“The past was erased, the erasure was forgotten, the lie became the truth.” – George Orwell, 1984

“Great is truth, but still greater, from a practical point of view, is silence about truth.” ― Aldous Huxley, Brave New World

I wish I could go through a day without having to reference Orwell and Huxley when observing how the ruling class is able to manipulate, subjugate, and propagandize the willfully ignorant masses through lies, deceptions, disinformation, and fear. But here we are, living through a dystopian nightmare blending the worst aspects of Orwell’s 1984 and Huxley’s Brave New World.

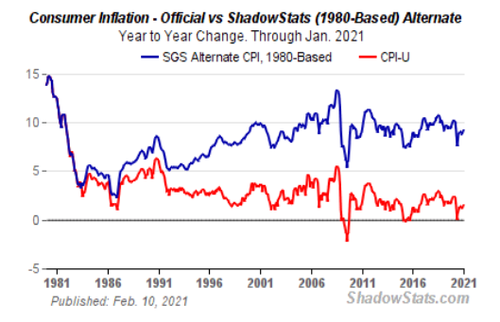

It’s as if O’Brien and Mustapha Mond are running the show, using behavioral conditioning, restricting freedom of speech, adhering to a strict caste system, surveilling everything we say or do, using our fears to control us, utilizing propaganda to produce false narratives, and ultimately threatening to stomp a boot on our faces forever if we do not obey and conform. Virtually everything we are told by politicians, government bureaucrats, military brass, “esteemed” journalists, medical “experts”, bankers, and corporate executives is lies. They do not believe their lies, but they know it benefits themselves financially to lie, and as long as they work together, they know the ignorant masses will believe them.