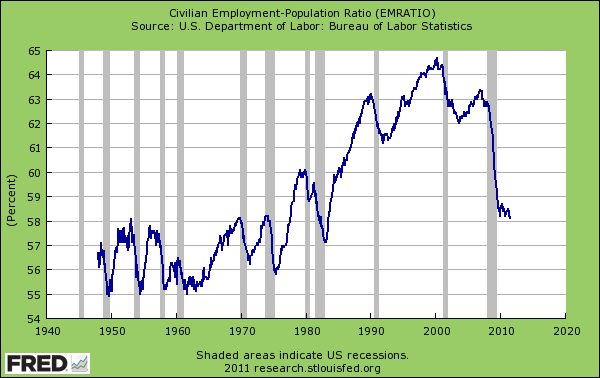

- The employment to population ratio of 58.2% is at the same level as 1969, before women entered the workforce in record numbers. As wages stagnated and inflation drove costs higher, families were forced to send two parents into the workforce, with predictable consequences to their latchkey children. The ratio peaked in 2001 at 64.4% and has declined precipitously since 2008.

Poverty

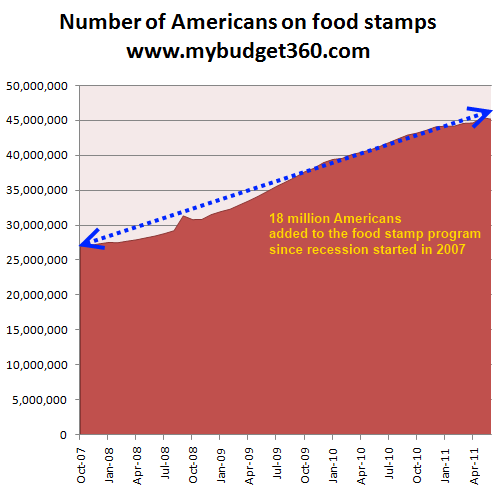

- The number of people on food stamps has gone from 27 million people receiving $30 billion of aid in 2007 to 45 million people (14.5% of U.S. population) receiving $72 billion in aid today.

- The number of uninsured Americans totals 49.9 million.

- Those covered by employer-based insurance continued to decline in 2010, to about 55%, while those with government-provided coverage continued to increase, up slightly to 31%. Employer-based coverage was down from 65% in 2000.

- One out of every six elderly Americans now lives below the federal poverty line.

- Another 2.6 million people slipped into poverty in the United States last year and the number of Americans living below the official poverty line, 46.2 million people, was the highest number in the 52 years the Census Bureau has been publishing figures on it.

- The percentage of Americans living below the poverty line last year, 15.1%, was the highest level since 1993. (The poverty line in 2010 for a family of four was $22,314)

- Blacks experienced the highest poverty rate, at 27%, up from 25% in 2009, and Hispanics rose to 26% from 25%. For whites, 9.9% lived in poverty, up from 9.4% in 2009. Asians were unchanged at 12.1%.

Income

- Median household income fell 2.3% to $49,445 last year and has dropped 7% from the peak of $53,252 reached in 1999.

- Median household income for the bottom tenth of the income spectrum fell by 12% from a peak in 1999, while the top 90th percentile dropped by just 1.5%.

- Between 1969 and 2009, the median wages earned by American men between the ages of 30 and 50 dropped by 27% after you account for inflation.

- Median income fell across all working-age categories, but the sharpest drop was among young working Americans, ages 15 to 24, which experienced a decline of 9%.

- When you adjust wages for inflation, middle class workers in the United States make less money today than they did back in 1971.

Wealth Inequality

- The wealthiest 1% of all Americans now controls 43% of all the financial wealth in this country.

- According to the Federal Reserve, the richest 1% of all Americans has a greater net worth than the bottom 90% combined.

- The fact is that many people in the bottom half of the top 1% wealthiest Americans usually achieved their success after decades of education, hard work, saving and investing as a professional or small business person. A recent article by William Domhoff quotes an investment manager who works with very wealthy clients regarding the top 0.1%:

Unlike those in the lower half of the top 1%, those in the top half and, particularly, top 0.1%, can often borrow for almost nothing, keep profits and production overseas, hold personal assets in tax havens, ride out down markets and economies, and influence legislation in the U.S. They have access to the very best in accounting firms, tax and other attorneys, numerous consultants, private wealth managers, a network of other wealthy and powerful friends, lucrative business opportunities, and many other benefits. Membership in this elite group is likely to come from being involved in some aspect of the financial services or banking industry, real estate development involved with those industries, or government contracting.

