SCARED YET????

“While Elizabeth Warren attempted to deliver her keynote speech at the Democratic Convention in July, which included an unabashed endorsement of Hillary Clinton after Warren had failed to endorse Senator Bernie Sanders during the critical primary campaign, chants of ‘we trusted you’ could be heard reverberating through the cavernous hall in Philadelphia…

It’s long past the time for the U.S. Senate to stop conducting isolated, piecemeal investigations and undertake the type of in-depth hearings that the Senate held from 1929 to 1932 that led to the public’s understanding of the serial criminal activities on Wall Street that had produced the Great Depression and which led to the passage of the Glass-Steagall Act — legislation which protected this nation for 66 years until its repeal in 1999 during the Bill Clinton administration.”

Pam and Russ Martens, Elizabeth Warren Opens Up Pandora’s Box

“All the big players have been sheep-dipped in a world view that becomes a reflex. The twin seductions of money and Washington group think have led our Wise Men into one disaster after another in both domestic and foreign policy. In view of their lamentable record over the last decade and a half, their advice and counsel is probably no better than that of a snake-handling shaman in the remotest hollow of West Virginia, and certainly a good deal more expensive.”

Mike Lofgren

“After dinner, Larry [Summers] leaned back in his chair and offered me some advice. I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want. But people on the inside don’t listen to them.

Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say.

But insiders also understand one unbreakable rule: They don’t criticize other insiders.

I had been warned.”

Elizabeth Warren, A Fighting Chance

And he said to me, he said, “Neil, you’re a smart guy. You’re a young guy. You’re a talented guy. You got your whole future in front of you. You’ve got a young family that’s starting out. But you’re doing yourself real harm.” And the reason why you’re doing yourself real harm is the harsh tone that I had towards the government as well as to Wall Street, based on what I was seeing down in Washington. And he told me that if I wanted to get a job out on the Street afterwards, it was going to really be hard for me.

And I explained to him that I wasn’t really interested in that. And he said, “Well, maybe a judgeship. Maybe an appointment from the Obama administration for a federal judgeship.” And I said, “Well, again, that would be great. But I don’t really think that’s going to happen with my criticisms.” And he said it didn’t have to be that way. “If all you do is soften your tone, be a little bit more upbeat, all this stuff can happen for you.”

And I felt a real obligation and sense of duty to fulfill the oath that I took in Secretary Paulson’s office on December 15th, 2008 to do the job that I was sent down there to do. But I wasn’t really tempted with a big job on Wall Street. And frankly, if it meant getting a judgeship, compromising the job that I needed to do and was supposed to do, it just wasn’t interesting to me.

When I had my incident with the assistant secretary that my deputy, who had come down from– who’s another former federal prosecutor, who did narcotics work, said to me, Kevin Puvalowski. And he said to me, “Neil, you were just offered the bullet or the bribe, the gold or the lead.”

That’s kind of what happens in a society where the rewards and incentives are, again, nobody’s getting shot in the head thank goodness. But it’s a breakdown of the system.

And in some ways, it creates this false illusion that there are people out there looking out for the interest of taxpayers, the checks and balances that are built into the system are operational, when in fact they’re not. And what you’re going to see and what we are seeing is it’ll be a breakdown of those governmental institutions. And you’ll see governments that continue to have policies that feed the interests of — and I don’t want to get clichéd, but the one percent or the .1 percent – to the detriment of everyone else.”

Neil Barofsky, Interview with Bill Moyers

“Larry [Summers] leaned back in his chair and offered me some advice. I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want.

But people on the inside don’t listen to them. Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say. But insiders also understand one unbreakable rule: they don’t criticize other insiders.”

Elizabeth Warren, A Fighting Chance

“Rich Cordray was still serving as director of the consumer agency under a recess appointment; he hadn’t yet been confirmed by the Senate, which meant that the agency was vulnerable to legal challenges over its work. Dimon told me what he thought it would take to get Congress to confirm a director, terms that included gutting the agency’s power to regulate banks like his.

