I’ve posted this March 2009 article by Doug Casey a number of times in the past. With the recent info about military exercises in our communities, I was reminded of his article. The sections about Civil Unrest and particularly how sociopaths are drawn into the police and armed forces at times like these. His points about the Germans being a highly educated society with centuries of creating art, literature, and architecture needs to be understood. If it happened in Germany, it can happen here.

Street Fighting Man

From Doug Casey

Chairman, Casey Research

Published Jul 29, 2009

For decades, Doug Casey, legendary contrarian investor and financial best-seller author, has been foretelling the advent of a “Greater Depression.” Recently, as we are drawing closer to feeling its full impact, Doug has been elaborating on the economic ifs, hows, and whats of the imminent crisis. In this article, he focuses his, as usual, politically not-so-correct musings on how it will change the face of American society.

Longtime readers know my standard response to questions about the severity of the Greater Depression: It’s going to be worse than even I think it’s going to be. “Coming Collapse” books will undoubtedly accumulate into an entire genre in the next few years, as they did a generation ago. This time it’s not just fear mongering, although things won’t get as bad as in James Kunstler’s book The Long Emergency and certainly not as rough as in the movies Road Warrior or I Am Legend. But it’s a good bet that a lot more is going to change than just some features of the financial system. Let’s engage in a little speculation as to the shape of things to come.

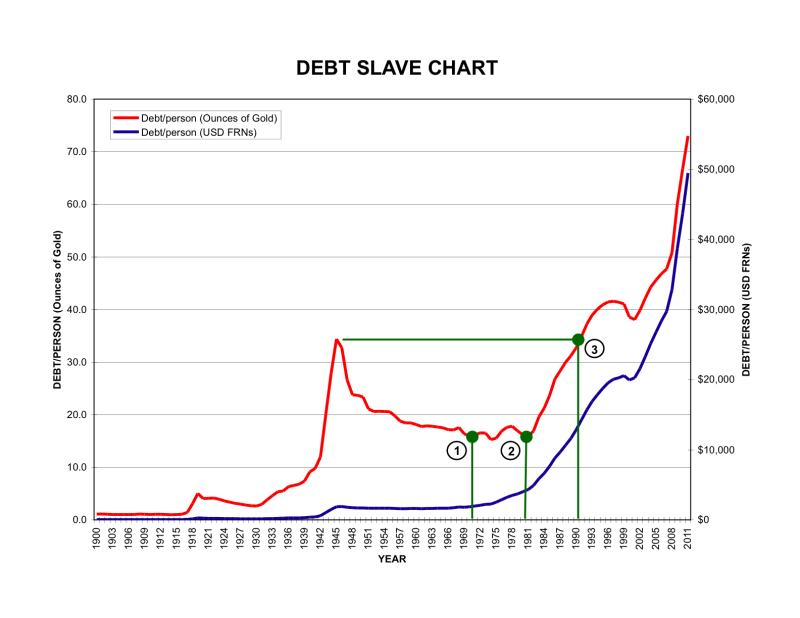

I’ve long believed that this depression would not only be much different but much worse than the unpleasantness of the ’30s and ’40s. In those days, only a few people were involved in the financial markets; now almost anyone with any assets at all is a player. In those days, there were no credit cards, consumer debts, or student loans; now those things are ubiquitous. It’s true that nobody will lose any money because of bank failures this time around; instead, everybody is going to suffer a loss from a collapse of the U.S. dollar, which is much worse.

In the ’30s and ’40s, the U.S. population was still largely rural in character, including people living in the cities. The average American was just off the farm and had a lot of practical skills as well as traditional values. Now he has skills mainly at paper shuffling or in highly specialized technologies, and it doesn’t seem to me that the values of hard work, self-reliance, honesty, prudence, and the rest of the Boy Scout virtues are as common as they once were. In those days, the U.S. was a creditor to the world and the world’s factories to boot; now there are perhaps 8 trillion dollars outside the U.S. waiting to pour back in, and the country is all about consuming, not producing. Even with what the New Deal brought in, there was vastly less regulation and litigation, leaving the economy with much greater flexibility to adjust and innovate; today, few people do anything without consulting counsel.