- Until 1980, the U.S. economic system was reasonably balanced, with manufacturing still the driving force in creating wealth for the middle class. In the three decades since, our political, banking and corporate elite have gutted our industrial base, shipped millions of jobs overseas and have used financial schemes and scams to suck the vast majority of middle class wealth into their grubby little hands. Wall Street has slowly and methodically pillaged the nation’s wealth, hollowing out a once vibrant nation, and their insatiable greed driven appetite drives them to want more.

Consumer Debt

- Total consumer debt in the United States at $2.45 trillion is now more than 8 times larger than it was just 30 years ago. The recent leveling off is completely due to hundreds of billions in write-offs by the Wall Street banks. The chart below is a Keynesian dream of government borrowing to create prosperity. The fallacy of Keynesianism is evident for all to see.

- According to the Federal Reserve, between 2007 and 2009 household net worth in the United States fell by 25%, or $16.4 trillion.

- The Federal Reserve says that median household debt in the United States has risen to $75,600.

- Of U.S. households that have credit card debt, the average amount owed on credit cards is $15,800.

- The top 10 credit card issuing banks control 80% of the credit card market, with Bank of America, Citicorp, JP Morgan Chase and Wells Fargo accounting for almost 60% of the market.

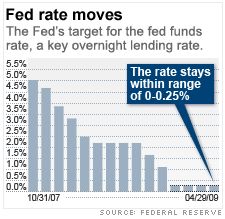

- The average APR on credit card with a balance on it is 13.1%. These same banks are borrowing at 0% from the Federal Reserve.

- Penalty fees from credit cards added up to over $21 billion in 2010.

- There are 610 million credit cards held by U.S. consumers, with 3.5 credit cards per cardholder.

- Americans now owe more than $887 billion on student loans, which is even more than they owe on credit cards.

Real Estate

- U.S. home values have fallen an astounding $6.6 trillion since the peak of the real estate market.

- National home prices have fallen 31% from their peak in 2005.

- Approximately 11 million households, or 23% of all households with a mortgage, are underwater on their mortgage.

- Household percent of equity is at 38.6% today, down from 60% in 2006. There are 87 million households in the U.S. Approximately 25 million of these houses have no mortgage, so the 52 million have significantly less than 38.6% equity.

- Americans were so sure their houses would appreciate to infinity during boom years of 2005 through 2008 they withdrew over $3 trillion of equity from their homes and spent it like drunken sailors. The hangover will last for decades.

Savings & Retirement

- The S&P 500 Index reached 1,100 on March 24, 1998. The S&P 500 Index on October 4, 2011 is 1,100. Wall Street convinced millions of dupes that they needed to buy stocks for the long run. Thirteen years later, the average investor has nothing, while the shysters on Wall Street have reaped hundreds of billions in fees.

- The stock market is priced to return 5% over the next decade, while bonds are priced to deliver no more than 2%.

- 1 out of 3 Americans has no savings at all.

- Workers estimate their retirement savings needs at $600,000 (median), but in comparison, less than one-third (30%) have currently saved more than $100,000 in all household retirement accounts.

- The average 401k balance at the end of 2010 was $71,500. Aon Hewitt estimates that it will take retirement savings of 15 times your final salary to maintain your current lifestyle. Someone making $50,000 per year would need $750,000.

- 50% of all the households in the U.S. (57 million households) have a total net worth less than $70,000.

- Robert Novy-Marx of the University of Chicago and Joshua D. Rauh of Northwestern’s Kellogg School of Management recently calculated the combined pension liability for all 50 U.S. states. What they found was that the 50 states are collectively facing $5.17 trillion in pension obligations, but they only have $1.94 trillion set aside in state pension funds.

- Every single day more than 10,000 Baby Boomers will reach the age of 65. That is going to keep happening every single day for the next 19 years.

- Approximately 3 out of 4 Americans start claiming Social Security benefits the moment they are eligible at age 62. Most are doing this out of necessity.

- 35% of Americans already over the age of 65 rely almost entirely on Social Security payments alone.

Foreign Trade

- The U.S. trade deficit is now running at approximately $600 billion per year. It is clear that with the shift from a manufacturing based saving society in the 1960s and 1970s to a Wall Street finance based, debt driven consumption society from 1980 onward has led to massive trade deficits.

