Authored by Chris Martenson via PeakProsperity.com,

It’s time to be our own heroes, because those in charge sure won’t be…

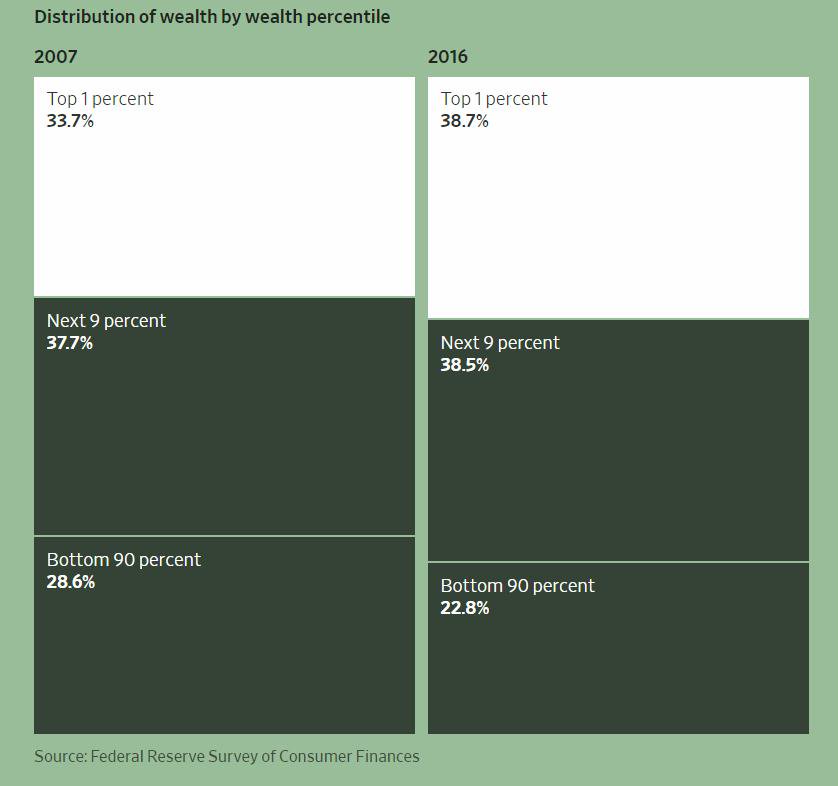

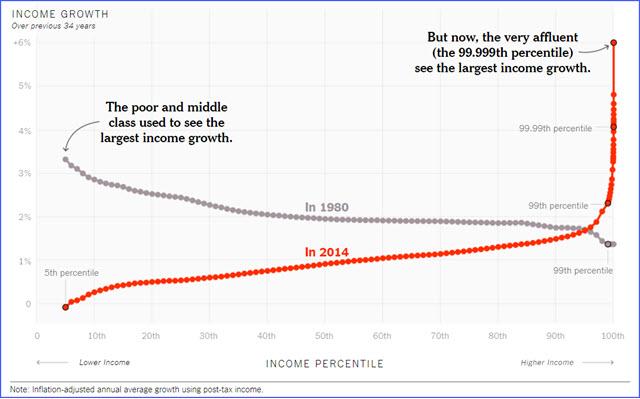

Even before the coronavirus pandemic hit, things weren’t all that great for the bottom 90% of households.

The median household was barely scraping by with ultra-low financial reserves, meager retirement savings and high levels of debt. All while being relentlessly crushed by cost of living inflation running far higher than the blatantly fraudulent government statistics offered up by the BLS.

Even more infuriating, the economic pie was preferentially handed to the top 10% — well, more specifically, to the top 1%. And even more dramatically to the top 0.1%. Don’t even get me started on the 0.001%…

Continue reading “Martenson: We Are On Our Own In The Post-COVID World”