Of course things are immensely better today than 80 years ago in at least one important way: technology. I love technology, but unfortunately, improvements in that area do nothing to prevent an economic depression or many of the ancillary problems that will likely accompany this one. In fact, it can be a hindrance in some ways.

So, accepting the premise of a depression, let’s examine some of its likely consequences.

Civil Unrest

I’ve puzzled over who will go into the streets as the depression deepens and when they’ll do it. Nikolai Kondratieff, of Long Wave fame, was of the opinion that the natives tend to get restless at economic peaks (like the late 1960s, when riots broke out all over the world) and at economic troughs (like the 1930s, when the same thing happened). His reasoning is not dissimilar from that of Strauss and Howe, authors of The Fourth Turning. At peaks, people are just feeling their oats, which can evidence itself domestically in riots inspired by rising expectations, and internationally in optional sport wars, like that in Viet Nam. Such peak-time disturbances are troublesome but don’t really threaten society. That’s largely because when times are good, people feel they have a lot to lose and they believe things can get even better. In prosperous times, people don’t usually feel like overthrowing the government or transforming the basis of society.

Not so at economic troughs. People believe they have little to lose, they’re eager to hang those they believe responsible for their problems, and they’ll listen to radical or violent proposals. We’re now just entering what will likely be the worst economic trough since the Industrial Revolution.

But why do humans tend to riot when the going gets rough? How can they think that solves anything? Do they believe it’s going to make their jobs or money reappear? Perhaps I ask that question only because I can’t see myself rioting. You and I might discount the thought of Americans going wild, because we wouldn’t likely join them. But we’re not, I suspect, the average American. People, throughout history, have always been prone to violence when times get tough. Is there any reason that should change now?

Recently, there have been — really for the first time in this downturn — reports of large, angry demonstrations all over the world. The UK, France, Eastern Europe, now China. If a place like Iceland, as placid and homogeneous as any in the world, can blow up, then any place can. And probably will.

A rioter is typically an angry person looking for vengeance because he blames someone else for his problem. So far, rioters seem to be directing their attention at governments. Correct target, of course, but they don’t have the rationale quite right. They’re not angry because governments inflated the currency, promoted fractional reserve banking, and nurtured all the cockamamie socialist programs that caused this crisis. Not at all; they rather liked all that. They’re angry only because their governments haven’t adequately protected them from the consequences of what they did. So as conditions worsen, we can expect governments worldwide to pull out absolutely all the stops to show they’re “doing something.” And round up scapegoats to satisfy the mob and divert anger from themselves.

I fully expect civil unrest to spread everywhere, simply because the depression will spread everywhere. It will be worst in places that have been most overextended, most debt leveraged, most urban, and have the largest numbers of unemployed workers — the U.S., Europe, and China.

In the last couple of generations, most rioters in the U.S. have been students who basically just raise some hell on their campuses and inner-city blacks who burn down their own neighborhoods. Maybe the students who’ve wasted a huge amount of time and money in gender studies and sociology will get angry as they figure out they’re not going to have jobs when they graduate — forget about making $100,000 plus as an investment banker. Maybe blacks, who have apparently been hurt the worst by subprime lending and still may be the last hired and first fired, will take to the streets. Maybe. But I think it’s more likely the turn of the Mexicans and other Latinos. They’re the ones raided by la migra and stopped at checkpoints, whether they’re legal or not. They’re the ones who may be implicated in the wave of violence flowing up from northern Mexico. There is a real strain of revanchist nationalism throughout their community that hopes for the reconquista of lands the Anglos stole in the 19th century. And they have all the other problems you might expect with an ethnic underclass.

But will ordinary middle-class Americans riot? I don’t expect it until later in the game. Union members will be treated well by the Obama regime. And most whites live in the suburbs; it’s tough to get people who live in detached houses out into the streets. Ozzie and Harriet just don’t seem likely to burn down their house, even if the bank owns it. Besides, a lot of the parents are on Prozac and their kids on Ritalin. Of course, on the other hand, most of the people who perpetrated mass murders over the last 25 years were on some type of psychiatric drug.

