In Part One of this article I explained the model of generational theory as conveyed by Strauss and Howe in The Fourth Turning. In Part Two I provided an overwhelming avalanche of evidence this Crisis has only yet begun, with debt, civic decay and global disorder propelling the world towards the next more violent phase of this Crisis. In Part Three I addressed how the most likely clash on the horizon is between the government and the people. War on multiple fronts will thrust the world through the great gate of history towards an uncertain future.

“The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, a total war. Every Fourth Turning has registered an upward ratchet in the technology of destruction, and in mankind’s willingness to use it.” – Strauss & Howe – The Fourth Turning

The drumbeats of war are pounding. Sanctions are implemented against any country that dares question American imperialism (Russia, Iran). Overthrow and ignominious imprisonment or death awaits any foreign leader questioning the petrodollar or standing in the way of America spreading democracy (Iraq, Libya, Syria, Ukraine, Egypt). The mega-media complex of six corporations peddle the government issued pabulum about ISIS being an existential threat to our freedoms; Russia being led by the new Hitler and poised to take over Europe; Syria gassing innocent women and children; and Iran only six months away from a nuclear bomb (they’ve been six months away for the last fourteen years). Hollywood does their part with patriotic drivel like American Sniper, designed to compel low IQ unemployed American youths to swell with pride and march down to enlistment centers, located in our plentiful urban ghettos.

The most disconcerting aspect of Fourth Turnings is they have always climaxed with total destructive all-out war. Not wars to enrich arms dealers like Iraq, Afghanistan, and Syria, but incomprehensibly violent, brutal, wars of annihilation. There are clear winners and losers at the conclusion of Fourth Turning wars. Leaders mobilize all forces, refuse to compromise, define their enemies in moral terms, demand sacrifice on the battlefield and home front, build the most destructive weapons imaginable, and employ those weapons to obtain victory at any cost.

It may seem inconceivable that war on such a scale will happen within the next ten years, but it was equally inconceivable in 1936 that 65 million people would die in the next ten years during World War II. We valued all the wrong things and made all the wrong choices leading up to this Crisis and during the early stages of this Crisis. The accumulation of unmet obligations, unpaid bills, un-kept promises and unresolved issues will provide the fuel for an upheaval that will shake our society to its core and transforms the country’s direction for the next sixty years. The outcome of the conflict could be tragedy or triumph. Our choices will make a difference.

There will be war on many fronts, and they have already begun. The culmination will likely be World War III, with the outcome highly uncertain and potentially disastrous.

Continue reading “FOURTH TURNING – THE SHADOW OF CRISIS HAS NOT PASSED – PART FOUR”

In Part One of this article I attempted to illuminate the concept of generational theory as articulated by Strauss and Howe in The Fourth Turning. In Part Two I provided proof this Crisis is far from over, with ever increasing debt, civic decay and global disorder propelling the world towards war.

“The seasons of time offer no guarantees. For modern societies, no less than for all forms of life, transformative change is discontinuous. For what seems an eternity, history goes nowhere – and then it suddenly flings us forward across some vast chaos that defies any mortal effort to plan our way there. The Fourth Turning will try our souls – and the saecular rhythm tells us that much will depend on how we face up to that trial. The saeculum does not reveal whether the story will have a happy ending, but it does tell us how and when our choices will make a difference.” – Strauss & Howe – The Fourth Turning

When you accept the fact history is cyclical and continuous linear progress is not what transpires in the real world, you free yourself from the mental debilitation of normalcy bias and cognitive dissonance. Things do get worse. There are dark periods of history and they recur on a regular cycle. And we are in the midst of one of those dark periods. This Crisis will not be resolved without much pain, sacrifice, bloodshed, and ultimately war. Catastrophe is a strong possibility. The core elements of this Crisis – debt, civic decay, global disorder – are coalescing into a perfect storm which will rage for the next ten to fifteen years. The rhythms of history only provide a guidepost of timing, while the specific events and outcomes are unknowable in advance. The regeneracy of society into a cohesive, unified community, supporting the government in a collective effort to solve society’s most fundamental problems seems to have been delayed. Or has it?

