Guest Post by Eugene Ludwig

The ‘True Cost of Living’ index shows millions of low- and middle-income families don’t earn enough to buy necessities like shelter, food, and child care

For several years now, many of us have focused on the scourge of “fake news.” But much as we may blame avaricious social platforms and conniving public figures for driving widespread cynicism, we need to consider the role played by another more innocuous reality: misleading statistics.

Flagging confidence in both government and the mainstream media tracks decades in which official economic indicators—most notably those that purport to gauge the cost of living—have fundamentally failed to mirror middle-class reality.

Perhaps “fake” is too strong a term to describe the data-driven consumer price index (CPI), which serves as the U.S. government’s proxy for inflation. But the narrative the CPI has long burnished—namely that, since 2000, ordinary expenses have been fairly manageable amid rising wages—is entirely debunked by new research.

CPI understates rising costs

Over the 20 years that preceded the present crisis, prices for things middle- and low-income Americans must purchase rose 40% beyond what CPI would indicate, more than wiping out a median earner’s income gains. In short, the CPI-driven narrative is something akin to “fake news.”

The implications are dire. Not so long ago, a family of four earning the median income in the United States could make ends meet with a little left over.

But, as a study done by the Ludwig Institute for Shared Economic Prosperity (LISEP) reveals, that’s no longer true. A two-income family—say, one where one parent works as an emergency-room technician and the other as a home-health aide—would at the median have had $4,000 extra to spend after covering their basic needs in 2001. Today, by contrast, that same family would have to go $2,000 into debt to sustain a very modest lifestyle.

Follow all the inflation news on MarketWatch

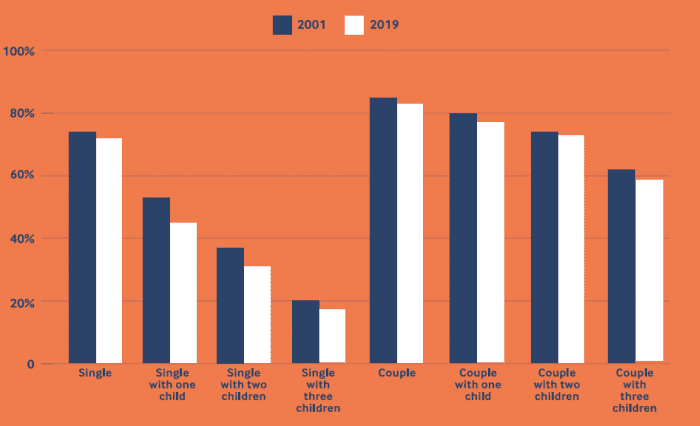

Percentage of families in the U.S. population with sufficient household income to meet all minimal adequate needs, 2001 and 2019, by family type. For example, more than 80% of families with two adults and no children could afford the basics in 2019, but less than 20% of single parents with three children could.

LISEP

Divorced from reality

That’s not to insinuate that the government is purposefully misleading the public. Rather, it suggests that the prevailing statistical methodology produces tragically misleading information for one clear reason: Prices for yachts, luxury hotel rooms, and other high-end items have risen much more modestly than the everyday items—food, housing, medical bills—that middle-class families are compelled to cover.

So the CPI’s heavy weighting of those luxury goods divorces it from the inflationary reality it purports to track.

Oddly enough, conventional wisdom within the world of economics isn’t that the government’s prevailing indicator understates inflation—but rather that the figure overstates it. For decades, many have worried that CPI fails to account for the possibility that consumers would find substitutes for more expensive products rather than accept a higher price. More recent studies have argued that CPI does not properly account for technological change.

But between 2001 and 2020, rents shot up by 150% at the same time CPI’s measure of housing costs grew by a mere 54%. Is it any wonder, then, why so many Americans sense that their plight is invisible to the people in charge?

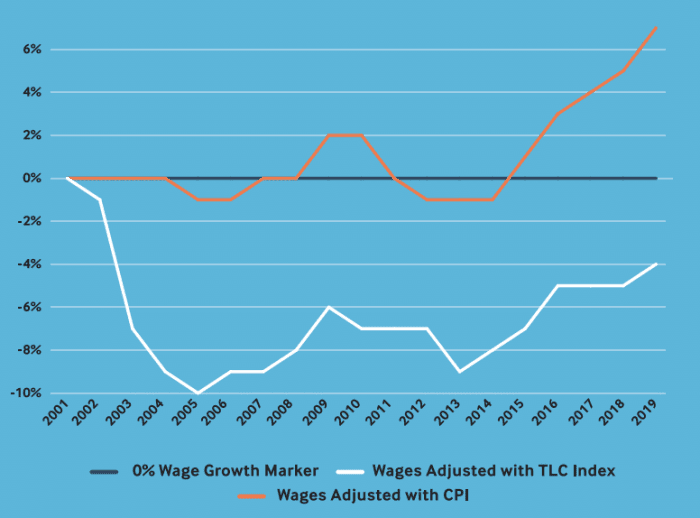

Median wages adjusted for the CPI (orange line) show healthy increases in the past two decades but have been falling (white line) when adjusted for the True Living Cost index.