Is there a catalyst that could turn your neighbors into a mob? Two possibilities are gun control and higher taxes, discussed below. But my guess is that riots will be headed off by the police, who are far more numerous, militarized, and better equipped than ever before, and by the military itself. You may think the cops and the military (and today most cops are exmilitary) would never turn on their fellow citizens, but you’d be wrong. Cops and soldiers are far more loyal to their colleagues and their organizations than they are to either some constitution or, absolutely, the mob that’s throwing bricks and bottles at them. They are also among the forces pumping for gun control.

Gun Control

This issue is potentially explosive. Although, sadly, gun culture in the U.S. isn’t nearly what it was even a generation or two ago, it’s still pretty strong in some regions. Most states make the open or concealed carrying of handguns a simple matter, and there’s evidence lots of people are taking advantage of it. Personally, I find it hard to fathom the psychology of people who want to disarm society. From a strictly practical point of view, the idea of having to engage in hand-to-hand combat, half naked, with an intruder in the middle of the night is most unappealing. Especially since the odds of that happening are going way up in the near future. Everyone should have a gun in his nightstand, at a minimum.

But that’s only a fraction of what gun ownership is really about. A free person should have the right to possess whatever he desires. End of story. And only slaves, or those with a slave mentality, comply with no thought of resistance when they’re told what they can or cannot own, especially if compliance means disarming themselves.

I’ve often wondered what would have happened in Germany after Kristallnacht if every Jew had been armed. None were, of course, because strict gun control had been imposed shortly after Hitler came to power, and like good little lambs, the population complied with the law. But my guess is that few would have defended themselves against the Gestapo anyway. Partly because they would have figured they were certain to get into serious trouble if they resisted, and partly because they couldn’t imagine the fate that actually awaited them. It wasn’t until the Warsaw Ghetto uprising in 1944, very late in the game, that people could finally read the writing on the wall and summoned the courage to fight.

If you follow these things, you’ll note that there’s been a lot of buzz about severe firearms regulation since Obama’s inauguration. Bills are being discussed about things like a national firearms registry, reinstituting the so-called “assault weapons” ban, requiring secure locks on all weapons, prohibiting the import of ammunition, and levying a substantial tax on ammunition, among other things. No outright prohibition, because they know that would catalyze gun owners. But they keep dialing up the pressure, moving toward a de facto ban.

I’ll guess there are at least two to three million Americans who adhere to a couple of succinct mottos: 1. You can have my gun when you pry it from my cold, dead fingers, and 2. It’s better to be tried by twelve than carried by six. This is a group that could catch fire at some point. But I don’t think it’s imminent, simply because the chances of outright prohibition of gun ownership are slim. The analogy of the frog in a gradually heating pot is apt. The taxpayer must also feel like a frog.

Tax Revolt

State and municipal governments all over the country are operating with rising outlays and radically declining incomes and so are running large deficits that add to their already massive debt. Since they can’t print dollars, they’ll raise taxes further, as New York and California have recently done. Most people don’t have any philosophical objection to taxes; they accept them, considering them part of the human condition, like disease or death. That’s unfortunate, of course, in that taxation is neither moral nor necessary. But such fine points of philosophy absolutely never enter the public debate.

What will be debated is the level of taxation. The last time we had widespread agitation on taxes was during the last serious recession, in the late ’70s. The result was things like Prop 13 (which capped property taxes in California for some homeowners) and the Reagan tax reforms.

I expect there will be serious whining about taxes this time around as well, but little will come of it. To start with, like every other organism on the planet, government puts its own interests first; society comes in a distant second. Actually a distant third, after powerful individuals who are wired to politicians and bureaucrats, and groups that hire the right lobbyists. Every level of government is more desperate for money than ever. Your taxes are going through the roof, and you’re going to see lots of new ones. Don’t expect any support from Boobus americanus. About half don’t earn enough to pay income tax. Most are net tax beneficiaries. And low taxes have somehow become associated with the late disastrous crackup boom and the corrupt Bush regime. So a popular tax revolt looks like a real long shot.