By this point I was furious. Dodd-Frank had created default provisions that would automatically go into effect if there was no confirmed director, and his bank was almost certainly not in compliance with the those rules. I told him that if that happened, ‘I think you guys are breaking the law.’

Suddenly Dimon got quiet. He leaned back and slowly smiled. ‘So hit me with a fine. We can afford it.'”

Elizabeth Warren, A Fighting Chance

Guest Post by

Having already proven that their institutions are above the law in the aftermath of the financial crisis, executives at the “Too Big to Fail and Jail” banks have decided it’s time to teach Senate Democrats a lesson. Not being content with trillions in taxpayer backed bailouts to protect and further consolidate virtually all wealth within their oligarch fiefdoms, these bankers are irate at the notion that a commoner would dare criticize their unassailable crony privilege.

However, the worst part of this story, is that while Warren is harsher than most of her completely bought and paid for colleagues, she is still pretty meek when it comes to the big bank oligopoly. In her most misguided position, she doesn’t even support an audit of the largest organized crime institution operating within these United States, the Federal Reserve. Oh and for those of you who will claim the Fed is already audited, think again. Read: The Fed Impedes GAO Audits by Destroying Source Documents.

Thus it seems even Warren’s meager push for reform is simply too much for the thin skinned bailout baby banks to handle. From The Hill:

Four major banks are threatening to withhold campaign donations to Senate Democrats in anger over Sen. Elizabeth Warren’s (D-Mass.) attacks on Wall Street.

Representatives from financial powerhouses Citigroup, JPMorgan, Goldman Sachs and Bank of America recently met in Washington and discussed the growing hostility towards big business within the Democratic ranks, according to a Reuters report Friday.

Bank officials cited Warren and Senate Banking Committee ranking member Sherrod Brown (Ohio) as the two main lawmakers leading the charge against them. But the banks have not agreed on how to respond together, with each firm making its own decision on donations, Reuters reported.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it’s 1999, central bankers not only don’t take away the punch bowl – they spike it with 200 proof grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn’t really deteriorating, and the entire façade is supposedly validated by all-time highs in the stock market. It’s nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun – Japan. The leaders of this former economic juggernaut have chosen to commit hara-kiri on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn’t enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers – again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn’t need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn – excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world’s central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it’s with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender – Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

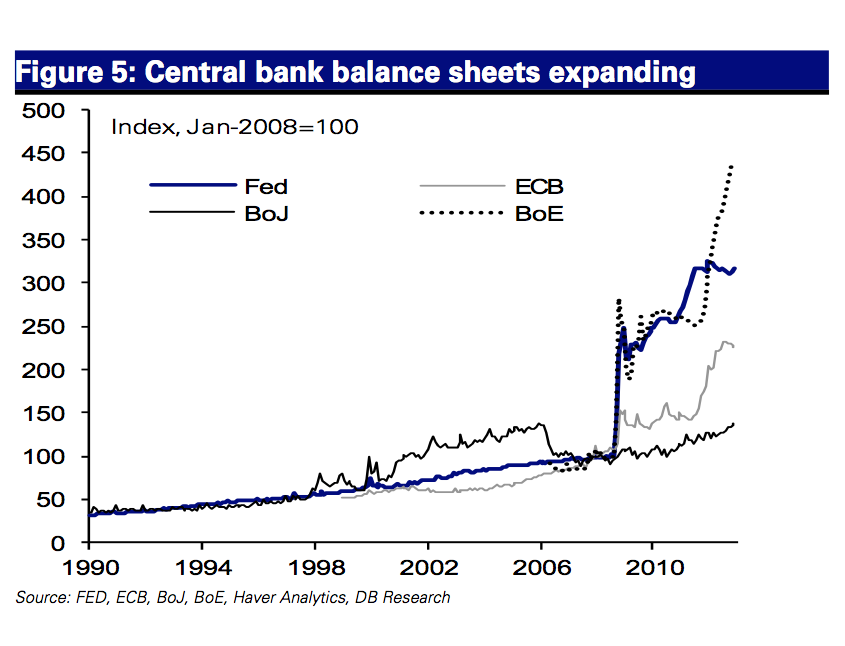

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive “surprise” increase in purchases of bonds and stocks. It wasn’t a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it’s not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn’t even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe’s solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises

“The real owners are the big wealthy business interests that control things and make all the important decisions. Forget the politicians, they’re an irrelevancy. The politicians are put there to give you the idea that you have freedom of choice. You don’t. You have no choice. You have owners. They own you. They own everything. They own all the important land. They own and control the corporations. They’ve long since bought and paid for the Senate, the Congress, the statehouses, the city halls. They’ve got the judges in their back pockets. And they own all the big media companies, so that they control just about all of the news and information you hear. They’ve got you by the balls. They spend billions of dollars every year lobbying lobbying to get what they want. Well, we know what they want; they want more for themselves and less for everybody else.” – George Carlin

After the disgusting example of politicians of both spineless parties bowing down before Wall Street, the military industrial complex and corporate interests this weekend with the passage of a bloated pig of a spending bill totaling $1.1 trillion, how can anyone not on the payroll of the vested interests not admit there is only one party – and it serves only the needs of the wealthy business interests. Obama, champion of the common folk, signed this putrid example of political corruption and corporate capture of the American political system. For all the believers who voted for the red team in the November mid-terms, this is what you got – a bipartisanship screwing of the American people.

The entire episode has been nothing but Kabuki Theater. Both parties have proven to be puppets marching to the tune of Wall Street moneyed interests, while further entrenching the status quo by voting to allow more corporate influence over the election process. Each side of the aisle allowed just enough dissent to make it appear they might not reach an agreement. But at the end of the day Pelosi, Boehner, Reid and McConnell joined hands and gave it to the American public good and hard. And of course we had the candidates for president in 2016 Warren and Cruz playing to their constituents with speeches and maneuvers designed to make them look like fighters for the common man. It was nothing but a show, as they did nothing substantive to stop the bill from passing.

What this entire debacle has proven is that voting doesn’t matter. Your vote is meaningless. Political parties are nothing more than a front for the vested interests. The corrupt politicians are bought and sold by Wall Street and corporate interests. The bills are written by lobbyists for the vested interests. When a spending bill is over 1,700 pages, the purpose is to obscure, hide and insert provisions that will benefit those with money to influence the process at the expense of average Americans. None of the perpetrators in Congress actually read this bill. The public had no say regarding this bill. If this is what bipartisan cooperation looks like, I’ll take gridlock. The system has been so completely captured by those pulling the wires, they no longer even pretend to care what we think. They keep winning and care not about the consequences of their ruthless despicable pillaging.

Politicians decry money in politics when they are paraded onto the mainstream media talk shows. They profess to be men and women of the people, fighting for our rights. So how do they go about getting money out of politics? They dramatically expand the amount of money wealthy political donors can inject into the national parties, drastically undercutting the 2002 landmark McCain-Feingold campaign finance overhaul. A wealthy donor who could only give a maximum of $32,400 this year to the Democratic National Committee or Republican National Committee can now give ten times as much – a total of $324,000. Do you think these wealthy donors might have ten times more influence over government policies, laws, regulations, and tax codes? Do you think these donors are contributing these funds to fight for the rights of average Americans making $50,000 per year? This change just further entrenches the rich vested interests. Your vote just became even more meaningless.

The most outrageous provision in the spending bill is Wall Street putting the American taxpayer on the hook for when their $250 trillion of derivatives of mass destruction blow up the worldwide financial system again. Elizabeth Warren, playing her part in this farce, feigns outrage, knowing it will pass anyway:

“Mr. President, Democrats don’t like Wall Street bailouts. Republicans don’t like Wall Street bailouts. The American people are disgusted by Wall Street bailouts. And yet here we are five years after Dodd-Frank with Congress on the verge of ramming through a provision that would do nothing for the middle class, do nothing for community banks, do nothing but raise the risk that taxpayers will have to bail out the biggest banks once again. You know, there is a lot of talk lately about how Dodd-Frank isn’t perfect. There is a lot of talk coming from CitiGroup about how Dodd-Frank isn’t perfect. So let me say this to anyone listening at Citi —I agree with you. Dodd-Frank isn’t perfect. It should have broken you into pieces. If this Congress is going to open up Dodd-Frank in the months ahead then let’s open it up to get tougher, not to create more bailout opportunities.”