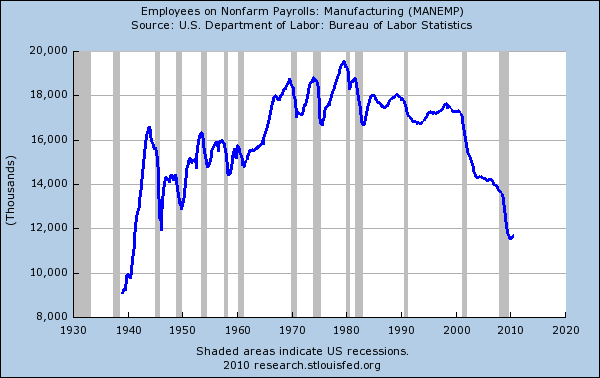

- The gutting of the American middle class can again be traced back to 1980 when manufacturing employment peaked at 19.5 million. Once corporate CEOs embraced “globalization” in the late 1990s and realized they could reap obscene profits and compensation packages by utilizing slave labor in China to do American manufacturing jobs at 10% of the cost, the jobs disappeared. There are less than 12 million manufacturing jobs in the U.S. today, replaced by jobs at Wal-Mart and McDonalds.

- The U.S. imports 9.5 million barrels per day of oil, more than 50% of our daily consumption. At an average price of $90 for 2011, we are sending $300 billion per year to countries that hate us and despise our way of life.

Energy

- The U.S consumes 22% of the world’s oil output despite having only 4.5% of the world’s population.

- The U.S. has less than 3% of the world’s proven oil reserves.

- The Department of Energy was created in 1977 with the mission to reduce our dependence on foreign oil. The country has not built a new oil refinery or nuclear power plant since 1980.

- In 1980 the U.S. imported 37% of our oil consumption. We now import 51% of our oil consumption.

- In 1980 the price of a gallon was $0.58 per gallon ($1.90 adjusted for inflation). Today, the price of a gallon of gasoline is $3.40.

- The DOE employs 16,000 workers & 100,000 contract workers, and operates on a mere $27 billion per year. Ironically, the DOE spends $300 million per year for energy in its 9,000 buildings around the country.

- Despite being created to create a comprehensive energy policy, the DOE has no plan or strategy to address peak cheap oil. The impact on U.S. society from declining world oil supply will be devastating to the U.S. economy within the next five years.

Foreign Interventionism

- America’s two wars of choice in the Middle East have cost $1.3 trillion in direct costs, thus far. The long-term costs will total over $3 trillion.

- The United States annual military spending is 8 times as large as China and Russia. We spend 73 times as much as the supposed dire threat of Iran. The U.S. accounts for over 44% of worldwide military spending.

- In the year 2000, the U.S. spent $359 billion on Defense, including veterans and foreign aid ($17 billion). The 2011 expenditure is $965 billion, with $45 billion in foreign aid. Do the politicians in Washington D.C. recognize the irony of borrowing $45 billion from foreigners and then giving the $45 billion to other foreigners?

- The U.S. operates 11 large carriers, all nuclear powered. In terms of size and striking power, no other country has even one comparable ship. The displacement of the U.S. battle fleet – a proxy for overall fleet capabilities – exceeds, by one recent estimate, at least the next 13 navies combined, of which 11 are our allies or partners.

- The U.S. military empire is vast. Officially, more than 190,000 troops and 115,000 civilian employees are massed in approximately 900 military facilities in 46 countries and territories (the unofficial figure is far greater). The US military owns or rents 795,000 acres of land, with 26,000 buildings and structures, valued at $146 billion.

- With the collapse of the Soviet Union in the early 1990s, the military industrial complex needed to create a new enemy in order to keep the billions in profits flowing to the arms manufacturers. The War on Terror has been a windfall for the military industrial complex. The American people did not heed President Eisenhower’s warning.

Monetary Policy

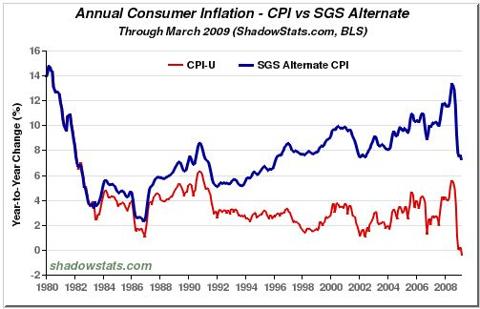

- The Federal Reserve was created in 1913 with the purpose of stabilizing the country’s financial system, eliminating financial panics, keeping prices steady, and insuring maximum employment. The result has been more instability, depressions, recessions, market crashes, unemployment as high as 25%, and inflation that has reduced the purchasing power of the U.S. dollar by 96% since 1913.

- The Consumer Price Index was 10.0 in December 1913 when the Federal Reserve was created. Today, the index stands at 227. Prices have risen 2,270% in the almost 100 years since the Federal Reserve’s inception, or inversely the dollar can buy what it took $.04 to buy in 1913. Somehow, the banking syndicate that has “achieved” this result has convinced the public that inflation is good for them.