At the same time, a portion of the productive people in the country feel genuinely resentful at having to subsidize the losers and ne’er-do-wells. What are they going to do? I think they have only two alternatives. Tax evasion, which is both hard and increasingly risky, since the IRS will be hiring plenty of freshly unemployed financial workers. And expatriation. My guess is that scores of thousands of Americans are going to make “the Chicken Run” (as Rhodesians called it) in the next few years.

But the biggest danger to your personal freedom and your wealth, as well as to the U.S. as a whole, is likely to be war.

War

It always impressed me as odd that while Obama ran on a platform of ending the pointless and counterproductive adventure in Iraq, he wanted to ramp up the war in Afghanistan. What possible reason could anyone have for wanting to fight an optional war in what may be the most backward and xenophobic place on the planet? Even if every Afghan made a personal pledge of Death to America (which they eventually will, thanks to the occupation), who cares? Who cares if the Pygmies of the Ituri Rainforest or the Yànomamö of the Amazon join them? It’s strange that no one ever questioned Obama on this nonsensical and contradictory policy.

Now it seems he’s very slow in leaving Iraq. I expect the reason is that the U.S. has built elaborate bases the size of small cities that they’re loathe to leave, partly on general principles and partly because they might be needed to attack Iran or Pakistan. The Obama regime is literally asking for trouble in both places. And partly because he knows that the collaborators set up to run the Iraqi government will promptly be deposed, and probably executed, by whoever might win the civil war that would ensue if the U.S. really left. The USG is apparently set on having a stooge in charge of both Iraq and Afghanistan.

The National Security State has a life of its own. Renditions haven’t been stopped. Guantanamo still operates, as do other overseas prisons holding thousands. Military spending not only won’t be cut, it will likely rise.

Wars start for all kinds of reasons. But tough economic times probably rank number one as a cause. The 1930s were a natural overture for the ’40s. Politicians like to find a foreign enemy to blame problems on. Theft of foreign resources can seem like a good idea. And part of the economic mythology fabricated by the malevolent and repeated by the ignorant is that WWII cured the last depression.

Will there be another 9/11? It’s a good bet, but there’s no way it will involve airplanes; the 50,000 zombies employed by TSA serve absolutely no purpose except to accustom Americans to being treated like prisoners. One possibility is the surreptitious placement of one or more nuclear devices in U.S. cities. As Pakistan disintegrates, their nuclear arsenal may fall into quite irresponsible hands. Or, perhaps, devices could be procured in a number of ways from Russia, India, Israel, or North Korea. Another, much more likely scenario is a repetition of what happened in Mumbai recently. A small force of dedicated and well-armed operatives could create unbelievable havoc in a U.S. city or in several at once. And probably will. Americans just don’t appreciate how little people in the Islamic world like having aggressive, blue-eyed teenagers kick their doors down in the middle of the night, among other pranks.

You may be thinking that, with the American military the most powerful in the world, it’s not about to lose a war. I question that. The bloated military is a major factor in bankrupting the U.S., and a bankrupt country can’t win a war. Its $6 billion carriers, $1 billion B-2s and $400 million F-22s are all built to fight a kind of enemy that no longer exists. They’re sitting ducks for massive numbers of cheap missiles and jihadists that can swarm them where they’re parked. The military wanted to fight WWI with cavalry and WWII with battleships. They’re seemingly doomed to a repeat performance in the next major conflict.

In short, everything on this horizon looks very grim for a long time to come. Incidentally, the U.S. military is by far the world’s largest single consumer of oil.

