Bear markets become bear markets because people don’t believe they are in a bear market until it is too late. The fast and furious low volume surge last week has the fools cackling and saying “see I told you so”. As Hussman notes, we’ve been here before:

“The Market Climate remains on a Crash Warning… but we have to allow for the possibility of the usual fast, furious bear market rallies that can occur after the market becomes oversold. In short, near term direction is a coin toss, but the next few days could involve a sizeable move one way or another. Overall, our position remains defensive, but we’re managing our risks in a way that accommodates the possibility of a bounce. It’s unfortunate, in my view, that investors have so much faith that a monetary easing can and will bail out the economy and the stock market. My view is fairly simple – the economic boom we’ve enjoyed has been driven by an inordinate amount of leverage, much of it of very poor credit quality, and by capital spending financed through the import of foreign savings. In an environment where demand for new capital investment was strong, easy bank credit and ample foreign savings fed extremely good economic growth rates. But I believe we are past that point here.”

Hussman Weekly Market Comment (link) December 19, 2000

“The market weakness we’ve observed since last year has been fairly tame in the sense that the S&P 500 has to-date suffered a fraction of the loss that we typically observe in a standard, run-of-the-mill bear. It can be dangerous to attempt trading bear market rallies early into a decline – especially when valuations remain rich. It’s useful to remember that the 1929 and 1987 crashes started after the S&P 500 was already down about 14% from its highs. So emerging panic is not enough – there has to be some basis to believe that a positive shift in investor attitudes toward risk would be sustainable. Again, falling interest rates, moderate valuations, and very strong market action early into the rebound are useful in separating sustainable advances (even sustainable bear-market rallies) from the fast, furious, prone-to-failure variety. Presently, we don’t even see emerging panic. What we do observe, however, is that prices are somewhat oversold on a very short-term basis, so it’s reasonable to allow for one of those fast, furious bounces to clear that condition. Not a forecast – particularly because the prevailing Market Climate is unfavorable – but even high-risk markets can produce very strong short-term advances, and investors should not immediately abandon caution when they emerge.”