Senator Warren does hit at the heart of the matter. The Too Big To Fail banks should have been made too small to matter after they created the 2008 worldwide financial collapse. Congress should have reinstated Glass Steagall, the insolvent Wall Street banks should have been liquidated or sold off piece by piece, and the American taxpayer shouldn’t have had to pay one dime. Instead, those banks became bigger, more powerful, more arrogant, and more reckless. And now they are writing the laws supposedly regulating them. Regulatory capture at its finest.

Dodd-Frank was already a behemoth mess of a law, written by bank lobbyists, and so complex it was always destined to fail. The law that set up America’s banking system in 1864 ran to 29 pages; the Federal Reserve Act of 1913 went to 32 pages; the Banking Act that transformed American finance after the Wall Street Crash, commonly known as the Glass-Steagall act, spread out to 37 pages. Dodd-Frank was 848 pages long. One of the few beneficial sections of the law was the provision that required banks to “push out” their derivatives trading into separate entities not backed by the Federal Deposit Insurance Corporation. Essentially, this provision prohibited the Too Big To Trust Wall Street Banks from using the deposits of customers to gamble on derivatives, with no capital behind the gambling. Any Wall Street bank that wanted to trade derivatives had to do it in non-insured subsidiaries, and when these trades blew up in their faces, the banks would be solely on the hook. They prefer the they win you lose method.

This spending bill included language written directly by Citigroup and inserted by the politicians in the back pocket of Jamie Dimon and the rest of the Wall Street cabal. Dimon showed no shame as he personally called lawmakers to insist they pass this bill with the gutting of Dodd Frank. Wall Street bankers can now gamble with the deposits of their clients with impunity generating obscene insider profits, and when they inevitably blow up the financial system again the American taxpayer will be on the hook for the losses. In a shocking development, the members who voted for the spending bill had received vastly more political contributions (bribes) than those who voted no. Simon Johnson, former chief economist of the International Monetary Fund and a professor at the MIT Sloan School of Management, concisely sums up the goal of this provision:

“It is because there is a lot of money at stake. They want to be able to take big risks where they get the upside and the taxpayer gets the potential downside.”

And there will be downside. Like Captain Renault in Casablanca, Jamie Dimon and the rest of the Wall Street CEOs will be shocked to find there has been gambling going on in their upstanding institutions of finance, as they cash their $10 million bonus checks. The markets are already overvalued, built on a foundation of debt, and rigged by the Wall Street scumbags. They make Bernie Madoff look like an upstanding citizen. It seems awfully coincidental this provision was inserted into the 1,700 page bill just as the markets have begun to tremor. Wall Street wouldn’t be preparing for another earthquake, would they? The fact that Obama signed this bill is a reflection of him being a spineless toady figurehead, doing the bidding of the ruling class.

The Republicans have run against Obamacare since the day it was passed in 2009. They have threatened to overturn it, de-fund it, and scale it back. This spending bill fully funds Obamacare just as it was passed. Dozens of Republicans voted for a spending bill that fully funds the program they despise. Obama recently subverted the U.S. Constitution once again with his latest executive order allowing illegal immigrants to stay in the U.S. and enjoy our wonderful welfare system. The Republicans were morally outraged and their response was to fund Obama’s executive order to the tune of $2.5 billion. There’s $948 million for the Department of Health and Human Service’s unaccompanied children program — an $80 million increase. The department also gets $14 million to help school districts absorbing new immigrant students. And the State Department gets $260 million to assist Central American countries from where of the immigrant children are coming.