Peak Oil

There hasn’t been much discussion of this since oil has come down from its July 2008 peak near $150 to its recent low of close to $30. Longtime readers know I’m philosophically quite reluctant to give credence to any theory that would seem to imply we can run out of anything. I come down firmly on the side of Julian Simon. Which is to say resources are essentially infinite, and technology and capital can solve almost any problem in the material world. That said, there are problems that need to be solved. One is presented by the geological theory of M. King Hubbert, who predicted in the 1950s that the production of light sweet crude in the continental U.S. would go into irreversible decline by the early ’70s. He was correct. He also predicted that the same would happen on a worldwide basis in the first decade of this century. It now appears production has maxed out at about 80 million barrels a day and is headed down.

This isn’t the time or place for a detailed discussion of why and how this is true. It’s certainly not the end of the world, as some appear to believe. Just a major inconvenience. Practically infinite power is available from a wide variety of sources, starting with nuclear. The problem is that oil is a particularly concentrated, convenient, and (in the past) cheap source, so the entire world’s economy has been built around it. It will take a decade or so to adjust to the much, much higher prices that will be needed to bring consumption into balance with production. And absolutely everything that relies on oil is going to become much more expensive — especially transportation (for obvious reasons) and food. Food is interesting in that mass production is highly mechanized and oil intensive, as well as fertilizer and pesticide intensive — which again rely on hydrocarbons. The oilfood problem is aggravated by so much of what we eat being shipped very long distances.

Anything is possible, of course, but I think the most likely scenario is simply a large reorientation in patterns of production and consumption as a result of $200 oil. This would be tough enough by itself. But it’s going to put tremendous extra strain on the average American at exactly the time he’s already under maximum strain from a shrinking economy.

Right now things aren’t so bad, because energy prices are low. The depression has cut oil consumption and, conveniently, prices as well. That’s taken a lot of pressure off the average American’s pocket book and at a felicitous moment. And prices may stay low for a year or so as people the world over economize. But oil consumption doesn’t need to rise to put pressure on the price; from here, the main pressure is likely to come from falling supply, not rising demand. So oil prices are likely to start heading up, for strictly geological reasons, even as the depression grows deeper. That will prove most uncomfortable. And will have significant consequences for two mainstays of U.S. culture: cars and suburbia.

Collapse of Suburbia and the Car Culture

Suburbs are creatures of the automobile. I’ve been a car buff my entire life. I love cars for their technology. I love them because they’re fun. But most of all, I love them because even more than the ship, the train, and the airplane, they liberate the average person to — cheaply and quickly – go anywhere he wants, whenever he wants. They’ve made it possible for people to break the mold of the medieval serf tied to the community he was born into. I don’t think cars are going to disappear, but the internal combustion engine is, as a result of Peak Oil, on its way out. I suspect battery power will start rapidly replacing gasoline and diesel. The problem lies in the transition, which is going to be expensive, considering the huge sunk investment in the current technology. There’s going to be an interim period, when people can’t afford to drive their pickups, SUVs, or practically anything else hundreds of miles a week to distant work places and kids’ soccer games or on promiscuous shopping trips. But neither will they be able to afford a new electric car.

American culture revolves around the car. The car facilitated the growth of suburbs and exurbs, shopping malls and big boxes, most of which will become completely uneconomical with the rapid decline of the car. That’s entirely apart from the suburbs and exurbs being exactly where people already can’t make their mortgage payments. And can’t afford to shop. They can’t get by even at current bargain oil prices in the $40 to $50 range. It’s going to be much tougher when gas is $8 a gallon; if they can get a job, they’re going to have to live within a few miles of it.

Entirely apart from that, people aren’t going to be buying much stuff to store in the houses they can’t afford. As George Carlin pointed out in his famous routine about “Stuff” (http://www.youtube.com/watch?v=MvgN5gCuLac), that’s what houses are for — storing stuff. And people are going to be liquidating what they have, not buying more, when they won’t even have a proper place to store it. I’d hate to be in the furniture business over the next decade. Even if unemployment weren’t going much higher.

Unemployment

The official numbers say unemployment is 7.6%. But just as the definition of inflation keeps evolving to accommodate a number that looks better than the reality, the same is true for unemployment figures. John Williams’ Shadow Government Statistics (www.shadowstats.com) computes the figures the way the government used to — mainly by adding back in parttime workers and those considered “discouraged.” They show 17.5% as the historically comparable unemployment figure.

