Via ZeroHedge

Earlier, we reported on the deranged, confused, false ramblings of a senile old man who is so out of his depth in running the world’s biggest economy, the catastrophic results will soon be obvious to even his most die-hard fans. Now, it’s time for his nemesis on the world scene, Russia’s Vladimir Putin to respond.

Speaking in a TV interview on Friday evening, following a meeting with African leaders in Sochi, Putin accused Western leaders of trying “to shift the responsibility for what is happening in the world food market” and said that “restrictions imposed by the US and its allies against Russia and Belarus will only exacerbate the looming global food crisis by affecting fertilizer trade and sending the food prices further up.”

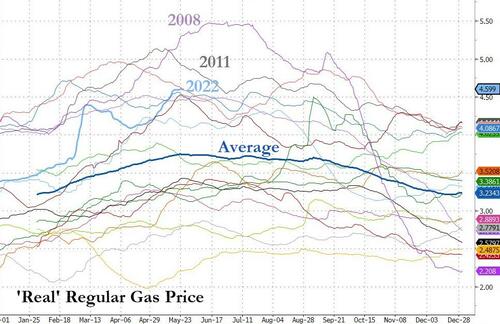

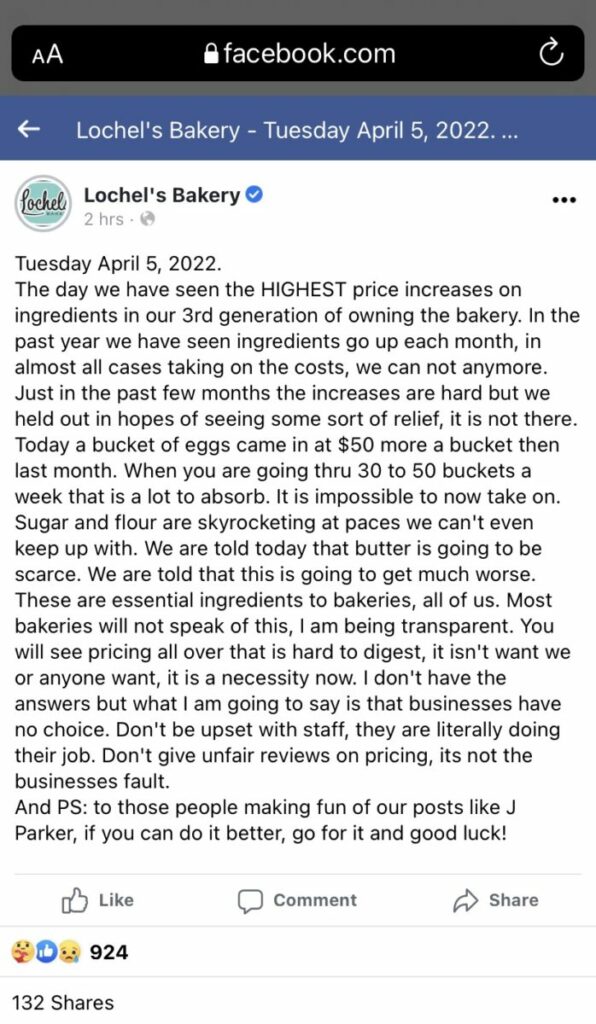

Instead of looking toward Russian, Putin said that the root causes of the crisis lie with the US decision to print record amounts of money which led to an increase in global food prices, as well as Europe’s over-reliance on renewables and short-term gas contracts, which have led to price hikes and rising inflation.

“It began to take shape as early as February 2020 in the process of combating the consequences of the coronavirus pandemic,” he added.

Continue reading “Putin Says US Decision To Print Money Is Behind Soaring Food Prices”