So much for principles, ethics, and courage. You see bipartisanship in Congress means that one side will agree to fully fund the welfare state as long as the other side will fully fund the warfare state, while both sides do whatever Wall Street instructs them to do. Neither side cares that the National Debt increases by $2.5 billion per day. That’s what the Fed is for. The neo-cons in the Republican party were happy, as their dreams of World War III come closer to fruition. There’s $1.3 billion for a new Counterterrorism Partnership Fund; $5 billion for military operations to combat the Islamic State, including $1.6 billion to train Iraqi and Kurdish forces (I thought we already trained them once before); $500 million for a Pentagon-led program to train and equip vetted Syrian opposition fighters; $810 million for ongoing military operations in Europe, including requirements that at least $175 million is spent in support of Ukraine and Baltic nations. And you were worried about Defense cuts. The military industrial complex will never allow their profits to decline. If we run out of real enemies, we just make them up out of thin air – ISIS, or go back to the Cold War playbook and declare Russia to be an imminent threat to our safety and security.

Despite running $800 billion actual (not the BS reported deficits) annual deficits, the political hacks of the ruling party still funnel $3.1 billion per year to Israel, $1.3 billion to the dictator in Egypt, and $1 billion to our puppets in Jordan. This hyper-interventionism in the affairs of countries around the globe, either through military intervention, supplying arms, overthrowing elected leaders, or funding dictators has destabilized the entire world. Russia is not the aggressor on the world stage, as portrayed by the mouthpieces for the state in the mainstream corporate media. The American empire has created the conditions for havoc, disarray and war to flourish. Someone will ultimately do something stupid and the fury of hell will be unleashed across the globe. And it is our fault.

You’ll be happy to know the trucking industry still has some pull in Congress. Their drivers will be allowed to work 82 hours per week, versus the far too restrictive 70 hours per week. When you are driving your economy car on the interstate and that 18 wheeler is barreling down on you from behind, thank Congress when the drowsy dude behind the wheel is working his 81st hour of the week. And if you were a hard working middle income blue collar worker in businesses such as trucking, construction and supermarkets and were promised a pension, tough luck. Hidden inside the bill was a haircut for pensions. This provision allows the promised pension benefits of up to 1.5 million workers and retirees to be cut. It affects the pooled pension plans — called multi-employer plans — of mostly union workers across a bunch of companies, where it looks like the plans won’t be able to cover full benefits in coming decades.

Could it be any clearer that we are nothing but lowly peasants and the aristocracy inhabiting the protected luxury skyscrapers suites in New York City and the government buildings in Washington D.C. have nothing but contempt and scorn for our plight, as they gorge themselves like pigs at the trough of working people’s wealth? They use taxes and inflation to siphon your savings and earnings, rig the markets so they always win, write the laws to favor themselves, and use the mass media and the police surveillance state to crush dissent, control the message and intimidate the masses. The ruling class fears the masses and continues to prepare for a coming conflict. Within the Intelligence Authorization Act for FY 2015, passed this week, was written a new section that grants the executive branch virtually unlimited access to the communications of every American.

Sec. 309 authorizes “the acquisition, retention, and dissemination” of nonpublic communications, including those to and from U.S. persons. The section contemplates that those private communications of Americans, obtained without a court order, may be transferred to domestic law enforcement for criminal investigations. Sec. 309 provides the first statutory authority for the acquisition, retention, and dissemination of U.S. persons’ private communications obtained without legal process such as a court order or a subpoena. The administration currently may conduct such surveillance under a claim of executive authority, such as E.O. 12333. However, Congress never has approved of using executive authority in that way to capture and use Americans’ private telephone records, electronic communications, or cloud data.

The majority of American people still believe they live in a democracy where their vote matters. Sadly, they are living in a delusional fantasy world, as they actually live in a corporate fascist welfare/warfare surveillance state run by one party of vested corporate interests. Until consent is withdrawn and the pigmen are violently confronted, nothing will change. The existing social order will be swept away within the next fifteen years as this Fourth Turning reaches its bloody conclusion. You may think we are all equal under the law, but Orwell knew that some are more equal than others. Can you distinguish the pigs from the men?