Society has been living above its means for well over a generation, long enough to ingrain unsustainable patterns of production and consumption in the economy. Did everybody need/have a personal trainer 20 years ago? Was “shopping” a major recreational activity in the days before everyone had a pocketful of credit cards? Do all kitchens really need granite counter tops? I think not. As people cut down to the bare basics to enable themselves to rebuild capital, millions and millions more workers are going to have to find other things to do. And, while they’re figuring out what, cut back their consumption drastically as well.

I suspect the readjustment will push unemployment to at least the levels of the Great Depression, which would mean going past 25%. But some will argue: “Yes, but we now have a safety net to catch the fallen. That will make it less serious.” No, it will make it more serious and more prolonged as well. The so-called safety net consumes capital that could have been used productively. It decreases the urgency for each person to find a solution to his own problems. And it has given people a false sense of security, leaving them to save less for a rainy day. The looming collapse of things like Social Security and Medicare will be a bigger disaster than all the banks failing. The Social Security “trust fund,” which has been a swindle, a Ponzi scheme in slow motion, and a moral wrecking ball almost from its beginning, is going to go much deeper into the red. Before they collapse, Medicare, Medicaid, and their cousins will be expanded by some form of free care for the legions of the newly unemployed. Will doctors and nurses be made indentured servants (such as through mandatory voluntary community service) to provide care for everyone who may need it? Perhaps not as long as taxes can be raised further on the middle class.

Sorry this has all been so gloomy so far. Now that the mood is set for recounting all the problems that are going to beset us, some of you are probably saying to yourselves: “Yes, and that’s on top of global warming.”

Global Smarming

This is on just about everybody’s list of Big Problems. Except mine. I’m not a professional climatologist, or even an amateur, so I lack any technical qualifications for commenting on the subject – like almost everybody else who does, prominently including Al Gore. But my guess is that in the next decade, the global warming hysteria (and that’s exactly what I believe it is) will be viewed, with embarrassment, as one of the great episodes in the history of the delusions of the crowd.

Have you noticed that “global warming” is gradually being supplanted by “climate change”? The fact is that the earth’s climate has been changing constantly for at least 500 million years and has generally gotten much cooler over that time. It has certainly warmed since the end of the last Ice Age, 12,000 years ago, and was much warmer than now at the height of the Roman Empire. It cooled during what became known as the Dark Ages, warmed again during medieval times (when grapes grew in Greenland and northern England), and cooled again during the Little Ice Age (which ended about 200 years ago). During the ’70s, as you may recall, some magazines ran cover stories featuring glaciers intruding into New York City. And for the last ten years, it appears the Earth has been cooling, although that’s not widely reported. Change is a constant when it comes to the climate, and warmer is generally better.

Is the science “settled” on the subject? The very concept strikes me as ridiculous, in that science is rarely “settled” on anything short of it being proclaimed a law of nature. And, contrary to popular opinion, it seems most scientists with credentials in the field are either agnostic on the question or debunk the proposition of anthropogenic global warming. But the intellectual climate is such that most scientists are afraid to question out loud the reality of warming. Since almost all funding today comes from politically correct sources, namely the government and foundations, the money goes to those who are known to be looking for the “right” answers. Science has been corrupted.

Of course man can change the environment. But our power to do so is trivial next to the sun, volcanism, cosmic rays, and the churning ocean. None of those forces gets any mention in the popular press, which fixates on carbon, which has replaced plutonium as public enemy #1. Carbon may be the basis of life on earth, but it’s supposed to be our new enemy nonetheless. The masses, who don’t even know carbon is a “natural” element and think the periodic table is a piece of antique furniture now feel guilty about breathing, because exhaled breath is a source of CO2.