- When Richard Nixon closed the gold window in 1971, the last check and balance on politicians and bankers was scrapped. The result has been predictable. The National Debt swelled from $400 billion in 1971 to $14.6 trillion today, a 3,650% increase in 40 years. The GDP grew from $1.13 trillion to $15.0 trillion today, a 1,332% increase in 40 years. Politicians have bought the votes of their constituents by making promises and financial commitments that have made debt slaves out of future unborn generations. Without a restraint on money printing, politicians will always choose to not worry about tomorrow.

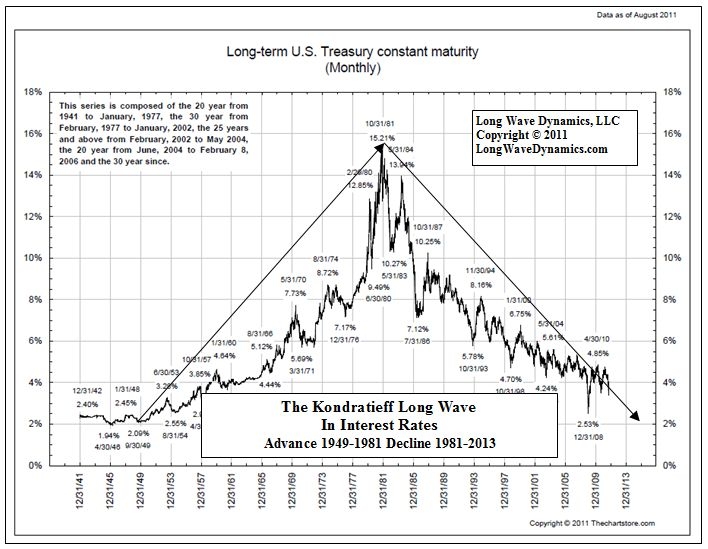

- The Federal Reserve policies of Alan Greenspan and Ben Bernanke were the single biggest cause of the 2008 financial catastrophe and their current policies have set the country up for the final cataclysmic disintegration of our economic system. By bailing out Wall Street every time they made a high risk bet and lost (1987 Crash, Latin America, S&L Crisis, Asian Crisis, LTCM, Dot Com, 9/11, Housing collapse, Lehman) the Federal Reserve has proven to be a tool for the super rich power elite. By keeping interest rates below where they would be in a free market, the Federal Reserve created the climate for gambling on Wall Street, the home price 3 standard deviation bubble, and the current screwing of senior citizens and savers to boost the profits of Wall Street bankers.

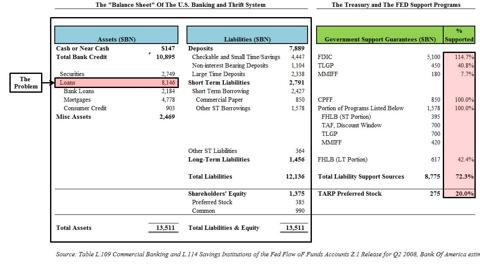

- In August 2008 the Federal Reserve balance sheet consisted of $940 billion of mostly U.S. Treasury securities. Today, the Federal Reserve balance sheet totals $2.9 trillion and is filled with toxic mortgage debt shoveled from the insolvent Wall Street banks onto the plate of the American taxpayer. The Federal Reserve balance sheet is leveraged 55 to 1, meaning a 2% loss would wipe out their capital. Lehman Brothers and Bear Stearns were leveraged 30 to 1 when they went belly up.