“The creatures outside looked from pig to man, and from man to pig, and from pig to man again; but already it was impossible to say which was which.” ― George Orwell, Animal Farm

“Democracy is the theory that the common people know what they want and deserve to get it good and hard.” ― H.L. Mencken

Before you watch the video, I want to highlight an excellent article published this morning by Yves Smith over at Naked Capitalism titled, Yellen Tells Whoppers to the New Yorker. The title doesn’t do justice to the powerful and scathing critique of the fraud that is the current Federal Reserve Chairwoman. In a nutshell, the article exposes how Yellen’s acting routine is worthy of an Academy Award. In her role, she plays a caring, sweet, grandmotherly type figure all concerned about the poor and middle-class, when reality points to a career as a staunch, frontline protecter of the bankster oligarchy.

Before you watch the video, I want to highlight an excellent article published this morning by Yves Smith over at Naked Capitalism titled, Yellen Tells Whoppers to the New Yorker. The title doesn’t do justice to the powerful and scathing critique of the fraud that is the current Federal Reserve Chairwoman. In a nutshell, the article exposes how Yellen’s acting routine is worthy of an Academy Award. In her role, she plays a caring, sweet, grandmotherly type figure all concerned about the poor and middle-class, when reality points to a career as a staunch, frontline protecter of the bankster oligarchy.

From Naked Capitalism (for background, much of the article is criticism of a propaganda piece on Yellen recently published by the New Yorker):

In other words, readers are supposed to take Yellen’s claims at face value, when the Fed’s policy of saving banks by goosing asset prices and convincing itself that ordinary people would benefit because the “wealth effect” would lead to more consumption. The result has been widening income and wealth disparity and corporate profits at record levels as a percent of GDP, meaning workers are getting less than they’ve ever gotten. Yellen as the head of one of the regional Federal Reserve Banks and member of the FOMC can’t escape from responsibility for these policies. And there’s no evidence of meaningful opposition; unlike some Federal Reserve presidents, like Charles Plosser and Dick Fisher, who have often taken issue with the Fed’s official position in their speeches, Yellen made little use of her bully pulpit at the San Francisco Fed.

Although these differences are significant, Lehmann overstates the dichotomy between monetarist followers of Milton Friedman and American Keynesians. In particular, Keynes himself debunked the “loanable funds” fallacy, that putting money on sale would induce businesses to take advantage of the cheap price and borrow and invest (the only ones that do are ones where the cost of money is a major product cost, and that’s financial players, who as we have found, plow it into speculation). Yet you see defenders of the Fed’s actions (usually making the argument that QE was beneficial, if less so than fiscal stimulus would have been) relying on “loanable funds” type arguments.How about the most obvious answer, that Yellen is using this interview to run PR for the Fed. She leading a major institution that is under well-deserved criticism for its obvious preoccupation with banks during the crisis and post crisis period (and Lehmann takes note of that issue, pointing out that the central bank’s critics range from Rand Paul to Bernie Sanders). She’s trying to brand herself as a caring grandmother who can relate to regular folks because she came from the wrong side of the tracks, and the chump public should trust the Fed’s actions as embodying her professed world view. Lehmann promotes this effort to identify the Fed with Yellen’s supposed compassion for regular folk, starting with the article’s subhead: “How Janet Yellen is redefining the Federal Reserve.”And this isn’t all she stood for. Contrary to her pious claims of empathizing with the downtrodden, if you read her testimony during the 1990s, she was regularly described by Senators during her tenure at the Council for Economic Advisers as one of the most hawkish members of the Administration. She advocated cutting veterans’ benefits. She pointedly refused to cite increased concentration in banking as an antitrust risk and approved of communications industry mergers. She supported cap and trade. She favored austerity for Mexico during its 1994-5 crisis. She also stood with Gene Ludwig complained about deadbeat borrowers declaring bankruptcy in 1997, which was tantamount to throwing her support behind the bankruptcy reform bill that eventually passed in 2005. Reversing that bill has been widely cited as one of the most powerful single steps the government could have taken to stem foreclosures, since the threat of bankruptcy would have forced more servicers to restructure mortgages.At the Fed, Yellen is given more credit than she deserves for sounding some mild concern about rising housing prices. She’s also been cited as the best forecaster on the FOMC, but given how the FOMC failed to see the crisis coming, her “success” is tantamount to declaring her the winner of a height competition among peanuts.Yellen’s contention that she’s really out to help little people would be far more credible if she acknowledged her past anti-middle class policy positions and claimed that she’d made a Pauline conversion. But her institutional and political loyalties preclude that.