Interestingly, a rise in atmospheric carbon dioxide levels doesn’t precede but follows, by several hundred years, phases of global warming. Everything you hear about saving the planet through carbon credits is as ridiculous and counterproductive as recent disastrous programs to turn corn into ethanol. In any event, carbon dioxide’s effects as a greenhouse gas are completely overwhelmed by those of water vapor. God forbid anyone warns the public of the numerous dangers posed by compounds like dihydrogen monoxide (also known as hydroxic acid).

As a lifelong science buff, I find the whole subject quite interesting and am tempted to do an article on it. The reason I mention it here, however, is that the global warming hysteria, as opposed to possible cyclical global warming itself, has serious economic consequences. The chances are excellent that governments will direct scores of billions of dollars into further research, devising computer projections of catastrophe to come, and fighting the presumed warming.

Much more serious are laws they’ll pass in the war against carbon (and methane, which amounts to a war against cattle and sheep), which could retard the economy by hundreds of billions of dollars. Most serious, in the long run, is likely to be a discrediting of science itself in the eyes of the common man once anthropogenic warming is exposed as a giant false alarm.

The Political Future

We can be quite confident the economic future is going to be grim. The military future, ugly and busy. The social future, turbulent. So is it reasonable to expect politics as usual? That would be rather anomalous. Especially since the trend towards much more State power, centered strongly on the executive, has been in motion, and accelerating, for at least four generations in the U.S., even during the best of times. No surprises there. That is pretty much what observers of history from at least Plato on would expect.

In that America is recently deceased and only the United States survives, I see no reason that the trend won’t continue accelerating, to be supercharged by the next Black Swan that might land. After the next real, fabricated, or imagined 9/11-style incident occurs or major war begins, it will be surprising if a state of emergency isn’t declared. Perhaps martial law in the U.S. will, perversely, provide the impetus needed to “bring the troops home,” in that they’ll be needed more in the U.S. than in Fuhgedabouditstan or wherever.

I leave the practical implications of that entirely to your imagination. But to maintain what little will be left of domestic tranquility at that point, the authorities will almost certainly feel compelled to round up dissidents, potential troublemakers, tents, libertarians, and the usual suspects generally. It seems inevitable to me, and I’d prefer to be somewhere else when it happens. I’m loathe to make outlandish political predictions, if only because the inevitable isn’t necessarily the imminent. But if the U.S. survives the current crisis in its present form, I’ll be surprised.

As always, there’s a bright side. Obama will be a one-term president. And, as middle- and upper-middle-class Americans come to see the government less as a cornucopia — that’s inevitable, because the cupboard is empty — they’ll start to see it ever more as a predator. The government will become increasingly delegitimized in the eyes of what’s left of the middle class. But what will they do? If they still have a home in the suburbs or a condo in the city, they’re not going to burn it down like the poor. I’m not even sure they’ll riot. But they will see the discontent. New affinity groups will coalesce. And they’ll wait until something really catalyzes them. Is another revolution possible? Why not? The U.S. is just another country at this point.

I’m convinced that the nationstate, which is to say countries with governments based on geography, is on its way out fairly soon. And good riddance. Perhaps the U.S. will be among the first. What form of social organization will replace it? [Note: That will be the subject of an article soon to come in The Casey Report.]

In the near future, though, there will be a struggle between the best features of what little is left of America and the worst elements of humanity, whom we have in some abundance.

Emigrants and Sociopaths

Americans no longer appear to be a special breed. Of course absolutely every nation likes to think it’s a special, better breed – the Chinese, the Japanese, the British, the French, the Germans, absolutely everybody. It’s a stupid but universal conceit, like the one putting God (presumably Yahweh) on their side during a war.

I used to fancy Americans actually could be a cut above simply because they’re all the progeny of emigrants, and there are at least three reasons emigrants tend to be the “best” kind of people — at least from the point of view of someone who values freedom. First, emigrants tend to be more enterprising than their neighbors at home, willing to leave everything they have to pursue opportunity. Second, they tend to be harder working, since they know they’ll get nothing they don’t earn from strangers in a new land. Third, they tend to be anti-political, since political elites and conditions are usually what caused them to emigrate in the first place. Whether these things are because of a genetic predisposition or whether it’s simply a cultural artifact within some families and groups, or both, I think it’s a fact.