Maybe the answer can be found in the resolution of the last Fourth Turning. The seeds of the next crisis are always planted during the climax of the previous crisis, when the new social order is established. The American Revolution Crisis created a new nation, but left unresolved the issue of slavery. This seed grew to become the catalyst for the Civil War Crisis. The resolution of the Civil War Crisis greatly enhanced the power of the central government, while reducing the influence of the States. The rise of central authority led to the creation of the Federal Reserve, the implementation of income taxes to fund a vastly larger Federal government and the belief among the political class that America should intervene militarily in the affairs of other countries. The Great Depression was created by the monetary policies of the Federal Reserve; the New Deal programs were a further expansion of Federal government; FDR outlawed the ownership of gold; and America’s subsequent involvement in World War II created a military and economic superpower.

Continue reading “FOURTH TURNING – THE SHADOW OF CRISIS HAS NOT PASSED – PART THREE”

In Part One of this article I laid the groundwork of the Fourth Turning generational theory. I refuted President Obama’s claim that the shadow of crisis has passed. The shadow grows ever larger and will engulf the world in darkness in the coming years. The Crisis will be fueled by the worsening debt, civic decay and global disorder. I will address these issues in this article.

The core elements propelling this Crisis – debt, civic decay, and global disorder – were obvious over a decade before the financial meltdown catalyst sparked this ongoing two decade long Crisis. With the following issues unresolved, the shadow of this crisis has only grown larger and more ominous:

Debt

“To honor these obligations we could (a) raise all federal taxes, immediately and permanently, by 57%, (b) cut all federal spending, apart from interest on the debt, by 37%, immediately and permanently, or (c) do some combination of (a) and (b).”

The level of taxation and/or Federal Reserve created inflation necessary to honor these politician promises is too large to be considered feasible. Therefore, these promises, made to get corrupt political hacks elected to public office, will be defaulted upon.

Continue reading “FOURTH TURNING – THE SHADOW OF CRISIS HAS NOT PASSED – PART TWO”

We stand with the Communists!

That’s right – shoulder-to-shoulder, singing “The Internationale” with Syriza, the ruling party of Greece, after an election campaign marked by an unusual degree of honesty.

At least, one party was telling the truth when it sent an “open letter” to the voters of another nation! More on that in a minute.

First, let’s follow up on our travel memoirs. We are a reluctant tourist; wherever we go, nothing quite measures up to Baltimore. Once you have come to know Charm City, well, there’s nothing else like it.

Which is too bad for a rogue economist, condemned to wander the earth in search of fleeting insights. He sees the most bizarre, appalling, and often fetching, things… and they all remind him of home.

Meanwhile, strange things are happening elsewhere. Among them is a letter published in German business newspaper Handelsblatt (think the Wall Street Journal for Germans).

Alexis Tsipras, leader of the radical left-wing coalition that now governs Greece, was surprisingly forthright.

“In 2010, the Greek state ceased to be able to service its debt. Unfortunately, European officials decided to pretend that this problem could be overcome by means of the largest loan in history on condition of fiscal austerity that would, with mathematical precision, shrink the national income from which both new and old loans must be paid. An insolvency problem was thus dealt with as if it were a case of illiquidity.

In other words, Europe adopted the tactics of the least reputable bankers who refuse to acknowledge bad loans, preferring to grant new ones to the insolvent entity so as to pretend that the original loan is performing while extending the bankruptcy into the future.

Nothing more than common sense was required to see that the application of the “extend and pretend” tactic would lead my country to a tragic state. That instead of Greece’s stabilization, Europe was creating the circumstances for a self-reinforcing crisis that undermines the foundations of Europe itself.”

Greece had never really taken “austerity” seriously. Government spending and debt had both risen since the bailout program began. Dear readers wrote to tell us how wrong we were not to consider the plight of Greek widows and orphans, suffering under the austerity program.

Most of you, dear Handesblatt readers, will have formed a preconception of what this article is about before you actually read it. I am imploring you not to succumb to such preconceptions. Prejudice was never a good guide, especially during periods when an economic crisis reinforces stereotypes and breeds biggotry, nationalism, even violence.

In 2010, the Greek state ceased to be able to service its debt. Unfortunately, European officials decided to pretend that this problem could be overcome by means of the largest loan in history on condition of fiscal austerity that would, with mathematical precision, shrink the national income from which both new and old loans must be paid. An insolvency problem was thus dealt with as if it were a case of illiquidity.

In other words, Europe adopted the tactics of the least reputable bankers who refuse to acknowledge bad loans, preferring to grant new ones to the insolvent entity so as to pretend that the original loan is performing while extending the bankruptcy into the future. Nothing more than common sense was required to see that the application of the ‘extend and pretend’ tactic would lead my country to a tragic state. That instead of Greece’s stabilization, Europe was creating the circumstances for a self-reinforcing crisis that undermines the foundations of Europe itself.