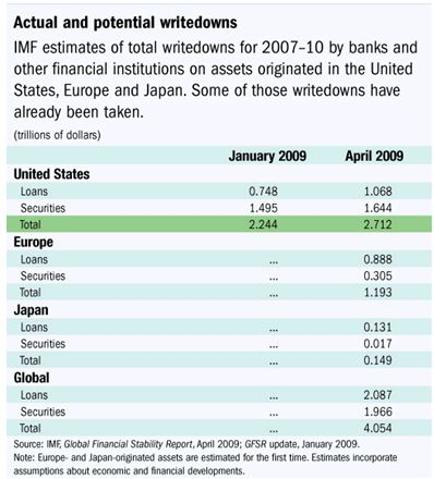

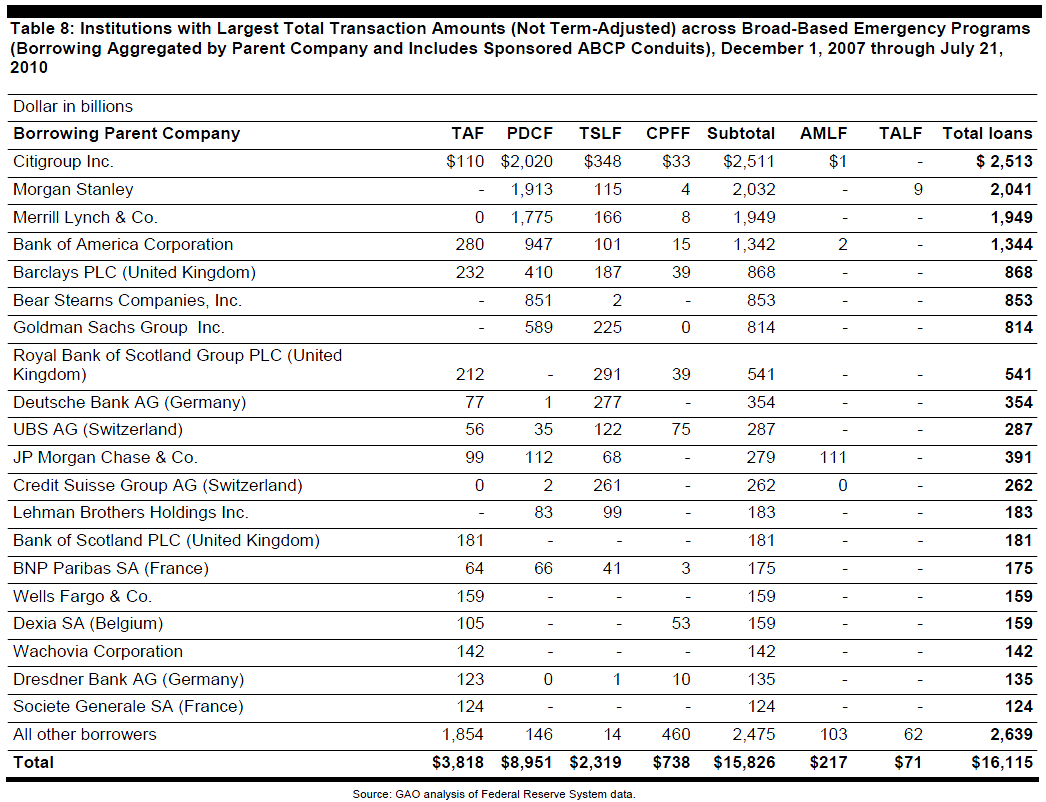

- During the recent financial crisis the Federal Reserve secretly loaned $16 trillion to the biggest banks in the world, including $4 trillion to foreign banks. This goes far beyond the mandate they were given by Congress in 1913. The Fed had no regulatory authority or ability to judge the credit worthiness of these foreign banks, but risked $4 trillion of U.S. taxpayer funds propping them up. With European banks on the verge of bankruptcy, the Federal Reserve risks losing even more money if they become the lender of last resort.

- In the 3rd Quarter of 2008 American savers were able to generate $1.4 trillion of interest income on their savings. Much of this interest went to risk adverse senior citizens who depended on this income to make ends meet after two years of no increases in their Social Security payments. Three years later savers are only generating $1 trillion of interest income or 30% less, while their costs for food and energy have risen 5% to 10%. The Federal Reserve instituted a zero interest rate policy in order to enrich their Wall Street masters, while further impoverishing the middle class and senior citizen savers that are the true backbone of the nation. Ben Bernanke has purposely transferred $400 billion from the prudent to the profligate.

When I started to detail the issues facing our country today, I expected to come up with 10 to 20 bullet points of key concerns. As I methodically worked through the categories of challenges facing the American Empire, the total reached 76 bullet points. The facts as presented above paint a picture of impending doom for America. The slogans and vapid “solutions” proposed by political candidates and entrenched Washington politicians do not even scratch the surface of what would need to be done to save this country from economic collapse. Many of these problems took decades to create and are not solvable in a reasonable time frame. With the country still delusional, overleveraged, and underemployed, it seems like the existing economic and social structure will need to be blown up to restore hope in this country.

“A building is a symbol, as is the act of destroying it. Symbols are given power by people. A symbol, in and of itself is powerless, but with enough people behind it, blowing up a building can change the world.” – V in V for Vendetta

Look In the Mirror

After accepting the fact that the economic situation as presented above is beyond repair, two questions come to mind:

- How did we get in this predicament?

- How do we get out of this predicament?

The difficulty with trying to explain how we got here is that people want simple answers and a bad guy to blame. People want to blame the rich or blame the poor or blame the phantom ruling elite or blame the other political party. They prefer to blame someone else, rather than looking in the mirror. It took a century of bad decisions, delusional thinking, unparalleled hubris, greed, sloth and willful ignorance to place the country on the precipice of ruin. The American people are responsible for the situation they find themselves in today. We elected the politicians that passed the laws, created the agencies, borrowed the money, and spent the country into oblivion. The truth is human beings are flawed creatures. We are prone to greed, laziness, seeking power, worrying about what others think about us, delusional thinking, herd mentality, shallowness, and cognitive dissonance. All of these human weaknesses have contributed to our current dilemma.