From the founding of the country, America has always had a strong emigrant ethos, and that’s one of the things that has made it different and better. But all things degrade and revert to the mean with the passage of time. The country is now a fugitive from entropy.

Another reason for taking a pessimistic view is that — notwithstanding the point I made above — there’s no reason not to believe there’s a fairly uniform distribution of sociopaths across time and space, including in America today. All countries, in all eras, have them — but in good times, they stay under their rocks. Who would have guessed that the Germans of the last century, who had much more than their share of writers, composers, philosophers, scientists, plain middle-class shopkeepers, and a well-educated, orderly population would have bred the Nazis? The Turks in the ’20s, the Russians in the ’20s and ’30s, the Chinese in the ’50s and ’60s, the Serbs in the ’90s, the Rwandans It would be easy to recount dozens of recent examples of perfectly ordinary countries that have gone bonkers. The fact is that your neighbor or your mailman, who pets his dog, hugs his kids, and plays softball on the weekends, might exhibit a much less appealing, indeed an appalling, side when social conditions change.

You’ve, of course, heard of the Milgram experiment, wherein researchers asked members of the public to torture subjects with electric shocks, all the way up to what they believed were lethal levels. Most of them did it, after being assured that it was “alright” and “necessary” by men in authority.

The problem arises when a society becomes highly politicized. In normal times, a sociopath stays under the radar. Perhaps he’ll commit a common crime when he thinks he can get away with it, but social mores keep him reined in. However, once the government changes its emphasis from protecting citizens from force to initiating it with laws and taxes, those social mores break down. Peer pressure and moral opprobrium, the forces that keep a healthy society orderly and together, are replaced by regulation enforced by cops funded by taxes. And sociopaths start coming out of the woodwork and are drawn to the State, where they can get licensed and paid to do what they’ve always wanted to do. It’s very simple, really. There are two ways people can relate to each other: voluntarily or coercively. The government is pure coercion, and sociopaths are drawn to its power and force.

After a certain point, a critical mass is reached. The sociopaths who are naturally drawn to government start to dominate it. They reset the social mores of the country they control. And it’s game over. I suspect we’re approaching that point.

A Happy Note

There’s no telling how bad things will actually get. The worst thing that could happen is a major war. But, barring that, what’s happened in Zimbabwe, surprisingly, actually offers cause for some optimism. I was last there a couple of years ago, when, although it was a disaster, it hadn’t descended into the absolute catastrophe that’s going on now. Still, with draconian taxes, regulations, and hyperinflation, life goes on.

Plumbers, electricians, and mechanics still repair things. Farmers still grow things — albeit on a much smaller scale. Stores still stock merchandise, even if there’s not much of it. And I just heard yesterday from an ex-Zimbabwean that some of his friends there still play polo. And Zim is about as bad as it gets. But maybe it’s also reason for pessimism. Why, out of the whole damned country, wasn’t there at least one man with the courage to shoot Mugabe?

Look at Eastern Europe. After a horrible depression that lasted from about 1930 to 1990, the whole region blossomed in the space of a decade. It went from the grimmest dystopia, a veritable hologram of Mordor itself, to being almost indistinguishable from Western Europe. It shows how quickly things can improve, as long as there isn’t a backdrop of purposeful stupidity. Try as governments may to destroy it, there’s an immense amount of capital that the world has built up over the past few centuries. Individuals and small groups will continue building their capital everywhere, notwithstanding any kind of State action. The pace of technology should continue, if not accelerate.

As someone who always looks at the bright side, the final bit of good news I can offer you in this extraordinarily troubled milieu is that things are likely to be very interesting, even quite exciting, over the years to come. Notwithstanding the well-known Chinese curse, I’m not completely averse to interesting times. And remember, you don’t have to be adversely affected by them; they set up opportunities for greater profits than even the wildest bull market.

![[Review & Outlook]](http://sg.wsj.net/public/resources/images/ED-AI932_1stimu_NS_20090127200020.gif)