My party, and I personally, disagreed fiercely with the May 2010 loan agreement not because you, the citizens of Germany, did not give us enough money but because you gave us much, much more than you should have and our government accepted far, far more than it had a right to. Money that would, in any case, neither help the people of Greece (as it was being thrown into the black hole of an unsustainable debt) nor prevent the ballooning of Greek government debt, at great expense to the Greek and German taxpayer.

Continue reading “Alexis Tsipras’ Open letter to the German readers”

Source: flickr

Dear Diary,

And then democracy comes into being after the poor have conquered their opponents, slaughtering some and banishing some, while to the remainder they give an equal share of freedom and power.

– Socrates, Plato’s The Republic

A snowstorm battered the East Coast of the US today. Politics rocked southern Europe.

Sitting here on the edge of the beach, overlooking the Pacific Ocean, a gentle breeze stirring the trees… birds singing… surfers carrying their boards across the sand…

…it’s hard to imagine the tempest in North America, let alone the swirling clouds over the Parthenon. The radical left-wing Syriza coalition party won in Greece.

Once again, Greece is a victim of democracy.

Austerity? What Austerity?

What this means, exactly, is anybody’s guess. The Wall Street Journal struggled:

Within minutes of the close of the polls, Germany’s powerful central-bank chief, Jens Weidmann, pushed back.

“It is clear that Greece will remain dependent on support and it’s also clear that this aid will be provided only when it is in an aid program,” he said in an interview with television broadcaster ARD.

A message on British Prime Minister David Cameron’s usual Twitter account, meanwhile, warned that the Greek result will “increase economic uncertainty across Europe.”

Increased uncertainty is a good bet.

Meanwhile, the papers reported that Europe’s apparatchiks were working overtime to accommodate the new government so as to keep the system functioning. Also reported was that Greek voters were fed up with “austerity.”

As to the first bit of news we have no doubt. All the powers-that-be don’t want to become the powers-that-used-to-be. They’ll do whatever it takes to hold on to their authority.

It’s the second bit of news that makes us say, “Huh?”

Not that we haven’t heard it before. The Greeks… the Spaniards… the Italians… the Portuguese… the French – they’re all supposed to be tired of “austerity.”

But what austerity?

Continue reading “Greece Is Once Again a Victim of Democracy”

I find it absolutely stunning whenever a government official tells the unvarnished blunt truth. Do you loan someone more money when they don’t have the means to repay what they have borrowed already? The evilness of central bankers is revealed in this short exchange. It’s time to end Wimpy economics.

Submitted by Tyler Durden on 01/27/2015 13:19 -0500

“This is not blackmail,” explains new Greek Finance Minister Yanis Varoufakis, “we simply want to end this seemingly never-ending Greek Crisis.” In what must be worryingly calm and simple to comprehend words for Brussels, Varoufakis tells CNBC’s Michelle Caruso-Cabrera, “this is what happens when you humiliate a nation and don’t give it any hope.” Carefully noting that membership in the Euro is not imperative, Varoufakis concludes “bankruptcy cannot be dealt with by borrowing more,” asking rhetorically, “how can I look the German and Finnish taxpayer in the eye and tell them you know I can’t really pay you the money I have already borrowed from you…” but lend me more so I can pay back the ECB?

As Varoufakis explains, he believes Europe is willing to negotiate haircuts – anything else appears a waste of time.

Continue reading “NEW GREEK FINANCE MINISTER TELLS THE TRUTH”

As we all know, central bankers across the world have only delayed the inevitable economic collapse and made it far worse through their money printing and debt manipulations. Greece started this charade and they appear to be the country which will end it. Fourth Turnings always intensify. Hold on.

Guest Post by Jesse

Here’s summary of a momentous election result for the future of Greece and Europe:

- The anti-austerity far left party Syriza has won the Greek election by a decisive margin, but just short of an outright majority. With more than three-quarters of the results in Syriza is projected to win 149 seats in the 300 seat parliament.

- Syriza leader Alexis Tsipras said his party’s victory marked an end to the “viscious cycle of austerity”. Referring to the neoliberal conditions set by the IMF, the European Commission and the European Central Bank, he said: “ The verdict of the Greek people renders the troika a thing of the past for our common European framework.”

- Outgoing prime minister Antonis Samaras conceded defeated by acknowledging some mistakes. But he added: “We restored Greece’s international credibility”.