LISEP

Failure of fiscal policy

None of this is to absolve those who have cynically exploited American skepticism by stirring various pots or spreading false conspiracies. Nor is it to argue that the Federal Reserve should pursue a monetary policy different from what the board of governors might be inclined to employ given more traditional indicators. Today’s situation is real, and policy makers should work in concert, as President Joe Biden has proposed, to curtail the price increase borne primarily from the supply-chain bottleneck and the war in Ukraine.

But what has now been revealed as a more endemic divergence between CPI and a more accurate measure of middle-class inflation suggests that our fiscal policy has over the decades failed to ensure that successive generations of Americans have equal opportunity to enjoy the fruits of upward mobility.

Bad statistics have shrouded a worrisome economic reality that affects not only the poor and working class, but those earning median incomes as well. And once today’s crisis is stabilized, Washington should be focused squarely on rectifying that oversight.

Those of us who believe a responsible civic discourse rests on broad public understanding of the real world should stand strong against those who would exploit misinformation to serve their own interests. But we should also acknowledge reality. Purveyors of what is supposed to be good, fact-based, information have done us no favors by championing statistics born in some unreality. And the fact that government statistics have inadvertently done more to hide than reveal the extent to which America’s middle class has been hollowed out suggests we need to rethink the way we understand the world as it is.

Eugene Ludwig, a former U.S. comptroller of the currency, is chair of the Ludwig Institute for Shared Economic Prosperity and author of “The Vanishing American Dream.“

It is my sincere desire to provide readers of this site with the best unbiased information available, and a forum where it can be discussed openly, as our Founders intended. But it is not easy nor inexpensive to do so, especially when those who wish to prevent us from making the truth known, attack us without mercy on all fronts on a daily basis. So each time you visit the site, I would ask that you consider the value that you receive and have received from The Burning Platform and the community of which you are a vital part. I can't do it all alone, and I need your help and support to keep it alive. Please consider contributing an amount commensurate to the value that you receive from this site and community, or even by becoming a sustaining supporter through periodic contributions. [Burning Platform LLC - PO Box 1520 Kulpsville, PA 19443] or Paypal

-----------------------------------------------------

To donate via Stripe, click here.

-----------------------------------------------------

Use promo code ILMF2, and save up to 66% on all MyPillow purchases. (The Burning Platform benefits when you use this promo code.)

“Perhaps ‘fake’ is too strong a term to describe the data-driven consumer price index”

not strong enough. “deliberately misleading”, “con job”, and “bald faced lie” come to mind.

“Nor is it to argue that the Federal Reserve should pursue a monetary policy different from what the board of governors might be inclined to employ”

the federal reserve is a front for a tribal mafia. the dollar is a debt pyramid scheme. it should all be rounded up and expelled. again.

This entire administration has not done anything different than most administrations for the past 50 years ! Of course there have been a few positive economic blips here and there but in an overall “BIG PICTURE” the ruling elites and the parasitic class in government elected appointed and hired has FUCKED THIS NATION AND EVERY AVERAGE AMERICAN CITIZEN UP THE ASS WITH A BURNING LOG !

Their combined treasonous actions in everything they touch has profited and protected a few as the majority of average Americans and the industrial jobs and tax base evaporated and the DC gang of thieves printed their way to prosperity while their victims circle The Drain !

THE FAT LADY IS SINGING

This administration has now overplayed this poker hand and they better fold quick !

There is no reason to trust anything from government Executive Judicial Legislation down to local police no longer are subservient to the citizens and are merely parasites killing the host

The late, great Dick Motta upon saying his Wash. Bullets were dead in the NBA Finals back in the mid-70s, “It ain’t over until the Fat Lady sings.”

BTW, they won.

The only cheaper products I have been able to find is road kill.

But just think how much the gas cost to get it.

The 99¢ ONLY STORE is now the $1.29 to $1.99+ STORE — gas is up 100% over the price from last year. Last time I checked, folks in THE REAL WORLD need to EAT & GAS UP THEIR VEHICLES.

Therefore, REAL FUCKING WORLD INFLATION is up 30% to 100% YEAR OVER YEAR, so FUCK the BS BLS CPI numbers, and take John W of shadowstats & at least DOUBLE HIS INFLATION #s to get THE REAL WORLD #