A confluence of events last week has me reminiscing about the days gone by and apprehensive about the future. I’ve spent a substantial portion of my adulthood rushing to baseball fields, hockey rinks, gymnasiums, and school auditoriums after a long day at work. I’d be lying if I said I enjoyed every moment. Watching eight year olds trying to throw a strike for two hours can become excruciatingly mind-numbing. But, the years of baseball, hockey, basketball, and band taught my boys life lessons about teamwork, sportsmanship, winning, losing, hard work, and having fun. There were championship teams, awful teams and of course trophies for finishing in 7th place. As my boys have gotten older and no longer participate in organized sports, the time commitment has dropped considerably. Last week was one of those few occasions where I had to rush home from work, wolf down a slice of pizza and head out to a school function. It was the annual 8th grade Spring concert.

My youngest son was one of a hundred kids in the 8th grade choir. I think it was mandatory, since none of my kids like to sing. As my wife and I found a seat in the back of the auditorium where we could make a quick escape at the conclusion of the show, neither of us were enthused with the prospect of spending the next ninety minutes listening to off-key music and lame songs. I’ve been jaded by sitting through these ordeals since pre-school. But a funny thing happened during my 30th band concert. I began to feel sentimental about the past and sorrowful about the future for these Millennials.

The Millennial generation was born between 1982 and 2004. Therefore, they range in age from 9 years old to 31 years old. There are approximately 87 million of them, or 27.5% of the U.S. population. In comparison, the much ballyhooed Boomer generation only has 65 million cohorts remaining on this earth. The Millennials will have a much greater influence on the direction of this country over the next fifteen years than the currently in control Boomers. There has been abundant scorn heaped upon this young generation by their elders. In a fit of irrationality befit the arrogant, hubristic, delusional elder generations, they somehow blame a cohort in which 54 million of them are still younger than 21 years old for many of the ills afflicting our society. This disgusting display of hubris is par for the course among these delusional elders.

Are Millennials addicted to their iGadgets, cell phones and Facebook pages? Probably. Do they spend too much time on the internet and playing PS3 & Xbox? Certainly. Have they been indoctrinated in social engineering gibberish like diversity and planet worship by government run public school bureaucrats? Absolutely. Are they young, foolish, immature, irrational and not respectful towards their elders? You betcha. Teenagers have acted like this forever. You acted like that. The ongoing crisis in this country and our unsustainable economic system are in no way the result of anything perpetrated by the Millennial generation.

Can the Millennial generation be blamed for the $17 trillion national debt, $222 trillion of unfunded un-payable social obligations promised by corrupt politicians, $1 trillion of annual deficits, undeclared wars being waged across the globe on behalf of the military industrial complex arms dealer mega-corporations, economic policies that have resulted in 48 million people dependent on food stamps, tax policies that enrich those who write the code, trade policies that benefit corporations who gutted the industrial base and shipped jobs overseas to slave labor factories, or monetary policies that have destroyed 96% of the dollar’s purchasing power? They had no say in the creation of our untenable welfare/warfare state.

There are no Millennials among the 535 corrupt bought off politicians slithering down the halls of Congress. There are no Millennials running the Too Big To Control Wall Street banks. There are no Millennials in charge of the mega-corporations that buy and sell our politicians. There are no Millennials at the upper echelon of the Military Industrial Complex or in the upper ranks of the U.S. Military. But, and this is a big but, they have done most of the dying in the Middle East over the last ten years in our multiple undeclared preemptive wars of aggression. They have died under the false pretenses of a War on Terror, when they are truly dying on behalf of the crony capitalists who profit from never ending war. They have been fighting and dying to protect “our oil” that happens to be under “their sand”. If the energy independence storyline was true, why is our military perpetually at war in the Middle East?