- To Potami, the centre-left party could be the kingmakers in the new parliament, with a project 16 seats. Its leader Stavros Theodorakis has not ruled out a deal with Syriza. “It’s too early for such details,” he said.

- The far-right Golden Dawn party is projected to come third in election, despite having more than half of its MPs in jail. Speaking from prison its leader Nikolaos Michaloliakos said the result was a “great victory” for the neo-fascist party.

- Syriza victory has been greeted with alarm in Germany. The ruling CDU party insisting that Greece should stick to the austerity programme. But Belgium’s finance minister said there is room for negotiation with Syriza.

- Leftwingers across Europe have hailed Syriza win. Spain’s anti-austerity party Podemos said Greece finally had a government rather than a German envoy. Britain’s Green Party said Syriza’s victory was an inspiration.

By Raul Ilargi Meijer of The Automatic Earth

Bunch Of Criminals!

I was going to start out saying Thursday was the saddest day in Europe in 50 years, or something like that, because of the insane and completely nonsensical largesse the ECB permits itself to launch, aimed at once again saving a banking system, but which will not only not help the European people, it will make things even much worse than they already are.

I’ve said many times that the EU in its present form should be dismantled tomorrow morning (even though it’s not the same tomorrow morning anymore), and if Draghi’s $1.1 million x million ‘stimulus’ should make anything clear, it’s that the dismantling gets more urgent by the day.

But calling it the saddest day in Europe in 50 years would show far too little respect for the people who died in former Yugoslavia, and in eastern Ukraine. It’s still a very sad day, though. And I was already thinking about that even before I read Theopi Skarlatos’ article for the BBC; that really made me want to cry.

When you read about female doctors(!) feeling forced to prostitute themselves to feed their children, about the number of miscarriages doubling, and about the overall sense of helplessness and destitution among the Greek population, especially the young, who see no way of even starting to build a family, then I can only say: Brussels is a bunch of criminals. And Draghi’s QE announcement is a criminal act. It’s a good thing the bond-buying doesn’t start until March, and that it’s on a monthly basis: that means it can still be stopped.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

The surreal nature of this world as we enter 2015 feels like being trapped in a Fellini movie. The .1% party like it’s 1999, central bankers not only don’t take away the punch bowl – they spike it with 200 proof grain alcohol, the purveyors of propaganda in the mainstream media encourage the party to reach Caligula orgy levels, the captured political class and their government apparatchiks propagate manipulated and massaged economic data to convince the masses their standard of living isn’t really deteriorating, and the entire façade is supposedly validated by all-time highs in the stock market. It’s nothing but mass delusion perpetuated by the issuance of prodigious amounts of debt by central bankers around the globe. And nowhere has the obliteration of a currency through money printing been more flagrant than in the land of the setting sun – Japan. The leaders of this former economic juggernaut have chosen to commit hara-kiri on behalf of the Japanese people, while enriching the elite, insiders, bankers, and their global banking co-conspirators.

Japan is just the point of the global debt spear in a world gone mad. Total world debt, excluding financial firms, now exceeds $100 trillion. The worldwide banking syndicate has an additional $130 trillion of debt on their insolvent books. As if this wasn’t enough, there are over $700 trillion of derivatives of mass destruction layered on top in this pyramid of debt. Just five Too Big To Trust Wall Street banks control 95% of the $302 trillion U.S. derivatives market. The reason Jamie Dimon and the rest of the leaders of the Wall Street criminal syndicate commanded their politician puppets in Congress to reverse the Dodd Frank rule on separating derivatives trading from normal bank lending is because these high stakes gamblers want to shift their future losses onto the backs of middle class taxpayers – again. The bankers, with the full support of their captured Washington politicians, will abscond with the deposits of the people to pay for their system destroying risk taking, just as they did in 2008 by holding taxpayers hostage for a $700 billion bailout.

Only the ignorant, intellectually dishonest, employees of the Deep State, CNBC cheerleaders for the oligarchy, or Ivy League educated Keynesian loving economists choose to be willfully ignorant regarding the true cause of the 2008 implosion of the worldwide financial system. The immense expansion of credit in the U.S. from 2000 through 2008 was created, encouraged, supported and sustained by Alan Greenspan, Ben Bernanke and their cohorts at the Federal Reserve through their reckless lowering of interest rates and abdication of regulatory oversight, as their owner banks committed the greatest financial control fraud in world history. Total credit market debt in the U.S. grew from $25 trillion in 2000 (already up 100% from $12.5 trillion in 1990) to $53 trillion by 2008.