Hussman Weekly Market Comment (link) June 23, 2008

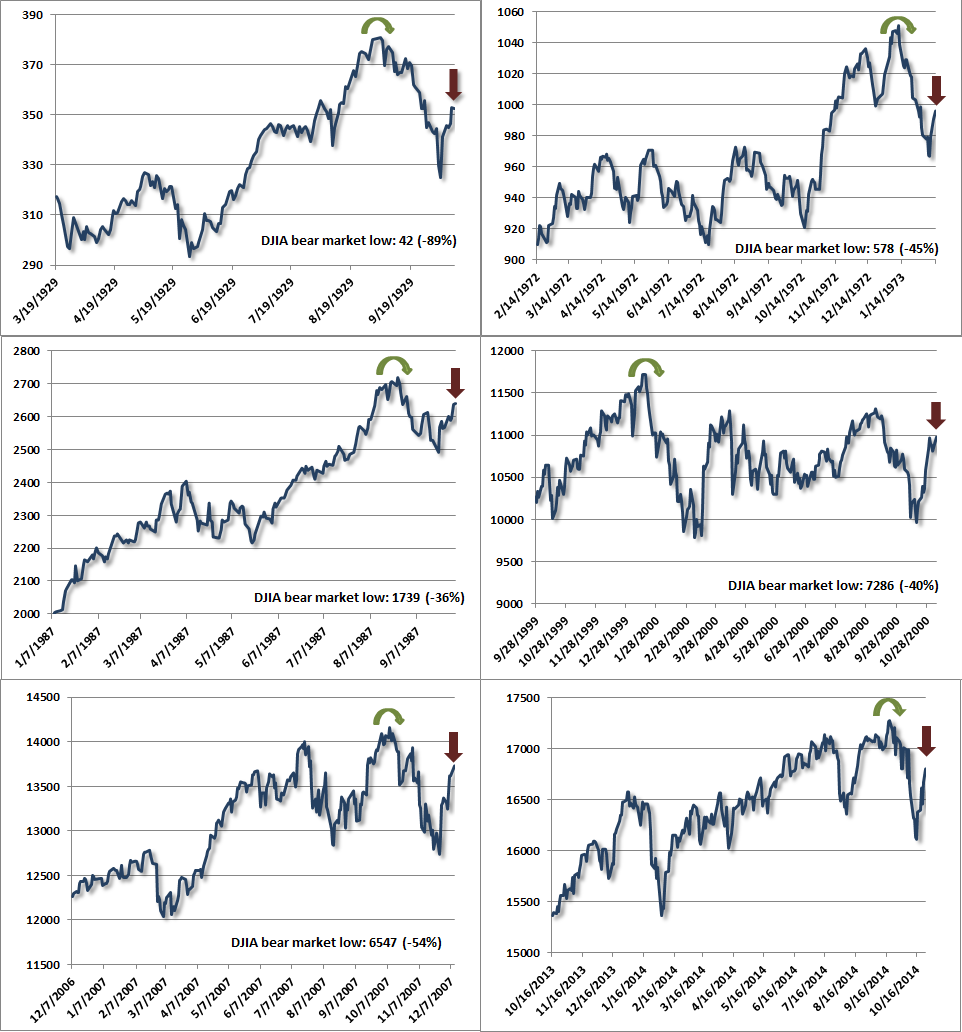

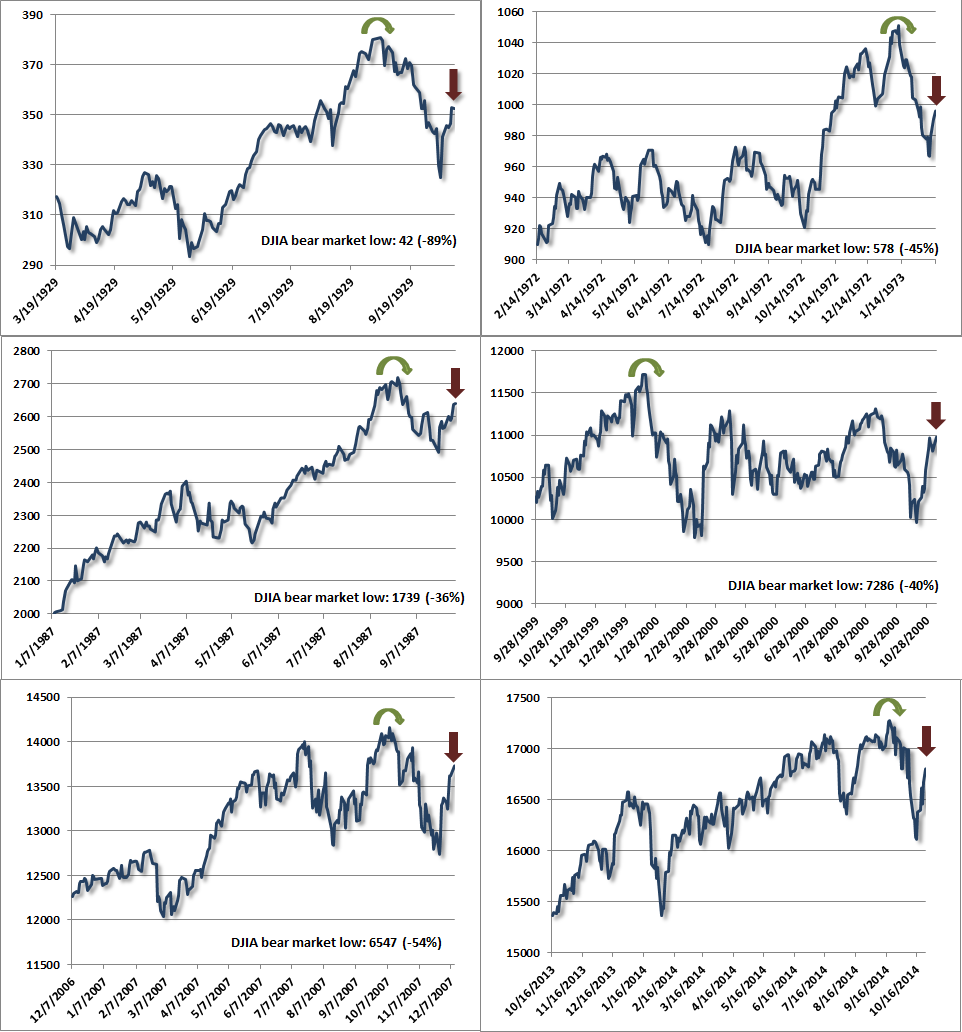

The global economy has turned south. Interest rates are falling sharply, a prelude to recession. The consumer is “debt” in the water. As you can see from these pertinent charts, every major bear market has had dramatic advances that fooled people into believing all was well. Note the similarity. Note the future lows after these dramatic advances.

What characterizes the instances below is not simply a decline from a market peak and a subsequent rally, but the sequence from historically extreme overvalued, overbought, overbullish conditions (see Exit Strategy) to a deterioration in market internals, an initial “air pocket” decline, and a subsequent short-squeeze that fails to restore market internals to a favorable condition.

The fact is the market is extremely overvalued due to the easy money policies of the Federal Reserve. QE is over this week. The economy is deteriorating. Europe is imploding again, led by Germany. China’s real estate bubble is in full collapse mode. Winter is coming. It might even snow. Imagine the devastation to our economy. Based upon historical facts Hussman’s warning has never been more valid:

So allow for any sort of action in the near term, but recognize that from a full-cycle perspective, we continue to view a 40-50% market loss as having very reasonable plausibility over the completion of this market cycle.

Click Here to read Hussman’s Full Letter