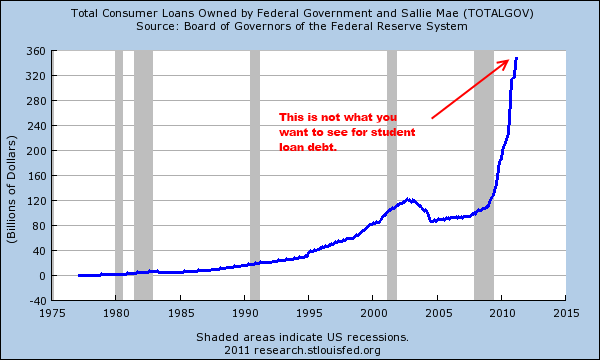

The Millennials will also be required to do the heavy lifting over the next fifteen years of this Fourth Turning Crisis. The Silent Generation is dying off rapidly. The Boomer generation has done some hard living and some hefty eating and with the oldest of their cohort hitting 70 years old, their supremacy will begin to diminish over the coming fifteen years. At 87 million strong, and millions yet to reach voting age, the Millennials will become more influential by the day regarding the future course of this nation. The question is what will be left of this country by the time they assume control. They are saddled with $1 trillion of student loan debt, peddled to them by the government and Wall Street with the false promise of good paying jobs and the opportunity for a better life than their parents lived. They have obediently followed the path laid out by their elders, but they have been badly misled. This American dream has been shattered upon an iceberg of debt, delusion, deception and denial. The unsinkable American empire’s hubris and arrogance are leading to its demise. The Millennials are coming of age during a Crisis that will reach momentous magnitudes over the next fifteen years, and they had nothing to do with creating the circumstances which will propel the chaos and anarchy that ensues. But, they will bear the brunt of the dreadful consequences.

Generational Bridge

“The Boomers’ old age will loom, exposing the thinness in private savings and the unsustainability of public promises. The 13ers will reach their make or break peak earning years, realizing at last that they can’t all be lucky exceptions to their stagnating average income. Millennials will come of age facing debts, tax burdens, and two tier wage structures that older generations will now declare intolerable.” – Strauss & Howe – The Fourth Turning

The kids on the stage at the 8th grade Spring concert were all around 14 years old. They are unaware they are in the midst of a twenty year period of Crisis. The boys are at that gawky looking stage with pimply faces and gawky limbs. The girls mature quicker than the boys at that age. These youngsters have barely begun their lives. I was amazed at their proficiency with a wide variety of musical instruments. They displayed poise and talent. The soloists exhibited composure well beyond their years. The performers were all musically endowed and proved that hard work and practice pays off. They were clearly enjoying themselves. They were all dressed in their Sunday best. I found myself enjoying the show despite my jaded attitude upon entering the auditorium. Even my son, wearing one of my ties, actually appeared to be singing during the choir performance. What I saw were hundreds of bright eyed Millennials with their hopes and dreams for a bright future intact. They have no idea what trials and tribulations await them.

I reached a milestone on the age chart last week that had me ruminating about yesteryear and contemplating the future. I reached the half century mark. Birthdays generally do not faze me, but the intersection of the 8th grade concert and my landmark birthday had me pondering my purpose for inhabiting this world. I’ve likely realized two-thirds of my life. The final third of my life will be spent trying to maneuver through the minefields of this Fourth Turning. I’m a father to three Millennial boys. I consider it my duty to defend and support them during this Crisis. Strauss & Howe wrote their book in 1997 and predicted a Great Devaluation in the financial markets around the time Millennials were entering their twenties. This Crisis began in September 2008 with the worldwide financial collapse created by Wall Street “Greed is Good” Boomers, as the oldest Millennials entered their twenties. It continues to worsen as more Millennials approach their twenties. We’ve reached a point in history when the elder generations need to sacrifice in order to insure younger generations have a chance at some form of the American dream.