The bankers, politicians, mainstream media corporations, and mega-corporations that run the show lured Americans into increasing their credit card, auto loan, and student loan debt from $1.6 trillion in 2000 to $2.7 trillion in 2008, while extracting over $600 billion of phantom home equity from their McMansions. And it was all spent on things they didn’t need, produced in Chinese slave labor factories. The mal-investment boom was epic and the collapse in 2008 would have purged the bad debt, punished the risk takers, bankrupted the criminal banks, reset the financial system, and taught generations a lesson they needed to learn – excess debt kills. Instead of voluntarily abandoning the madness of never ending credit expansion and accepting the consequences of their folly, the world’s central bankers and captured politician hacks chose to save bankers, billionaires, and the ruling elite at the expense of the common people.

The false storyline of government austerity continues to be peddled to the public, but is nothing but pablum served to the mentally infantile masses, while the criminals continue to manufacture debt out of thin air, pillage the wealth of the working class, gamble recklessly knowing it’s with taxpayer funds, debase their currencies in an effort to make their debts easier to service, and enrich themselves and their cohorts, while impoverishing the little people. Consumer credit card debt peaked at $1.02 trillion in mid-2008. After hundreds of billions in bad debt write-offs by the Wall Street banks and shifted to the taxpayer, the American consumer has purposefully avoided running up credit card debt on Chinese produced crap, despite the urging of bankers, the mainstream media and politicians to revive our warped, debt laden, consumption dependent economy. Credit card debt is currently $140 billion BELOW levels in 2008, despite the never ending propaganda about an economic and jobs recovery. The fake Wall Street created housing recovery is confirmed by the fact mortgage debt outstanding is $1.4 trillion LOWER than 2008 heights and mortgage applications are hovering at 1999 levels.

Where Americans were in control and understood the consequences of their actions, they willingly reduced their debt based consumption. This was unacceptable to the powers that be at the Federal Reserve, in the banking sector, consumption dependent mega-corporations, and their government puppets on a string. The government took complete control of the student loan market and used their ownership of the largest auto lender – Ally Financial (aka GMAC, aka Ditech, aka Rescap) to dole out subprime auto loans and subprime student loans at a prodigious rate. The Wall Street banks joined the party, with assurance from Yellen and the Obama administration their future losses would be covered.

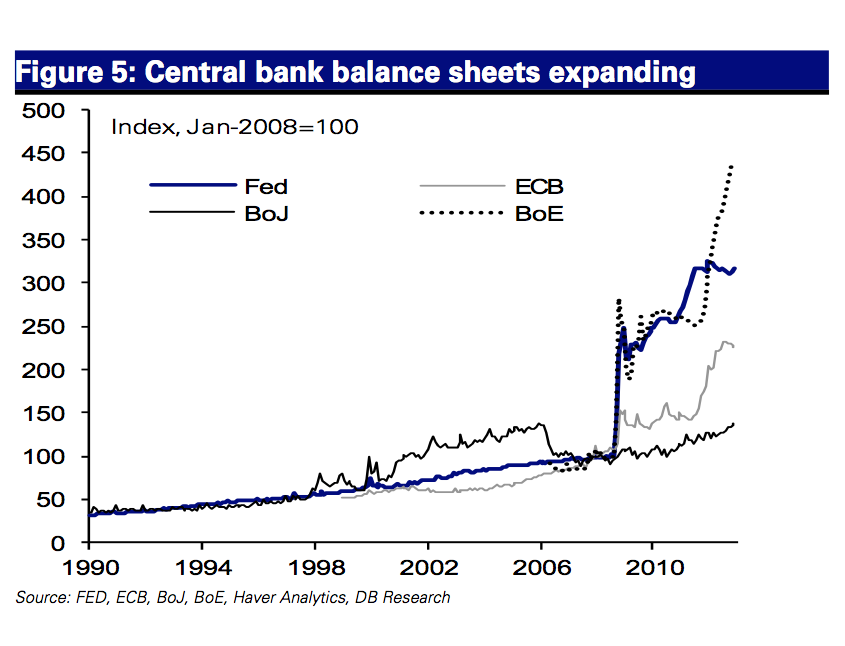

The Greenspan/Bernanke/Yellen Put lives on. So, while credit card debt is 14% below 2008 levels, student loan and auto loan debt has soared by 47%, up $769 billion from its early 2010 lows. The Fed and their government minions have desperately accelerated their credit expansion in a futile effort to revive our moribund, debt saturated, welfare/warfare empire of delusion. After temporarily plateauing at $52 trillion in 2010, the acceleration of consumer credit, issuance of corporate debt to fund stock buybacks, and of course the $5 trillion added to the National Debt by Obama, have driven total credit market debt to an all-time high of $58 trillion. In addition, the Fed expanded their balance sheet by $3.6 trillion through their various QE schemes, funneling the interest free funds to their Wall Street owners to create the illusion of economic recovery through a stock market surge. The .1% never had it so good.