Until the twentieth century the United States generally kept their nose out of foreign conflicts, only getting involved in small regional conflicts. The country experienced tremendous growth during the 1800s and early 1900s with virtually no inflation and no central bank. The country experienced this remarkable expansion with no personal or corporate income tax. The nation also benefitted tremendously from the discovery of oil in Titusville, PA in 1859, as oil fueled the industrial revolution in the U.S. The election of Woodrow Wilson in 1912 marked a dramatic turning point in U.S. history. Within one year the country had a personal income tax and a central bank. As with most things created by politicians, they seemed harmless at first. The tax rate for 99% of Americans was 1%. The central bank was given a limited mandate to keep our banking system stable. Within a century we have a 60,000 page Federal tax code and a myriad of taxes at the Federal, State and local level. The Federal Reserve has more power and control over our lives than any entity on earth.

Giving politicians the ability to tax its citizens and print money allowed them to do things and make commitments that would have been impossible prior to 1913. After being re-elected in 1916 on a platform of keeping the country out of World War I, Wilson committed the country to that war. By 1919 the tax rate was already at 4% for most Americans and the Federal Reserve was printing money to finance the war, generating inflation of 16% per year between 1917 and 1920. Thus began a century of foreign interventionism and debt financed social welfare programs. The Federal Reserve created the easy monetary conditions of the 1920s which brought about the boom and bust of the 1929 stock market collapse. This precipitated the Great Depression and the conditions that led to the rise of fascism and World War II. The tinkering by politicians with our monetary system created more problems, which politicians attempted to solve by passing new laws and creating new programs and agencies. Without an unlimited supply of taxes and money printed by the Federal Reserve, politicians would have been constrained.

The somewhat logical reaction to the Great Depression by Franklin Delano Roosevelt was to create make work programs, housing agencies and social welfare programs to keep the citizens from revolting. He did this through the creation of debt, doubling the National Debt from $22 billion in 1932 to $44 billion by 1940. This is when the entitlement mindset took root. The creation of OASDI (Old Age, Survivors, and Disability Insurance) in 1935 was not supposed to be a retirement plan. People didn’t retire in 1935. It was created to make sure widows and orphans did not starve to death during the Great Depression. Again, the rate was only 1% at the outset. The age at which you were eligible to receive assistance was 65, four years greater than the average life expectancy of 61 years old. It was created as an insurance program and has morphed into a glorified retirement plan that convinced millions of Americans they didn’t need to save for their own retirement. It is $17.5 trillion in the hole because life expectancy is now 79 years old, politicians expanded coverage and refused to level with the American public for fear of losing elections.

The psychology of entitlement has grown over the decades as politicians made promises with borrowed money. They created Social Security, Medicaid, and Medicare to provide pension and healthcare to all senior citizens. They created Fannie Mae, Freddie Mac and Section 8 housing because everyone deserved to own a home. They created unemployment compensation, SNAP, and SSDI to sustain the disabled and down on their luck. Veterans are entitled to benefits as a result of their military service. These entitlements have become ingrained in our society. Charles Hugh Smith captured the essence of our entitlement mindset in a recent article:

“The entitlement mindset is thus firmly established in the American psyche. If we experience bad luck and/or the negative consequences of poor choices, we have been trained to expect the government at some level to alleviate our suffering, cut us a check or otherwise address our difficulties. The poisonous problem with the entitlement mindset is intrinsic to human nature: once we “deserve” something, then our minds fill with resentment and greed, and we focus obsessively on creating multiple rationalizations for why we deserve our fair share.”

The ability to tax and print trillions of dollars has enabled politicians to convince Americans they don’t need to save for their own retirement, they don’t need to worry about the cost of their healthcare, they don’t need to educate themselves, and they don’t need to help their neighbors because the government will do it for them. Once the entitlement mindset became ingrained in our society, self reliance, the ability to adapt to adverse circumstances, charitable acts, and taking responsibility for your own health and welfare rapidly declined among the populace. Government programs have been sold to the American people as acts of compassion for the less fortunate. Instead they have become a bureaucratic nightmare, creating dependence and a permanent underclass with no incentive, ability or desire to raise themselves up.