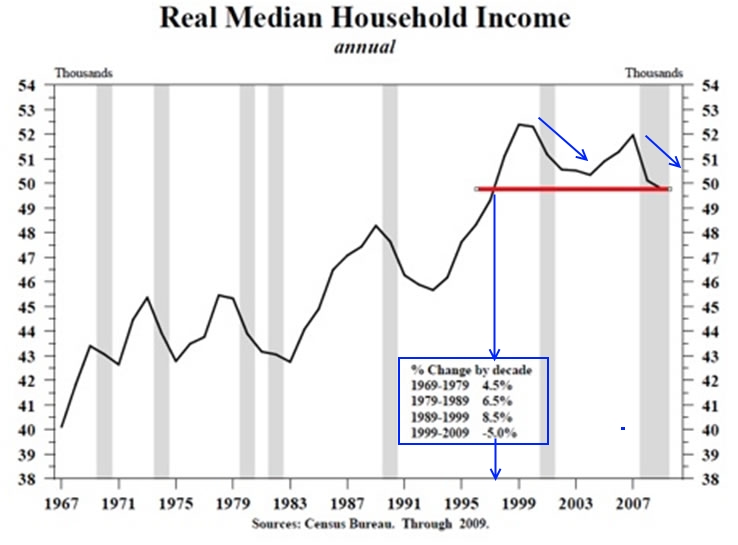

I believe each generation has an obligation to future generations. We are bridge between preceding generations and future generations. We have a civic obligation to manage the resources of the country in a prudent manner. It’s our duty to leave the country in a financially viable condition so younger generations have an opportunity to live a better life than their parents. Every generation that preceded the Millennials has achieved the goal of having a better standard of living than their parents. I don’t believe my boys will enjoy a better life than I’ve lived. We’ve lived well beyond our means for decades. Government, Wall Street banks, corporations and individuals have run up a $56 trillion tab and are sticking the Millennials with the bill.

The $17 trillion national debt accumulated by elder generations to benefit themselves and $222 trillion of unfunded entitlements promised to themselves is nothing but generational theft. It’s immoral and possibly the most selfish act in human history. I’m ashamed that my generation and older generations have committed this criminal act of theft. Deficit spending today with no intention of repaying that debt is a tax on future generations. This egotistical abuse of power by the current and past regimes must be reversed voluntarily or it will be done by force. I’m 50 years old and will dedicating my remaining time on this earth fighting to create a sustainable future for my kids and their kids. The lucky among us get eighty years on this planet to make a difference. When did the definition of success become dying with the most toys and spending your life screwing your fellow man by accumulating obscene levels of wealth at their expense? If Boomers and Generation X have any sense of guilt about what they have done, they would be willingly offering to sacrifice their ill-gotten entitlements.

Not only are those currently in power not proposing to scale back their spending, debt accumulation, or entitlement transfers, but they have accelerated the pace of each in the last five years. An already unsustainable corrupted economic structure is being driven towards collapse by psychopathic central bankers and cowardly captured politicians. These are acts of treason against the youth of this country and larceny on a grand scale. It will lead to generational warfare and these crooks will pay for their transgressions. Strauss & Howe suspected in 1997 the elders might cling to their illicit profits acquired at the expense of the Millennials:

“When young adults encounter leaders who cling to the old regime (and who keep propping up senior benefit programs that will by then be busting the budget), they will not tune out, 13er – style. Instead, they will get busy working to defeat or overcome their adversaries. Their success will lead some older critics to perceive real danger in a rising generation perceived as capable but naïve.” – Strauss & Howe – The Fourth Turning

The elders who represent the status quo do perceive real danger in the rising Millennial generation. The initial skirmishes occurred in the midst of the Occupy protests. The young protestors initially focused on the true culprits in the crashing of the financial system and vaporizing of the net worth of millions – Wall Street bankers and their sugar daddy at the Federal Reserve. In a display of status quo bipartisanship you had liberal Democrat mayors in cities across the country call out their armed thugs to beat the millennial protestors into submission while being cheered on by Fox News and the neo-cons.