Of course, the U.S. has not been alone in attempting to cure a disease caused by excessive debt by issuing trillions in new debt. It is clear to anyone not in the employ of the Deep State that central bankers in the U.S. are working in concert with central bankers in Europe and Japan to keep this farcical Keynesian nightmare from imploding under an avalanche of deflation, wealth destruction, chaos and retribution for the guilty. The Federal Reserve used every means at their disposal to hide the fact they bought over $400 billion of mortgage backed securities from European banks and in excess of $1.5 trillion of their QE benefited foreign banks. It was no coincidence that one day after the Fed ended QE3, the Bank of Japan announced a massive “surprise” increase in purchases of bonds and stocks. It wasn’t a surprise to Janet Yellen, as this was the plan to keep stock markets rising, record Wall Street bonuses being paid, and further enrichment of the .1% global elite. The Japanese stock market has surged 18% since the October 31 announcement, with the U.S. market up 10%. Now it is time for Draghi to pick up the baton and create another trillion or two to support the lifestyles of the rich and famous. Central bankers know who they really work for, and it’s not you.

With global worldwide debt now exceeding $230 trillion we have far surpassed the point of no return. There is no mathematical possibility this debt will ever be repaid. And this doesn’t even include the hundreds of trillions of unfunded liability promises made by corrupt politicians around the world. The level of total global debt to global GDP, at nosebleed levels of 210% in 2008, has escalated past 240% as central bankers push the world towards a final and total catastrophe. With U.S. credit market debt of $58 trillion and GDP of $17.6 trillion, the U.S. is a basket case at 330%. The UK, Sweden and Canada are on par with the U.S.

But Japan takes the cake with total debt to GDP exceeding 500% and headed higher by the second. Their 25 year Keynesian experiment by mad central bankers and politicians enters its final phase of currency failure. Negative real interest rates, trillions wasted on worthless stimulus programs, and currency debasement have failed miserably, so Abe’s solution has been to double down and accelerate failed solutions. Only an Austrian economist can appreciate the foolishness of such a reckless act.

“Credit expansion is the governments’ foremost tool in their struggle against the market economy. In their hands it is the magic wand designed to conjure away the scarcity of capital goods, to lower the rate of interest or to abolish it altogether, to finance lavish government spending, to expropriate the capitalists, to contrive everlasting booms, and to make everybody prosperous. – Ludwig von Mises

It looks like the country that started the EU financial crisis is back for round two. Nothing was fixed. Nothing was resolved. More debt doesn’t solve a debt problem. It was all explained in this video from two years ago. The Greeks are just implementing their master plan to get back at Germany.

While central bankers, politicians, Wall Street economists, and propaganda mouthpieces in the corporate mainstream media pull the levers of monetary policy, blather about economic recoveries, and live in multi-million dollar estates, the real people in the real world suffer and sink further into despair. It is happening in Greece, all across Europe, and it will happen here after the next collapse in this ongoing Greater Depression. Everything done since the 2008 collapse has been to save bankers and crony capitalists.

Squeezed between steering wheel, handbrake, door and dashboard, Katerina reads in her history book, takes notes for school. Next to her, on the driver’s seat, cat Eddy stares right in the camera lens. It may look like a cute snapshot on a sunny day, if it wasn’t for a sad detail: a withering spring stuck in a roll of toilet paper. A distinctive memory of a former normal life that turned into a grim reality for a family of four.

At night the seat where Katerina sits during the day turns into a bed for her sister Fay. Cat Eddy cuddles with Katerina on the back seat. Father Nikos and mother Maria sleep in shifts on the driver’s seat. When the one parent is in the car, the other spends the night on a bench of the park where the car has been parked, on a side road of Irakleio suburb of West Athens. “It’s dangerous when it gets dark,” Maria says “we have to watch out.”

With both parents without a job and all savings already spent, the family of four has been living in the uncomfortable environment of an old car for the last two weeks. They were evicted from the home they were renting due to a mountain of outstanding debts to the landlord and utility companies.