Yellen’s acting performance is strangely reminiscent of the most disingenuous crony billionaire operating in America today: Warren Buffet. There is no single person who has fooled more people, more of the time than the hamburger eating, ice-cream cone licking, cherry coke slugging. “Uncle” Warren Buffet. As I wrote in the 2011 post, A Wolf in Sheep’s Clothing:

Anyone that has read these pieces for a while knows where I stand on Warren Buffett. Namely I can’t stand him. It has nothing to do with the fact that he has so much money. I am not an envious person and moreover I think having wealth anywhere near his is more of a curse than a blessing. The reason I can’t stand him is because he is a fraud. While he may have been a great investor at one point, he is more of a great actor than anything else. Here is one of the richest people in the world. He sits there in Nebraska, chuckling, drinking his cherry coke and eating hamburgers in this pathetically obvious attempt to convince the masses he is “just like us.” The term wolf in sheep’s was invented for guys like this. Like most people out there I don’t like bad guys. The trick; however, is that the most dangerous bad guys don’t come out and tell you they are bad guys and how they are going to fleece you. What they do is pretend they are the good guys. Pretend that they are on the side of the little guy or working for the “collective good,” which is a preposterous statement because there is no such thing. Human desires and notions of what is a good life are as varied as the stars in the sky. Once we start allowing officials or rich people to define “collective good” you can be sure we are finished.

Now here is Senator Elizabeth Warren torching the fraud Janet Yellen. Enjoy.

In Liberty,

Michael Krieger

Guest Post by Mike Krieger

A couple of weeks ago, Princeton and Northwestern released a very important study that proved statistically what many of us already knew about the American political process. It is nothing more than an oligarchy.

It’s one thing to read an academic study showing how cancerous the political system is, it’s quite another to hear a description of how things work from one of the biggest crony weapons of mass societal destruction himself, Mr. Larry Summers.

A recent review in the New York Times of Massachusetts Senator Elizabeth Warren’s new memoir “A Fighting Chance” recalls a stunningly despicable quote by Summers. In the spring of 2009, when the banker handout, I mean bailout, was a heated topic of discussion, Elizabeth Warren attended a dinner with Mr. Summers who at the time was the director of the National Economic Council and a top economic adviser to President Obama. This is what transpired:

After dinner, “Larry leaned back in his chair and offered me some advice,” Ms. Warren writes. “I had a choice. I could be an insider or I could be an outsider. Outsiders can say whatever they want. But people on the inside don’t listen to them. Insiders, however, get lots of access and a chance to push their ideas. People — powerful people — listen to what they have to say. But insiders also understand one unbreakable rule: They don’t criticize other insiders.

What is so incredible about the quote above is that it essentially proves correct everything I and many others have been saying about how “things work” in America these days. The statements above describe a petty, childish oligarchy of arrogant fools. This small club of people call all the shots and do not listen to “outside” ideas whatsoever. This is why nothing changes. This is why the same people are recycled through positions of power over and over again no matter how badly they screw up and how many millions of lives they ruin. This is why there is a two-tiered justice system in which the rich and connected never go to jail, while the average citizen can have his home raided by police for a parody Twitter account. This is why the 0.01% have been able to loot all of the nation’s wealth while median inflation adjusted wages have been declining for 40 years.

The reason is because the “status quo” in America consists of a deranged, immoral, arrogant, selfish fraternity of inept children who protect each other at the expense of everyone and everything else. Until the status quo gets the boot, this nation will continue to decline. Forget reforms, the entire status quo needs to be tossed aside once and for all. The insiders must be turned into outsiders.

In Liberty,

Michael Krieger