The existing status quo regime provides the illusion of choice, but both political parties are interchangeable in their desire to control our lives, flex our military might around the globe, indebt future generations and write laws to favor their corporate and banking masters. The establishment is showing contempt for the futures of our youth. Their solutions to the criminally created financial crisis have been to reward reckless debtors and bankers at the expense of future generations. Their doling out of hundreds of billions in student loan debt and artificial propping up of home prices has effectively made it impossible for millions of young people to get their lives started. Boomers have done such a poor job saving for their retirements they are unable to leave the workforce. Since January 2009, despite adding $400 billion of student loan debt, Millennials have a net loss in jobs, while the Boomers have taken 4 million jobs.

Strauss & Howe anticipated that older people would be anguished to see good kids suffer for the mistakes they had made. They thought the elders couldn’t possibly be shallow enough, selfish enough, or immoral enough to deny the Millennial generation a chance at the American Dream. They were wrong. The old regime has no plans to step aside or sacrifice on behalf of younger generations. The implications of this resistance will be dire.

“The youthful hunger for social discipline and centralized authority could lead Millennial youth brigades to lend mass to dangerous demagogues. The risk of class warfare will be especially grave if the 20% of Millennials who were poor as children (50% in inner cities) come of age seeing their peer-bonded paths to generational progress blocked by elder inertia.” – Strauss & Howe – The Fourth Turning

The social mood in this country continues to deteriorate as the sociopathic financial elite accelerate their pillaging of the working middle class, steal money from senior citizens through zero interest rate inflationary policies, and enslave our youth in the chains of crushing debt and promise of dead end jobs. When the next leg down in this ongoing depression strikes like an F5 tornado, the simmering anger in this country will explode in a chaotic frenzy of violence and retribution. The chances of class and generational warfare have increased exponentially due to the actions of the elderly regime over the last five years.

Generational Sacrifice

“You got your whole life ahead of you, but for me, I finish things.” – Walt Kowalski – Gran Torino

A couple days after the Spring concert I was flipping through the 650 channels on my TV with nothing worth watching when I stumbled across the 2008 Clint Eastwood movie Gran Torino. This was the third episode within the week that had me thinking about the future of my kids. It was his highest grossing film in history. Eastwood played a bigoted tough guy Korean War veteran whose Detroit suburban neighborhood had deteriorated into a dangerous gang infested Asian war zone. The movie did not follow the standard Eastwood plot where he kills dozens of bad guys. He grudgingly befriends two young Millennial teenage Laos refugees who live next door. He had lost his wife of 50 years. He was in his 70s and dying from some undiagnosed illness. I viewed the movie as an allegory for the generational sacrifice that should be taking place now.

Eastwood’s character, Walt Kowlaski, decided to finish things his way. He realized the two Millennials would never find peace or have a chance at a better life until the criminal gang running the show in the neighborhood were confronted and defeated. He knew he was too old to kill six gang members singlehandedly, so he made a choice to sacrifice himself and be gunned down in cold blood in front of multiple witnesses so the perpetrators would go to jail and allow his Millennial companions to have a chance at a better life. He sacrificed his life for the good of young people who weren’t even related to him. This message has not connected with the elder generations who control the purse strings and political system in this country. The media propaganda machine supporting the existing regime continues to peddle a storyline that debt doesn’t matter, consumption is good, saving is for suckers, and passing the bill for unfunded entitlements to future generations is not immoral and cowardly. Walt Kowalski displayed courage, bravery, and valor that is sorely lacking in the elderly generations today.