Nikos and Maria at their late 40′s, Fay and Katerina aged 16 and 14, packed a few things, took their pet in their arms and made their old car their new home.

“The girls started to cry when we told them that we’re going to live in the car,” Maria told the reporter of Sunday newspaper Proto Thema that revealed the story. “The first night in the car was the most difficult, psychologically,” Maria adds with a trembling voice.

“We had our decent home, our cooked food, we offered our kids what they needed. I could never think that I will end up like that at my 49. We knew that times are tough, but never thought that we will end up on the street,” Maria said.

It’s Greece’s new homeless: decent families who lost everything due to economic crisis and austerity measures and they live their own hell in social isolation in a collapsed welfare state.

Decent families who live from charity aid, food packages, soup kitchens or neighbors’ help.

Decent families who cannot even enjoy a warm bed and a proper shower, a home-cooked meal, a flower in the vase.

The story of the family is common to many Greek households with no extraordinary means and salaries. Their economic decline started in 2012, when the bakery where Nikos was working closed down. Maria, who was working as a school traffic woman, was fired. The family managed to survive using the thin compensation Nikos received after being fired. Both parents tried to find new jobs but without result. Soon all the money available for the family was vanished.

In Greece of Samaras’ success story and IMF’s wrong calculations, there are hardly job vacancies available after four full years of recession.

According to official statistics, 27 percent, that is 1.3 million people are unemployed, the majority of them long-term jobless. These numbers refer only to employees and not to self-employed or free-lancers. Unemployment allowance is just 365 euro per month for the duration of total 12 months independently of the years of work life.

At the same time, more than 60% of the country’s population lives either in poverty or is at risk of poverty. According to State Budget Office of the Greek Parliament, 2.5 million Greeks live below the line of relative poverty and another 3.8 million people are at risk of poverty. “Relative poverty” is defined when a family of four has less than 908 euro per month.

Being one of the country’s 1.3m unemployed for more than three years, father Nikos managed to find a job at the kiosk. For 300 euro per month. The money maybe enough to feed the family or cover elementary needs but hardly rent and utility bills. Official statistics define as “Relative poverty” the monthly income of below €908 for a family of four.

Maria told the Proto Thema reporter that it was their pride that has hindered them so far from seeking charity aid and possible beds at the Homeless Shelter.

The story of the new-homeless family shocked the public opinion and mobilized a lot of Greeks who urged the media to open a bank account so that they could send donations. Many offered food and clothing and even work.

A man called at a TV-news magazine featuring the drama of the family and offered a home for the family to live in free of charge.

Deputy Labor Minister Vasilis Kerkeroglou intervened in one of the morning TV-news magazines reporting on the fate of the family and said that there was a plan on the way to shelter 1,500 homeless and that “half of them could even find a job.”

When the plan will be implemented in real life, it is not known yet.

PS thank God, the government has plans for the poor, who turned poor after the government taxed also the poor, apart from destroyed any effort for growth and development…