Human weakness and failings have also led to an over-class that have done far more damage to the country than those in society dependent on the state for their subsistence. The best description of this country at this point in history is a Warfare-Welfare-Corporatocracy. Since World War II the undue influence of the military industrial complex has led to almost constant conflict and foreign interventionism on a grand scale never matched in world history. President Eisenhower’s warning went unheeded:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military industrial complex. The potential for the disastrous rise of misplaced power exists and will persist. We must never let the weight of this combination endanger our liberties or democratic processes. We should take nothing for granted. Only an alert and knowledgeable citizenry can compel the proper meshing of the huge industrial and military machinery of defense with our peaceful methods and goals, so that security and liberty may prosper together.”

The people of this country have traded liberty and freedom for the appearance of safety and security by allowing the corporate military establishment and their bought political cronies to use fear and phantom threats to convince the non-critical thinking masses to beg for protection. The Cold War was replaced by the War on Terror, while the truth is that we keep our troops in the Middle East to protect “our” oil under “their” sand. Attempting to maintain an empire through troops garrisoned in countries across the globe, patrolling the seas with our navies, buying the “friendship” of dictators, and saber rattling or invading countries we don’t like is a folly that has brought down many empires before ours.

The most decisive factor in the disastrous financial predicament we are experiencing today is the tsunami of Wall Street greed and avarice that was unleashed upon the nation starting in 1971 with Nixon closing the gold window and allowing the Federal Reserve to “manage” the currency with no hindrances like gold to keep them from going too far. Prior to the 1980’s Wall Street investment banks were partnerships. If a partner took an extreme risk he would endanger the personal assets of all the partners. This insured prudent lending practices. Once they became corporations the risk was passed to shareholders and as we’ve recently found out – taxpayers, while bank executives could reap obscene compensation by taking world shattering risks. The repeal of the Glass Steagall Act in 1999 and the obstruction in regulating the derivatives market by Alan Greenspan and Larry Summers created the playing field that allowed Wall Street go on a drunken rampage, pushing the worldwide financial system to the point of collapse in 2008.

What Happens Next?

“I felt like I could see everything that happened, and everything that is going to happen. It was like a perfect pattern, laid out in front of me. And I realized we’re all part of it, and all trapped by it. With so much chaos, someone will do something stupid. And when they do, things will turn nasty.” – Inspector Finch – V for Vendetta

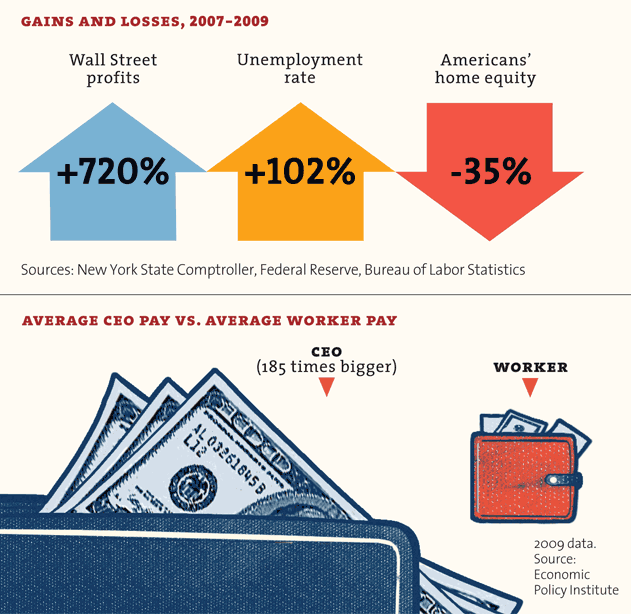

The chart above explains why anger and rage are beginning to bubble to the surface in cities across the country. It is clear there are no simple explanations or one answer to why the country is facing such calamitous circumstances. Essentially, human failings that have existed for all eternity have conspired to drain the vitality, risk taking, self reliance, personal responsibility and common sense from a once great nation. We know the uneducated, unmotivated lower classes, after decades of being kept down through our entitlement system, are unable and unwilling to do anything about their situation, as long as the entitlements keep flowing. It is the richest .01% that has accumulated the wealth, power and undue influence over the management of country. Either through inheritance, intelligence, connections, hard work, or luck, a few hundred thousand individuals out of 310 million people control the system. Immense wealth in the hands of the few has created a system where the few control the media, politicians, banking system, and mega-corporations that dominate our economy. Their human weaknesses include being egomaniacal power hungry materialistic greedy men who will stop at nothing to retain and increase their vast wealth. They have succeeded beyond their wildest dreams in pillaging the wealth of the middle class. But, they’ve gone too far.