At the age of 50 I have a choice with my remaining 20 or 30 years. I can choose to keep accumulating material goods with debt, voting for politicians who promise never to cut my entitlements, believing deficits growing to infinity are beneficial to the economic health of the nation, supporting the military industrial complex as they wage undeclared wars across the world, applauding the Orwellian fascist surveillance measures instituted to give the illusion of safety while sacrificing freedoms and liberties and selfishly looking out for my best interests. Or I can stand up to the corporate fascist old boy regime and lure them into a violent response that will ultimately lead to their downfall. I’m willing to sacrifice what is supposedly “owed” to me on behalf of my kids and all Millennials. They don’t deserve to start life in a $200 trillion hole created by their parents and grandparents. It is disconcerting to me that more Boomer and Generation X parents are unprepared, unwilling or too willfully ignorant to forfeit entitlements awarded them under false pretenses in order to preserve a decent standard of living for their children and grandchildren. The Bernaysian propaganda programmed into their brains over decades by the sociopathic central planning status quo has created this inertia.

The inertia will be replaced by frenzied activity when this unsustainable system ultimately fails. Time seems to be standing still. People have been lulled into a false sense of security even though history is about to fling us into a chaotic transformational period in history. How do I know this is going to happen? Because it happens every eighty years like clockwork. The best laid plans of the men running the show will be swept away in a whirl of pandemonium, violence, war and reckoning for sins committed against humanity. There will be no escape.

“Don’t think you can escape the Fourth Turning the way you might today distance yourself from news, national politics, or even taxes you don’t feel like paying. History warns that a Crisis will reshape the basic social and economic environment that you now take for granted. The Fourth Turning necessitates the death and rebirth of the social order. It is the ultimate rite of passage for an entire people, requiring a luminal state of sheer chaos whose nature and duration no one can predict in advance. The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it.” – Strauss & Howe – The Fourth Turning

Our country has entered a period of Crisis. We may or may not successfully navigate our way through the visible icebergs and more dangerous icebergs just below the surface. The similarities between the course of our country and the maiden voyage of the Titanic are eerily allegorical.

The owners of the ship (Wall Street, Washington politicians, crony capitalists) are arrogant and reckless. They declare the ship unsinkable, while only providing half the lifeboats needed to save all the passengers in case of disaster in order to maximize their profits. The captain (Ben Bernanke) has been tendered the greatest cruise liner (United States) in history. The initial voyage across the Atlantic Ocean has drawn the financial elite ruling class (financers & bankers) onboard, occupying the luxurious state rooms on the upper decks. But, the lower decks are filled with young poor peasants (Millennials) who are sneered at and ridiculed by those in the upper decks. A maiden voyage should always be approached cautiously. A prudent captain would not take undue risks.

Our captain (Ben Bernanke) wants to make his mark on history. He considers himself an expert in navigating dangerous waters (Great Depression) because he studied dangerous waters at his Ivy League school. It doesn’t matter that he never actually captained a ship in the real world. He declares full steam ahead (reducing interest rates to 0% and throwing vast amounts of fiat currency into the engine room boilers). Midway through the voyage, the captain is handed a telegram warning of icebergs (potential financial catastrophe) ahead. If he slows down the vessel, he will not set the speed record and receive the accolades of an adoring public. He ignores the warning and steams on to his rendezvous (eternal disgrace) with destiny.

In the middle of the night, the lookouts (Ron Paul, John Hussman, Zero Hedge) cry iceberg!! But, it is too late. The great ship (United States) has struck an enormous iceberg (debt & currency crisis). At first, it seems like everything will be OK. The captain and crew assure the passengers that everything is under control and their evasive action has saved the ship. But below the waterline, the great ship (United States) is taking on water (toxic levels of debt, un-payable entitlement promises, trillion dollar deficits, political & financial corruption). The engine room (Federal Reserve) works frantically to alleviate the damage (QE to infinity). The captain is sure the compartmentalization of the ship will save it. One of the designers of the ship (David Stockman) sadly declares that the ship will surely sink. The captain orders the band (CNBC, Fox, MSNBC, CNN) on deck to distract the passengers from their impending fate with soothing music. The owners of the ship (Wall Street, Washington politicians, crony capitalists) aren’t worried. They collected their fees upfront and over-insured the vessel. They anticipate a windfall when the ship sinks. It worked last time.

