By Doug Casey

International Man: In practically every country, the allowable limit for cash withdrawals and transactions continues to be lowered.

Further, rampant currency debasement is lowering the real value of these ridiculous limits.

Why are governments so intent on phasing out cash? What is really behind this coordinated effort?

Doug Casey: Let me draw your attention to three truths that my friend Nick Giambruno has pointed out about money in bank accounts.

#1. The money isn’t really yours. You’re just another unsecured creditor if the bank goes bust.

#2. The money isn’t actually there. It’s been lent out to borrowers who are illiquid or insolvent.

#3. The money isn’t really money. It’s credit created out of thin air.

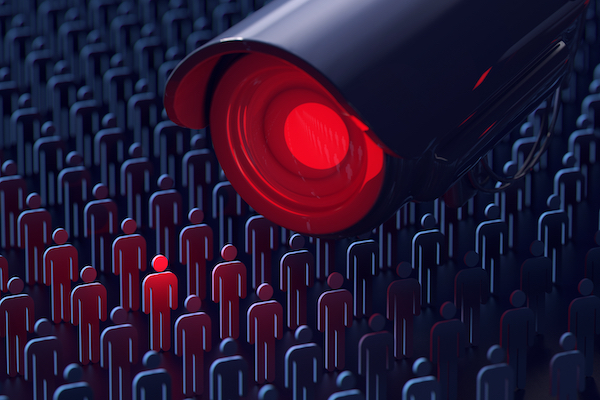

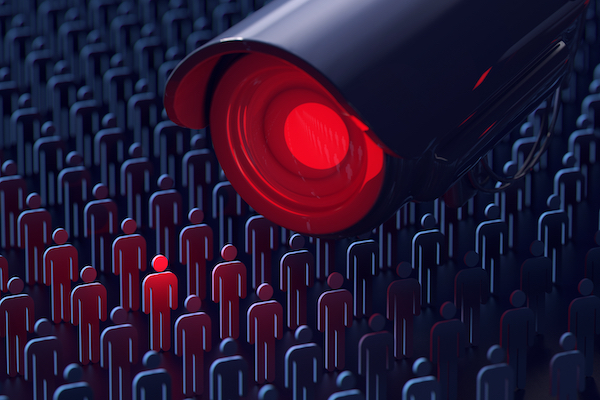

The point is that cash is freedom. And when the State limits the utility of cash—physical dollars that don’t leave an electronic trail—they are limiting your personal freedom to act and compromising your privacy. Governments are naturally opposed to personal freedom and personal privacy because those things limit their control, and governments are all about control. Continue reading “Doug Casey on the Death of Privacy… and What Comes Next”