They’ve manipulated the tax code in their favor. They make up most of the Senate, House and Judiciary. They own the mainstream media outlets. They are the masters of the universe on Wall Street. They run the mega-corporations that have shipped American jobs overseas. They pay millions to have the laws and regulations written for their benefit. They created the social welfare system, the public education system, and the healthcare system that keeps a vast swath of the population impoverished, ignorant and dependent upon the mutant organism that enriches the few. They’ve convinced the bulk of non-critical thinking Americans that the government can create jobs and make their lives safe and secure. This is the point where critical thinking Americans need to honestly answer a few questions to decide what happens next.

Did Social Security make our retirements more secure? Did the Department of Education make our children smarter? Did the Department of Energy reduce our dependence on foreign oil? Would there be more or less than 160,000 structurally deficient bridges in the U.S. without the Department of Transportation? Does paying unemployment compensation for 99 weeks increase employment or create jobs? Did Medicare and Medicaid make people healthier and reduce healthcare costs? Has putting our faith in mega-corporations for health insurance, drugs and job creation benefitted middle class workers? Has the War on Terror made the average American safer? Did the War on Drugs reduce the usage and availability of illegal drugs? Did passing more laws lead to a more law abiding society? Does incarcerating more criminals in more prisons reduce crime? Does a 60,000 page IRS tax code result in more taxes being collected? Has issuing more debt to solve a debt induced crisis resulted in a stronger financial system? Does the Republican or Democratic parties have your best interests at heart? Does it matter who is elected President in 2012?

There are solutions to the issues facing our country but they all would result in painful choices, tremendous sacrifice, a willingness to rebalance our economy and lives, and the loss of vast stores of wealth by the top .01% richest Americans. The steps needed would be:

- A nationalization of the Too Big To Fail banks with the required losses inflicted upon shareholders, bondholders and executives.

- Re-institution of mark to market accounting rules requiring companies to truthfully report the losses on their loan portfolios.

- The re-institution of Glass-Steagall to insure that no bank could become too big to fail.

- Instituting a transparent regulated derivatives market that would insure that no single entity could threaten to crash the worldwide financial system.

- Scrapping the existing individual personal income tax and replacing it with a flat, fair and/or consumption tax would take away the power of politicians.

- The elimination of all corporate tax breaks so that multi-billion dollar conglomerates could not get away with paying no corporate taxes (GE).

- The withdrawal of thousands of U.S. troops from across the globe and a dramatic decrease in military spending would be a voluntary reduction in our empire.

- A renegotiation of the social contract with changes in eligibility based on age and financial means is the only way to retain a semblance of a social net to protect those who are truly needy. Otherwise the social welfare system will crash.

- The population would need to accept a dramatic decrease in their standard of living as interest rates would need to be raised and saving would need to replace borrowing as our economic mantra.

- Acceptance of the impact from peak oil would require a complete restructuring of our suburban sprawl existence with communities forced to become more locally self sufficient.

- The political system would need to be overhauled with term limits and the elimination of corporate and special interest control over the election process.

- The Federal Reserve would need to be constrained through the re-introduction of gold and/or a basket of hard currencies as a check on their ability to print money.

Sadly, we all know that none of these solutions would ever be willingly implemented by the existing ruling class. Anyone with an ounce of common sense can see the system is crumbling. The .01% went too far and stole too much. An unsustainable system will not be sustained. The debt load is too burdensome. The peasants are growing restless. Young people have occupied Wall Street. They are beginning to occupy other cities. 700 were arrested on the Brooklyn Bridge. Older people are joining the protests. There isn’t a cohesive message coming from the protestors other than the system is rigged in favor of the top .01%. Those who think they are in control are losing their grip. They see their power and wealth slipping away. They’ve had their way for decades and will not willingly submit to a change in the existing social order. Last night Jim Cramer voiced the concerns of the .01% by saying the Occupy Wall Street protests were worrisome. They are worrisome to the moneyed interests. They are a reason for hope to the 99.9%. We are approaching our moment of truth. There is something terribly wrong with this country. A new American Revolution has begun. It is time to stop being afraid and take this country back. What happens next? The choice is ours.

While the truncheon may be used in lieu of conversation, words will always retain their power. Words offer the means to meaning, and for those who will listen, the enunciation of truth. And the truth is, there is something terribly wrong with this country, isn’t there? Cruelty and injustice, intolerance and oppression. And where once you had the freedom to object, to think and speak as you saw fit, you now have censors and systems of surveillance coercing your conformity and soliciting your submission. How did this happen? Who’s to blame? Well certainly there are those more responsible than others, and they will be held accountable, but again truth be told, if you’re looking for the guilty, you need only look into a mirror. I know why you did it. I know you were afraid. Who wouldn’t be? War, terror, disease. There were a myriad of problems which conspired to corrupt your reason and rob you of your common sense. Fear got the best of you, and in your panic you turned to….. – V’s speech to the British people in V for Vendetta