To avoid mass panic, the crew (government apparatchiks) has locked the youthful poor peasants (Millennials) below deck. The captain and his crew are content to let them go down with the ship. They’ve decided the women, children, and senior citizens (Middle Class) can also be sacrificed. The financial elite ruling class (financers and bankers) are piling into the boats with the ship’s jewels, escaping the fate of the peasants. The captain (Ben Bernanke) has no intention of going down with the ship. In a cowardly act, he leaps onto the 1st lifeboat to be launched. We are on a voyage of the damned. The great cruise liner (United States) has a fatal wound and is headed for a watery grave. Are we going to let the owners, captain and crew dictate who will be saved in the few lifeboats or will we rise up and throw these guilty parties overboard?

It comes down to the abuse of power by a few evil men and their henchmen as they have centralized their control over our financial, political, economic and social institutions. The existing social order is an ancient, rotting, fetid swamp of parasites that will be drained during this Fourth Turning. The Millennials are rising and will be the spearhead of the coming revolution. As each day passes they will become a more powerful force and the power of the existing regime will wane. Meanwhile, the band will play on as the ship of state descends into the abyss.

Nobody ever talks about generational conflict. Who wants to bring up that the old are eating the young at the dinner table? How are you going to mention that to your boss? If you’re a politician, how are you going to tell your donors? Even the Occupy Wall Street crowd, while rejecting the modes and rhetoric and institutional support of Boomer progressives, shied away from articulating the fundamental distinction that fills their spaces with crowds: young against old.

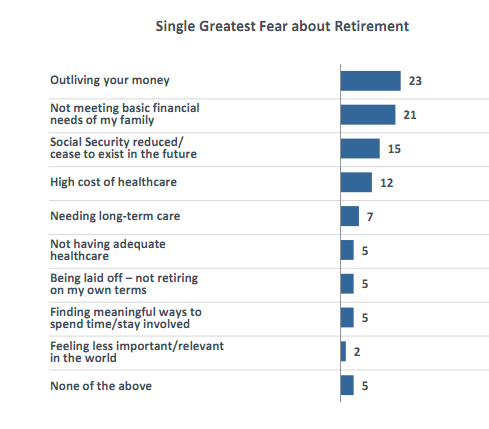

Nobody ever talks about generational conflict. Who wants to bring up that the old are eating the young at the dinner table? How are you going to mention that to your boss? If you’re a politician, how are you going to tell your donors? Even the Occupy Wall Street crowd, while rejecting the modes and rhetoric and institutional support of Boomer progressives, shied away from articulating the fundamental distinction that fills their spaces with crowds: young against old. Only 58 percent of Boomers have more than $25,000 put aside for retirement, so the rest will either starve or the government will have to pay for them. But the government’s future ability to pay is decreasing rapidly precisely because the Boomers splurged so heavily during the Bush and Clinton years. Public debt per person in the United States currently stands at $33,777. George W. Bush inherited a public-debt-to-GDP ratio of 32.5 percent and brought it up to 54.1 percent during a period of economic growth. (The money borrowed from the future paid for massive tax cuts, with no serious reductions in domestic spending, two expensive wars, and a prescription-drug benefit added to Medicare.) Under Obama, the debt-to-GDP ratio has risen to 67.7 percent and is projected to rise to 74.2 percent this year.

Only 58 percent of Boomers have more than $25,000 put aside for retirement, so the rest will either starve or the government will have to pay for them. But the government’s future ability to pay is decreasing rapidly precisely because the Boomers splurged so heavily during the Bush and Clinton years. Public debt per person in the United States currently stands at $33,777. George W. Bush inherited a public-debt-to-GDP ratio of 32.5 percent and brought it up to 54.1 percent during a period of economic growth. (The money borrowed from the future paid for massive tax cuts, with no serious reductions in domestic spending, two expensive wars, and a prescription-drug benefit added to Medicare.) Under Obama, the debt-to-GDP ratio has risen to 67.7 percent and is projected to rise to 74.2 percent this year.