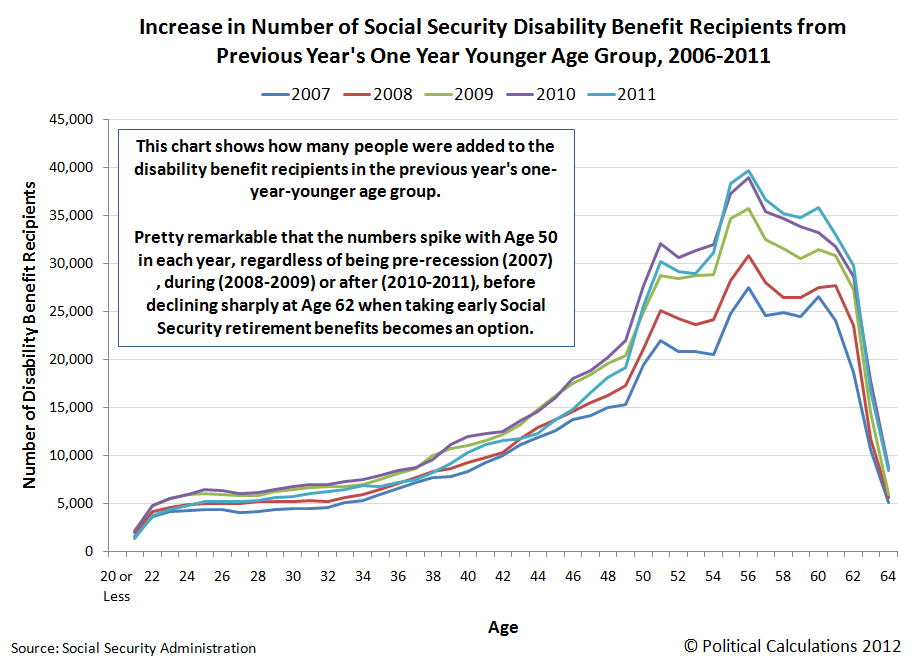

The number of people on SSDI now exceeds the entire population of Greece. Anyone who argues that the rise in people on SSDI is normal and predictable is either a dumbfuck or a lying liberal Obama lover. The aging of the population has nothing to do with the increase. In 1968 there were 51 workers for every person on disability. Today there are 13 workers for every person on disablity. I think even liberal douchebags would agree that medical advancements since 1968 have been significant. These medical advancements would argue for less people being on disability and unable to work. Even a liberal douchebag would agree that workplace safety measures have been increased exponentially since 1968, so that also argues for less disabled workers. The good old ADA law forced all workplaces to become disabled friendly. That argues for less people on disability. The country has transitioned from a manufacturing society to a service society. Workers don’t work on dangerous assembly lines anymore. Robots do the dangerous stuff. Even a liberal ideologue would agree. This should have dramatically reduced worker injuries and disabilities.

Everything I’ve pointed out is true. The tremendous increase in people on SSDI is nothing but a gigantic fraud, perpetuated by the Federal government and slimy lawyers. The government broadened the scope of disabilities to include stress, depression, and non-diagnosable things like aches and pains. I have stress, depression and pains too, but I get the fuck up at 5:15 every morning and go to work. The SSDI program is a joke. More than half the people on SSDI are lazy good for nothing leeches. They are sucking you and I dry while sitting around eating cheetos, watching Judge Judy on their government subsidized cable TV, and texting with other lazy fucks on their iPhones.

Now lets hear from the a few liberal douchebags about the cruelty of my assessment and how Wall Street does far worse things. I love that line of reasoning. The next time I see one of those shyster lawyer commercials urging me to get what I deserve, maybe I should join the FSASSDI party. You get the added benefit of Medicare coverage after only two years of SSDI stress.

The story below is a reflection of the entitlement mindset that has proliferated for decades in Europe and the United States. It is a mindset of corruption, laziness, and entitlement that has been encouraged and exacerbated by the socialist welfare policies and programs that were supposed to help the poor and disadvantaged. Instead these programs morphed into a way for politicians to dole out benefits for votes. Generations have now become dependent upon the government for their subsistence from birth until death. The learned helplessness has been a key tactic for liberal/ left wing politicians across Europe and the USA. Keep promising people more free shit and they’ll keep voting for you. It works until you run out of other people’s money. Greece has run out of other people’s money. Now the blind can see.

The story below would be funny if it wasn’t so sad. The cancer of entitlement and corruption is so ingrained in Greece society that the patient can never recover. It’s too late. Southern Europe is dead entitlement states walking. There is no rescue plan big enough to save these people from their debt based delusions. Reality is really going to bite for these people.

We sit here across the pond and chuckle at this story about the island of the blind. But, we are only a couple years behind Greece and the ability to print more fiat currency will not save us. Chris Christie is right – we’ve become a paternalistic entitlement society. The 47 year War on Poverty has successfully enslaved millions into an entitlement mindset of not working, not caring, and gaming the system for everything they can get away with. This behavior and these programs have been actively encouraged by liberals and do-gooders looking for easy votes. The ridiculous solutions implemented since 2008 have made the situation 100 times worse as we have an all-time record of 47 million people on food stamps paying out $72 billion annually. The government has been paying millions of people to not work for 99 weeks. And now that the 99 week gravy train is drying up, millions have just realized they are disabled. The rampant fraud in the SSDI program is actively encouraged by Obama and his minions. The $132 billion per year is well spent for a few more voters. The Federal Government lets you into this lifelong program for depression, muscle pain, or being too fucking fat to get out of a chair. Anyone who doesn’t think millions are gaming this system should look at this little chart. The number of 50 to 55 year olds piling into the SSDI rose by 50% between 2007 and 2011. Wow!!! Our workplace safety must have really gone downhill in the last 4 years.

It is surely just a coincidence that as soon as the FSA got kicked off the 99 week unemployment rolls, the SSDI rolls began to surge. No fraud there.